Table of Contents

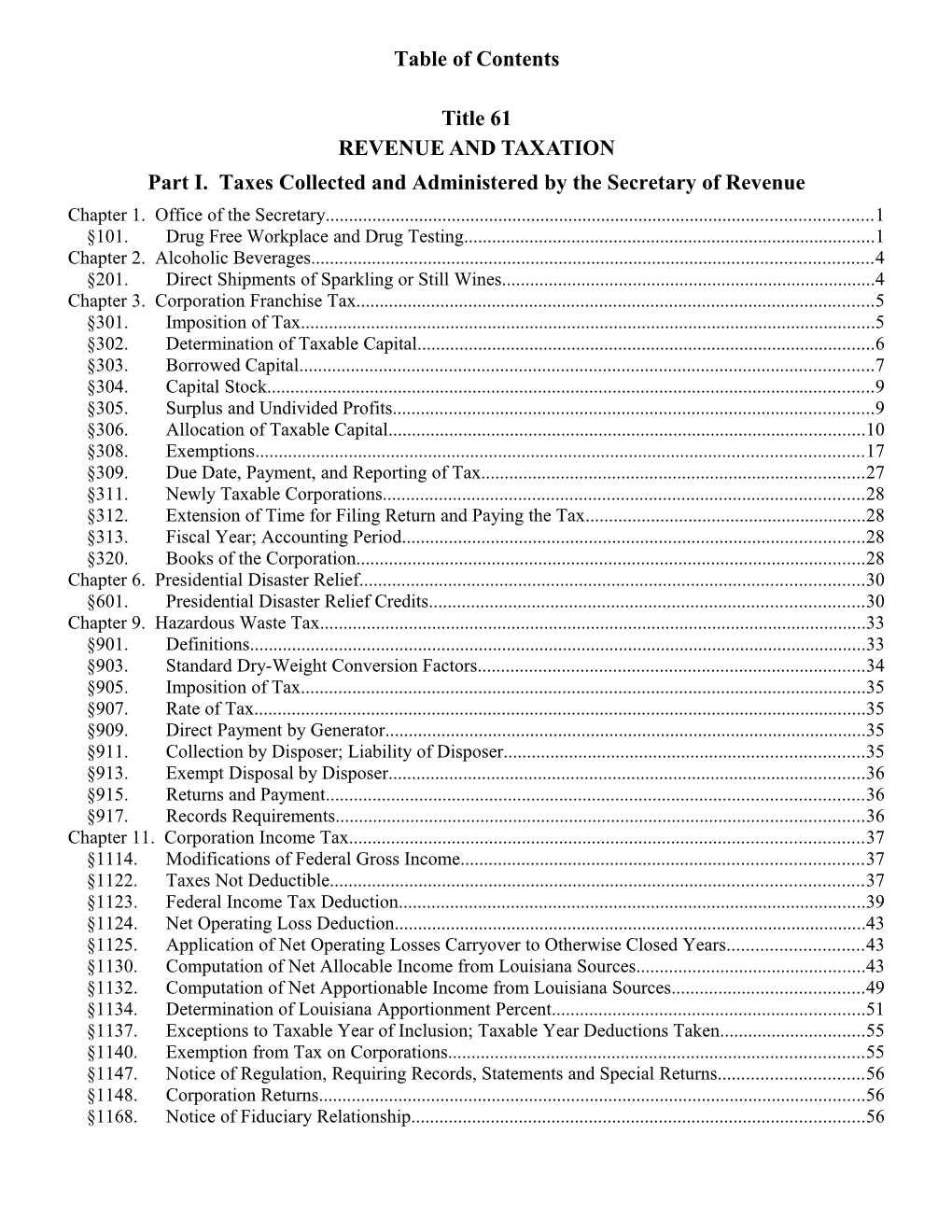

Title 61 REVENUE AND TAXATION Part I. Taxes Collected and Administered by the Secretary of Revenue Chapter 1. Office of the Secretary...... 1 §101. Drug Free Workplace and Drug Testing...... 1 Chapter 2. Alcoholic Beverages...... 4 §201. Direct Shipments of Sparkling or Still Wines...... 4 Chapter 3. Corporation Franchise Tax...... 5 §301. Imposition of Tax...... 5 §302. Determination of Taxable Capital...... 6 §303. Borrowed Capital...... 7 §304. Capital Stock...... 9 §305. Surplus and Undivided Profits...... 9 §306. Allocation of Taxable Capital...... 10 §308. Exemptions...... 17 §309. Due Date, Payment, and Reporting of Tax...... 27 §311. Newly Taxable Corporations...... 28 §312. Extension of Time for Filing Return and Paying the Tax...... 28 §313. Fiscal Year; Accounting Period...... 28 §320. Books of the Corporation...... 28 Chapter 6. Presidential Disaster Relief...... 30 §601. Presidential Disaster Relief Credits...... 30 Chapter 9. Hazardous Waste Tax...... 33 §901. Definitions...... 33 §903. Standard Dry-Weight Conversion Factors...... 34 §905. Imposition of Tax...... 35 §907. Rate of Tax...... 35 §909. Direct Payment by Generator...... 35 §911. Collection by Disposer; Liability of Disposer...... 35 §913. Exempt Disposal by Disposer...... 36 §915. Returns and Payment...... 36 §917. Records Requirements...... 36 Chapter 11. Corporation Income Tax...... 37 §1114. Modifications of Federal Gross Income...... 37 §1122. Taxes Not Deductible...... 37 §1123. Federal Income Tax Deduction...... 39 §1124. Net Operating Loss Deduction...... 43 §1125. Application of Net Operating Losses Carryover to Otherwise Closed Years...... 43 §1130. Computation of Net Allocable Income from Louisiana Sources...... 43 §1132. Computation of Net Apportionable Income from Louisiana Sources...... 49 §1134. Determination of Louisiana Apportionment Percent...... 51 §1137. Exceptions to Taxable Year of Inclusion; Taxable Year Deductions Taken...... 55 §1140. Exemption from Tax on Corporations...... 55 §1147. Notice of Regulation, Requiring Records, Statements and Special Returns...... 56 §1148. Corporation Returns...... 56 §1168. Notice of Fiduciary Relationship...... 56 Table of Contents

§1175. Definition of Separate Corporation Basis...... 57 §1189. Situs of Stock Canceled or Redeemed in Liquidation...... 57 §1195. Health Insurance Credit for Contractors of Public Works...... 58 Chapter 13. Income: Individual...... 59 §1301. Requirements for Submitting Claims for Offset of Individual Income Tax Refunds against Debts Owed Certain State Agencies...... 59 §1302. Nonresident Net Operating Losses...... 59 §1303. Application of the Louisiana Individual Income Tax to Native Americans...... 60 §1304. Nonresident Apportionment of Compensation from Personal Services Rendered in Louisiana.60 §1305. Income Tax Schedule Requirement for Certain Nonresident Professional Athletes and Professional Sports Franchises...... 63 §1306. Offset of Individual Income Tax Refunds against Debts Owed Certain Persons...... 63 §1307. Federal Income Tax Deduction...... 63 §1310. Income Tax Tables...... 64 §1311. Annual Retirement Income Exemption for Individuals 65 or Older...... 80 §1351. Suspension, Revocation, and Denial of Hunting and Fishing Licenses...... 81 §1355. Suspension and Denial of Renewal of Drivers' Licenses...... 82 Chapter 14. Income: Partnerships...... 83 §1401. Partnership Composite Return Requirement, Composite Payment Requirement, Exceptions....83 Chapter 15. Income: Withholding Tax...... 85 §1501. Income Tax Withholding Tables...... 85 §1505. Electronic Systems for Withholding Exemption Certificates...... 100 §1510. Requirements for Substitute Form W-2, Copy 2, Furnished to Payees...... 101 §1515. Withholding Tax Statements and Returns―Electronic Filing Requirements...... 101 §1516. Payment...... 102 §1520. Withholding by Professional Athletic Teams...... 102 §1525. Income Tax Withholding on Gaming Winnings...... 103 Chapter 16. Louisiana Entertainment Industry Tax Credit Programs...... 104 Subchapter A. Motion Picture Investor Tax Credit Program...... 104 §1601. Purpose...... 104 §1603. General Description...... 104 §1605. Definitions...... 105 §1607. Certification Procedures...... 107 §1609. Additional Program Provisions―Production...... 109 §1611. Additional Program Provisions―Infrastructure...... 110 §1613. Application of the Tax Credit...... 111 §1615. Louisiana Screenplay Credit...... 112 §1617. Louisiana Music...... 113 §1619. Louisiana Promotional Graphic...... 113 §1621. Louisiana Filmmaker Credit...... 114 Subchapter B. Louisiana Sound Recording Investor Tax Credit Program...... 114 §1631. Purpose and Description of Louisiana Sound Recording Investor Tax Credit Program...... 114 §1633. Definitions...... 114 §1635. Rules of Application...... 115 §1637. Certification...... 116 §1639. Credits...... 118 §1641. Illustrative Examples of Production Expenses...... 119 Subchapter C. Louisiana Digital Media and Software Act...... 119 §1661. Purpose...... 119 §1663. General Description...... 119 Table of Contents

