SYDNEY CBD Office Q2 2021

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Visitor and Admission Information

The following COVID-19 precautions apply to all admissions, parents/carers and visitors to Allowah We continue to adjust our visiting and admission restrictions in light of advice from New South Wales Health. Effective immediately, the following will apply. Can I visit Allowah? 1. No. From 6pm 26 June 2021 to 7 July 2021 there will be no visitors allowed at Allowah. The only exceptions are for parents and carers on compassionate or essential care grounds. These visits must be approved in advance by the Executive Leadership Team (ELT) following a risk assessment. If you arrive at Allowah without prior approval from the ELT you will be denied access. You must call at least 24 hours in advance so that a risk assessment can be conducted before you come. We send an email detailing any changes to the Screening Form each time a change takes place. Special conditions will be placed on any parent or carer given access under these provisions and these must be adhered to. Staff will be advised for each individual visit what these conditions are. Can my child come to the School Holiday or Weekend Day program? 2. Not as a day program. Our School Holiday and weekend day programs have been cancelled for children not admitted to the hospital due to the lockdown in place from 26 June 2021 to 7 July 2021. Children admitted to Allowah for overnight stays may still take part in the School Holiday and Weekend Programs. Can my child be admitted to Allowah? 3. Yes, providing they meet the screening criteria. -

Authorised by Marcia Venegas | Company Secretary

17 August 2021 ASX Limited ASX Market Announcements Office Exchange Centre 20 Bridge Street Sydney NSW 2000 ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 June 2021 Magellan Financial Group Limited (ASX code: MFG) hereby lodges: 1. Appendix 4E Statement for the year ended 30 June 2021; and 2. Annual Report for the year ended 30 June 2021, incorporating the Chairman's Report, the Chief Executive Officer's Annual Letter and the financial statements. Yours faithfully, Authorised by Marcia Venegas | Company Secretary Page 1 Appendix 4E Magellan Financial Group Limited Results for Announcement to the Market 30 June 2021 30 June 2020 % change $’000 $’000 Total revenue and other income 3 to 715,012 693,952 Net profit after tax (33) to 265,156 396,214 Total comprehensive income (34) to 261,672 397,096 Adjusted net profit after tax (6) to 412,659 438,299 Basic and diluted earnings cents per share 144.6 218.3 Adjusted basic and diluted earnings cents per share 225.0 241.5 Net tangible assets ("NTA") per share1 As at 30 June 2021 $4.77 As at 30 June 2020 $5.08 1 NTA per ordinary share includes right-of-use assets. Dividends Amount per security Franked Amount per security Interim dividend (paid on 25 February 2021) 97.1 cents 72.82 cents Final dividends (to be paid 23 September 2021)1 114.1 cents 85.57 cents Total dividends 211.2 cents 158.40 cents Final dividend dates Ex-dividend date 23 August 2021 Record date 24 August 2021 DRP election date 7 September 2021 Cash payment date 23 September 2021 DRP issue date 30 September 2021 1 Comprises a final dividend of 102.6 cents per share and a performance fee dividend of 11.5 cents per share. -

