Sungard Capital Corp. Consolidated Statement of Changes in Equity (Continued) (In Millions)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Federal Register/Vol. 66, No. 10/Tuesday, January 16, 2001

3592 Federal Register / Vol. 66, No. 10 / Tuesday, January 16, 2001 / Notices By the Federal Housing Finance Board. 1. Admiral Family Banks, Inc., Alsip, indicated or the offices of the Board of James L. Bothwell, Illinois; to acquire 100 percent of the Governors not later than January 30, Managing Director. voting shares of Federated Bancorp, 2001. [FR Doc. 01±382 Filed 1±12±01; 8:45 am] Inc., Loda, Illinois, and thereby A. Federal Reserve Bank of Chicago BILLING CODE 6725±01±P indirectly acquire voting shares of (Phillip Jackson, Applications Officer) Federated Bank, Onarga, Illinois. 230 South LaSalle Street, Chicago, Board of Governors of the Federal Reserve Illinois 60690±1414: FEDERAL RESERVE SYSTEM System, January 9, 2001. 1. Worth Bancorp, Spartanburg, Robert deV. Frierson Indiana; to become a bank holding Formations of, Acquisitions by, and Associate Secretary of the Board. company by acquiring 100 percent of Mergers of Bank Holding Companies [FR Doc. 01±1124 Filed 1±12±01; 8:45 am] the voting shares of Worth Bank (in organization), Spartanburg, Indiana, The companies listed in this notice BILLING CODE 6210±01±S which will merge with Greensfork have applied to the Board for approval, Township State Bank, Spartanburg, pursuant to the Bank Holding Company Indiana. Act of 1956 (12 U.S.C. 1841 et seq.) FEDERAL RESERVE SYSTEM (BHC Act), Regulation Y (12 CFR Part Board of Governors of the Federal Reserve Formations of, Acquisitions by, and System, January 10, 2001. 225), and all other applicable statutes Mergers of Bank Holding Companies and regulations to become a bank Robert deV. -

Chicago Board Options Exchange Annual Report 2001

01 Chicago Board Options Exchange Annual Report 2001 cv2 CBOE ‘01 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 CBOE is the largest and 01010101010101010most successful options 01010101010101010marketplace in the world. 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010 01010101010101010ifc1 CBOE ‘01 ONE HAS OPPORTUNITIES The NUMBER ONE Options Exchange provides customers with a wide selection of products to achieve their unique investment goals. ONE HAS RESPONSIBILITIES The NUMBER ONE Options Exchange is responsible for representing the interests of its members and customers. Whether testifying before Congress, commenting on proposed legislation or working with the Securities and Exchange Commission on finalizing regulations, the CBOE weighs in on behalf of options users everywhere. As an advocate for informed investing, CBOE offers a wide array of educational vehicles, all targeted at educating investors about the use of options as an effective risk management tool. ONE HAS RESOURCES The NUMBER ONE Options Exchange offers a wide variety of resources beginning with a large community of traders who are the most experienced, highly-skilled, well-capitalized liquidity providers in the options arena. In addition, CBOE has a unique, sophisticated hybrid trading floor that facilitates efficient trading. 01 CBOE ‘01 2 CBOE ‘01 “ TO BE THE LEADING MARKETPLACE FOR FINANCIAL DERIVATIVE PRODUCTS, WITH FAIR AND EFFICIENT MARKETS CHARACTERIZED BY DEPTH, LIQUIDITY AND BEST EXECUTION OF PARTICIPANT ORDERS.” CBOE MISSION LETTER FROM THE OFFICE OF THE CHAIRMAN Unprecedented challenges and a need for strategic agility characterized a positive but demanding year in the overall options marketplace. The Chicago Board Options Exchange ® (CBOE®) enjoyed a record-breaking fiscal year, with a 2.2% growth in contracts traded when compared to Fiscal Year 2000, also a record-breaker. -

