Fixed Assets Inventory Procedures

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

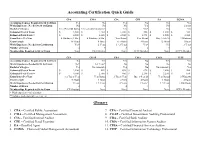

Accounting Certification Quick Guide

Accounting Certification Quick Guide CPA CMA CIA CFE EA CGMA Accounting Courses Required to Sit for Exam Yes No Yes No No Yes Work Experience Needed to Sit for Exam No No No Yes No 2 years Bachelor's Degree Yes (150 credit hours) Yes (can sit b/f graduated) Yes Yes* No Yes Estimated Cost of Exam $ 3,000 $ 1,750 $ 1,500 $ 400 $ 1,000 $ 325 Estimated Total Costs** $ 4,500 $ 2,230 $ 2,300 $ 1,395 $ 1,500 $ 2,600 Exam Dates Per Year 4 Windows (9 Mo.) 4 Windows (6 Mo.) Year Round Year Round May 1-Feb 28 3 Windows Exam Length 16 Hours 8 Hours 6.5 Hours 8 Hours 12 Hours 3 Hours Work Experience Needed for Certification Yes* 2 Years 1 - 2 Years Yes* No 3 Years Number of Exams 4 2 3 4 3 1 Memberships Required to Sit for Exam None IMA Member None ACFE Member None AICPA Member CFA CGAP CBA CISA CFSA CITP Accounting Courses Required to Sit for Exam No Yes Yes No Yes Yes Work Experience Needed to Sit for Exam No* 1-5 Years* No No No No Bachelor's Degree Yes No (associate) Yes No No (associate) Yes Estimated Cost of Exam $ 2,500 $ 855 $ 498 $ 670 $ 2,000 $ 500 Estimated Total Costs** $ 4,600 $ 2,500 $ 900 $ 2,240 $ 2,250 $ 650 Exam Dates Per Year 1-2 Times/ Year Year Round 3 Times/ Year June 1-Sept 23 Year Round 3 Windows Exam Length 18 Hours 3 Hours 4 Parts 4 Hours 3 Hours 4 Hours Work Experience Needed for Certification 4 Years 1-5 Years 2 Years 3 Years* 1-5 Years 1,000 Hours Number of Exams 3 1 4 1 1 1 Memberships Required to Sit for Exam CFA Institute None None None None AICPA Member * Work experience varies by state **Includes study material, fees, test, etc. -

3.5 FINANCIAL ASSETS and LIABILITIES Definitions 1. Financial Assets Include Cash, Equity Instruments of Other Entities

128 SU 3: Financial Accounting I 3.5 FINANCIAL ASSETS AND LIABILITIES Definitions 1. Financial assets include cash, equity instruments of other entities (e.g., preference shares), contract rights to receive cash or other financial assets from other entities (e.g., accounts receivable), etc. 2. Financial liabilities include obligations to deliver cash or another financial asset (e.g., bonds or accounts payable), obligations to exchange financial instruments under potentially unfavorable conditions (e.g., written options), etc. Initial Recognition 3. A financial asset or liability is initially recognized only when the entity is a party to the contract. Thus, contract rights and obligations under derivatives are recognized as assets and liabilities, respectively. a. A firm commitment to buy or sell goods or services ordinarily does not result in recognition until at least one party has performed. 1) However, certain contracts to buy or sell a nonfinancial item may result in recognition of an asset or liability. a) For example, a firm commitment to buy a commodity in the future that (1) can be settled in cash and (2) is not held for the purpose of receiving the commodity is treated as a financial instrument. Accordingly, its net fair value is recognized at the commitment date. b) If an unrecognized firm commitment is hedged in a fair value hedge,a change in its net fair value related to the hedged risk is recognized as an asset or liability. 4. An issuer of a financial guarantee initially recognizes a liability and measures it at fair value. Subsequent measurement is at the greater of (a) the amount based on accounting for provisions or (b) the amortized amount. -

