Form Y-203-I, If You Had More Than One Job, Or If You Had a Job for Only Part of the Year

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Research Brief March 2017 Publication #2017-16

Research Brief March 2017 Publication #2017-16 Flourishing From the Start: What Is It and How Can It Be Measured? Kristin Anderson Moore, PhD, Child Trends Christina D. Bethell, PhD, The Child and Adolescent Health Measurement Introduction Initiative, Johns Hopkins Bloomberg School of Every parent wants their child to flourish, and every community wants its Public Health children to thrive. It is not sufficient for children to avoid negative outcomes. Rather, from their earliest years, we should foster positive outcomes for David Murphey, PhD, children. Substantial evidence indicates that early investments to foster positive child development can reap large and lasting gains.1 But in order to Child Trends implement and sustain policies and programs that help children flourish, we need to accurately define, measure, and then monitor, “flourishing.”a Miranda Carver Martin, BA, Child Trends By comparing the available child development research literature with the data currently being collected by health researchers and other practitioners, Martha Beltz, BA, we have identified important gaps in our definition of flourishing.2 In formerly of Child Trends particular, the field lacks a set of brief, robust, and culturally sensitive measures of “thriving” constructs critical for young children.3 This is also true for measures of the promotive and protective factors that contribute to thriving. Even when measures do exist, there are serious concerns regarding their validity and utility. We instead recommend these high-priority measures of flourishing -

The Origin of the Peculiarities of the Vietnamese Alphabet André-Georges Haudricourt

The origin of the peculiarities of the Vietnamese alphabet André-Georges Haudricourt To cite this version: André-Georges Haudricourt. The origin of the peculiarities of the Vietnamese alphabet. Mon-Khmer Studies, 2010, 39, pp.89-104. halshs-00918824v2 HAL Id: halshs-00918824 https://halshs.archives-ouvertes.fr/halshs-00918824v2 Submitted on 17 Dec 2013 HAL is a multi-disciplinary open access L’archive ouverte pluridisciplinaire HAL, est archive for the deposit and dissemination of sci- destinée au dépôt et à la diffusion de documents entific research documents, whether they are pub- scientifiques de niveau recherche, publiés ou non, lished or not. The documents may come from émanant des établissements d’enseignement et de teaching and research institutions in France or recherche français ou étrangers, des laboratoires abroad, or from public or private research centers. publics ou privés. Published in Mon-Khmer Studies 39. 89–104 (2010). The origin of the peculiarities of the Vietnamese alphabet by André-Georges Haudricourt Translated by Alexis Michaud, LACITO-CNRS, France Originally published as: L’origine des particularités de l’alphabet vietnamien, Dân Việt Nam 3:61-68, 1949. Translator’s foreword André-Georges Haudricourt’s contribution to Southeast Asian studies is internationally acknowledged, witness the Haudricourt Festschrift (Suriya, Thomas and Suwilai 1985). However, many of Haudricourt’s works are not yet available to the English-reading public. A volume of the most important papers by André-Georges Haudricourt, translated by an international team of specialists, is currently in preparation. Its aim is to share with the English- speaking academic community Haudricourt’s seminal publications, many of which address issues in Southeast Asian languages, linguistics and social anthropology. -

