5Ef2605b993edc8098ff2f23 AG

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Securities and Exchange Commission Sec Form 17-A, As Amended

CR02659-2021 SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A, AS AMENDED ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF THE CORPORATION CODE OF THE PHILIPPINES 1. For the fiscal year ended Dec 31, 2020 2. SEC Identification Number 52412 3. BIR Tax Identification No. 000-156-011 4. Exact name of issuer as specified in its charter BELLE CORPORATION 5. Province, country or other jurisdiction of incorporation or organization Metro Manila Philippines 6. Industry Classification Code(SEC Use Only) 7. Address of principal office 5/F Tower A, Two ECom Center, Palm Coast Avenue, MOA Complex, Pasay City Postal Code 1300 8. Issuer's telephone number, including area code 02-86628888 9. Former name or former address, and former fiscal year, if changed since last report n/a 10. Securities registered pursuant to Sections 8 and 12 of the SRC or Sections 4 and 8 of the RSA Number of Shares of Common Stock Outstanding and Amount of Debt Title of Each Class Outstanding Common Stock, Php 1.00 par 9,763,126,297 value 11. Are any or all of registrant's securities listed on a Stock Exchange? Yes No If yes, state the name of such stock exchange and the classes of securities listed therein: Philippine Stock Exchange, Inc. / Common shares 12. Check whether the issuer: (a) has filed all reports required to be filed by Section 17 of the SRC and SRC Rule 17.1 thereunder or Section 11 of the RSA and RSA Rule 11(a)-1 thereunder, and Sections 26 and 141 of The Corporation Code of the Philippines during the preceding twelve (12) months (or for such shorter period that the registrant was required to file such reports) Yes No (b) has been subject to such filing requirements for the past ninety (90) days Yes No 13. -

Hotel Restaurant Institutional Philippines

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: GAIN Report Number: 1725 Philippines Food Service - Hotel Restaurant Institutional 2017 HRI Food Service Approved By: Ralph Bean Prepared By: Joycelyn Claridades-Rubio Report Highlights: Increased spending and growing dining habits of the emerging middle class in the Philippines has contributed to the growth of the HRI sector by 6.7% from 2015 with sales of US$12 billion. This growth in the foodservice industry provides greater opportunities for exports of U.S. food and beverage products to the Philippines. Post: Manila General Information: Table 1 – Philippine Market Profile I. Overview of the Philippine Market Population: The Philippines is the largest market in Southeast Asia for U.S. consumer-oriented food and beverage 104.2 Million (July 2017 est.), (f&b) products and one of the fastest growing annual growth rate of 1.6% markets in the world, importing $923.4 billion in 19.17% below 24 years old U.S. f&b products in 2016. 52% living in urban areas A mature market with growing demand for Land Area: 298,170 sq.km. consumer-oriented products, the United States remains the Philippines’ largest supplier for food, beverage and ingredient products. 2016 GDP Growth: 6.8% Ranked as the 11th largest export market for U.S. GDP Per Capita: $7,700 (2016 est.) high-value, consumer-oriented products, the Philippines imported $716.1 million from January Source: CIA World Fact Book through September 2017. -

Sands Residences Average 9.3%**

1st Philippine Conglomerate to breach PHP 1 Trillion in Market Capitalization RETAIL BANKS PROPERTY BANKING RETAIL PROPERTY OTHER INVESTMENTS GROUP COMPANY RANKINGS SMIC, SM Prime, and BDO comprise 30% of the value of the Philippine Index Philippine Conglomerates Philippine Retailers Philippine Banks Property Developers Market Cap (USD bn) FY 2019 Total Sales (USD mn) Total Resources (USD bn) Market Cap (USD bn) SMIC 23.6 SM Retail 6,838 BDO 62.1 SMPH 20.1 JG Summit 10.0 Robinsons 3,146 Metrobank 48.8 Ayala Land 10.0 Ayala Corp 9.9 Puregold 2,984 BPI 43.2 Megaworld 2.0 Aboitiz Equity 5.2 Landbank 40.2 Robinsons Land 1.6 SMC 5.0 PNB 22.3 Vistaland 0.9 LT Group 2.6 Philippine Retailers China Bank 19.0 Double Dragon 0.7 Metro Pacific 2.5 FY 2019 Store Count Security Bank 15.7 Filinvest 0.5 GT Capial 1.9 SM Retail 2,799 UBP 15.2 Alliance Global 1.6 Robinsons 1,938 RCBC 15.2 DMCI 1.2 Puregold 436 DBP 15.1 Source: Bloomberg; Source: Company Information end-2019 Source: Consolidated statements of Source: Bloomberg; Figures as of October 30, 2020 condition (SOC), FY 2019 Figures as of October 30, 2020 1st Philippine Property Company to breach PHP 1 Trillion in Market Capitalization One E-com (2008) Sea Residences (2008) Two E-com Conrad Manila (2012) Shell Residences SM Arena (2016) (2011) (2012) Five E-com Shore SMX (2015) Residences Mall of Asia Convention (2017) (2006) Center, Manila (2007) SM Development Corporation commits itself to provide access to luxurious urban living through its vertical villages and gated horizontal communities, designed with thoughtful features and generous resort-like amenities, all perfectly integrated with a commercial retail environment, thus giving its residents access to a truly cosmopolitan lifestyle. -

