COMPLETING and RECORDING DEEDS Adding Or Changing Names on Property This Guide Includes Instructions and Sample Forms

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Real Estate Marketplace Glossary: How to Talk the Talk

Federal Trade Commission ftc.gov The Real Estate Marketplace Glossary: How to Talk the Talk Buying a home can be exciting. It also can be somewhat daunting, even if you’ve done it before. You will deal with mortgage options, credit reports, loan applications, contracts, points, appraisals, change orders, inspections, warranties, walk-throughs, settlement sheets, escrow accounts, recording fees, insurance, taxes...the list goes on. No doubt you will hear and see words and terms you’ve never heard before. Just what do they all mean? The Federal Trade Commission, the agency that promotes competition and protects consumers, has prepared this glossary to help you better understand the terms commonly used in the real estate and mortgage marketplace. A Annual Percentage Rate (APR): The cost of Appraisal: A professional analysis used a loan or other financing as an annual rate. to estimate the value of the property. This The APR includes the interest rate, points, includes examples of sales of similar prop- broker fees and certain other credit charges erties. a borrower is required to pay. Appraiser: A professional who conducts an Annuity: An amount paid yearly or at other analysis of the property, including examples regular intervals, often at a guaranteed of sales of similar properties in order to de- minimum amount. Also, a type of insurance velop an estimate of the value of the prop- policy in which the policy holder makes erty. The analysis is called an “appraisal.” payments for a fixed period or until a stated age, and then receives annuity payments Appreciation: An increase in the market from the insurance company. -

UNIFORM REAL PROPERTY ELECTRONIC RECORDING ACT (Last Revised Or Amended in 2005)

UNIFORM REAL PROPERTY ELECTRONIC RECORDING ACT (Last Revised or Amended in 2005) drafted by the NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS and by it APPROVED AND RECOMMENDED FOR ENACTMENT IN ALL THE STATES at its ANNUAL CONFERENCE MEETING IN ITS ONE-HUNDRED-AND-THIRTEENTH YEAR PORTLAND, OREGON JULY 30-AUGUST 6, 2004 WITH PREFATORY NOTE AND COMMENTS Copyright ©2004 By NATIONAL CONFERENCE OF COMMISSIONERS ON UNIFORM STATE LAWS April 2005 ABOUT NCCUSL The National Conference of Commissioners on Uniform State Laws (NCCUSL), now in its 114th year, provides states with non-partisan, well-conceived and well-drafted legislation that brings clarity and stability to critical areas of state statutory law. Conference members must be lawyers, qualified to practice law. They are practicing lawyers, judges, legislators and legislative staff and law professors, who have been appointed by state governments as well as the District of Columbia, Puerto Rico and the U.S. Virgin Islands to research, draft and promote enactment of uniform state laws in areas of state law where uniformity is desirable and practical. • NCCUSL strengthens the federal system by providing rules and procedures that are consistent from state to state but that also reflect the diverse experience of the states. • NCCUSL statutes are representative of state experience, because the organization is made up of representatives from each state, appointed by state government. • NCCUSL keeps state law up-to-date by addressing important and timely legal issues. • NCCUSL’s efforts reduce the need for individuals and businesses to deal with different laws as they move and do business in different states. -