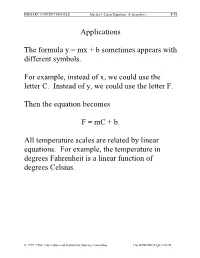

Applications the Formula Y = Mx + B Sometimes Appears with Different

PRIMARY CONTENT MODULE Algebra I -Linear Equations & Inequalities T-71 Applications The formula y = mx + b sometimes appears with different symbols. For example, instead of x, we could use the letter C. Instead of y, we could use the letter F. Then the equation becomes F = mC + b. All temperature scales are related by linear equations. For example, the temperature in degrees Fahrenheit is a linear function of degrees Celsius. © 1999, CISC: Curriculum and Instruction Steering Committee The WINNING EQUATION PRIMARY CONTENT MODULE Algebra I -Linear Equations & Inequalities T-72 Basic Temperature Facts Water freezes at: 0°C, 32°F Water Boils at: 100°C, 212°F F • (100, 212) • (0, 32) C Can you solve for m and b in F = mC + b? © 1999, CISC: Curriculum and Instruction Steering Committee The WINNING EQUATION PRIMARY CONTENT MODULE Algebra I -Linear Equations & Inequalities T-73 To find the equation relating Fahrenheit to Celsius we need m and b F – F m = 2 1 C2 – C1 212 – 32 m = 100 – 0 180 9 m = = 100 5 9 Therefore F = C + b 5 To find b, substitute the coordinates of either point. 9 32 = (0) + b 5 Therefore b = 32 Therefore the equation is 9 F = C + 32 5 Can you solve for C in terms of F? © 1999, CISC: Curriculum and Instruction Steering Committee The WINNING EQUATION PRIMARY CONTENT MODULE Algebra I -Linear Equations & Inequalities T-74 Celsius in terms of Fahrenheit 9 F = C + 32 5 5 5 9 F = æ C +32ö 9 9è 5 ø 5 5 F = C + (32) 9 9 5 5 F – (32) = C 9 9 5 5 C = F – (32) 9 9 5 C = (F – 32) 9 Example: How many degrees Celsius is77°F? 5 C = (77 – 32) 9 5 C = (45) 9 C = 25° So 72°F = 25°C © 1999, CISC: Curriculum and Instruction Steering Committee The WINNING EQUATION PRIMARY CONTENT MODULE Algebra I -Linear Equations & Inequalities T-75 Standard 8 Algebra I, Grade 8 Standards Students understand the concept of parallel and perpendicular lines and how their slopes are related. -

Ffontiau Cymraeg

This publication is available in other languages and formats on request. Mae'r cyhoeddiad hwn ar gael mewn ieithoedd a fformatau eraill ar gais. [email protected] www.caerphilly.gov.uk/equalities How to type Accented Characters This guidance document has been produced to provide practical help when typing letters or circulars, or when designing posters or flyers so that getting accents on various letters when typing is made easier. The guide should be used alongside the Council’s Guidance on Equalities in Designing and Printing. Please note this is for PCs only and will not work on Macs. Firstly, on your keyboard make sure the Num Lock is switched on, or the codes shown in this document won’t work (this button is found above the numeric keypad on the right of your keyboard). By pressing the ALT key (to the left of the space bar), holding it down and then entering a certain sequence of numbers on the numeric keypad, it's very easy to get almost any accented character you want. For example, to get the letter “ô”, press and hold the ALT key, type in the code 0 2 4 4, then release the ALT key. The number sequences shown from page 3 onwards work in most fonts in order to get an accent over “a, e, i, o, u”, the vowels in the English alphabet. In other languages, for example in French, the letter "c" can be accented and in Spanish, "n" can be accented too. Many other languages have accents on consonants as well as vowels. -

(3) (Y'(Uf)\L + 2A(U)B(Y(U))\\O

proceedings of the american mathematical society Volume 34, Number 1, July 1972 PROPERTIES OF SOLUTIONS OF DIFFERENTIAL EQUATIONS OF THE FORM / 4- a(t)b(y) = 0 ALLAN KROOPNICK Abstract. Two theorems are presented which guarantee the boundedness and oscillation of solutions of certain classes of second order nonlinear differential equations. In this paper we shall show boundedness of solutions of the differential equation y"+a(t)b(y)=0 with appropriate conditions on a(t) and b(y). Furthermore, all solutions will be oscillatory subject to a further condition. By oscillatory we shall mean a function having arbitrarily large zeros. The first theorem is an extension of a result of Utz [1] in which he con- siders b(y)=y2n~1. We now prove a result for boundedness of solutions. Theorem I. If a(t)> a>0 and da/dt^O on [T, oo), b(y) continuous, and limj,^±00B(y)=$yb(u) du=co then all solutions of (1) / + a(t)b(y)=0 are bounded as r—>-oo. Proof. Multiply (1) by 2/ to get (2) 2y'y" + 2a(t)b(y)y' = 0. Upon integration by parts we have (3) (y'(uf)\l+ 2a(u)B(y(u))\\o- 2 P df B(y)du = 0. J ir, Uli Thus (4) y'(tf + 2a(t)B(y(t))- 2 f ^ B(y)du = K Jto du where K=y'(t0)2-r-2a(to)B(y(to)). Now the above implies \y'\ and \y\ remain bounded. If not, the left side of (4) would become infinite which is impossible. -