2021 Interim Result Data Pack

16 August 2021 2021 Interim Result Data Pack GPT provides its 2021 Interim Result Data Pack which has been approved for release by the Chief Executive Officer. -ENDS- For more information, please contact: INVESTORS MEDIA Penny Berger Grant Taylor Head of Investor Relations & Corporate Communications Manager Affairs +61 402 079 955 +61 403 772 123 Level 51, 25 Martin Place, Sydney NSW 2000 www.gpt.com.au Market Briefing 16 August 2021 The GPT Group acknowledges the Traditional Custodians of the lands on which our business and assets operate, and recognises their ongoing connection to land, waters and community. We pay our respects to First Nations Elders past, present and emerging. Artwork created by Molly Wallace 2021 Half Year in Review | Bob Johnston 4 Finance and Treasury | Anastasia Clarke 9 Office and Logistics | Matthew Faddy 13 Retail | Chris Barnett 28 Funds Management | Nicholas Harris 36 Summary and outlook | Bob Johnston 39 Agenda THE GPT GROUP | 2021 INTERIM RESULT 4 Strong first half recovery interrupted by recent COVID-19 restrictions » Strong momentum in six months to 30 June 2021 − Operating environment strengthened from economic recovery − Minimal disruptions from COVID-19 − Robust recovery in retail sales − 104% of 1H 2021 Retail net billings collected − Continued to execute on strategy − Solid capital position maintained » From late June 2021, trading conditions impacted by COVID-19 lockdowns » 2021 Funds From Operations and distribution guidance withdrawn in July 2021 » Recovery in retail sales expected following the lifting of restrictions 8 Exhibition Street, Melbourne 2021 Interim Result Financial summary 15.64cents 13.3cents Funds From Operations Distribution per security, up 24.6% per security, up 43.0% $5.86 10.2% Net Tangible Assets per security, up 5.2%1 Total Return2 Investment portfolio Portfolio Assets under occupancy 95.6% management $25.3b Weighted average Weighted average lease expiry 4.8yrs capitalisation rate 4.85% One One One Eagle Street and Riverside Centre, Brisbane 1. -

2021 Annual Report Dexus Releases Its 2021 Annual Report, Which Will Be Mailed to Security Holders Who Have Elected to Receive a Hard Copy in Mid-September 2021

Dexus (ASX: DXS) ASX release 17 August 2021 2021 Annual Report Dexus releases its 2021 Annual Report, which will be mailed to Security holders who have elected to receive a hard copy in mid-September 2021. Authorised by the Board of Dexus Funds Management Limited For further information please contact: Investors Media Rowena Causley Louise Murray Senior Manager, Investor Relations Senior Manager, Corporate Communications +61 2 9017 1390 +61 2 9017 1446 +61 416 122 383 +61 403 260 754 [email protected] [email protected] About Dexus Dexus (ASX: DXS) is one of Australia’s leading fully integrated real estate groups, managing a high-quality Australian property portfolio valued at $42.5 billion. We believe that the strength and quality of our relationships will always be central to our success and are deeply committed to working with our customers to provide spaces that engage and inspire. We invest only in Australia, and directly own $17.5 billion of office, industrial and healthcare properties, and investments. We manage a further $25.0 billion of office, retail, industrial and healthcare properties for third party clients. The group’s $14.6 billion development pipeline provides the opportunity to grow both portfolios and enhance future returns. Sustainability is integrated across our business, and our sustainability approach is the lens we use to manage emerging ESG risks and opportunities for all our stakeholders. Dexus is a Top 50 entity by market capitalisation listed on the Australian Securities Exchange and is supported by more than 30,000 investors from 23 countries. With over 35 years of expertise in property investment, funds management, asset management and development, we have a proven track record in capital and risk management and delivering superior risk-adjusted returns for investors. -

Notes to the Financial Statements 51 1

17 August 2021 ASX Limited ASX Market Announcements Office Exchange Centre 20 Bridge Street Sydney NSW 2000 ANNUAL REPORT AND FINANCIAL STATEMENTS FOR THE YEAR ENDED 30 June 2021 Magellan Financial Group Limited (ASX code: MFG) hereby lodges: 1. Appendix 4E Statement for the year ended 30 June 2021; and 2. Annual Report for the year ended 30 June 2021, incorporating the Chairman's Report, the Chief Executive Officer's Annual Letter and the financial statements. Yours faithfully, Authorised by Marcia Venegas | Company Secretary For personal use only Page 1 Appendix 4E Magellan Financial Group Limited Results for Announcement to the Market 30 June 2021 30 June 2020 % change $’000 $’000 Total revenue and other income 3 to 715,012 693,952 Net profit after tax (33) to 265,156 396,214 Total comprehensive income (34) to 261,672 397,096 Adjusted net profit after tax (6) to 412,659 438,299 Basic and diluted earnings cents per share 144.6 218.3 Adjusted basic and diluted earnings cents per share 225.0 241.5 Net tangible assets ("NTA") per share1 As at 30 June 2021 $4.77 As at 30 June 2020 $5.08 1 NTA per ordinary share includes right-of-use assets. Dividends Amount per security Franked Amount per security Interim dividend (paid on 25 February 2021) 97.1 cents 72.82 cents Final dividends (to be paid 23 September 2021)1 114.1 cents 85.57 cents Total dividends 211.2 cents 158.40 cents Final dividend dates Ex-dividend date 23 August 2021 Record date 24 August 2021 DRP election date 7 September 2021 Cash payment date 23 September 2021 DRP issue date 30 September 2021 1 Comprises a final dividend of 102.6 cents per share and a performance fee dividend of 11.5 cents per share. -

