6.14. Oscillators and Indicators

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A Novel Hybrid Model for Stock Price Forecasting Based on Metaheuristics and Support Vector Machine

data Article A Novel Hybrid Model for Stock Price Forecasting Based on Metaheuristics and Support Vector Machine Mojtaba Sedighi 1,2,* , Hossein Jahangirnia 3, Mohsen Gharakhani 4 and Saeed Farahani Fard 5 1 Department of Finance, Qom Branch, Islamic Azad University, Qom 3749113191, Iran 2 Young Researchers and Elite Club, Qom Branch, Islamic Azad University, Qom 88447678, Iran 3 Department of Accounting, Qom Branch, Islamic Azad University, Qom 3749113191, Iran; [email protected] 4 Department of Finance, Iranian Institute of Higher Education, Tehran 13445353, Iran; [email protected] 5 Department of Management and Economics, University of Qom, Qom 3716146611, Iran; [email protected] * Correspondence: [email protected] Received: 2 May 2019; Accepted: 20 May 2019; Published: 22 May 2019 Abstract: This paper intends to present a new model for the accurate forecast of the stock’s future price. Stock price forecasting is one of the most complicated issues in view of the high fluctuation of the stock exchange and also it is a key issue for traders and investors. Many predicting models were upgraded by academy investigators to predict stock price. Despite this, after reviewing the past research, there are several negative aspects in the previous approaches, namely: (1) stringent statistical hypotheses are essential; (2) human interventions take part in predicting process; and (3) an appropriate range is complex to be discovered. Due to the problems mentioned, we plan to provide a new integrated approach based on Artificial Bee Colony (ABC), Adaptive Neuro-Fuzzy Inference System (ANFIS), and Support Vector Machine (SVM). -

Stock Chart Pattern Recognition with Deep Learning

Stock Chart Pattern recognition with Deep Learning Marc Velay and Fabrice Daniel Artificial Intelligence Department of Lusis, Paris, France [email protected] http://www.lusis.fr June 2018 ABSTRACT the number of patterns recognized implies having a human examining candlestick charts in order to deduce signal char- This study evaluates the performances of CNN and LSTM acteristics before implementing the detection using condi- for recognizing common charts patterns in a stock historical tions specific to that pattern. Adding different parameters data. It presents two common patterns, the method used to to modulate ratios allows us to tweak the patterns’ charac- build the training set, the neural networks architectures and teristics. This technique does not have any generalization the accuracies obtained. potential. If the pattern is slightly outside of the defined Keywords: Deep Learning, CNN, LSTM, Pattern recogni- bounds, it will not be detected, even if a human would have tion, Technical Analysis classified it otherwise. Another solution is DTW3 which consists in computing 1 INTRODUCTION the distance between two time series. DTW allows us to Patterns are recurring sequences found in OHLC1 candle- recognize a pattern that could vary in size and length. To stick charts which traders have historically used as buy and use this algorithm, we must use reference time series, which sell signals. Several studies, notably by Bulkowski2, have have to be selected by a human. The references must gener- found some correlation between patterns and future trends, alize well when compared with signals similar to the pattern although to a limited extent. The correlations were found to in order to capture the whole range. -

Forecasting Direction of Exchange Rate Fluctuations with Two Dimensional Patterns and Currency Strength

FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH A THESIS SUBMITTED TO THE GRADUATE SCHOOL OF NATURAL AND APPLIED SCIENCES OF MIDDLE EAST TECHNICAL UNIVERSITY BY MUSTAFA ONUR ÖZORHAN IN PARTIAL FULFILLMENT OF THE REQUIREMENTS FOR THE DEGREE OF DOCTOR OF PILOSOPHY IN COMPUTER ENGINEERING MAY 2017 Approval of the thesis: FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH submitted by MUSTAFA ONUR ÖZORHAN in partial fulfillment of the requirements for the degree of Doctor of Philosophy in Computer Engineering Department, Middle East Technical University by, Prof. Dr. Gülbin Dural Ünver _______________ Dean, Graduate School of Natural and Applied Sciences Prof. Dr. Adnan Yazıcı _______________ Head of Department, Computer Engineering Prof. Dr. İsmail Hakkı Toroslu _______________ Supervisor, Computer Engineering Department, METU Examining Committee Members: Prof. Dr. Tolga Can _______________ Computer Engineering Department, METU Prof. Dr. İsmail Hakkı Toroslu _______________ Computer Engineering Department, METU Assoc. Prof. Dr. Cem İyigün _______________ Industrial Engineering Department, METU Assoc. Prof. Dr. Tansel Özyer _______________ Computer Engineering Department, TOBB University of Economics and Technology Assist. Prof. Dr. Murat Özbayoğlu _______________ Computer Engineering Department, TOBB University of Economics and Technology Date: ___24.05.2017___ I hereby declare that all information in this document has been obtained and presented in accordance with academic rules and ethical conduct. I also declare that, as required by these rules and conduct, I have fully cited and referenced all material and results that are not original to this work. Name, Last name: MUSTAFA ONUR ÖZORHAN Signature: iv ABSTRACT FORECASTING DIRECTION OF EXCHANGE RATE FLUCTUATIONS WITH TWO DIMENSIONAL PATTERNS AND CURRENCY STRENGTH Özorhan, Mustafa Onur Ph.D., Department of Computer Engineering Supervisor: Prof. -

Point and Figure Relative Strength Signals

February 2016 Point and Figure Relative Strength Signals JOHN LEWIS / CMT, Dorsey, Wright & Associates Relative Strength, also known as momentum, has been proven to be one of the premier investment factors in use today. Numerous studies by both academics and investment ABOUT US professionals have demonstrated that winning securities continue to outperform. This phenomenon has been found Dorsey, Wright & Associates, a Nasdaq Company, is a in equity markets all over the globe as well as commodity registered investment advisory firm based in Richmond, markets and in asset allocation strategies. Momentum works Virginia. Since 1987, Dorsey Wright has been a leading well within and across markets. advisor to financial professionals on Wall Street and investment managers worldwide. Relative Strength strategies focus on purchasing securities that have already demonstrated the ability to outperform Dorsey Wright offers comprehensive investment research a broad market benchmark or the other securities in the and analysis through their Global Technical Research Platform investment universe. As a result, a momentum strategy and provides research, modeling and indexes that apply requires investors to purchase securities that have already Dorsey Wright’s expertise in Relative Strength to various appreciated quite a bit in price. financial products including exchange-traded funds, mutual funds, UITs, structured products, and separately managed There are many different ways to calculate and quantify accounts. Dorsey Wright’s expertise is technical analysis. The momentum. This is similar to a value strategy. There are Company uses Point and Figure Charting, Relative Strength many different metrics that can be used to determine a Analysis, and numerous other tools to analyze market data security’s value. -

Data Visualization and Analysis

HTML5 Financial Charts Data visualization and analysis Xinfinit’s advanced HTML5 charting tool is also available separately from the managed data container and can be licensed for use with other tools and used in conjunction with any editor. It includes a comprehensive library of over sixty technical indictors, additional ones can easily be developed and added on request. 2 Features Analysis Tools Trading from Chart Trend Channel Drawing Instrument Selection Circle Drawing Chart Duration Rectangle Drawing Chart Intervals Fibonacci Patterns Chart Styles (Line, OHLC etc.) Andrew’s Pitchfork Comparison Regression Line and Channel Percentage (Y-axis) Up and Down arrows Log (Y-axis) Text box Show Volume Save Template Show Data values Load Template Show Last Value Save Show Cross Hair Load Show Cross Hair with Last Show Min / Max Show / Hide History panel Show Previous Close Technical Indicators Show News Flags Zooming Data Streaming Full Screen Print Select Tool Horizontal Divider Trend tool Volume by Price Horizonal Line Drawing Book Volumes 3 Features Technical Indicators Acceleration/Deceleration Oscillator Elliot Wave Oscillator Accumulation Distribution Line Envelopes Aroon Oscilltor Fast Stochastic Oscillator Aroon Up/Down Full Stochastic Oscillator Average Directional Index GMMA Average True Range GMMA Oscillator Awesome Oscillator Highest High Bearish Engulfing Historical Volatility Bollinger Band Width Ichimoku Kinko Hyo Bollinger Bands Keltner Indicator Bullish Engulfing Know Sure Thing Chaikin Money Flow Lowest Low Chaikin Oscillator -

