Q3 Fy 17 Business Review

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Grand Project Study on a PERCEPTION of PEOPLE on ³NANO´ CAR Based on Customer Survey

The grand project study on a PERCEPTION OF PEOPLE ON ³NANO´ CAR based on customer survey. The main objectives of the project are ! To know the perception of people about ³NANO´ car in Baroda city. ! To know about awareness of products. ! To know about factors affecting purchase decision of ³NANO´. ! To know how purchase decision of ³NANO´.varies from different Income group. For this project customer research was carried out at various area of Baroda City. In this customer research, I learnt about different types of customer¶s perception about TATA´s NANO in Baroda City. 1 JOSEPH SCHOOL OF BUSINESS STUDIES (SHIATS) C,B. MISHRA INDEX Sr. NO. CONTENTS PAGE NO. 1. INDUSTRY PROFILE 2. COMPANY PROFILE 3. THEORITICAL BACKGROUND 4. IDENTIFICATION OF THE STUDY 5.1 MARKETING RESEARCH PROBLEM 5.2 SCOPE OF THE STUDY 5.3 OBJECTIVE OF THE STUDY 5.4 LIMITATION OF THE STUDY 5. RESEARCH METHODOLOGY 6. INTERPRETATION AND ANALYSIS 6. INTERPRETATION OF RESULTS 7. CONCLUSION 9 ANNEXURE 9.1 BIBLIOGRAPHY 2 JOSEPH SCHOOL OF BUSINESS STUDIES (SHIATS) C,B. MISHRA TATA GROUP PROFILE: THE TATA GROUP COMPRISES 98 OPERATING COMPANIES IN SEVEN BUSINESS SECTORS: INFORMATION SYSTEMS AND COMMUNICATIONS; ENGINEERING; MATERIALS; SERVICES; ENERGY; CONSUMER PRODUCTS; AND CHEMICALS. THE GROUP WAS FOUNDED BY JAMSETJI TATA IN THE MID 19TH CENTURY, A PERIOD WHEN INDIA HAD JUST SET OUT ON THE ROAD TO GAINING INDEPENDENCE FROM BRITISH RULE. CONSEQUENTLY, JAMSETJI TATA AND THOSE WHO FOLLOWED HIM ALIGNED BUSINESS OPPORTUNITIES WITH THE OBJECTIVE OF NATION BUILDING. THIS APPROACH REMAINS ENSHRINED IN THE GROUP'S ETHOS TO THIS DAY. -

20F for 2019

As filed with the Securities and Exchange Commission on July 30, 2019 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F ☐ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended March 31, 2019 OR ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to ☐ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 001-32294 TATA MOTORS LIMITED (Exact name of Registrant as specified in its charter) Bombay House 24, Homi Mody Street Republic of India Mumbai 400 001, India (Jurisdiction of incorporation or organization) (Address of principal executive offices) H.K. Sethna Tel.: +91 22 6665 7219 Facsimile: +91 22 6665 7790 Email: [email protected] Address: Bombay House 24, Homi Mody Street Mumbai 400 001, India (Name, Telephone, Facsimile number, Email and Address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Trading Symbol(s) Name of Each Exchange On Which Registered Ordinary Shares, par value Rs.2 per TTM New York Stock Exchange share* Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: ‘A’ Ordinary Shares, par value Rs.2 per share (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 2,887,348,694 Ordinary Shares and 508,502,371 ‘A’ Ordinary Shares, including 323,696,360 Ordinary Shares represented by 64,735,220 American Depositary Shares (“ADSs”), outstanding as of March 31, 2019. -

Concorde Motors India LTD

+91-7710066601 Concorde Motors India LTD https://www.indiamart.com/concordemotorsindia/ The Tata Indica, our first Hatchback, was built to deliver on the promise of 'More car per car', set standards for interior space and value for money. It is your first choice when you need a hard- working hatchback for personal or business use. ... About Us The Tata Indica, our first Hatchback, was built to deliver on the promise of 'More car per car', set standards for interior space and value for money. It is your first choice when you need a hard-working hatchback for personal or business use. Owners love the robust, rugged build, fuel economy and the comfortable ride over rough roads. The Indica continues to be a best-selling car in some of the most competitive hatch markets worldwide. Tata Indica, the most fuel efficient car in its class is not only a fleet owner's delight but also an ultimate match for the family. The new Indica EV2 is available in 4 vibrant colors. The new BS4, CR4 engine delivers maximum power of 70PS at 4000 RPM and a torque of 140NM at 1800-3000 RPM. New transmission with smart-shift gear (TA 65) technology helps in easy manoeuvres during city traffic. All these features deliver an impeccable 25kmpl mileage which is by far the best in its class. Dual tone interiors and spacious cabin space adds up to the performance and enhances the comfort level. New Tata Indica is suitably embellished with chrome finished exteriors which is sure to command the attention of the onlookers. -

