Manila Hotel Market Update

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Standards Monitoring and Enforcement Division List Of

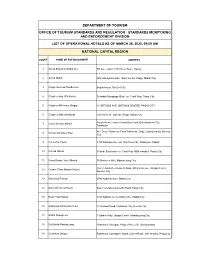

DEPARTMENT OF TOURISM OFFICE OF TOURISM STANDARDS AND REGULATION - STANDARDS MONITORING AND ENFORCEMENT DIVISION LIST OF OPERATIONAL HOTELS AS OF MARCH 26, 2020, 09:00 AM NATIONAL CAPITAL REGION COUNT NAME OF ESTABLISHMENT ADDRESS 1 Ascott Bonifacio Global City 5th ave. Corner 28th Street, BGC, Taguig 2 Ascott Makati Glorietta Ayala Center, San Lorenzo Village, Makati City 3 Cirque Serviced Residences Bagumbayan, Quezon City 4 Citadines Bay City Manila Diosdado Macapagal Blvd. cor. Coral Way, Pasay City 5 Citadines Millenium Ortigas 11 ORTIGAS AVE. ORTIGAS CENTER, PASIG CITY 6 Citadines Salcedo Makati 148 Valero St. Salcedo Village, Makati city Asean Avenue corner Roxas Boulevard, Entertainment City, 7 City of Dreams Manila Paranaque #61 Scout Tobias cor Scout Rallos sts., Brgy. Laging Handa, Quezon 8 Cocoon Boutique Hotel City 9 Connector Hostel 8459 Kalayaan Ave. cor. Don Pedro St., POblacion, Makati 10 Conrad Manila Seaside Boulevard cor. Coral Way MOA complex, Pasay City 11 Cross Roads Hostel Manila 76 Mariveles Hills, Mandaluyong City Corner Asian Development Bank, Ortigas Avenue, Ortigas Center, 12 Crowne Plaza Manila Galleria Quezon City 13 Discovery Primea 6749 Ayala Avenue, Makati City 14 Domestic Guest House Salem Complex Domestic Road, Pasay City 15 Dusit Thani Manila 1223 Epifanio de los Santos Ave, Makati City 16 Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Quezon City 17 EDSA Shangri-La 1 Garden Way, Ortigas Center, Mandaluyong City 18 Go Hotels Mandaluyong Robinsons Cybergate Plaza, Pioneer St., Mandaluyong 19 Go Hotels Ortigas Robinsons Cyberspace Alpha, Garnet Road., San Antonio, Pasig City 20 Gran Prix Manila Hotel 1325 A Mabini St., Ermita, Manila 21 Herald Suites 2168 Chino Roces Ave. -

Hotel Address Contact Number Email

HOTEL ADDRESS CONTACT NUMBER EMAIL Astoria Bohol Baranggay Taguihon, Baclayon, Bohol 335-1111 [email protected] 036-2881111/ Astoria Boracay Station 1, Boracay Island, Malay, Aklan [email protected] 036-2883536 Km 62 North National Highway, Brgy. San Rafael, Puerto Princesa Astoria Palawan 335-1111 [email protected] City, Palawan Astoria Plaza 15 J. Escriva Drive, Ortigas Business District, Pasig City 335-1131 to 35 [email protected] 2107 Prime Street, Madrigal Business Park, Ayala Alabang, B Hotel Alabang 828-8181 Muntinlupa City B Hotel Quezon City 14 Scout Rallos Street, Brgy. Laging Handa, Quezon City 990-5000 Chardonnay by Astoria 352 Captain Henry P. Javier, Brgy. Oranbo, Pasig City 335-1131 to 35 [email protected] Asean Avenue corner Roxas Boulevard, Entertainment City, City of Dreams Manila 800-8080 [email protected] Paranque Conrad Manila Seaside Boulevard, Coral Way, Pasay City 833-9999 Seascapes Resort Town, Soong, Lapu-Lapu City, Mactan Island, 032-4019999/ Crimson Resort & Spa Mactan [email protected] Cebu 239-3900 Ortigas Avenue corner Asian Development Bank Ave, Ortigas Crowne Plaza Manila Galleria 633-7222 Center, Quezon City Diamond Hotel Roxas Boulevard corner Dr. J. Quintos Street, Manila 528-3000/ 305-3000 [email protected] Discovery Suites 25 ADB Avenue, Ortigas Center, Pasig City 719-8888 [email protected] Dusit Thani Manila Ayala Center, Makati City 238-8888 [email protected] Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Bagumbayan, Quezon City 570-7777 [email protected] F1 Hotel Manila 32nd Street, Bonifacio Global City, Taguig City 928-9888 Fairmont Makati 1 Raffles Drive, Makati Avenue, Makati City 795-1888 [email protected] Las Casas Filipinas de Acuzar Brgy. -

