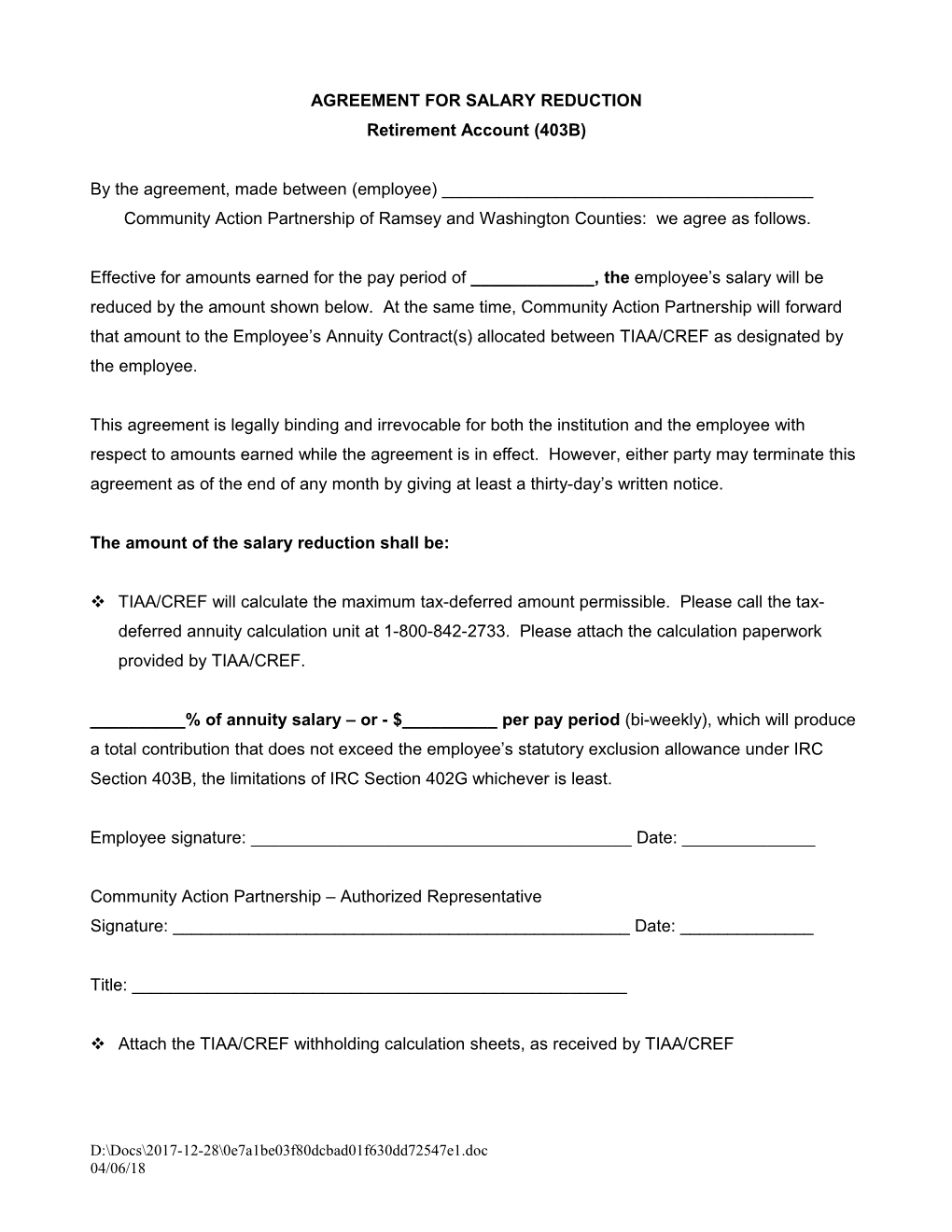

AGREEMENT FOR SALARY REDUCTION Retirement Account (403B)

By the agreement, made between (employee) ______Community Action Partnership of Ramsey and Washington Counties: we agree as follows.

Effective for amounts earned for the pay period of ______, the employee’s salary will be reduced by the amount shown below. At the same time, Community Action Partnership will forward that amount to the Employee’s Annuity Contract(s) allocated between TIAA/CREF as designated by the employee.

This agreement is legally binding and irrevocable for both the institution and the employee with respect to amounts earned while the agreement is in effect. However, either party may terminate this agreement as of the end of any month by giving at least a thirty-day’s written notice.

The amount of the salary reduction shall be:

TIAA/CREF will calculate the maximum tax-deferred amount permissible. Please call the tax- deferred annuity calculation unit at 1-800-842-2733. Please attach the calculation paperwork provided by TIAA/CREF.

______% of annuity salary – or - $______per pay period (bi-weekly), which will produce a total contribution that does not exceed the employee’s statutory exclusion allowance under IRC Section 403B, the limitations of IRC Section 402G whichever is least.

Employee signature: ______Date: ______

Community Action Partnership – Authorized Representative Signature: ______Date: ______

Title: ______

Attach the TIAA/CREF withholding calculation sheets, as received by TIAA/CREF

D:\Docs\2017-12-28\0e7a1be03f80dcbad01f630dd72547e1.doc 04/06/18