Moving Average Convergence Divergence (MACD)

Understanding Technical Analysis : Moving Average Convergence Divergence (MACD) Apart from candlestick chart pattern indicators, traders or analysts often use the Hi 74.57 Moving Average Convergence Divergence (MACD) and Relative Strength Index Potential supply (RSI) in technical analysis of financial security. Like the candlestickdisruption chart indicators, due to MACD is also used to identify any trend pattern movement. attacks on two oil Brent tankers near Iran What is MACD? WTI Momentum • MACD is a momentum oscillator indicator WTI Oscillator which is used to identify trend formation Lo 2,237.40 (24 Mar 2020) • MACD shows a relationship betweenLo 18,591.93 two (24 Mar 2020) Moving moving averages of a financial instrument. • It combines price points of an instrument over Averages a specified time frame, divided by the number of data points, to give a single trend line Simple Moving Average (SMA) Exponential Moving Average (EMA) • The most basic MA, which is just a • A type of moving average that gives straight calculation of the mean price more weight to recent prices which of a set of values over a given time involves three steps. periods. • The SMA is computed first. Next, we • If you were to calculate the SMA for a must calculate the multiplier for ten-day period, you would take the weighting the EMA. The final step summed value of the last ten days involves the use of formula to and divide the result by ten. compute the current EMA. Level 6, Kenanga Tower, 237 Jalan Tun Razak, 50400 Kuala Lumpur, Malaysia. Tel: (603) 2172 3888 Fax: (603) 2172 2729 Email: [email protected] Website: www.kenangafutures.com.my How MACD works? MACD is generated by subtracting the long term EMAs (26 period) from the short term EMAs (12 periods) to form the main line known as MACD line. -

Candlesticks, Fibonacci, and Chart Pattern Trading Tools

ffirs.qxd 6/17/03 8:17 AM Page iii CANDLESTICKS, FIBONACCI, AND CHART PATTERN TRADING TOOLS A SYNERGISTIC STRATEGY TO ENHANCE PROFITS AND REDUCE RISK ROBERT FISCHER JENS FISCHER JOHN WILEY & SONS, INC. ffirs.qxd 6/17/03 8:17 AM Page iii ffirs.qxd 6/17/03 8:17 AM Page i CANDLESTICKS, FIBONACCI, AND CHART PATTERN TRADING TOOLS ffirs.qxd 6/17/03 8:17 AM Page ii Founded in 1870, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and market- ing print and electronic products and services for our customers’ professional and personal knowledge and understanding. The Wiley Trading series features books by traders who have survived the market’s ever-changing temperament and have prospered—some by re- investing systems, others by getting back to basics. Whether a novice trader, professional, or somewhere in-between, these books will provide the advice and strategies needed to prosper today and well into the future. For a list of available titles, visit our web site at www.WileyFinance.com. ffirs.qxd 6/17/03 8:17 AM Page iii CANDLESTICKS, FIBONACCI, AND CHART PATTERN TRADING TOOLS A SYNERGISTIC STRATEGY TO ENHANCE PROFITS AND REDUCE RISK ROBERT FISCHER JENS FISCHER JOHN WILEY & SONS, INC. ffirs.qxd 6/17/03 8:17 AM Page iv Copyright © 2003 by Robert Fischer, Dr. Jens Fischer. All rights reserved. Published by John Wiley & Sons, Inc., Hoboken, New Jersey. Published simultaneously in Canada. PHI-spirals, PHI-ellipse, PHI-channel, and www.fibotrader.com are registered trademarks and protected by U.S. -

