LIBOR Transition Playbook

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Ginnie Mae: How Does It Work and What Does It Do?

Economic Policy Program Housing Commission Ginnie Mae: How Does it Work and What Does it Do? The Government National Mortgage What Does Ginnie Mae Do? Association (or Ginnie Mae) is a Ginnie Mae only guarantees securities created by approved government corporation within the issuers and backed by mortgages covered by other federal U.S. Department of Housing and programs. Urban Development (HUD). It was The Ginnie Mae guarantee ensures that investors in these established in 1968 when Fannie mortgage-backed securities (MBS) do not experience any Mae was privatized. Its mission is disruption of the timely payment of principal and interest, thus shielding them from losses resulting from borrower to expand funding for mortgages defaults. As a result, these MBS appeal to a wide range that are insured or guaranteed by of investors and trade at a price similar to that of U.S. other federal agencies. When these government bonds of comparable maturity. However, the guarantee also places Ginnie Mae, and ultimately American mortgages are bundled into securities, taxpayers, at risk of losses not covered by the other federal Ginnie Mae provides a full-faith-and- programs (see When Does a Ginnie Mae Guarantee Apply?). credit guarantee on these securities, thus lessening the risk for investors and broadening the market for the securities. WWW.BIPARTISANPOLICY.ORG When Does a Ginnie Mae Why Does Ginnie Mae Use the Term Guarantee Apply? “Issuer/Servicer?” Ginnie Mae guarantees MBS backed by loans covered Ginnie Mae MBS can include mortgages by the following programs: purchased from multiple originators n The Federal Housing Administration’s single-family and multifamily mortgage insurance programs, which and serviced by third parties. -

Housing and the Financial Crisis

This PDF is a selection from a published volume from the National Bureau of Economic Research Volume Title: Housing and the Financial Crisis Volume Author/Editor: Edward L. Glaeser and Todd Sinai, editors Volume Publisher: University of Chicago Press Volume ISBN: 978-0-226-03058-6 Volume URL: http://www.nber.org/books/glae11-1 Conference Date: November 17-18, 2011 Publication Date: August 2013 Chapter Title: The Future of the Government-Sponsored Enterprises: The Role for Government in the U.S. Mortgage Market Chapter Author(s): Dwight Jaffee, John M. Quigley Chapter URL: http://www.nber.org/chapters/c12625 Chapter pages in book: (p. 361 - 417) 8 The Future of the Government- Sponsored Enterprises The Role for Government in the US Mortgage Market Dwight Jaffee and John M. Quigley 8.1 Introduction The two large government- sponsored housing enterprises (GSEs),1 the Federal National Mortgage Association (“Fannie Mae”) and the Federal Home Loan Mortgage Corporation (“Freddie Mac”), evolved over three- quarters of a century from a single small government agency, to a large and powerful duopoly, and ultimately to insolvent institutions protected from bankruptcy only by the full faith and credit of the US government. From the beginning of 2008 to the end of 2011, the two GSEs lost capital of $266 billion, requiring draws of $188 billion under the Treasured Preferred Stock Purchase Agreements to remain in operation; see Federal Housing Finance Agency (2011). This downfall of the two GSEs was primarily a question of “when,” not “if,” given that their structure as a public/private Dwight Jaffee is the Willis Booth Professor of Banking, Finance, and Real Estate at the University of California, Berkeley. -

Appraisal and Property Related Faqs

Appraisal and Property-Related Frequently Asked Questions Updated August 2021 This FAQ document provides responses to common questions related to Fannie Mae’s property eligibility and appraisal policies. Table of Contents Resources .............................................................................................................................................................................................. 1 FAQs ....................................................................................................................................................................................................... 1 Property Eligibility ............................................................................................................................................................................. 1 Appraiser Selection and Management ............................................................................................................................................. 2 Appraisal Submission and Forms ..................................................................................................................................................... 3 Appraisal Policy ................................................................................................................................................................................. 4 Resources For additional information about Fannie Mae’s appraisal policies, refer to the Selling Guide. Other resources are available on the Appraisers page on Fannie Mae’s -

THE 2019 STRATEGIC PLAN for the CONSERVATORSHIPS of FANNIE MAE and FREDDIE MAC October 2019

