Annual Report 2019 (PDF)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

MKS/EQD/07/21 日期 Date: 01/02/2021

編號 Ref. No.: MKS/EQD/07/21 日期 Date: 01/02/2021 香港聯合交易所有限公司 (香港交易及結算所有限公司全資附屬公司) THE STOCK EXCHANGE OF HONG KONG LIMITED (A wholly-owned subsidiary of Hong Kong Exchanges and Clearing Limited) 通告 CIRCULAR Subject: Introduction of New Stock Option Class on Kuaishou Technology Enquiry: Mr. Wallace Chan (Tel: 2211-6139 E-mail: [email protected]) The Stock Exchange of Hong Kong Limited (the “Exchange”) is pleased to announce that stock option class on Kuaishou Technology (“KST”) will commence trading on Friday, 5 February 2021 (“Commencement Date”), subject to the successful listing of KST: Expiry Months Contract Min. No. of Trading Underlying Stock HKATS Tier Available Size Fluctuation Board Tariff (Stock Code) Code Level on the (shares) (HK$) Lots (HK$) Commence ment Date Feb 21, Mar 21, Apr 21, Kuaishou Technology May 21, KST 500 $0.01 5 1 $3 (1024) Jun 21, Sep 21 & Dec 21 The list of stock option classes available for trading is set forth in Attachment I. For details of the contract specifications, please refer to Appendix B of the Operational Trading Procedures for Options Trading Exchange Participants (“Options Contract Specifications”). Strike Price In order to offer more choices for investors, 28 strikes above and below HK$115 (which is the offer price of the underlying stock) will be available for trading on the Commencement Date (see Attachment II). New strike prices subsequent to the Commencement Date will be introduced according to the Operational Trading Procedures for Options Trading Exchange Participants. 2 Position Limit The position limit for KST options contracts will be 50,000 open contracts in any one market direction for all expiry months combined. -

CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) And

HUTCHISON WHAMPOA INTERNATIONAL (03/33) LIMITED (the “Issuer”) US$1,500,000,000 7.45% Guaranteed Notes due 2033 (the “Notes”) (ISIN: US44841SAC35/CUSIP: 44841SAC3/Common Code: 018124572 for Rule 144A Notes) (ISIN: USG4672CAC94/CUSIP: G4672CAC9/Common Code: 018124629 for Regulation S Notes) unconditionally and irrevocably guaranteed by CK HUTCHISON HOLDINGS LIMITED (“CK Hutchison”) and HUTCHISON WHAMPOA LIMITED In accordance with Regulation (EU) No. 596/2014 on market abuse and the law of 11 January 2008 on transparency requirements, as amended, the Issuer is filing with the Commission de Surveillance du Secteur Financier, storing with the Officially Appointed Mechanism and publishing the attached unaudited results for the six months ended 30 June 2019 of CK Hutchison, a guarantor of the Notes issued by the Issuer. The attached document was also published by CK Hutchison at 4:31 pm and 4:32 pm (Hong Kong time), 1 August 2019 on the websites of Hong Kong Exchanges and Clearing Limited and CK Hutchison, respectively. Hutchison Whampoa International (03/33) Limited Edith Shih Director and Company Secretary 1 August 2019 Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. UNAUDITED RESULTS FOR THE SIX MONTHS ENDED 30 JUNE 2019 HIGHLIGHTS -

Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD

UOB KAY HIAN (SINGAPORE) PRIVATE LIMITED MARGIN STOCK LIST - HONG KONG MARKET 1 April 2021 Stock Code Stock Name Margin Category HK 1 CK HUTCHISON HOLDINGS LTD. SA HK 2 CLP HOLDINGS LTD. A HK 3 HONG KONG AND CHINA GAS CO. LTD. A HK 4 WHARF (HOLDINGS) LTD. A HK 5 HSBC HOLDINGS PLC SA HK 6 POWER ASSETS HOLDINGS LTD. SA HK 8 PCCW LTD. C HK 10 HANG LUNG GROUP LTD. A HK 11 HANG SENG BANK LTD. SA HK 12 HENDERSON LAND DEVELOPMENT CO. LTD. A HK 14 HYSAN DEVELOPMENT CO. LTD. B HK 16 SUN HUNG KAI PROPERTIES LTD. SA HK 17 NEW WORLD DEVELOPMENT CO. LTD. A HK 19 SWIRE PACIFIC LTD. 'A' A HK 23 BANK OF EAST ASIA, LTD. A HK 27 GALAXY ENTERTAINMENT GROUP LTD. A HK 38 FIRST TRACTOR CO LTD. - H SHARES D HK 41 GREAT EAGLE HOLDINGS LTD. C (Max Net Loan H$10M) HK 45 HONGKONG AND SHANGHAI HOTELS, LTD. B (Max Net Loan H$10M) HK 53 GUOCO GROUP LTD. B (Max Net Loan H$10M) HK 56 ALLIED PROPERTIES (HK) LTD. D HK 62 TRANSPORT INTERNATIONAL HOLDINGS LTD. D (Max Net Loan H$1M) HK 66 MTR CORPORATION LTD. SA HK 69 SHANGRI-LA ASIA LTD. A HK 81 CHINA OVERSEAS GRAND OCEANS GROUP LTD. C HK 83 SINO LAND CO. LTD. A HK 86 SUN HUNG KAI & CO. LTD. D HK 87 SWIRE PACIFIC LTD. 'B' A (Max Net Loan H$10m) HK 101 HANG LUNG PROPERTIES LTD. A HK 107 SICHUAN EXPRESSWAY CO. -