Indicators Nison Power Concept EAST & WEST CONFIRMATION

Instructors: Syl Desaulniers, Nison Certified Trainer™ Tracy Knudsen, Nison Certified Trainer™ Improve Your Process… Get BIG Results KAIZEN TRADING APPRENTICESHIP Bonus Session Address student trades, concerns, follow-up questions Analysis of current market conditions Awarding of Kaizen Technician™ certification Strict Candlestick Patterns Qualifications for Strict Candle Patterns: - Shape of Candle Lines or Pattern - Trend requirement is the same for strict and non-strict patterns Important Concept with Candle Lines/Patterns: - Confirmation: Using a move after the initial candle signal to validate a move - Less important with East/West Confirmation Candlestick Lines and Patterns In Order of Candle Progression - Least to Most Bullish - Least to Most Bearish - Risk/Reward Tradeoff comes with candle progression Strict Candlestick Patterns - Bullish Strict Candlestick Patterns - Bearish Trend Progression/Multiple Time Frames Monthly, Weekly, Daily, 4 Hour, 2 Hour, 60 Minute, 30 Minute, 15 Minute… • Involves monitoring the same instrument across different frequencies (or time compressions) • No real limit as to how many frequencies can be monitored or which specific ones to choose • Trades placed in direction of longer term trend have higher probability of success • There are general guidelines that most practitioners will follow Trend Progression/Multiple Time Frames • Looking at a stock through different time frames can be confusing as a new trader. Why? • Because each time frame looks different! • A stock may look great on the daily chart, but look horrible on a 5 minute chart. • How many timeframes should a trader use? • Using three different periods gives a broad enough reading on the market • using fewer than this can result in a considerable loss of data • while using more typically provides redundant analysis. -

Accumulation/Distribution Line -- Chart School

Accumulation/Distribution Line -- Chart School Chart School Accumulation/Distribution Line Introduction - Volume and the Flow of Money There are many indicators available to measure volume and the flow of money for a particular stock, index or security. One of the most popular volume indicators over the years has been the Accumulation/Distribution Line. The basic premise behind volume indicators, including the Accumulation/Distribution Line, is that volume precedes price. Volume reflects the amount of shares traded in a particular stock and is a direct reflection of the money flowing into and out of a stock. Many times before a stock advances, there will be period of increased volume just prior to the move. Most volume or money flow indicators are designed to identify early increases in positive or negative volume flow to gain an edge before the price moves. (Note: the terms "money flow" and "volume flow" are essentially interchangeable.) Methodology (Click here to see a live example of the Acc/Dist Line) The Accumulation/Distribution Line was developed by Marc Chaikin to assess the cumulative flow of money into and out of a security. In order to fully appreciate the methodology behind the Accumulation/Distribution Line, it may be helpful to examine one of the earliest volume indicators and see how it compares. In 1963, Joe Granville developed On Balance Volume (OBV), which was one of the earliest and most popular indicators to measure positive and negative volume flow. OBV is a relatively simple indicator that adds the corresponding period's volume when the close is up and subtracts it when the close is down. -

A Survey of Forex and Stock Price Prediction Using Deep Learning

Review A Survey of Forex and Stock Price Prediction Using Deep Learning Zexin Hu †, Yiqi Zhao † and Matloob Khushi * School of Computer Science, The University of Sydney, Building J12/1 Cleveland St., Camperdown, NSW 2006, Australia; [email protected] (Z.H.); [email protected] (Y.Z.) * Correspondence: [email protected] † The authors contributed equally; both authors should be considered the first author. Abstract: Predictions of stock and foreign exchange (Forex) have always been a hot and profitable area of study. Deep learning applications have been proven to yield better accuracy and return in the field of financial prediction and forecasting. In this survey, we selected papers from the Digital Bibliography & Library Project (DBLP) database for comparison and analysis. We classified papers according to different deep learning methods, which included Convolutional neural network (CNN); Long Short-Term Memory (LSTM); Deep neural network (DNN); Recurrent Neural Network (RNN); Reinforcement Learning; and other deep learning methods such as Hybrid Attention Networks (HAN), self-paced learning mechanism (NLP), and Wavenet. Furthermore, this paper reviews the dataset, variable, model, and results of each article. The survey used presents the results through the most used performance metrics: Root Mean Square Error (RMSE), Mean Absolute Percentage Error (MAPE), Mean Absolute Error (MAE), Mean Square Error (MSE), accuracy, Sharpe ratio, and return rate. We identified that recent models combining LSTM with other methods, for example, DNN, are widely researched. Reinforcement learning and other deep learning methods yielded great returns and performances. We conclude that, in recent years, the trend of using deep-learning-based methods for financial modeling is rising exponentially. -