ANALYST QUICK NOTES New Products, M&A

ANALYST QUICK NOTES New products, M&A announcements, management shakeups, earnings surprises. Whatever the news, you want to know what Argus thinks. Our Quick Notes fill this need by providing real-time analysis of current news about Argus-covered companies or other market-moving events. Please check back regularly for new Quick Notes. Important disclaimer information is on the last page of this document. The Blackstone Group (NYSE: BX: BUY) Target Price: $47 Stephen Biggar 5/13/2015 Investment Thesis Favorable events in the past week: o On May 11, BX announced sale of an additional 103.5 million shares in Hilton Worldwide (HLT), which will bring in $3.1 billion: . BX took HLT public in December 2013. Shares up 31% in the past year. Stake will be reduced from 55% to 45%, sparking the notion of potential HLT inclusion in S&P 500. o On May 5, BX sold balance of stake in Pinnacle Foods: . Last filing showed 19.2 million shares valued at $790 million. o On May 5, news reports indicated SunGard Data Systems was readying an IPO: . BX, GS, KKR, Bain and others took SunGard private in 2005 Events show Private Equity segment still has a solid monetization pipeline, to result in strong cash distributions. Signed agreement in April to purchase GE Capital Real Estate - to close in second and third quarters. Upcoming spin-off of financial advisory business will reduce in-house conflicts, including distressed debt investing, and allow additional investments. o BX will hold 65% of spun-off entity. 1Q15 capital raised was a record $30.4 billion: o Dry powder was $64.5 billion at March 31. -

Cio Strategy Meeting

CIO STRATEGY MEETING The Knowledge Exchange Program for Corporate IT Leaders NOVEMBER 6-7, 2014 | LAS VEGAS, NV Organized By: INVITE ONLY Attended exclusively by CIOs and Senior VPs of IT from America’s largest 2,000 companies CHIEF INFORMATION OFFICERS STRATEGY MEETING NOVEMBER 6-7, 2014 | LAS VEGAS, NV | A 1 EVENING, 1 DAY EVENT Purpose of the Meeting… This CIO Strategy Meeting brings together and represents the strongest group of CIOs and Organizations you will find at any IT event across North America. We work with the largest 2,000 Companies in the US and bring in exclusively: CIOs, SVPs, and VPs of Information Technology and Information Systems. We provide a valuable platform for in-depth IT education, qualified CIO engagement, and specific Business Development opportunity for all Suppliers and CIOs in attendance. Partial List of CIO Advisory Board & Confirmed CIOs: CIO - JOHNSON CONTROLS VP & CIO - INTERNATIONAL FLAVORS & FRAGRANCES CIO - BMO HARRIS VP & CTO - CNO FINANCIAL CIO - GAVILON GROUP “Great density with high quality CIO Downstream & Technology Solutions - GE OIL & GAS Execs (CIO level). Strong alignment on what we do and what the CIOs CIO McGraw-Hill Education - MCGRAW-HILL were interested in.” VP & CIO - SOUTHERN COMPANY - V P, Canopy Cloud Americas CIO - TRW AUTOMOTIVE SVP & CIO - YOUNG’S MARKET “Good topics. Lots of networking/ CTO - DREAMWORKS ANIMATION discussion time. Good venue. CIO - TITAN INTERNATIONAL Quality time with suppliers.” CIO - SEVERSTAL - CIO, ZF North America VP, Global Business Solutions, INTERNATIONAL GAME TECHNOLOGY CIO - MEADOWBROOK INSURANCE CTO - KIA MOTORS USA “Great interface with leaders from many different industries. Length of Global CIO - SMITHS GROUP the conference was just right.. -

AT&T Inc. Financial Review 2007

AT&T Inc. Financial Review 2007 Selected Financial and Operating Data 26 Management’s Discussion and Analysis of Financial Condition and Results of Operations 27 Consolidated Financial Statements 53 Notes to Consolidated Financial Statements 57 Report of Management 80 Report of Independent Registered Public Accounting Firm 81 Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting 82 Board of Directors 83 Senior Officers 84 2007 AT&T Annual Report | 25 55488_MD&A_Feb22.indd488_MD&A_Feb22.indd 2255 22/29/08/29/08 112:02:282:02:28 PPMM Selected Financial and Operating Data Dollars in millions except per share amounts At December 31 or for the year ended: 2007 20062 20053 2004 2003 Financial Data1 Operating revenues $118,928 $ 63,055 $ 43,764 $ 40,733 $ 40,498 Operating expenses $ 98,524 $ 52,767 $ 37,596 $ 34,832 $ 34,214 Operating income $ 20,404 $ 10,288 $ 6,168 $ 5,901 $ 6,284 Interest expense $ 3,507 $ 1,843 $ 1,456 $ 1,023 $ 1,191 Equity in net income of affiliates $ 692 $ 2,043 $ 609 $ 873 $ 1,253 Other income (expense) – net $ 615 $ 393 $ 397 $ 1,414 $ 2,370 Income taxes $ 6,253 $ 3,525 $ 932 $ 2,186 $ 2,857 Income from continuing operations $ 11,951 $ 7,356 $ 4,786 $ 4,979 $ 5,859 Income from discontinued operations, net of tax4 $ — $ — $ — $ 908 $ 112 Income before extraordinary item and cumulative effect of accounting changes $ 11,951 $ 7,356 $ 4,786 $ 5,887 $ 5,971 Net income5 $ 11,951 $ 7,356 $ 4,786 $ 5,887 $ 8,505 Earnings per common share: Income from continuing operations $ 1.95 -