THE 2019 STRATEGIC PLAN FOR THE CONSERVATORSHIPS OF FANNIE MAE AND FREDDIE MAC October 2019 Page Footer Division of Conservatorship THE 2019 STRATEGIC PLAN FOR THE CONSERVATORSHIPS OF FANNIE MAE AND FREDDIE MAC Table of Contents Executive Summary ................................................................................. 1 Introduction ........................................................................................... 6 A History of the Federal Housing Finance Agency and the Conservatorships of Fannie Mae and Freddie Mac .................................. 6 A New Conservatorship Strategic Plan ........................................................ 9 I. Changes to the Market 9 II. Changes to the Regulator 10 III. Changes to the Enterprises 10 Executing the Strategic Plan: A New Scorecard With 3 Key Objectives ............ 11 I. Section 1: Foster a CLEAR National Housing Finance Markets 12 II. Section 2: Operate in a Safe and Sound Manner Appropriate for Conservatorship 13 III. Section 3: Prepare to Exit Conservatorship 15 Conclusion ............................................................................................ 16 i THE 2019 STRATEGIC PLAN FOR THE CONSERVATORSHIPS OF FANNIE MAE AND FREDDIE MAC Executive Summary September 6, 2019, marked 11 years since the Federal National Mortgage Association and the Federal Home Loan Mortgage Corporation (Fannie Mae and Freddie Mac, respectively, and together the Enterprises) were placed into conservatorships in the middle of the financial crisis of 2008. A root cause of the -

Uniform Collateral Data Portal® (UCDP®) User Guide for Fannie Mae Messaging

Uniform Collateral Data Portal® (UCDP®) User Guide for Fannie Mae Messaging September 2021 © 2021 Fannie Mae September 2021 Page 1 of 24 Table of Contents Introduction .............................................................................................................................................................................................. 3 What is the UCDP User Guide for Fannie Mae Messaging? ............................................................................................................... 3 Who should read this manual? .............................................................................................................................................................. 3 What’s in this manual? .......................................................................................................................................................................... 3 1. View/Edit Pages for Appraisal Submissions .......................................................................................................................... 3 Figure 1.0.1 View/Edit Page with Fannie Mae Tabs .............................................................................................................................. 4 Table 1.0.2 Appraisal Information Subsections .................................................................................................................................... 5 2. Viewing and Editing Appraisal Information ......................................................................................................................... -

Fannie Mae and Freddie Mac in Conservatorship: Frequently Asked Questions

Fannie Mae and Freddie Mac in Conservatorship: Frequently Asked Questions Updated May 31, 2019 Congressional Research Service https://crsreports.congress.gov R44525 Fannie Mae and Freddie Mac in Conservatorship: Frequently Asked Questions Summary Fannie Mae and Freddie Mac are chartered by Congress as government-sponsored enterprises (GSEs) to provide liquidity in the mortgage market and promote homeownership for underserved groups and locations. The GSEs purchase mortgages, retain the credit risk (for a fee), and package them into mortgage-backed securities (MBSs) that they either keep as investments or sell to institutional investors. In the years following the housing and mortgage market turmoil that began around 2007, the GSEs experienced financial difficulty. By 2008, the GSEs’ financial condition had weakened, generating concerns over their ability to meet their combined obligations on $1.2 trillion in bonds and $3.7 trillion in MBSs that they had guaranteed at the time. In response, the Federal Housing Finance Agency (FHFA), the GSEs’ primary regulator, took control of them in a process known as conservatorship. Subject to the terms of the Senior Preferred Stock Purchase Agreements (PSPAs) between the U.S. Treasury and the GSEs, Treasury provided funds to keep the GSEs solvent. The GSEs initially agreed to pay Treasury a 10% cash dividend on funds received, and dividends were suspended for all other GSE stockholders. If the GSEs had enough profit at the end of the quarter, the dividend came out of the profit. When the GSEs did not have enough cash to pay their dividend to Treasury, they asked for additional cash to make the payment instead of issuing additional stock. -

