St. Louis Office Market

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Before the Public Service Commission of the State of Missouri

BEFORE THE PUBLIC SERVICE COMMISSION OF THE STATE OF MISSOURI Halo Wireless, Inc., ) ) Complainant, ) ) v. ) ) Craw-Kan Telephone Cooperative, Inc., ) Ellington Telephone Company, Goodman ) Telephone Company, Granby Telephone ) Company, Iamo Telephone Company, Le-Ru ) Telephone Company, McDonald County ) Telephone Company, Miller Telephone ) Case No. TC-2012-0331 Company, Ozark Telephone Company, Rock ) Port Telephone Company, Seneca Telephone ) Company, Alma Communications Company ) d/b/a Alma Telephone Company, Choctaw ) Telephone Company, Mokan Dial, Inc., ) Peace Valley Telephone Company, Inc., and ) Southwestern Bell Telephone Company, ) d/b/a AT&T Missouri, ) ) Respondents. ) AT&T RESPONSE TO HALO REQUEST FOR STAY Halo's request that this action be “stayed until the Bankruptcy Court rules on the propriety of the blocking notices”1 is simply another transparent attempt by Halo to forestall state commission adjudication of Halo's unlawful practices in proceedings that are plainly within state commission authority. The Commission should see through Halo's obvious stall tactics and direct this case to proceed. 1. Courts and Other Commissions Have Rejected Similar Attempts by Halo to Stay State Regulatory Proceedings. Halo has done its utmost to try to prevent this Commission, and others, from reaching a decision on the merits (while in the meantime Halo continues to send millions of minutes of traffic 1 Halo Formal Complaint, filed April 3, 2012 at p. 21. each month to AT&T and other carriers, for which Halo is not paying the applicable access charges). Halo’s tactics have been rejected at every turn. Halo began its attempts to stall state regulatory proceedings by filing for bankruptcy on the day before the first evidentiary hearing was supposed to occur before a state commission (in Georgia) and claiming that this stayed all the state commission proceedings. -

Before the Public Service Commission of the State of Missouri

BEFORE THE PUBLIC SERVICE COMMISSION OF THE STATE OF MISSOURI Big River Telephone Company, LLC, ) ) Complainant, ) ) v. ) Case No. TC-2012-0284 ) Southwestern Bell Telephone Company, ) d/b/a AT&T Missouri, ) ) Respondent. ) BIG RIVER TELEPHONE COMPANY, LLC’S PROPOSED ORDER Complainant Big River Telephone Company, LLC submits the following proposed findings of fact and conclusions of law pursuant to the Missouri Public Service Commission’s (“Commission”) scheduling order. APPEARANCES APPEARING FOR BIG RIVER TELEPHONE COMPANY, LLC: Brian C. Howe, 12444 Powerscourt Drive, St. Louis, Missouri 63131 APPEARING FOR SOUTHWESTERN BELL TELEPHONE COMPANY, D/B/A AT&T MISSOURI: Robert J. Gryzmala, 909 Chestnut Street, Room 3518, St. Louis, Missouri 63101, and Hans J. German, Mayer Brown, L.L.P., 71 South Wacker Drive, Chicago, Illinois 60606. APPEARING FOR THE STAFF OF THE MISSOURI PUBLIC SERVICE COMMISSION: Colleen M. Dale, Senior Counsel, and John D. Borgmeyer, Legal Counsel, Governor Office Building, 200 Madison Street, Jefferson City, Missouri 65102. REGULATORY LAW JUDGE: Michael Bushman, Deputy Chief Regulatory Law Judge Granting the Office of the Public Counsel’s Motion to be Excused, issued June 22, 2012. EFIS is the INTRODUCTION AND SUMMARY This case arises out of a billing dispute between Big River Telephone Company, LLC (“Big River”) and Southwestern Bell Telephone Company d/b/a AT&T Missouri (“AT&T Missouri”). Big River filed a Complaint, requesting that the Commission find that certain traffic Big River exchanged with AT&T Missouri was “enhanced services traffic” and, therefore, not subject to exchange access charges. As a part of its response to Big River’s Complaint, AT&T Missouri filed a counterclaim seeking a finding that the access charges that AT&T Missouri billed to Big River are due and owing and that Big River violated the parties Interconnection Agreement (“ICA”). -

