National Hockey League

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Listening to a Legend

Summer 2011 For Alumni and Friends of the University Listening to a Legend Plus: MEN'S BASKETBALL SENIORS 10 YEARS BARNES ARICO MULLIN TO HALL OF FAME first glance The Thrill Is Back It was a season of renewed excitement as the Red Storm men’s basketball team brought fans to their feet and returned St. John’s to a level of national prominence reminiscent of the glory days of old. Midway through the season, following thrilling victories over nationally ranked opponents, students began poking good natured fun at Head Coach Steve Lavin’s California roots by dubbing their cheering section ”Lavinwood.” president’s message Dear Friends, As you are all aware, St. John’s University is primarily an academic institution. We have a long tradition of providing quality education marked by the uniqueness of our Catholic, Vincentian and metropolitan mission. The past few months have served as a wonderful reminder, fan base this energized in quite some time. On behalf of each and however, that athletics are also an important part of the St. John’s every Red Storm fan, I’d like to thank the recently graduated seniors tradition, especially our storied men’s basketball program. from both the men’s and women’s teams for all their hard work and This issue of theSt. John’s University Magazine pays special determination. Their outstanding contributions, both on and off the attention to Red Storm basketball, highlighting our recent success court, were responsible for the Johnnies’ return to prominence and and looking back on our proud history. I hope you enjoy the profile reminded us of how special St. -

Work Readiness Entrepreneurship Financial Literacy

Annual Report 2010 work readiness entrepreneurship financial literacy Year At A Glance V F A T I-S A A-S S F A S 2200 “JA provides an exceptional opportunity for my stu- 270 “When I went through the Finance Park pilot 2100 260 2000 dents to hear how their content knowledge applies in program last year, I realized how complicated being 1900 the real world. I continue to reach out year after year 250 an adult would be! After six weeks of training, 1800 because of the warmth and energy of volunteers!” 240 I became an adult for a day and learned that 1700 managing finances can be tough! ere are so many Jamie Gadley 230 1600 things I take for granted— entertainment, food, cell 1500 4th Grade Teacher 220 phones—all of them have to come out of the budget! 1400 Dogwood Elementary School 1300 200 And that’s just the beginning. 1200 180 I thank Junior Achievement for instilling in me, 1100 S C H 160 and thousands of other students, the tools we need 1000 ( ) 900 140 to be prepared for the competitive world in front 280 800 of us. Because of your commitment, we have every 120 700 260 reason to be excited. Junior Achievement has helped 600 100 240 me feel prepared to overcome the challenges ahead 500 80 and reach my financial goals.” 400 220 300 60 James Joo 200 200 40 9th Grade 100 180 W.T. Woodson High School 20 0 160 04 05 06 07 08 09 10 0 140 04 05 06 07 08 09 10 F A V 120 C 100 “I enjoy teaching the students and I love seeing S S 1 Leadership’s Message their bright eyes, smiles, and curious minds 80 ( ) 2 Student Competitions absorb business knowledge. -

An Ice Hockey Legend, Mario Lemieux (1949 – ) Rewrote the Sport's Record

An ice hockey legend, Mario Lemieux (1949 – ) rewrote the sport’s record books. Having lead his team to multiple championships and his country to gold medals, Lemieux is one of the most decorated athletes of his generation. Despite being unable to play for three years due to a cancer diagnosis and injuries, Lemieux’s career statistics stand up against the best of all-time. Use the diagrams or the given dimensions to calculate the indicated measurement. Round to the nearest tenth. The word or phrase next to the correct response will complete the statement. Find the Area Find the Circumference Mario Lemieux was born in ____, QC, Canada. At age three Lemieux and his brothers a. 113.1 Montréal practiced hockey in their basement with ____. b. 215.7 Quebec City a. 14.1 toy swords c. 452.3 Sherbrooke b. 14.9 tree branches c. 15.7 wooden spoons Find the Area Find the Circumference According to family legend, they would In the 1984 draft, Lemieux was chosen first ________ in the living room so they could overall by the ________. practice at dark. a. 100 Chicago Blackhawks a. 920,866.0 build goals out of tables b. 105 Edmonton Oilers b. 1,539,380.4 pack snow in the carpet c. 110 Pittsburgh Penguins c. 1,813,429.5 remove all furniture If d = 3.5, Find the Area If r = 28, Find the Circumference In the 1988-89 season, Lemieux totaled a Despite suffering a _______, Lemieux led his mammoth 199 points including ______. team to the first of two consecutive Stanley a. -

