Statement of Accounts 2014/15

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Working for Outwood Grange Academies Trust

Working for Outwood Grange Academies Trust Welcome, Thank you for choosing to apply to Outwood. If you are successful, we hope that you will have an enjoyable and fulfi lling career with us and that together, we continue to have a positive impact on the life-chances of thousands of young people. While this pack will provide you with all the details you’ll need as you progress with your application, and hopefully your career with us, I wanted to introduce myself as the Chief Executive and Accounting Offi cer of Outwood Grange Academies Trust and introduce the Outwood vision to you. Quite simply, we want to be known for putting Students First, raising standards and transforming lives. It’s a bold vision, we know, but every day our colleagues strive to put it in place, whether that be in the classroom or in one of our business services roles, and we make sure we support every Outwood colleague in doing so. Whether you’re joining us as a support staff member, an NQT, teacher or in a leadership position, and everything in between, we will invest in you and your development throughout your career. By all working together, supporting and motivating each other, we believe we can raise current standards, and transform the lives of our students. We fully understand that as a Trust if we support and care for you to help you reach your potential, then in turn we can help ensure all the children in your charge will also reach theirs. With all but one of our inspected academies now rated as a Good or Outstanding school, even though almost all of them joined the Trust when they were inadequate or requiring improvement, now is an exciting time to join us. -

Bullock70v.1.Pdf

CONTAINS PULLOUTS Spatial Adjustments in the Teesside Economy, 1851-81. I. Bullock. NEWCASTLE UNIVERSITY LIBRARY ---------------------------- 087 12198 3 ---------------------------- A Thesis Submitted to the University of Newcastle upon Tyne in Fulfilment of the Requirements for the Degree of PhD, Department of Geography 1970a ABSTRACT. This study is concerned with spatial change in a reg, - ional economy during a period of industrialization and rapid growth. It focuses on two main issues : the spatial pattl-rn of economic growth, and the locational adjustments induced and required by that process in individual sectors of the economy. Conceptually, therefore, the thesis belongs to the category of economic development studies, but it also makes an empirical contribution to knowledge of Teesside in a cru- cial period of the regionts history. In the first place, it was deemed necessary to estab- lish that economic growth did occur on Teesside between 1851 and 1881. To that end, use was made of a number of indirect indices of economic performance. These included population change, net migration, urbanization and changes in the empl. oyment structure of the region. It was found that these indicators provided evidence of economic growth, and evide- nce that growth was concentrated in and around existing urban centres and in those rural areas which had substantial mineral resources. To facilitate the examination of locational change in individual sectors of the economy - in mining, agriculture, manufacturing and the tertiary industries -, the actual spa- tial patterns were compared with theoretical models based on the several branches of location theory. In general, the models proved to be useful tools for furthering understand- ing of the patterns of economic activity and for predicting the types of change likely to be experienced during industr- ial revolution. -

Cleveland Naturalists' Field Club and a Valued Contributor, After First Accepting the British