Metro Manila Office Property Market Study (FINAL REPORT)

Metro Manila Office Property Market Study (FINAL REPORT) 19 November 2020 Prepared by: Prepared for: Theresa Teodoro DDMP REIT, Inc. Karla Domingo Veronica Cabigao Our Ref: CIP/CONS20-026 19 November 2020 DDMP REIT Inc. 10th Floor, Tower 1 DoubleDragon Plaza DD Meridian Park corner Macapagal Avenue and EDSA Avenue Bay Area, Pasay City Attn: Ms. Hannah Yulo-Luccini Re: Metro Manila Office Property Market Study (the ‘Project’) With reference to your instructions received on July 2020, we have prepared the Metro Manila Office Property Market Update (the “Project”) for your perusal. As we understand, this report will serve as an attachment to the REIT Plan and submission to the Philippine Securities and Exchange Commission (SEC) and the Philippine Stock Exchange (PSE). The market report is enclosed herewith. Yours faithfully, For and on behalf of Colliers International Philippines, Inc. ___________________________________________ Theresa Teodoro Director Valuation and Advisory Services 1 Metro Manila Office Property Market Study (FINAL REPORT) TABLE OF CONTENTS 1 INTRODUCTION .......................................................................................................................................... 5 INSTRUCTIONS ........................................................................................................................................ 5 INFORMATION SOURCES ......................................................................................................................... 5 CAVEATS AND ASSUMPTIONS ................................................................................................................. -

PAGCOR) Launched an Intensive Communication Campaign to Emphasize the Agency’S Contributions to the Government

About the Cover In November 2018, the Philippine Amusement and Gaming Corporation (PAGCOR) launched an intensive communication campaign to emphasize the agency’s contributions to the government. The “PAG” campaign is anchored on the agency’s revenue-generating function which many people, Filipinos included, are not aware of. We used various media platforms to educate the general public about PAGCOR’s programs and to heighten public awareness about our noble goals. Many people associate PAGCOR with gaming and casinos. But while operating and regulating games of chance are among our core mandates, our important mission is to help build a strong nation. As we remit half of our income to the National Treasury, we have become one of the biggest revenue generators of the government. A sizeable portion is also allocated for the agency’s mandated beneficiaries and the privileged sectors of society. We were able to provide funds for our various mandated beneficiaries by regulating gaming and preventing the proliferation of illegal gambling in the Philippines. Most of all, the dedication, talent and commitment of employees to their work enabled PAGCOR to achieve greater heights. At the end of the day, our real mission is to serve the nation and help build a sustainable future for our country. #PAGsilbisabayan 3 HIS EXCELLENCY RODRIGO ROA DUTERTE President, Republic of the Philippines Annual Report 2018 CONTENTS 8-9 Corporate Profile ................................................................................................................................................................................... -

