To Financial Statements

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Staffing M&A Funders and Advisors

Global Market Information and Forecasts Staffing M&A Funders and Advisors 2 September 2020 | Adam Pode, Director of Research (EMEA & APAC) | [email protected] M&A Funders and Advisors Directory | 2 September 2020 Introduction Use this report to identify M&A • This directory provides full records for over 30 companies operating in the M&A space funders and advisors and around the world. Some firms provide services in just one market while others provide understand the nature of their international and cross-border M&A advice and services in up to 40+ countries. They are services listed in alphabetical order, and an index is provided at the rear of this document (page 34). • An additional 115+ firms who have been identified as providing M&A services are also shown (pages 28 to 33). We have tried to make this report as exhaustive as possible, but if there are additional companies you believe should be listed, or if you would like to contribute a “full” entry within this directory, please contact the author, shown below. • This report is designed as a standalone document but can also be read in conjunction with our M&A reports which are available to subscribers of Staffing Industry Analysts’ research services. These included our interactive dashboard of staffing and workforce solutions M&A activity, which details more than 1,300 transactions in the sector. • If you are interested in joining our service or require further information, please contact Tina McGarvey at [email protected]. In addition, you can subscribe free to our Daily News, which reports deals as and when they happen, by clicking here. -

Powerpoint Template

BeBeez Magazine 10 febbraio 2018 - n.3/2018 - Le news del private capital dal 3 febbraio al 9 febbraio 2018 Per le news del weekend appuntamento lunedì su BeBeez Gli azionisti di Italo-Ntv accettano l’offerta di Global Infrastructure Partners In Private Equity pag. 3 I EdiBeez srl - Corso Italia, 22 – 20122 Milano – PIVA 09375120962 1 SOMMARIO PRIVATE EQUITY In Italia 3 All’estero 4 SOCIETA’ 6 PRIVATE DEBT 6 REAL ESTATE In Italia 7 All’estero 7 VENTURE CAPITAL 9 ANGELS & INCUBATORS 9 CROWDFUNDING 10 CRISI E RILANCI 10 NPL 11 LIBRI 12 ARTE 13 EdiBeez srl - Corso Italia, 22 – 20122 Milano – PIVA 09375120962 2 PRIVATE EQUITY LA SETTIMANA DEL PRIVATE EQUITY IN ITALIA BC Partners studia l’exit dai ristoranti Il Cda di Ntv rimanda a oggi la Old Wild West decisione sull’offerta del fondo GIP 9 febbraio 2018 - Mentre Cigierre è in corsa per 7 febbraio 2018 - Il consiglio di amministrazione comprare Sebeto, la holding a capo delle catene di di Nuovo Trasporto Viaggiatori (Ntv) che si è riunito ristorazione Rossopomodoro, Anema&Cozze, ieri ha lasciato aperti lavori sino a questo pomeriggio (si Rossosapore e Ham Holy Burger, controllate dai veda qui il comunicato stampa), per valutare con il fondi Change Capital e Quadrivio, ma per le quali in supporto dei propri advisor quale decisione prendere a pole position pare ci sia il fondo OPCapita. Leggi tutto. proposito dell’offerta inattesa da parte del fondo Global Infrastructure Partners di acquisto del 100% della società per 1,9 miliardi di euro di valore dell’equity, Leggi tutto. -

1Q 2019 Relationship Management Purpose-Built for Finance Learn More at Affinity.Co

Co-sponsored by Global League Tables 1Q 2019 Relationship Management Purpose-Built for Finance Learn more at affinity.co IMPROVE ELIMINATE SUPPORT DISCOVER PROPIERTARY CROSSING YOUR NEW EXECUTIVE DEAL FLOW WIRES PORTFOLIO CONNECTIONS Learn why 500+ firms use Affinity's patented technology to leverage their network and increase deal flow “Within weeks of moving “The biggest problems Affinity “Let’s be honest, no one wants to Affinity, we were able to helps me solve are how to to use Salesforce reporting. easily discover and manage track all of my activity and how Affinity isn’t just better for most the 1,000s of entrepreneur to prioritize my time. It makes teams, it’ll make the difference and venture community me a better investor. All of the between managing your relationships already latent things I need to do on a day-to- pipeline to success, versus not within our team." day basis I now do in Affinity.” tracking it at all.” ERIC EMMONS KYLE LUI KEVIN ZHANG Managing Director Partner Principal MassMutual Ventures DCM Ventures Bain Capital Ventures [email protected]@affinity.co AffinityAffinity is a relationship is a relationship intelligence intelligence platform platform built to builtexpand to expandand evolve and theevolve traditional the traditional CRM. AffinityCRM. Affinityinstantly instantly surfaces surfaces all all www.affinity.cowww.affinity.co of yourof team’s your team’sdata to data show to you show who you is bestwho issuited best tosuited make to the make crucial the crucialintroductions introductions you need you to need close to your close next your big next deal. big deal. -

