Real Estate Investment

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Crafting Distinction

Perennial Real Estate Holdings Limited Estate Holdings Real Perennial 精 益 求 铸 精 就 卓 越 Annual Report 2019 Perennial Real Estate Holdings Limited 8 Shenton Way #36-01, AXA Tower Refining Strategy Singapore 068811 Tel : (65) 6602 6800 Fax : (65) 6602 6801 Crafting Distinction [email protected] PERENNIAL REAL ESTATE HOLDINGS LIMITED www.perennialrealestate.com.sg Annual Report 2019 CONTENTS CORPORATE INFORMATION OVERVIEW BOARD OF DIRECTORS INDEPENDENT AUDITOR Corporate Profile 02 Other Markets 74 Mr Kuok Khoon Hong KPMG LLP Financial Highlights 03 The Light City, Penang, Malaysia 77 Chairman, Non-Independent Non-Executive Director Public Accountants and Chartered Accountants Chairman’s Statement (English) 06 Other Markets Portfolio at a Glance 78 16 Raffles Quay Chairman’s Statement (Chinese) 07 Mr Ron Sim #22-00 Hong Leong Building CEO’s Statement (English) 08 BUSINESS REVIEW – Vice-Chairman, Non-Independent Non-Executive Director Singapore 048581 CEO’s Statement (Chinese) 12 HEALTHCARE BUSINESS Our Presence 16 Mr Eugene Paul Lai Chin Look Audit Partner-in-Charge: Ms Karen Lee Shu Pei China 80 Our Milestones 18 Lead Independent Non-Executive Director (Appointed since 27 October 2014) Hospitals and Medical Centres 85 Our Business Model 20 Eldercare and Senior Housing 86 Our Integrated Strategy 22 Healthcare Portfolio at a Glance 88 Mr Ooi Eng Peng Board of Directors 24 Independent Non-Executive Director SHARE REGISTRAR Management Team 28 SUSTAINABILITY Mr Lee Suan Hiang Boardroom Corporate & Advisory Services Pte Ltd PERFORMANCE -

Independent Market Overview | by Cbre Pte Ltd

INDEPENDENT MARKET OVERVIEW | BY CBRE PTE LTD 1. THE SINGAPORE ECONOMY 2. THE OFFICE MARKET 1.1 Economic Overview 2.1 Existing Office Supply According to the Ministry of Trade & Industry (“MTI”), In 1Q 2019, the total islandwide office stock tracked by Singapore’s economy grew by 3.1% in 2018, easing CBRE rose by 2.2% year-on-year to 60.8 million sf. This from the 3.7% expansion recorded in the previous year. was largely due to the completions of Paya Lebar Quarter Growth was primarily driven by the manufacturing sector. (870,170 sf) and Frasers Tower (663,000 sf). Supported by the electronics, transport engineering and biomedical manufacturing clusters, the manufacturing Core CBD (made up of Raffles Place, Shenton Way, sector expanded by 7.0% in 2018. The services sector Marina Centre and Marina Bay), the most sought-after expanded by 2.9% with strong performance from the prominent location for large corporate office occupiers information & communications, finance & insurance and to house their businesses’ front office functions and business services sectors. In contrast, the construction headquarters, accounted for close to half (49.9% or sector shrank by 3.7% in 2018, weighed down by public 30.3 million sf) of the islandwide stock. The remaining sector construction activities. 26.9% and 23.2% of the total islandwide office stock is distributed in the Fringe CBD and Decentralised Headline inflation eased from 0.6% in 2017 to 0.4% in submarkets respectively. 2018. Meanwhile, core inflation averaged at 1.7% in 2018. The latest Monetary Authority of Singapore Economic Tanjong Pagar and HarbourFront/Alexandra Micro-markets Survey expects core inflation to be 1.4% in 2019. -

UPL) Is a Subterranean Pedestrian Connection That Directly Links the Basement Levels of Developments to One Another and / Or to Public Transport Nodes