5Ef2605b993edc8098ff2f23 AG

JURISDICTION UPDATES March 2018 Edition In focus pg.30 Shaking the status quo MACAU MGM unveils Cotai gem pg.6 KOREA Fourth IR bets on Incheon pg.12 SINGAPORE No wind in top line sales pg.14 VIETNAM Hoiana woos Macau VIPs pg.34 ASEAN 2018 SUPPLIER SPECIALS pg.42 MESSAGE 3 Engaging the industry at ASEAN GB is proud to be hosting the second edition of casino industry. Leaked proposals have so far suggested a the ASEAN Gaming Summit in Manila, where high-tax environment, with restrictions on space, which 300 guests from both the land-based and some warn will lead to lower investment levels. online gaming fields will gather to engage with While Japan delays, South Korea steams ahead, with Incheon Amore than 80 leading speakers lined up to discuss the attracting its fourth IR. A Chinese property developer has state of the industry. announced plans for $4.5 billion resort on Yeongjong Island, Rosalind While the 2017 show focused on the convergence of online which authorities are touting as a major step towards creating Wade and land-based gaming, the 2018 event takes a look at an entertainment hub in the Incheon Free Economic Zone. disruptive technologies, as well as innovative operational In Singapore, operators continue to squeeze out profits and management strategies. from flat revenue. LVS argues that while a success story, The Focus section of this edition is dedicated to lifting the the city state is a very large EBITDA producer without top- veil on some of the discussions you can expect in Manila. -

(CAO) As of 05 February 2021

ACCOMMODATION ESTABLISHMENTS WITH CERTIFICATE OF AUTHORITY TO OPERATE (CAO) as of 05 February 2021 NAME OF ACCREDITATION CERTIFICATE OPERATIONAL QUARANTINE OPEN FOR ADDRESS CONTACT DETAILS CLASSIFICATION ESTABLISHMENT STATUS ISSUED STATUS FACILITY LEISURE CORDILLERA ADMINISTRATIVE REGION (CAR) BAGUIO CITY (074) 422-2075-76-80/ John Hay Special theforestlodge@campjohnhayhotel THE FOREST LODGE AT Economic Zone, Loakan s.ph/ Accredited 4 STAR HTL CAO OPEN No Yes CAMP JOHN HAY Road, Baguio City [email protected] h The Manor at Camp John THE MANOR AT CAMP (074) 424-0931 to 50/ Hay, Loakan Road, Accredited 4 STAR RES CAO OPEN No Yes JOHN HAY [email protected] Baguio City #1 J Felipe Street, (074) 619-0367/ HOTEL ELIZABETH Gibraltar Road, Baguio salesaccount2.baguio@hotelelizab Accredited 3 STAR HTL CAO OPEN No Yes BAGUIO City eth.com.ph #40 Bokawkan Rd., 09173981120/ (074) 442-3350/ Mabuhay PINE BREEZE COTTAGES Accredited CAO OPEN No Yes Baguio City [email protected] Accommodation #01 Apostol St., Corner (074) 442-1559/ 09176786874/ MINES VIEW PARK HOTEL Outlook Drive, Mines 09190660902/ Accredited Hotel CAO OPEN No Yes View, Baguio City [email protected] (074) 619-2050 (074) 442-7674/ Country Club Road, BAGUIO COUNTRY CLUB [email protected] Accredited 5 STAR Resort CAO OPEN No Yes Baguio City [email protected] [email protected] #37 Sepic St. Campo (074) 424-6092 (074) 620-3117/ NYC MANHATTAN HOTEL Accredited Hotel CAO OPEN No Yes Filipino, Baguio City [email protected] -

