Imedia Brands, Inc. (Exact Name of Registrant As Specified in Its Charter)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

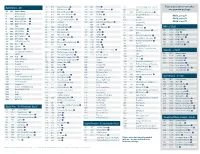

Verizon Fios Channel Guide

1/14/2020 Extreme HD Print 344 Ch, 151 HD # A 169 A Wealth of Entertainment 669 A Wealth of Entertainment HD 181 A&E 681 A&E HD 571 ACC Network HD 119 AccuWeather DC MD VA 619 AccuWeather DC MD VA HD 424 Action Max 924 Action Max HD 425 Action Max West 231 AMC 731 AMC HD 125 American Heroes Channel 625 American Heroes Channel HD 130 Animal Planet 630 Animal Planet HD 215 AXS tv 569 AXS tv HD # B 765 BabyFirst HD 189 BBC America 689 BBC America HD 107 BBC World News 609 BBC World News HD 596 beIN Sports HD 270 BET 225 BET Gospel 770 BET HD 213 BET Jams 219 BET Soul 330 Big Ten 1 331 Big Ten 2 Programming Service offered in each package are subject to change and not all programming Included Channel Premium Available For Additional Cost services will be available at all times, Blackout restrictions apply. 1/15 1/14/2020 Extreme HD Print 344 Ch, 151 HD 333 Big Ten 3 85 Big Ten Network 585 Big Ten Network HD 258 Boomerang Brambleton Community 42 Access [HOA] 185 Bravo 685 Bravo HD 951 Brazzers 290 BYU Television # C 109 C-SPAN 110 C-SPAN 2 111 C-SPAN 3 599 Cars.TV HD 257 Cartoon Network 757 Cartoon Network HD 94 CBS Sports Network 594 CBS Sports Network HD 277 CGTN 420 Cinemax 920 Cinemax HD 421 Cinemax West 921 Cinemax West HD 236 Cinémoi 221 CMT 721 CMT HD 222 CMT Music 102 CNBC 602 CNBC HD+ 100 CNN 600 CNN HD 105 CNN International 190 Comedy Central 690 Comedy Central HD 695 Comedy.TV HD 163 Cooking Channel 663 Cooking Channel HD Programming Service offered in each package are subject to change and not all programming Included Channel Premium Available For Additional Cost services will be available at all times, Blackout restrictions apply. -

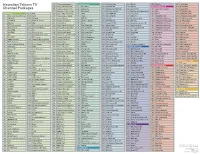

SPECTRUM TV PACKAGES Hillsborough, Pinellas, Pasco & Hernando Counties |

SPECTRUM TV PACKAGES Hillsborough, Pinellas, Pasco & Hernando Counties | Investigation Discovery WFTS - ABC HD GEM Shopping Network Tennis Channel 87 1011 1331 804 TV PACKAGES SEC Extra HD WMOR - IND HD GEM Shopping Network HD FOX Sports 2 88 1012 1331 806 SundanceTV WTVT - FOX HD EWTN CBS Sports Network 89 1013 1340 807 Travel Channel WRMD - Telemundo HD AMC MLB Network SPECTRUM SELECT 90 1014 1355 815 WTAM - Azteca America WVEA - Univisión HD SundanceTV Olympic Channel 93 1015 1356 816 (Includes Spectrum TV Basic Community Programming WEDU - PBS Encore HD IFC NFL Network 95 1016 1363 825 and the following services) ACC Network HD WXPX - ION HD Hallmark Mov. & Myst. ESPN Deportes 99 1017 1374 914 WCLF - CTN HSN WGN America IFC FOX Deportes 2 101 1018 1384 915 WEDU - PBS HSN HD Nickelodeon Hallmark Mov. & Myst. NBC Universo 3 101 1102 1385 929 WTOG - The CW Disney Channel Disney Channel FX Movie Channel El Rey Network 4 105 1105 1389 940 WFTT - UniMás Travel Channel SonLife WVEA - Univisión HD TUDN 5 106 1116 1901 942 WTTA - MyTV EWTN Daystar WFTT - UniMás HD Disney Junior 6 111 1117 1903 1106 WFLA - NBC FOX Sports 1 INSP Galavisión Disney XD 8 112 1119 1917 1107 Bay News 9 IFC Freeform WRMD - Telemundo HD Universal Kids 9 113 1121 1918 1109 WTSP - CBS SundanceTV Hallmark Channel Nick Jr. 10 117 1122 1110 WFTS - ABC FX Upliftv HD BYUtv 11 119 1123 SPECTRUM TV BRONZE 1118 WMOR - IND FXX ESPN ESPNEWS 12 120 1127 1129 WTVT - FOX Bloomberg Television ESPN2 (Includes Spectrum TV Select ESPNU 13 127 1128 and the following channels) 1131 C-SPAN TBN FS Sun ESPN Deportes 14 131 1148 1132 WVEA - Univisión Investigation Discovery FS Florida FOX Sports 2 15 135 1149 1136 WXPX - ION FOX Business Network SEC Network Digi Tier 1 CBS Sports Network 17 149 1150 1137 WGN America Galavisión NBC Sports Network LMN NBA TV 18 155 1152 50 1140 WRMD - Telemundo SHOPHQ FOX Sports 1 TCM MLB Network 19 160 1153 53 1141 TBS HSN2 HD SEC Extra HD Golf Channel NFL Network 23 161 1191 67 1145 OWN QVC2 - HD Spectrum Sports Networ. -