2017-2018 Roster

2017-2018 ROSTER Page 1 REGIONAL BUSINESS COUNCIL The Regional Business Council concentrates the resources, expertise and passion of 100 of St. Louis’ most respected business leaders on high-impact business, civic and philanthropic initiatives for the betterment of the St. Louis region. In that spirit, the RBC works to increase the recruitment, hiring, retention, and promotion of ethnically diverse professionals, as well as support the efforts of community-based organizations that foster an inclusive business community. YOUNG PROFESSIONALS NETWORK The Regional Business Council’s Young Professionals Network (YPN) was established to attract, retain, develop and engage diverse young professionals in St. Louis. Membership in the YPN helps young professionals develop leadership abilities, build social and business networks, and give back to the community. The Young Professionals Network has grown to include over 3,500 members representing over 750 companies. LEADERSHIP 100 Each year, 100 professionals are selected to be a part of the YPN Leadership 100 cohort because of their demonstrated leadership and service to the community. This group of professionals is provided with unique professional, cultural, and community service opportunities that offer unique experiences in St. Louis. Page 32 “I am honored and excited for my first year as chair of the Young Professionals Network. The Young Professionals Network Leadership 100 is exactly what our region needs to remain competitive in recruiting, retaining, and developing the Young Professionalsnext generation Network of our region’sSponsors leaders. Congratulations to this year’s cohort.” Ascension Jimmy Williams Owner The Boeing Company Estel Foods Dot Foods, Inc. Member, RegionalEdward Business Council Jones Chair, Young Professionals Network [email protected] Holdings Foundation 618-876-3289 RubinBrown LLP The Regional Business Council Wells“The Fargo Regional Advisors Business Council works to attract, retain and develop the business talent our region needs to ensure that St. -

1 8/01/2018 Personal Property Listing Pgm-Paedrl Bus

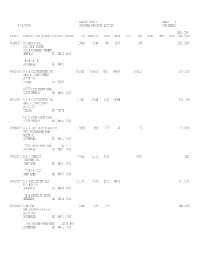

DESOTO COUNTY PAGE- 1 8/01/2018 PERSONAL PROPERTY LISTING PGM-PAEDRL BUS. TAX ______PARCEL _____________________________________NAME/MAILING ADDRESS/PHYSICAL ADDRESS ____TRUE ________ASSESSED ____FURN ____MECH ____LESD ____INVT ____BANK ____DEBT ____MISC ____TYPE ____DIST 001692000 #1 AUTO STORE 13662 2049 654 1197 198 1022 2400 C/O JOHN TURNER 503 N HIGHLAND STREET MEMPHIS TN 38122 4521 8108 HWY 51 SOUTHAVEN MS 38671 000103000 A & B DISTRIBUTING INC 4503421 675514 40237 86064 549213 339 1300 4800 E. 42ND STREET SUITE 400 ODESSA TX 79762 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 000103001 A & B DISTRIBUTING INC 417651 62648 5660 56988 339 1306 4800 E. 42ND STREET SUITE 400 ODESSA TX 79762 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 002663000 A & B FAST AUTO GLASS INC 5938 891 770 46 75 31 2400 7020 TCHULAHOMA ROAD SUITE #1 SOUTHAVEN MS 38671 0000 7020 TCHULAHOMA ROAD SUITE 1 SOUTHAVEN MS 38671 0000 002132000 A & J TOBACCO 74082 11112 4362 6750 3221 7128 HWY 301 HORN LAKE MS 38637 0000 7128 HWY 301 HORN LAKE MS 38637 0000 002722000 A C SPECIALTIES LLC 271145 40672 2131 38541 314 5101 P O BOX 277 HERNANDO MS 38632 0000 3425 MAGNOLIA DRIVE HERNANDO MS 38632 0000 001532000 A MC INC 2468 370 370 588 3400 946 GOODMAN ROAD EAST SUITE 8-A SOUTHAVEN MS 38671 0000 946 GOODMAN ROAD EAST SUITE 8-A SOUTHAVEN MS 38671 0000 DESOTO COUNTY PAGE- 2 8/01/2018 PERSONAL PROPERTY LISTING PGM-PAEDRL BUS. TAX ______PARCEL _____________________________________NAME/MAILING ADDRESS/PHYSICAL ADDRESS ____TRUE ________ASSESSED ____FURN ____MECH ____LESD -

