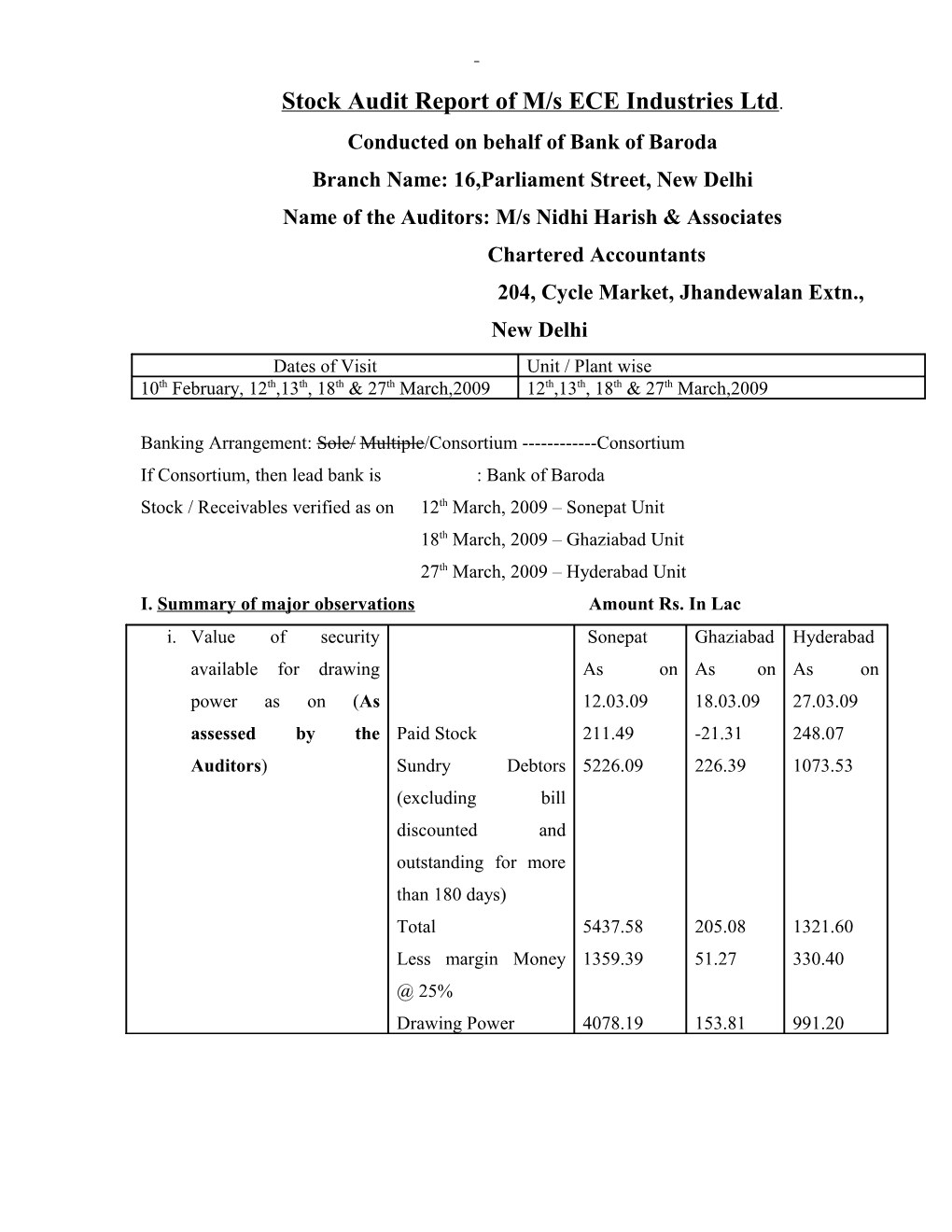

Stock Audit Report of M/s ECE Industries Ltd. Conducted on behalf of Bank of Baroda Branch Name: 16,Parliament Street, New Delhi Name of the Auditors: M/s Nidhi Harish & Associates Chartered Accountants 204, Cycle Market, Jhandewalan Extn., New Delhi Dates of Visit Unit / Plant wise 10th February, 12th,13th, 18th & 27th March,2009 12th,13th, 18th & 27th March,2009

