Semi Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

ANNUAL REPORT June 30, 2021

JOB TITLE SA FUNDS AR REVISION 8 SERIAL <12345678> TIME Friday, August 27, 2021 JOB NUMBER 393837-1 TYPE PAGE NO. I ANNUAL REPORT June 30, 2021 PORTFOLIOS OF INVESTMENTS SA U.S. Fixed Income Fund SA Global Fixed Income Fund SA U.S. Core Market Fund SA U.S. Value Fund SA U.S. Small Company Fund SA International Value Fund SA International Small Company Fund SA Emerging Markets Value Fund SA Real Estate Securities Fund SA Worldwide Moderate Growth Fund Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of each Fund’s shareholder reports, unless you specifically request paper copies of the reports from the SA Funds - Investment Trust (the “Trust”) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Trust’s website (http://www.sa-funds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Trust, you may inform the Trust that you wish to continue receiving paper copies of your shareholder reports by contacting us at (844) 366-0905. -

2020 Annual Report

JULY31, 2020 2020 Annual Report BlackRock Funds II • BlackRock Dynamic High Income Portfolio • BlackRock Multi-Asset Income Portfolio Beginning on January1,2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of each Fund’sshareholder reports will no longer be sent by mail, unlessyou specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as abroker-dealer or bank. Instead, the reports will be made available on awebsite, and you will be notified by mail each time areportisposted and provided with awebsite link to accessthe report. Youmay elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call (800) 441-7762 to inform BlackRock that you wish to continue receiving paper copies of your shareholder reports. If you hold accounts through afinancial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediarytorequest that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC, BlackRock Fund Advisors or their affiliates, or all funds held with your financial intermediary, as applicable. If you already elected to receive shareholder reports electronically,you will not be affected by this change and you need not take any action. Youmay elect to receive electronic deliveryofshareholder reports and other communications by:(i) accessing the BlackRock website at blackrock.com/edeliveryand logging into your accounts, if you hold accounts directly with BlackRock, or (ii) contacting your financial intermediary, if you hold accounts through afinancial intermediary. -

Investment Portfolio 2019

Teachers’ Retirement System of the City of New York Contents Introduction . .1 Statement of Total Investments for the Pension Fund . .3 Statement of Total Investments for the Diversified Equity Fund . .7 Statement of Total Investments for the Balanced Fund . .117 Statement of Total Investments for the International Equity Fund . .121 Statement of Total Investments for the Inflation Protection Fund . .161 Statement of Total Investments for the Socially Responsive Equity Fund . .165 Summary of Investment Managers . .169 Introduction The Teachers’ Retirement System of the City of New York (TRS) is pleased to present you with our Investment Portfolios publication for the fiscal year ended June 30, 2019. This publication lists the name and value of each investment that TRS held in its six investment programs at the closing of the fiscal year. Cash, receivables, and collateral from securities-lending transactions are assets of TRS but not of the investment programs; therefore, they are not included in this report. TRS’ investments as of June 30, 2019 are described briefly below: The Pension Fund consists of U.S. and international equities and fixed-income instruments, with smaller allocations made to private equity and real estate investments. It contains the City’s contributions toward TRS members’ retirement allowances (pension reserves) and members’ contributions to the Qualified Pension Plan (QPP). It also includes the assets of the Fixed Return Fund, an investment option for members that provides a fixed rate of return, determined by the New York State Legislature in accordance with applicable laws. The Diversified Equity Fund invests primarily in the stocks of U.S. -