GRI-09-10.Pdf

1 CONTENTS KEY FEATURES 2 Key Features 2 This is Tata Motors Limited’s sixth1 Sustainability Report covering data from 01 April 2009 to 31 March 2010. The report includes performance data and information related to Indian operations at View from the Driver’s Seat 3 Jamshedpur, Lucknow, Pune and Pantnagar. The unit at Sanand was in the construction phase during Designed for Global Excellence 7 the reporting period, and hence it has been covered separately. The report does not include Guided by a Clear Vision 11 performance data and information related to Joint Ventures and subsidiaries. Driving on a Robust Chassis 13 This report is based on Global Reporting Initiative’s G3 Guidelines and is self – rated at applicability level A. Further, this Report serves as our Communication on Progress on the United Nations Global Delivered by a Skilled Assembly Line 17 Compact principles. This year we have engaged KPMG to provide professional services for Accelerating Growth 23 developing this report. Cruising Towards a Greener Environment 29 2009-10 was the year of innovation at Tata Motors and hence we have selected “Wheeling Ensuring a Safe Journey 39 Innovation” as the theme for this report. Innovation is an intrinsic part of our growth strategy and we Powered by an Efficient and Powerful Engine 45 demonstrate it through our approach in everything we do. From changing customer needs to managing scarce resources, elements of innovation are embedded into our business processes. Caring for the Neighbourhood 49 Our culture of perpetual search for excellence is attributed to our ethos and our efforts to serve Disclosure on Management Approach 55 customers over several decades by bringing continuous innovation in our products and processes. -

20F for 2011

As filed with the Securities and Exchange Commission on July 28, 2011 UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 20-F REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 OR ⌧ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal year ended March 31, 2011 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report Commission file number: 001-32294 TATA MOTORS LIMITED (Exact name of Registrant as specified in its charter) Not applicable (Translation of Registrant’s name into English) Bombay House 24, Homi Mody Street Republic of India Mumbai 400 001, India (Jurisdiction of incorporation or organization) (Address of principal executive offices) H.K. Sethna Tel.: +91 22 6665 7219 Facsimile: +91 22 6665 7260 Address: Bombay House 24, Homi Mody Street Mumbai 400 001, India (Name, telephone, facsimile number and address of company contact person) Securities registered or to be registered pursuant to Section 12(b) of the Act: Title of each class Name of each exchange on which registered Ordinary Shares, par value Rs. 10 per share * The New York Stock Exchange, Inc Securities registered or to be registered pursuant to Section 12(g) of the Act: None (Title of Class) Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None (Title of Class) Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report. -

APPROVED MODELS of VEHICLES UNDER Bharat Stage-III

¼ 1 ½ LIST OF APPROVED MODELS OF VEHICLES UNDER Bharat Stage-III. M/s Tata Motors Ltd. Sl. Approval Approved Model No. Date 1 Tata Safari EX 4x4 ,07 Seats,4DLTC. Diesel. 21.05.2005 2 Tata Indica DLS-V2,with A/C, Power Steering, Diesel 05 Seats. 21.05.2005 3 Tata Indica DLE-V2,with A/C,(Mech. Stg. Std) Diesel 05 Seats. 21.05.2005 4 Tata Indica DLX-V2 with HVAC( Power Stg.) Diesel 05 Seats. 21.05.2005 5 Tata Indigo LS 05 Seats, Diesel. 27.05.2005 6 Tata Indica 05 Seats, Diesel. 01.06.2005 7 Tata Indica LGI, 05 Seats, Petrol. 01.06.2005 8 Tata Indigo LX, 05 Seats, Diesel. 01.06.2005 9 Tata Safari LX-4x2 with 4DLTC, 07 Seats, Diesel. 01.06.2005 10 Tata Indica Turbo DLG-V2, 05 Seats Diesel. 16.11.2005 11 Tata Indigo Tdi SX, 05 Seats, Diesel. 16.11.2005 12 Tata LP-410 EX 01 Seats, with Twin Tyre Rear Axel . 19.11.2005 13 Tata Indica XETA GLX-V2, 05 Seats (Petrol). 03.03.2006 14 Tata Indica XETA GLE-V2, 05 Seats(Petrol). 03.03.2006 15 Tata Indica XETA GLG-V2, 05 Seats(Petrol). 03.03.2006 16 Tata Indica XETA GLS-V2, 05 Seats (Petrol). 03.03.2006 17 Tata LPT-712 EX/38 Truck Chassis, and Tata LP-712EX/38, Full Control 18.03.2006 Bus Chassis. 18 Tata LP 1112/42 Full Forward Control Bus Chassis with Cowl & with 03.06.2006 Windshield, 01 Seats. 19 Tata Indica XETA GVG-V-2, 05 Seats. -