§1665. Definitions...... 119 §1667. Certification Procedures...... 121 §1668. Illustrative Examples of Production Expenses...... 124 §1669. Use of Tax Credits...... 125 §1671. Recapture and Recovery of Tax Credits...... 127 §1673. Agreed-Upon Accounting Procedures...... 127 Subchapter D. Musical and Theatrical Production Income Tax Credit Program...... 127 §1690. Purpose...... 127 §1691. General Description...... 127 §1692. Definitions...... 128 §1693. Certification Procedures...... 130 §1694. Illustrative Examples of Production Expenses...... 131 §1695. Additional Program Procedures—State-Certified Musical or Theatrical ProductionReceiving Initial Certification prior to July 1, 2015...... 132 §1696. Additional Program Procedures—State-Certified Musical or Theatrical ProductionReceiving Initial Certification on or after July 1, 2015...... 133 §1697. Additional Program Procedures—State-Certified Higher-Education Musical or Theatrical Infrastructure ProjectsReceiving Initial Certification on or after July 1, 2015....133 §1698. Certification Procedures—Infrastructure [Formerly §1697]...... 134 §1699. Application of the Tax Credit...... 135 Chapter 19. Miscellaneous Tax Exemptions, Credits and Deductions...... 135 §1901. Employer Tax Credits for Donations of Materials, Equipment, or Instructors to Certain Training Programs or Schools...... 135 §1902. Inventory Tax Credits...... 136 §1903. Administration of the School Readiness Tax Credits...... 137 §1905. Telephone Company Property Assessment Relief Fund...... 138 §1907. Income Tax Credits for Solar Energy Systems...... 138 §1909. National Center for Construction Education and Research Apprenticeship Tax Credits...... 142 §1911. Louisiana New Markets Tax Credit...... 143 §1912. Louisiana New Markets Jobs ActPremium Tax Credit...... 144 §1913. Alternative Fuel Tax Credit...... 146 Chapter 29. Natural Resources: Severance Tax...... 149 §2901. Severance Tax on Timber, Pulpwood and Minerals Other Than Gas and Oil...... 149 §2903. Severance Taxes on Oil; Distillate, Condensate or Similar Natural Resources; Natural Gasoline or Casinghead Gasoline; Liquefied Petroleum Gases and Other Natural Gas Liquids; and Gas...... 151 Chapter 31. Petroleum Products: Gasoline Tax...... 155 §3101. Government Exemptions...... 155 §3103. Bonded Jobbers...... 155 §3105. Purchase, Storage and Use of Refund Gasoline by Farmers, Fishermen and Operators of Aircraft...... 156 §3107. Sale of Refund Gasoline by Dealers...... 156 Chapter 33. Petroleum Products: Special Fuels Tax...... 157 Subchapter A. Retail Dealers of Special Fuels...... 157 §3301. Definitions...... 157 §3303. Collection and Payment of Tax...... 157 §3305. Records Required; Invoices; False or Inadequate Records a Violation...... 158 §3307. Sale of Dyed Special Fuels...... 158 Subchapter B. Users of Special Fuels...... 158 §3351. Provisions Relating to Users of Special Fuels...... 158 Table of Contents

§3353. Invoice Requirements...... 160 §3355. Refunds or Credits; Undyed Diesel Fuel Used for Other than Highway Purposes...... 160 §3357. Use by State Agencies, Parish and Municipal Governments, and Other Political Subdivisions...... 161 §3359. Sales; Uses of Dyed Fuel...... 161 §3361. Use by Farmers...... 161 §3363. Use of Dyed Special Fuel by Fire Trucks...... 161 Chapter 35. Petroleum Products: Provisions Common to Taxes on Gasoline or Motor Fuel and Lubricating Oils...... 162 §3501. Designated Routes...... 162 Chapter 39. Public Utilities and Carriers: Transportation and Communications Tax...... 163 §3901. Provisions Relating to the Transportation and Communications Tax...... 163 Chapter 41. Public Utilities and Carriers: Natural Gas Franchise Tax...... 163 §4101. Imposition of Tax...... 163 §4103. Gross Receipts; General Definition...... 163 §4105. Gross Receipts; Interstate Business...... 163 §4107. Gross Receipts; Transportation for Own Use...... 163 Chapter 43. Sales and Use Tax...... 164 §4301. Uniform State and Local Sales Tax Definitions...... 164 §4302. Pollution Control Devices and Systems Excluded from the Definition of "Sale at Retail"...... 179 §4303. Imposition of Tax...... 180 §4305. Imposition of Tax...... 182 §4307. Collection...... 182 §4309. Collection of Tax...... 186 §4311. Treatment of Tax by Dealer...... 186 §4351. Returns and Payment of Tax, Penalty for Absorption of Tax...... 187 §4353. Collection from Interstate and Foreign Transportation Dealers...... 188 §4355. Collector's Authority to Determine the Tax in Certain Cases...... 189 §4357. Termination or Transfer of a Business...... 190 §4359. Dealers Required to Keep Records...... 190 §4361. Wholesalers and Jobbers Required to Keep Records...... 191 §4363. Collector's Authority to Examine Records of Transportation Companies...... 191 §4365. Failure to Pay Tax on Imported Tangible Personal Property; Grounds for Attachment...... 191 §4367. Failure to Pay Tax; Rule to Cease Business...... 191 §4369. Sales Returned to Dealer; Credit or Refund of Tax...... 192 §4371. Sales Tax Refund for Tangible Personal Property Destroyed in a Natural Disaster...... 193 §4372. Payment of Sales and Use Taxes by Persons Constructing, Renovating, or Altering Immovable Property...... 193 §4373. Nonresident Contractors...... 194 Chapter 44. Sales and Use Tax Exemptions...... 195 §4401. Various Exemptions from Tax...... 195 §4402. Exemptions from Lease or Rental Tax, Helicopters...... 199 §4403. Ships and Ships' Supplies...... 199 §4404. Seeds Used in Planting of Crops...... 200 §4406. Little Theater Tickets...... 200 §4407. Tickets to Musical Performances of Nonprofit Musical Organizations...... 201 §4408. Pesticides Used for Agricultural Purposes...... 201 §4409. Motion Picture Film Rental...... 201 §4410. Property Purchased for First Use Outside the State...... 201 §4411. Contracts Prior to and within 90 Days of Tax Levy...... 203 Table of Contents

§4413. Admissions to Entertainment Furnished by Certain Domestic Nonprofit Corporations...... 203 §4414. Cable Television Installation and Repair...... 204 §4416. Purchases of Mardi Gras Specialty Items...... 204 §4417. Exclusions and Exemptions; Purchases Made with United States Department of Agriculture Food Stamp Coupons and Purchases Made under the Women, Infants, and Children's Program...... 205 §4418. Nonprofit Organizations; Nature of Exemption; Limitations; Qualifications...... 205 §4420. Property Used in Interstate Commerce...... 206 §4423. State Sales Tax Holiday on Purchases of Hurricane-Preparedness Items...... 207 Chapter 49. Tax Collection...... 208 §4901. Alternative Remedies for the Collection of Taxes...... 208 §4903. Timely Filing When the Due Date Falls on Saturday, Sunday, or Legal Holiday...... 210 §4905. Signature Alternatives; Electronic Filings...... 210 §4906. Signature Alternatives for Preparers...... 210 §4907. Remittance of Tax under Protest, Suits or Petitions to Recover...... 210 §4908. Insufficient Funds Checks...... 210 §4909. Refund Claims...... 211 §4910. Electronic Funds Transfer...... 211 §4911. File Date of Returns and Other Documents; Payment Dates...... 213 §4913. Collection of In-State Tax Liabilities by Debt Collection Agencies or the Attorney General's Office...... 214 §4915. Louisiana Tax Delinquency Amnesty Act of 2014...... 215 §4919. Installment Agreement for Payment of Tax...... 215 Chapter 51. Tobacco Tax...... 216 §5101. Reporting of Certain Imported Cigarettes; Penalty...... 216 Chapter 53. Miscellaneous Fees...... 217 §5301. Oilfield Site Restoration Fee...... 217 §5302. Issuance and Cancellation of a Lien; Fees...... 217 Part III. Administrative and Miscellaneous Provisions Chapter 1. Agency Guidelines...... 219 §101. Policy Statements...... 219 Chapter 3. Alternative Dispute Resolution Procedures...... 222 §301. Definitions...... 222 §303. Type of Alternative Dispute Resolution Process...... 222 §305. Initiation of Arbitration...... 222 §307. Persons Authorized to Participate in Arbitration...... 223 §309. Registry of Arbitrators...... 223 §311. Time Delay for Providing Names of Arbitrators...... 223 §313. Selection of Arbitration Company...... 223 §315. Disclosure of Conflict of Interest...... 223 §317. Procedures for Arbitration...... 223 §319. Discovery...... 224 §321. Arbitration Hearing...... 224 §323. Sequence of the Arbitration Hearing...... 224 §325. Ex Parte Communication with the Arbitrator...... 224 §327. Privacy...... 225 §329. Confidentiality...... 225 §331. Fees and Expenses...... 225 §333. Taxpayer's Duty to Protect Protests and Appeals...... 225 Table of Contents