2019 - Dallas, Tx

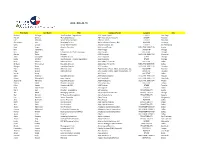

2019 - DALLAS, TX First Name Last Name Title Company Name Category City Richard Bollinger Vice President, Originations 36th Street Capital LENDER San Diego Patrick Gimlett Managing Director AB Private Credit Investors LENDER Houston Eric Petersen Senior Vice President Abacus Finance LENDER New York Christopher Lisle Managing Partner Acclaro Growth Partners, LLC ADVISOR leesburg Lilies Lanway Senior Vice President Accord Financial, Inc. LENDER St. Petersburg Sara Singer Chapter Executive ACG Central Texas EXECUTIVE DIRECTOR Austin Kim Hammond CEO ACG Chicago ACG STAFF Chicago Kris Mayo Convention and Events Manager ACG Chicago ACG STAFF Chicago Marcie Taylor Director ACG Cincinnati EXECUTIVE DIRECTOR Cincinnati John O'Loughlin President & CEO ACG Corporate OTHER Chicago Leslie Whittet Vice President - Chapter Operations ACG Corporate OTHER Chicago Kristi Roberts Administration ACG Dallas / Ft. Worth ACG STAFF Dallas Brittany Timmerman Executive Director ACG Dallas / Ft. Worth EXECUTIVE DIRECTOR Dallas Morgan Stone Executive Director ACG Houston EXECUTIVE DIRECTOR Houston Marc Wilkins Administration ACG Houston /Assoc. Mgmt. Consultants, LLC ACG STAFF Houston Dale Wilkins Administration ACG Houston /Assoc. Mgmt. Consultants, LLC ACG STAFF Houston Yu-chi Wang ACG Intern ACG STAFF Dallas Katie Newland Executive Director ACG National Capital EXECUTIVE DIRECTOR McLean Robert Blumenfeld exec Director ACG New York EXECUTIVE DIRECTOR New York Stephanie McAlaine Executive Director ACG Philadelphia EXECUTIVE DIRECTOR Wayne Sherry Smith Chapter Executive -

Deals Closed in Q2 2017 Deals Closed in Q2 2017

28 | BUYOUTS | July 24, 2017 www.buyoutsnews.com DEALS CLOSEDCLOSED IN IN Q2 Q2 2017 2017 Sponsor Acquiring entity (if Target Value ($Mil) Industry Add-on? Secondary? Deal Type Target add-on) Advisors 125 South Wacker 125 South Wacker Drive, 145.000 Real Estate No No Standalone Buyout - Drive, Chicago SPV Chicago ABRY Partners LLC Confie Seguros Inc EZ Insurance Inc 0.000 Financials Yes No Standalone Buyout - ABRY Partners LLC Confie Seguros Inc Louis p Ferrari Agency Inc 0.000 Financials Yes No Standalone Buyout - ABRY Partners LLC Confie Seguros Inc Rodney D Young Insurance 0.000 Financials Yes No Standalone Buyout - Inc ABRY Partners LLC Confie Seguros Inc Tremont Spirit Insurance Inc 0.000 Financials Yes No Standalone Buyout - ABRY Partners LLC Confie Seguros Inc Valletta Insurance Inc 0.000 Financials Yes No Standalone Buyout - Accel Partners JAGGAER Inc POOL4TOOL AG 0.000 High Technology Yes No Standalone Buyout goetzpartners Corp Finance Signal Hill Capital Group LLC Advent International GTM do Brasil Quantiq Distribuidora Ltda 172.053 Materials Yes Yes Standalone Buyout Bradesco BBI Corp Comercio de Produtos Quimicos Ltda Advent International UNIT4 NV Assistance Software EMEA 0.000 High Technology Yes No Standalone Buyout Corum Group Ltd. Corp BV Advent International GMD SA 84.700 High Technology No No Carve-out - Corp Advent International Invercap Holdings SA de CV 0.000 Financials No No Standalone Buyout - Corp AE Industrial Belcan LLC Schafer Corp 0.000 Industrials Yes Yes Standalone Buyout Raymond James & Partners LLC Associates -