Vdr # Name Name2 Dba 7067 Auto Electric Services Co

VDR # NAME NAME2 DBA 7067 AUTO ELECTRIC SERVICES CO INC 8523 BENNETT'S CARPETS, INC 940 HARTFORD STEAM BOILER 9727 HELEN MILLER BOWLES 9220 JEANNA SLUSHER 9561 JESSICA MADDOCKS 1690 KY NASP FOUNDATION 9093 LESLIE CELESTE HACKNEY 8746 100% EDUCATIONAL VIDEOS 7472 127 SOCCER CONFERENCE TOLIVER EL 3261 2008 KLA/SELA CONFERENCE 9739 4 T'S INC 6457 4/J ENTERPRISES INC 10187 4-C 10187 4-C 10187 4-C 10187 4-C 6011 4IMPRINT 7651 4SIGHT LEARNING 10124 555 PRODUCTIONS INC 7816 A & A SAFETY 12 A & J SERVICE CENTER 7300 A & J'S SONS CONSTRUCTION, INC 8257 A D TROPHY 9693 A PLUS LAWN & LANDSCAPE 2228 A T & T 2228 A T & T 2228 A T & T 2228 A T & T 2228 A T & T 2228 A T & T 6397 A T & T 8400 A T & T 8400 A T & T 22288 A T & T 7980 A T & T CONNECTIVITY SOLUTIONS 8400 A T & T CONNECTIVITY SOLUTIONS 2228 A T & T MOBILITY 7754 A T & T WIRELESS 8680 A W PELLAR & ASSOC INC 8174 A&E HOME VIDEO 8174 A&E HOME VIDEO 8174 A&E HOME VIDEO 8716 A. DAIGGER & COMPANY INC 7537 A+ QUALITY PRESSURE WASHING 6239 A-1 AUDIO VISUAL 8332 A-1 PORTABLE BUILDINGS 9974 AACER FLOORING, LLC 7535 AAEC 6899 AAP PUBLICATIONS / CHILD CARE BOOK 9156 AARON HARVEY 122 AASA 122 AASA 122 AASA 122 AASA 9947 AASPA AMERICAN 7140 AATF 7140 AATF - JAYNE ABRATE,EXEC DIR 3438 A-B ROOFING CO INC 8591 ABC 110 ABC SCHOOL SUPPLY INC 8419 ABC SUPPLY CO INC 9214 ABC TEACH 7020 ABC-CLIO INC 6357 ABDO PUBLISHING CO 7562 ABELL & ATHERTON EDUCATIONAL 7116 ABG PETROLEUM CONTRACTORS LLC 2331 ABILITATIONS 5164 ABILITATIONS 5164 ABILITATIONS 5164 ABILITATIONS 5164 ABILITATIONS/INTEGRA 3042 ABLENET INC 8721 ABNET -