Timeframeset

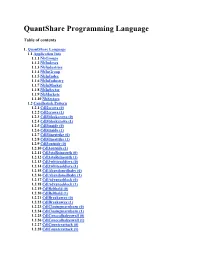

QuantShare Programming Language Table of contents 1. QuantShare Language 1.1 Application Info 1.1.1 NbGroups 1.1.2 NbIndexes 1.1.3 NbIndustries 1.1.4 NbInGroup 1.1.5 NbInIndex 1.1.6 NbInIndustry 1.1.7 NbInMarket 1.1.8 NbInSector 1.1.9 NbMarkets 1.1.10 NbSectors 1.2 Candlestick Pattern 1.2.1 Cdl2crows (0) 1.2.2 Cdl2crows (1) 1.2.3 Cdl3blackcrows (0) 1.2.4 Cdl3blackcrows (1) 1.2.5 Cdl3inside (0) 1.2.6 Cdl3inside (1) 1.2.7 Cdl3linestrike (0) 1.2.8 Cdl3linestrike (1) 1.2.9 Cdl3outside (0) 1.2.10 Cdl3outside (1) 1.2.11 Cdl3staRsinsouth (0) 1.2.12 Cdl3staRsinsouth (1) 1.2.13 Cdl3whitesoldiers (0) 1.2.14 Cdl3whitesoldiers (1) 1.2.15 CdlAbandonedbaby (0) 1.2.16 CdlAbandonedbaby (1) 1.2.17 CdlAdvanceblock (0) 1.2.18 CdlAdvanceblock (1) 1.2.19 CdlBelthold (0) 1.2.20 CdlBelthold (1) 1.2.21 CdlBreakaway (0) 1.2.22 CdlBreakaway (1) 1.2.23 CdlClosingmarubozu (0) 1.2.24 CdlClosingmarubozu (1) 1.2.25 CdlConcealbabyswall (0) 1.2.26 CdlConcealbabyswall (1) 1.2.27 CdlCounterattack (0) 1.2.28 CdlCounterattack (1) 1.2.29 CdlDarkcloudcover (0) 1.2.30 CdlDarkcloudcover (1) 1.2.31 CdlDoji (0) 1.2.32 CdlDoji (1) 1.2.33 CdlDojistar (0) 1.2.34 CdlDojistar (1) 1.2.35 CdlDragonflydoji (0) 1.2.36 CdlDragonflydoji (1) 1.2.37 CdlEngulfing (0) 1.2.38 CdlEngulfing (1) 1.2.39 CdlEveningdojistar (0) 1.2.40 CdlEveningdojistar (1) 1.2.41 CdlEveningstar (0) 1.2.42 CdlEveningstar (1) 1.2.43 CdlGapsidesidewhite (0) 1.2.44 CdlGapsidesidewhite (1) 1.2.45 CdlGravestonedoji (0) 1.2.46 CdlGravestonedoji (1) 1.2.47 CdlHammer (0) 1.2.48 CdlHammer (1) 1.2.49 CdlHangingman (0) 1.2.50 -

Profiting with Chart Patterns.Book

Profiting with Chart Patterns by Ed Downs Profiting with Chart Patterns November 2016 Edition BK-02-01-01 Support Worldwide Technical Support and Product Information www.nirvanasystems.com Nirvana Systems Corporate Headquarters 9111Jollyville Rd, Suite 275, Austin, Texas 78759 USA Tel: 512 345 2545 Fax: 512 345 4225 Sales Information For product information or to place an order, please contact 800 880 0338 or 512 345 2566. You may also fax 512 345 4225 or send email to [email protected]. Technical Support Information For assistance in installing or using Nirvana products, please contact 512 345 2592. You may also fax 512 345 4225 or send email to [email protected]. To comment on the documentation, send email to [email protected]. © 2016 Nirvana Systems Inc. All rights reserved. Contents Chapter 1 Confirming Entries & Managing Exits What is a Pattern? ..........................................................................................................1-1 Psychology of Support Bounces ....................................................................................1-2 Goals of Chart Pattern Analysis.....................................................................................1-3 Chapter 2 Tools of the Trade 7 Chart Pattern Method..................................................................................................2-1 Pattern Timeframe .........................................................................................................2-2 Prior Move Test .............................................................................................................2-3