Channel Lineup

47 847 Tennis Channel HD 182 982 HLN HD Stadium College Sports Pacific Enjoy a discount on more than Digital Basic - $35 46* 49 849 ACC Network HD 183 983 Fox News Channel HD 48 SEC one premium package. SD HD Station Name 50 850 The Golf Channel HD 185 985 CNBC HD 55 855 World Fishing Network HD 1 Remote Guide 52 852 NBC Sports Network HD 186 986 MSNBC HD 56 Outside Television 2 WLXI (61) TCT Add 2, save $1 53 853 Outdoor Channel HD 187 Fusion 57 TVG2 Circle 3 803 WCWG (20) CW HD Add 3, save $4 54 854 The Sportsman Channel HD 189 989 C-SPAN3 HD 5 8 Cars TV 4 804 WUNL (26) PBS HD Add 4, save $7 60 860 TV Land 191 991 Fox Business Channel HD 62 Boomerang 5 805 WGPX (16) ION HD 63 Universal Kids 994 AXS TV HD 67 UNC Kids 6 TBN HD HD HBO - $15.95 64 864 Disney Channel 995 HDNet Movies 75 875 Teen Nick HD 8 808 FOX (WGHP) HD HD HD 65 865 Disney XD 196 996 E! 77 877 Nicktoons Network HD SD HD** Station Name 9 809 CBS (WFMY) HD 66 Disney Junior US 197 997 QVC2 HD 79 GritTV 300 1300 HBO HD HD 10 810 ABC (WXLV) 68 868 Nickelodeon HD 198 998 HSN2 HD 301 1301 HBO Comedy HD 83 883 Destination America HD HD 11 811 MyTV (WMYV) 69 869 Cartoon Network HD 999 MTV LIVE HD 302 1302 HBO Family HD 84 884 Investigation Discovery HD HD 12 812 NBC (WXII) 76 876 Nick Jr HD 200 1200 MTV HD 303 1303 HBO2 HD 93 893 Smithsonian Network HD 14 ACTV (Alleghany TV) 80 880 Discovery Family Channel HD 201 1201 VH1 HD 304 1304 HBO Signature HD HD 98 Pets TV 16 816 QVC 82 882 Science HD 202 1202 CMT HD 305 1305 HBO Zone HD HD 104 My Destination TV 17 817 CSPAN 85 OWN 205 -