Investor Presentation March 2021 Learn More About SM Investments

Investor Presentation March 2021 Learn more about SM Investments 2019 Annual Report 2019 Sustainability Report Scanning QR code: 1. Install a QR Code Reader app on your smartphone. 2. Open the QR Code Reader app on your smartphone and scan the QR Code. You will be redirected to where the report can be found. SMIC Investor Presentation 1 Table of Contents The Philippine Economy 3 About SM Investments 4 What’s New In SM? 13 SM Retail 19 Banking 24 SM Prime 27 SM Equity Investments 38 CAPEX 46 Financials 47 SMIC Investor Presentation 2 Philippines: Strong Macroeconomic Fundamentals Young Workforce with Rising Incomes Opportunities GDP Growth Per Capita GDP Median Age . Improved Infrastructure development -9.5% USD3,330 23 . Provincial growth – Luzon, Visayas, Mindanao . Job creation and inclusive growth Consumption Driven Per Capita GNI Population . Agriculture, Manufacturing, Services 73.7% of GDP USD3,596 105M +1.6% p.a. Foreign Direct Investments Inflation and Interest Rate Environment Net External Inflows and ICT Exports . Avg. Inflation rate: 4.5% (Jan-Feb 2021) 51 . T-Bills (91-day): 1.0% (Jan-Feb 2021) 6 . T-Bills (364-day): 1.5% (Jan-Feb 2021) 32 33 1 Healthy Fiscal and Monetary System 35 USD bn USD 20 12 17 14 7 . Debt/GDP: 54.5% Current Credit Ratings 3 2 19 S&P BBB+ Stable 13 16 . CAR: 17.2% 9 10 . NPLs: 3.2% Moody's Baa2 Stable Fitch BBB Stable Malaysia Thailand Indonesia Vietnam Philippines Net FDI Inflows Remittances ICT Export Source: BSP Selected Economic and Financial Indicators Release as of March 31, 2021 Source: The World Bank, Most Recent Data (2019) SMIC Investor Presentation 3 About SM Investments SMIC is a leading Philippine company that is invested in market leading businesses in retail, banking and property. -

Breakfast Included Internet Included Remarks

Room Rate Room Rate Breakfast Internet Hotel Contact Person Room Type Single Room Twin Room remarks included Included (PHP) (PHP) Ms. Marie Faustine Arce 1 King Bed 6,500++ 7,500++ Associate Director Of Sales Hyatt City Of Dreams Manila (Subject to 10% Asean Avenue Corner Roxas Boulevard 2 Twin Bed 7,000++ 8,000++ Service Charge, Entertainment City Value Added tax 1 Hyatt City of Dream YES YES Parañaque City 1701 Metro Manila currently at 12% Philippines 1 King Deluxe 9,000++ 10,500++ and 0.75% T: +(632) 691 1222 Government tax) E: [email protected] 2 Twin Deluxe 9,000++ 10,500++ codmanilahyatt.com Ms. Beryl R. Modesto Sales Manager Midas Hotel & Casino inclusive of 10% 2702 Roxas Boulevard service charge and 2 Midas Hotel & Casino Pasay City 1300 Metro Manila Deluxe 4,500 Net 4,500 Net YES YES applicable Philippines government tax T: +6325850319; +6329020100 Local 1169 E: [email protected] M: +639175977879 (globe) +639283010080 (smart) 2 Queen Beds Ms. Zeng S.J. Liwanag Standard 4,600 Net 4,600 Net Senior Sales Manager Inclusions: Room TRYP by Wyndham •12% Government Coral Way corner Seaside Boulevard Tax and 5% Service Mall of Asia Complex 2 Queen Beds Charge 3 Microtel by Wyndham 5,600 Net 5,600 Net YES YES Pasay City 1308 Metro Manila Corner Room Philippines •Scheduled shuttle T: +63.2.4033333 service from Hotel M: +639175905896 1 Queen Bed – Mall of Asia and 6,700 Net 6,700 Net E: [email protected] Suite vice versa Ms. Tonnette de Belen Sales Manager Deluxe Room 9,000+++ 8,500+++ (Single) Conrad Manila City View (Double) subject to 10% Conrad Manila Seaside Boulevard corner Coral Way service charge, 12% 4 Mall of Asia Complex YES YES VAT and prevailing Pasay City 1300 Metro Manila Local Tax of 0.825% Philippines Deluxe Room 9,800+++ 9,300+++ (Single) T: +6328339999 Bay View (Double) E: [email protected] Ms. -

Tourism and Health Agency-Accredited Quarantine Hotels for Returning Overseas Filipinos Pal Partner Hotels in Metro Manila