NB Private Equity Partners Limited 30 June 2014 Interim Financial Report for the Six Month Period Ended 30 June 2014 INTERIM FINANCIAL REPORT

NB Private Equity Partners Limited 30 June 2014 Interim Financial Report For the six month period ended 30 June 2014 INTERIM FINANCIAL REPORT • Company Overview 2 • Company Strategy 3 • Dividend Policy 4 • Key Performance Highlights for the Period 5 • Portfolio Highlights During the First Six Months of 2014 6 • 2014 Overview Investment Activity 7 Investment Results 11 • Portfolio Analysis Portfolio Overview 12 Portfolio Diversification 13 Current Fair Value by Year of Deployment 14 Unrealized Equity Co-investment & Direct Yielding Portfolio 15 Twenty Largest Investments 16 Equity Co-investment Portfolio 17 Direct Yielding Investment Portfolio 18 Fund Investment Portfolio 19 Portfolio Valuation 20 Performance Analysis 21 Equity Co-investment Performance 22 Direct Yielding Investment Performance 23 Fund Portfolio Investment Performance 24 Buyout Portfolio 25 Performance Since Inception 27 Fund Portfolio Liquidity & Cash Flow 29 • Unfunded Commitments 30 • Liquidity & Capital Resources 31 • Market Commentary 32 • Certain Information 34 • Statement of Responsibility 35 • Independent Review Report to NB Private Equity Partners Limited 36 • Consolidated Financial Statements 38 • Appendices Valuation Methodology 65 Forward Looking Statements 66 Overview of the Investment Manager 67 Directors, Advisors and Contact Information 68 NB PRIVATE EQUITY PARTNERS | INTERIM FINANCIAL REPORT 30 June 2014 1 For the six month period ended 30 June 2014 COMPANY OVERVIEW INTERIM FINANCIAL REPORT The Company’s objective is to produce attractive -

NB Private Equity Partners (“NBPE”) Overview NBPE Is a Closed End Investment Company Providing Investors with Diversified Exposure to the Private Equity Asset Class

NB Private Equity Partners March 2015 Financial Information as of 28 February 2015 unless otherwise indicated NB Private Equity Partners (“NBPE”) Overview NBPE is a closed end investment company providing investors with diversified exposure to the private equity asset class Providing investors the opportunity for… … both capital appreciation and current income… …through investments in private equity-backed companies… …benefiting from the attractiveness of private markets… …and our Manager’s information and sourcing advantages. 1 Compelling Investment Opportunity Structure designed to provide attractive returns, capital efficiency and current income • NAV per Share Cumulative Total Return1: • Calendar Year 2014: 16.2% • Jan 2014 – February 2015: 16.9% CAPITAL 1 APPRECIATION • Share Price Cumulative Total Return • Calendar Year 2014: 26.9% • Jan 2014 – February 2015: 37.6% • Dividend yield of 3.8% on stock price, 3.3% on NAV INCOME • Dividend is 132% covered2 STRONG • Total assets of $886.1mm, $688.5mm of net asset value ($14.11 NAV per share) BALANCE • Adjusted commitment coverage ratio of 113% SHEET _______________________ Note: As of 28 February 2015. Numbers may not sum due to rounding. Yields based on the NYSE Euronext closing share price of $12.20 on 28 February 2015 and the 28 February 2015 NAV of $14.11 per share. See endnote #5 for adjustments made to the commitment coverage ratio. 1. All performance figures assume re-investment of dividends and reflect cumulative returns over the relevant time periods shown and are not annualized returns. 2. 2015 annualized dividend is 132% covered from the run rate cash income from income investments. Cash yield is calculated including equity value of $22.3 million and debt value of $317.5 million. -