2015 Annual Report

Ports and Related Services Retail Infrastructure Energy Telecommunications 2015 Annual Report 22nd Floor, Hutchison House, 10 Harcourt Hutchison House, Hong Kong Road, 22nd Floor, Telephone: +852 2128 1188 Facsimile: www.ckh.com.hk +852 2128 1705 Corporate Information CK Hutchison Holdings Limited Board of dIreCtors eXeCUtIVe dIreCtors NoN-eXeCUtIVe dIreCtors Chairman CHOW Kun Chee, Roland, LLM LI Ka-shing, GBM, KBE, LLD (Hon), DSSc (Hon) LEE Yeh Kwong, Charles, GBM, GBS, OBE, JP Commandeur de la Légion d’Honneur Grand Officer of the Order Vasco Nunez de Balboa LEUNG Siu Hon, BA (Law) (Hons), Hon LL.D. Commandeur de l’Ordre de Léopold George Colin MAGNUS, OBE, BBS, MA Group Co-Managing director and INdepeNdeNt NoN-eXeCUtIVe dIreCtors Deputy Chairman KWOK Tun-li, Stanley, BSc (Arch), AA Dipl, LLD (Hon), ARIBA, MRAIC LI Tzar Kuoi, Victor, BSc, MSc, LLD (Hon) CHENG Hoi Chuen, Vincent, GBS, OBE, JP Group Co-Managing director The Hon Sir Michael David KADOORIE, GBS, LLD (Hon), DSc (Hon) FOK Kin Ning, Canning, BA, DFM, FCA (ANZ) Commandeur de la Légion d’Honneur Commandeur de l’Ordre des Arts et des Lettres Commandeur de l’Ordre de la Couronne CHOW WOO Mo Fong, Susan, BSc Commandeur de l’Ordre de Leopold II Group Deputy Managing Director LEE Wai Mun, Rose, JP, BBA Frank John SIXT, MA, LLL Group Finance Director and Deputy Managing Director William Elkin MOCATTA, FCA Alternate to Michael David Kadoorie IP Tak Chuen, Edmond, BA, MSc Deputy Managing Director William SHURNIAK, SOM, LLD (Hon) KAM Hing Lam, BSc, MBA WONG Chung Hin, CBE, JP Deputy -

Geotechnical and Geo-Environmental Desk Study Report

Index:- Page no: Contents: 1 ................. Guidance notes. 2 …………... The area covered by this guide. 3 1:500 view Network Records …………… Scenery. 4 …………… Scenery (UK Power Networks use only). 7 …………… Primary distribution cables (EHV). NetMAP Symbols 8 …………… Secondary distribution cables (HV/LV). 9 …………… Service cables/terminations. 10 …………… Cable ducts. 11 …………… EHV/HV/LV sites. Booklet - 13 …………… Mains joints. 14 …………… Service joints. 15 …………… Cross sections. East of England 17 …………… Common abbreviations/terminology (all views). 19 1:2500 (LV) & 1:10000 (HV) network views (UK Power Networks use only). …………… General. 20 …………… 1:2500 scale LV network. 22 …………… 1:10000 scale HV network. This symbol booklet is intended as a general 23 LV network diagram view (UK Power Networks use only). guide only - some local variations of these …………… Overhead lines. symbols may be found. 24 …………… Underground cables. 25 …………… Joints. 26 …………… Substations/pole transformers. Version 1.2 Released October 2010 Always check with your local Network Records office or the UK Power Networks server to ensure that you are using the most up to date copy of this booklet - Tel: 08000 565866. (i) (ii) Guidance notes. The area covered by this guide: Important notice: If you do not understand the NetMAP record that you are using, please UK Power Networks contact the UK Power Networks Network Records team for guidance East of England. Tel: 08000 565866. This is the only area where this document applies The position of apparatus shown on NetMAP is believed to be correct, but the original landmarks may have altered since the apparatus was installed. It must be assumed that there is at least one service to each property, lamp column, street sign etc. -