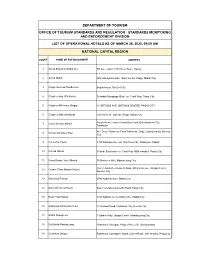

Standards Monitoring and Enforcement Division List Of

DEPARTMENT OF TOURISM OFFICE OF TOURISM STANDARDS AND REGULATION - STANDARDS MONITORING AND ENFORCEMENT DIVISION LIST OF OPERATIONAL HOTELS AS OF MARCH 26, 2020, 09:00 AM NATIONAL CAPITAL REGION COUNT NAME OF ESTABLISHMENT ADDRESS 1 Ascott Bonifacio Global City 5th ave. Corner 28th Street, BGC, Taguig 2 Ascott Makati Glorietta Ayala Center, San Lorenzo Village, Makati City 3 Cirque Serviced Residences Bagumbayan, Quezon City 4 Citadines Bay City Manila Diosdado Macapagal Blvd. cor. Coral Way, Pasay City 5 Citadines Millenium Ortigas 11 ORTIGAS AVE. ORTIGAS CENTER, PASIG CITY 6 Citadines Salcedo Makati 148 Valero St. Salcedo Village, Makati city Asean Avenue corner Roxas Boulevard, Entertainment City, 7 City of Dreams Manila Paranaque #61 Scout Tobias cor Scout Rallos sts., Brgy. Laging Handa, Quezon 8 Cocoon Boutique Hotel City 9 Connector Hostel 8459 Kalayaan Ave. cor. Don Pedro St., POblacion, Makati 10 Conrad Manila Seaside Boulevard cor. Coral Way MOA complex, Pasay City 11 Cross Roads Hostel Manila 76 Mariveles Hills, Mandaluyong City Corner Asian Development Bank, Ortigas Avenue, Ortigas Center, 12 Crowne Plaza Manila Galleria Quezon City 13 Discovery Primea 6749 Ayala Avenue, Makati City 14 Domestic Guest House Salem Complex Domestic Road, Pasay City 15 Dusit Thani Manila 1223 Epifanio de los Santos Ave, Makati City 16 Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Quezon City 17 EDSA Shangri-La 1 Garden Way, Ortigas Center, Mandaluyong City 18 Go Hotels Mandaluyong Robinsons Cybergate Plaza, Pioneer St., Mandaluyong 19 Go Hotels Ortigas Robinsons Cyberspace Alpha, Garnet Road., San Antonio, Pasig City 20 Gran Prix Manila Hotel 1325 A Mabini St., Ermita, Manila 21 Herald Suites 2168 Chino Roces Ave. -