§335. Notice of a Waiver or Extension...... 225 Chapter 5. Authorized Representatives...... 226 §501. Designation of Tax Matters Person...... 226 Chapter 11. Donations...... 227 §1101. Donations to the Louisiana Military Family Assistance Fund...... 227 Chapter 15. Mandatory Electronic Filing of Tax Returns and Payment...... 228 §1501. Requirement for Tax Preparers to File Income Tax Returns Electronically...... 228 §1511. Lessors of Motor Vehicles—Electronic Filing Requirement...... 228 §1513. Automobile Rental Tax Return, Form R-1329—Electronic Filing Requirement...... 229 §1515. Tax Increment Financing District Sales Tax Returns, Form R-1029—Electronic Filing Requirement...... 229 §1517. Hotel and Motel Sales Tax Return, Form R-1029DS—Electronic Filing Requirement...... 229 §1519. New Orleans Exhibition Hall Authority Additional Room Occupancy Tax and Food and Beverage Tax Return, Form R-1325—Electronic Filing Requirement...... 230 §1521. Louisiana State and Parish and Municipalities Beer Tax Return, Form R-5621—Electronic Filing Requirement...... 230 §1523. Hotel/Motel Sales Tax Return, Form R-1029H/M—Electronic Filing Requirement...... 230 §1525. Severance Tax—Oil or Gas...... 231 §1527. Electronic Filing Mandate for Reports and Returns related to the Sports Facility Assistance Fund...... 231 §1532. Payment of Taxes by Credit or Debit Cards; Other...... 232 Chapter 17. Administrative Fees...... 234 §1701. Fees for Searching for Returns and Other Documents, Authenticating and Certifying Copies of Records...... 234 Chapter 21. Interest and Penalties...... 235 §2101. Penalty Waiver...... 235 §2103. Voluntary Disclosure Agreements...... 235 §2115. Abatement and Compromise of Interest...... 237 § 2116. Interest Waiver and Filing Extensions Following Disasters...... 238 Chapter 25. Returns...... 238 §2501. Individual Income Tax Filing Extensions...... 238 §2503. Corporation Income and Franchise Tax Filing Extensions...... 239 §2505. Filling Extensions for Partnerships filing Composite Returns...... 239 Chapter 27. Transferable Income and Franchise Tax Credits...... 239 §2701. Public Registry of Motion Picture Investor Tax Credit Brokers...... 239 Part V. Ad Valorem Taxation Chapter 1. Constitutional and Statutory Guides to Property Taxation...... 243 §100. Introduction...... 243 §101. Constitutional Principles for Property Taxation...... 243 §103. Exempt Property...... 246 §105. Constitutional Principles in Determination of Fair Market Value and Use of Reappraisal...... 247 §107. Statutory Guide for Property Taxation...... 248 §109. Fair Market Value Defined...... 248 §111. Criteria for Determining Fair Market Value...... 248 §113. Assessments: General Information...... 248 §114. Property Defined...... 249 §115. Real Property Defined...... 249 §117. Personal Property Defined...... 249 §118. Data Collection by the Assessor...... 249 Table of Contents

§119. Forms...... 249 §121. Reappraisal...... 249 §123. Statutes Pertaining to Specific Personal Property...... 250 §125. Statutes Pertaining to Specific Real Property...... 250 Chapter 2. Policies and Procedures for Assessment and Change Order Practices...... 250 §201. Introduction...... 250 §203. Change Orders...... 250 §207. Use Value Properties...... 252 §209. Non-Profit Organizations...... 252 §211. Industrial Exemption Properties...... 252 §213. Assessment Policies and Procedures...... 253 Chapter 3. Real and Personal Property...... 254 §301. Definitions...... 254 §303. Real Property...... 255 §304. Electronic Change Order Specifications, Property Classifications Standards and Electronic Tax Roll Export Specifications...... 256 §305. Real Property Report Forms...... 270 §307. Personal Property Report Forms...... 270 §309. Tax Commission Miscellaneous Forms...... 271 Chapter 5. Loan and Finance Companies...... 272 §501. Guidelines for Ascertaining Fair Market Value of Loan and Finance Company Personal Property...... 272 Chapter 7. Watercraft...... 272 §701. Guidelines for Ascertaining Fair Market Value of Watercraft...... 272 §703. Tables―Watercraft...... 272 §705. Tables―Watercraft...... 273 Chapter 9. Oil and Gas Properties...... 275 §901. Guidelines for Ascertaining the Fair Market Value of Oil and Gas Properties...... 275 §903. Instructions for Reporting Oil and Gas Properties...... 276 §905. Reporting Procedures...... 276 §907. Valuation of Oil, Gas, and Other Wells...... 277 Chapter 11. Drilling Rigs and Related Equipment...... 282 §1101. Guidelines for Ascertaining the Fair Market Value of Drilling Rigs and Related Equipment...... 282 §1103. Drilling Rigs and Related Equipment Tables...... 283 Chapter 13. Pipelines...... 284 §1301. Guidelines for Ascertaining the Fair Market Value of Pipelines...... 284 §1303. Instructions for Reporting "Other Pipelines"...... 285 §1305. Reporting Procedures...... 285 §1307. Pipeline Transportation Tables...... 285 Chapter 15. Aircraft...... 286 §1501. Guidelines for Ascertaining the Fair Market Value of Aircraft...... 286 §1503. Aircraft (Including Helicopters) Table...... 287 Chapter 17. Inventories...... 287 §1701. Guidelines for Ascertaining the Fair Market Value of Inventories...... 287 §1703. Addendum...... 288 Chapter 19. Leasehold Improvements...... 289 §1901. Guidelines for Ascertaining the Fair Market Value of Leasehold Improvements...... 289 §1903. Reporting and Assessment of Leasehold Improvements...... 289 Chapter 21. Leased Equipment...... 289 Table of Contents

§2101. Guidelines for Ascertaining the Fair Market Value of Leased Equipment...... 289 Chapter 23. Insurance Companies...... 289 §2301. Guidelines for Ascertaining the Fair Market Value of Insurance Companies...... 289 §2303. Exemption of Life Insurance Companies and Other Insurance Premiums...... 289 Chapter 25. General Business Assets...... 290 §2501. Guidelines for Ascertaining the Fair Market Value of Office Furniture and Equipment, Machinery and Equipment, and Other Assets Used in General Business Activity...... 290 §2503. Tables Ascertaining Economic Lives, Percent Good and Composite Multipliers of Business and Industrial Personal Property...... 291 Chapter 27. Guidelines for Application, Classification and Assessment of Land Eligible to be Assessed at Use Value...... 295 §2701. Definitions of Land Eligible for Use Value Assessment...... 295 §2703. Eligibility Requirements and Application for Use Value Assessment...... 295 §2705. Classification...... 296 §2707. Map Index Table...... 296 §2709. Assessment and Classification―Agricultural and Horticultural...... 297 §2711. Tables―Agricultural and Horticultural Lands...... 297 §2713. Assessment of Timberland...... 298 §2715. Assessment of Marsh Land...... 298 §2717. Tables―Use Value...... 299 Chapter 29. Public Service Properties...... 299 §2901. Non-Operating or Non-Utility Property...... 299 §2903. Immovable Property of Electric Membership Corporations, Electric Power Companies, Gas Companies, Pipeline Companies, Railroad Companies, Telegraph Companies, Telephone Companies and Water Companies Assessed as Public Service Companies by the Louisiana Tax Commission...... 300 §2905. Report of Values to the Assessor...... 300 §2909. Appraisal of Public Service Properties...... 300 Chapter 31. Public Exposure of Assessments; Appeals...... 300 §3101. Public Exposure of Assessments, Appeals to the Board of Review and Board of Review Hearings...... 300 §3103. Appeals to the Louisiana Tax Commission...... 302 §3105. Practice and Procedure for Public Service Properties Hearings...... 305 §3106. Practice and Procedure for the Appeal of Bank Assessments...... 307 §3107. Practice and Procedure for Appeal of Insurance Credit Assessments...... 308 Chapter 33. Financial Institutions...... 310 §3301. Guidelines for Ascertaining the Fair Market Value of Financial Institutions...... 310 §3303. Allocation for Credit Purposes of Assessments Not Directly Attributable to a Specific Office...... 311 §3305. Listing and Assessing of Stock; Place (Multi-Parish Branch Offices)...... 311 §3307. Methods of Branch Office Allocations...... 311 §3309. Listing and Assessing of Stock; Branch Offices...... 312 Chapter 35. Miscellaneous...... 312 §3501. Service Fees―Tax Commission...... 312 §3503. Homestead Exemptions...... 313 §3505. Housing for the Homeless...... 313 §3507. Claim for Taxes Paid in Error...... 313 §3509. Tulane University―Exemption Allocation Regulation...... 315 §3511. Tulane University―Purpose...... 315 §3513. Tulane University―Definitions...... 315 Table of Contents

