2009 Annual Report

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

2019-Annual-Report.Pdf

2019 URBAN INSTITUTE ANNUAL REPORT A Message from the President Dear Friends, Inspired by our 50th anniversary, the Urban Institute kicked off our next 50 years in 2019 with a renewed commitment to advancing upward mobility, equity, and shared prosperity. We also collaborated with changemakers across the country to develop innovative ideas for how Urban could best fulfill our mission in light of trends likely to bring disruptive change in the decades to come. We did not expect such change to arrive in 2020 in the form of a pandemic that has exposed so many fissures in our society, including the disproportionate vulnerability of people of color to health and economic risks. Nor did we anticipate the powerful uprisings that have called needed attention to police brutality, antiblackness, and racism in our country. But as I consider the work Urban is undertaking to inform an inclusive recovery from the coronavirus pandemic and dismantle the systems and structures that drive racism, I am grateful for the many partners who, by engaging with our Next50 initiative in 2019, helped Urban accelerate the development of capacities and initiatives that are having an impact. Among the ways our work made a difference last year: ▪ Influencing efforts to boost Black homeownership. Our groundbreaking work on dramatic declines in Black homeownership helped make the issue an urgent concern in advocacy and policy circles. Urban delivered powerful new findings showing how a set of housing finance innovations can build wealth in communities of color. We also helped launch a collaborative effort with real estate professionals, lenders, and nonprofit leaders to amplify and solidify a framework for reducing the racial homeownership gap. -

Expanding Insurance Coverage for Children

XPANDING E INSURANCE COVERAGE FOR CHILDREN John Holahan XPANDING EINSURANCE COVERAGE FOR CHILDREN John Holahan Copyright © 1997. The Urban Institute. All rights reserved. Except for short quotes, no part of this publication may be reproduced or used in any form or by any means, electronic or mechanical including photo- copying, recording, or by information storage or retrieval system, with- out written permission from the Urban Institute. BOARD OF TRUSTEES URBAN INSTITUTE is a non- Richard B. Fisher profit policy research and educa- Chairman tional organization established in Joel L. Fleishman Vice Chairman Washington, D.C., in 1968. Its staff Katharine Graham investigates the social and economic Vice Chairman William Gorham problems confronting the nation and President public and private means to alleviate Jeffrey S. Berg Joan Toland Bok them. The Institute disseminates sig- Marcia L. Carsey nificant findings of its research Carol Thompson Cole Richard C. Green, Jr. through the publications program of Jack Kemp its Press. The goals of the Institute are Robert S. McNamara to sharpen thinking about societal Charles L. Mee, Jr. Robert C. Miller problems and efforts to solve them, Lucio Noto improve government decisions and Hugh B. Price Sol Price performance, and increase citizen Robert M. Solow awareness of important policy choices. Dick Thornburgh Judy Woodruff Through work that ranges from LIFE TRUSTEES broad conceptual studies to adminis- trative and technical assistance, Warren E. Buffett James E. Burke Institute researchers contribute to the Joseph A. Califano, Jr. stock of knowledge available to guide William T. Coleman, Jr. John M. Deutch decision making in the public interest. -