Fixed Asset Inventory System

PROCEDURES MANUAL FIXED ASSET INVENTORY SYSTEM FOR COUNTY BOARDS OF EDUCATION IN THE STATE OF WEST VIRGINIA Office of School Finance West Virginia Department of Education PROCEDURES MANUAL FIXED ASSET INVENTORY SYSTEM FOR COUNTY BOARDS OF EDUCATION IN THE STATE OF WEST VIRGINIA Revised July 16, 2001 Copies may be obtained from: West Virginia Department of Education Office of School Finance Building 6, Room 215 1900 Kanawha Boulevard E. Charleston, West Virginia 25305 FIXED ASSET INVENTORY SYSTEM PROCEDURES MANUAL FOREWORD Allocating, operating, and accounting for the physical assets of a school system are among the most important responsibilities of school administrators. Expenditures for fixed assets are generally the most visible costs a school district incurs. Yet, the accounting for such assets, once acquired, has generally received little attention. Implementation of a fixed asset inventory accounting system will enable local education agencies to maintain an inventory of all assets, including those purchased with federal funds. In addition, the system will assist all agencies in obtaining an unqualified opinion on their audited financial statements, and will assign responsibility and accountability for the security of fixed assets. The system can also be used for purposes of insurance and proof of loss. This manual has been developed by the West Virginia Department of Education in order to provide uniform standards throughout the State for all county boards of education, regional education service agencies, and multi-county vocational centers to use in developing a fixed asset inventory accounting system. The manual prescribes the minimum requirements that are to be encompassed in establishing such a system, and provides a list of the codes that are to be used in classifying fixed assets. -

Accountant Exempt, Full-Time Administrative Department

Accountant Exempt, Full-Time Administrative Department Job Summary: Under general supervision of the Finance Director, responsible for accounting and support services. The employee must routinely use independent judgment when performing tasks. Equipment Used / Job Locations / Work Environment: The work environment characteristics described here are representative of those an employee encounters while performing the essential functions of this class. Reasonable accommodations may be made to enable individuals with disabilities to perform the essential functions. The employee will operate a computer, fax machines, copier and other modern office equipment. The employee generally works indoors in an office. Essential Functions & Job Responsibilities: The duties listed below are intended only as illustrations of the various types of work that may be performed. The omission of specific statements of duties does not exclude them from the position if the work is similar, related or a logical assignment to this class. Responsible for accounting and financial records of all funds, including reconciling bank statements and invoices, reconciling General Ledger (G/L) accounts and sub ledgers, bond payments, verifying accounts payable, and payroll; balances all receipts and tax collections monthly; responsible for journal entries to G/L; records fixed assets; assists with annual audit; assist with annual budget preparation; assist with annual and monthly financial report; assists users in resolving problems on various accounting systems. Additional Work Performed: Prepares social security and tax withholding reports; prepares quarterly unemployment reports; maintains general records of account according to established accounting classifications, including various ledgers, registers, and journals; posts entries to books and computer from supporting records, makes adjustments, and prepares financial statements. -

Chapter 3 CT 1. A. If Inventory Is Purchased with Cash, Then There Is

Chapter 3 CT 1. a. If inventory is purchased with cash, then there is no change in the current ratio. If inventory is purchased on credit, then there is a decrease in the current ratio if it was initially greater than 1.0. b. Reducing accounts payable with cash increases the current ratio if it was initially greater than 1.0. c. Reducing short-term debt with cash increases the current ratio if it was initially greater than 1.0. d. As long-term debt approaches maturity, the principal repayment and the remaining interest expense become current liabilities. Thus, if debt is paid off with cash, the current ratio increases if it was initially greater than 1.0. If the debt has not yet become a current liability, then paying it off will reduce the current ratio since current liabilities are not affected. e. Reduction of accounts receivables and an increase in cash leaves the current ratio unchanged. f. Inventory sold at cost reduces inventory and raises cash, so the current ratio is unchanged. g. Inventory sold for a profit raises cash in excess of the inventory recorded at cost, so the current ratio increases. 3. A current ratio of 0.50 means that the firm has twice as much in current liabilities as it does in current assets; the firm potentially has poor liquidity. If pressed by its short-term creditors and suppliers for immediate payment, the firm might have a difficult time meeting its obligations. A current ratio of 1.50 means the firm has 50% more current assets than it does current liabilities. -

Speech: What Is an Asset?, January 12, 1993

For Release January 8, 1993 Walter P. Schuetze Chief Accountant Securities and Exchange Commission American Institute of Certified Public Accountants' Twentieth Annual National Conference on CUrrent SEC Developments , < i January 12, 1993 What is an Asset? The Securities and Exchange commission, as a matter of policy, disclaims responsibility for any publication or statement by its employees. The views expressed herein are those of Mr. Schuetze and do not necessarily reflect the views of the Commission or the other staff of the Commission. What is an Asset? I am pleased to make my second appearance on the program of this annual national conference on current SEC developments. The year gone by has been one where the staff has concentrated on promoting the Commission's drive for mark-to-market accounting for marketable debt and equity securities. That policy was set out in Congressional testimony in september 1990 by Chairman Breeden and in December 1990 by James Doty, the Commission's.former General Counsel. We have continued to encourage the Financial Accounting standards Board, and the financial community in general, to embrace the idea of mark-to-market for marketable securities. contrary to the perception by some, we have not been promoting mark-to-market for other assets, such as plant and equipment, pa tents and copyrights, or commercial loans held by banks. What the staff has done, however, is to suggest the idea that, when one is looking to identify impairment of the carrying amount of assets such as stocks, bonds, loans, plant, and patents, it is appropriate to look at the fair value of the asset and compare that fair value to the carrying amount of the asset. -