§3515. General Rule...... 316 §3517. Tulane University―Reporting and Valuation Procedure...... 316 §3519. Tulane University―Allocation Formula...... 317 §3521. Tulane University―Allocation Report...... 318 §3523. Tulane University―Forms...... 318 §3525. Reporting of Certain Property Assessments by Assessors and Louisiana Tax Commission Members...... 318 Chapter 37. Reassessment Guidelines Pursuant to R.S. 47.1978 and 1978.1...... 319 §3701. Listing and Assessing of Overflowed Lands...... 319 §3702. Listing and Assessing of Land and Property Damaged or Destroyed during a Disaster or Emergency Declared by the Governor or Fire...... 319 Title 61 REVENUE AND TAXATION Part I. Taxes Collected and Administered by the Secretary of Revenue

Chapter 1. Office of the Secretary nfirmatory testing levels as established in the contract betwe en the state of Louisiana and the official provider of drug tes §101. Drug Free Workplace and Drug Testing ting services will classify alcohol as an illegal drug. A. Introduction and Purpose Public Vehicle—any motor vehicle, water craft, air craft or rail vehicle owned or controlled by the state of Louisiana. 1. The employees of the Department of Revenue are a mong the state's most valuable resources, and the physical an Random Testing—testing randomly performed on emplo d mental well-being of our employees is necessary for them t yees holding a safety-sensitive or security-sensitive position. o properly carry out their responsibilities. Substance abuse c The secretary shall periodically call for a sample of such em auses serious adverse consequences to users, affecting their ployees, selected at random by a computer generated random productivity, health and safety, dependents, and co-workers, selection process. as well as the general public. Reasonable Suspicion―belief based upon reliable, obje ctive and articulable facts derived from direct observation of 2. The state of Louisiana and the Department of Reve specific physical, behavioral, odorous presence, or performa nue have a long-standing commitment to working toward a d nce indicators and being of sufficient import and quantity to rug-free, alcohol-free workplace. In order to curb the use of i lead a prudent person to suspect that an employee is in violat llegal drugs by employees of the state of Louisiana, the Loui ion of this regulation. siana Legislature enacted laws that provide for the creation a nd implementation of drug testing programs for state employ Safety-Sensitive or Security-Sensitive Position—a positi ees. Further, the Governor of the State of Louisiana issued E on determined by the secretary to contain duties of such natu xecutive Orders KBB 2005-08 and 2005-11 providing for th re that the compelling state interest to keep the incumbent dr e promulgation by executive agencies of written policies ma ug-free and alcohol-free outweighs the employee's privacy i ndating drug testing of employees, appointees, prospective e nterests. Positions considered as safety-sensitive or security- mployees and prospective appointees, pursuant to R.S. 49:10 sensitive are listed in §101.J. These positions were determine 01 et seq. d with consideration of statutory law, jurisprudence, and the practices of this agency. Examples of safety-sensitive and se B. Applicability curity-sensitive positions are as follows: 1. This regulation applies to all Department of Revenu a. positions with duties that are required or are auth e employees including appointees and all other persons havi orized to carry a firearm; ng an employment relationship with this agency. b. positions with duties that require operation or ma C. Definitions intenance of any heavy equipment or machinery, or the super vision of such an employee; Controlled Substances—a drug, chemical substance or i mmediate precursor in Schedules I through V of R.S. 40:964 c. positions with duties that require the operation or or Section 202 of the Controlled Substances Act (21 U.S.C. maintenance of a public vehicle, or the supervision of such a 812). n employee. Designer (Synthetic) Drugs—those chemical substances Secretary—Secretary of the Department of Revenue. that are made in clandestine laboratories where the molecula Testing with Cause—testing performed on employees o r structure of both legal and illegal drugs is altered to create n the basis of reasonable suspicion, post accident, rehabilitati a drug that is not explicitly banned by federal law. on monitoring, or possession of illegal drugs or drug paraphe rnalia while in the workplace. Employee—unclassified, classified, and student employ ees, student interns, and any other person having an employ Under the Influence—for the purposes of this regulation, ment relationship with this agency, regardless of the appoint a drug, chemical substance, or the combination of a drug or ment type (e.g., full time, part time, temporary, restricted, de chemical substance that affects an employee in any detectabl tailed, job appointment, etc.). e manner. The symptoms or influence are not confined to tha t consistent with misbehavior, nor to obvious impairment of Illegal Drug—any drug that is not legally obtainable or physical or mental ability, such as slurred speech, or difficult that has not been legally obtained, to include prescribed drug y in maintaining balance. A determination of influence can b s not legally obtained and prescribed drugs not being used fo e established by a professional opinion or a scientifically vali r prescribed purposes or being used by one other than the per d test. son for whom prescribed. For purposes of this regulation, alc ohol consumption at or above the initial testing levels and co

1 Louisiana Administrative Code April 2017 REVENUE AND TAXATION

Workplace—any location on agency property including 5. Safety-Sensitive and Security-Sensitive Positions all property, offices, and facilities, including all vehicles and a. Appointments and Promotions. Each employee w equipment, whether owned, leased, or otherwise used by the ho is offered a safety-sensitive or security-sensitive position agency or by an employee on behalf of the agency in the con as defined in §101.J shall be required to pass a drug test befo duct of its business in addition to any location from which an re being placed in such position, whether through appointme individual conducts agency business while such business is b nt or promotion. All such testing shall, if applicable, occur d eing conducted. uring the selected employee's work schedule. D. Drug-Free Workplace Policy b. Random Testing. Every employee in a safety-sen 1. It shall be the policy of the Department of Revenue sitive or security-sensitive position shall be required to subm to maintain a drug-free, alcohol-free workplace and a workfo it to drug testing as required by the secretary, who shall perio rce free of substance abuse. dically call for a sample of such employees, selected at rand om by a computer-generated random selection process, and r 2. Employees are prohibited from reporting to work or equire them to report for testing. All such testing shall, if app performing work with the presence in their bodies of illegal licable, occur during the selected employee's work schedule. drugs, controlled substances, designer (synthetic) drugs, or a lcohol at or above the initial testing levels and confirmatory t 6. Employees in Possession of Illegal Drugs. Any emp esting levels as established in the contract between the state loyee previously found in possession of suspected illegal dru of Louisiana and the official provider of drug testing service gs or drug paraphernalia in the workplace shall be required t s. o submit to subsequent random drug tests. 3. Employees are further prohibited from the illegal us F. Drug and Alcohol Testing Procedure e, possession, dispensation, distribution, manufacture, or sale 1. Drug testing pursuant to this regulation shall be con of controlled substances, designer (synthetic) drugs, illegal d ducted for the presence of any illegal drugs, including, canna rugs, and alcohol at the work site and while on official state binoids (marijuana metabolites), cocaine metabolites, opiate business, on duty or on call for duty. metabolites, phencyclidine, and amphetamines in accordance E. Conditions Requiring Drug Tests. Drug and alcohol te with the provisions of R.S. 49:1001 et seq. The Department sting shall be required under the following conditions. of Revenue reserves the right to test its employees for the pr esence of alcohol, any other illegal drugs, or controlled subst 1. Reasonable Suspicion. Any employee shall be requi ances when there is reasonable suspicion to do so. For purpo red to submit to a drug and alcohol test if there is reasonable ses of this regulation, alcohol consumption at or above the in suspicion, as defined in §101.C.Reasonable Suspicion, that t itial testing levels and confirmatory testing levels as establis he employee is using illegal drugs or is under the influence o hed in the contract between the state of Louisiana and the off f alcohol while on duty. icial provider of drug testing services will classify alcohol as 2. Post Accident. Each employee involved in an accid an illegal drug. ent that occurs during the course and scope of employment s 2. The Director of Human Resources and the secretary hall be required to submit to a drug and alcohol test if the ac shall be involved in any determination that one of the above- cident: named conditions requiring drug and alcohol testing exists. a. involves circumstances leading to a reasonable su All recommendations for drug testing must be approved by t spicion of the employee's drug or alcohol use; or he secretary. Upon final determination by the responsible off icials, the Director of the Human Resources shall notify the s b. results in a fatality. upervisor of the employee to be tested, and the supervisor sh 3. Rehabilitation Monitoring. Any employee who is pa all immediately notify the employee where and when to repo rticipating in a substance abuse after-treatment program or w rt for the testing. ho has a rehabilitation agreement with the agency following 3. Testing services shall be performed by a provider c an incident involving substance abuse shall be required to su hosen by the Office of State Purchasing, Division of Admini bmit to periodic drug testing. stration, pursuant to applicable bid laws. At a minimum, the t 4. Pre-Employment. Each prospective employee shall esting service shall assure the following. be required to submit to drug screening at the time and place a. All specimen collections will be performed in acc designated by the Director of the Human Resources followin ordance with applicable federal and state regulations and gui g a job offer contingent upon a negative drug-testing result. delines to ensure the integrity of the specimen and the privac A prospective employee who tests positive for the presence o y of the donor. The Director of Human Resources shall revie f drugs in the initial screening or who fails to submit to drug w and concur in advance with any decision by a collection si testing shall be eliminated from consideration for employme te person to obtain a specimen under direct supervision. All nt. Employees transferring to the department from other state direct observation shall be conducted by a person of the sam agencies without a break in service are exempt from pre-emp e-sex at the collection site. loyment testing. Title 61, Part I