Banking Arrangement: Sole/ Multiple/Consortium ------Consortium If Consortium, then lead bank is : Bank of Baroda Stock / Receivables verified as on 12th March, 2009 – Sonepat Unit 18th March, 2009 – Ghaziabad Unit 27th March, 2009 – Hyderabad Unit I. Summary of major observations Amount Rs. In Lac i. Value of security Sonepat Ghaziabad Hyderabad available for drawing As on As on As on power as on (As 12.03.09 18.03.09 27.03.09 assessed by the Paid Stock 211.49 -21.31 248.07 Auditors) Sundry Debtors 5226.09 226.39 1073.53 (excluding bill discounted and outstanding for more than 180 days) Total 5437.58 205.08 1321.60 Less margin Money 1359.39 51.27 330.40 @ 25% Drawing Power 4078.19 153.81 991.20 ii. Value of security Paid Stock 225.24 available for drawing Sundry Debtors 8865.15 power as on 31.01.2009 (excluding bill (As reported by the discounted and company in Stock / outstanding for more Book Debt Statement) than 180 days) Total 9090.39 Less margin Money 2272.60 @ 25% Drawing Power 6817.79 iii. Shortfall in drawing Drawing power as on the date of verification of stocks i.e. as on power, if any, as 12.03.09 for Sonepat Unit, as on 17.03.09 for Ghaziabad unit assessed by the Auditors. and as on 27.03.09 for Hyderabad unit has been assessed at Rs. 4078.19 lac, Rs. 153.81 lac and Rs. 991.20 lac respectively, thus totaling Rs. 5223.20 lac, as against Rs. 6817.79 lacs as on 31.01.2009. iv. Position of the account as on the date of inspection (31.03.2009): (Rs. in lacs) Nature of facility Limit Drawing Balance Excess over sanctioned Power/Limit Outstanding drawing limit 1. Cash Credit 1400.00 1218.75 977.00 Nil 2. LC/Bank Guarantee 3000.00 1727.00 Nil Brief comments on: 1) Stocks Position of stock value as on 21-02-09 (Rs. In lacs ) Stock Sonepat Ghaziabad Hyderabad Total Value of Stock 2969.93 159.63 715.49 3845.05 Less Sundry Creditor 2761.14 192.99 474.75 3428.88 Total Paid Stock 208.79 -33.36 240.74 416.17 Less Margin 25% 52.20 8.34 60.19 104.05 Drawing Power 156.59 -25.02 180.55 312.12 Stock : i) Condition of Stock : Satisfactory ii) Age of Stocks : Majority of the stocks are fast moving. Company has the system of identifying old stocks. Old stocks are valued at substantially lower value. However for the purpose of calculation of Drawing power these stocks are excluded. iii) Valuation of Stocks : Raw Material is valued at the purchase price including of taxes and pro-rata cost of transportation and other costs. We have verified the latest purchase price of all the high value stock items. As per the normal accounting practice, raw material should be valued at purchase price or market price, whichever is lower. It has been explained by the officials of the company that all their raw material are procured against specific order and as long as the sale against order is in profit, they value the raw material at cost, irrespective of current market price. Work in progress is valued by the management on the basis of cost of input and prorates cost of labor and overheads. No quantitative details of work in progress were made available to us. As explained by the company officials, it is not possible for them to make quantitative details in the middle of the month. Figure of work in progress has been worked out on the basis of value as at the opening day of month plus value of material issued less value of dispatch made. Finished goods are valued by the management on the basis of cost of production or sale price, whichever is lower. However, no cost sheet was made available to us for verification of valuation of finished goods. Consumables and stores and spares are also valued at cost price and are shown as part of raw material. iv) Rejected stock : No rejected stock observed