PDS Dated 9 February 2018 Containing an SPDS Dated 28 May 2018 Is Changed to Level 47, Suite 2, 25 Martin Place, Sydney NSW 2000 and Renamed As Follows

VanEck Investments Limited ABN 22 146 596 116, AFSL 416755 Level 47, Suite 2, 25 Martin Place Sydney NSW 2000 www.vaneck.com.au 26 July 2021 PRODUCT DISCLOSURE STATEMENT DATED 9 FEBRUARY 2018 NOTICE OF ADDRESS AND NAME CHANGE Effective 26 July 2021, the address of the fund offered under the PDS dated 9 February 2018 containing an SPDS dated 28 May 2018 is changed to Level 47, Suite 2, 25 Martin Place, Sydney NSW 2000 and renamed as follows: Code Previous name New name VanEck Vectors MSCI International VanEck MSCI International Sustainable ESGI Sustainable Equity ETF Equity ETF All other contact details remain unchanged and the change of name has no impact on the management or operation of the fund. The ASX trading codes for the fund has not changed. For more information: Call 1300 68 38 37 Go to vaneck.com.au IMPORTANT NOTICE: VanEck Investments Limited is the responsible entity and issuer of a range of VanEck exchange traded funds on ASX (“Funds”). This information contains general advice only about financial products and is not personal advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to a Fund, you should read the relevant PDS available at www.vaneck.com.au or by calling 1300 68 38 37 and with the assistance of a financial adviser consider if it is appropriate for your circumstances. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the performance, or any particular rate of return of any Fund. -

PDS Dated 23 March 2020 Is Changed to Level 47, Suite 2, 25 Martin Place, Sydney NSW 2000 and Renamed As Follows

VanEck Investments Limited ABN 22 146 596 116, AFSL 416755 Level 47, Suite 2, 25 Martin Place Sydney NSW 2000 www.vaneck.com.au 26 July 2021 PRODUCT DISCLOSURE STATEMENT DATED 23 MARCH 2020 NOTICE OF ADDRESS AND NAME CHANGE Effective 26 July 2021, the address of the fund offered under the PDS dated 23 March 2020 is changed to Level 47, Suite 2, 25 Martin Place, Sydney NSW 2000 and renamed as follows: Code Previous name New name CETF VanEck Vectors FTSE China A50 ETF VanEck FTSE China A50 ETF All other contact details remain unchanged and the change of name has no impact on the management or operation of the fund. The ASX trading code for the fund has not changed. For more information: Call 1300 68 38 37 Go to vaneck.com.au IMPORTANT NOTICE: VanEck Investments Limited is the responsible entity and issuer of a range of VanEck exchange traded funds on ASX (“Funds”). This information contains general advice only about financial products and is not personal advice. It does not take into account any person’s individual objectives, financial situation or needs. Before making an investment decision in relation to a Fund, you should read the relevant PDS available at www.vaneck.com.au or by calling 1300 68 38 37 and with the assistance of a financial adviser consider if it is appropriate for your circumstances. No member of the VanEck group of companies gives any guarantee or assurance as to the repayment of capital, the performance, or any particular rate of return of any Fund. -