b. Chain of custody forms must be provided to ensu 1. All initial screening tests with positive results must re the integrity of each urine specimen by tracking its handli be confirmed by a second test with the results reviewed by a ng and storage from point of collection to final disposition. medical review officer. c. Testing shall be performed by a Substance Abuse a. A breath test resulting in 0.08 or greater alcohol c Mental Services Health Administration (SAMSHA) certified oncentration level will be considered an initial positive result. laboratory. b. If a positive test result occurs, the confirmation te d. The laboratory shall use a cut-off of 50 ng/ml for st will be performed within 30 minutes, but not less than 15 a positive finding in testing for cannabinoids. minutes, of completion of the initial screening test. e. The laboratory shall use a concentration cut-off o c. Urine samples will be tested using the split sampl f 0.08 or more for the initial positive finding in testing for al e method, with a confirmation test performed on the second cohol. half of the sample in the event that a positive test result occu f. All positives reported by the laboratory must be c rs. onfirmed by gas chromatography/mass spectrometry. 2. If the confirmation test produces positive results, th 4. All confirmed positive results of alcohol and drug t e medical review officer will contact the employee/applicant esting shall be reported by the laboratory to a qualified medi prior to posting the results of the test as positive. cal review officer. a. The employee/applicant will have the opportunit G. Confidentiality y to verify the legitimacy of the result, i.e., producing a valid 1. All information, interviews, reports, statements, me prescription in his/her name. moranda, or test results received through this drug testing pr ogram are confidential communications, pursuant to R.S. 49: b. If the employee applicant is able to successfully v 1012, and may not be used or received in evidence, obtained erify the legitimacy of the positive results, the medical revie in discovery, or disclosed in any public or private proceeding w officer will confirm the result as negative and report the re s, except in an administrative or disciplinary proceeding or h sults to the department. earing, or civil litigation where drug use by the tested individ c. If the employee is unable to successfully verify th ual is relevant. e legitimacy of the positive results, the employee shall be su 2. All records regarding this policy shall be maintaine bject to disciplinary action up to and including possible term d by the Director of Human Resources in a secured, confiden ination of employment, as determined by the secretary. tial file. 3. Each violation and alleged violation of this regulati H. Responsibilities on will be handled individually, taking into account all data, 1. The secretary is responsible for the overall complia including the risk to self, fellow employees, and the general nce with this regulation and shall submit to the Office of the public. Governor, through the Commissioner of Administration, a re 4. Any employee whose drug test is confirmed positiv port on this regulation and drug testing program, describing e may make a written request for access to records relating t progress, the number of employees affected, the categories o o his drug tests and any records relating to the results of any f testing being conducted, the associated costs for testing, an relevant certification, review, or suspension/revocation-of-ce d the effectiveness of the program by November 1 of each ye rtification proceedings within seven working days. ar. 5. The secretary may, but shall not be required to, allo 2. The Director of the Human Resources is responsibl w an employee whose drug test is certified positive by the m e for administering the drug and alcohol testing program; rec edical review officer the opportunity to undergo rehabilitatio ommending to the secretary when drug testing is appropriate n without termination of employment, subject to the employ receiving, acting on, and holding confidential all informatio ee complying with the following conditions. n received from the testing services provider and from the m a. The employee must meet with an approved chem edical review officer; collecting appropriate information nec ical abuse counselor for a substance abuse evaluation. essary to agency defense in the event of legal challenge; and providing the secretary with the data necessary to submit a d b. The employee must release the substance abuse e etailed report to the Office of the Governor as described abo valuation before returning to work. ve. c. The employee shall be screened on a periodic bas 3. All supervisory personnel are responsible for report is for not less than 12 months nor more than 60 months. ing to the Director of Human Resources any employee they s d. The employee will be responsible for costs associ uspect may be under the influence of any illegal drug, alcoho ated with follow-up testing, return to duty testing, counselin l, or chemical substance. Supervisory personnel are also resp g and any other recommended treatment. onsible for assuring that each employee under their supervisi on understands or is given the opportunity to understand and 6. Positive post accident or return to duty tests will res have questions answered about this regulation's contents. ult in the employee's immediate dismissal. I. Violation of the Regulation REVENUE AND TAXATION

7. Any employee who refuses to submit to a urine test d. Alcohol Beverage Control Staff Officer for the presence of illegal drugs or a breath test for the prese e. Alcohol Beverage Control Special Investigator nce of alcohol shall be subject to the consequences of a posit ive test. f. Alcohol and Tobacco Control Agent 1-6 8. In the event that a current or prospective employee g. Alcohol and Tobacco Control Commissioner receives a confirmed positive test result, the employee may c h. Alcohol and Tobacco Control Deputy Commissio hallenge the test results within 72 hours of actual notification. ner a. The employee's challenge will not prevent the em i. Alcohol and Tobacco Control Financial Investiga ployee from being placed on suspension pending the investig tor 1-2 ation until the challenge is resolved. j. Alcohol and Tobacco Control Special Investigato b. The employee may submit a written explanation r 1-2 of the reason for the positive test result to the medical review officer. k. Alcohol and Tobacco Control Specialist c. Employees who are on legally prescribed and obt l. Special Investigation Division—Assistant Direct ained medication for a documented illness, injury or ailment or will be eligible for continued employment upon receiving cl earance from the medical review officer. m. Special Investigations Division—Director 9. In the event that a current or prospective employee n. Special Investigations Division—Revenue Agent remains unable to provide a sufficient urine specimen or am 3 ount of breath, the collector or Breath Alcohol Technician (B AUTHORITY NOTE: Promulgated in accordance with Execut AT) must discontinue testing and notify the Director of Hum ive Orders KBB 2005-08 and 2005-11 and R.S. 49:1015 et seq. an Resources of their actions. HISTORICAL NOTE: Promulgated by the Department of Reve nue, Office of the Secretary, LR 25:1523 (August 1999), amended a. In both instances, whether the discrepancy is an i LR 34:668 (April 2008). nsufficient urine specimen or amount of breath, the Director of Human Resources shall promptly inform the secretary. Chapter 2. Alcoholic Beverages b. The secretary shall then direct the employees to h §201. Direct Shipments of Sparkling or Still Wines ave a medical evaluation, at the expense of the Department o A. Identification of Shipments f Revenue, by a licensed physician who possesses expertise i n the medical issue surrounding the failure to provide a suffi 1. All shipments made by an authorized manufacturer cient specimen. or retailer of sparkling or still wines that are shipped directly to any consumer in Louisiana shall be identified as follows: c. This medical evaluation must be performed withi n five working days after the secretary is notified of the empl a. the words "Alcoholic Beverage―Direct Shipmen oyee's inability to provide a sufficient specimen. t" shall be marked and clearly visible on both the front and b ack of the package in lettering measuring at least 1/4 inch in d. The physician shall provide the secretary with a r height; and eport of his/her conclusions as to whether the employee's ina bility to provide a sufficient urine specimen or amount of bre b. the words "Unlawful to Sell or Deliver to Anyone ath is genuine. under 21 Years of Age" must be clearly visible on the front o f the package, in lettering measuring at least 1/4 inch in heig e. If the physician determines that the employee's in ht. ability to provide a sufficient urine specimen or amount of br eath is not genuine, the employees will be subject to the cons 2. The manufacturer's or retailer's Louisiana registrati equences of a positive test. on or permit number assigned by the Excise Taxes Division s hall be clearly displayed on the front of the package. J. Safety-Sensitive or Security-Sensitive Positions to be Randomly Drug Tested 3. All shipments shall have affixed to the exterior pac kaging a notification to the person making the delivery that a 1. All candidates for the following positions are requir signature of the recipient is required prior to delivery. The no ed to pass a drug test before being placed in the position, wh tice should be at least 3" by 3" and contain words similar to t ether through appointment or promotion and employees who he following. occupy these positions are subject to random drug/alcohol te A T T E N T I O N sting. Courier SIGNATURE REQUIRED a. Alcohol Beverage Control Investigator Superviso r Deliver to RECIPIENT address only. No indirect delivery. Disregard any Signature Release. Recipient MUST be at least b. Alcohol Beverage Control Investigator 21 years old, and not show signs of intoxication. c. Alcohol Beverage Control Manager Title 61, Part I