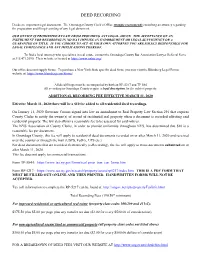

Deed Recording

DEED RECORDING Deeds are important legal documents. The Onondaga County Clerk’s Office strongly recommends consulting an attorney regarding the preparation and filing/recording of any legal document. OUR OFFICE IS PROHIBITED BY LAW FROM PROVIDING ANY LEGAL ADVCE. THE ACCEPTANCE OF AN INSTRUMENT FOR RECORDING IN NO WAY IMPLIES AN ENDORSEMENT OR LEGAL SUFFICIENCY OR A GUARANTEE OF TITLE. IF YOU CHOOSE TO ACT AS YOUR OWN ATTORNEY YOU ARE SOLELY RESPONSIBLE FOR LEGAL COMPLIANCE AND ANY IMPLICATIONS THEREOF. To find a local attorney who specializes in real estate, contact the Onondaga County Bar Association Lawyer Referral Serve at 315.471.2690. Their website is located at https://www.onbar.org/ Our office does not supply forms. To purchase a New York State specific deed form, you may visit the Blumberg Legal Forms website at: https://www.blumberg.com/forms/ All deed filings must be accompanied by both an RP-5217 and TP 584 All recording in Onondaga County require a legal description for the subject property. ADDITIONAL RECORDING FEE EFFECTIVE MARCH 11, 2020 Effective March 11, 2020 there will be a $10 fee added to all residential deed recordings. On January 11, 2020 Governor Cuomo signed into law an amendment to Real Property Law Section 291 that requires County Clerks to notify the owner(s) of record of residential real property when a document is recorded affecting said residential property. The law also allows a reasonable fee to be assessed for said notices. The NYS Association of County Clerks, in order to provide uniformity throughout NYS, has determined that $10 is a reasonable fee per document. -

Attachment A

Attachment A Below is a list of the new transfer types in part 4 of the RTC form. A definition is given along with what instrument needs to be recorded for that specific transfer type. • Sheriff’s Sale ‐ mortgage ‐ A mortgage involves two parties—the property owner who borrowed the money and the bank or lender—and is a written agreement executed by the property owner to secure the payment of a loan that is evidenced by a promissory note. If the property owner misses scheduled payment(s) and the lender sends a notice of default, the foreclosure process is initiated. The lender “accelerates” the time for all payment under the loan so that the full amount is due. The borrower cannot stop the foreclosure proceedings by paying only the late payments; the entire loan must be paid off. For one year after the foreclosure sale, the borrower has the right to redeem the property back by paying the amount of the loan, any taxes or repair cost the buyer paid, and interest. Also, during this one year period of “redemption”, the borrower is entitled to retain possession if they and their family occupied the property as a home. Publicly advertising mortgage sales in the foreclosure process is required. The notice of sale must be physically posted on the property and legal notification to all parties claiming an interest in the property is required. The instrument that will be recorded is the sheriff’s certificate of sale. • Sheriff’s Sale ‐ trust indenture ‐ A trust indenture involves three parties—the borrower (also known as the grantor) , the trustee (often an attorney), and the name of the bank or other lender set out as a beneficiary—and is a written agreement executed by a borrower to give bare legal title to a trustee to secure payment of a loan. -

Commercial Vs Residential Transactions the Complexities & Needed Due Diligence

A Division of American Surveying & Mapping, Inc. Commercial vs Residential Transactions The Complexities & Needed Due Diligence National Marketing Director Service Provider to the David Herrin, Fidelity National Title Group Cindy Jared, SVP, Major Accounts Family of Companies Thank You Thank You • Thank you to ALTA and to Fidelity National Title Group for sponsorship of this Webinar and the opportunity to present to ALTA members • My name is David Herrin the National Marketing Director of National Due Diligence Services (NDDS) • NDDS is a Division of American Surveying & Mapping, Inc. • We are a national land surveying and professional due diligence firm • Established in 1992 with over 25 years of service • One of the nation's largest, private sector, survey firms • Staff of 150 dedicated & experienced professionals ® 2 Commercial vs Residential Transactions • Residential Transactions – Systematic and Regulated • Commercial Transaction – Complexities • Commercial - Due Diligence Phase – ALTA Survey – Related Title Endorsements • Other Commercial Due Diligence Needs – Environmental Site Assessments – Property Condition Assessments, – Seismic Risk Assessments (PML) – Zoning ® 3 Subject Matter Expert Speakers may include: David Herrin, National Marketing Director, NDDS Mr. Herrin offers over 35 years real estate experience including 10 years as a Georgia licensed Real Estate Broker (prior GRS & CCIM designates), regional manager for a national title insurance company & qualified MCLE instructor in multiple states. Brett Moscovitz, President, -