Managing Gentrification

ULI Community Catalyst Report NUMBER 5 Managing Gentrification UrbanUrban LandLand $ InstituteInstitute COVER: A Chicago greystone; Julie Jaidenger/UIC City Design Center. ULI Community Catalyst Report NUMBER 5 Managing Gentrification The 2006 ULI/Charles H. Shaw Forum on Urban Community Issues September 21–22, 2006 Prepared by Deborah L. Myerson Urban Land $ Institute ULI Community Catalyst Report ABOUT ULI–the Urban Land Institute ULI PROJECT STAFF The mission of the Urban Land Institute is to provide leadership in Maureen McAvey the responsible use of land and in creating and sustaining thriving Executive Vice President, Initiatives communities worldwide. ULI is committed to: Michael Pawlukiewicz • Bringing together leaders from across the fields of real estate and land use policy to exchange best practices and serve community Director, Environment and needs; Sustainable Development • Fostering collaboration within and beyond ULI’s membership Deborah L. Myerson through mentoring, dialogue, and problem solving; Consultant to ULI • Exploring issues of urbanization, conservation, regeneration, land Samara Wolf use, capital formation, and sustainable development; Manager, Meetings and Events • Advancing land use policies and design practices that respect the uniqueness of both built and natural environments; Nancy H. Stewart Director, Book Program • Sharing knowledge through education, applied research, publish- ing, and electronic media; and Laura Glassman, Publications • Sustaining a diverse global network of local practice and advisory -

Multifamily Housing Finance and Selected Policy Issues

Multifamily Housing Finance and Selected Policy Issues August 7, 2020 Congressional Research Service https://crsreports.congress.gov R46480 SUMMARY R46480 Multifamily Housing Finance and Selected August 7, 2020 Policy Issues Darryl E. Getter A mortgage is a loan secured by the underlying real estate collateral being financed by the loan. Specialist in Financial Single-family mortgages are loans secured by a residential dwelling having at least one and no Economics more than four separate units. A single-family mortgage borrower is typically the homeowner using the loan to purchase the residence. By contrast, multifamily mortgages are loans secured by a residential dwelling, such as an apartment building, with at least five or more separate units. Multifamily real estate frequently refers to properties used as residential dwellings, including traditional apartment buildings, subsidized housing, housing for seniors (age-restricted, independent and assisted living), and housing for students (dormitories). Developers that want to purchase, construct, or rehabilitate these structures are likely to seek multifamily mortgages from financial institutions. Developers are generally attracted to multifamily properties because of the potential profitability they generate in the form of rental income. Lenders also treat rental income as a key determinant when evaluating requests for multifamily mortgages. Financing may be limited for certain multifamily projects that are unlikely to generate the cash flows commensurate with the greater financial risks. Low- and moderate-income (LMI) tenants, for example, may not be able to pay rents that would generate sufficient revenues for developers to repay their multifamily mortgage loans and meet targeted profitability levels. Lenders specialize in pricing default risk, and they typically increase the financing costs linked to riskier loans to receive compensation for assuming the greater levels of risk. -

LIBOR Transition Faqs

LIBOR Transition FAQs Under the guidance of FHFA, Fannie Mae and Freddie Mac are providing jointly prepared answers to frequently asked questions related to the GSE’s transition away from LIBOR-Indexed products to SOFR-indexed products. The Enterprise section answers high-level questions applicable to all products followed by Q&A sections specific to Single-Family adjustable rate mortgages and PCs/UMBs, Credit Risk Transfer transactions, Multifamily adjustable rate mortgages and securities and Collateralized Mortgage Obligations. Contents Summary of Changes .................................................................................................................................................................................... 1 Enterprise ...................................................................................................................................................................................................... 3 Single-Family Adjustable-Rate Mortgages (ARMs) ....................................................................................................................................... 8 Single-Family Credit Risk Transfer (SF CRT) ................................................................................................................................................. 13 Collateral Mortgage Obligations (CMOs) .................................................................................................................................................... 16 Fannie Mae - Multifamily Adjustable-Rate -

History of the Government Sponsored Enterprises.Pdf

A BRIEF HISTORY OF THE HOUSING GOVERNMENT-SPONSORED ENTERPRISES A Brief History of the Housing Government-Sponsored Enterprises The housing Government-Sponsored Enterprises (GSEs) have a long history. Understanding the role that these organizations played historically in the mortgage markets is important to understanding the financial crisis, its causes, and lessons for the future. The housing GSEs are the Federal National Mortgage Association (Fannie Mae), the Federal Home Loan Mortgage Corporation (Freddie Mac), and the Federal Home Loan Bank System (FHLBank System), which currently consists of 12 Federal Home Loan Banks (FHLBanks). HOUSING FINANCE BEFORE FEDERAL INVOLVEMENT Before the Great Depression of the 1930s, housing finance was exclusively the realm of the private sector. Housing finance generally consisted of short term renewable loans. The features of these loans, which included high down payments (approximately half the home’s purchase price), short maturities (10 years or less), and large balloon payments, presented significant challenges to widespread home ownership.1 The primary source of mortgage funding came from life insurers, commercial banks, and thrifts.2 In the absence of a nationwide housing finance market, availability and pricing for mortgage loans varied widely across the country.3 THE GREAT DEPRESSION The Great Depression proved as traumatic to the nation’s housing market as it was to the U.S. economy. By 1932, the unemployment rate had risen to 23.6%,4 and by early 1933, the government estimated that 20% to 25% of the nation’s home mortgage debt was in default.5 FEDERAL RESPONSE TO THE DEPRESSION ERA HOUSING CRISIS The federal government began its response to the housing crisis in 1932, with the enactment of the Federal Home Loan Bank Act (the Bank Act). -