Tax Policy— Unfinished Business

37th Annual Spring Symposium and State-Local Tax Program Tax Policy— Unfinished Business Tangle of Taxes Health Policy Tax Policy and Retirement Issues in Corporate Taxation Tax Compliance Thoughts for the New Congress The Role of Federal and State Federal Impact on State Spending May 17–18, 2007 Holiday Inn Capitol Washington DC REGISTRATION — Columbia Foyer President Thursday, May 17, 8:00 AM - 4:00 PM Robert Tannenwald Friday, May 18, 8:00 AM - 12:30 PM Program Chair All sessions will meet in the COLUMBIA BALLROOM Thomas Woodward Executive Director J. Fred Giertz Thursday, May 17 8:45–9:00 AM WELCOME AND INTRODUCTION 9:00–10:30 AM ROUNDTABLE: RICHARD MUSGRAVE REMEMBERED Organizer: Diane Lim Rogers, Committee on the Budget, U.S. House of Representatives Moderator: Henry Aaron, The Brookings Institution Discussants: Helen Ladd, Duke University; Wallace Oates, University of Maryland ; Joel Slemrod, University of Michigan 10:30–10:45 AM BREAK 10:45–12:15 PM TANGLES OF TAXES: PROBLEMS IN THE TAX CODE Organizer/Moderator: Roberton Williams Jr., Urban-Brookings Tax Policy Center Alex Brill, American Enterprise Institute — The Individual Income Tax After 2010: Post-Permanencism Ellen Harrison, Winthrop Shaw Pittman LLP — Estate Planning Under the Bush Tax Cuts Leonard Burman, William Gale, Gregory Leiserson, and Jeffery Rohaly, Urban-Brookings Tax Policy Center — The AMT: What’s Wrong and How to Fix It Discussants: Roberta Mann, Widener University School of Law; David Weiner, Congressional Budget Office 12:30–1:45 PM LUNCHEON - DISCOVERY BALLROOM Speaker: Peter Orszag, Director, Congressional Budget Office Presentation of Davie-Davis Award for Public Service 2:00–3:30 PM HEALTH POLICY: THE ROLE FOR TAXES Organizer: Timothy Dowd, Joint Committee on Taxation Moderator: Alexandra Minicozzi, Office of Tax Analysis, U.S. -

Brief of Amici Curiae Bipartisan Economic Scholars

No. 19-840 In the Supreme Court of the United States _________ CALIFORNIA, ET AL., Petitioners, v. TEXAS, ET AL., Respondents. _________ On Writ of Certiorari to the United States Court of Appeals for the Fifth Circuit _________ BRIEF AMICI CURIAE FOR BIPARTISAN ECONOMIC SCHOLARS IN SUPPORT OF PETITIONERS _________ SHANNA H. RIFKIN MATTHEW S. HELLMAN JENNER & BLOCK LLP Counsel of Record 353 N. Clark Street JENNER & BLOCK LLP Chicago, IL 60654 1099 New York Avenue, NW Washington, DC 20001 (202) 639-6000 May 13, 2020 [email protected] i TABLE OF CONTENTS TABLE OF AUTHORITIES ......................................... iii INTEREST OF AMICI CURIAE .................................. 1 INTRODUCTION AND SUMMARY OF ARGUMENT ....................................................................... 3 ARGUMENT ....................................................................... 5 I. The Fifth Circuit’s Severability Analysis Lacks Any Economic Foundation And Would Cause Egregious Harm To Those Currently Enrolled In Medicaid And Private Individual Market Insurance As Well As Health Care Providers. ....................................................................... 5 A. Economic Data Establish That The ACA Markets Can Operate Without The Mandate. ................................................................... 5 B. There Is No Economic Reason Why Congress Would Have Wanted The Myriad Other Provisions In The ACA To Be Invalidated. ....................................................... 10 II. Because The ACA Can Operate Effectively Without -

HAMILTON Achieving Progressive Tax Reform PROJECT in an Increasingly Global Economy Strategy Paper JUNE 2007 Jason Furman, Lawrence H

THE HAMILTON Achieving Progressive Tax Reform PROJECT in an Increasingly Global Economy STRATEGY PAPER JUNE 2007 Jason Furman, Lawrence H. Summers, and Jason Bordoff The Brookings Institution The Hamilton Project seeks to advance America’s promise of opportunity, prosperity, and growth. The Project’s economic strategy reflects a judgment that long-term prosperity is best achieved by making economic growth broad-based, by enhancing individual economic security, and by embracing a role for effective government in making needed public investments. Our strategy—strikingly different from the theories driving economic policy in recent years—calls for fiscal discipline and for increased public investment in key growth- enhancing areas. The Project will put forward innovative policy ideas from leading economic thinkers throughout the United States—ideas based on experience and evidence, not ideology and doctrine—to introduce new, sometimes controversial, policy options into the national debate with the goal of improving our country’s economic policy. The Project is named after Alexander Hamilton, the nation’s first treasury secretary, who laid the foundation for the modern American economy. Consistent with the guiding principles of the Project, Hamilton stood for sound fiscal policy, believed that broad-based opportunity for advancement would drive American economic growth, and recognized that “prudent aids and encouragements on the part of government” are necessary to enhance and guide market forces. THE Advancing Opportunity, HAMILTON Prosperity and Growth PROJECT Printed on recycled paper. THE HAMILTON PROJECT Achieving Progressive Tax Reform in an Increasingly Global Economy Jason Furman Lawrence H. Summers Jason Bordoff The Brookings Institution JUNE 2007 The views expressed in this strategy paper are those of the authors and are not necessarily those of The Hamilton Project Advisory Council or the trustees, officers, or staff members of the Brookings Institution. -

