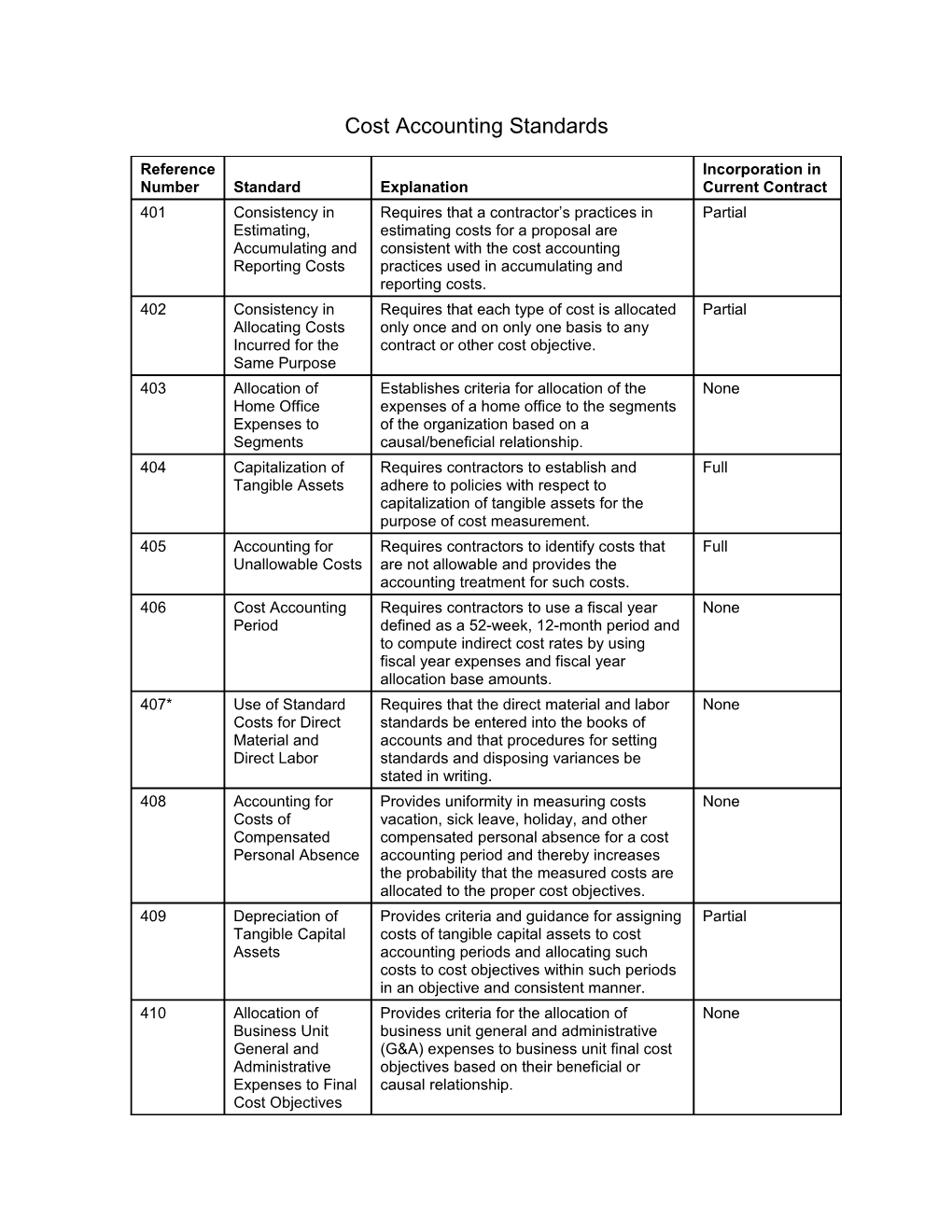

Cost Accounting Standards

Reference Incorporation in Number Standard Explanation Current Contract 401 Consistency in Requires that a contractor’s practices in Partial Estimating, estimating costs for a proposal are Accumulating and consistent with the cost accounting Reporting Costs practices used in accumulating and reporting costs. 402 Consistency in Requires that each type of cost is allocated Partial Allocating Costs only once and on only one basis to any Incurred for the contract or other cost objective. Same Purpose 403 Allocation of Establishes criteria for allocation of the None Home Office expenses of a home office to the segments Expenses to of the organization based on a Segments causal/beneficial relationship. 404 Capitalization of Requires contractors to establish and Full Tangible Assets adhere to policies with respect to capitalization of tangible assets for the purpose of cost measurement. 405 Accounting for Requires contractors to identify costs that Full Unallowable Costs are not allowable and provides the accounting treatment for such costs. 406 Cost Accounting Requires contractors to use a fiscal year None Period defined as a 52-week, 12-month period and to compute indirect cost rates by using fiscal year expenses and fiscal year allocation base amounts. 407* Use of Standard Requires that the direct material and labor None Costs for Direct standards be entered into the books of Material and accounts and that procedures for setting Direct Labor standards and disposing variances be stated in writing. 408 Accounting for Provides uniformity in measuring costs None Costs of vacation, sick leave, holiday, and other Compensated compensated personal absence for a cost Personal Absence accounting period and thereby increases the probability that the measured costs are allocated to the proper cost objectives. 409 Depreciation of Provides criteria and guidance for assigning Partial Tangible Capital costs of tangible capital assets to cost Assets accounting periods and allocating such costs to cost objectives within such periods in an objective and consistent manner. 410 Allocation of Provides criteria for the allocation of None Business Unit business unit general and administrative General and (G&A) expenses to business unit final cost Administrative objectives based on their beneficial or Expenses to Final causal relationship. Cost Objectives Reference Incorporation in Number Standard Explanation Current Contract 411 Accounting for Provides criteria for accounting for the direct None Acquisition Costs and indirect costs of materials. of Material 412 Compensation Provides guidance for determining pension Full and Measurement costs for a cost accounting period and of Pension Cost distinguishes between defined benefit plans and defined contribution plans. 413 Adjustment and Provides guidance for determining pension Full Allocation of costs for a period and actuarial gains and Pension Cost losses and criteria for the allocation of pension costs among the segments of a contractor. 414 Cost of Money as Recognizes the cost of money invested in a Full an Element of the contractor’s facilities as a cost of Cost of Facilities Government contracts. Capital 415 Accounting for the Provides criteria for measuring the costs of Full Cost of Deferred deferred compensation and the Compensation determination of the period in which it is recognized as a cost. 416 Accounting for Provides criteria for measuring insurance Partial Insurance Costs costs, assigning costs to cost accounting periods, and allocating them to cost objectives. 417 Cost of Money as Establishes criteria for measuring and Full an Element of the allocating the cost of money attributable to Cost of Capital capital assets under construction. Assets Under Construction 418 Allocation of Provides for the consistent determination of None Direct and Indirect direct and indirect cost, criteria for the Costs accumulation of indirect costs, and guidance relating to the selection of allocation bases. 419 Reserved 420 Accounting for Provides criteria for accumulating Partial Independent independent research and development Research and costs and bid and proposal costs and for Development allocating of such costs to cost objectives Costs and Bid and based on the beneficial or causal Proposal Costs relationship between such costs and cost objectives.