Hotel Address Contact Number Email

HOTEL ADDRESS CONTACT NUMBER EMAIL Astoria Bohol Baranggay Taguihon, Baclayon, Bohol 335-1111 [email protected] 036-2881111/ Astoria Boracay Station 1, Boracay Island, Malay, Aklan [email protected] 036-2883536 Km 62 North National Highway, Brgy. San Rafael, Puerto Princesa Astoria Palawan 335-1111 [email protected] City, Palawan Astoria Plaza 15 J. Escriva Drive, Ortigas Business District, Pasig City 335-1131 to 35 [email protected] 2107 Prime Street, Madrigal Business Park, Ayala Alabang, B Hotel Alabang 828-8181 Muntinlupa City B Hotel Quezon City 14 Scout Rallos Street, Brgy. Laging Handa, Quezon City 990-5000 Chardonnay by Astoria 352 Captain Henry P. Javier, Brgy. Oranbo, Pasig City 335-1131 to 35 [email protected] Asean Avenue corner Roxas Boulevard, Entertainment City, City of Dreams Manila 800-8080 [email protected] Paranque Conrad Manila Seaside Boulevard, Coral Way, Pasay City 833-9999 Seascapes Resort Town, Soong, Lapu-Lapu City, Mactan Island, 032-4019999/ Crimson Resort & Spa Mactan [email protected] Cebu 239-3900 Ortigas Avenue corner Asian Development Bank Ave, Ortigas Crowne Plaza Manila Galleria 633-7222 Center, Quezon City Diamond Hotel Roxas Boulevard corner Dr. J. Quintos Street, Manila 528-3000/ 305-3000 [email protected] Discovery Suites 25 ADB Avenue, Ortigas Center, Pasig City 719-8888 [email protected] Dusit Thani Manila Ayala Center, Makati City 238-8888 [email protected] Eastwood Richmonde Hotel 17 Orchard Road, Eastwood City, Bagumbayan, Quezon City 570-7777 [email protected] F1 Hotel Manila 32nd Street, Bonifacio Global City, Taguig City 928-9888 Fairmont Makati 1 Raffles Drive, Makati Avenue, Makati City 795-1888 [email protected] Las Casas Filipinas de Acuzar Brgy. -

Metro Manila Market Update Q1 2017

RESEARCH METRO MANILA MARKET UPDATE Q1 2017 METRO MANILA REAL ESTATE SECTOR REVIEW METRO MANILA AND THE THREAT OF EMERGING CITIES The attractiveness of Metro Manila for real estate developers and investors continues to exist. Although highly congested and vacancy rates are constantly dwindling, it is still the best location for business and investment activities. Considering that the seat of government, head offices of key companies, and the most reputable universities and institutions are located in Metro Manila, demand is perceived to always be buoyant and pervasive. The real challenge is innovation and the creation of new stock to cater to the limitless demand. The Philippine National Economic and Development Authority defines Philippine Emerging Cities as cities, relative to Manila, that are rapidly catching up in terms of business activities, innovation and ability to attract people. A few of the notable emerging cities in the Philippines are Angeles (Clark), Cebu, Davao, Iloilo and Zamboanga. Cebu, Davao and Iloilo are top 5, 6 and 8, respectively, among the Philippine Highly Urbanized Cities (HUC) of the country. Angeles City’s makings is supplemented by the much- awaited Clark Green City. Zamboanga City was identified as one of the emerging cities when it comes to information technology Source: Wikipedia operations. The city has the propensity to flourish being the third major gateway and transshipment important transportation networks, largest city in the Philippines in hub in Northern Mindanao, it will increase access to jobs and terms of land area. Furthermore, continue to be a key educational services by people in smaller Bacolod, Bohol, Leyte, Naga, center in the region. -

Land-Based Casinos Prepare for Resumption of Operations

CEO UNDERSCORES SURVIVAL IN THE HOMEGROWN PAGCOR’S ROLE IN TIME OF COVID 19 BETS POST-COVID-19 PAGCORIANS VENTURE AVP Hernando Apigo PH ECONOMIC INTO BUSINESS GM Jethro Chancoco RECOVERY AMID PANDEMIC VP Tomas A. Consolacion, Jr PAGE 2 CENTERSPREAD TO PAGE 12 P20 The APRIL TO JUNE 2020 INSIDEROfficial Newsletter of the Philippine Amusement and Gaming Corporation www.pagcor.ph Land-based casinos prepare for resumption of operations Strict health and safety protocols slated FTER four months of temporary suspension due to the Corona Virus Disease 2019 (CO- AVID-19) pandemic, land-based casinos may be able to resume operations once community quarantine restrictions further ease up. In line with this, PAGCOR submitted its recommenda- tion to the Inter-Agency Task Force for COVID-19 (IATF) last May, to allow the resump- If approved under tion of casino operations with the proposed safety and health the modified protocols. According to PAGCOR general community Chairman and CEO Andrea D. quarantine (MGCQ), Domingo, the safety protocols are well-crafted and are even PAGCOR hopes to more stringent compared to provide job security other businesses that are now in operation. for most of the “If approved under the modified general community gaming employees quarantine (MGCQ), PAGCOR in the country. hopes to provide job security for most of the gaming employ- CF branches nationwide prepare for the reopening of operations. In photo are CF Olongapo personnel ees in the country. It is also disinfecting the branch’s gaming equipment and furniture. during this phase that the local gaming industry transitions to cially frequent-contact surfac- ance to social distancing, pro- Gradually, said procedures the new normal.” – Andrea D. -