B. Reporting of Shipments d in the certificate of authorization, and in addition thereto pr ovides that they shall enjoy the same, but no greater, rights a 1. For each shipment made by an authorized manufact nd privileges as a business or nonprofit corporation organize urer or retailer of sparkling or still wines that is shipped dire d under the laws of the state of Louisiana to transact the busi ctly to any consumer in the state of Louisiana, the authorized ness which such corporation is authorized to contract, and ar manufacturer or retailer shall maintain the following records e subject to the same duties, restrictions, penalties, and liabil until December 31 of the year following the year in which th ities (including the payment of taxes) as are imposed on a bu e shipment was made. These records shall be available for in siness or nonprofit corporation organized under the laws of t spection by the Department of Revenue upon request: his state. In view of the grant of such rights, privileges, imm a. an invoice detailing the transaction; and unities, and the imposition of the same duties, restrictions, p enalties, and liabilities on foreign corporations as are impose b. a certification, on a written form as specified by t d on domestic corporations, the exercise of any right, privile he secretary, by the person receiving the shipment that the re ge, or the enjoyment of any immunity within this state by a f cipient is 21 years of age or older. oreign corporation which might be exercised or enjoyed by a 2. Each certification required by §201.B.1.b must be s domestic business or nonprofit corporation organized under t igned and dated at the time of delivery to any consumer in L he laws of this state renders the foreign corporation liable for ouisiana. the same taxes, penalties, and interest, where applicable, whi ch would be imposed on a domestic corporation. 3. The carrier making the actual delivery of packages of sparkling or still wines shall forward copies of the bills of C. Thus, both domestic and foreign corporations which e lading to the Excise Tax Division of the Louisiana Departme njoy or exercise within this state any of the powers, privilege nt of Revenue by the fifteenth day of the month following th s, or immunities granted to business corporations organized e month of delivery in the same manner as reports showing t under the provisions of R.S. 12:41 are subject to and liable f he handling of alcoholic beverages as required under R.S. 26: or the payment of the franchise tax imposed by this Section. 369. R.S. 12:41 recites those privileges to be as follows: AUTHORITY NOTE: Promulgated in accordance with R.S. 26 1. the power to perform any acts which are necessary 341, 26:344, and 26:359. or proper to accomplish its purposes as expressed or implied HISTORICAL NOTE: Promulgated by the Department of Reve in the articles of incorporation, or which may be incidental t nue, Excise Taxes Division, LR 25:526 (March 1999). hereto and which are not repugnant to law; Chapter 3. Corporation Franchise Ta 2. without limiting the grant of power contained in §3 x 01.C.1, every corporation shall have the authority to: §301. Imposition of Tax a. have a corporate seal which may be altered at ple asure, and to use the same by causing it or a facsimile thereo A. Except as specifically exempted by R.S. 47:608, R.S. f to be impressed or affixed or in any manner reproduced; bu 47:601 imposes a corporation franchise tax, in addition to all t failure to affix a seal shall not affect the validity of any inst other taxes levied by any other statute, on all corporations, jo rument; int stock companies or associations, or other business organi zations organized under the laws of the state of Louisiana wh b. have perpetual existence, unless a limited period ich have privileges, powers, rights, or immunities not posses of duration is stated in its articles of incorporation; sed by individuals or partnerships, all of which are hereinaft c. sue and be sued in its corporate name; er designated as domestic corporations, for the right granted by the laws of this state to exist as such an organization and d. in any legal manner to acquire, hold, use, and alie on both domestic and foreign corporations for the enjoyment nate or encumber property of any kind, including its own sha under the protection of the laws of this state of the powers, ri res, subject to special provisions and limitations prescribed b ghts, privileges, and immunities derived by reason of the cor y law or the articles; porate form of existence and operation. Liability for the tax i e. in any legal manner to acquire, hold, vote, and us s created whenever any such organization qualifies to do bus e, alienate and encumber, and to deal in and with, shares, me iness in this state, exercises its charter or continues its charte mberships, or other interests in, or obligations of, other busin r within this state, owns or uses any part of its capital, plant, esses, nonprofit or foreign corporations, associations, partner or any other property in this state, through the buying, sellin ships, joint ventures, individuals, or governmental entities; g, or procuring of services in this state, or actually does busi ness in this state through exercising or enjoying each and ev f. make contracts and guarantees, including guarant ery act, power, right, privilege, or immunity as an incident to ees of the obligations of other businesses, nonprofit or foreig or by virtue of the powers and privileges acquired by the nat n corporations, associations, partnerships, joint ventures, ind ure of such organizations. ividuals, or governmental entities, incur liabilities, borrow m oney, issue notes, bonds, and other obligations, and secure a B. With respect to foreign corporations, R.S. 12:306 gen ny of its obligations by hypothecation of any kind of propert erally grants such organizations authority to transact busines y; s in this state subject to and limited by any restrictions recite REVENUE AND TAXATION