Deals Closed in Q1 2018

36 | BUYOUTS | April 2, 2018 www.buyoutsnews.com DEALS CLOSEDCLOSED IN IN Q1 Q1 2018 2018 Sponsor Target Value ($Mil) Industry 10th Magnitude (Alex Brown), Pamlico Capital (Scott Stevens) Northwest Cadence High Technology 1315 Capital, Ampersand Capital Partners, Genoptix CynoGen 1.000 Healthcare 32 Equity (Kevin LaForce), Bain Capital, Blue Star Sports (Alex Alt), Genstar Capital (Eli Weiss), Providence TeamINN High Technology Equity Partners (Marco Ferrari) 32 Equity (Kevin LaForce), Bain Capital, Blue Star Sports (Alex Alt), Genstar Capital (Eli Weiss), Providence Skyhawks Sports Real Estate Equity Partners (Marco Ferrari) 32 Equity (Kevin LaForce), Bain Capital, Blue Star Sports (Alex Alt), Genstar Capital (Eli Weiss), Providence Eclipse Timing Consumer Products/ Equity Partners (Marco Ferrari) Services 32 Equity (Kevin LaForce), Bain Capital, Blue Star Sports (Alex Alt), Genstar Capital (Eli Weiss), Providence eCamps Sports Network Retail Equity Partners (Marco Ferrari) 32 Equity (Kevin LaForce), Bain Capital, Blue Star Sports (Alex Alt), Genstar Capital (Eli Weiss), Providence CrazyRaise High Technology Equity Partners (Marco Ferrari) 9 Story Media Group (Vince Commisso), Zelnick Media Capital (Strauss Zelnick) Out of the Blue Enterprises Media & Entertainment ABDD Capital (Erica Wishnow), Orangewood Partners (Alan Goldfarb) Taco bell (24 Outlets, Louisville) Consumer Products/ Services ABRY Partners (Brent Stone), U.S. Dermatology Partners (Geoff Wayne) Dr. Robert Silverman, Fairfax Healthcare ABRY Partners (C. J. Brucato), HarbourVest -

CSR Advisory Group

O’Melveny & Myers LLP CSR Advisory Group November 2020 Eric Rothenberg (Chair) Partner New York tel: +1 212 326 2003 [email protected] Contents EHS and Energy Conservation Tech 3 Paul Sieben 4 EHS Stewardship 6 Kelly McTigue 7 Geoff Yost 9 Environmental 11 Eric Rothenberg, CSR Advisory Group Chair 12 FCPA and White Collar 16 David L. Kirman 17 Greta Lichtenbaum 22 Food and Product Safety 28 Hannah Y. Chanoine 29 Impact Funds 33 Alicja Biskupska-Haas 34 Labor Stewardship 36 Aparna B. Joshi 37 Adam Karr 41 Privacy and Security 45 Lisa Monaco 46 Real Estate 51 O’Melveny & Myers LLP 1 Michael D. Hamilton 52 Renewable Energy Stewardship 57 Junaid Chida 58 Water Stewardship 64 Matt Kline 65 Heather Welles 69 O’Melveny & Myers LLP 2 EHS and Energy Conservation Tech O’Melveny & Myers LLP 3 Paul Sieben Partner Silicon Valley D: +1-650-473-2613 [email protected] Paul Sieben, Head of O’Melveny’s Silicon Valley office, Admissions represents all stages of technology companies as well as numerous venture capital firms, other investors and market Bar Admissions participants. Paul’s practice is focused on M&A, venture capital, California private equity, early liquidity transactions, spin-offs, recapitalizations, public equity offerings and private debt Education transactions. Paul has served as lead counsel on hundreds of University of California, Los Angeles, venture capital, angel and private-equity financings, more than a J.D., 1998: Order of the Coif; Corpus hundred and fifty M&A transactions of all sizes, and a significant Juris Secundum Awards in Tort Law number of recapitalizations, public offerings and other and Civil Procedure transactions — many on behalf of, or opposite, major tech University of California, Santa companies, venture capital and private equity firms. -

Economy Puts Chill Into

CNYB 12-01-08 A 1 11/26/2008 8:26 PM Page 1 INSIDE Saying TOP STORIES goodbye Jets and Giants flex to many marketing muscle greats —Alair in winning seasons ® Townsend PAGE 3 Page 11 Boutique banks cash in on Wall St.’s VOL. XXIV, NO. 48 WWW.CRAINSNEWYORK.COM DECEMBER 1-7, 2008 PRICE: $3.00 implosion PAGE 3 Loan modification Economy companies promise a lot, deliver little PAGE 3 puts chill SPECIAL REPORT SEXTON MAKES RIGHT MOVES into NYC Poll respondents CRAIN’S POLL President’s pre-crash efforts keep say city’s economy How would you rate the New York University on course is in poor condition; state of the economy in 40% fear for jobs New York City? BY AMANDA FUNG ’03 ’08 BY MATTHEW SOLLARS REAL ESTATE REPORT luck or prescience? Excellent 1% 1% Developers pushed into wall street’s worst collapse Good 22% 7% frontier neighborhoods at In March,New York University embarked on a plan to reduce administrative costs by 10%, putting it on track to since the Great Depression has put Fair 40% 31% the height of the bubble. a scare into New Yorkers, with Now what? save more than $25 million within 18 months. A few nearly 40% believing their jobs are Poor 34% 59% PAGES 17-29 months later, the university completed a seven-year at risk, a new Crain’s New York Don’t know/ capital campaign that raised close to $3.1billion,exceeding Business poll shows. refused to answer 3% 1% Harlem: A renaissance fails A growing fear that job losses to reach the commercial See SEXTON on Page 8 will ripple throughout the city is G sector P. -