Frontier Fiberoptic TV Florida Residential Channel Lineup and TV

Frontier® FiberOptic TV Florida Channel Lineup Effective September 2021 Welcome to Frontier ® FiberOptic TV Got Questions? Get Answers. Whenever you have questions or need help with your Frontier TV service, we make it easy to get the answers you need. Here’s how: Online, go to Frontier.com/helpcenter to fi nd the Frontier User Guides to get help with your Internet and Voice services, as well as detailed instructions on how to make the most of your TV service. Make any night movie night. Choose from a selection of thousands of On Demand titles. Add to your plan with our great premium off erings including HBO, Showtime, Cinemax and Epix. Get in on the action. Sign up for NHL Center Ice, NBA League Pass and MLS Direct Kick. There is something for everyone. Check out our large selection of international off erings and specialty channels. Viewing Options: Look for this icon for channels that you can stream in the FrontierTV App or website, using your smart phone, tablet or laptop. The availability of streaming content depends on your Frontier package and content made available via various programmers. Certain channels are not available in all areas. Some live streaming channels are only available through the FrontierTV App and website when you are at home and connected to your Frontier equipment via Wi-Fi. Also, programmers like HBO, ESPN and many others have TV Everywhere products that Frontier TV subscribers can sign into and watch subscribed content. These partner products are available here: https://frontier.com/resources/tveverywhere 2 -

Celebrate Fusiontv Fusiontv Brings You an Enhanced TV Viewing Experience with More Local Features, Family Program- Ming, Movies and Sporting Events

Celebrate FusionTV FusionTV brings you an enhanced TV viewing experience with more local features, family program- ming, movies and sporting events. Thanks to the advanced fiber optic Fusion Network in Elkader and For more information on FusionTV, Guttenberg, everyone will enjoy the crystal clear just give us a call or stop by the office. picture and sound. FusionTV also gives you the option to choose the premium programming that fits your lifestyle and interests, as well as special features like Caller ID, Whole-Home DVR, Parental Controls and Exclusive Internet Content. Your Best Choice for With FusionTV, you’ll enjoy: Digital Television • Clear signal, no matter what the weather Phone: 563-245-4000 • An expanded channel line-up including PO Box 1008 • 923 Humphrey St. • Elkader, IA 52043 HD programming www.alpinecom.net • A wide variety of premium channels • Easy, in-home installation Premier Package - $69.95/month Lots of options for FusionTV Includes all Local Plus and Essential channels plus... Local Plus Package - $34.95/month your choosing ... AXS ESPN Classic American Heroes ACTV - Alpine TBN KCRG 9.1 BBC America ESPNews Military History Channel Video Packages CSPAN IPTV 32.1 FYI ESPN U MTV2 KPXR ION 48 Includes two standard definition digital boxes KPXR qubo 48.2 KFXA 28.1 Chiller Esquire MTV Hits KGAN CBS 2 Local Plus $34.95 KPXR ION Life 48.3 WGN Cloo Fox Business MTV Jams KWWL NBC 7 Essentials $59.95 KWKB2 20.2 CW Alpine Weather 100 CMT Pure Country FX Movies Nat Geo Wild KCRG ABC 9 Premier $69.95 KWWL This TV 7.2 KCRG 9.3 CNBC World G4 NBC Sports KRIN IPTV 32 KWWL METV 7.3 Weather Channel Cooking Channel Network HD Plus (Available with Premier) $4.95 GAC - Great Amer. -

Hawaiian Telcom TV Channel Packages

Hawaiian Telcom TV 604 Stingray Everything 80’s ADVANTAGE PLUS 1003 FOX-KHON HD 1208 BET HD 1712 Pets.TV 525 Thriller Max 605 Stingray Nothin but 90’s 21 NHK World 1004 ABC-KITV HD 1209 VH1 HD MOVIE VARIETY PACK 526 Movie MAX Channel Packages 606 Stingray Jukebox Oldies 22 Arirang TV 1005 KFVE (Independent) HD 1226 Lifetime HD 380 Sony Movie Channel 527 Latino MAX 607 Stingray Groove (Disco & Funk) 23 KBS World 1006 KBFD (Korean) HD 1227 Lifetime Movie Network HD 381 EPIX 1401 STARZ (East) HD ADVANTAGE 125 TNT 608 Stingray Maximum Party 24 TVK1 1007 CBS-KGMB HD 1229 Oxygen HD 382 EPIX 2 1402 STARZ (West) HD 1 Video On Demand Previews 126 truTV 609 Stingray Dance Clubbin’ 25 TVK2 1008 NBC-KHNL HD 1230 WE tv HD 387 STARZ ENCORE 1405 STARZ Kids & Family HD 2 CW-KHON 127 TV Land 610 Stingray The Spa 28 NTD TV 1009 QVC HD 1231 Food Network HD 388 STARZ ENCORE Black 1407 STARZ Comedy HD 3 FOX-KHON 128 Hallmark Channel 611 Stingray Classic Rock 29 MYX TV (Filipino) 1011 PBS-KHET HD 1232 HGTV HD 389 STARZ ENCORE Suspense 1409 STARZ Edge HD 4 ABC-KITV 129 A&E 612 Stingray Rock 30 Mnet 1017 Jewelry TV HD 1233 Destination America HD 390 STARZ ENCORE Family 1451 Showtime HD 5 KFVE (Independent) 130 National Geographic Channel 613 Stingray Alt Rock Classics 31 PAC-12 National 1027 KPXO ION HD 1234 DIY Network HD 391 STARZ ENCORE Action 1452 Showtime East HD 6 KBFD (Korean) 131 Discovery Channel 614 Stingray Rock Alternative 32 PAC-12 Arizona 1069 TWC SportsNet HD 1235 Cooking Channel HD 392 STARZ ENCORE Classic 1453 Showtime - SHO2 HD 7 CBS-KGMB 132 -