County Property Tax Rolls for the Public Utility and Transportation

STATE OF TENNESSEE OFFICE OF COMPTROLLER OF THE TREASURY AD VALOREM ASSESSMENTS CERTIFIED BY COMPTROLLER TO ANDERSON COUNTY FOR YEAR 2016 THE COMPTROLLER OF THE TREASURY CANNOT GUARANTEE THE ACCURACY OF THE COMPUTED TAXES PAYABLE BECAUSE EACH INDIVIDUAL TAX RATE HAS NOT BEEN VERIFIED BY THIS OFFICE. PLEASE CHECK THE TAX RATES FOR ACCURACY FOR YOUR COUNTY BEFORE BILLING TAXPAYERS. COUNTY OF ANDERSON NOV 15, 2016 2016 TAX ROLL PAGE: 2 08:29 AM BASED ON COMPTROLLER OF THE TREASURY ASSESSMENTS TX540TN JURISDICTION ASSESSMENT RATE TAX AMOUNT ITEM NO A D M TRANSPORTATION COMPANY OUTSIDE CITIES $17,656 2.7903 $493.00 1 P. O. BOX 1470 DECATUR IL 62525 TOTALS *** TAXES $493.00 *** PENALTY & INTEREST COMPANY CODE PROPERTY CLASS *** TOTAL TAXES PC000100 Private Car *** DATE PAID *** ASSESSMENT $17,656.00 COMMENTS- Regular JURISDICTION ASSESSMENT RATE TAX AMOUNT ITEM NO A T & T COMMUNICATIONS OUTSIDE CITIES $49,226 2.7903 $1,374.00 2 P. O. BOX 7207 CLINTON $312 2.7589 $9.00 BEDMINSTER NJ 07921 OAK RIDGE $989 2.5945 $26.00 COMPANY CODE PROPERTY CLASS TOTALS *** TAXES $1,409.00 TL000025 Telephone Long Distance *** PENALTY & INTEREST *** TOTAL TAXES COMMENTS- Regular *** DATE PAID *** ASSESSMENT $50,527.00 JURISDICTION ASSESSMENT RATE TAX AMOUNT ITEM NO A T & T MOBILITY, LLC OUTSIDE CITIES $981,692 2.7903 $27,392.00 3 RM 36-M-1 CLINTON $582,436 2.7589 $16,069.00 909 CHESTNUT STREET NORRIS $97,037 2.7903 $2,708.00 ST.LOUIS MO 63101 OAK RIDGE $1,349,933 2.5945 $35,024.00 OLIVER SPRINGS $96,340 2.7903 $2,688.00 COMPANY CODE PROPERTY CLASS ROCKY TOP $153,277 2.7903 $4,277.00 WC000025 Wireless Company TOTALS *** TAXES $88,158.00 COMMENTS- Regular *** PENALTY & INTEREST *** TOTAL TAXES *** DATE PAID *** ASSESSMENT $3,260,715.00 JURISDICTION ASSESSMENT RATE TAX AMOUNT ITEM NO ADVANCE TRANSPORTATION , INC. -