У^C/ ^Xaxxlty^Yy Yyy- Y/A М /A XX

1 5 2 Va X A y // /^ //X A ^ M a i Y'YY/ ’^y y y -ì - A Y & y n / X X - y7 AAl/XX /AlAX AA /X y ^z^s -i o y ^ y y H ^ - z ^ A c ^ J Ì^Ystn^XUY Y LY X ’YYi yl^-CY7 A/ y A A Y ^ t V Y f AC-, C x ix x r~/Y- CYtS Vy* X{ l à / ¿ Y l ^ l Y A". A X r u / , A / C A ut Y A l' T O tl / V l X ^ ì y y Z A ^/Aa ^ A y y A c y ^ yl A A t d l f H ^ c ò / a AtA r t / ^ ¿ ù a / z Cy/ X X-CAX? yCA %-O > yCCfl/Cj t L ^ H ' Ì ^ ì y AC A & A / c i Cy y ^ ehf yZy y y Y- ACC y i C C A A ^ tiY 'l'VZY-YcZo 'SA y y - Z-eY^Y A iaA a ^ C c' A^ . 7 ' Y ^ C / / ¿ H y/yi-C-td A#A y -AA Yy y y A 'iCA uX ZY lls X^^y y y y y y y A y '* 1 Xt i 'l-tA Y V Y l' '/A A in - r iY -t^Y d X y v A y y > y Y Y Y y CitYYyACAty C/ y y y 'lA 'V ¿A,A a 4 aC y y A i Y Y y 'Y> '-/AYYA •■*yv/ ’a a a i a U ^ t & l i - AA-Y>t/ACy-7A ^ < / A - '" 'X X X 'X t X d'PY'. -

1. First Examples a Differential Equation for a Variable U(X, Y, . . .)

1. First examples A differential equation for a variable u(x; y; : : : ), which depends on the independent variables x, y, . , is an equation which involves u and some of its partial derivatives. Differential equations have traditionally played a huge role in the sciences and so they have been heavily studied in mathematics. If u depends on x and y, there are two partial derivatives, @u @u and : @x @y Since partial differential equations might involve lots of variables and derivatives, it is convenient to introduce some more compact notation. @u @u = u and = u : @x x @y y Note that @2u @2u @2u u = u = and u = : xx @x2 xy @x@y yy @y2 Recall some basic facts about derivatives. First of all derivatives are local, meaning if you only change the function away from a point then the derivative is unchanged (contrast this with the integral, which is far from local; the area under the graph depends on the global behaviour). Secondly if all 2nd derivatives exist and they are continuous then the mixed partials are equal: uxy = uyx: Example 1.1. Suppose that u(x; y) = sin(xy): Then ux = y cos(xy) and uy = x cos(xy): But then uyx = cos(xy) − xy sin(xy) and uxy = cos(xy) − xy sin(xy): Partial differential equations are in general very complicated and normally we can only make sense of the solutions of those equations which come from applications. If there are two space variables then we typically call them x and y but as usual t denotes a time variable and x a space variable. -

