The Russian Stock Market in 2015: Returns, Liquidity and the Drivers of Change

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Execution Venues List

Execution Venues List This list should be read in conjunction with the Best Execution policy for Credit Suisse AG (excluding branches and subsidiaries), Credit Suisse (Switzerland) Ltd, Credit Suisse (Luxembourg) S.A, Credit Suisse (Luxembourg) S.A. Zweigniederlassung Österreichand, Neue Aargauer Bank AG published at www.credit-suisse.com/MiFID and https://www.credit-suisse.com/lu/en/private-banking/best-execution.html The Execution Venues1) shown enable the in scope legal entities to obtain on a consistent basis the best possible result for the execution of client orders. Accordingly, where the in scope legal entities may place significant reliance on these Execution Venues. Equity Cash & Exchange Traded Funds Country/Liquidity Pool Execution Venue1) Name MIC Code2) Regulated Markets & 3rd party exchanges Europe Austria Wiener Börse – Official Market WBAH Austria Wiener Börse – Securities Exchange XVIE Austria Wiener Börse XWBO Austria Wiener Börse Dritter Markt WBDM Belgium Euronext Brussels XBRU Belgium Euronext Growth Brussels ALXB Czech Republic Prague Stock Exchange XPRA Cyprus Cyprus Stock Exchange XCYS Denmark NASDAQ Copenhagen XCSE Estonia NASDAQ Tallinn XTAL Finland NASDAQ Helsinki XHEL France EURONEXT Paris XPAR France EURONEXT Growth Paris ALXP Germany Börse Berlin XBER Germany Börse Berlin – Equiduct Trading XEQT Germany Deutsche Börse XFRA Germany Börse Frankfurt Warrants XSCO Germany Börse Hamburg XHAM Germany Börse Düsseldorf XDUS Germany Börse München XMUN Germany Börse Stuttgart XSTU Germany Hannover Stock Exchange XHAN -

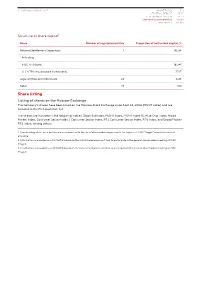

Outstanding Shares

PJSC RusHydro | Annual Report 2018 Share of securities in free float1 Shareholder agreements Date Free-float factor RusHydro’s shareholders can enter into Last trading day of 2016 0.23 shareholder agreements, including Last trading day of 2017 0.25 those that afford them an extent of Last trading day of 2018 0.19 control disproportionate to their contribution to the authorized capital2. Notifications on concluded shareholder agreements received by RusHydro Parties to the shareholder agreement Date of the shareholder agreement ↗ The Russian Federation as represented by the Federal Agency for State Property Management March 7, 2017 ↗ VTB Bank (PJSC) ↗ The Russian Federation as represented by the Federal Agency for State Property Management June 23, 2016 ↗ RusHydro’s subsidiaries: Hydroinvest3, EZOP, Energy Index – HydroOGK Outstanding shares Moscow Exchange listing Index inclusion: ↗ FTSE All-World Index AWORLDS; ↗ MOEX Russia Index (previous name – ↗ FTSE4Good Emerging; The Company’s shares have been MICEX Index) IMOEX; ↗ NASDAQ Russia NQRU; traded on the Moscow Exchange ↗ Electric Utilities Index MOEXEU; ↗ Nasdaq AlphaDEX Emerging Markets (formerly MICEX Stock Exchange). ↗ Broad Market Index MOEXBMI; NQDXEM; since February 4, 2008 (ticker: HYDR). ↗ State-Owned Companies Index ↗ STOXX Russia Total Market TCRUP; The securities are listed in Level 1, MOEXSCI; ↗ STOXX Optimized Russia EEORGT. the Exchange’s top quotation list. ↗ FTSE Emerging Index AWALLE; Moscow Exchange trading information Item 2016 2017 2018 Trading mode T+: stocks and DRs T+: stocks and DRs T+: stocks and DRs Currency RUB RUB RUB Maximum trade price 0.994 1.100 0.810 Minimum trade price 0.575 0.717 0.476 Year-end trade price 0.926 0.729 0.486 Trading volume, bn pcs 134 173 136 1 In accordance with the Moscow Exchange’s methodology for calculating the free-float factor published at http://www.moex.com/ru/index/MICEXINDEXCF/constituents/. -