Evaluation: Rebuild by Design Phase I June 2014

EVALUATION OFFICE EVALUATION THE Rockefeller Foundation Rockefeller Evaluation: Rebuild by Design Phase I June 2014 Financial support provided by About the Urban Institute Founded in 1968 to understand the problems facing America’s cities and assess the programs of the War on Poverty, the Urban Institute brings decades of objective analysis and expertise to policy debates – in city halls and state houses, Congress and the White House, and emerging democracies around the world. Today, our research portfolio ranges from the social safety net to health and tax policies; the well-being of families and neigh- borhoods; and trends in work, earnings, and wealth building. Our scholars have a distin- guished track record of turning evidence into solutions. About the Rockefeller Foundation Evaluation Office For more than 100 years, the Rockefeller Foundation’s mission has been to promote the well-being of humanity throughout the world. Today, the Rockefeller Foundation pursues this mission through dual goals: advancing inclusive economies that expand opportunities for more broadly shared prosperity, and building resilience by helping people, communi- ties and institutions prepare for, withstand and emerge stronger from acute shocks and chronic stresses. Committed to supporting learning, accountability and performance im- provements, the Evaluation Office of the Rockefeller Foundation works with staff, grantees and partners to strengthen evaluation practice and to support innovative approaches to monitoring, evaluation and learning. Cover photo: Cameron Blaylock Evaluation: Rebuild by Design Phase I June 2014 THE Rockefeller Foundation Rockefeller EVALUATION OFFICE EVALUATION Financial support provided by The contents of this report are the views of the authors and do not necessarily reflect the views or policies of the Rockefeller Foundation. -

Economic Report of the President.” ______

REFERENCES Chapter 1 American Civil Liberties Union. 2013. “The War on Marijuana in Black and White.” Accessed January 31, 2016. Aizer, Anna, Shari Eli, Joseph P. Ferrie, and Adriana Lleras-Muney. 2014. “The Long Term Impact of Cash Transfers to Poor Families.” NBER Working Paper 20103. Autor, David. 2010. “The Polarization of Job Opportunities in the U.S. Labor Market.” Center for American Progress, the Hamilton Project. Bakija, Jon, Adam Cole and Bradley T. Heim. 2010. “Jobs and Income Growth of Top Earners and the Causes of Changing Income Inequality: Evidence from U.S. Tax Return Data.” Department of Economics Working Paper 2010–24. Williams College. Boskin, Michael J. 1972. “Unions and Relative Real Wages.” The American Economic Review 62(3): 466-472. Bricker, Jesse, Lisa J. Dettling, Alice Henriques, Joanne W. Hsu, Kevin B. Moore, John Sabelhaus, Jeffrey Thompson, and Richard A. Windle. 2014. “Changes in U.S. Family Finances from 2010 to 2013: Evidence from the Survey of Consumer Finances.” Federal Reserve Bulletin, Vol. 100, No. 4. Brown, David W., Amanda E. Kowalski, and Ithai Z. Lurie. 2015. “Medicaid as an Investment in Children: What is the Long-term Impact on Tax Receipts?” National Bureau of Economic Research Working Paper No. 20835. Card, David, Thomas Lemieux, and W. Craig Riddell. 2004. “Unions and Wage Inequality.” Journal of Labor Research, 25(4): 519-559. 331 Carson, Ann. 2015. “Prisoners in 2014.” Bureau of Justice Statistics, Depart- ment of Justice. Chetty, Raj, Nathaniel Hendren, Patrick Kline, Emmanuel Saez, and Nich- olas Turner. 2014. “Is the United States Still a Land of Opportunity? Recent Trends in Intergenerational Mobility.” NBER Working Paper 19844. -