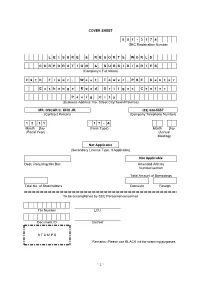

Lrwc 2018 Annual Report

COVER SHEET 0 0 1 - 3 1 7 4 SEC Registration Number L E I S U R E & R E S O R T S W O R L D C O R P O R A T I O N & S U B S I D I A R I E S (Company’s Full Name) 2 6 t h F l o o r , W e s t T o w e r , P S E C e n t e r E x c h a n g e R o a d O r t i g a s C e n t e r P a s i g C i t y (Business Address: No. Street City/Town/Province) MR. OSCAR C. KHO JR. (02) 638-5557 (Contract Person) (Company Telephone Number) 1 2 3 1 1 7 - A Month Day (Form Type) Month Day (Fiscal Year) (Annual Meeting) Not Applicable (Secondary License Type, If Applicable) Not Applicable Dept. Requiring this Doc. Amended Articles Number/section Total Amount of Borrowings Total No. of Stockholders Domestic Foreign To be accomplished by SEC Personnel concerned File Number LCU Document ID Cashier S T A M P S Remarks: Please use BLACK ink for scanning purposes. ~ 1 ~ SECURITIES AND EXCHANGE COMMISSION SEC FORM 17-A ANNUAL REPORT PURSUANT TO SECTION 17 OF THE SECURITIES REGULATION CODE AND SECTION 141 OF THE CORPORATION CODE OF THE PHILIPPINES 1. For the fiscal year ended December 31, 2018 2. Commission identification number 13174 3. BIR tax identification number 321-000-108-278 LEISURE & RESORTS WORLD CORPORATION 4. -

For Immediate Release City of Dreams Manila Temporarily

FOR IMMEDIATE RELEASE CITY OF DREAMS MANILA TEMPORARILY SUSPENDS ITS CASINO, HOTEL AND RESTAURANT OPERATIONS (UPDATED) Manila, March 17, 2020 - Following the earlier announcement of City of Dreams Manila of the temporary closure of all its casino operations effective March 15 in full compliance with PAGCOR’s order to suspend all gaming operations, its three luxury hotels: Nuwa, Nobu and Hyatt Regency and all restaurants and guest facilities on property will also temporarily suspend operations effective March 18, in adherence with the Enhanced Community Quarantine guidelines in Metro Manila and Luzon. “In these extraordinary times that call for extraordinary measures, we rally behind President Rodrigo Duterte in the actions he has implemented to curb the spread of the Coronavirus, and we fully support PAGCOR under the leadership of Chairman Andrea Domingo in its order to temporarily suspend gaming operations in the best interest of all,” says City of Dreams Manila Chief Operating Officer Kevin Benning. “We are also one with our industry colleagues who in this time of need have prioritized the safety of our colleagues and guests over economic goals,” he continues. In implementing the Enhanced Community Quarantine, the management is extending beneficial schemes for affected colleagues to tide them over the period. The property remains vigilant while installing stringent protocols and precautionary measures for the protection and well-being of its colleagues and guests from COVID-19. During the integrated resort’s closure, guests are encouraged to check on the service advisory updates on its website, Facebook and social media channels. Stringent social distancing and application of sanitation and hygiene protocols continue to be implemented for the skeletal workforce involved in the maintenance of the property. -