2016 Real / Tangible Tax List TIVERTON RI 12

2016 Real / Tangible Tax List TIVERTON RIAssessed 12/31/2015 Page # 1 Assessments Account Name/Address/Description Legal Use Bank / FD Land Building Tangible Tax Value Tax 00-0006-25 12 ALAN STREET REALTY TRUST 12 ALAN ST TIVERTON RI 02878 113-167 at 12 ALAN STREET 01 00/ Nort $74,300 $103,900 $178,200 $3,410.75 Total $3,410.75 00-0163-00 1631 FISH ROAD LLC 202 CHASE RD PORTSMOUTH RI 02871 311-170 at 1631 FISH ROAD 06 00 $193,000 $69,300 $262,300 $5,020.42 Total $5,020.42 2016 Real / Tangible Tax List TIVERTON RIAssessed 12/31/2015 Page # 2 Assessments Account Name/Address/Description Legal Use Bank / FD Land Building Tangible Tax Value Tax 00-0013-75 216-226 MAIN ROAD LLC 295 LEPES RD TIVERTON RI 02878 102-348 at 220-224 MAIN ROAD 02 00/ Nort $62,900 $72,200 $135,100 $2,585.81 Total $2,585.81 00-0013-76 216-226 MAIN ROAD LLC 295 LEPES RD TIVERTON RI 02878 102-347 at 216-224 MAIN ROAD 02 00/ Nort $67,000 $261,800 $328,800 $6,293.23 Total $6,293.23 00-0013-77 216-226 MAIN ROAD LLC 295 LEPES RD TIVERTON RI 02878 102-350 at 226-226 MAIN ROAD 02 00/ Nort $62,800 $127,800 $190,600 $3,648.08 Total $3,648.08 00-0019-00 22 HOLDINGS COMPANY LLC PO BOX 453 JAMESTOWN RI 02835 203-140 at 11 HURST LANE 04 00/ Nort $115,800 $177,800 $293,600 $5,619.50 Total $5,619.50 00-0080-00 2490 MAIN ROAD LLC 127 DEXTER ST PORTSMOUTH RI 02871 409-153 at 2490 MAIN ROAD 06 00 $173,700 $394,500 $568,200 $10,875.35 Total $10,875.35 2016 Real / Tangible Tax List TIVERTON RIAssessed 12/31/2015 Page # 3 Assessments Account Name/Address/Description Legal Use Bank / FD -

Listing of State Assessees

STATE OF CALIFORNIA BETTY T. YEE STATE BOARD OF EQUALIZATION First District, San Francisco PROPERTY AND SPECIAL TAXES DEPARTMENT MICHELLE STEEL 450 N STREET, SACRAMENTO, CALIFORNIA Third District, Rolling Hills Estates PO BOX 942879, SACRAMENTO, CALIFORNIA 94279-0061 JEROME E. HORTON 916 322-2323 FAX 916 324-2787 Fourth District, Los Angeles www.boe.ca.gov JOHN CHIANG State Controller July 16, 2010 _______ BARBARA ALBY Acting Member Second District, Sacramento _______ RAMON J. HIRSIG Executive Director No. 2010/035 TO COUNTY ASSESSORS AND COUNTY AUDITOR/CONTROLLERS: LISTING OF STATE ASSESSEES Enclosed are two listings of 721 companies whose property is subject to ad valorem tax assessment by the Board of Equalization (Board) for the lien date 2010. The first list is alphabetical by assessee name. The second list is numerical by assessee SBE number. These listings are current as of July 15, 2010. The State-Assessed Properties Division groups the assessees numerically by industry as follows: Industry SBE No. Gas, Electric, Water and Gas Transmission 100 - 199 Local Exchange Telephone Companies 200 - 399 Pipeline Companies 400 - 499 Railcar Maintenance Facilities 500 - 699 Railroad Companies 800 - 899 Electric Generation Facilities 1100 - 1199 Long Distance Telephone Companies 2000 - 2499 Wireless Telephone Companies 2500 - 2999 Radio Common Carrier Companies 3000 - 3999 Long Distance Telephone Companies 7500 - 8999 Wireless Telephone Companies D001 - D999 Electric Generation Facilities E001 - E999 Long Distance Telephone Companies P001 - P999 Long Distance Telephone Companies Q001 - Q999 The property of these companies is subject to state assessment pursuant to section 721 and section 721.5 of the Revenue and Taxation Code and section 19 of Article XIII of the California Constitution. -