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016

STOXX Hong Kong All Shares 50 Last Updated: 01.12.2016 Rank Rank (PREVIOUS ISIN Sedol RIC Int.Key Company Name Country Currency Component FF Mcap (BEUR) (FINAL) ) KYG875721634 BMMV2K8 0700.HK B01CT3 Tencent Holdings Ltd. CN HKD Y 128.4 1 1 HK0000069689 B4TX8S1 1299.HK HK1013 AIA GROUP HK HKD Y 69.3 2 2 CNE1000002H1 B0LMTQ3 0939.HK CN0010 CHINA CONSTRUCTION BANK CORP H CN HKD Y 60.3 3 4 HK0941009539 6073556 0941.HK 607355 China Mobile Ltd. CN HKD Y 57.5 4 3 CNE1000003G1 B1G1QD8 1398.HK CN0021 ICBC H CN HKD Y 37.7 5 5 CNE1000001Z5 B154564 3988.HK CN0032 BANK OF CHINA 'H' CN HKD Y 32.6 6 7 KYG217651051 BW9P816 0001.HK 619027 CK HUTCHISON HOLDINGS HK HKD Y 32.0 7 6 HK0388045442 6267359 0388.HK 626735 Hong Kong Exchanges & Clearing HK HKD Y 28.5 8 8 CNE1000003X6 B01FLR7 2318.HK CN0076 PING AN INSUR GP CO. OF CN 'H' CN HKD Y 26.5 9 9 CNE1000002L3 6718976 2628.HK CN0043 China Life Insurance Co 'H' CN HKD Y 20.4 10 15 HK0016000132 6859927 0016.HK 685992 Sun Hung Kai Properties Ltd. HK HKD Y 19.4 11 10 HK0883013259 B00G0S5 0883.HK 617994 CNOOC Ltd. CN HKD Y 18.9 12 12 HK0002007356 6097017 0002.HK 619091 CLP Holdings Ltd. HK HKD Y 18.3 13 13 KYG2103F1019 BWX52N2 1113.HK HK50CI CK Property Holdings HK HKD Y 17.9 14 11 CNE1000002Q2 6291819 0386.HK CN0098 China Petroleum & Chemical 'H' CN HKD Y 16.8 15 14 HK0688002218 6192150 0688.HK 619215 China Overseas Land & Investme CN HKD Y 14.8 16 16 HK0823032773 B0PB4M7 0823.HK B0PB4M Link Real Estate Investment Tr HK HKD Y 14.6 17 17 CNE1000003W8 6226576 0857.HK CN0065 PetroChina Co Ltd 'H' CN HKD Y 13.5 18 19 HK0003000038 6436557 0003.HK 643655 Hong Kong & China Gas Co. -

Annual Report 2006 Annual Report2006

(incorporated in the Cayman Islands with limited liability) (Stock Code: 8222) Better Health Better Life Annual Report 2006 Annual Report2006 2 Dai Fu Street, Tai Po Industrial Estate, Hong Kong Tel: (852) 2126 1212 Fax: (852) 2126 1211 www.ck-lifesciences.com Characteristics of the Growth Enterprise Market (”GEM”) of The Stock Exchange of Hong Kong Limited (the “Stock Exchange”) GEM has been established as a market designed to accommodate companies to which a high investment risk may be attached. In particular, companies may list on GEM with neither a track record of profi tability nor any obligation to forecast future profi tability. Furthermore, there may be risks arising out of the emerging nature of companies listed on GEM and the business sectors or countries in which the companies operate. Prospective investors should be aware of the potential risks of investing in such companies and should make the This annual report (“Annual Report”) is available in both decision to invest only after due and careful consideration. English and Chinese. Shareholders who have received either The greater risk profi le and other characteristics of GEM the English or the Chinese version of the Annual Report mean that it is a market more suited to professional and other may request a copy in the language different from that has sophisticated investors. been received by writing to: Computershare Hong Kong Investor Services Limited, 46th Floor, Hopewell Centre, 183 Given the emerging nature of companies listed on GEM, there Queen’s Road East, Hong Kong. is a risk that securities traded on GEM may be more susceptible to high market volatility than securities traded on the Main The Annual Report (in both English and Chinese versions) Board and no assurance is given that there will be a liquid has been posted on the Company’s website at market in the securities traded on GEM. -