Ticket Sales Report

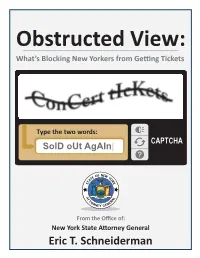

Obstructed View: What’s Blocking New Yorkers from Geng Tickets Type the two words: CAPTCHA SolD oUt AgAIn| From the Office of: New York State Aorney General Eric T. Schneiderman 1 This report was a collaborative effort prepared by the Bureau of Internet and Technology and the Research Department, with special thanks to Assistant Attorneys General Jordan Adler, Noah Stein, Aaron Chase, and Lydia Reynolds; Director of Special Projects Vanessa Ip; Researcher John Ferrara; Director of Research and Analytics Lacey Keller; Bureau of Internet and Technology Chief Kathleen McGee; Chief Economist Guy Ben-Ishai; Senior Enforcement Counsel and Special Advisor Tim Wu; and Executive Deputy Attorney General Karla G. Sanchez. 1 TABLE OF CONTENTS Executive Summary ....................................................................... 3 The History of, and Policy Behind, New York’s Ticketing Laws ....... 7 Current Law ................................................................................... 9 Who’s Who in the Ticketing Industry ........................................... 10 Findings ....................................................................................... 11 A. The General Public Loses Out on Tickets to Insiders and Brokers .................................................................... 11 1. The Majority of Tickets for Popular Concerts Are Not Reserved For the General Public .......................................................................... 11 2. Brokers & Bots Buy Tickets in Bulk, Further Crowding Out Fans ...... 15 -

Download Chauffeur Application

All Transportation Network Inc. 800-525-2306 Chauffeur Application Full Name ______________________________ Phone # ________________________________ Present Address _________________________ Social Security # _________________________ City, State, Zip _________________________ Date of Birth ____________________________ Driver's License # ________________________ Class of License & Endorsements ___________ Availability Part Time _____________ Full Time ____________ Please specify schedule available to work: Weekdays (Monday-Friday) ______________________________________________________________ Weekends (Saturday-Sunday) ____________________________________________________________ If hired, what day will you be available to start? _______________________________________________ Have you been convicted of a crime or felony within the last 5 years? Yes ______ No _______ If yes, please explain the conviction: ________________________________________________________ _____________________________________________________________________________________ (The existence of a criminal record does not create an automatic barrier to employment) Have you had any accidents in the last 5 years? Yes ______ No _______ If yes, please explain: __________________________________________________________________ _____________________________________________________________________________________ Have you had received any tickets in the last 5 years? Yes ______ No _______ If yes, please explain: __________________________________________________________________ -

Mario Lemieux, Jennifer Capriati

University of Central Florida STARS On Sport and Society Public History 2-5-2001 Mario Lemieux, Jennifer Capriati Richard C. Crepeau University of Central Florida, [email protected] Part of the Cultural History Commons, Journalism Studies Commons, Other History Commons, Sports Management Commons, and the Sports Studies Commons Find similar works at: https://stars.library.ucf.edu/onsportandsociety University of Central Florida Libraries http://library.ucf.edu This Commentary is brought to you for free and open access by the Public History at STARS. It has been accepted for inclusion in On Sport and Society by an authorized administrator of STARS. For more information, please contact [email protected]. Recommended Citation Crepeau, Richard C., "Mario Lemieux, Jennifer Capriati" (2001). On Sport and Society. 615. https://stars.library.ucf.edu/onsportandsociety/615 SPORT AND SOCIETY FOR H-ARETE February 5, 2001 The comeback of Mario Lemieux with the Pittsburgh Penguins has converged very nicely with that of Jennifer Capriati. In the past week Capriati completed her long climb back to the top of women's tennis, and in the middle of his latest comeback Lemieux was voted NHL player of the month for January. For Lemieux this is at least the second comeback of his remarkable career. The first calamity struck in January of 1993 when Mario was diagnosed with a form of Hodgkin's disease. Radiation treatments ravaged his body and he was unable to perform normal everyday tasks, let alone play hockey. After sitting out the 1994-95 season he came back and performed better than ever continuing at the record breaking pace of points and goals that once made him a legitimate threat to challenge the scoring records of Wayne Gretzky. -