See TV in a Whole

1688 PAC-12 Washington HD NEW 1908 Starz! Cinema HD (E) NEW 3302 ESPN Deportes 1682 PAC-12 Network HD NEW 1904 Starz! Edge HD NEW 3077 EWTN en Espanol 106 Pay Per View Events HD 1902 Starz! HD (E) NEW 3303 FOX Deportes 1101 Pay Per View Events HD 1903 Starz! HD (W) NEW 3304 GolTV 1012 PBS HD (WHLADT) 1906 Starz! In Black HD NEW 3104 History en Espanol See TV in a whole 1170 Pets.TV HD NEW 1912 Starz! Kids and Family HD NEW 3056 La Familia Cosmovision 9161 Premier League Extra 1931 Starz! On Demand 3017 Latele Novela Time 1 HD NEW 1151 Syfy HD 3078 TBN Enlace 9162 Premier League Extra 1560 TBN HD 3024 TV Chile Time 2 HD NEW 1112 TBS HD 3020 Video Rola 9163 Premier League Extra 1010 The CW HD (WXOWDT2) 3013 WAPA America Time 3 HD NEW 1335 The Hub HD 9164 Premier League Extra 1225 The Weather Channel HD Time 4 HD NEW 1838 ThrillerMAX HD (E) 9165 Premier League Extra 1839 ThrillerMAX HD (W) International Programming Time 5 HD NEW 1250 TLC HD 1420 QVC HD 1882 TMC HD (E) NEW 3740 Al Jazeera America 1458 Recipe.TV HD NEW 1883 TMC HD (W) NEW 3710 Bollywood Hits on Demand 1799 REELZ HD 1888 TMC On Demand 3882 Channel One Russia 1916 RetroPlex HD NEW 1884 TMC Xtra HD (E) NEW 3603 China Central TV 1476 RFD-TV HD NEW 1885 TMC Xtra HD (W) NEW 3604 CTI-Zhong Tian Channel 1258 Science HD 1108 TNT HD 3682 Filipino on Demand 1424 ShopHQ HD 1/1/14 1254 Travel Channel HD 3802 Rai Italia 1789 Shorts NEW 1164 truTV HD 3704 Sony Entertainment 1854 Showtime 2 HD (E) NEW 1790 Turner Classic Movies HD Television Asia (SET Asia) 1855 Showtime 2 HD (W) NEW 1138 TV Land HD 3706 STAR India PLUS La Crosse 1860 Showtime Beyond HD (E) NEW 1157 TV One HD 3681 The Filipino Channel 1861 Showtime Beyond 4005 UniMas HD 3703 TV Asia HD (W) NEW 1104 Universal HD 3680 TV Japan Channel Lineup 1858 Showtime Extreme 1644 Universal Sports HD NEW 3832 TV5 Monde Channel lineup is subject to change. -