Philippines: Food Service

THIS REPORT CONTAINS ASSESSMENTS OF COMMODITY AND TRADE ISSUES MADE BY USDA STAFF AND NOT NECESSARILY STATEMENTS OF OFFICIAL U.S. GOVERNMENT POLICY Required Report - public distribution Date: 12-13-2016 GAIN Report Number: 1625 Philippines Food Service - Hotel Restaurant Institutional HRI Sectoral Report Approved By: Ralph Bean Prepared By: Joycelyn Claridades Report Highlights: The food service industry in the Philippines continuous to expand as more and more shopping malls and new hotels are being opened throughout the country. The influx of foreign-branded restaurants coupled with the growing affluence of Filipino consumers has also contributed to the growth of the HRI sector. This growth in the foodservice industry provides greater opportunities for exports of U.S. food and beverage products to the Philippines. Post: Manila I. Overview of the Philippine Market The Philippines is still the largest market in Southeast Asia for U.S. consumer-oriented food and beverage (F&B) products and one of the fastest growing markets in the world, importing $898.4 million in U.S. F&B products in 2015. A mature market with growing demand for U.S. consumer-oriented products, the United States remains the Philippines’ largest supplier for food, beverage and ingredient products. Ranked as the 13th largest export market for U.S. high-value, consumer-oriented products, the Philippines imported $569.8 million from January through August 2016. Based on the chart below, the United States remains the largest supplier with seventeen percent (16%) market share, followed by China (10%), and Indonesia, Singapore, and New Zealand (9%). Total imports of consumer-oriented food grew annually by an average of 15%. -

Business in Harmony Cebu Exchange

BUSINESS IN HARMONY CEBU EXCHANGE www.arthaland.com +63 917 77 ARTHA (27842) | [email protected] Visit our showroom on-site along Salinas Drive, Lahug, Cebu City CLIENT PROSPECTUS HLURB LTS No. 032788 CLIENT PROSPECTUS Salinas Drive, Lahug, Cebu City. Issued on 11 September 2017. Completion on 30 June 2021. Project Developer: Cebu Lavana Land Corporation. Project Manager: Arthaland Corporation. HLURB CVR AA-2019/01-550. Harmony… The beautiful interweaving of different elements into a singular experience. An experience so diverse, yet utterly cohesive; complete and perfectly balanced. Welcome to the Cebu Exchange. A holistic, sustainable, and highly connected work environment where harmony is not just a way of life, but a way of doing business. THE PHILIPPINE MARKET: A LANDSCAPE OF POSSIBILITIES*: AN OVERTURE • GROWTH: 6.7% GDP • OFW REMITTANCES: US$30 billion p.a. • BPO REVENUE: US$23 billion • 10-YEAR BOND YIELD: 6.3% Ranking among the top growth performers of Asia • POPULATION: 102 million in 2017*, the Philippines has cemented its position (67% below 35 years old) • MANILA at the top of the charts as one of the most • INFRASTRUCTURE SPENDING: US$160 billion (from 2016 to 2022) attractive economies in the entire region; • 3.8% Managed Inflation as of Q1 2018 attracting investors across the globe with more exciting and lucrative investment opportunities over other neighboring countries. CEBU CITY • DAVAO CITY *Sources: World Bank Group, 2017 Bangko Sentral ng Pilipinas, 2018 Contact Center Association of the Philippines, 2018 World Government Bonds, 2018 Philippine Statistics Authority, 2018 Department of Budget and Management, 2018 CEBU CITY: A DYNAMIC DESTINATION Known for its powdery white sand beaches, delicious local fare and artisan crafts, Cebu, the Queen City of the South, has always been one of the most important and influential economic centers in the Philippines and is quickly emerging as one of the most prominent IT-BPM destinations in the world. -

Manila Hotel Market Update

Manila Hotel Market Update November 2013 Manila’s gaming push aiming to induce tourism demand 4.2 million international Gaming Revenue Trend visitors recorded in 2012 Key Casino Operators Billion US$ % “Manila’s tourism market is taking a 1.8 80 decided turn away from a vanilla offering 1.6 1.4 60 to boost visitor numbers. Over the past 1.2 18 months, there was an influx of Korean 1.0 40 0.8 20 and Chinese visitors into the Philippines. 0.6 0.4 0 The country has a competitive advantage 0.2 over others in South East Asia in terms -20 of its location, approximately 1.5 - 3 2006 2007 2008 2009 2010 2011 2012 hours from major cities in China. Last Gaming Revenue Annual Growth year it recorded it’s highest growth ever. Source: PAGCOR and Resort World Manila Annual Reports, As Russian tourists arrived in the first and C9 Hotelworks Market Research Russian charter flight to Manila, which By 2017 the Manila hotel supply is launched in October. Viewing the trend anticipated to add over 6,000 keys of Russian visitors in other regional into the market, approximately leisure markets, the potential to tap into one-third of the existing keys. Given mass tourism remains strong. the fact that tourist arrivals to the country are still at a low compared The South East Asian casino dreamscape to its peers such as Thailand and is setting up a battle between established Malaysia, the current focus is on gaming giants and independent operators generating more demand. Looking in a high stakes contest of win or lose.