1 CLEVELAND NATURALISTS’ FIELD CLUB RECORD OF PROCEEDINGS 1920 - 1925 VOL.III. Part IV. Edited by Ernest W. Jackson F.I.C., F.G.S. PRICE THREE SHILLINGS (FREE TO MEMBERS) MIDDLESBROUGH; JORDISON AND CO., LTD, PRINTERS AND PUBLISHERS 1926 CONTENTS MEMOIR OF W.H. THOMAS - J.W.R. PUNCH 187 ROSEBERRY TOPPING IN FACT AND FICTION - J.J. BURTON, F.G.S. 190 WHITE FLINT NEAR LEALHOLME - EARNEST W. JACKSON, F.I.C. 206 THE MOUND BREAKERS OF CLEVELAND - WILLIAM HORNSBY, B.A 209 PEAT DEPOSITS AT HARTLEPOOL - J INGRAM, B. SC 217 COLEOPTERA OBSERVED IN CLEVELAND - M LAWSON THOMPSON, F.E.S. 222 ORIGIN OF THE FIELD CLUB - THE LATE J.S. CALVERT 226 MEMOIRS OF J.S. CALVERT - J.J. BURTON 229 MEMOIR OF BAKER HUDSON - F ELGEE 233 OFFICERS 1926 President Ernest W Jackson F.I.C., F.G.S Vice-Presidents F Elgee Miss Calvert J J Burton F.G.S. M.L.Thompson F.E.S. J W R Punch T A Lofthouse A.R.I.B.A., F.E.S H Frankland Committee Mrs Hood Miss Cotton C Postgate Miss Vero Dr Robinson P Hood Hon Treasurer H Frankland, Argyle Villa, Whitby Sectional Secretaries Archaeology – P Hood Geology – J J Burton, F.G.S. Botany – Miss Calvert Ornithology ) Conchology ) and ) - T A Lofthouse And )- T A Lofthouse Mammalogy ) F.E.S. Entomology ) F.E.S. Microscopy – Mrs Hood Hon. Secretaries G Knight, 16 Hawthorne Terrace, Eston M Odling, M.A., B.Sc.,”Cherwell,” the Grove, Marton-in-Cleveland Past Presidents 1881 - Dr W Y Veitch M.R.C.S. -

Open PDF 715KB

LBP0018 Written evidence submitted by The Northern Powerhouse Education Consortium Education Select Committee Left behind white pupils from disadvantaged backgrounds Inquiry SUBMISSION FROM THE NORTHERN POWERHOUSE EDUCATION CONSORTIUM Introduction and summary of recommendations Northern Powerhouse Education Consortium are a group of organisations with focus on education and disadvantage campaigning in the North of England, including SHINE, Northern Powerhouse Partnership (NPP) and Tutor Trust. This is a joint submission to the inquiry, acting together as ‘The Northern Powerhouse Education Consortium’. We make the case that ethnicity is a major factor in the long term disadvantage gap, in particular white working class girls and boys. These issues are highly concentrated in left behind towns and the most deprived communities across the North of England. In the submission, we recommend strong actions for Government in particular: o New smart Opportunity Areas across the North of England. o An Emergency Pupil Premium distribution arrangement for 2020-21, including reform to better tackle long-term disadvantage. o A Catch-up Premium for the return to school. o Support to Northern Universities to provide additional temporary capacity for tutoring, including a key role for recent graduates and students to take part in accredited training. About the Organisations in our consortium SHINE (Support and Help IN Education) are a charity based in Leeds that help to raise the attainment of disadvantaged children across the Northern Powerhouse. Trustees include Lord Jim O’Neill, also a co-founder of SHINE, and Raksha Pattni. The Northern Powerhouse Partnership’s Education Committee works as part of the Northern Powerhouse Partnership (NPP) focusing on the Education and Skills agenda in the North of England. -

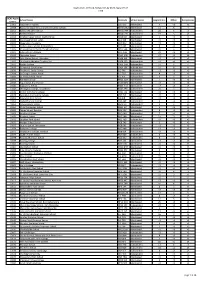

Is Your School

URN DFE School Name Does your Does your Is your Number school school meet our school our attainment eligible? Ever6FSM criteria? 137377 8734603 Abbey College, Ramsey Ncriteria? N N 137083 3835400 Abbey Grange Church of England Academy N N N 131969 8654000 Abbeyfield School N N N 138858 9284069 Abbeyfield School N Y Y 139067 8034113 Abbeywood Community School N Y Y 124449 8604500 Abbot Beyne School N Y Y 102449 3125409 Abbotsfield School N Y Y 136663 3115401 Abbs Cross Academy and Arts College N N N 135582 8946906 Abraham Darby Academy Y Y Y 137210 3594001 Abraham Guest Academy N Y Y 105560 3524271 Abraham Moss Community School Y Y Y 135622 3946905 Academy 360 Y Y Y 139290 8884140 Academy@Worden N Y Y 135649 8886905 Accrington Academy N Y Y 137421 8884630 Accrington St Christopher's Church of England High School N N N 111751 8064136 Acklam Grange School A Specialist Technology College for Maths and Computing N Y Y 100053 2024285 Acland Burghley School Y Y Y 138758 9265405 Acle Academy N N Y 101932 3074035 Acton High School Y Y Y 137446 8945400 Adams' Grammar School N N N 100748 2094600 Addey and Stanhope School Y Y Y 139074 3064042 Addington High School Y Y Y 117512 9194029 Adeyfield School N Y Y 140697 8514320 Admiral Lord Nelson School N N N 136613 3844026 Airedale Academy N Y Y 121691 8154208 Aireville School N N Y 138544 8884403 Albany Academy N N N 137172 9374240 Alcester Academy N N N 136622 9375407 Alcester Grammar School N N N 124819 9354059 Alde Valley School N N Y 134283 3574006 Alder Community High School N Y Y 119722 8884030 -