CK Hutchison Highlights of the Unaudited Results for the Six Months Ended 30 June 2015

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this document, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this document. Highlights of the Unaudited Results for the six months ended 30 June 2015 CKHH six months statutory results (1) For the six months ended 30 June 2015 HK$ millions Total Revenue 117,250 Profit attributable to ordinary shareholders from continuing business 21,477 Profit attributable to ordinary shareholders from discontinued business 80,381 Profit attributable to ordinary shareholders 101,858 Earnings per share – statutory (2) HK$39.87 CKHH six months management pro forma results (3) (compared to HWL results for businesses continued by CKHH) CKHH Results HWL Results for the six for the six months ended months ended 30 June 2015 30 June 2014 HK$ millions HK$ millions Change Total Revenue (4) 197,019 196,671 - Total EBITDA (4) 46,165 42,587 +8% Total EBIT (4) 30,677 26,815 +14% Profit attributable to ordinary shareholders before profits on disposal of investments & others (5) 14,938 10,220 +46% Profits on disposal of investments & others (482) 14,921 -103% Total profit attributable to ordinary shareholders (6) 14,456 25,141 -43% Recurring earnings per share – pro forma (7) HK$3.87 For the six months ended 30 June 2015 Interim dividend per share HK$0.70 CKHH 2015 Interim Results Page 1 of 98 Note (1) Statutory results of CK Hutchison Holdings Limited (“CKHH” or the “Group”) for the six months ended 30 June 2015 include the one-time effects of the Reorganisation that occurred on 3 June 2015. -

Enhancing Everyday Living

(Incorporated in the Cayman Islands with limited liability) (Stock Code: 0775) Annual Report 2017 Enhancing Everyday Living PHARMACEUTICAL 2 Dai Fu Street, Tai Po Industrial Estate, Hong Kong Tel: (852) 2126 1212 Fax: (852) 2126 1211 NUTRACEUTICAL www.ck-lifesciences.com Annual Report 2017 AGRICULTURE–RELATED About CK Life Sciences CK Life Sciences Int’l., (Holdings) Inc. is listed on The Stock Exchange of Hong Kong Limited. Bearing the mission of improving the quality of life, CK Life Sciences is engaged in the business of research and development, manufacturing, commercialisation, marketing, sale of, and investment in, products and assets which fall into three core categories – nutraceuticals, pharmaceuticals and agriculture-related. CK Life Sciences is a member of the CK Hutchison Group. Contents 2 Chairman’s Statement 6 Business Review Agriculture-related Business Nutraceutical Business Pharmaceutical Business 24 Long Term Development Strategy 25 Financial Summary 26 Financial Review 28 Directors and Key Personnel 35 Report of the Directors 46 Independent Auditor’s Report 52 Consolidated Income Statement 53 Consolidated Statement of Comprehensive Income 54 Consolidated Statement of Financial Position 56 Consolidated Statement of Changes in Equity 57 Consolidated Statement of Cash Flows 59 Notes to the Consolidated Financial Statements 124 Principal Subsidiaries 129 Principal Joint Ventures 130 Schedule of Major Investment Properties 131 Corporate Governance Report 163 Environmental, Social and Governance Report 173 Risk Factors 178 Corporate Information and Key Dates Chairman’s Statement 2 CK Life Sciences Int’l., (Holdings) Inc. For the year ended 31 December 2017, CK Life Sciences Int’l., (Holdings) Inc. (“CK Life Sciences” or the “Company”) reported profit attributable to shareholders of HK$258 million, an increase of 2% as compared to the Company’s restated profit1 in 2016. -

A Holistic Framework for the Study of Interdependence Between Electricity and Gas Sectors

November 2015 A holistic framework for the study of interdependence between electricity and gas sectors OIES PAPER: EL 16 Donna Peng Rahmatallah Poudineh The contents of this paper are the authors’ sole responsibility. They do not necessarily represent the views of the Oxford Institute for Energy Studies or any of its members. Copyright © 2015 Oxford Institute for Energy Studies (Registered Charity, No. 286084) This publication may be reproduced in part for educational or non-profit purposes without special permission from the copyright holder, provided acknowledgment of the source is made. No use of this publication may be made for resale or for any other commercial purpose whatsoever without prior permission in writing from the Oxford Institute for Energy Studies. ISBN 978-1-78467-042-9 A holistic framework for the study of interdependence between electricity and gas sectors i Acknowledgements The authors are thankful to Malcolm Keay, Howard Rogers and Pablo Dueñas for their invaluable comments on the earlier version of this paper. The authors would also like to extend their sincere gratitude to Bassam Fattouh, director of OIES, for his support during this project. A holistic framework for the study of interdependence between electricity and gas sectors ii Contents Acknowledgements .............................................................................................................................. ii Contents ............................................................................................................................................... -