v) Insurance Coverage : Sonepat Unit Stocks are insured for Rs. 5500 lac, which is sufficient considering the level of inventory maintained. Ghaziabad Unit Stocks are insured for Rs. 350 lac, which is sufficient considering the level of inventory maintained. Hyderabad Unit Stocks are insured for Rs. 350 lac, which is substantially lower than the level of inventory maintained. 2) Receivables (Rs. In Lacs) Sonepat Ghaziabad Hyderabad Total i) Age of Receivables Total Debtors 8353.82 298.82 1082.93 9735.57 Less Debtors older than 180 days 3127.72 72.43 9.40 3209.55 Less Bill Discounted by Bank 0.00 0.00 0.00 0.00 Balance 5226.10 226.39 1073.53 6526.02 Less Margin @ 25 % 1306.53 56.60 268.38 1631.51 Drawing Power 3919.57 169.79 805.15 4894.51 Age wise & Value wise evaluation (Rs. In Lacs) of debtors (receivables) 0-180 days 6526.02 above 180 days 3209.55 ii) Disputed receivables, if any No disputed receivables reported. iii) Doubtful Debts No doubtful debts noticed. 3) Creditors Details of unpaid stock as on . There are sundry creditors of Rs. 3428.88 lacs as on the date of verification of stocks. No disputed creditors were reported. 4) Other Areas covered (such as Turnover in the account is satisfactory. However, turnover in account, transactions we do not have details of operation of account with with other banks etc.) other consortium member bank. II. Main Report

1) Working Capital facilities (FB+NFB) enjoyed with the bank / consortium of banks and position of account with various banks. (Amount Rs. In lac) Nature of facility Limit Drawing Balance Excess over sanctioned Power/Limit** Outstanding drawing limit 1. Cash Credit a. Bank of Baroda 1400.00 1218.75 977 b. Canara Bank 1300.00* 1131.69 c. Central Bank of India 1200.00* 1044.64 d. State Bank of India 1700.00* 1479.91 e. State Bank of Hyderabad 400.00 * 348.21 2. Letter of Credit/Bank Guarantee a. Bank of Baroda 3000.00 1727 b. Canara Bank 2850.00* c. Central Bank of India 1500.00* d. State Bank of India 7800.00* e. State Bank of Hyderabad 500.00* *Figures of balance outstanding with other banks are not available with us. ** Drawing power calculated by us has been allocated proportionately to the member banks