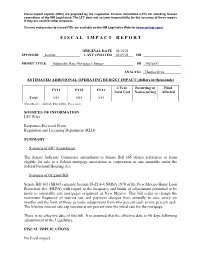

F I S C a L I M P a C T R E P O

Fiscal impact reports (FIRs) are prepared by the Legislative Finance Committee (LFC) for standing finance committees of the NM Legislature. The LFC does not assume responsibility for the accuracy of these reports if they are used for other purposes. Current and previously issued FIRs are available on the NM Legislative Website (www.nmlegis.gov). F I S C A L I M P A C T R E P O R T ORIGINAL DATE 02/15/21 SPONSOR Kernan LAST UPDATED 03/09/21 HB SHORT TITLE Adjustable Rate Mortgage Changes SB 365/aSJC ANALYST Hanika-Ortiz ESTIMATED ADDITIONAL OPERATING BUDGET IMPACT (dollars in thousands) 3 Year Recurring or Fund FY21 FY22 FY23 Total Cost Nonrecurring Affected Total NFI NFI NFI (Parenthesis ( ) Indicate Expenditure Decreases) SOURCES OF INFORMATION LFC Files Responses Received From Regulation and Licensing Department (RLD) SUMMARY Synopsis of SJC Amendment The Senate Judiciary Committee amendment to Senate Bill 365 strikes references to loans eligible for sale to a federal mortgage association or corporation or one insurable under the federal National Housing Act. Synopsis of Original Bill Senate Bill 365 (SB365) amends Section 58-21A-4 NMSA 1978 of the New Mexico Home Loan Protection Act (HLPA) with regard to the frequency and limits of adjustments permitted to be made to adjustable rate mortgages originated in New Mexico. This bill seeks to change the maximum frequency of interest rate and payment changes from annually to once every six months and the limit of those periodic adjustments from two percent each to one percent each. The lifetime interest rate cap remains at six percent over the initial rate for the mortgage. -

Lender Letter (LL-2020-02) Oct

Updated: Dec. 9, 2020 Lender Letter (LL-2020-02) Oct. 14, 2020 Please note this Lender Letter has been replaced by LL-2021-02 Aug. 27, 2020 Jul. 15, 2020 Jun. 24, 2020 Jun. 10, 2020 To: All Fannie Mae Single-Family Servicers May 14, 2020 Apr. 29, 2020 Impact of COVID-19 on Servicing Apr. 8, 2020 Mar. 25, 2020 Mar. 18, 2020 We are actively monitoring reports about the spread of COVID-19 (coronavirus) in the United States and understand that there are concerns about its potential impact on borrowers. At the direction of the Federal Housing Finance Agency (FHFA) and in alignment with Freddie Mac, we are communicating temporary policies in this Lender Letter to enable servicers to better assist borrowers impacted by COVID-19. The policies in this Lender Letter are effective immediately and are effective until Fannie Mae provides further notice, unless otherwise stated. We are releasing information to our servicers as quickly as possible and will update and republish this Lender Letter as new guidance becomes available. Additions to Lender Letter on Dec. 9 ▪ Mortgage Insurance Termination: Temporary policy change related to verifying an acceptable payment record for borrowers that experience a financial hardship related to COVID-19. We also extended suspension of foreclosure activities. Additions to Lender Letter on Jul. 15, updated Oct. 14 ▪ Disbursing insurance loss proceeds: Clarifying servicer requirements related to disbursing insurance loss proceeds for borrowers impacted by COVID-19. ▪ Impact of COVID-19 on Fannie Mae Home Affordable Modification Program (HAMP) ”Pay for Performance” incentives: Clarifying when a borrower on a COVID-19 related forbearance plan maintains good standing.