Appendix 1-1 PARAMETERS UNDERGROUND PEDESTRIAN LINKS 1 Definition An Underground Pedestrian Link (UPL) is a subterranean pedestrian connection that directly links the basement levels of developments to one another and / or to public transport nodes. To qualify for the Cash Grant Reimbursement Scheme, the UPL shall be one of the identified links as reflected in the planned Underground Pedestrian Network within the city centre (See Appendices 1-2 to 1-4). In addition, the UPL shall: 1. Connect between the basement levels of developments; 2. Be directly accessible from the common public areas of the adjoining developments; and 3. Be open for public access during the operating hours of the Mass Rapid Transit (MRT) stations or at all times. 2 Locations The following strategic UPLs may qualify for the Cash Grant Reimbursement Scheme: Orchard Road (See Appendix 1-2) New Underground Pedestrian Links 1. Palais Renaissance / Forum The Shopping Mall 2. Far East Shopping Centre / Liat Towers 3. Scotts Square / Tangs Plaza 4. Lucky Plaza / Tong Building / Paragon 5. Paragon / Ngee Ann City 6. Paragon / Grand Park Hotel 7. Grand Park Orchard Hotel / 268 Orchard 8. Ngee Ann City / Mandarin Gallery 9. Mandarin Gallery / Orchard Building 10. The Centrepoint / Orchard Point 11. Orchard Point / Orchard Plaza Existing Underground Pedestrian Links to be Upgraded 12. Tangs Plaza / Shaw House 13. Lucky Plaza / Ngee Ann City Central Business District (See Appendix 1-3) New Underground Pedestrian Links 14. 79 Robinson Road / 8 Shenton Way 15. Capital Tower / 79 Robinson Road Civic District (See Appendix 1-4) New Underground Pedestrian Links 16. -

About Dividend Titan

About Dividend Titan Hello, my name is Willie Keng, Chief Editor of Dividend Titan. Before we go deep into the trenches to build your rich life and make tons of money in the stock market, I like to share with you a bit more about myself. I run a boutique consulting practice helping clients in the investment industry improve their business processes. I’ve written investment frameworks, consulted on investment committees, trained portfolio managers, investment advisors and research analysts to improve their contribution to the work they do. Friends who know me will say I’m an investing nut. For the past 10 years, I’ve run 6-figure portfolios not only for myself, but my family too. The strategy I’m about to share with you is a culmination of my personal investment experience, past work as an ex-research analyst and investment advisor for major financial institutions. Along the way, I’ve decided to pen down all my lessons and mistakes into a micro-brand called Dividend Titan (www.dividendtitan.com). Its sole purpose is investment education. I’ve been round the block. Seen a fair share of clients, friends, family and relatives getting their savings burnt in the stock market. Not because they were any less smart, but they just didn’t understand the right path to investing success. And I believe the purest way to achieve a rich life through investing is in the LEARNING. 1 Table of Contents Introduction ............................................................................................. 3 1. Buying Singapore’s Biggest Industrial REIT ...................................... 5 2. Getting into CapitaLand’s Most Overlooked Brand ........................... -

TB Operating Hours

With regard to the recent announcements made, please be assured that Toast Box remains open for takeaway and deliveries (GrabFood/FoodPanda/Deliveroo). Do note that there are changes to our outlets operating hours, please refer to the table below (effective from 16th May 2021, till further notice). Together, we can overcome the situation. Thank you for your continuous support, stay healthy and safe everyone! ♥️ NORTH AMK HUB Daily: 7am to 9pm Causeway Point L1 Daily: 7am to 830pm Causeway Point L4 Daily: 9am to 830pm Compass One Daily: 8am to 930pm Greenwich Village Closed for renovations from 9 – 23 June Heartland Mall Daily: 730am to 9pm Hougang Mall Daily: 730am to 9pm myVillage Daily: 730am to 845pm Mon – Fri: 730am to 9pm NEX Serangoon Sat – Sun, PH & Eve of PH: 8am to 9pm Mon - Sat: 730am to 9pm Northpoint City Sun & PH: 8am to 9pm Rivervale Mall Daily: 730am to 830pm Seletar Mall Daily: 730am to 930pm Sun Plaza Daily: 730am to 9pm Mon – Thurs: 9am to 9pm Waterway Point Fri – Sun & PH: 8am to 9pm SOUTH Mon - Fri: 730am to 8pm 100AM Sat - Sun, Eve of PH & PH: 830am to 8pm Mon – Fri: 730am to 330pm Guoco Tower (TPC) Sat – Sun & PH: Closed Marina Bay Sands Daily: 730am to 7pm Mon – Fri: 730am to 6pm Marina Bay Link Mall Sat - Sun & PH: 9am to 530pm Resorts World Sentosa Daily: 8am - 8pm Singapore Cruise Centre Daily: 730am to 4pm Mon - Fri: 730am to 6pm Tea Loft Sat - Sun, PH: Closed Tiong Bahru Plaza Daily: 8am to 9pm URA Centre Closed from 19 May Sun - Thurs & PH: 730am to 9pm VivoCity B2 Fri - Sat & Eve of PH: 730am to 9pm VivoCity -