2) Security Primary Cash Credit Hypothecation of entire current assets including stocks consisting of raw materials, stock in progress, finished goods, stock in transit packing materials, consumables etc. & Book-Debts. Letter of Credit/Bank Guarantee 10% margin 3) System of maintenance of Stock and Stock records at all the three locations i.e. Sonepat, Stock records Ghaziabad and Hyderabad are maintained in software developed in house by the company. a) Physical verification & condition Physical verification of the stocks was carried by us of stocks at three location of the company and except for minor variation the stock was found to be in order. Stocks are kept properly and were in satisfactory condition. Obsolete/ old stocks are segregated from rest of the stocks. Extent of physical verification carried is mentioned below in the column named basis of verification. Display of Bank’s name plate Bank’s name plate is displayed at the unit, but carries the name of K G Marg branch.. Basis of verification 100% for high value items 10% for mid value items 1% for low value items Location and upkeep of godowns. Verification of the stocks were carried at following locations 1. Transformer Division, Delhi Road, Sonepat. 2. Elevator Division, A-20, Industrial Area, Merrut Road, Ghaziabad. 3. Transformer Division, Ashok Marg, Sanathnagar, Hyderabad. Space at godowns at Sonepat and Ghaziabad and stocks are kept properly. However, at Hyderabad godown is small keeping view of level of stocks. Location, storage and upkeep of stocks. Stocks are properly maintained at Sonepat and Ghaziabad units of the company. However, in case of Sonepat unit, heavy items of stocks are stacked at the floor of the factory. It was explained to us due to difficulty in movement of these items, these are stacked at the point near to consumption. In case of Hyderabad unit stocks are not properly stacked and are mixed up with the work in progress. It become very difficult to ascertain, whether a particular item is part of raw material stock or stock in process. Further, items of same description are not kept at one place and are scattered at more than one place. It has been explained to us that due to paucity of space in stores, some material is kept at factory floor. Observation on verification: plant, raw Stock level at the time of inspection was almost at the materials, work in process, finished same level as submitted in the stock statements. Stock goods, stores and spares, stock in transit of raw material and finished goods were verified etc. during the course of audit. As regards stocks of work in progress, the figures provided by the party have been relied upon. Stock in process is worked out on the basis of opening value of stock in process plus value of material issued to floor minus dispatches made during the month. It was explained to us that it is not possible to stop the production to take physical inventory of stock in process. Company has the system of taking physical inventory of work in process at the year end. However, considering the level of operation of the unit, level of stock in process provided by the party seems to be reasonable. b) Verification of Stocks sent/ received At the time of verification of stocks as on 12.03.2009, for job work/ in transit stock of Rs. 35.05 lac was reported to be sent for job work at Sonepat Unit. c) Maintenance of Stock records Stock records of the company are maintained (including excise records, if any separately at the stores . These records are maintained in software specifically developed in house by the company. All proper excise records are maintained at the respective units. 4) Valuation of stocks a) Basis of valuation of Raw Material is valued at the purchase price raw materials, work in including of taxes and pro-rata cost of transportation process, finished and other costs. We have verified the latest purchase goods, stores & spares, price of all the high value stock items. We have stock in transit etc. noticed that some of raw material items at Sonepat unit are valued at the original purchase price, in spite of substantial reduction in purchase prices of similar nature items. As per the normal accounting practice, raw material should be valued at purchase price or market price, whichever is lower. It has been explained by the officials of the company that all their raw material are procured against specific order and as long as the sale against order is in profit, they value the raw material at cost, irrespective of current market price. Work in progress is valued by the management on the basis of cost of input and prorates cost of labor and overheads. No quantitative details of work in progress were made available to us. As explained by the company officials, it is not possible for them to make quantitative details in the middle of the month. Figure of work in progress has been worked out on the basis of value as at the opening day of month plus value of material