OAK KNOLL Design Guidelines May 2016 CLIENT

OAK KNOLL Design Guidelines May 2016 CLIENT Oak Knoll Venture Acquisitions LLC c/o Suncal 2392 Morse Avenue Irvine, CA 92614 CONSULTANT TEAM Hart Howerton 1 Union Street, 3rd Floor San Francisco, CA 94111 Contact: Chris Hall Civil Engineer BKF Engineers 300 Frank Ogawa Plaza Oakland, CA 94612 Contact: Jacob Nguyen CONTENTS 1.0 INTRODUCTION 1.1 Community Vision ........................................................................7 4.5 Community Trails and Recreation ...........................................62 1.2 How to use these Guidelines ....................................................9 4.6 Signage and Monumentation ...................................................64 4.7 Walls ..................................................................................................66 2.0 PLANNING GUIDELINES 4.8 Residential Landscape Design .................................................67 2.1 Oak Knoll Neighborhoods .........................................................13 4.9 Single Family Residential ...........................................................68 2.2 Neighborhood Streetscapes ....................................................14 4.11 Side and Rear Yard Fencing ......................................................71 2.3 Commercial Development Standards....................................18 4.12 Retaining Walls on Lots ..............................................................72 2.4 Townhome Development Standards ......................................22 2.5 Setback and Height Standards ................................................24 -

Personal Property Tax Commitment Book

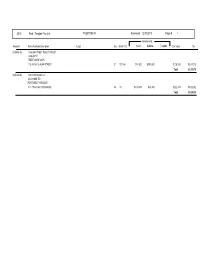

SEDGWICK Personal Property Tax Commitment Book - 2016 11.350 10/13/2016 6:41 PM Page 1 Account Name & Address Category Breakdown Assessment Exempt Total Tax 48 AT&T MOBILITY LLC 32,400 0 32,400 367.74 ATTN: PROPERTY TAX EQUIPMENT 32,400 DEPARTMENT 909 CHESTNUT STREET, RM 36-M-01 ST. LOUIS MO 63101 9 CARTER, PAUL 5,500 0 5,500 62.43 716 MINES ROAD EQUIPMENT 5,500 SEDGWICK ME 04676 10 CARTER, WAYNE A. & 2,200 0 2,200 24.97 EYLEEN SIVIGNY 613 SEDGWICK RIDGE ROAD EQUIPMENT 2,200 SEDGWICK ME 04676 38 COCA COLA OF NORTHERN 2,800 0 2,800 31.78 NEW ENGLAND C/O CINDY PALANGE OTHER 2,800 ONE EXECUTIVE PARK DRIVE BEDFORD NH 03110-6913 33 DIRECTV, INC 31,100 0 31,100 352.98 2256 . E IMPERIAL EQUIPMENT 31,100 HIGHWAY CA/LA5/MS A130 EL SEGUNDO CA 90245 34 DISH NETWORK, LLC 7,100 0 7,100 80.58 PO BOX 6623 EQUIPMENT 7,100 ENGLEWOOD CO 80155 51 DISHNET SATELLITE 400 0 400 4.54 BROADBAND LLC P.O. BOX 6623 EQUIPMENT 400 ENGLEWOOD CO 80155 32 FAIRPOINT 7,700 0 7,700 87.40 COMMUNICATIONS, INC ATTN: TAX DEPARTMENT EQUIPMENT 7,700 770 ELM STREET 2ND FLOOR MANCHESTER NH 03101 16 GRAY, GLEASON 7,150 0 7,150 81.15 518 GRAYTOWN ROAD EQUIPMENT 7,150 SEDGWICK ME 04676 Assessment Exempt Total Tax Page Totals: 96,350 0 96,350 1,093.57 Subtotals: 96,350 0 96,350 1,093.57 SEDGWICK Personal Property Tax Commitment Book - 2016 11.350 10/13/2016 6:41 PM Page 2 Account Name & Address Category Breakdown Assessment Exempt Total Tax 41 GRAYHAWK LEASING LLC 3,100 0 3,100 35.18 ATT: TAX DEPARTMENT OTHER 3,100 3A-300 P.O.BOX 660937 DALLAS TX 75266-0937 19 GRINDAL, BRUCE & 2,200 0 2,200 24.97 LINETTE 148 NORTH SEDGWICK ROAD EQUIPMENT 2,200 SEDGWICK ME 04676 20 HITCHCOCK, ROBERT 15,497 0 15,497 175.89 P. -