The Dynamics of Secondaries

AVCJ Private Equity & Venture Forum 2010 India Summit 2010 New Delhi 26 - 27 August Hong Kong 9 -12 November 2010 ASIAN VENTURE CAPITAL JOURNAL Asia’s Private Equity News Source avcj.com July 27 2010 Volume 23 Number 28 EDITOR’S VIEWPOINT It’s a wrap Page 3 NEWS PRIVATE EQUITY ASIA Private equity and VC news of the week, with Actis, Blackstone, Carlyle, CHAMP, CVCI, Evolvence, IDG, Khazanah, Sequoia, Starr, TPG Page 5 DEALS OF THE WEEK Gung-ho for Kyobo as M&A ASIA buyout firms assess stake Page 13 Bain goes for Mr. China’s ASIMCO Page 13 FUNDRAISING NEWS Navis VI nears $1.2 billion close Page 15 INDUSTRY Q&A The dynamics of Industry Q&A: Hu Zhanghong, CEO, CCB International Page 17 Limited Partner Q&A: secondaries International Finance Once-owned LP positions for Asia Pacific and elsewhere Page 8 Corporation Page 19 DEALS OF THE WEEK FUNDRAISING NEWS Yellow Pages auction Greene’s Diamond Dragon up a gum tree? Page 11 takes flight Page 15 Anything is possible... There are many barriers to liquidity in private equity: complexity, transaction size, deadlines, disparate assets, confidentiality, alignment, tax, shareholder sensitivities – the list goes on. European Secondaries Firm of the Year But with creativity, experience and determination ... anything is possible. for the 6th consecutive year www.collercapital.com London New York 33 Cavendish Square 410 Park Avenue London New York Liquidity for private equity investors worldwide Contact: [email protected] EDITOR’S VIEWPOINT [email protected] ASIAN VENTURE CAPITAL -

Infrastructure-2008/07/25 1

INFRASTRUCTURE-2008/07/25 1 THE HAMILTON PROJECT THE BROOKINGS INSTITUTION INVESTING IN AMERICA’S INFRASTRUCTURE: FROM BRIDGES TO BROADBAND Washington, D.C. Friday, July 25, 2008 ANDERSON COURT REPORTING 706 Duke Street, Suite 100 Alexandria, VA 22314 Phone (703) 519-7180 Fax (703) 519-7190 INFRASTRUCTURE-2008/07/25 2 Opening Session ROBERT E. RUBIN, Citigroup Inc. LAWRENCE H. SUMMERS, Harvard University Special Guest: GOVERNOR TIM KAINE, Commonwealth of Virginia Overview of Strategy Paper DOUGLAS W. ELMENDORF, The Hamilton Project, The Brookings Institution Roundtable on Telecommunications Infrastructure Moderator: GLENN HUTCHINS, Silver Lake Panelists: BLAIR LEVIN, Stifel Nicolaus JON M. PEHA, Carnegie Mellon University PHILIP J. WEISER, University of Colorado Roundtable on Physical Infrastructure Moderator: NANCY CORDES, CBS News Panelists: RONALD BLACKWELL, AFL-CIO JASON BORDOFF, The Hamilton Project, The Brookings Institution DAVID LEWIS, HDR Decision Economics DOROTHY ROBYN, The Brattle Group ANDERSON COURT REPORTING 706 Duke Street, Suite 100 Alexandria, VA 22314 Phone (703) 519-7180 Fax (703) 519-7190 INFRASTRUCTURE-2008/07/25 3 * * * * * ANDERSON COURT REPORTING 706 Duke Street, Suite 100 Alexandria, VA 22314 Phone (703) 519-7180 Fax (703) 519-7190 INFRASTRUCTURE-2008/07/25 4 P R O C E E D I N G S MR. RUBIN: Good morning. Welcome. I’m Bob Rubin. On behalf of all my colleagues at The Hamilton Project, let me welcome you this morning to our program on infrastructure, from bridges to broadband. As most of you know, The Hamilton Project was begun about three years ago. Our objective was to set forth, which we did in the form of a paper, an economic strategy for the country in the face of a period of change of truly historic proportions, transformational change. -