g. lend money for its corporate purposes and invest AUTHORITY NOTE: Promulgated in accordance with R.S. 47 and reinvest its funds, and take and hold property or rights of 601. any kind as security for loans or investments; HISTORICAL NOTE: Promulgated by the Department of Reve nue and Taxation, Income and Corporation Franchise Taxes Section h. conduct business and exercise its powers in this s Office of Group III, LR 6:25 (January 1980), amended LR 11:108 tate and elsewhere as may be permitted by law; (February 1985), repromulgated by the Department of Revenue, Po licy Services Division, LR 30:448 (March 2004). i. elect or appoint officers and agents, define their d §302. Determination of Taxable Capital uties, and fix their compensation; pay pensions and establish pension plans, pension trusts, profit-sharing plans, and other A. Taxable Capital. Every corporation subject to the tax i incentive and benefit plans for any or all of its directors, offi mposed by R.S. 47:601 must determine the total of its capita cers, and employees; and establish stock bonus plans, stock l stock, as defined in R.S. 47:604, its surplus and undivided option plans, and plans for the offer and sale of any or all of profits, as defined in R.S. 47:605, and its borrowed capital, a its unissued shares, or of shares purchased or to be purchase s defined in R.S. 47:603, which total amount shall be used as d, to the employees of the corporation, or to employees of su the basis for determining the extent to which its franchise an bsidiary corporations, or to trustees on their behalf; such pla d the rights, powers, and immunities granted by Louisiana ar ns: e exercised within this state. Determination of the taxable a i. may include the establishment of a special fund mount thereof shall be made in accordance with the provisio or funds for the purchase of such shares, in which such empl ns of R.S. 47:606 and R.S. 47:607, and the rules and regulati oyees, during the period of their employment, or any other p ons issued thereunder by the secretary of revenue and taxatio eriod of time, may be privileged to share on such terms as ar n. e imposed with respect thereto; and B. Holding Corporation Deduction. Any corporation whi ii. may provide for the payment of the price of suc ch owns at least 80 percent of the capital stock of a banking h shares in installments; corporation organized under the laws of the United States or of the state of Louisiana may deduct from its total taxable ba j. make and alter bylaws, not inconsistent with the l se, determined as provided in §302.A and before the allocati aws of this state or with the articles, for the administration a on of taxable base to Louisiana as provided in R.S. 47:606 a nd regulation of the affairs of the corporation; nd R.S. 47:607, the amount by which its investment in and a k. provide indemnity and insurance pursuant to R.S. dvances to such banking corporation exceeds the excess of t 12:83; otal assets of the holding corporation over total taxable capit l. make donations for the public welfare, or for char al of the holding corporation, determined as provided in §30 itable, scientific, educational, or civic purposes; and 2.A. m. in time of war or other national emergency, do an C. Public Utility Holding Corporation Deductions. Any c y lawful business in aid thereof, at the request or direction of orporation registered under the Public Utility Holding Comp any apparently authorized governmental authority. any Act of 1935 that owns at least 80 percent of the voting p D. Thus, the mere ownership of property within this state, ower of all classes of the stock in another corporation (not in or an interest in property within this state, including but not cluding nonvoting stock which is limited and preferred as to limited to mineral interests and oil payments dependent upon dividends) may, after having determined its Louisiana taxabl production within Louisiana, whether owned directly or by o e capital as provided in R.S. 47:602(A), R.S. 47:606, and R. r through a partnership or joint venture or otherwise, renders S. 47:607, deduct therefrom the amount of investment in and the corporation subject to franchise tax in Louisiana since a advances to such corporation which was allocated to Louisia portion of its capital is employed in this state. na under the provisions of R.S. 47:606(B). The only reductio n for investment in and advances to subsidiaries allowed by t E. The tax imposed by this Section shall be at the rate pr his Subsection is with respect to those subsidiaries in which t escribed in R.S. 47:601 for each $1,000, or a major fraction t he registered public utility holding company owns at least 80 hereof, on the amount of its capital stock, determined as pro percent of all classes of stock described herein; the reduction vided in R.S. 47:604, its surplus and undivided profits, deter is not allowable with respect to other subsidiaries in which t mined as provided in R.S. 47:605, and its borrowed capital, he holding company owns less than 80 percent of the stock o determined as provided in R.S. 47:603 on the amount of suc f the subsidiary, notwithstanding the fact that such investmen h capital stock, surplus, and undivided profits, and borrowed ts in and advances to the subsidiary may have been attribute capital as is employed in the exercise of its rights, powers, a d to Louisiana under the provisions of R.S. 47:606(B). In no nd immunities within this state determined in compliance wi case shall a reduction be allowed with respect to revenues fr th the provisions of R.S. 47:606 and R.S. 47:607. om the subsidiary. Any repeal of the Public Utility Holding F. The accrual, payment, and reporting of franchise taxe Company Act of 1935 shall not affect the entitlement to dedu s imposed by this Section are set forth in R.S. 47:609. ctions under this Subsection of corporations registered under G. In the case of any domestic or foreign corporation sub the provisions of the Public Utility Holding Company Act of ject to the tax herein imposed, the tax shall not be less than t 1935 prior to its repeal. he minimum tax provided in R.S. 47:601. AUTHORITY NOTE: Promulgated in accordance with R.S. 47 602. Title 61, Part I