issued less value of dispatch made. Finished goods are valued by the management on the basis of cost of production or sale price, whichever is lower. However, no cost sheet was made available to us for verification of valuation of finished goods. Consumables and stores and spares are also valued at cost price and are shown as part of raw material. . b) Comments on No major discrepancies were observed during the discrepancies found if verification of stocks, except the following any 1. Quantitative details of work in progress have not been provided to us. Values as submitted by the management, have been relied upon. 2. Cost sheet in respect of finished goods has not been provided by the management. Hence, valuation as carried by the management, has been relied upon. 3. Physical stocks of the raw material at Hyderabad unit are kept at the factory floor and are mixed up with the work in progress. Hence it becomes very difficult to segregate the stock of raw material and stock in progress. 5) Insurance coverage/ availability of Bank clause/ status of claims made, if any. a) Amount of Insurance Policy Factory Building Rs. 260 lac Rs. 80 lac Nil Rs. 200 lac Rs. 120 lac Nil Plant & Machinery Rs. 860 lac Rs.500 lac Nil Rs.200 lac Rs.225 lac Nil Furniture & Fixture Rs. 50 lac Rs.260 lac Nil Rs.15 lac Rs.22 lac Nil Stock Rs. 5500 lac Rs.350 lac Rs.18 lac Rs.125 lac Rs.350 lac Nil Residential Rs. 112 lac Rs. 27 lac Nil Nil Nil Nil Building Office Building Nil Rs. 21 lac Rs. 20 lac Rs. 60 lac Nil Rs. 4 lac Jigs Nil Rs 140 lac Nil Nil Rs 0.40 lac Nil Total Rs. 6782 lac Rs. 1144 lac Rs. 38 lac Rs. 600 lac Rs. 698 lac Rs. 4 lac b) Valid till 31.10.2009 31.10.2009 31.10.2009 31.10.2009 31.10.2009 31.10.2009 c) Risk Covered Fire Fire Fire Fire Fire Fire including including including including including including earthquake earthquake earthquak earthquake earthquake earthquake e d) Banker’s Clause Yes Yes Yes Yes Yes Yes e) Location stated Delhi A-2, 9, Ashok Ashok 9, Woods in the policy Sonepat Industrial Kaliprasan Marg, Marg, Road, Road, Area, na Road, Sanantha Sanantha Chennai Sonepat Ghaziabad Kolkata Nagar, Nagar, (Transforme (Elevator ECE Hyderabad Hyderabad r Unit) unit) nagar, (Meter (Transfor Bata Unit) mer Unit) Nagar, 24 Pargana 6 a) Whether Stock statements are Stock statement is submitted by the party in their format. submitted in prescribed format and within Stock statement for the month of Jan was submitted on 14th stipulated time. February, 2009. Stock Statement for the month of Feb. 09 was not submitted till 13th March, 2009. b)Whether Letters of Credit opened during Letter of credit opened by the borrower is not reflected in the relevant period and stocks received on the books of accounts of the borrower and are shown as account of the same are properly reflected contingent liability in the annual accounts. However, from in the borrower’s books and statements the date of receipt of goods/documents till the date of submitted to the branch. payment, amount payable is reflected as sundry creditors in the books of the borrower. Outstanding sundry creditors are reflected in the stock statement submitted by the borrower. 7) Analysis of Receivables a) Major customers of the borrower Transformer Division, Sonepat 1. HPSEB, Shimla 2. HVPNL, Panchkula 3. MPEB, Jabalpur 4. PSEB 5. PVVNL, Merrut 6. RRVPNL 7. Siddhartha Engineering Ltd. 8. TNEB, Chennai 9. WBSEB, Kokata Elevator Division, Ghaziabad 1) Hooghly River Bridge Commission 2) Mahanadi Coal Fields Ltd. 3) Hotel Rohit Budha Park, Kolkata 4) Birla Tyres Laksar 5) Eminent infra Dev. Pvt. Ltd. 6) Jamia Milia Islamia 7) P N Writer co. Pvt. Ltd. Transformer Division, Hyderabad 1) SPDCL of Andhra Pradesh 2) TNEB Chennai 3) NESCO Orissa 4) SOUTHCO Orissa 5) WESCO, Orissa b) Verification of Receivables (Rs. In Lacs) Age of receivables, doubtful debts, chances of 0-180 days 6526.02 recovery, position regarding confirmation of above 180 days 3209.55 balance from debtors, dispute on outstanding receivables, if any c) Whether Book Debt statements are submitted Book Debts statements are submitted party by the party wise and age wise and within wise and age wise. Book-debts statement for stipulated time the month of Jan was submitted on 14th February, 2009. Book-debts Statement for the month of Feb. 09 was not submitted till 13th March, 2009. d) Whether the quarterly statements of debtors No chartered accountants verified book debt submitted to the branch are duly verified by the statement was made available to us. Chartered Accountants. e) Discrepancies, if any, found in reporting in No Discrepancy was observed during verification of borrower’s records, bills/ verification of books of accounts of the invoices raised and statement of Book Debts borrower. submitted to the bank f) Whether advance received from the Yes customers / discount allowed on sales are properly accounted. g) Whether receivables already advanced by N.A. way of bill finance are excluded in the book debts statement h) Book Debts of associate concerns No such book debt was observed. 