TOURISM AND HEALTH AGENCY-ACCREDITED QUARANTINE HOTELS FOR RETURNING OVERSEAS FILIPINOS PAL PARTNER HOTELS IN METRO MANILA Updated as of September 18, 2020 (hotel list and rates are subject to change). Download a QR Scanner App for better readability of the reservation QR code. NIGHTLY RATE W/ TELEPHONE RESERVATION LOCATION HOTEL NAME ADDRESS CONTACT PERSON RESERVATION E-MAIL MOBILE NUMBER FULL BOARD MEALS NUMBER QR CODE (IN PHP) Century Park Hotel 599 P. Ocampo St, Malate, +632 8528- Single- 4,000 1 MANILA Roselle Ann Dalisay [email protected] +639176332522 PAL SISTER COMPANY Manila 8888 Twin- 5,500 The Mini Suites- Eton 128 Dela Street, cor V.A. 2 MAKATI Tower Makati Rufino Street, Legaspi Chona Alejan [email protected] 2,800 PAL SISTER COMPANY Village, Makati City The Charter House 114 Legazpi St., Legazpi www.charterhouse.com.ph +632 8817- 3 MAKATI Henry Sitosta +639438318262 2,600 PAL SISTER COMPANY Village, Makati City 1229 [email protected] 6001 to 16 Newport Boulevard, [email protected] Belmont Hotel +632 5318- 4 PASAY Newport City, Pasay, 1309 Wenie Maligaya [email protected] +639178728773 4,500 Manila 8888 Metro Manila m Citadines Bay City Diosdado Macapagal Blvd. Casey Faylona / karlene.capunitan@the- +639175366646 / 5 PASAY 3,000 Manila corner Coral Way Pasay City Honeyleen Tan ascott.com +639178030482 TOURISM AND HEALTH AGENCY-ACCREDITED QUARANTINE HOTELS FOR RETURNING OVERSEAS FILIPINOS PAL PARTNER HOTELS IN METRO MANILA Updated as of September 18, 2020 (hotel list and rates are subject to change). Download a QR Scanner App for better readability of the reservation QR code. -

LOCATION Manila, Philippines VENUE SMX Convention Centre

LOCATION Manila, Philippines VENUE SMX Convention Centre, Mall of Asia Function Room 3 and 4 (2nd Floor) SMX Convention Centre, Mall of Asia Seashell Lane, Pasay City 1300 Metro Manila EVENT DATE & TIME SUNDAY 15TH JULY 2018 *8:00AM – 7:00PM *The speakers are committed to the highest standard of presentation and insist that all materials are covered. Therefore, the schedule may vary. REGISTRATION SUNDAY 15TH JULY 2018 STARTS AT 6:30AM For Solitaire Ticket Holders The registration will be held at the Solitaire Room located INSIDE Function Room 3, 2nd floor, SMX Convention Center, Mall of Asia, Pasay City. Please feel free to approach our Event Staff to assist you. Laurus Enterprises and Eventbrite Issued Tickets The registration is located INSIDE Function Room 3, 2nd floor, SMX Convention Center, Mall of Asia, Pasay City. SM Tickets, Ticketworld, Ticketnet Issued Tickets The registration is located at the Foyer, in front of Function Room 3, 2nd floor, SMX Convention Center, Mall of Asia, Pasay City. Every participant MUST register. The program will start promptly at 8:00AM. Hence, we highly recommend you arrive and register early to maximize your learning. This is an extremely popular course and we anticipate a full house. Latecomers will be admitted at the first suitable break in the program. TICKET Official Entry Tickets The following tickets are the official entry tickets to the event: LAURUS E-ticket SM Tickets Ticketworld Ticketnet Eventbrite Please bring your ticket for registration purposes. NO TICKET, NO ENTRY. The Seating category (General, VIP, or Solitaire) printed on your ticket indicates your seating section. -