Indian Passenger Vehicle Industry Strategic Analysis with Focus on The

main heading sub heading table heading NMIMS JOURNAL OF ECONOMICS AND PUBLIC POLICY Volume II • Issue 1 • April 2017 Indian Passenger Vehicle Industry: Strategic Analysis with Focus on the Big Four Firms KARUNAKAR B. mall farmers. Majority of the farmers (82%) borrow less than Abstract Rs 5 lakhs, and 18% borrow between Rs 5 – 10 lakhs on a per India's automobile industry is one of the largest in the world with an annual production at 23.96 million vehicles in FY 2015-16 annum basis. Most farmers accounting for around 7% of the country's Gross Domestic Product (GDP). The automobile industry comprises of two wheelers, (65.79%) ar three wheelers, passenger cars, multi-utility vehicles and commercial vehicles. The focus of this research paper is on the Indian Passenger Vehicle (IPV) industry. The Five Forces that shape competition in the IPV industry is elucidated taking into consideration the government policies. The specifics of the IPV industry have been understood through the value chain with focus on the segments and product lines offered by IPV firms. The segmentation and value proposition of a typical IPV player is explained through its product portfolio and positioning. The strategy of the big four Indian firms (Maruti Suzuki, Hyundai Motors, Mahindra & Mahindra, Tata Motors) in terms of product development, marketing, sales, distribution and services, is discussed. A comparative study is made and concludes with a perspective on the road ahead. Keywords: Indian Passenger Vehicle Industry, Five Forces Framework, Value Proposition, Positioning, Strategy, Value Chain Analysis (I) Introduction The automobile industry in India is one of the largest in the world with an annual production at 23.96 million vehicles in FY 2015-16 compared to 23.37 million vehicles in FY 2014-15, registering a growth of 2.58 per cent over the previous year. -

A Study on the Sales and Marketing Challenges with Reference to KBS Tata Motors

A study on the sales and marketing challenges with reference to KBS Tata Motors A PROJECT REPORT ON A PROJECT REPORT ON “A study on the sales and marketing challenges with reference to KBS Tata Motors” 5 9 SUBMITED BY: Priya Upadhyay Sangeeta Rajbonshi Neha Gupta Beronica pariat A report submitted in partial fulfilment Of the requirement of The BBA Program (The Class of 2011-2014) ICFAI University Meghalaya DECLARATION BBA SEMSESTER IV SUMMER PROJECT 2 We hereby declare that the Project Work entitled “A study on the sales and marketing challenges with reference to KBS Tata Motors” Submitted to the ICFAI University Meghalaya, Shillong campus, in partial fulfilment of the requirements for the award of the BBA Program is our original work and has not been submitted elsewhere. PRIYA UPADHYAY {151110920070} SANGEETA RAJBONSHI {151110920072} 5 9 NEHA GUPTA {151110920067} BERONICA PARIAT {151110920039} Students of BBA Semester IV The class of 2011-14 The ICFAI University Meghalaya Shillong BBA SEMSESTER IV SUMMER PROJECT 2 TABLE OF CONTENTS 5 Terms of Reference 6 Preface 7 Acknowledgment 8 Executive Summary 1 Introduction 9 Study Area 10 Statement of the problem 10 Objectives 11 Limitations of the study 11 5 9 Methodology 12 Sources of data 12 2 Company profile 13 Tata motors (group profile) 14 KBS Tata motors 15 Team work in KBS motors 16 3- types of forms 17 Tata cars in India 18 3 Main element in a car 19 Chassis 20 Engine 23 Steering 25 4 Sales 27 Tata product knowledge 33 Process of sales 37 Promotion BBA SEMSESTER IV SUMMER PROJECT 2 5 -