8) Position of Creditors for purchase of Raw Materials, Stores & Spares a) Whether outstanding amount of creditors is There are sundry creditors of Rs. 3428.88 lacs properly reported in the stock statement as on the date of verification of stocks. No (including unpaid bills under LCs for goods) disputed creditors were reported.. This figure include unpaid bill under letter of credit. As mentioned earlier that company does not record goods procured under L/C in the books. But the same are recorded as outstanding creditors. Sundry creditors are deducted from the stocks, while calculating drawing power. b) Any long outstanding creditors, if so, reasons No such outstanding reported. 9) Comments on treatment of inter-group/ No inter group/inter divisional transaction inter-divisional sales/ purchases and observed comments thereon. 10) a) Comments on production and sales of For the year 2008-09, company has projected the company vis-à-vis estimates/ projections total sales turnover of Rs. 26753.00 lac. submitted to bank for working capital During the current year of operation company assessment has registered sales turnover of Rs.19170 lac till February, 2009 (Transformer Division, Sonepat – Rs. 15472 lac, Transformer Division, Hyderabad – Rs. 2591 lac and Elevator Division, Ghaziabad – Rs. 1097 lac). Turnover achieved till February, 2009 is about 72% of total projected turnover, considering the monthly sales trend the targeted turnover of Rs. 26753 lac seems to be difficult to achieve b) Comments on submission of quarterly Quarterly statements are submitted in line statements and actual performance vis-à-vis with the annual projection. The company has quarterly projections achieved sales of Rs. 3201.84 lac, Rs. 6851.51 lac and Rs.4222.24 during quarter ended June 2008, September, 2008 and December 2008 respectively. 11) Routing of banking transactions Routine banking transactions in the account of the borrower are satisfactory. Till date total credit in account with Ban of Baroda during the current year is 46.76 crores. 12) Variance, if any, in calculation of drawing power as per Bank’s guidelines. Value as assessed Value as reported Variance, Reasons for variance by the auditors by the Company if any (as on as on 31.01.2009 31.01.2009) Stocks Rs. 168.93 lac Rs.115.18 lac Rs.53.75 Stocks of Rs. 71.67 lac are lac shown at Meter Division at Hyderabad. But this unit is not in operation. Receivables Rs. 6648.86 lac Rs.6648.86 lac Nil Whether stipulated margins are Yes maintained and sub-limits are adhered to 13) Gist of discussions had with a. Company should improve store management at officials of the company. Hyderabad unit. b. Method of valuation of raw material at Sonepat unit, was discussed with the company officials and their view point & our view point has been reflected in the column method of valuation. 14) Any other Comments/ I. As per stock statement of January, 2009, company Observations: has shown stock of Rs. 71.67 lac at Meter Division at Hyderabad. We were informed by the company officials that this unit is closed and is not in operation. II. Stock of raw material at transformer division, Hyderabad should be properly segregated from work in progress. III. Raw material should be properly stacked and marked for proper identification. IV. Raw material of similar nature and variety should be kept in vicinity and should not be scattered. V. Borrower should submit basis of valuation of finished goods properly supported by cost sheet along with justification of cost of each material. VI. Valuation of raw material should be carried at cost price or market price, whichever is lower, as against the company’s present policy of valuing raw material at cost price as long as the order for which material is procured, is in profit. VII. Insurance coverage of stocks at Transformer Division, Hyderabad should be increased by Rs. 300-400 lacs. VIII. Sales Record of Transformer Division, Hyderabad indicates that there are no sales during the month of November and December 2008, which indicate that the unit was not in production during that time. For Nidhi Harish & Associates Chartered Accountants Place : New Delhi Date : 16-03-09 Harish Rohila Partner BOB/StockAudit/08-09/02 31st March, 2009

The Dy. General Manager Bank of Baroda Parliament Street Branch Parliament Street New Delhi – 110 001..

Dear Sir,

Sub. : Stock Audit Report of M/s ECE Industries Limited

This is in reference to your Regional office letter no RO/DMR-1/ADV/48/97 dated 09.01.2009 regarding allocation of stock audit of captioned Borrower.

In this regard, we are enclosing our stock audit report dated 31th March, 2009 of the captioned borrower.

Hope you will find the same in order.

Thanking You

Yours truly, For Nidhi Harish & Associates Chartered Accountants

Harish Rohila Partner

CC: Bank of Baroda Regional Office (DMR-1) New Delhi