1 Sustainability Report 2018

K C M Y RED 80K 40K K C M Y GREEN 80C 40C K C M Y BLUE 80M 40M K C M Y 80Y 40Y Paper K C M Y RED 80K 40K K C M Y GREEN 80C 40C K C M Y BLUE 80M 40M K C M Y 80Y 40Y Paper K C M Y RED 80K 40K K C M Y GREEN 80C 40C K C M Y BLUE 80M 40M K C M Y 80Y 40Y Paper K C M Y RED 80K 40K K C Prime SR Cover proofing.pdf 1 4/8/19 10:10 PM C M Y CM MY CY CMY K Sustainability Report 2018 1 SM @ 60 Years About this Report (102-46,47,49,50,51,54) SM Prime Holdings, Inc. presents the 11th annual Sustainability Report and the 7th edition following the Global Reporting Initiative (GRI). This Sustainability Report features highlights from the Company’s material topics on: ECONOMIC ENVIRONMENTAL SOCIAL Economic Performance Energy Employment Indirect Economic Impacts Water Occupational Health and Safety Anti-Corruption Emissions Training and Education Anti-competitive Behavior Effluents and Waste Diversity and Equal Opportunities Biodiversity Non-discrimination Environmental Compliance Security Practices Human Rights Assessment Local Communities Socio-economic Compliance The sustainability information contained herein covers reporting from January to December 2018 and will discuss SM Prime’s assets where the business has organizational boundary. This report has been prepared in accordance with the GRI Standards: Core option. The 2018 SM Prime Sustainability Report must be read in conjunction with the 2018 SM Prime Annual Report. -

Standards Monitoring and Enforcement Division List Of

DEPARTMENT OF TOURISM OFFICE OF TOURISM STANDARDS AND REGULATION - STANDARDS MONITORING AND ENFORCEMENT DIVISION LIST OF OPERATIONAL HOTELS AS OF MARCH 26, 2020, 09:00 AM NATIONAL CAPITAL REGION COUNT NAME OF ESTABLISHMENT ADDRESS 1 Ascott Bonifacio Global City 5th ave. Corner 28th Street, BGC, Taguig 2 Ascott Makati Glorietta Ayala Center, San Lorenzo Village, Makati City 3 Cirque Serviced Residences Bagumbayan, Quezon City 4 Citadines Bay City Manila Diosdado Macapagal Blvd. cor. Coral Way, Pasay City 5 Citadines Millenium Ortigas 11 ORTIGAS AVE. ORTIGAS CENTER, PASIG CITY 6 Citadines Salcedo Makati 148 Valero St. Salcedo Village, Makati city Asean Avenue corner Roxas Boulevard, Entertainment City, 7 City of Dreams Manila Paranaque #61 Scout Tobias cor Scout Rallos sts., Brgy. Laging Handa, Quezon 8 Cocoon Boutique Hotel City 9 Connector Hostel 8459 Kalayaan Ave. cor. Don Pedro St., POblacion, Makati 10 Conrad Manila Seaside Boulevard cor. Coral Way MOA complex, Pasay City 11 Cross Roads Hostel Manila 76 Mariveles Hills, Mandaluyong City Corner Asian Development Bank, Ortigas Avenue, Ortigas Center, 12 Crowne Plaza Manila Galleria Quezon City 13 Discovery Primea 6749 Ayala Avenue, Makati City 14 Domestic Guest House Salem Complex Domestic Road, Pasay City 15 Dusit Thani Manila 1223 Epifanio de los Santos Ave, Makati City 16 Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Quezon City 17 EDSA Shangri-La 1 Garden Way, Ortigas Center, Mandaluyong City 18 Go Hotels Mandaluyong Robinsons Cybergate Plaza, Pioneer St., Mandaluyong 19 Go Hotels Ortigas Robinsons Cyberspace Alpha, Garnet Road., San Antonio, Pasig City 20 Gran Prix Manila Hotel 1325 A Mabini St., Ermita, Manila 21 Herald Suites 2168 Chino Roces Ave.