Nastaleeq: a Challenge Accepted by Omega

Nastaleeq: A challenge accepted by Omega Atif Gulzar, Shafiq ur Rahman Center for Research in Urdu Language Processing, National University of Computer and Emerging Sciences, Lahore, Pakistan atif dot gulzar (at) gmail dot com, shafiq dot rahman (at) nu dot edu dot pk Abstract Urdu is the lingua franca as well as the national language of Pakistan. It is based on Arabic script, and Nastaleeq is its default writing style. The complexity of Nastaleeq makes it one of the world's most challenging writing styles. Nastaleeq has a strong contextual dependency. It is a cursive writing style and is written diagonally from right to left. The overlapping shapes make the nuqta (dots) and kerning problem even harder. With the advent of multilingual support in computer systems, different solu- tions have been proposed and implemented. But most of these are immature or platform-specific. This paper discuses the complexity of Nastaleeq and a solution that uses Omega as the typesetting engine for rendering Nastaleeq. 1 Introduction 1.1 Complexity of the Nastaleeq writing Urdu is the lingua franca as well as the national style language of Pakistan. It has more than 60 mil- The Nastaleeq writing style is far more complex lion speakers in over 20 countries [1]. Urdu writing than other writing styles of Arabic script{based lan- style is derived from Arabic script. Arabic script has guages. The salient features`r of Nastaleeq that many writing styles including Naskh, Sulus, Riqah make it more complex are these: and Deevani, as shown in figure 1. Urdu may be • Nastaleeq is a cursive writing style, like other written in any of these styles, however, Nastaleeq Arabic styles, but it is written diagonally from is the default writing style of Urdu. -

Second Order Linear Differential Equations Y

Second Order Linear Differential Equations Second order linear equations with constant coefficients; Fundamental solutions; Wronskian; Existence and Uniqueness of solutions; the characteristic equation; solutions of homogeneous linear equations; reduction of order; Euler equations In this chapter we will study ordinary differential equations of the standard form below, known as the second order linear equations : y″ + p(t) y′ + q(t) y = g(t). Homogeneous Equations : If g(t) = 0, then the equation above becomes y″ + p(t) y′ + q(t) y = 0. It is called a homogeneous equation. Otherwise, the equation is nonhomogeneous (or inhomogeneous ). Trivial Solution : For the homogeneous equation above, note that the function y(t) = 0 always satisfies the given equation, regardless what p(t) and q(t) are. This constant zero solution is called the trivial solution of such an equation. © 2008, 2016 Zachary S Tseng B-1 - 1 Second Order Linear Homogeneous Differential Equations with Constant Coefficients For the most part, we will only learn how to solve second order linear equation with constant coefficients (that is, when p(t) and q(t) are constants). Since a homogeneous equation is easier to solve compares to its nonhomogeneous counterpart, we start with second order linear homogeneous equations that contain constant coefficients only: a y″ + b y′ + c y = 0. Where a, b, and c are constants, a ≠ 0. A very simple instance of such type of equations is y″ − y = 0 . The equation’s solution is any function satisfying the equality t y″ = y. Obviously y1 = e is a solution, and so is any constant multiple t −t of it, C1 e . -

FR Y-10 INSTRUCTIONS for PREPARATION of Report of Changes in Organizational Structure FR Y–10

Board of Governors of the Federal Reserve System Instructions for Preparation of Report of Changes in Organizational Structure Reporting Form FR Y-10 INSTRUCTIONS FOR PREPARATION OF Report of Changes in Organizational Structure FR Y–10 GENERAL INSTRUCTIONS • certain merchant banking or insurance company invest- ments; Introduction • establishment in the United States of branches, agen- Use the FR Y-10 to report changes to the worldwide cies, and representative offices of FBOs and activities organizational structure of bank holding companies through managed non-U.S. branches; (BHCs), savings and loan holding companies (SLHCs),1 • opening, closing, or relocation of foreign branches of U.S. intermediate holding companies (IHCs), member banks, Edge and agreement corporations, and to the U.S. member banks, BHCs, IHCs, or Edge or agreement corporations and of their foreign subsidiaries; operations of foreign banking organizations (FBOs).2 Such changes include: • opening, acquisition, sale, closing or relocation of • information about the Reporter itself; domestic branches of U.S. subsidiary depository insti- tutions of top-tier BHCs, IHCs, or SLHCs, of unaffili- • acquisition of interests in BHCs, IHCs, SLHCs, FBOs, ated state member banks, and of Edge and agreement banks organized under U.S. law and savings associa- corporations; and tions; • changes to previously reported information. • acquisition of interests in nonbanking companies that are owned by BHCs, IHCs, SLHCs, and non-qualifying Depending on the nature of reported changes in structure FBOs, and nonbanking companies conducting business and activity information, it will not always be necessary in the United States that are owned by qualifying to file all schedules. -