2014 Annual Newsletter

THE FRIENDS OF LINTHORPE CEMETERY & NATURE RESERVE YEARLY NEWSLETTER – JANUARY 2014 Welcome to an update from The Friends of Linthorpe Cemetery and Nature Reserve. It has been an extremely busy and productive year and we have been pleased to have seen so many people come to this valued green space throughout the past months. The year started with the Friends Annual General Meeting on 7 th February. Keith Harker retired as Treasurer and Alison Brown was proposed as the new Treasurer. The Committee members were voted in unopposed and with no further changes. Keith Harker carried out a Winter Bird Count on behalf of the Friends and the findings were passed to the RSPB who are collating information as part of a three year mapping of birds. March saw members of the public helping with our Planting and Clean Up Day which was very much appreciated. Wildflowers and bulbs were planted around the Information Centre and the Butterfly Tree Meadow. The group carried out a detailed survey of people using the cemetery. The results indicated a favourable account of what we are trying to achieve and Peter Kettlewell, former Head of Bereavement Services, accepted the survey which became part of the application for Green Flag status. Peter Kettlewell mentioned that he had a pot of money he had earmarked for the renovaton of a selection of graves. We were constricted by the amount so we were only able to renovate five at the moment but we are delighted that this list may be added to. The memorial to Father Burn, who lies near the Nursery Lane Entrance, was renovated. -

Industry in the Tees Valley

Industry in the Tees Valley Industry in the Tees Valley A Guide by Alan Betteney This guide was produced as part of the River Tees Rediscovered Landscape Partnership, thanks to money raised by National Lottery players. Funding raised by the National Lottery and awarded by the Heritage Lottery Fund It was put together by Cleveland Industrial Archaeology Society & Tees Archaeology Tees Archaeology logo © 2018 The Author & Heritage Lottery/Tees Archaeology CONTENTS Page Foreword ........................................................................................ X 1. Introduction....... ...................................................................... 8 2. The Industrial Revolution .......... .............................................11 3. Railways ................................................................................ 14 4. Reclamation of the River ....................................................... 18 5. Extractive industries .............................................................. 20 6. Flour Mills .............................................................................. 21 7. Railway works ........................................................................ 22 8. The Iron Industry .................................................................... 23 9. Shipbuilding ........................................................................... 27 10. The Chemical industry ............................................................ 30 11. Workers ................................................................................. -