Introduction Consumer Satisfaction

INTRODUCTION CONSUMER SATISFACTION MEANING CONSUMER satisfaction means taking complete care of CONSUMER by giving them complete knowledge about the product and about all the feature of that particular product CONSUMER satisfaction is the end result of your interaction with the CONSUMER. By giving the best CONSUMER service and making sure that the CONSUMER was given the best resolution at the end of the call, then we can say that the CONSUMER is satisfied even if it's not verbally said. According to me CONSUMERs are those who pay (salary). Satisfaction is the key to hold the CONSUMER for future business. Complete knowledge must be given; each and every query must be clarified by the seller. If a CONSUMER remembers you for future business then we can say that CONSUMER is satisfied. DEFINITION According to Harold E Edmondson “CONSUMER satisfaction” is defined as "the number of CONSUMERs, or percentage of total CONSUMERs, whose reported experience with a firm, its products, or its services (ratings) exceeds specified satisfaction goals.". CONSUMER satisfaction is defined by whether the CONSUMER chooses to do business with you or your company in the future. Many factors play a role in CONSUMER satisfaction, including CONSUMER service, product quality and the ease of doing business. 1 Companies must consider CONSUMER satisfaction as an important role in the lifetime value of a CONSUMER. CONSUMER satisfaction, a term frequently used in marketing, is a measure of how products and services supplied by a company meet or surpass CONSUMER expectation. In a survey of nearly 200 senior marketing managers, 71 percent responded that they found a CONSUMER satisfaction metric very useful in managing and monitoring their businesses. -

Starter Motor

CONTENTS FULL UNITS 1 SPARE PARTS 21 AUTOMOTIVE FILTER 100 INDUSTRIAL FILTER 104 HORN 104 HEAD LAMP 105 HALOGEN BULB 106 REMY PARTS 107 FAN MOTORS 112 SUPERSEDED PARTS 114 OBSOLETE PARTS 119 ALL MAKE SPARES SALES & SERVICE NETWORK 127 FULL UNITS S. No. PART NO. UOS M.R.P DESCRIPTION APPLICATION STARTER MOTOR 1 25092D 1 9704.00 STARTER MOTOR AMBASSADOR PETROL 1.5 HM PLUS 2 26024007A 1 11350.00 STARTER MOTOR ESCORTS FORD PT35 3 26024012A 1 7934.00 STARTER MOTOR TATA MOTORS- INDIGO DIESEL 4 26024013A 1 8153.00 STARTER MOTOR TATA MOTORS- INDIGO PETROL 5 26024022A 1 7249.00 STARTER MOTOR TATA MOTORS- INDICA PETROL MPFI EURO 3 6 26024025A 1 72270.00 STARTER MOTOR CUMMINS INDIA - ENGINE TYPES-K6 (19LT) KV16 (50LT) V28 (28LT) EXPORT 7 26024026B 1 4600.00 STARTER MOTOR GREAVES LTD 3 WHEELER 8 26024028A 1 9715.00 STARTER MOTOR AL HINO 4CTI ENGINE 9 26024029 1 13404.00 STARTER MOTOR TATA MOTORS- 2515 LPT-697 CMVR BS-I & BS-II 10 26024033A 1 5775.00 STARTER MOTOR JOHN DEERE TRACTORS 35-50 HP 11 26024034A 1 5775.00 STARTER MOTOR ESCORTS FARMTRAC FT45 / FT50 / FT55 / FT65 / FT70 12 26024035A 1 5775.00 STARTER MOTOR ESCORTS POWER TRAC TRACTORS 13 26024036A 1 5775.00 STARTER MOTOR M&M 225DI/265DI/275DI 14 26024037A 1 5775.00 STARTER MOTOR TRACTORS & FARM EQUIPMENTS 15 26024038A 1 18287.00 STARTER MOTOR COMMERCIAL VEHICLES 16 26024039A 1 8342.00 STARTER MOTOR AFTER MARKET -GENSET 17 26024045 1 18238.00 STARTER MOTOR TATA MOTORS- CUMMINS 6BT FOR TATA MOTORS- BIPOLAR 18 26024046A 1 6058.00 STARTER MOTOR APE - PIAGGIO 3 WHEELER 19 26024049A 1 23625.00 STARTER -