Cost of Goods Sold

Cost of Goods Sold Inventory •Items purchased for the purpose of being sold to customers. The cost of the items purchased but not yet sold is reported in the resale inventory account or central storeroom inventory account. Inventory is reported as a current asset on the balance sheet. Inventory is a significant asset that needs to be monitored closely. Too much inventory can result in cash flow problems, additional expenses and losses if the items become obsolete. Too little inventory can result in lost sales and lost customers. Inventory is reported on the balance sheet at the amount paid to obtain (purchase) the items, not at its selling price. Cost of Goods Sold • Inventory management Involves regulation of the size of the investment in goods on hand, the types of goods carried in stock, and turnover rates. The investment in inventory should be kept at a minimum consistent with maintenance of adequate stocks of proper quality to meet sales demand. Increases or decreases in the inventory investment must be tested against the effect on profits and working capital. Standard levels of inventory should be established as adequate for a given volume of business, and stock control procedures applied so as to limit purchase as required. Such controls should not preclude volume purchase of nonperishable items when price advantages may be obtained under unusual circumstances. The rate of inventory turnover is a valuable test of merchandising efficiency and should be computed monthly Cost of Goods Sold • Inventory management All inventories are valued at cost which is defined as invoice price plus freight charges less discounts. -

SWOSU Business Affairs Capital Asset Inventory Review

SWOSU Business Affairs Capital Asset Inventory Review Scope and Objectives The scope of the inventory review includes all equipment purchased, owned, leased, or on loan to the university; regardless of the location of the equipment. The object is to maintain accurate records regarding cost, location, and disposition of the inventory. The objects are to: Assure all capital assets are properly located. Assure all capital assets are recorded with correct descriptions and dates acquired. Assure all capital assets are recorded at the correct amount or invoice cost. Assure that additions, deletions, and changes to capital asset inventories are recorded accurately and timely. Risk Assessment Inaccurate records regarding capital asset equipment can lead to loss and misuse of state equipment. Equipment Inventory Policy The policy is posted on the SWOSU website under Equipment Inventory Policy and is Attachment A to this document. Procedures In an effort to maintain accurate capital asset control, the following procedures will be administered by the Business Affairs staff. The Purchasing Coordinator/Inventory Control Clerk (ICC) will spend approximately 24 hours per month physically documenting the inventory in each building or department in this order: a) Comptroller will send an email to department head and administrative assistant to set up a date and time for the review. b) ICC will be furnished a list of capital assets for the department or building and a list of inventory assets for all grants. c) ICC will work with Administrative Assistants or others to locate the equipment. All notes on the equipment list will be initialed by the ICC and Administrative Assistant (Ref Attachment B). -

CHOOSING a BOOKKEEPING SOLUTION Step 1

CHOOSING A BOOKKEEPING SOLUTION Step 1: Determine skill requirements (The chart below is offered as a general guide to creating a job description.) Basic Bookkeeping Advanced Bookkeeping Accounting Finance Recording basic daily Recording more Handling accounting Handling other financial transactions such as: complex transactions functions such as: and managerial ‐Receipts & Deposits such as: ‐Processing payroll activities such as: ‐Disbursements ‐Payroll ‐Maintaining fixed asset ‐Budgeting ‐Vendor bills & credits ‐Credit card activity schedules ‐Projections ‐Customer invoices, ‐Journal entries ‐Inventory valuation ‐Cash flow analysis credits and statements ‐Inventory ‐Work‐in‐process ‐Financing ‐Project/Job costing Accounting ‐Tax preparation or ‐Estimates ‐Overhead allocations interfacing with your ‐Purchase orders ‐Cost of good/services CPA ‐Allocation by profit accounting center ‐Tax reporting (sales & ‐Bank and credit card use, gross receipts, account reconciliation 1099, payroll taxes) ‐Interfacing with a point of sale system ‐Internally prepared financial statements Job titles may include: Job titles may include: Job titles may include: Job titles may include: ‐Data Entry Clerk ‐Bookkeeper ‐Office Manager ‐Accounting Manager ‐Payables and/or ‐Senior Bookkeeper ‐Staff Accountant ‐Director of Finance Receivables Clerk ‐Full charge Bookkeeper ‐Accountant and/or Accounting ‐Entry Level Bookkeeper ‐Junior Accountant ‐Payroll Accountant ‐Chief Finance Officer ‐Bookkeeper ‐Office Manager ‐Senior Accountant Education required: Education -