Tax Stimulus Options in the Aftermath of the Terrorist Attack

TAX STIMULUS OPTIONS IN THE AFTERMATH OF THE TERRORIST ATTACK By William Gale, Peter Orszag, and Gene Sperling William Gale is the Joseph A. Pechman Senior outlook thus suggests the need for policies that Fellow in Economic Studies at the Brookings Institu- stimulate the economy in the short run. The budget tion. Peter Orszag is Senior Fellow in Economic outlook suggests that the long-run revenue impact Studies at the Brookings Institution. Gene Sperling is of stimulus policies should be limited, so as to avoid Visiting Fellow in Economic Studies at the Brookings exacerbating the nation’s long-term fiscal challen- Institution, and served as chief economic adviser to ges, which would raise interest rates and undermine President Clinton. The authors thank Henry Aaron, the effectiveness of the stimulus. Michael Armacost, Alan Auerbach, Leonard Burman, In short, say the authors, the most effective Christopher Carroll, Robert Cumby, Al Davis, Eric stimulus package would be temporary and maxi- Engen, Joel Friedman, Jane Gravelle, Robert mize its “bang for the buck.” It would direct the Greenstein, Richard Kogan, Iris Lav, Alice Rivlin, Joel largest share of its tax cuts toward spurring new Slemrod, and Jonathan Talisman for helpful discus- economic activity, and it would minimize long-term sions. The opinions expressed represent those of the revenue losses. This reasoning suggests five prin- authors and should not be attributed to the staff, of- ciples for designing the most effective tax stimulus ficers, or trustees of the Brookings Institution. package: (1) Allow only temporary, not permanent, In the aftermath of the recent terrorist attacks, the items. -

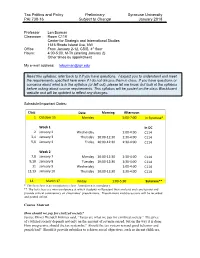

Notes for Tax Policy Course

Tax Politics and Policy Preliminary Syracuse University PAI 730-16 Subject to Change January 2018 Professor Len Burman Classroom Room C119 Center for Strategic and International Studies 1616 Rhode Island Ave, NW Office From January 2-12, CSIS, 4th floor Hours: 4:00-5:00, M-Th (starting January 2) Other times by appointment My e-mail address: [email protected] Read this syllabus; refer back to it if you have questions. I expect you to understand and meet the requirements specified here even if I do not discuss them in class. If you have questions or concerns about what is in the syllabus (or left out), please let me know, but look at the syllabus before asking about course requirements. This syllabus will be posted on the class Blackboard website and will be updated to reflect any changes. Schedule/Important Dates: Class Date Morning Afternoon 1 October 15 Monday 5:00-7:00 In Syracuse* Week 1 In DC 2 January 2 Wednesday 1:00-4:00 C114 3,4 January 3 Thursday 10:00-12:30 1:30-4:00 C114 5,6 January 4 Friday 10:00-12:30 1:30-4:00 C114 Week 2 7,8 January 7 Monday 10:00-12:30 1:30-4:00 C114 9,10 January 8 Tuesday 10:00-12:30 1:30-4:00 C114 11 January 9 Wednesday 1:00-4:00 C114 12,13 January 10 Thursday 10:00-12:30 1:30-4:00 C114 14 March 1? Friday 1:00-5:30 Syracuse** * The first class is an introductory class. -