FORM 10-Q Kosmos Energy Ltd

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-Q (Mark One) x QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2013 o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number: 001-35167 Kosmos Energy Ltd. (Exact name of registrant as specified in its charter) Bermuda 98-0686001 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) Clarendon House 2 Church Street Hamilton, Bermuda HM 11 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: +1 441 295 5950 Not applicable (Former name, former address and former fiscal year, if changed since last report) Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x Noo Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). -

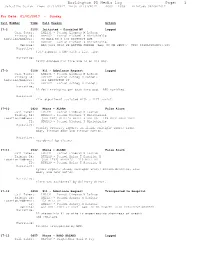

Burlington PD Media Log Page: 1 Selective Search From: 01/01/2017 Thru: 01/31/2017 0000 - 2359 Printed: 06/08/2017

Burlington PD Media log Page: 1 Selective Search From: 01/01/2017 Thru: 01/31/2017 0000 - 2359 Printed: 06/08/2017 For Date: 01/01/2017 - Sunday Call Number Time Call Reason Action 17-2 0100 Initiated - Disabled MV Logged Call Taker: LML131 - Patrol Lindsay M LaPrad Primary Id: MPM103 - Patrol Michael P Minichiello Location/Address: 80 MALL RD @ 100 DISTRICT AVE ID: MPM103 - Patrol Michael P Minichiello Vehicle: BRO 1999 NISS SE ALTIMA GXEGLE Reg: PC MA 2EW877 VIN: 1N4DL01D4XC177689 Narrative: #103 reports a DMV with a flat tire. Narrative: Party changed his tire and is on his way. 17-3 0108 911 - Ambulance Request Logged Call Taker: LML131 - Patrol Lindsay M LaPrad Primary Id: AMD127 - Patrol Ashley M Daniels Location/Address: 111 LEXINGTON ST ID: AMD127 - Patrol Ashley M Daniels Narrative: RP fell trying to get back into bed. BFD notified. Narrative: Fire department assisted with a lift assist. 17-10 0420 Phone - ALARM False Alarm Call Taker: LML131 - Patrol Lindsay M LaPrad Primary Id: MPM103 - Patrol Michael P Minichiello Location/Address: [BUR 260] CHILI'S GRILL & BAR #9 - 108 MIDDLESEX TPKE ID: MPM103 - Patrol Michael P Minichiello Narrative: Stanley Security reports an alarm, multiple zones; front door, kitchen door and kitchen motion. Narrative: Accidental by cleaner. 17-11 0542 Phone - ALARM False Alarm Call Taker: LML131 - Patrol Lindsay M LaPrad Primary Id: BTH129 - Patrol Brian T Hanafin, B Location/Address: [BUR 1763] WENDY'S - 112 MALL RD ID: BTH129 - Patrol Brian T Hanafin, B Narrative: Tycois reports alarm, multiple zones; motion detector, rear door, and rear motion. -

ANNUAL REPORT June 30, 2021

JOB TITLE SA FUNDS AR REVISION 8 SERIAL <12345678> TIME Friday, August 27, 2021 JOB NUMBER 393837-1 TYPE PAGE NO. I ANNUAL REPORT June 30, 2021 PORTFOLIOS OF INVESTMENTS SA U.S. Fixed Income Fund SA Global Fixed Income Fund SA U.S. Core Market Fund SA U.S. Value Fund SA U.S. Small Company Fund SA International Value Fund SA International Small Company Fund SA Emerging Markets Value Fund SA Real Estate Securities Fund SA Worldwide Moderate Growth Fund Beginning on January 1, 2022, as permitted by regulations adopted by the Securities and Exchange Commission, we intend to no longer mail paper copies of each Fund’s shareholder reports, unless you specifically request paper copies of the reports from the SA Funds - Investment Trust (the “Trust”) or from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on the Trust’s website (http://www.sa-funds.com), and you will be notified by mail each time a report is posted and provided with a website link to access the report. If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. You may elect to continue to receive paper copies of all future reports free of charge. If you invest through a financial intermediary, you may contact your financial intermediary to request that you continue to receive paper copies of your shareholder reports. If you invest directly with the Trust, you may inform the Trust that you wish to continue receiving paper copies of your shareholder reports by contacting us at (844) 366-0905. -