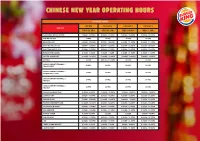

CNY Operating Hours

CHINESE NEW YEAR OPERATING HOURS BUSINESS HOURS CNY EVE CNY DAY 4 CNY DAY 2 CNY DAY 3 OUTLET TUES (24 DEC) WED (25 JAN) TUES (26 DEC) WED (1 JAN) ALEXANDRA RETAIL CENTRE 7.30AM - 10.00PM 8.00AM - 10.00PM 8.00AM - 10.00PM 8.00AM - 10.00PM ANG MO KIO HUB 24 HRS 24 HRS 24 HRS 24 HRS BUGIS VILLAGE 8.00AM - 12.00MN 8.00AM - 12.00MN 8.00AM - 11.30PM 8.00AM - 11.00PM BUKIT BATOK EAST CC 8.00AM - 12.00MN 8.00AM - 12.00MN 8.00AM - 12.00MN 8.00AM - 10.00PM BUKIT PANJANG PLAZA 8.00AM - 11.00PM 8.00AM - 11.00PM 8.00AM - 11.00PM 8.00AM - 10.00PM BURLINGTON SQUARE 8.30AM - 1.00AM 8.30AM - 1.00AM 8.30AM - 11.30PM 8.30AM - 11.00PM CAPITOL SINGAPORE 10.00AM - 10.00PM 10.00AM - 10.00PM 10.00AM - 10.00PM 10.00AM - 10.00PM CENTRAL 24 HRS 8.00 AM - 11.00PM 24 HRS 24 HRS CHANGI AIRPORT TERMINAL 1 24 HRS 24 HRS 24 HRS 24 HRS TRANSIT WEST CHANGI AIRPORT TERMINAL 1 24 HRS 24 HRS 24 HRS 24 HRS VIEWING MALL EAST CHANGI AIRPORT TERMINAL 3 24 HRS 24 HRS 24 HRS 24 HRS TRANSIT CHANGI AIRPORT TERMINAL 4 24 HRS 24 HRS 24 HRS 24 HRS TRANSIT CHANGI BUSINESS PARK 8.00AM - 6.00PM 10.00AM - 10.00PM 10.00AM - 10.00PM 10.00AM - 10.00PM COMPASS ONE 8.00AM - 10.30PM 8.00AM - 10.30PM 8.00AM - 10.30PM 8.00AM - 10.30PM FAIRPRICE HUB 7.00AM - 10.00PM 10.00AM - 10.00PM 10.00AM - 10.00PM 7.00AM - 10.00PM FUCHUN COMMUNITY CLUB 10.00AM - 10.00PM 8.00AM - 10.00PM 8.00AM - 10.00PM 8.00AM - 10.00PM HEARTBEAT @ BEDOK 8.00AM - 12.00MN 8.00AM - 12.00MN 8.00AM - 12.00MN 8.00AM - 12.00MN HILLVIEW RISE 8.00AM - 11.00PM 8.00AM - 11.00PM 8.00AM - 11.00PM 8.00AM - 10.00PM HITACHI TOWER 7.30AM - -

SHA 58Th Anniversary Dinner

Sep 2019 - Jan 2020 MCI(P)028/02/2020 SHA 58th Anniversary Dinner Celebrating 25 years of Excellent Service Award and Service Gold “The National Kindness Award” Your Say on Top 3 Wishes for 2020 Annual Hotel Security Awards and Conference SHA Welcomes New Members SHA Welcomes New General Managers SHA Web-Based Repository Tourist Tracks CONTENTS 13 14 15 21 Sep 2019 - Jan 2020 SHA NEWS SHATEC NEWS MCI(P)028/02/2020 4 SHA 58th Anniversary Dinner 18 SHATEC Graduation 2019 Chief Editor Ms Margaret Heng 6 Your Say on Top 3 Wishes for 2020 19 SHATEC Hospitality Conference 2019 Love in a Bento – Christmas 2019 Edition Writers 7 SHA Welcomes New Ordinary Members Ms Charmaine Thiang SHATEC Wins The BrandLaureate 20 Ms Li Shaoting 9 SHA Welcomes New Associate Members BestBrands Award 2019 - Culinary and Hospitality Talent Development Ms Shrestha Sook Yean 10 SHA Welcomes New General Managers Industry Mentorship Programme – Published by Town Hall Session Singapore Hotel Association 11 SHA-Intel Hospitality Technology Seminar 21 Ms Margaret Heng Wins the Executive 12 GM Networking Sessions on 3 October of the Year at the Singapore Business Design & Printed by and 9 December 2019 Review Management Excellence Awards Colorcom Graphics Pte Ltd 2019 STB-SHA Hotel Industry Conference 13 Spotlight: Michael Tan Email 14 Annual Hotel Security Awards and [email protected] Conference 2019 HOTEL CIRCUIT Celebrating 25 years of Excellent Service Website 15 Award (EXSA) www.sha.org.sg 22 Oakwood Premier AMTD Singapore SHA/SKM Service Gold “The National 16 -