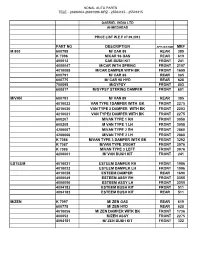

Part No Description Mrp M 800 600795 M

SONAL AUTO PARTS TELE - 26890304-26891698-MRZ - 25504145 - 25503315 GABRIEL INDIA LTD AHMEDABAD PRICE LIST W.E.F 07.09.2012 PART NO DESCRIPTION APPLICATION MRP M 800 600795 M/ CAR 89 REAR 385 K 7096 M/CAR 96 GAS REAR 619 400012 CAR BUSH KIT FRONT 241 4000047 M/CAR WITH SPRING FRONT 2107 4010055 M/CAR DAMPER WITH BK FRONT 1609 600791 M/ CAR 86 REAR 385 600775 M/ CAR 98 HYD REAR 628 700595 M/GYPSY FRONT 803 600817 M/GYPSY STERING DAMPER FRONT 601 M/VAN 600793 M/ VAN 89 REAR 385 4010022 VAN TYPE 1DAMPER WITH BK FRONT 2275 4210020 VAN TYPE 2 DAMPER WITH BK FRONT 2203 4210021 VAN TYPE2 DAMPER WITH BK FRONT 2275 600207 M/VAN TYPE 1 RH FRONT 3058 600208 M VAN TYPE 1 LH FRONT 3058 4200007 M/VAN TYPE 2 RH FRONT 2860 4200006 M/VAN TYPE 2 LH FRONT 2860 K 7086 M/VAN TYPE 3 DAMPER WITK BK FRONT 3292 K 7087 M/VAN TYPE 3RIGHT FRONT 3976 K 7088 M/VAN TYPE 3 LEFT FRONT 3976 4200001 M/ VAN BUSH KIT FRONT 241 ESTEEM 4010031 ESTEEM DAMPER RH FRONT 1906 4010032 ESTEEM DAMPER LH FRONT 1906 4010028 ESTEEM DAMPER REAR 1690 4000049 ESTEEM ASSY RH FRONT 3355 4000050 ESTEEM ASSY LH FRONT 3355 4094182 ESTEEM BUSH KIT FRONT 511 4094183 ESTEEM BUSH KIT REAR 511 M/ZEN K 7097 M/ ZEN GAS REAR 619 600778 M/ ZEN HYD REAR 628 4010056 M/ ZEN DAMPER WITK BK FRONT 1736 400052 M/ZEN ASSY FRONT 2275 4094181 M/ ZEN BUSH KIT FRONT 322 SONAL AUTO PARTS TELE - 26890304-26891698-MRZ - 25504145 - 25503315 WAGON R K 7099 WAGON R GAS REAR 619 K 1000031 DAMPER WITH BK FRONT 2032 K 100131 WAGON R ASSY FRONT 2662 K07331 M/Wagon R K Series Assy LH (GAS) FRONT 2491 K07330 M/Wagon R K Series -

Tata Motors Ltd

+91-7819244444 Tata Motors Ltd. https://www.indiamart.com/tatamotors-ltd-champa/ Tata Motors is part of the USD 100 billion Tata group founded by Jamsetji Tata in 1868. Sustainability and the spirit of ‘giving back to society’ is a core philosophy and good corporate citizenship is strongly embedded in our DNA. Tata ... About Us Tata Motors is part of the USD 100 billion Tata group founded by Jamsetji Tata in 1868. Sustainability and the spirit of ‘giving back to society’ is a core philosophy and good corporate citizenship is strongly embedded in our DNA. Tata Motors is India’s largest automobile company. We bring to the customer a proven legacy of thought leadership with respect to customer-centricity and technology. We are driving the transformation of the Indian commercial vehicle landscape by offering customers leading edge auto technologies, packaged for power performances and lowest life-cycle costs. Our new passenger cars are designed for superior comfort, connectivity and performance. What keeps us at the forefront of the market is our focus on future-readiness and our pipeline of tech-enabled products. Our design and R&D centres located in India, the UK, Italy and Korea strive to innovate new products that achieve performances that will fire the imagination of GenNext customers. Across the globally dispersed organisation that we are today, there is one thing that energises and drives all our people and our activities – and that is our mission “to be passionate in anticipating and providing the best vehicles and experiences that