Carpenter . . . Airlines

Jr i IP / :||l =mm ... ■I ^ *4- '«• ■ ;S.:'i ■ ■i .................................■*• 1 ^ }' jj'^ . ■ ■ . * * HHH " : ■ * m r' m m ■■#j 1 ■ ■ ■ ■ ■ * ■ 'mMm m ■ ■i 1 ■ ■ ■ ■ ■ Gordon's Guides V *►■...... ^ ■1 < - M- '..... ' .] M •' m m ■ *- / ■ ■ mm ■ j - ■ .1 ■ ■ ■ L * The Journal of the AVIATION HISTORICAL SOCIETY am of AUSTRALIA Inc. A00336533P, ARBN 092-671-773 Volume 33 - Number 2 - June 2002 EDITORS, DESIGN & PRODUCTION EDITORIAL Bill and Judith Baker We present another fine spread of Australian aviation Address all correspondence to; subjects, most of which you will not see anywhere else. I am The Editor, AHSA, particularly fond of Roger McDonald's article on Gordon's P.O. Box 2007, Guides, perhaps because it takes me back to my youth South Melbourne 3205 Victoria, Australia. when as a young chap I would go up to McGills newsagency 03 9583 4072 Phone & Fax in Elizabeth Street, Melbourne and buy a copy. I would then E.mail: [email protected] spend hours planning trips that I would never take. www.ctie.monash.edu.au/hargrave/ahsa.html 1 keep on harping about the need to grow membership, and Subscription Rates; I have thought often about our NSW Branch which does not Australia A$45. contribute many members to the total membership. If you Rest of World A$68, have friends in that Branch please tell them about what they Overseas payment to be in Australian are missing. currency by International Money Order or I must confess a twinge of alarm about the talk of postage Bank Draft. Overseas personal cheques increases. If it is the same percentage for postage of AH as cannot be accepted. -

2021 06 02 MLC Centre Sydney Gets a New Name As

Dexus Media Release 2 June 2021 MLC Centre, Sydney gets a new name as part of a $170 million transformation The iconic MLC Centre will be known as 25 Martin Place as new retailers were unveiled today as part of the first stage of the circa $170 million transformation. The new name, 25 Martin Place, celebrates the location in the heart of Sydney’s thriving CBD and will showcase new and contemporary luxury retail, dining and cultural spaces. A highlight of the vibrant entertainment precinct will be a new dining experience that overlooks Martin Place, creating an al fresco setting for visitors to socialise and connect. The first of the new retailers will open their doors later this year with the arrival New Zealand Restaurant Good Group’s Botswana Butchery, Nour Group’s Aalia and Japanese restaurant, Kazan. This will coincide with the re-opening of the Theatre Royal Sydney with the Australian launch of the musical, Jagged Little Pill, inspired by Grammy Award winner Alanis Morissette. International luxury fashion house Valentino will unveil a new Australian flagship in time for Christmas. Taking one of Sydney’s most prestigious retail addresses, Valentino will present a luxury fashion experience spanning two levels across 765 square metres on the corner of Castlereagh and King Streets. Dexus CEO, Darren Steinberg said: “Together with our capital partner, Dexus Wholesale Property Fund, Dexus is making a significant investment in a great city asset to ensure 25 Martin Place continues to contribute to the CBD for years to come. “This transformation into a vibrant CBD destination will generate new jobs, support the culture of the city, and contribute to Sydney’s day and night economy, helping to drive economic growth into the future.” On completion, it is estimated 25 Martin Place will generate over 300 new retail, hospitality, and theatre jobs and attract tens of thousands of locals and tourists to the centre of Sydney daily. -