Share Listing

Annual Report 2018 | MAGNIT MAGNIT TODAY 3-11 99 STRATEGIC REPORT 13-27 PERFORMANCE REVIEW 29-53 CORPORATE GOVERNANCE 55-113 APPENDICES 115-189 Structure of share capital1 Name Number of registered entities Proportion of authorized capital, % National Settlement Depositary 1 95.54 Including: PJSC VTB Bank 18.342 LLC VTB Infrastructure Investments 7.723 Legal entities and individuals 24 4.46 Total: 25 100 Share listing Listing of shares on the Moscow Exchange The Company’s shares have been listed on the Moscow Stock Exchange since April 24, 2006 (MGNT ticker) and are included in the first quotation list. The shares are included in the following indices: Stock Subindex, MOEX Index, MOEX Index 10, Blue Chip Index, Broad Market Index, Consumer Sector Index / Consumer Sector Index, RTS Consumer Sector Index, RTS Index, and Broad Market RTS Index, among others. 1. Shareholding structure is provided in accordance with the list of shareholders registered in the register of PJSC “Magnit” shareholders as of 31.12.2018 2. Information is provided as of 12.11.2018 based on the list of shareholders entitled to participate in the general shareholders meeting of PJSC “Magnit 3. Information is provided as of 12.11.2018 based on the list of shareholders entitled to participate in the general shareholders meeting of PJSC “Magnit 100 101 Weight of shares in indices Ticker Index name Weight in index, % RDXUSD Russian Depositary Index USD 2.85 RDX Russian Depositary Index EUR 2.85 NU137529 MSCI EM IMI (VRS Taxes) Net Return USD Index 0.09 RIOB FTSE Russia IOB -

On Determination of Market Price of One Ordinary Registered Share of the Moscow Exchange (State Registration Number 1-05-8443-H Dated 16.11.2011)

2, 3-ya ulitsa Yamskogo Polya, bld. 7, office 301, Moscow, 125040 Tel.: +7 (495) 717-01-01 +7 (495) 557-07-97 www.evcons.ru REPORT No. 134/16 dated June 29, 2016 On determination of market price of one ordinary registered share of the Moscow Exchange (state registration number 1-05-8443-H dated 16.11.2011) Customer: Moscow Exchange Contractor: Everest Consulting Moscow 2016 EVEREST Consulting LLC 1 Att: Evgeny Fetisov CFO Moscow Exchange Dear Evgeny, Under Agreement No.134/16 dated 16.06.2016 executed by and between Everest Consulting Limited Liability Company (hereinafter Everest Consulting LLC, the Contractor), and Public Joint-Stock Company Moscow Exchange MICEX-RTS (hereinafter the Moscow Exchange, the Customer), the appraiser employed by the Contractor (hereinafter the Appraiser) carried out valuation of one registered ordinary share of the Moscow Exchange (hereinafter the Object of Valuation). The principle task and intended use of valuation was to measure the market price of the Object of Valuation for the purpose of share buyback from shareholders who voted against the corporate restructuring or failed to participate in voting in pursuance with clause 1 and clause 3 Article 75 of the Federal Law No.208-FZ On Joint-stock Companies dated 26 December 1995. The valuation was done in accordance with the Federal Law No.135-FZ On Valuation Activity in the Russian Federation dated 29 July 1998, Federal Evaluation Standard General Concepts of the Valuation, Approaches and Requirements to Carrying Out the Valuation (FES No.1) approved by the Order of the Ministry of Economy No. -