Bundle of S Cks—Real Property Rights and Title Insurance Coverage

Bundle of Scks—Real Property Rights and Title Insurance Coverage Marc Israel, Esq. What Does Title Insurance “Insure”? • Title is Vested in Named Insured • Title is Free of Liens and Encumbrances • Title is Marketable • Full Legal Use and Access to Property Real Property Defined All land, structures, fixtures, anything growing on the land, and all interests in the property, which may include the right to future ownership (remainder), right to occupy for a period of +me (tenancy or life estate), the right to build up (airspace) and drill down (minerals), the right to get the property back (reversion), or an easement across another's property.” Bundle of Scks—Start with Fee Simple Absolute • Fee Simple Absolute • The Greatest Possible Rights Insured by ALTA 2006 Policy • “The greatest possible estate in land, wherein the owner has the right to use it, exclusively possess it, improve it, dispose of it by deed or will, and take its fruits.” Fee Simple—Lots of Rights • Includes Right to: • Occupy (ALTA 2006) • Use (ALTA 2006) • Lease (Schedule B-Rights of Tenants) • Mortgage (Schedule B-Mortgage) • Subdivide (Subject to Zoning—Insurable in Certain States) • Create a Covenant Running with the Land (Schedule B) • Dispose Life Estate S+ck • Life Estate to Person to Occupy for His Life+me • Life Estate can be Conveyed but Only for the Original Grantee’s Lifeme • Remainderman—Defined in Deed • Right of Reversion—Defined in Deed S+cks Above, On and Below the Ground • Subsurface Rights • Drilling, Removing Minerals • Grazing Rights • Air Rights (Not Development Rights—TDRs) • Canlever Over a Property • Subject to FAA Rules NYC Air Rights –Actually Development Rights • Development Rights are not Real Property • Purely Statutory Rights • Transferrable Development Rights (TDRs) Under the NYC Zoning Resoluon and Department of Buildings Rules • Not Insurable as They are Not Real Property Title Insurance on NYC “Air Rights” • Easement is an Insurable Real Property Interest • Easement for Light and Air Gives the Owner of the Merged Lots Ability to Insure. -

Title Matters Affecting Parties in Possession: By

TITLE MATTERS AFFECTING PARTIES IN POSSESSION: ADVERSE POSSESSION, AFTER-ACQUIRED TITLE, & THE RULE AGAINST PERPETUITIES BY DONALD G. SINEX SCOTT C. PETRY SUSAN A. STANTON TABLE OF CONTENTS INTRODUCTION…………………………………………………………………………….. 1 I. ADVERSE POSSESSION…….……………………………………………………………. 1 1. Adverse Possession………...………………...……………………………………….......... 2 2. Identifying Issues in Record Title…………………………………………………………. 3 a. Historical Changes in Metes and Bounds…………………………………………… 4 b. Adverse Possession of Minerals……………………………………………………… 4 c. Adverse Possession in Cotenancy, Landlord-Tenant, & Grantor-Grantee Situations………………………………………………………………………….…...... 5 d. Distinguishing Coholders from Cotenants………………………………………….. 6 3. Adverse Possession Requirement………………………………………………………… 7 4. Other Issues………………………………………...……………………………………….. 9 II. AFTER ACQUIRED TITLE………………………….…………………………………………. 10 1. The Doctrine………………..……... ……………………………………………………….. 10 2. Bases Used by Courts in Applying the Doctrine…………………………………........... 11 3. Conveyance Instruments that an Examiner is Likely to Encounter…………………… 12 a. Deeds of Trust and Liens……………………………………………………………... 12 b. Oil & Gas Leases and Limitations……………………………………………………. 14 c. Public Lands……………………………………………………………………………. 15 d. Title Acquired in Trust………………………………………………………………… 16 e. Quitclaims and Limitations…………………………………………………………… 16 4. Effect on Notice and Purchasers………………………………………………………….. 18 a. Subsequent Purchaser…………………………………………………………………. 19 b. Protections……………………………………...………………………………………. 19 c. Duty to Search…………………………………………………………………………. -