Code of Ethics for Professional Accountants Contents

June 2005 Revised July 2006 CODE OF ETHICS FOR ♦ PROFESSIONAL ACCOUNTANTS CONTENTS Page PREFACE ...................................................................................................... 1102 PART A: GENERAL APPLICATION OF THE CODE ............................... 1103 100 Introduction and Fundamental Principles ........................................ 1104 110 Integrity ........................................................................................... 1110 120 Objectivity ....................................................................................... 1111 130 Professional Competence and Due Care .......................................... 1112 140 Confidentiality ................................................................................. 1113 150 Professional Behavior ...................................................................... 1115 PART B: PROFESSIONAL ACCOUNTANTS IN PUBLIC PRACTICE ... 1116 200 Introduction ..................................................................................... 1117 210 Professional Appointment ............................................................... 1123 220 Conflicts of Interest ......................................................................... 1127 230 Second Opinions .............................................................................. 1129 240 Fees and Other Types of Remuneration .......................................... 1130 250 Marketing Professional Services ..................................................... 1133 260 Gifts and -

Roles and Practices In

Cost Management Roles and Practices in Management Accounting Today RESULTS FROM THE 2003 IMA-E&Y SURVEY B Y A SHISH G ARG,DEBASHIS G HOSH,JAMES H UDICK, AND C HUEN N OWACKI anagement accounting is at a critical juncture. themselves against their peers. What’s more, more than Increased competition and uncertain business 200 members indicated that they would like to participate Mconditions have put significant pressure on in detailed interviews about industry-wide best practices corporate management to make informed business deci- in management accounting. sions and maximize their company’s financial perfor- mance. In response, a range of management accounting KEY FINDINGS tools and techniques has emerged. The survey revealed six major findings: Given this abundance of solutions, what decision- 1. Cost management is a key input to strategic decision support tools and cost analytics methodologies are makers. finance professionals employing? And what are the fron- 2. Decision makers and decision enablers alike identify tier issues in cost management? Surprisingly, there have “actionable” cost information as their topmost priori- been few contemporary broad-based surveys that illumi- ty.(For purposes of this analysis, we presumed that nate and identify cutting-edge issues in cost management decision makers run the finance or accounting depart- today. That’s why the Institute of Management Accoun- ment and decision enablers include all other manage- tants (IMA) and Ernst & Young (E&Y) undertook a sur- ment accountants.) vey to understand the evolving role of management 3. Several factors impair cost visibility. accountants, the goals of the organizations they serve, 4. Adopting new cost management tools isn’t a priority and the tools they use to meet those goals. -

The Challenge of XBRL: Business Reporting for the Investor

Thechallenge of XBRL: business reportingfor theinvestor Alison Jonesand Mike Willis Abstract The Internet nancialreporting language known asXBRL continues to developand has now reachedthe point wheremuch of its promised benets areavailable. The authors look atthe history of this project, provide acasestudy of how Morgan Stanleyhas madeuse of the system andpredict some developmentsfor the future. Keywords Financial reporting, Financial services,Internet Alison Jones isan Assurance enyears ago, only ahandful of visionaries could haveforeseen the impactof the Internet Partner specializingin on the entire business world andthe information-exchange community. Today, a technology, infocomms and T decadelater, we areon the brinkof anInternet revolution that will redene the ‘‘business entertainment,and media. She reporting’’ paradigm.This revolution will not taketen years to impactbusiness communication. isthe PricewaterhouseCoopers The newInternet technology, eXtensibleBusiness Reporting Language (XBRL), is alreadybeing XBRLServices Leader for the deployedand used across the world. UK, andrepresents the rm on theUK XBRLconsortium. For many companies, the Internet playsa keyrole in communicating business information, MikeWillis, Deputy Chief internally to management andexternally to stakeholders.Company Web sites, extranets and Knowledge Ofcer of intranets enableclients, business partners, employees, nancial marketparticipants and PricewaterhouseCoopers’ other stakeholders to accessbusiness information. Although the needfor standardization of