Royal Air Force Visits to Schools

Location Location Name Description Date Location Address/Venue Town/City Postcode NE1 - AFCO Newcas Ferryhill Business and tle Ferryhill Business and Enterprise College Science of our lives. Organised by DEBP 14/07/2016 (RAF) Enterprise College Durham NE1 - AFCO Newcas Dene Community tle School Presentations to Year 10 26/04/2016 (RAF) Dene Community School Peterlee NE1 - AFCO Newcas tle St Benet Biscop School ‘Futures Evening’ aimed at Year 11 and Sixth Form 04/07/2016 (RAF) St Benet Biscop School Bedlington LS1 - Area Hemsworth Arts and Office Community Academy Careers Fair 30/06/2016 Leeds Hemsworth Academy Pontefract LS1 - Area Office Gateways School Activity Day - PDT 17/06/2016 Leeds Gateways School Leeds LS1 - Area Grammar School at Office The Grammar School at Leeds PDT with CCF 09/05/2016 Leeds Leeds Leeds LS1 - Area Queen Ethelburgas Office College Careers Fair 18/04/2016 Leeds Queen Ethelburgas College York NE1 - AFCO Newcas City of Sunderland tle Sunderland College Bede College Careers Fair 20/04/2016 (RAF) Campus Sunderland LS1 - Area Office King James's School PDT 17/06/2016 Leeds King James's School Knareborough LS1 - Area Wickersley School And Office Sports College Careers Fair 27/04/2016 Leeds Wickersley School Rotherham LS1 - Area Office York High School Speed dating events for Year 10 organised by NYBEP 21/07/2016 Leeds York High School York LS1 - Area Caedmon College Office Whitby 4 x Presentation and possible PDT 22/04/2016 Leeds Caedmon College Whitby Whitby LS1 - Area Ermysted's Grammar Office School 2 x Operation -

Trinity Catholic College, Middlesbrough

A P P L I C A N T P A C K School Attendance Day Call Assistant Trinity Catholic College, Middlesbrough 1 Letter to Applicants Dear applicant, We are delighted you have shown an interest in the role of School Attendance Day Call Assistant. Within this application pack you will find: a) Information on how to access the online application form and additional forms related to this (these can be completed electronically and emailed) b) Job Description and Person Specification c) Further information about our Trust including our Benefits and Wellbeing package, along with information on the many advantages of living and working in the North East. Applicants should complete their application forms to the Trust by the closing date, Friday 2nd July 2021 by 12 noon. Any gaps in previous employment must be explained. Should you wish to have an informal discussion, please do not hesitate to contact Mrs Jill Benson, Head of Attendance and Welfare at the Trust via email [email protected]. As mentioned in the advertisement, a DBS disclosure is required for this post. It is important to note that: Nicholas Postgate Catholic Academy Trust is committed to safeguarding and promoting the welfare of . I would like to take this opportunity to thank you for your interest in this vacancy and wish you well with your application. Hugh Hegarty CEO NPQH | MSc | PGCCGC | BEd Hons | CTC Nicholas Postgate Catholic Academy Trust: Applicant Pack 2 Why work for us? The Nicholas Postgate Catholic Academy Trust family of 23 primary schools, four secondary schools, a sixth form and teaching school, promotes the dignity, self-esteem and development of every one of our pupils and staff. -

Zone-Finalists-Team-2019.Pdf

ENGLISH SCHOOLS TABLE TENNIS BUTTERFLY NATIONAL SCHOOLS’ TEAM CHAMPIONSHIPS 2019 Teams in italics were runners up in their county championship; list of entries may be subject to change before the Zone Finals are played ZONE 1 Boys’ Under-19 Humber St Mary’s College, Kingston upon Hull North Yorkshire St John Fisher Catholic High School, Harrogate Boys’ Under-16 Cleveland Nunthorpe Academy Cumbria Windermere School St Bernard’s RC High School, Barrow in Furness Durham Longfield Academy of Sport, Darlington Humber St Mary’s College, Kingston upon Hull North Yorkshire St John Fisher Catholic High School, Harrogate Tyne & Wear Newcastle School for Boys Boys’ Under-13 Cleveland Nunthorpe Academy Cumbria Kirkby Stephen Grammar School Humber St Mary’s College, Kingston upon Hull North Yorkshire Harrogate Grammar School Tyne &Wear Kings Priory School, Tynemouth Boys’ Under-11 Cleveland Bankfields Primary School, Middlesbrough Humber Wybers Wood Academy, Grimsby Victoria Dock Primary School, Kingston upon Hull North Yorkshire Pannal Primary School, Pannal, Harrogate Girls’ Under-16 Cleveland Acklam Grange School, Acklam, Middlesbrough Cumbria St Bernard’s RC High School, Barrow in Furness Humber Sir John Nelthorpe School, Brigg Girls’ Under-13 Cleveland Acklam Grange School, Acklam, Middlesbrough Humber St Mary’s College, Kingston upon Hull North Yorkshire St John Fisher Catholic High School, Harrogate Girls’ Under-11 Cleveland Harewood Primary School, Thornaby Humber Hilderthorpe Primary School, Bridlington ZONE 2 Boys’ Under-19 Nottinghamshire -