Property Ownership for Women Enriches, Empowers and Protects

ICRW Millennium Development Goals Series PROPERTY OWNERSHIP FOR WOMEN ENRICHES, EMPOWERS AND PROTECTS Toward Achieving the Third Millennium Development Goal to Promote Gender Equality and Empower Women It is widely recognized that if women are to improve their lives and escape poverty, they need the appropriate skills and tools to do so. Yet women in many countries are far less likely than men to own property and otherwise control assets—key tools to gaining eco- nomic security and earning higher incomes. Women’s lack of property ownership is important because it contributes to women’s low social status and their vulnerability to poverty. It also increasingly is linked to development-related problems, including HIV and AIDS, hunger, urbanization, migration, and domestic violence. Women who do not own property are far less likely to take economic risks and realize their full economic potential. The international community and policymakers increasingly are aware that guaranteeing women’s property and inheritance rights must be part of any development agenda. But no single global blueprint can address the complex landscape of property and inheritance practices—practices that are country- and culture-specific. For international development efforts to succeed—be they focused on reducing poverty broadly or empowering women purposely—women need effective land and housing rights as well as equal access to credit, technical information and other inputs. ENRICH, EMPOWER, PROTECT Women who own property or otherwise con- and tools—assets taken trol assets are better positioned to improve away when these women their lives and cope should they experience and their children need them most. -

How to Buy Title Insurance In

How to Buy Title Insurance in [Insert State] This guide: • Covers the basics of title insurance. • Explains the need for title insurance. • Offers tips to shop for title insurance and closing services. • Gives you questions you should ask before you buy title insurance. [Name] [DOI Logo] [Superintendent of Insurance] [DOI Website Address] Drafting Note: This template has been developed for state departments of insurance who are interested in providing a consumer education publication regarding title insurance. The template was developed as a comprehensive guide that can be edited/personalized to meet the individual needs of a state. DRAFT: 3-23-215-25-21 1 Table of Contents Introduction Page 3 Buying or Refinancing a Property Page 3 What is Title Insurance, and What Does it Cover? Page 4 Two Types of Title Insurance—Owner’s and Lender’s Policies Page 4 What Doesn’t Title Insurance Cover? Page 4 Who Sells Title Insurance? Page 5 The Right to Choose Your Own Title Agent/Company Page 5 Who Pays for Title Insurance? Page 5 What Does Title Insurance Cost? Page 6 Ask if You’re Eligible for Discounts Page 6 The Difference Between Title and Homeowners Insurance Page 6 Questions to Ask Before You Buy Title Insurance Page 6 The Real Estate Closing Page 7 Closing Agents Page 8 Questions to Ask When You Choose a Closing Agent Page 8 Closing Protection Page 8 Shop Around for Title Insurance and Closing Services Page 8 Cost Comparison Chart Page 9 Final Tips to Remember Page 10 How to File a Title Insurance Claim Page 10 The [INSERT DOI NAME] is Here to Help Page 10 Other Resources Available Page 11 Disclaimer: The information included in this publication is meant to serve as a guide and is not a substitute for legal or professional advice. -

Informationfriday

#InformationFriday LEASEHOLD TITLE INSURANCE: A PATHWAY TO CLOSING By: S. H. Spencer Compton, Vice President-Special Counsel, First American Title Insurance Company June 12, 2015 Law school teaches that real property consists of a bundle of rights associated with certain estates or interests, foremost of which is the fee simple absolute. Much has been written about the insurability of fee estates. This article will discuss title insurance products for leasehold estates and their practical value in consummating significant commercial lease transactions. Just like fee owners and fee mortgagees, certain prospective tenants, tenants’ assignees and leasehold lenders can benefit from the information furnished in a title report and the subsequent protections of a leasehold title insurance policy. Nonetheless, only a few long-term lessors of high value real property with costly leasehold improvements purchase leasehold title insurance unless their lenders simultaneously purchase it, thus affording such lessors a discounted premium rate. This is counterintuitive, given that the impairment or loss of a long-term leasehold estate due to a title claim or failure of title can be every bit as devastating to the tenant as such a loss or claim might be to a fee owner. In addition, the leasehold endorsement to the 2006 ALTA owner’s policy expands the policy as to the computation of loss or damage and identifies compensable items of loss for a policy insuring a leasehold. The value question of whether or not to purchase a Leasehold Owner’s title insurance policy is a secondary consideration. First, let us focus on what information can be derived from a leasehold title report: 1. -