Your Favorite Channels at Your Fingertips

TV Channels *TVE - Watch TV Everywhere Basic Channels Golf Channel *TVE 33 533 Game Show Network *TVE 49 549 Basic Channels Hallmark Channel *TVE 54 554 A&E *TVE 35 535 Hallmark Movies & Mysteries 105 Your Favorite Channels Altitude 30 530 HGTV *TVE 43 543 AMC *TVE 59 559 Hillsong Channel 137 590 At Your Fingertips American Heroes *TVE 55 History Channel *TVE 37 537 Animal Planet *TVE 62 562 HLN *TVE 92 592 BBC America 76 576 HSN 18 Local Channels- Ogallala BBC World 79 579 IFC 66 566 BET *TVE 104 504 Investigation Discovery *TVE 50 550 VOD Video On Demand 1 Big 10 Network *TVE 21 521 INSP 144 KWGN CW 2 302 Boomerang 81 ION 563 KNOP NBC 3 303 Bravo *TVE 73 573 Jewelry 17 517 KNGH ABC 4 C-SPAN *TVE 146 Lifetime *TVE 46 546 KDVR FOX 5 305 C-SPAN2 147 Lifetime Movie Network *TVE 48 548 KHGI ABC 6 306 C-SPAN3 148 Lifetime Real Women 47 KCNC 7 CBS Cartoon Network *TVE 82 582 MLB Network 34 534 8 KUSA NBC CBS Sports Network 29 529 MSNBC *TVE 96 596 NET 1 PBS 9 309 Chiller 99 MTV *TVE 101 501 KNPL CBS 10 310 CMT *TVE 103 503 MTV Live 583 KTVD My Network 11 CNBC *TVE 97 597 Mun2 *TVE 108 TWC The Weather Channel 12 CNBC World 95 National Geographic Channel *TVE 45 545 KDUH ABC 13 311 CNN *TVE 91 591 NBC Sports Network *TVE 32 532 NET 4 PBS Kids 16 CNN en Español 110 NFL *TVE 31 531 NET 2 World 140 CNN International 98 Nick *TVE 88 588 NET 3 Create 141 Comedy Central *TVE 52 552 Olympic Channel 68 568 KGIN My Network 145 Destination America *TVE 78 578 OWN *TVE 58 564 Discovery Channel *TVE 44 544 Oxygen *TVE 75 575 Discovery en Español 112 Paramount Network *TVE 53 553 Discovery Familia 113 QVC *TVE 14 514 Discovery Family 86 586 Science Channel *TVE 77 577 Discovery Life *TVE 70 SONLIFE 136 Disney *TVE 85 585 SportsNet Rocky Mtn. -

Television Channel Guide • 1-877-666-4932

OmniTel Communications TELEVISION CHANNEL GUIDE www.omnitel.biz • 1-877-666-4932 Value TV 51 NFL Network HD 133 Bravo 264 COZI WOIDT4 52 The Golf Channel 134 Bravo HD 266 CREATE KDINDT4 1 OmniTel 53 The Golf Channel HD 135 FYI 267 THIS TV WHODT4 2 KDIN-DT2 (Kids HD) 54 Fox Sports 1 136 FYI Channel HD 268 TBD TV KDSMDT4 3 KDIN-DT2 (Kids HD) 55 Fox Sports 1 HD 137 E! Entertainment Television 269 Bounce KCWIDT3 4 KDIN-DT3 (World) 56 Bally’s Sports Midwest Plus HD 138 E! Entertainment Television HD 271 AXS TV 5 WOI (ABC) 57 NBCSN 141 The Travel Channel 280 Olympic Channel SD 6 WOI-DT (ABC HD) 58 NBCSN HD 142 The Travel Channel HD 281 Olympic Channel 7 WOI-DT2 (Laff) 59 Outdoor Channel 143 Cooking Channel 8 KCCI (CBS) 60 Outdoor Channel HD 145 Food Network 9 KCCIDT (CBS HD) Premium Packages 62 Fox Sports 2 146 Food Network HD 10 KCCIDT2 (Me TV) 63 Fox Sports 2 HD 147 Home & Garden Television 11 KDIN (PBS) HBO 69 TNT 148 HGTV HD 12 KDIN-DT (PBS HD) 290 Home Box Office 13 WHO (NBC) 70 Turner Network TV HD 149 Do-It-Yourself Network 291 HBO HD 14 WHO-DT (NBC HD) 71 USA Network 155 History 292 HBO 2 15 WHO-DT2 (Weather) 72 USA Network HD 156 History HD 294 HBO Signature 16 WHO-DT3 (Antenna TV) 73 FX 157 Viceland 296 HBO Family 17 KDSM (Fox) 74 FX HD 158 Viceland HD 298 HBO Comedy 18 KDSMDT (Fox HD) 75 Paramount Network 159 Military History Channel 300 HBO Zone 19 KDSM-DT2 (CometTV) 76 Paramount Network HD 163 National Geographic USA 20 KDSM-DT3 (CHARGE!) 77 Comedy Central 164 National Geographic HD Cinemax 21 KDMI-DT (Tri-State 78 Comedy Central -