HISTORICAL NOTE: Promulgated by the Department of Reve e one-year controlling factor will be measured from the date nue and Taxation, Income and Corporation Franchise Taxes Section that the new debt is incurred. Office of Group III, LR 6:25 (January 1980), amended LR 11:108 (February 1985), repromulgated by the Department of Revenue, Po 6. For purposes of determining whether indebtedness licy Services Division, LR 30:449 (March 2004). has a maturity date in excess of one year from the date incurr §303. Borrowed Capital ed or whether the indebtedness was paid within one year fro m the date incurred, with respect to the amount due on a mor A. General tgage on real estate purchased subject to the mortgage, the d 1. As used in this Chapter, borrowed capital means all ate the indebtedness was originally incurred shall be the date indebtedness of a corporation, subject to the provisions of thi the property subject to the mortgage was acquired by the cor s Chapter, maturing more than one year from the date incurr poration. ed, or which is not paid within one year from the date incurr 7. In the case of amounts owed by a corporation to a c ed regardless of maturity date. reditor who meets the definition of an affiliated corporation 2. All indebtedness of a corporation is construed to be contained in R.S. 47:603, the age or maturity date of the inde capital employed by the corporation in the conduct of its bus btedness is immaterial. An affiliated corporation is defined t iness or pursuit of the purpose for which it was organized, an o be any corporation which through (a) stock ownership, (b) d in the absence of a specific exclusion, qualification, or limi directorate control, or (c) any other means, substantially infl tation contained in the statute, must be included in the total t uences policy of some other corporation or is influenced thro axable base. No amount of indebtedness of a corporation ma ugh the same channels by some other corporation. It is not n y be excluded from borrowed capital except in those cases in ecessary that control exist between the corporations but only which the corporation can demonstrate conclusively that a sp that policy be influenced substantially. Any indebtedness bet ecific statutory provision permits exclusion of the indebtedn ween such corporations constitutes borrowed capital to the e ess from borrowed capital. xtent it represents capital substantially used to finance or car ry on the business of the debtor corporation, regardless of th 3. In the case of amounts owed by a corporation to a c e age of the indebtedness. For this purpose, all funds, materi reditor who does not meet the definition of an affiliated corp als, products, or services furnished to a corporation for whic oration contained in R.S. 47:603, all indebtedness of a corpo h indebtedness is incurred, except as provided in this Section ration which has a maturity date of more than one year from with respect to normal trading accounts and offsetting indebt the date on which the debt was incurred and all indebtedness edness, are construed to be used by the corporation to financ which has not been paid within one year from the date the in e or carry on the business of the corporation; in the absence debtedness was incurred, regardless of the maturity or due d of a conclusive showing by the taxpayer to the contrary, all s ate of the indebtedness, shall be included in borrowed capital uch indebtedness shall be included in borrowed capital. Determination of the one-year controlling factor is with resp a. To illustrate this principle, assume: ect to the original date that the indebtedness was incurred an d is not to be determined by any date the debt is renewed or r i. Corporation A―Parent of B, C, D, and E; efinanced. The entire amount of long-term debt not having a maturity date of less than one year, which was not paid withi ii. Corporation B―Nonoperating, funds flow con n the one-year period, constitutes borrowed capital, even tho duit, owning no stock in C, D, or E; ugh it may constitute the current liability for payment on the iii. Corporation C―Other Corporation; long-term debt. iv. Corporation D―Other Corporation; 4. The fact that indebtedness which had a maturity dat e of more than one year from the date it was incurred, was ac v. Corporation E―Other Corporation; tually liquidated within one year does not remove the indebt vi. any funds furnished by the parent A to either B, edness from the definition of borrowed capital. C, D, or E constitute either a contribution to capital or an ad 5. For purposes of determining whether indebtedness vance which must be included in the taxable base of the rece has a maturity date in excess of one year from the date incurr iving corporation; ed or whether the indebtedness was paid within one year fro vii. any funds supplied by D or E to C, whether or m the date incurred, the following shall apply: With respect t not channeled through A or B, would constitute borrowed ca o any indebtedness which was extended, renewed, or refinan pital to C, and the indebtedness must be included in the taxa ced, the date the indebtedness was originally incurred shall b ble base. In the absence of a formal declaration of a dividend e the date the extended, renewed, or refinanced indebtedness from D or E to A, the funds constitute an advance to A by D was incurred. All debt extended, renewed, or refinanced shal or E and borrowed capital to A. In all such financing arrange l be included in borrowed capital if the extended maturity da ments, the multiple transfers of funds are held to constitute c te is more than one year from, or if the debt has not been pai apital substantially used to carry on each taxpayer's business. d within one year from, that date. In instances of debts which 8. The amount that normal trading-account indebtedne are extended, renewed, or refinanced by initiating indebtedn ss bears to capitalization of a debtor determines to what exte ess with a creditor different from the original creditor, the in nt said indebtedness constitutes borrowed capital substantiall debtedness shall be construed to be new indebtedness and th y used to finance or carry on the business of the debtor. Due REVENUE AND TAXATION consideration should also be given to the debtor's ability to h rate or special account may be excluded from the indebtedne ave incurred a similar amount of indebtedness, equally paya ss which would otherwise constitute borrowed capital if such ble as to terms and periods of time. segregation is fixed by a prior written commitment or court 9. In the case of equally demandable and payable inde order for the payment of principal or interest on funded inde btedness of the same type between two corporations, wherei btedness or other fixed obligations. In the absence of a prior n each is indebted to the other, only the excess of the amount written commitment or court order fixing segregation of the due by any such corporation over the amount of its receivabl funds or securities, no reduction of borrowed capital shall be e from the other corporation shall be deemed to be borrowed made with respect to such deposits or segregated amounts. capital. b. Whenever a liability for the payment of dividend 10. With respect to any amount due from which debt di s theretofore lawfully and formally authorized would constit scount was paid upon inception of the debt, that portion of th ute borrowed capital as defined in this Section, an amount eq e unamortized debt discount applicable to the indebtedness uivalent to the amount of cash or securities deposited with a which would otherwise constitute borrowed capital shall be trustee or other custodian or segregated into a separate or spe eliminated in calculating the amount of the indebtedness to b cial account for payment of the dividend liability may be exc e included in taxable base. luded from borrowed capital. B. Exclusions from Borrowed Capital 4. Receiverships, Bankruptcies and Reorganizations. I n the case of a corporation having indebtedness which could 1. Federal, State and Local Taxes. R.S. 47:603 provide have been paid from cash and temporary investments on han s that an amount equivalent to certain indebtedness shall not d which were not currently needed for working capital and i be included in borrowed capital. With respect to accruals of f n which case the corporation has secured approval or allowa ederal, state, and local taxes, the only amounts which may be nce by the court of the petition for receivership, bankruptcy, excluded are the tax accruals determined to be due to the taxi or reorganization under the bankruptcy law, after such allow ng authority or taxes due and not delinquent for more than 3 ance or approval by the court of the taxpayer's petition, the t 0 days. In the case of reserves for taxes, only so much of the axpayer may then reduce the amount which would otherwise reserve as represents the additional liability due at the taxpay constitute borrowed capital by the amount of cash or tempor er's year-end for taxes incurred during the accrual period ma ary investment which it could have paid on the indebtedness y be excluded. Any amount of the reserve balance in excess prior to such approval, to the extent that they are permitted t of the amount additionally due for the accrual period shall be o make such payments under the terms of the receivership, b included in the taxable base, since the excess does not consti ankruptcy, or reorganization proceedings. tute a reserve for a definitely fixed liability. This additional a mount due is determined by subtracting the taxpayer's tax de AUTHORITY NOTE: Promulgated in accordance with R.S. 47 posits during the year from the total liability for the period. 603. All reserves for anticipated future liabilities due to accountin HISTORICAL NOTE: Promulgated by the Department of Reve g and tax timing differences shall be included in the taxable nue and Taxation, Income and Corporation Franchise Taxes Section Office of Group III, LR 6:25 (January 1980), amended LR 11:108 base. Any taxes which are due and are delinquent more than (February 1985), repromulgated by the Department of Revenue, Po 30 days must be included in borrowed capital. For purposes licy Services Division, LR 30:450 (March 2004). of determining whether taxes are delinquent, extensions of ti §304. Capital Stock me granted by the taxing authority for the filing of the tax ret urn or for payment of the tax shall be considered as establish A. For the purpose of determining the amount of capital ing the date from which delinquency is measured. stock upon which the tax imposed by R.S. 47:601 is based, s 2. Voluntary Deposits uch stock shall in every instance have such value as is reflect ed on the books of the corporation, subject to whatever incre a. The liability of a taxpayer to a depositor created a ases to the recorded book values may be found necessary by s the result of advances, credits, or sums of money having be the Secretary of Revenue and taxation to reflect the true valu en voluntarily left on deposit shall not constitute borrowed c e of the stock. In no case shall the value upon which the tax i apital if: s based be less than is shown on the books of the corporation. i. said moneys have been voluntarily left on depo sit to facilitate the transaction of business between the partie B. In any case in which capital stock of a corporation has s; and been issued in exchange for assets, the capital stock shall ha ve a value equal to the fair market value of the assets receive ii. said moneys have been segregated by the taxpa d in exchange for the stock, plus any intangibles received in yer and are not otherwise used in the conduct of its business. the exchange, except as provided in the following Subsectio b. Neither the relationship of the depositor to the tax n. payer nor the length of time the deposits remain for the inten C. In any such case in which capital stock of a corporatio ded purpose has an effect on the amount of such liability whi n is transferred to one or more persons in exchange for assets, ch shall be excluded from borrowed capital. and the only consideration for the exchange was stock or se 3. Deposits with Trustees curities of the corporation, and immediately after the exchan a. The principal amount of cash or securities deposi ge such person or persons owned at least 80 percent of the to ted with a trustee or other custodian or segregated into a sepa tal voting power of all voting stock and at least 80 percent of Title 61, Part I the total number of shares of all of the stock of the corporati ction below zero value be recognized. Corresponding adjust on, the value of the stock exchanged for the assets so acquire ments shall in all instances be made to the value of assets for d shall be the same as the basis of the assets received in the h property factor purposes. ands of the transferor of the assets, plus any intangibles recei 3. In any instance in which an asset is required to be i ved in the exchange. The only other exception to the rule tha ncluded in the property factor under the provisions of R. S. 4 t capital stock exchanged for assets shall have such value as 7:606 and the regulations issued thereunder, the acquisition equals the fair market value of the assets received and any in of which resulted in the establishment of a contra account, su tangibles received is in the case of stock issued in exchange f ch as, but not limited to, an account to record unrealized gain or assets in a reorganization, which transaction was fully exe from an installment sale, all such contra accounts shall be in mpt from the tax imposed by the Louisiana income tax law, i cluded in the taxable base, except to the extent such contra a n which case the value of the stock shall have a value equal t ccounts constitute a reserve permitted to be excluded under t o the basis of the assets received in the hands of the transfero he provisions of R.S. 47:605(A) and the regulations issued u r of the assets, plus any intangibles received. nder §305.A. See §306.A for required adjustments to assets D. In any case in which an exchange of stock of a corpor with respect to any contra account or reserve which is not in ation for assets resulted in a transaction taxable in part or in f cluded in the taxable base. ull under the Louisiana income tax law, the value of the stoc 4. The minimum value under the statute is subject to e k so exchanged shall be equal to the fair market value of all xamination and revision by the secretary of revenue and taxa of the assets received in the exchange, including the value of tion. The recorded book value of surplus and undivided profi any intangibles received. ts may be increased, but not in excess of cost, as the result of E. Capital stock, valued as set forth heretofore, shall incl such examination to the extent found necessary by the secret ude all issued and outstanding stock, including treasury stoc ary to reflect the true value of surplus and undivided profits. k, fractional shares, full shares, and any certificates or option The secretary is prohibited from making revisions which wo s convertible into shares. uld reflect any value below the amount reflected on the book s of the taxpayer. A taxpayer may, in his own discretion, refl AUTHORITY NOTE: Promulgated in accordance with R.S. 47 ect values in excess of cost; that option is not extended to the 604. HISTORICAL NOTE: Promulgated by the Department of Reve secretary in any examination of recorded cost. nue and Taxation, Income and Corporation Franchise Taxes Section Office of Group III, LR 6:25 (January 1980), amended LR 11:108 (February 1985), repromulgated by the Department of Revenue, Po licy Services Division, LR 30:451 (March 2004). §305. Surplus and Undivided Profits A. Determination of Value―Assets 1. For the purpose of determining the tax imposed by R.S. 47:601, there are statutory limitations on both the maxi mum and minimum amounts which shall be included in the t axable base with respect to surplus and undivided profits. Th e minimum amount which shall be included in the taxable ba se shall be no less than the amount reflected on the books of the taxpayer. Irrespective of the reason for any book entry w hich increases the franchise tax base, such as, but not limited to, entries to record asset appreciation, entries to reflect equit y accounting for investments in affiliates or subsidiaries, and amounts credited to surplus to record accrual of anticipated f uture tax refunds created by accounting timing differences, t he amount reflected on the books must be included in the tax base. 2. Entries to the books of any corporation to record th e decrease in value of any investment through the use of equi ty accounting will be allowed as a reduction in taxable surpl us and its related asset account for property factor purposes. This is only in those cases in which all investments are recor ded under the principles of equity accounting, and such redu ctions in the value of any particular investment below cost th ereof to the taxpayer will not be allowed. The exception is in those instances in which the taxpayer can show that such red uction is in the nature of a bona fide valuation adjustment ba sed on the fair value of the investment. In no case will a redu REVENUE AND TAXATION