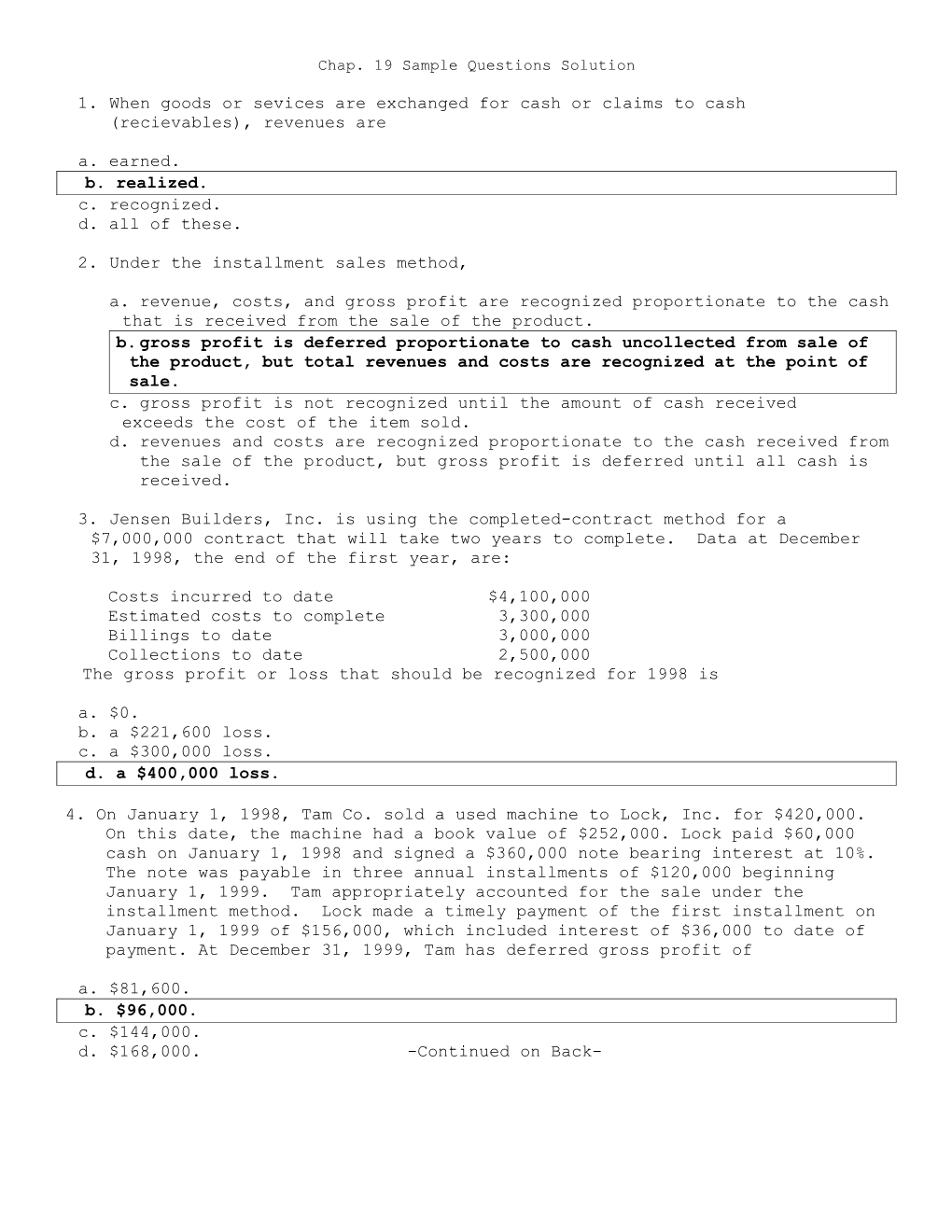

Chap. 19 Sample Questions Solution

1. When goods or sevices are exchanged for cash or claims to cash (recievables), revenues are

a. earned. b. realized. c. recognized. d. all of these.

2. Under the installment sales method,

a. revenue, costs, and gross profit are recognized proportionate to the cash that is received from the sale of the product. b. gross profit is deferred proportionate to cash uncollected from sale of the product, but total revenues and costs are recognized at the point of sale. c. gross profit is not recognized until the amount of cash received exceeds the cost of the item sold. d. revenues and costs are recognized proportionate to the cash received from the sale of the product, but gross profit is deferred until all cash is received.

3. Jensen Builders, Inc. is using the completed-contract method for a $7,000,000 contract that will take two years to complete. Data at December 31, 1998, the end of the first year, are:

Costs incurred to date $4,100,000 Estimated costs to complete 3,300,000 Billings to date 3,000,000 Collections to date 2,500,000 The gross profit or loss that should be recognized for 1998 is

a. $0. b. a $221,600 loss. c. a $300,000 loss. d. a $400,000 loss.

4. On January 1, 1998, Tam Co. sold a used machine to Lock, Inc. for $420,000. On this date, the machine had a book value of $252,000. Lock paid $60,000 cash on January 1, 1998 and signed a $360,000 note bearing interest at 10%. The note was payable in three annual installments of $120,000 beginning January 1, 1999. Tam appropriately accounted for the sale under the installment method. Lock made a timely payment of the first installment on January 1, 1999 of $156,000, which included interest of $36,000 to date of payment. At December 31, 1999, Tam has deferred gross profit of

a. $81,600. b. $96,000. c. $144,000. d. $168,000. -Continued on Back- Potter Builders contracted to build a high-rise for $12,500,000. Construction began in 1998 and is expected to be completed in 2001. Data for 1998 and 1999 are: 1998 1999 Actual total cost incurred through year end $2,000,000 $ 6,300,000 Year end Estimated costs to complete 8,000,000 4,200,000 Customer Billings for the year 2,400,000 3,000,000 Customer Collections for the year 2,200,000 3,100,000

Required: (a) How much gross profit should be reported by Potter on this contract for 1998? (Assuming percentage-of-completion accounting method) (1pts)

Total Gross profit (1998) = $12,500,000 - $10,000,000 = $2,500,000 Percentage complete end of 1998 ($2,000,000 / $10,000,000) = 20% Gross Profit recognized in 1998 $ 500,000

(b) Prepare the summary entry to recognize revenue, expense, and profit on the contract for 1999 (Assuming percentage-of-completion accounting method) (2pts)

Cost of L-T construction 4,300,000 Consturction in process 700,000 L-T Construction revenues 5,000,000 (40% of total)

(c) Assuming percentage-of-completion accounting method, the balance sheet at the end of 1998 should show a current Asset or Liability (circle appropriate response) in the amount of 100,000 dollars for the difference between billings and construction in process (2pts).

(d) If the completed contract method was used the balance sheet at the end of 1998 should show a current Asset or Liability (circle appropriate response) in the amount of 400,000 dollars for the difference between billings and construction in process (2pts).

Bonus Question:

What is the 1999 year end balance in accounts receivable for this contract? (1pt bonus)

Billings through end of 1999 $5,400,000 Less: Collection through end of 1999 5,300,000 Accounts receivable end of 1999 $ 100,000