Packages & Channel Lineup

™ ™ ENTERTAINMENT CHOICE ULTIMATE PREMIER PACKAGES & CHANNEL LINEUP ESNE3 456 • • • • Effective 6/17/21 ESPN 206 • • • • ESPN College Extra2 (c only) (Games only) 788-798 • ESPN2 209 • • • • • ENTERTAINMENT • ULTIMATE ESPNEWS 207 • • • • CHOICE™ • PREMIER™ ESPNU 208 • • • EWTN 370 • • • • FLIX® 556 • FM2 (c only) 386 • • Food Network 231 • • • • ™ ™ Fox Business Network 359 • • • • Fox News Channel 360 • • • • ENTERTAINMENT CHOICE ULTIMATE PREMIER FOX Sports 1 219 • • • • A Wealth of Entertainment 387 • • • FOX Sports 2 618 • • A&E 265 • • • • Free Speech TV3 348 • • • • ACC Network 612 • • • Freeform 311 • • • • AccuWeather 361 • • • • Fuse 339 • • • ActionMAX2 (c only) 519 • FX 248 • • • • AMC 254 • • • • FX Movie 258 • • American Heroes Channel 287 • • FXX 259 • • • • Animal Planet 282 • • • • fyi, 266 • • ASPiRE2 (HD only) 381 • • Galavisión 404 • • • • AXS TV2 (HD only) 340 • • • • GEB America3 363 • • • • BabyFirst TV3 293 • • • • GOD TV3 365 • • • • BBC America 264 • • • • Golf Channel 218 • • 2 c BBC World News ( only) 346 • • Great American Country (GAC) 326 • • BET 329 • • • • GSN 233 • • • BET HER 330 • • Hallmark Channel 312 • • • • BET West HD2 (c only) 329-1 2 • • • • Hallmark Movies & Mysteries (c only) 565 • • Big Ten Network 610 2 • • • HBO Comedy HD (c only) 506 • 2 Black News Channel (c only) 342 • • • • HBO East 501 • Bloomberg TV 353 • • • • HBO Family East 507 • Boomerang 298 • • • • HBO Family West 508 • Bravo 237 • • • • HBO Latino3 511 • BYUtv 374 • • • • HBO Signature 503 • C-SPAN2 351 • • • • HBO West 504 • -