Care of the Patient with Acute Ischemic Stroke

Stroke AHA SCIENTIFIC STATEMENT Care of the Patient With Acute Ischemic Stroke (Posthyperacute and Prehospital Discharge): Update to 2009 Comprehensive Nursing Care Scientific Statement A Scientific Statement From the American Heart Association Endorsed by the American Association of Neuroscience Nurses Theresa L. Green, PhD, RN, FAHA, Chair; Norma D. McNair, PhD, RN, FAHA, Vice Chair; Janice L. Hinkle, PhD, RN, FAHA; Sandy Middleton, PhD, RN, FAHA; Elaine T. Miller, PhD, RN, FAHA; Stacy Perrin, PhD, RN; Martha Power, MSN, APRN, FAHA; Andrew M. Southerland, MD, MSc, FAHA; Debbie V. Summers, MSN, RN, AHCNS-BC, FAHA; on behalf of the American Heart Association Stroke Nursing Committee of the Council on Cardiovascular and Stroke Nursing and the Stroke Council ABSTRACT: In 2009, the American Heart Association/American Stroke Association published a comprehensive scientific statement detailing the nursing care of the patient with an acute ischemic stroke through all phases of hospitalization. The purpose of this statement is to provide an update to the 2009 document by summarizing and incorporating current best practice evidence relevant to the provision of nursing and interprofessional care to patients with ischemic stroke and their Downloaded from http://ahajournals.org by on March 12, 2021 families during the acute (posthyperacute phase) inpatient admission phase of recovery. Many of the nursing care elements are informed by nurse-led research to embed best practices in the provision and standard of care for patients with stroke. The writing group comprised members of the Stroke Nursing Committee of the Council on Cardiovascular and Stroke Nursing and the Stroke Council. A literature review was undertaken to examine the best practices in the care of the patient with acute ischemic stroke. -

The Role of Gut Microbiota in an Ischemic Stroke

International Journal of Molecular Sciences Review The Role of Gut Microbiota in an Ischemic Stroke Ryszard Pluta 1,* , Sławomir Januszewski 1 and Stanisław J. Czuczwar 2 1 Laboratory of Ischemic and Neurodegenerative Brain Research, Mossakowski Medical Research Institute, Polish Academy of Sciences, 02-106 Warsaw, Poland; [email protected] 2 Department of Pathophysiology, Medical University of Lublin, 20-090 Lublin, Poland; [email protected] * Correspondence: [email protected]; Tel.: +48-22-6086-540 Abstract: The intestinal microbiome, the largest reservoir of microorganisms in the human body, plays an important role in neurological development and aging as well as in brain disorders such as an ischemic stroke. Increasing knowledge about mediators and triggered pathways has contributed to a better understanding of the interaction between the gut-brain axis and the brain-gut axis. Intestinal bacteria produce neuroactive compounds and can modulate neuronal function, which affects behavior after an ischemic stroke. In addition, intestinal microorganisms affect host metabolism and immune status, which in turn affects the neuronal network in the ischemic brain. Here we discuss the latest results of animal and human research on two-way communication along the gut-brain axis in an ischemic stroke. Moreover, several reports have revealed the impact of an ischemic stroke on gut dysfunction and intestinal dysbiosis, highlighting the delicate play between the brain, intestines and microbiome after this acute brain injury. Despite our growing knowledge of intestinal microflora in shaping brain health, host metabolism, the immune system and disease progression, its therapeutic options in an ischemic stroke have not yet been fully utilized.