Vet-Friendly Employers

VET-FRIENDLY EMPLOYERS ABB, Inc. American Tower Baylor Scott & White Health Abbott AmeriHealth Caritas Baystate Health ABBTECH Professional Resources, Amgen BB&T Inc. AmTrust Financial Services BBVA Compass AbbVie Anheuser-Busch BCD Travel ABF Freight System, Inc Anixter BD (Becton, Dickinson and ABS Careers Anthem, Inc Company) Abt Associates AOL Bechtel Corporation Accenture APL BG Group Acosta Sales & Marketing Apollo Group Biomet, Inc. ACT, Inc. Applied Materials Black & Veatch Actavis Apria BlackBerry Corporation Acuity Brands ARAMARK BlackRock Acxiom AREVA Bloomberg Adidas Group ARINC Blue Cross and Blue Shield ADM Armstrong World Industries Association Adobe Systems, Inc. Arrow Electronics BlueCross BlueShield of Advanced Technology Services, Ascension Health Tennessee Inc. Asplundh Tree Expert Co BlueLinx Corporation Advantage Sales and Marketing ASRC Federal Holding Company BMO Harris Bank AECOM Assurant BNY Mellon Aegion Corporation Astellas Pharma Boehringer Ingelheim Aerojet Rocketdyne AstraZeneca Pharmaceuticals LP Bombardier Aerotek AT&T Bosch Aetna Atrium Centers Bose AGL Resources Aultman Health Foundation Boston Properties Agrium Inc Autodesk BP Americas, Inc. Akamai Technologies, Inc. Avanade Inc. Bridgestone Americas Alamo Group Inc. Avery Dennison Bright House Networks Alaska Airlines Avis Budget Group Bristol Myers Squibb Alcatel-Lucent Bristow Group Alcoa Inc. B/E Aerospace, Inc. Broadcom Alion Science and Technology BAE SYSTEMS Brocade Communications Allegion Baker Concrete Construction, Inc. Systems, Inc. Allegis Global Solutions Baker Hughes Brookdale Senior Living Alliance HealthCare Services Ball Corporation / Ball Aerospace Brown -Forman AlliedBarton Security Services Bally Technologies Brunswick Allstate Banfield Pet Hospital/Mars Global BT Alstom Petcare Buck Consultants, LLC. Alutiiq, LLC Bank of America BUNZL American Bankers Association Bank of the West Burns & McDonnell American Electric Power Barclays American Express Barnes & Noble C&A Industries, Inc American Heart Association BASF C. -

Annual Report

SEPTEMBER 30, 2020 2020 Annual Report BlackRock Balanced Capital Fund, Inc. Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of the Fund’s shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the reports from BlackRock or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report. You may elect to receive all future reports in paper free of charge. If you hold accounts directly with BlackRock, you can call (800) 441- 7762 to inform BlackRock that you wish to continue receiving paper copies of your shareholder reports. If you hold accounts through a financial intermediary, you can follow the instructions included with this disclosure, if applicable, or contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. Please note that not all financial intermediaries may offer this service. Your election to receive reports in paper will apply to all funds advised by BlackRock Advisors, LLC, BlackRock Fund Advisors or their affiliates, or all funds held with your financial intermediary, as applicable. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to receive electronic delivery of shareholder reports and other communications by: (i) accessing the BlackRock website at blackrock.com/edelivery and logging into your accounts, if you hold accounts directly with BlackRock, or (ii) contacting your financial intermediary, if you hold accounts through a financial intermediary. -

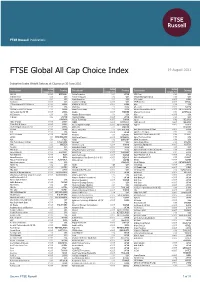

FTSE Global All Cap Choice Index

2 FTSE Russell Publications 19 August 2021 FTSE Global All Cap Choice Index Indicative Index Weight Data as at Closing on 30 June 2021 Index Index Index Constituent Country Constituent Country Constituent Country weight (%) weight (%) weight (%) 1&1 AG <0.005 GERMANY Activia Properties 0.01 JAPAN AES Corp. 0.03 USA 10X Genomics 0.03 USA Activision Blizzard 0.12 USA Affiliated Managers Group 0.01 USA 1Life Healthcare 0.01 USA Acuity Brands Inc 0.01 USA Affle (India) <0.005 INDIA 1st Source <0.005 USA Acushnet Holdings <0.005 USA AFI Properties <0.005 ISRAEL 21Vianet Group ADS (N Shares) <0.005 CHINA ADAMA (A) (SC SZ) <0.005 CHINA Aflac 0.06 USA 2U <0.005 USA Adani Gas 0.01 INDIA AfreecaTV <0.005 KOREA 360 DigiTech ADS (N Shares) 0.01 CHINA Adani Green Energy 0.01 INDIA African Rainbow Minerals Ltd <0.005 SOUTH AFRICA 360 Security (A) (SC SH) <0.005 CHINA Adapteo <0.005 SWEDEN Afterpay Touch Group 0.03 AUSTRALIA 3-D Systems 0.01 USA Adaptive Biotechnologies 0.01 USA Afya <0.005 USA 3i Group 0.02 UNITED Adastria Holdings <0.005 JAPAN AGCO Corp 0.01 USA KINGDOM A-Data Technology <0.005 TAIWAN Ageas 0.02 BELGIUM 3SBio (P Chip) <0.005 CHINA ADBRI <0.005 AUSTRALIA AGFA-Gevaert <0.005 BELGIUM 51job ADS (N Shares) <0.005 CHINA Adcock Ingram Holdings <0.005 SOUTH AFRICA Aggreko <0.005 UNITED 5I5j Holding Group (A) (SC SZ) <0.005 CHINA Addtech B 0.01 SWEDEN KINGDOM 77 Bank <0.005 JAPAN Adecco Group AG 0.02 SWITZERLAND Agile Group Holdings (P Chip) <0.005 CHINA 8x8 <0.005 USA Adeka <0.005 JAPAN Agilent Technologies 0.07 USA A.G.V. -