3 Datai Hotels & Resorts

TTG ASIA TTG Asia luxury | June 2014 for buyers of premium travel and luxury meetings KWEK LENG BENG MY WAY 12 NEW LUXURY HOTEL BRANDS TO WATCH DESTINATIONS Authenticity in the city LONGHAUL Not cold Turkey GASP! The audacity of luxury TTG Luxe-p00 cover +spine jul9.indd 1 9/7/14 9:38 am TTG_Asia_Luxury_PrivateDining_July2014.pdf 1 30/6/14 4:31 pm C M Y CM MY CY CMY K editor’s note his issue, we’re big on authenticity. It’s the overriding theme throughout the maga- zine as, lately, it has been said so often that Tluxury travellers today are not content merely with expensive, quality hardware; they want to touch the intangibles: priceless memories from real sense-of-place encounters. So help us all! I mean the exclamation. There are real chal- lenges in providing ’the real thing‘ to the well- heeled, as our series of Authenticity in the city destination pieces in this issue shows. To begin with, is there much authenticity left in Asian cities that are progressing so rapidly towards modernity? How do DMCs get their well-heeled clients to places of significance, or to meet locals, without these guests being tired and wary even before they start, thanks to being stuck in bad traffic? How do they make the must-see icons of a destination an authentic experience that is above the reach of the masses? Our guide to 12 new luxury hotel brands to watch also shows the birth of groups that put individu- ality and authenticity as the key pillars of success. -

Forett-Floorplan-Ebrochure.Pdf

THE ALLURE OF NATURE Bukit Timah. A district that can instantly conjure up images of greenery, privacy, premium and privilege. It’s where you’d find a 163-ha Nature Reserve including, Singapore’s highest hiking trail, Bukit Timah Hill. It is where you’d find the most selective of Singaporeans and expatriates retiring to serenity every night. And it is where you’d find the choicest of home addresses – like Forett. THE APPEAL OF FREEHOLD Artist’s Impression LEGEND Rail Corridor Park Connector Network EDUCATION RECREATION SHOPPING / F&B Primary Schools (Within 1km) Bukit Timah Nature Reserve Beauty World Plaza Pei Hwa Presbyterian Primary School Bukit Batok Nature Park Beauty World Centre Bukit Timah Primary School Rifle Range Nature Park Bukit Timah Shopping Centre Rail Corridor The Grandstand Primary Schools (Within 1-2km) Bukit Batok Town Park (Little Guilin) The Rail Mall Methodist Girls’ School MacRitchie Reservoir Coronation Shopping Plaza Keming Primary School Singapore Botanic Gardens The Star Vista Bukit View Primary School The Clementi Mall CLOSE Bukit Timah Railway Station Secondary & Tertiary Schools Westmall Old Bukit Timah Fire Station Methodist Girls’ School IMM Bukit Batok WWII Memorial TO HEART Nanyang Girls’ High School JEM Former Ford Factory NUS High School Westgate Temasek Club National Junior College JCube The British Club Hwa Chong Institution & Junior College Bukit Timah Food Centre Swiss Club Singapore Polytechnic Holland Village Singapore Island Country Club Ngee Ann Polytechnic Dempsey Hill Raffles Town Club National -

Gantry Graphic Copy

How automated SafeEntry gantries work More than 30 places around the island have rolled out automated gantries to manage visitor access and contact tracing, with more to be installed in the coming months. Rei Kurohi looks at how the system ensures visitors comply with safe management measures. KEY COMPONENTS OF THE GANTRY SYSTEM THREE WAYS THAT USERS CAN CHECK IN Camera for facial detection and Barcode and checking for masks QR code scanner • This counts the number of visitors in • Visitors can check a group if they check in together. in by allowing the • The gantry will open only if it detects gantry to scan their that visitors are wearing masks. TraceTogether token’s QR code. Infrared sensors for temperature measurement • They can also continue to use their NRIC barcodes until May 31. • Visitors with a body temperature above 37.5 deg C will not be allowed to enter. SafeEntry Gateway scanner • The Bluetooth-enabled scanner allows visitors to check in by tapping their TraceTogether tokens or smartphones with the TraceTogether app installed. • It has been built into the gantries under an ongoing trial with GovTech. Text recognition for checking the SafeEntry conrmation screen on smartphones • Use the Singpass app (only until May 17) or TraceTogether app on one’s smartphone to scan the QR code displayed at the entrance of the venue, then place the phone face down near the text recognition scanner that reads the conrmation screen. • The gantry will open only if the date, time and venue shown are correct. • Group check-ins can be done using this method. -