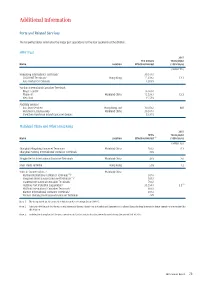

Additional Information

additional Information ports and related services The following tables summarise the major port operations for the four segments of the division. HpH trust 2015 The Group’s Throughput Name Location Effective Interest (100% basis) (million TEU) Hongkong International Terminals/ 30.07% / COSCO-HIT Terminals/ Hong Kong 15.03% / 12.1 Asia Container Terminals 12.03% Yantian International Container Terminals - Phase I and II/ 16.96% / Phase III/ Mainland China 15.53% / 12.2 West Port 15.53% Ancillary Services - Asia Port Services/ Hong Kong and 30.07% / N/A Hutchison Logistics (HK)/ Mainland China 30.07% / Shenzhen Hutchison Inland Container Depots 23.35% Mainland China and other Hong Kong 2015 HPH’s Throughput Name Location Effective Interest (1) (100% basis) (million TEU) Shanghai Mingdong Container Terminals/ Mainland China 50% / 8.3 Shanghai Pudong International Container Terminals 30% Ningbo Beilun International Container Terminals Mainland China 49% 2.0 River Trade Terminal Hong Kong 50% 1.2 Ports in Southern China - Mainland China (2) Nanhai International Container Terminals / 50% / (2) Jiangmen International Container Terminals / 50% / Shantou International Container Terminals/ 70% / (3) Huizhou Port Industrial Corporation/ 33.59% / 2.5 Huizhou International Container Terminals/ 80% / Xiamen International Container Terminals/ 49% / Xiamen Haicang International Container Terminals 49% Note 1: The Group holds an 80% interest in Hutchison Ports Holdings Group (“HPH”). Note 2: Although HPH Trust holds the economic interest in the two River Ports in Nanhai and Jiangmen in Southern China, the legal interests in these operations are retained by this division. Note 3: Includes the throughput of the port operations in Gaolan and Jiuzhou that were disposed during the second half of 2015. -

CK Hutchison Holding(1

Equity Market Hong Kong Equity Morning note Martin Ma (SFC CE:BOB758) (852) 3519 1055 Friday, September 25,2020 Market Wrap HSI▼1.82% HSCEI▼1.96% Turnover HK$117.16 bn ▼9% (30-day average) SSE Composite▼1.72% SZSE Component ▼2.24% Sector tracking Stock tracking 1D ▲% 1Y ▲% 1D ▲% 1Q ▲% Utilities 0.5 Automobiles 88.6 SOLARGIGA ENERGY(757) 38.0 NEXION TECHNOLOG(8420) 339.6 Real Estate 1.0 Durable & Tech 54.9 GOLDWAY EDUCATIO(8160) 21.4 HAINAN MEILAN IN(357) 286.2 GOLDWAY EDUCATIO HAINAN MEILAN IN Consumer Goods Health Care IN TECHNICAL PRO(8446) 1.4 49.8 CORNERSTONE FINA(8112) 20.0 227.1 CORNERSTONE FINA IN TECHNICAL PRO Capital Goods 1.4 Consumer Goods 29.2 CHINA ALUMINUM C(6898) 19.5 KNK HOLDINGS LTD(8039) 222.8 Telecom Services 1.6 Materials 25.6 ROYALCHINA CENTURY ALUMINUM RE(8125) C 18.2 YTOKNK EXPRESS HOLDINGS HOLD LTD(6123) 220.9 MarketROYAL CENTURY Highlight RE YTO EXPRESS HOLD Hong Kong Utilities Series 4 – CKGOLDWAY Hutchison EDUCATIO Holding(1 HK): CORNERSTONE FINA CK Hutchison Holding Limited is a CHINA ALUMINUM C Hutchison Telecommunications HK Holding multinational conglomerate that ROYAL CENTURY RE (0215 HK) operate variety sector of business in around 50 countries and have over CK Infrastructure Holding 300,000 employees around the world. (01038 HK) The business involve including Ports and related services, retail, infrastructure, Energy and Li Ka-shing Telecommunications. CK Hutchison Holding For the year 20201H, Hutchison Group (0001 HK) reported HK$ 189,942 million revenue, with YoY changes of -12%, HK$28,619 of total EBIT, with YoY changes of -21%.