Housing Policy in the Great Society, Part Two

Joint Center for Housing Studies Harvard University Into the Wild Blue Yonder: The Urban Crisis, Rocket Science, and the Pursuit of Transformation Housing Policy in the Great Society, Part Two Alexander von Hoffman March 2011 W11-3 The research for this working paper was conducted with the support of the John D. and Catherine T. MacArthur Foundation, The Ford Foundation, and the Fannie Mae Foundation. © by Alexander von Hoffman. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. Off we go into the wild blue yonder, Climbing high into the sun Introduction Of the several large and important domestic housing and urban programs produced by Lyndon Johnson’s Great Society administration, the best-known is Model Cities. Although it lasted only from 1966 to 1974, its advocates believed Model Cities had promised a better tomorrow for America’s cities and bitterly lamented its termination—blaming Richard Nixon’s policies, diversion of funds for the Vietnam war, and the nation’s lack of commitment to social progress. Yet the legislation that created Model Cities was ambitious, contradictory, and vague. As such, it vividly expressed the idealistic impulses, currents of thought, and reactions to events that converged, however incoherently, in national urban policy of the 1960s. At the center of the fervor for domestic policy was the president of the United States, Lyndon Johnson, who hungered for dramatic new programs that would transform the country the way New Deal policies had reshaped America in his youth. -

EFFECTS of the TAX CUTS and JOBS ACT: a PRELIMINARY ANALYSIS William G

EFFECTS OF THE TAX CUTS AND JOBS ACT: A PRELIMINARY ANALYSIS William G. Gale, Hilary Gelfond, Aaron Krupkin, Mark J. Mazur, and Eric Toder June 13, 2018 ABSTRACT This paper examines the Tax Cuts and Jobs Act (TCJA) of 2017, the largest tax overhaul since 1986. The new tax law makes substantial changes to the rates and bases of both the individual and corporate income taxes, cutting the corporate income tax rate to 21 percent, redesigning international tax rules, and providing a deduction for pass-through income. TCJA will stimulate the economy in the near term. Most models indicate that the long-term impact on GDP will be small. The impact will be smaller on GNP than on GDP because the law will generate net capital inflows from abroad that have to be repaid in the future. The new law will reduce federal revenues by significant amounts, even after allowing for the modest impact on economic growth. It will make the distribution of after-tax income more unequal, raise federal debt, and impose burdens on future generations. When it is ultimately financed with spending cuts or other tax increases, as it must be in the long run, TCJA will, under the most plausible scenarios, end up making most households worse off than if TCJA had not been enacted. The new law simplifies taxes in some ways but creates new complexity and compliance issues in others. It will raise health care premiums and reduce health insurance coverage and will have adverse effects on charitable contributions and some state and local governments. -

Department of the Treasury Internal Revenue Service

Department of the Treasury Internal Revenue Service Mark W. Everson Commissioner Mark J. Mazur Director, Research, Analysis, and Statistics Janice M. Hedemann Director, Office of Research IRS Research Bulletin Recent Research on Tax Administration and Compliance Selected Papers Given at the 2006 IRS Research Conference Georgetown University School of Law Washington, DC June 14-15, 2006 Compiled and Edited by James Dalton and Beth Kilss* Statistics of Income Division Internal Revenue Service *Prepared under the direction of Janet McCubbin, Chief, Special Studies Branch IRS Research Bulletin iii Foreword This edition of the IRS Research Bulletin (Publication 1500) features selected papers from the latest IRS Research Conference, held at the Georgetown Uni- versity School of Law in Washington, DC, on June 14-15, 2006. Conference presenters and attendees included researchers from all areas of IRS, represen- tatives of other government agencies (including from the United Kingdom, Australia, and New Zealand), and academic and private sector experts on tax policy, tax administration, and tax compliance. The conference began with a keynote address by Mark Matthews, Deputy Commissioner for Services and Enforcement. Mr. Matthews emphasized the importance of using high-quality data and analysis to drive key decisions. Mark Mazur, Director, Research, Analysis and Statistics, then led a panel discus- sion on compliance and administrative aspects of tax reform. The panelists, including former Assistant Secretaries for Tax Policy Pamela Olson and Ronald Pearlman, former Deputy Assistant Secretary for Tax Analysis Leonard Burman, and Jane Gravelle of the Congressional Research Service, emphasized the need to use data and analysis to inform policies as they are first being formulated, rather than after positions have hardened.