Charting Ahead

CHARTING AHEAD ANNUAL REPORT 2018/19 Mapletree Commercial Trust Management Ltd. (as Manager of Mapletree Commercial Trust) Co. Reg. No.:200708826C) 10 Pasir Panjang Road #13-01 Mapletree Business City This report is printed on Singapore 117438 environmentally friendly paper TABLE OF KEY CONTENTS HIGHLIGHTS 1 Key Highlights 2 Corporate Overview 3 Strategy 4 Financial Highlights DISTRIBUTABLE INCOME DISTRIBUTION PER UNIT 8 Letter to Unitholders million 1.4% cents 1.1% 12 Year in Review S$264.0 9.14 14 Unit Price Performance 16 Trust Structure 17 Organisation Structure 18 Property Overview 34 Operations Review 38 Financial Review & Capital Management MARKET CAPITALISATION INVESTMENT PROPERTIES 43 Independent Market Overview 56 Board of Directors S$5.5 billion 20.8% S$7.0 billion 5.3% 60 Management Team & Property Management Team 64 Corporate Governance 82 Risk Management 85 Sustainability Report 103 Investor Relations 106 Financial Statements NET ASSET VALUE PER UNIT GEARING RATIO 167 Interested Person Transactions 169 Statistics of Unitholdings S$1.60 7.4% 33.1% 1.4 p.p 171 Notice of Annual General Meeting Proxy Form Corporate Directory CREDIT RATING (MOODY’S INVESTORS SERVICES) PORTFOLIO COMMITED OCCUPANCY Baa1 (Stable) UNCHANGED 98.5% 1.0 p.p VIVOCITY SHOPPER TRAFFIC VIVOCITY TENANT SALES 55.2 million 0.5% S$939.1 million 2.0% Featured art piece on cover: Wind Sculpture I by Yinka Shonibare MBE ANNUAL REPORT 2018/19 1 CORPORATE STRATEGY OVERVIEW KEY OBJECTIVES VivoCity Mapletree Business City I The Manager’s key objectives are to provide unitholders of MCT with a relatively attractive rate of return on their investment through regular and steady distributions, and to achieve long-term stability in DPU and NAV per unit, while maintaining an appropriate capital structure for MCT. -

Singapore Industry Focus

Singapore Industry Focus Singapore Property Refer to important disclosures at the end of this report DBS Group Research . Equity 8 Jan 2015 STI : 3,281.95 Year of Reckoning Analyst Modest growth prospects for Singapore property Derek TAN +65 6682 3716 market; sectors linked to external demand to do well [email protected] Prefer Developers to S-REITs on valuations Mervin SONG CFA +65 6682 3715 [email protected] S-REITs – focus on growth rather than rate hikes Rachael TAN +65 6682 3713 Modest growth prospects; sectors linked to external The Singapore property market [email protected] demand to outperform. will likely see a further downshift in growth in 2015 as prices STOCKS PICKS and rentals across major real estate subsectors feel the brunt Price Mkt Cap Target Price Yield (%) P/Bk of ongoing economic restructuring (Retail sector). In addition, (S$) demand/supply imbalance due to supply completion schedules 6/1/15 US$m S$ FY15F FY15F Rating is positive for Office prospects but result in a drop in rents and Developers prices in Industrial and Residential sector respectively. We CapitaLand 3.24 10,349 3.84 2.3% 0.8 BUY believe that the Hospitality sector will post a rebound in RevPARs as accommodation demand (mainly from China) REITs 1.75 1,294 1.86 6.8% 1.1 BUY picks up faster than supply growth. CDL Hospitality Trusts From a valuation Prefer Property Developers to S-REITs. Ascendas REIT 2.40 4,276 2.49 6.3% 1.2 BUY perspective, we prefer developers to S-REITs as we expect Capitamall Trust 2.06 5,245 2.12 5.5% 1.2 BUY valuations to normalize towards historical average of 0.90x Mapletree Greater 0.95 1,932 1.04 7.0% 0.9 BUY P/Bk NAV (vs 0.83x P/Bk NAV currently) while forward yield China Trust spreads at c.