Enhancing Liquidity in Emerging Market Exchanges

ENHANCING LIQUIDITY IN EMERGING MARKET EXCHANGES ENHANCING LIQUIDITY IN EMERGING MARKET EXCHANGES OLIVER WYMAN | WORLD FEDERATION OF EXCHANGES 1 CONTENTS 1 2 THE IMPORTANCE OF EXECUTIVE SUMMARY GROWING LIQUIDITY page 2 page 5 3 PROMOTING THE DEVELOPMENT OF A DIVERSE INVESTOR BASE page 10 AUTHORS Daniela Peterhoff, Partner Siobhan Cleary Head of Market Infrastructure Practice Head of Research & Public Policy [email protected] [email protected] Paul Calvey, Partner Stefano Alderighi Market Infrastructure Practice Senior Economist-Researcher [email protected] [email protected] Quinton Goddard, Principal Market Infrastructure Practice [email protected] 4 5 INCREASING THE INVESTING IN THE POOL OF SECURITIES CREATION OF AN AND ASSOCIATED ENABLING MARKET FINANCIAL PRODUCTS ENVIRONMENT page 18 page 28 6 SUMMARY page 36 1 EXECUTIVE SUMMARY Trading venue liquidity is the fundamental enabler of the rapid and fair exchange of securities and derivatives contracts between capital market participants. Liquidity enables investors and issuers to meet their requirements in capital markets, be it an investment, financing, or hedging, as well as reducing investment costs and the cost of capital. Through this, liquidity has a lasting and positive impact on economies. While liquidity across many products remains high in developed markets, many emerging markets suffer from significantly low levels of trading venue liquidity, effectively placing a constraint on economic and market development. We believe that exchanges, regulators, and capital market participants can take action to grow liquidity, improve the efficiency of trading, and better service issuers and investors in their markets. The indirect benefits to emerging market economies could be significant. -

Moscow Exchange Investor Presentation

March 2015 Investor presentation 1 MOEX Overview 2 Recent achievements 3 Where we are heading 4 Strong operating and financial results 2 Highly diversified product offering… Investing and trading . Listing . Local and foreign shares, DRsnew . International ETFsnew Hedging Investing and trading . Indexes . Government bonds . FX EQUITIES . Municipal bonds . Local and foreignnew single stocks . Corporate bonds . Commodities . ABS, MBS . Interest ratesnew . Eurobonds Currency conversion Funding + FX swaps . Credit & deposit operations . Swap instruments . REPO with CCP . Spot instruments (USD, EUR, COMMODITIES . REPO with CBR with CMS CNY, HKDnew, GBPnew and CIS . Inter-dealer REPO currencies) Investing and trading . Spot and swap precious metals . Grain marketnew 3 …coupled with strong post-trade infrastructure Post-Trade Excellence: CCP and CSD National Clearing Centre (NCC) CCP cleared value based on own funds (capital)1 ADTV (Jan – Dec 2014) Comments RUB bln RUB bln 43.1 39.5 FX 910.5 . Well-capitalized NCC as CCP 28.8 Derivatives 244.3 for all asset classes REPO with CCP 99.7 . Bank of Russia qualified CCP 13.2 Equities 41.0 status CLEARING 10.1 Fixed income 42.2 . Centralized clearing of OTC Commodities 0.07 derivatives 1 Jan 1 Jan 1 Jan 1 Jan 1 Mar 2012 2013 2014 2015 2015 OTC derivatives 0.01 National Settlement Depository2 (NSD) capital Assets in deposit3 Comments RUB bln RUB bln . Safekeeping and settlement 28 346 24 942 services 10.8 21 766 9.4 . Сollateral management 7.3 services for REPO transactions 5.4 6.0 12 291 11 280 . Repository for OTC trades DEPOSITORY . Links to ICSDs for Russian SETTLEMENT& bonds and equities 1 Jan 1 Jan 1 Jan 1 Jan 1 Mar 31 Dec 31 Dec 31 Dec 31 Dec 28 Feb . -

List of Execution Venues Made Available by Societe Generale

List of Execution Venues made available by Societe Generale January 2018 Note that this list of Execution Venues is not exhaustive and will be kept under review and updated in accordance with Societe Generale’s execution practices. Societe Generale reserves the right to use other Execution Venues in addition to those listed below where it deems it appropriate in accordance with execution practices. Where Societe Generale acts as the Execution Venue, it will consider all sources of reasonably available information to obtain the best possible outcome. Fixed Income . The main Execution Venue is Societe Generale SA (and its affiliates) . When the trading obligation for derivatives applies, execution will take place on MiFID trading venues (Regulated Markets, or MTF or OTF or all equivalent venues as SEF) Alternative Venues include: BGC Bloomberg Bloomberg FIET Brokertec GFI Marketaxess MTP MTS TP ICAP Tradeweb Tradition Forex . The main Execution Venue is Societe Generale SA (and its affiliates) Alternative Venues include: 360T Alpha BGC Bloomberg Currenex EBS Equilend FX Connect FX Spotstream FXall Hotpspot ICAP Integral FX inside Reuters Tradertools Cash Equities Abu Dhabi Securities Exchange EDGEA Exchange NYSE Amex Alpha EDGEX Exchange NYSE Arca AlphaY EDGX NYSE Stock Exchange Aquis Equilend Omega ARCA Stocks Euronext Amsterdam OMX Copenhagen ASX Centre Point Euronext Block OMX Helsinki Athens Stock Exchange Euronext Brussels OMX Stockholm ATHEX Euronext Cash Amsterdam OneChicago Australia Securities Exchange Euronext Cash Brussels Oslo -