TEAM 1271 Avenue of the Americas, 42Nd Floor New York, NY 10020

OVERVIEW INVESTMENT STRATEGY ▪ About Us: Bessemer Investors (BI) focuses on partnering with ▪ Investment Size: BI has flexibility to pursue investments across a middle-market businesses to support growth and enhance value broad size spectrum. Our platform investments tend to fall in the creation. We differentiate ourselves by combining a long-term, following ranges: flexible capital base with a team of experienced private equity ̶ Equity Investment: $50 - $150 million professionals ̶ Enterprise Value: $75 - $500 million ̶ BI was established in 2018 by Bessemer Securities, the family ̶ EBITDA: $5 - $50 million investment vehicle of the Phipps family, which traces its ▪ Investment Structure: BI invests across a wide range of origins to Henry Phipps’ partnership with Andrew Carnegie situations and structures including: and the sale of Carnegie Steel to J.P. Morgan in 1901 ̶ Majority or minority investments ̶ The Phipps family also owns Bessemer Trust, a leading private ̶ Family or sponsor owned businesses, corporate carve-outs, wealth management firm with 21 offices, >3,000 clients with and public-to-privates ~$180 billion of assets under supervision ̶ Platform acquisitions as well as buy and builds ▪ Bessemer Investment History: The Phipps family has been ̶ Primary growth capital or shareholder liquidity investing in private companies for more than a century. BI is the ▪ Industry Focus: BI targets companies in industries that leverage latest in a line of successful, distinct investment platforms that our experience, network, and value proposition, -

International Corporate Finance M&A • Private Equity • Banking & Finance • Tax • Antitrust

2016 EDITION INTERNATIONAL CORPORATE FINANCE M&A • PRIVATE EQUITY • BANKING & FINANCE • TAX • ANTITRUST Marco De Benedetti The Carlyle Group P. 54 Tania Daguere-Lindbäck Blackstone P. 38 Augusto Lima Anheuser-Busch InBev P. 45 Louis Schweitzer Renault P. 41 Luciane Ribeiro Santander Brasil Asset Management P. 37 Benedict Oramah Afreximbank P. 49 Mathilde Bluteau Microsoft France P. 35 Gaurav Malik Philips Lighting P. 42 Giselle Luna de Mello Wells Fargo GFI RANKINGS P. 51 AMERICAS P.67 EXTERNAL CONTRIBUTORS EXECUTIVE SUMMARY EUROPE P.149 EXPERT VIEWS P.326 THE GLOBAL MARKET: ASIA P.301 Jeff Immelt MONEY TALKS P.12 TOP ADVISORS DIRECTORY Argentina, Brazil, Canada, Chile, Colombia, GE PRIVATE EQUITY FIRMS P.334 Mexico, Peru, Uruguay, USA, Austria, Belgium, 50 LEADERS P. 42 France, Germany, Italy, Luxembourg, Netherlands, INVESTMENT BANKS THE 50 PEOPLE OF THE YEAR Poland, Portugal, Russia, Spain, Switzerland, UK, & FINANCIAL ADVISORS P.337 IN CORPORATE FINANCE P.34 China, India, Japan EXECUTIVE SEARCH & ADVISORY P.341 LAW FIRMS P.342 Customized legal and fi nancial translation services HIGHLY SPECIALIZED LEGAL AND FINANCIAL TRANSLATION SERVICES ■ A skilled, experienced and dynamic team of in-house fi nancial and legal translators ■ Project managers capable of handling all types of projects ■ A network of highly-skilled freelance translators ■ Ability to rapidly meet the constraints of our specialist sectors ■ An in-depth awareness of clients’ needs Legal translation Financial translation ■ Arbitration and litigation ■ Invest ment funds ■ International Trade ■ Banking ■ Corporate fi nance ■ Real Estate ■ Asset Management ■ Mining, Petroleum ■ Private Equity ■ Intellectual Property ■ Information Technology ■ International organisations We specialise in Investment Funds Over the past 10 years, Tradewords has built up a network of leading European fund specia- lists.