REAL ESTATE LAW LESSON 1 OWNERSHIP RIGHTS (IN PROPERTY) Real Estate Law Outline LESSON 1 Pg

REAL ESTATE LAW LESSON 1 OWNERSHIP RIGHTS (IN PROPERTY) Real Estate Law Outline LESSON 1 Pg Ownership Rights (In Property) 3 Real vs Personal Property 5 . Personal Property 5 . Real Property 6 . Components of Real Property 6 . Subsurface Rights 6 . Air Rights 6 . Improvements 7 . Fixtures 7 The Four Tests of Intention 7 Manner of Attachment 7 Adaptation of the Object 8 Existence of an Agreement 8 Relationships of the Parties 8 Ownership of Plants and Trees 9 Severance 9 Water Rights 9 Appurtenances 10 Interest in Land 11 Estates in Land 11 Allodial System 11 Kinds of Estates 12 Freehold Estates 12 Fee Simple Absolute 12 Defeasible Fee 13 Fee Simple Determinable 13 Fee Simple Subject to Condition Subsequent 14 Fee Simple Subject to Condition Precedent 14 Fee Simple Subject to an Executory Limitation 15 Fee Tail 15 Life Estates 16 Legal Life Estates 17 Homestead Protection 17 Non-Freehold Estates 18 Estates for Years 19 Periodic Estate 19 Estates at Will 19 Estate at Sufferance 19 Common Law and Statutory Law 19 Copyright by Tony Portararo REV. 08-2014 1 REAL ESTATE LAW LESSON 1 OWNERSHIP RIGHTS (IN PROPERTY) Types of Ownership 20 Sole Ownership (An Estate in Severalty) 20 Partnerships 21 General Partnerships 21 Limited Partnerships 21 Joint Ventures 22 Syndications 22 Corporations 22 Concurrent Ownership 23 Tenants in Common 23 Joint Tenancy 24 Tenancy by the Entirety 25 Community Property 26 Trusts 26 Real Estate Investment Trusts 27 Intervivos and Testamentary Trusts 27 Land Trust 27 TEST ONE 29 TEST TWO (ANNOTATED) 39 Copyright by Tony Portararo REV. -

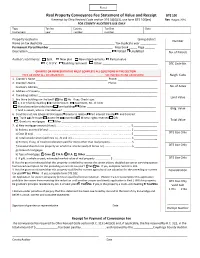

Real Property Conveyance Fee Statement of Value and Receipt

Real Property Conveyance Fee Statement of Value and Receipt DTE 100 If exempt by Ohio Revised Code section 319.54(G)(3), use form DTE 100(ex) Rev 1/14 FOR COUNTY AUDITOR’S USE ONLY Type Tax list County Tax Dist Date Instrument year number number Property located in ____________________________________________________________ taxing district Number Name on tax duplicate ____________________________________________ Tax duplicate year __________ Permanent Parcel Number _______________________________________ Map book _____ Page ______ Description ___________________________________________________ Platted Unplatted No. of Parcels Auditor’s comments: Split New plat New improvements Partial value C.A.U.V. Building removed Other __________________________________ DTE Code No. GRANTEE OR REPRESENTATIVE MUST COMPLETE ALL QUESTIONS IN THIS SECTION TYPE OR PRINT ALL INFORMATION SEE INSTRUCTIONS ON REVERSE Neigh. Code 1. Grantor’s Name _________________________________________________ Phone: ___________________________ 2. Grantee’s Name _________________________________________________ Phone: ___________________________ Grantee’s Address__________________________________________________________________________________ No. of Acres 3. Address of Property ________________________________________________________________________________ 4. Tax billing address _________________________________________________________________________________ Land Value 5. Are there buildings on the land? Yes No If yes, Check type: 1, 2 or 3 family dwelling Condominium