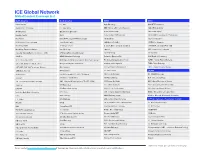

ICE Global Network Global Content Coverage List

ICE Global Network Global Content Coverage List North America North America EMEA APAC Activ Financial ICE TMC Aquis Exchange ASX (NTP Derivatives) Aequitas NEO Exchange ICE Swap Trade BME - Bolsas y Mercados Españoles CXA (CHI-X Australia) ATG Americas IEX (Investors Exchange) Borsa Italiana Group CXJ (CHI-X Japan) Barclays Capital IIROC Börse Stuttgart (SID platform) HKEX (OMD C Securities & D Derivatives) BGC Fenics Itiviti (NYFIX, ULLink PTRMS (Canada)) CBOE Europe ICE Clear Singapore BOX (Boston Stock Exchange) Jane Street Capital CME (BrokerTech EU) ICE Futures Singapore Broadridge (ADP) JP Morgan Chase Deutsche Börse Group (Xetra, Eurex) JPX (TSE Flex Standard/Full, OSE) Broadridge Financial Solutions Lime Brokerage Equiduct KRX - Korea Stock Exchange Canadian Imperial Bank of Commerce - CIBC LTSE (Long Term Stock Exchange) Euronext Group SBI Japanext CBOE US MEMX (Members Exchange) Fastmatch (Euronext FX) SGX (Equities, Derivatives) CBOE FX (Hotspot NY4) MIAX Options, MIAX Pearl Options, Miax Pearl Equities FIS Global (Sungard London-Paris) TAIFEX – Taiwan Futures Exchange CME (CME, NYMEX, COMEX, CBOT) Morgan Stanley Unicast Services Goldman Sachs Sigma-X TPEX – Taipei Exchange CME (BME, DME, MGEX, Indexes, Bitcoin) MSCI Indexes ICE Benchmark Administration TWSE - Taiwan Stock Exchange CME (BrokerTec US) MT Newswires ICE Clear Europe LATAM Credit Suisse NASDAQ Canada (CXC, CX2, CXD, Basic) ICE Clear Netherlands B3 - BM&F & Bovespa Creditex NASDAQ US (All Markets) ICE Futures Europe BCS - Bolsa de Santiago CSE - Canadian Securities -

Monthly Exchange Fees

Yen | October 2021 Exchange Enablement Price Trade Routing Availability Brazilian Futures BM&F Non-Brazil Non- 4500 Not tradable. Americas Professional Level 1 BM&F Non-Brazil Non- 6000 Not tradable. Professional Level 2 BM&F Non-Brazil 10700 Not tradable. Professional Level 1 BM&F Non-Brazil 13500 * Not tradable. Professional Level 2 BM&F Delay 2600 Not tradable. CBOE Futures Exchange CFE Level 1 Non- 1300 Trading requires Level 2 data. Professional CFE Level 1 2300 Trading requires Level 2 data. Professional CFE Level 2 Non- 1400 Tradable. Requires real-time exchange fee. Professional CFE Level 2 3200 Tradable. Requires real-time exchange fee. Professional CFE Delay 500 Not tradable. Chicago Board of Trade CBOT 12800 Tradable. Requires real-time exchange fee. CBOT E-Mini 4900 Tradable. Requires real-time exchange fee. CBOT Non-Professional 1200 Tradable. Requires real-time exchange fee. Market Depth1 CBOT Non-Professional 100 Tradable. Requires real-time exchange fee. Top of Book1 CBOT Delay 500 Not tradable. CBOT Delay Pit 500 Not tradable. Chicago Board Options Cboe Cryptocurrency 500 Not tradable. Exchange Indexes Cboe FTSE Indexes 200 Not tradable. Cboe MSCI Indexes 500 Not tradable. Requires MSCI Enterprise license. Cboe Streaming Market 1300 Not tradable. Indexes Cboe Streaming Market 800 Not tradable. Indexes Delay Chicago Mercantile Exchange CME 12800 Tradable. Requires real-time exchange fee. CME Bundled Non- 3400 Tradable. Requires real-time exchange fee. Professional Market Depth1,2 1 Exchange Enablement Price Trade Routing Availability CME Bundled Non- 300 Tradable. Requires real-time exchange fee. Professional Top of Book1,2 CME E-Mini 7100 Tradable. -