Télécharger La Page En Format

Portail de l'éducation de Historica Canada Canada's Game - The Modern Era Overview This lesson plan is based on viewing the Footprints videos for Gordie Howe, Bobby Orr, Father David Bauer, Bobby Hull,Wayne Gretzky, and The Forum. Throughout hockey's history, though they are not presented in the Footprints, francophone players like Guy Lafleur, Mario Lemieux, Raymond Bourque, Jacques Lemaire, and Patrick Roy also made a significant contribution to the sport. Parents still watch their children skate around cold arenas before the sun is up and backyard rinks remain national landmarks. But hockey is no longer just Canada's game. Now played in cities better known for their golf courses than their ice rinks, hockey is an international game. Hockey superstars and hallowed ice rinks became national icons as the game matured and Canadians negotiated their role in the modern era. Aims To increase student awareness of the development of the game of hockey in Canada; to increase student recognition of the contributions made by hockey players as innovators and their contributions to the game; to examine their accomplishments in their historical context; to explore how hockey has evolved into the modern game; to understand the role of memory and commemoration in our understanding of the past and present; and to critically investigate myth-making as a way of understanding the game’s relationship to national identity. Background Frozen fans huddled in the open air and helmet-less players battled for the puck in a -28 degree Celsius wind chill. The festive celebration was the second-ever outdoor National Hockey League game, held on 22 November 2003. -

Lfl-Press-Kit.Pdf

In the United States today, more than 2,500 individuals are serving life-without-parole sentences for crimes they committed when they were 17 years old or younger. Children as young as 13 are among the thousands serving these sentences. Lost for Life, a new film from director Joshua Rofé, produced by Ted Leonsis, Rick Allen, Mark Jonathan Harris (director of three Academy Award-winning films) and Peter Landesman, tells the stories of these individuals, of their families’ and of the families of victims of juvenile murder. The result of four years of Rofé’s intensive effort, Lost for Life is a searing documentary—one that tackles this contentious issue from multiple perspectives and explores the complexity of the affected individuals’ lives. Lost for Life refuses to give easy answers, but prompts many questions, and forces us to consider what we mean by justice, punishment, mercy, redemption and forgiveness. And this conversation is vitally important. On June 25, 2012, the Supreme Court issued an historic ruling in Miller v. Alabama, holding that mandatory life-without-parole sentences for juveniles constitute cruel and unusual punishment in violation of the Eighth Amendment to the U.S. Constitution. In arriving at this decision, the Court recognized that children are fundamentally different from adults, and the criminal justice system must treat them accordingly. Brain science has demonstrated that juveniles’ lack of maturity may include a biologically underdeveloped sense of responsibility, which may lead to recklessness, impulsivity, and heedless risk taking. Prior to this decision, in some states, certain crimes carried with them a mandatory sentence of life-without-parole upon conviction. -

2009-2010 Colorado Avalanche Media Guide

Qwest_AVS_MediaGuide.pdf 8/3/09 1:12:35 PM UCQRGQRFCDDGAG?J GEF³NCCB LRCPLCR PMTGBCPMDRFC Colorado MJMP?BMT?J?LAFCÍ Upgrade your speed. CUG@CP³NRGA?QR LRCPLCRDPMKUCQR®. Available only in select areas Choice of connection speeds up to: C M Y For always-on Internet households, wide-load CM Mbps data transfers and multi-HD video downloads. MY CY CMY For HD movies, video chat, content sharing K Mbps and frequent multi-tasking. For real-time movie streaming, Mbps gaming and fast music downloads. For basic Internet browsing, Mbps shopping and e-mail. ���.���.���� qwest.com/avs Qwest Connect: Service not available in all areas. Connection speeds are based on sync rates. Download speeds will be up to 15% lower due to network requirements and may vary for reasons such as customer location, websites accessed, Internet congestion and customer equipment. Fiber-optics exists from the neighborhood terminal to the Internet. Speed tiers of 7 Mbps and lower are provided over fiber optics in selected areas only. Requires compatible modem. Subject to additional restrictions and subscriber agreement. All trademarks are the property of their respective owners. Copyright © 2009 Qwest. All Rights Reserved. TABLE OF CONTENTS Joe Sakic ...........................................................................2-3 FRANCHISE RECORD BOOK Avalanche Directory ............................................................... 4 All-Time Record ..........................................................134-135 GM’s, Coaches ................................................................. -