2021 Quarterly Report (Unaudited)

APRIL 30, 2021 2021 Quarterly Report (Unaudited) BlackRock Funds II BlackRock Multi-Asset Income Portfolio Not FDIC Insured - May Lose Value - No Bank Guarantee Schedule of Investments (unaudited) BlackRock Multi-Asset Income Portfolio (Percentages shown are based on Net Assets) April 30, 2021 Par (000) Par (000) Security Par (000) Value Security Par (000) Value Asset-Backed Securities — 6.9% Asset-Backed Securities (continued) Accredited Mortgage Loan Trust, Series 2004-4, Series 2020-SFR1, Class F, 3.57%, Class M2, (LIBOR USD 1 Month + 1.58%), 04/17/37 ..................... USD 19,850 $ 20,201,395 1.68%, 01/25/35(a) ................. USD 1,126 $ 1,115,000 Series 2020-SFR1, Class G, 4.31%, AGL CLO 3 Ltd., Series 2020-3A, Class C, 04/17/37 ..................... 7,500 7,624,247 (LIBOR USD 3 Month + 2.15%), 2.33%, Anchorage Capital CLO 3-R Ltd.(a)(b): 01/15/33(a)(b) ..................... 2,000 2,001,417 Series 2014-3RA, Class B, (LIBOR USD 3 AGL Core CLO 5 Ltd., Series 2020-5A, Class Month + 1.50%), 1.68%, 01/28/31 .... 3,400 3,351,635 B, (LIBOR USD 3 Month + 2.78%), 2.97%, Series 2014-3RA, Class C, (LIBOR USD 3 07/20/30(a)(b) ..................... 3,000 3,007,297 Month + 1.85%), 2.03%, 01/28/31 .... 1,250 1,245,314 AIG CLO Ltd.(a)(b): Anchorage Capital CLO 4-R Ltd.(a)(b): Series 2018-1A, Class CR, (LIBOR USD 3 Series 2014-4RA, Class C, (LIBOR USD 3 Month + 2.05%), 2.22%, 04/20/32 ... -

AT&T Inc. Financial Review 2008

AT&T Inc. Financial Review 2008 Selected Financial and Operating Data 22 Management’s Discussion and Analysis of Financial Condition and Results of Operations 23 Consolidated Financial Statements 49 Notes to Consolidated Financial Statements 53 Report of Management 76 Report of Independent Registered Public Accounting Firm 77 Report of Independent Registered Public Accounting Firm on Internal Control over Financial Reporting 78 Board of Directors 79 Senior Officers 80 AT&T Annual Report 2008 | 21 Selected Financial and Operating Data Dollars in millions except per share amounts At December 31 or for the year ended: 2008 2007 20062 20053 2004 Financial Data1 Operating revenues $124,028 $118,928 $ 63,055 $ 43,764 $ 40,733 Operating expenses $100,965 $ 98,524 $ 52,767 $ 37,596 $ 34,832 Operating income $ 23,063 $ 20,404 $ 10,288 $ 6,168 $ 5,901 Interest expense $ 3,390 $ 3,507 $ 1,843 $ 1,456 $ 1,023 Equity in net income of affiliates $ 819 $ 692 $ 2,043 $ 609 $ 873 Other income (expense) – net $ (589) $ 615 $ 393 $ 397 $ 1,414 Income taxes $ 7,036 $ 6,253 $ 3,525 $ 932 $ 2,186 Income from continuing operations $ 12,867 $ 11,951 $ 7,356 $ 4,786 $ 4,979 Income from discontinued operations, net of tax4 $ — $ — $ — $ — $ 908 Net income $ 12,867 $ 11,951 $ 7,356 $ 4,786 $ 5,887 Earnings per common share: Income from continuing operations $ 2.17 $ 1.95 $ 1.89 $ 1.42 $ 1.50 Net income $ 2.17 $ 1.95 $ 1.89 $ 1.42 $ 1.78 Earnings per common share – assuming dilution: Income from continuing operations $ 2.16 $ 1.94 $ 1.89 $ 1.42 $ 1.50 Net income