13Th January 2017

Newcomen Primary School SPRING AND SUMMER DIARY DATES 2020 Dear Parents, Carers and Families, For your information, please find below all planned diary dates for this academic year. For all other year group visits and events yet to be organised, we will give as much notice as possible to help with your planning. SPRING TERM 2020 Tuesday, 14 January Classes 7 and 10 - Bowes Museum visit Thursday, 16 January Classes 8 and 9 - Bowes Museum visit Thursday, 6 February School Sport Partnership - Y5 Girls Netball 12:45pm-3:00pm 9 girls from Y5 - parents will be notified Monday, 10 February Nursery Expectations Meeting 3:30pm - School Hall Tuesday, 11 February Safer Internet Day Wednesday, 12 February Class 6 School Sport Partnership - Disney Flight Festival 12:45pm-3:00pm Friday, 14 February Y2 - Inspire2Learn Animation Workshop all day Friday, 14 February Children break up for half term Monday, 24 February Children return to school. Wednesday, 26 February Nursery - Time For Talk Workshop for Parents/Carers Thursday, 27 February School Sport Partnership - Y5 Table Tennis 1:00pm-3:30pm 8 children from Y5 - parents will be notified Wednesday, 4 March Nursery - Time For Talk Workshop for Parents/Carers Thursday, 5 March World Book Day Optional to dress up as character from a book or school uniform as normal Friday, 6 March KS2 (Y3 to Y6)Science Workshops PM Monday, 9 March Class 7 - Teesmouth Field Centre visit Tuesday, 10 March Class 8 - Teesmouth Field Centre visit Tuesday, 10 March Classes 7 and 9 - Cleveland Fire Brigade workshops PM Tuesday, -

2014 Admissions Cycle

Applications, Offers & Acceptances by UCAS Apply Centre 2014 UCAS Apply School Name Postcode School Sector Applications Offers Acceptances Centre 10002 Ysgol David Hughes LL59 5SS Maintained 4 <3 <3 10008 Redborne Upper School and Community College MK45 2NU Maintained 11 5 4 10011 Bedford Modern School MK41 7NT Independent 20 5 3 10012 Bedford School MK40 2TU Independent 19 3 <3 10018 Stratton Upper School, Bedfordshire SG18 8JB Maintained 3 <3 <3 10020 Manshead School, Luton LU1 4BB Maintained <3 <3 <3 10022 Queensbury Academy LU6 3BU Maintained <3 <3 <3 10024 Cedars Upper School, Bedfordshire LU7 2AE Maintained 4 <3 <3 10026 St Marylebone Church of England School W1U 5BA Maintained 20 6 5 10027 Luton VI Form College LU2 7EW Maintained 21 <3 <3 10029 Abingdon School OX14 1DE Independent 27 13 13 10030 John Mason School, Abingdon OX14 1JB Maintained <3 <3 <3 10031 Our Lady's Abingdon Trustees Ltd OX14 3PS Independent <3 <3 <3 10032 Radley College OX14 2HR Independent 10 4 4 10033 St Helen & St Katharine OX14 1BE Independent 14 8 8 10036 The Marist Senior School SL5 7PS Independent <3 <3 <3 10038 St Georges School, Ascot SL5 7DZ Independent 4 <3 <3 10039 St Marys School, Ascot SL5 9JF Independent 6 3 3 10041 Ranelagh School RG12 9DA Maintained 7 <3 <3 10043 Ysgol Gyfun Bro Myrddin SA32 8DN Maintained <3 <3 <3 10044 Edgbarrow School RG45 7HZ Maintained <3 <3 <3 10045 Wellington College, Crowthorne RG45 7PU Independent 20 6 6 10046 Didcot Sixth Form College OX11 7AJ Maintained <3 <3 <3 10048 Faringdon Community College SN7 7LB Maintained