UWE 11131 Annualreport Mec Cover And

MEANINGFUL RESULTS2014-2015 ANNUAL REPORT & LEADERSHIP SOCIETY MEMBERSHIP ROSTER United Way of Buffalo & Erie County THE POWER OF POSITIVE CHANGE Thanks to the support of our generous donors, volunteers, sponsors and partners, United Way exceeded its 2014 campaign goal, allowing us to make a meaningful difference in our community by improving quality of life for thousands of people. PEOPLE 5,300 VOLUNTEERED 27, HOURS OUR MISSION United Way brings people, organizations and resources together to improve community well-being. OUR VISION Every person in our community has the opportunity to enjoy the highest possible quality of life. OUR VALUES ENDOWMENT RAISED · Service $900K OVER THE in new grant awards · Integrity for partner initiatives $7M in gifts PAST 4 YEARS · Collaboration · Accountability PROGRAMS & SERVICES · Innovation $4.5M RECEIVED FUNDING 13,900 children improved 23,200 people improved academic performance their financial stability & related skills or employment skills 18,200 people improved 32,000 people received their health, safety needed services in or well-being a time of crisis MEANINGFUL MILESTONES BUILDING A STRONGER COMMUNITY MEANINGFUL MILESTONES CAMPAIGNS In 2014, the United Way campaign grew for the fifth consecutive year, yielding numerous key accomplishments that help children reach their full potential, adults and families become more self-sufficient, and people of all ages improve their health and well-being. 27% $301K $100K+ $171K+ RAISED FROM 75 NEW WORKPLACE CAMPAIGNS 10% RETAIL CHECKOUT SCANNING PROGRAM “When you support United Way with your time, talent and contributions, you help build solutions for thousands of people in Erie County facing critical challenges such as poverty. -

Pregame Notes

PREGAME NOTES 2019 TIM HORTONS NHL HERITAGE CLASSIC WINNIPEG JETS vs. CALGARY FLAMES MOSAIC STADIUM, REGINA, SASK. – OCT. 26, 2019 JETS, FLAMES FACE OFF OUTDOORS The Winnipeg Jets and Calgary Flames face off tonight in the 2019 Tim Hortons NHL Heritage Classic (10 p.m. ET / 8 p.m. CST, CBC, SN1, CITY, TVAS2, NBCSN) – the League’s 28th regular-season outdoor game and fifth in the Heritage Classic series. The Jets and Flames each have participated in one prior outdoor game, both under the Heritage Classic umbrella. Winnipeg played host to the 2016 Tim Hortons NHL Heritage Classic at Investors Group Field, falling 3-0 to the Edmonton Oilers. Nine Jets players who appeared in that game remain with the team: Kyle Connor, Nikolaj Ehlers, Connor Hellebuyck, Patrik Laine, Adam Lowry, Josh Morrissey, Mathieu Perreault, Mark Scheifele and Blake Wheeler. Current Calgary goaltender Cam Talbot started for Edmonton in that contest, stopping all 31 shots he faced for the third shutout in outdoor NHL game history. Current Jets forward Mark Letestu scored the winning goal (while shorthanded), as a member of the Oilers. And current Flames forward Milan Lucic recorded two penalty minutes for Edmonton. Calgary served as hosts for the 2011 Tim Hortons NHL Heritage Classic at McMahon Stadium, defeating the Montreal Canadiens 4-0. Two players who appeared in that game remain with the Flames: Mikael Backlund and Mark Giordano. Overall, the Jets feature 11 players who have participated in a prior outdoor NHL game (minimum: 1 GP in 2019-20), while the Flames have four. Talbot leads that group with four such appearances, though he served as a backup goaltender for three of them (2014 SS w/ NYR [2 GP], 2019 SS w/ PHI). -

THE BOSTON BRUINS WEEK AHEAD September 29 - October 5

FOR IMMEDIATE RELEASE Contact: Matthew Chmura September 28, 2018 617.624.1913 Brandon McNelis 857.241.8343 Travis Basciotta 617.459.6853 THE BOSTON BRUINS WEEK AHEAD September 29 - October 5 STAT OF THE WEEK: Currently on the Bruins roster there are 15 American and nine European players. Only five Canadian players remain after Training Camp cuts. MEDIA DAY: The Boston Bruins will hold their annual Media Day on Monday, October 1, at Warrior Ice Arena beginning with the team’s 12:00 p.m. practice. Approximately 15 minutes after practice, the team will hold a press conference in the Event Room (concourse level 3) with Owner Jeremy Jacobs, CEO Charlie Jacobs, President Cam Neely, General Manager Don Sweeney and Head Coach Bruce Cassidy. After the press conference, Bruins players will be available to the media inside the locker room. A media luncheon will be held in the Event Room after the player availability. Please note that the practice is closed to the general public. Media planning on attending should RSVP to Sarah McMahon ([email protected]). QUOTE OF THE WEEK: “I’m not really a morning guy and I’ve been waking up pretty early, maybe due to the time, like I wake up before my alarm clock and that’s probably a first in a couple years [laughs].”– Trent Frederic on adjusting to the time change coming back from China. TWEET OF THE WEEK (WEEK 5): @JoeyMacHockey (Joe McDonald, The Athletic): “I'm sure we're going to see many Halak-ious saves this season. I have no idea what that means.” HONORABLE MENTION: @HackswithHaggs (Joe Haggerty, NBCS Boston): “Looked like somebody named Joe Hicketts was lining up Brad Marchand a run as he was dangling with the puck.