Doing Data Differently

General Company Overview Doing data differently V.14.9. Company Overview Helping the global financial community make informed decisions through the provision of fast, accurate, timely and affordable reference data services With more than 20 years of experience, we offer comprehensive and complete securities reference and pricing data for equities, fixed income and derivative instruments around the globe. Our customers can rely on our successful track record to efficiently deliver high quality data sets including: § Worldwide Corporate Actions § Worldwide Fixed Income § Security Reference File § Worldwide End-of-Day Prices Exchange Data International has recently expanded its data coverage to include economic data. Currently it has three products: § African Economic Data www.africadata.com § Economic Indicator Service (EIS) § Global Economic Data Our professional sales, support and data/research teams deliver the lowest cost of ownership whilst at the same time being the most responsive to client requests. As a result of our on-going commitment to providing cost effective and innovative data solutions, whilst at the same time ensuring the highest standards, we have been awarded the internationally recognized symbol of quality ISO 9001. Headquartered in United Kingdom, we have staff in Canada, India, Morocco, South Africa and United States. www.exchange-data.com 2 Company Overview Contents Reference Data ............................................................................................................................................ -

List of Approved Regulated Stock Exchanges

Index Governance LIST OF APPROVED REGULATED STOCK EXCHANGES The following announcement applies to all equity indices calculated and owned by Solactive AG (“Solactive”). With respect to the term “regulated stock exchange” as widely used throughout the guidelines of our Indices, Solactive has decided to apply following definition: A Regulated Stock Exchange must – to be approved by Solactive for the purpose calculation of its indices - fulfil a set of criteria to enable foreign investors to trade listed shares without undue restrictions. Solactive will regularly review and update a list of eligible Regulated Stock Exchanges which at least 1) are Regulated Markets comparable to the definition in Art. 4(1) 21 of Directive 2014/65/EU, except Title III thereof; and 2) provide for an investor registration procedure, if any, not unduly restricting foreign investors. Other factors taken into account are the limits on foreign ownership, if any, imposed by the jurisdiction in which the Regulated Stock Exchange is located and other factors related to market accessibility and investability. Using above definition, Solactive has evaluated the global stock exchanges and decided to include the following in its List of Approved Regulated Stock Exchanges. This List will henceforth be used for calculating all of Solactive’s equity indices and will be reviewed and updated, if necessary, at least annually. List of Approved Regulated Stock Exchanges (February 2017): Argentina Bosnia and Herzegovina Bolsa de Comercio de Buenos Aires Banja Luka Stock Exchange -

Bofa List of Execution Venues

This List of Execution Venues and the associated Bank of America EMEA Order Execution Policy Summary form part of the General Terms & Conditions of Business available on the Bank of America MifID II Website www.bofaml.com/mifid2 The tables below set out the execution venues accessed by entities in the Bank of America Entities List and Associated Companies. These tables are not exhaustive and we may amend them from time to time in accordance with our policies. MLI and BofASE may also use other execution venues from time to time where they deem appropriate but in accordance with their policies (including the Bank of America Order Execution Policy). Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA Aquis UK Equities EMEA Athex Group Equities EMEA Bloomberg BV Equities EMEA Bloomberg UK Equities EMEA Borsa Italiana Equities EMEA Cboe BV Equities EMEA Cboe UK Equities EMEA Deutsche Borse Xetra Equities EMEA Equiduct Equities EMEA Euronext Amsterdam Equities EMEA Euronext Brussels Equities EMEA Euronext Dublin Equities EMEA Euronext Lisbon Equities EMEA Euronext Oslo Equities EMEA Euronext Paris Equities EMEA ITG Posit Equities EMEA Liquidnet Equities EMEA Liquidnet Europe Equities EMEA London Stock Exchange 1 – ©2020 Bank of America Corporation Asset class Region Regulated Markets of which MLI / BofASE is a direct member and MTFs accessed by MLI / BofASE Equities EMEA NASDAQ OMX Nordic – Helsinki Equities EMEA NASDAQ OMX Nordic – Stockholm Equities EMEA NASDAQ OMX