Fidelity® Variable Insurance Products

Fidelity® Variable Insurance Products: Strategic Income Portfolio Semi-Annual Report June 30, 2021 Contents Note to Shareholders 3 Investment Summary 4 Schedule of Investments 5 Financial Statements 30 Notes to Financial Statements 37 Shareholder Expense Example 45 Liquidity Risk Management Program 46 To view a fund’s proxy voting guidelines and proxy voting record for the 12-month period ended June 30, visit http://www.fidelity.com/proxyvotingresults or visit the Securities and Exchange Commission’s (SEC) web site at http://www.sec.gov. You may also call 1-877-208-0098 to request a free copy of the proxy voting guidelines. Fidelity® Variable Insurance Products are separate account options which are purchased through a variable insurance contract. Standard & Poor’s, S&P and S&P 500 are registered service marks of The McGraw-Hill Companies, Inc. and have been licensed for use by Fidelity Distributors Corporation. Other third-party marks appearing herein are the property of their respective owners. All other marks appearing herein are registered or unregistered trademarks or service marks of FMR LLC or an affiliated company. © 2021 FMR LLC. All rights reserved. This report and the financial statements contained herein are submitted for the general information of the shareholders of the Fund. This report is not authorized for distribution to prospective investors in the Fund unless preceded or accompanied by an effective prospectus. A fund files its complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year on Form N-PORT. Forms N-PORT are available on the SEC’s web site at http://www.sec.gov. -

Third Quarter Report

APRIL 30, 2021 2021 Quarterly Report (Unaudited) iShares U.S. ETF Trust Table of Contents Page iShares Evolved U.S. Consumer Staples ETF . ............................................................................................................................ 3 iShares Evolved U.S. Discretionary Spending ETF . ......................................................................................................................... 6 iShares Evolved U.S. Financials ETF ....................................................................................................................................... 10 iShares Evolved U.S. Healthcare Staples ETF .............................................................................................................................. 14 iShares Evolved U.S. Innovative Healthcare ETF ............................................................................................................................ 17 iShares Evolved U.S. Media and Entertainment ETF ........................................................................................................................ 21 iShares Evolved U.S. Technology ETF ...................................................................................................................................... 23 2 Schedule of Investments (unaudited) iShares Evolved U.S. Consumer Staples ETF April 30, 2021 (Percentages shown are based on Net Assets) SecurityShares Value SecurityShares Value Common Stocks Food (continued) Calavo Growers Inc. ....................................... -

Schedule of Investments September 30, 2019

schedule of investments September 30, 2019 City National Rochdale Government Money Market Fund Type of Security Weightings (unaudited)*: Description Face Amount (000)/Shares Value (000) 58.7% U.S. Government Agency Obligations 1.986%, 10/16/19 $ 39,000 $ 38,968 37.9% Repurchase Agreements 2.010%, 10/18/19 37,000 36,965 3.4% Short-Term Investment 2.020%, 10/23/19 120,000 119,852 2.031%, 10/25/19 70,000 69,906 *Percentages based on total investments. 2.110%, 10/30/19 50,000 49,915 2.056%, 11/01/19 55,000 54,903 Description Face Amount (000) Value (000) 2.001%, 11/06/19 50,000 49,900 U.S. Government Agency Obligations [58.7%] 1.985%, 11/08/19 16,000 15,967 FFCB 1.969%, 11/22/19 50,000 49,858 1.924%, VAR US Treasury 1.978%, 11/27/19 14,000 13,956 3 Month Bill Money Market 1.978%, 11/29/19 50,000 49,839 Yield+0.075%, 11/01/19 $ 50,000 $ 50,000 1.974%, 12/04/19 70,000 69,756 1.978%, VAR ICE LIBOR 1.965%, 12/06/19 25,000 24,910 USD 1 Month-0.040%, 1.951%, 12/11/19 25,000 24,904 06/25/20 56,000 55,992 1.945%, 12/13/19 25,000 24,902 2.081%, VAR ICE LIBOR FNMA USD 1 Month+0.035%, 1.920%, VAR United States 01/26/21 25,000 24,999 Secured Overnight Financing FHLB Rate+0.100%, 04/30/20 40,000 40,000 1.943%, VAR ICE LIBOR 1.880%, VAR United States USD 1 Month-0.075%, Secured Overnight Financing 10/25/19 50,000 50,000 Rate+0.060%, 07/30/20 25,000 25,000 1.984%, VAR ICE LIBOR USD 1 Month-0.060%, Total U.S. -