Oct. 15, 2016 Thank You for Supporting Our Hispanic Chamber of Commerce Members During Hispanic Heritage Month

HCC Business Guide To Sept. 15 - Oct. 15, 2016 Thank you for supporting our Hispanic Chamber of Commerce members during Hispanic Heritage Month. Below is a guide of all those who support our mission of promoting the economic development of Hispanic- owned businesses and improve business opportunities for all in the St. Louis region. Follow the Hispanic Chamber for the latest news and events this month: @HCCMetroSTL facebook.com/HCCSTL www.HCCSTL.com #HispanicHeritageSTL #HCCSTL EVENTS & SPECIALS ...................................................................................... 2-4 ADVERTISING & MEDIA ................................................................................ 5 ARTS, CULTURE & ENTERTAINMENT ............................................................... 5-6 AUTOMOTIVE................................................................................................. 6 BUSINESS & PROFESSIONAL SERVICES ......................................................... 7-8 COMPUTER & TELECOMMUNICATIONS ....................................................... 8 ENGINEERING, ARCHITECTURE & CONSTRUCTION ..................................... 8-9 FAMILY, COMMUNITY & CIVIC ORGANIZATIONS ...................................... 9-11 FINANCE & INSURANCE .............................................................................. 11-13 GOVERNMENT & EDUCATION ..................................................................... 13 HEALTH AND BEAUTY ................................................................................... 14 HEALTHCARE -

1 6/30/2015 Personal Property Listing Pgm-Paedrl Bus

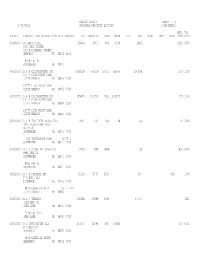

DESOTO COUNTY PAGE- 1 6/30/2015 PERSONAL PROPERTY LISTING PGM-PAEDRL BUS. TAX ______PARCEL _____________________________________NAME/MAILING ADDRESS/PHYSICAL ADDRESS ____TRUE ________ASSESSED ____FURN ____MECH ____LESD ____INVT ____BANK ____DEBT ____MISC ____TYPE ____DIST 001692000 #1 AUTO STORE 25404 3810 833 1335 1642 1022 2400 C/O JOHN TURNER 503 N HIGHLAND STREET MEMPHIS TN 38122 4521 8108 HWY 51 SOUTHAVEN MS 38671 000103000 A & B DISTRIBUTING INC 3568129 535219 57314 82957 394948 339 1300 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 000103001 A & B DISTRIBUTING INC 785834 117875 7581 110294 339 1306 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 10777 HIGH POINT ROAD OLIVE BRANCH MS 38654 0000 002663000 A & B FAST AUTO GLASS INC 6911 1037 936 48 53 31 2400 7020 TCHULAHOMA ROAD SUITE #1 SOUTHAVEN MS 38671 0000 7020 TCHULAHOMA ROAD SUITE 1 SOUTHAVEN MS 38671 0000 003356000 A & B SIGNS AND GRAPHICS 12639 1896 1858 38 854 3400 8985 HWY 51 SOUTHAVEN MS 38671 0000 8985 HWY 51 SOUTHAVEN MS 38671 0000 002526000 A & E HOSPICE INC 45150 6773 5557 600 616 1300 P O BOX 1332 FLORENCE AL 35631 0000 6810 CRUMPLER BLVD SUITE 101 OLIVE BRANCH MS 38654 002132000 A & J TOBACCO 139258 20889 6489 14400 3221 7128 HWY 301 HORN LAKE MS 38637 0000 7128 HWY 301 HORN LAKE MS 38637 0000 002722000 A C SPECIALTIES LLC 107237 16085 803 15282 314 5101 P O BOX 277 HERNANDO MS 38632 0000 3425 MAGNOLIA DRIVE HERNANDO MS 38632 0000 DESOTO COUNTY PAGE- 2 6/30/2015 PERSONAL PROPERTY LISTING PGM-PAEDRL BUS.