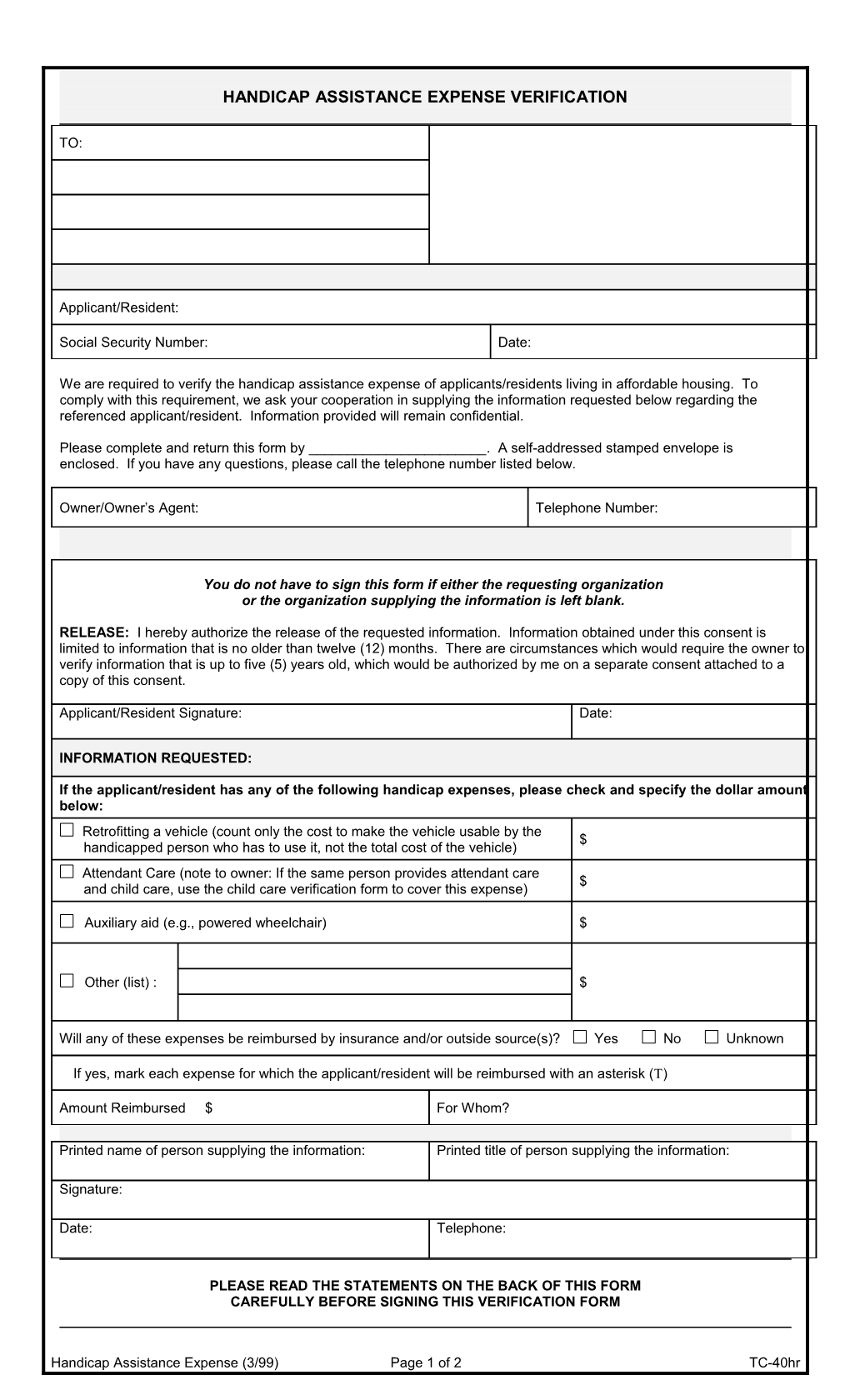

HANDICAP ASSISTANCE EXPENSE VERIFICATION

TO:

Applicant/Resident:

Social Security Number: Date:

We are required to verify the handicap assistance expense of applicants/residents living in affordable housing. To comply with this requirement, we ask your cooperation in supplying the information requested below regarding the referenced applicant/resident. Information provided will remain confidential.

Please complete and return this form by ______. A self-addressed stamped envelope is enclosed. If you have any questions, please call the telephone number listed below.

Owner/Owner’s Agent: Telephone Number:

You do not have to sign this form if either the requesting organization or the organization supplying the information is left blank.

RELEASE: I hereby authorize the release of the requested information. Information obtained under this consent is limited to information that is no older than twelve (12) months. There are circumstances which would require the owner to verify information that is up to five (5) years old, which would be authorized by me on a separate consent attached to a copy of this consent.

Applicant/Resident Signature: Date:

INFORMATION REQUESTED:

If the applicant/resident has any of the following handicap expenses, please check and specify the dollar amount below: Retrofitting a vehicle (count only the cost to make the vehicle usable by the $ handicapped person who has to use it, not the total cost of the vehicle) Attendant Care (note to owner: If the same person provides attendant care $ and child care, use the child care verification form to cover this expense)

Auxiliary aid (e.g., powered wheelchair) $

Other (list) : $

Will any of these expenses be reimbursed by insurance and/or outside source(s)? Yes No Unknown

If yes, mark each expense for which the applicant/resident will be reimbursed with an asterisk ()

Amount Reimbursed $ For Whom?

Printed name of person supplying the information: Printed title of person supplying the information:

Signature:

Date: Telephone:

PLEASE READ THE STATEMENTS ON THE BACK OF THIS FORM CAREFULLY BEFORE SIGNING THIS VERIFICATION FORM

Handicap Assistance Expense (3/99) Page 1 of 2 TC-40hr PENALTIES FOR MISUSING THIS CONSENT: Title 18, Section 1001 of the U.S. Code state that a person is guilty of a felony for knowingly and willingly making false or fraudulent statements to any department of the United States Government. HUD, the PHA, Rural Housing Service (RHS) and any owner (or any employee of HUD, the PHA, RHS or the owner) may be subject to penalties for unauthorized disclosures or improper uses of information collected based on the consent form. Use of the information collected based on this verification form is restricted to the purposes cited above. Any person who knowingly or willfully requests, obtains or discloses any information under false pretenses concerning an applicant or participant may be subject to a misdemeanor and fined not more than $5,000. Any applicant or participant affected by negligent disclosure or information may bring civil action for damages, and seek other relief, as may be appropriate, against the officer or employee of HUD, the PHA, RHS or the owner responsible for the unauthorized disclosure or improper use. Penalty provisions for misusing the social security number are contained in the Social Security Act at 42 U.S.C. 208 (f) (g) and (h). Violation of these provisions are cited as violations of 42 U.S.C. 408 f, g and h.

WARNING: Section 1001 of Title 18, United State code provides: “Whoever, in any matter within any jurisdiction of any department or agency of the United States knowingly or willfully falsifies, conceals or covers up… a material fact, or makes any false, fictitious or fraudulent statements or representation, or makes any false writing or document knowing the same to contain any false, fictitious or fraudulent statement or entry, shall be fined not more than $10,000 or imprisoned not more than 5 years or both.”

NOTE:

This Apartment Community does not discriminate on the basis of handicapped status in the admission or access to, or treatment or employment in, its federally assisted programs and activities.

Handicap Assistance Expense (3/99) Page 2 of 2 TC-40hr