Casscomm Tv Channel Guide

CASSCOMM TV CHANNEL GUIDE 1-800-252-1799 www.casscomm.com Havana, Buzzville, Manito, Talbott, Spring Lake, Easton, Bath, Forest City, Goofy Ridge, Mason City NetPak (Basic) BroadVision (Exp Basic) Digital Basic # Channel # Channel # Channel 1 Guide User Video 35 Golf Channel HD, WTVE 200 Discovery Family, WTVE 2 WAOE (MyNet) HD 36 Disney Channel HD, WTVE 201 Science Channel, WTVE 3 WMBD (CBS) HD 37 Disney XD HD, WTVE 202 Destination America, WTVE 4 WTVP (PBS) 38 Paramount HD, WTVE 203 ESPN News HD, WTVE 5 WYZZ (FOX) HD 39 GSN HD, WTVE 204 WE HD, WTVE 6 WEEK (CW) HD 40 HGTV HD, WTVE 205 Nick Jr., WTVE 7 PBS World 41 Travel Channel HD, WTVE 210 RFD TV 8 Hometown Happenings (H2) 42 Food Network HD, WTVE 211 Discovery Life, WTVE 9 INSP HD 43 EWTN 212 Outdoor Channel HD 10 WEEK (NBC) HD 44 E! HD, WTVE 216 OWN, WTVE 11 WEEK (ABC) HD 45 FX HD, WTVE 217 American Heroes, WTVE 12 The Weather Channel HD,WTVE 46 Nickelodeon HD, WTVE 218 Fox Business, WTVE 13 WICS (ABC) HD 47 TV Land HD, WTVE 220 FYI HD, WTVE 101 The Create Channel 48 USA HD, WTVE 221 Viceland HD, WTVE 102 This TV 49 Lifetime HD, WTVE 222 Hallmark Drama HD 103 MeTV 50 Freeform HD, WTVE 223 The Blaze HD 104 Comet 51 Comedy Central HD, WTVE 224 BET Her, WTVE 105 Cozi TV 52 Cartoon Network HD, WTVE 226 TEEN Nick 112 Antenna TV 53 Syfy HD, WTVE 227 Olympic Channel HD, WTVE 54 Fox News HD, WTVE 228 Hallmark Movies & Myst HD, WTVE 55 AMC HD, WTVE 229 Disney Junior, WTVE 56 Bravo HD, WTVE 230 Nick Toons BroadVision (Exp Basic) 57 TNT HD, WTVE 231 Fuse HD, WTVE 58 Hallmark Channel HD, WTVE -

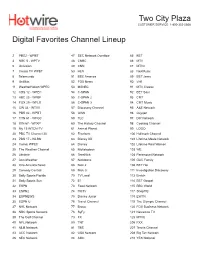

Digital Favorites Channel Lineup

Two City Plaza CUSTOMER SERVICE: 1-800-355-5668 Digital Favorites Channel Lineup 2 PBS2 - WPBT 47 SEC Network Overflow 85 BET 3 NBC 5 - WPTV 48 CNBC 86 MTV 5 Univision 49 CNN 87 MTV2 7 Create TV WPBT 50 HLN 88 NickMusic 8 Telemundo 51 BBC America 89 BET Jams 9 UniMas 52 FOX News 90 VH1 11 WeatherNation WPEC 53 MSNBC 91 MTV Classic 12 CBS 12 - WPEC 54 C-SPAN 92 BET Soul 13 ABC 25 - WPBF 55 C-SPAN 2 93 CMT 14 FOX 29 - WFLX 56 C-SPAN 3 94 CMT Music 15 CW 34 - WTVX 57 Discovery Channel 95 A&E Network 16 PBS 42 - WPBT 58 OWN 96 Oxygen 17 CTN 61 - WFGC 59 TLC 97 DIY Network 18 ION 67 - WPXP 60 The History Channel 98 Cooking Channel 19 My 15 WTCN-TV 61 Animal Planet 99 LOGO 20 PBC TV Channel 20 62 Freeform 100 Hallmark Channel 23 PBS 17 - WLRN 63 Disney XD 101 Lifetime Movie Network 24 Comet WPEC 64 Disney 102 Lifetime Real Women 25 The Weather Channel 65 Nickelodeon 103 WE 26 Lifetime 66 TeenNick 104 Paramount Network 27 AccuWeather 67 Nicktoons 105 GAC Family 28 One America News 68 Nick 2 106 BET Her 29 Comedy Central 69 Nick Jr 111 Investigation Discovery 30 Bally Sports Florida 70 TV Land 113 Enrich 31 Bally Sports Sun 72 E! 114 BET Gospel 32 ESPN 73 Food Network 115 BBC World 33 ESPN2 74 HGTV 117 ShopHQ 34 ESPNEWS 75 Disney Junior 118 EWTN 35 ESPN U 76 Travel Channel 119 The Olympic Channel 37 NHL Network 77 Bravo 120 FOX Business Network 38 NBC Sports Network 78 SyFy 121 Newsmax TV 39 The Golf Channel 79 FX 125 MTVU 40 NFL Network 80 TNT 205 FXX 41 MLB Network 81 TBS 207 Tennis Channel 43 ACC Network 82 USA Network 208 Big Ten Network