2021 Annual Report

APRIL 30, 2021 2021 Annual Report BlackRock FundsSM • BlackRock Advantage Emerging Markets Fund • BlackRock Global Long/Short Equity Fund Not FDIC Insured • May Lose Value • No Bank Guarantee The Markets in Review Dear Shareholder, The 12-month reporting period as of April 30, 2021 reflected a remarkable period of adaptation and recovery, as the global economy dealt with the implications of the coronavirus (or “COVID-19”) pandemic. As the period began, the response to the virus’s spread was well underway, and countries around the world felt the effect of economically disruptive countermeasures. Stay-at-home orders and closures of non-essential businesses were imposed in many parts of the world, workers were laid off, and unemployment claims spiked, causing a global recession. As May 2020 began, stocks had just begun to recover from the lowest point following the onset of the pandemic. This recovery continued throughout the reporting period, as businesses continued re-opening and Rob Kapito governments learned to adapt to life with the virus. Equity prices rose through the summer, fed by strong fiscal President, BlackRock Advisors, LLC and monetary support and improving economic indicators. The implementation of mass vaccination campaigns and passage of an additional $1.9 trillion of fiscal stimulus further boosted stocks, and many equity indices neared or surpassed all-time highs late in the reporting period. In the United States, both large- and small-capitalization stocks posted a significant advance. International equities also gained, as both developed Total Returns as of April 30, 2021 countries and emerging markets rebounded substantially. 6-Month 12-Month U.S. -

Fidelity® Variable Insurance Products: Strategic Income Portfolio

Quarterly Holdings Report for Fidelity® Variable Insurance Products: Strategic Income Portfolio March 31, 2021 VIPSI-QTLY-0521 1.799886.117 Schedule of Investments March 31, 2021 (Unaudited) Showing Percentage of Net Assets Corporate Bonds – 37.6% Principal Value Principal Value Amount(a) Amount(a) Convertible Bonds – 0.1% Total Play Telecomunicaciones SA de CV 7.5% 11/12/25 (d) $ 580,000 $ 577,680 7,739,241 ENERGY – 0.1% Interactive Media & Services – 0.1% Energy Equipment & Services – 0.0% ANGI Homeservices, Inc. 3.875% 8/15/28 (d) 335,000 335,000 Forum Energy Technologies, Inc. 9% 8/4/25 $ 718,113 $ 671,661 Baidu.com, Inc.: Oil, Gas & Consumable Fuels – 0.1% 1.72% 4/9/26 285,000 282,931 Mesquite Energy, Inc.: 2.375% 10/9/30 270,000 260,044 15% 7/15/23 (b) (c) 103,317 289,288 Tencent Holdings Ltd.: 15% 7/15/23 (b) (c) 179,776 568,092 2.39% 6/3/30 (d) 295,000 284,339 857,380 3.975% 4/11/29 (d) 180,000 195,188 1,357,502 TOTAL ENERGY 1,529,041 Media – 3.8% Nonconvertible Bonds – 37.5% Altice Financing SA 5% 1/15/28 (d) 2,250,000 2,221,729 Block Communications, Inc. 4.875% 3/1/28 (d) 410,000 417,589 COMMUNICATION SERVICES – 7.6% Cable Onda SA 4.5% 1/30/30 (d) 515,000 543,808 Diversified Telecommunication Services – 2.5% CCO Holdings LLC/CCO Holdings Capital Corp.: Axtel S.A.B. de CV 6.375% 11/14/24 (d) 100,000 104,406 4.25% 2/1/31 (d) 1,005,000 1,007,231 C&W Senior Financing Designated Activity Co. -

Vanguard Total World Stock Index Fund

Annual Report | October 31, 2020 Vanguard Total World Stock Index Fund See the inside front cover for important information about access to your fund’s annual and semiannual shareholder reports. Important information about access to shareholder reports Beginning on January 1, 2021, as permitted by regulations adopted by the Securities and Exchange Commission, paper copies of your fund’s annual and semiannual shareholder reports will no longer be sent to you by mail, unless you specifically request them. Instead, you will be notified by mail each time a report is posted on the website and will be provided with a link to access the report. If you have already elected to receive shareholder reports electronically, you will not be affected by this change and do not need to take any action. You may elect to receive shareholder reports and other communications from the fund electronically by contacting your financial intermediary (such as a broker-dealer or bank) or, if you invest directly with the fund, by calling Vanguard at one of the phone numbers on the back cover of this report or by logging on to vanguard.com. You may elect to receive paper copies of all future shareholder reports free of charge. If you invest through a financial intermediary, you can contact the intermediary to request that you continue to receive paper copies. If you invest directly with the fund, you can call Vanguard at one of the phone numbers on the back cover of this report or log on to vanguard.com. Your election to receive paper copies will apply to all the funds you hold through an intermediary or directly with Vanguard.