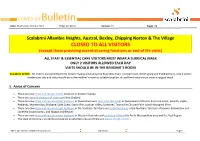

Closed to All Visitors

Date: Wednesday 30 June 2021 Time: 06:30 hrs Version: 0 1 Pages: 34 Scalabrini Allambie Heights, Austral, Bexley, Chipping Norton & The Village CLOSED TO ALL VISITORS (except those providing essential caring functions or end of life visits) ALL STAFF & ESSENTIAL CARE VISITORS MUST WEAR A SURGICAL MASK ONLY 2 VISITORS ALLOWED EACH DAY VISITS SHOULD BE IN THE RESIDENT'S ROOM Scalabrini Griffth - No visitors are permitted from Greater Sydney (including the Blue Mountains, Central Coast, Wollongong and Shellharbour), only 2 vistors resident per day and visits should be in the resident’s room or suitable location, all staff and vistors must wear a surgical mask. 1. Areas of Concern • There are new close and casual contact locations in Greater Sydney. • There are current locations of interest in New Zealand. • There are new close and casual contact locations in Queensland and restricted LGA areas in Queensland of Noosa, Sunshine Coast, Ipswich, Logan, Redlands, Moreton Bay, Brisbane, Gold Coast, Scenic Rim, Lockyer Valley, Somerset, Townsville City and Palm Island Aboriginal Shire. • There are new close and casual contact locations in the Northern Territory and restricted shires in the Northern Territory of Darwin, Palmerston and Litchfield Council areas, and Wagait and Belyuen. • There are new close and casual contact locations in Western Australia and restricted LGAs in the Perth Metropolitan area and the Peel Region • The state of Victoria is currently considered an affected area and there are places of high concern. 2021_06_30 SVL COVID-19 -

2021 Sustainability Report

Dexus (ASX: DXS) ASX release 17 August 2021 2021 Sustainability Report Dexus releases its 2021 Sustainability Report, which includes the: − Sustainability Performance Pack − Sustainability Data Appendix − Sustainability Approach and Procedures − GRI Content Index − Sustainability Assurance Statement This report should be read in conjunction with Dexus’s 2021 Annual Report. Authorised by the Board of Dexus Funds Management Limited For further information please contact: Investors Media Rowena Causley Louise Murray Senior Manager, Investor Relations Senior Manager, Corporate Communications +61 2 9017 1390 +61 2 9017 1446 +61 416 122 383 +61 403 260 754 [email protected] [email protected] About Dexus Dexus (ASX: DXS) is one of Australia’s leading fully integrated real estate groups, managing a high-quality Australian property portfolio valued at $42.5 billion. We believe that the strength and quality of our relationships will always be central to our success and are deeply committed to working with our customers to provide spaces that engage and inspire. We invest only in Australia, and directly own $17.5 billion of office, industrial and healthcare properties, and investments. We manage a further $25.0 billion of office, retail, industrial and healthcare properties for third party clients. The group’s $14.6 billion development pipeline provides the opportunity to grow both portfolios and enhance future returns. Sustainability is integrated across our business, and our sustainability approach is the lens we use to manage emerging ESG risks and opportunities for all our stakeholders. Dexus is a Top 50 entity by market capitalisation listed on the Australian Securities Exchange and is supported by more than 30,000 investors from 23 countries. -

Sydney Metro Chatswood to Sydenham Technical Paper 3: Local Business

CHATSWOOD TO SYDENHAM ENVIRONMENTAL IMPACT STATEMENT MAY 2016 TECHNICAL PAPER 3: LOCAL BUSINESS Sydney Metro Chatswood to Sydenham Technical Paper 3: local Business May 2016 Sydney Metro Chatswood to Sydenham CONTENTS List of Abbreviations ................................................................................. 7 Executive Summary ......................................................................................... 8 Project overview ....................................................................................... 8 Approach to the local business impacts assessment ............................... 9 Overview of potential impacts ............................................................... 10 1 Introduction............................................................................................ 13 1.2 Overview of the project .................................................................... 15 1.3 Purpose and scope of this study....................................................... 19 1.4 Secretary’s environmental assessment requirements ..................... 20 1.5 What is a local business impact assessment? .................................. 20 1.6 Methodology .................................................................................... 20 2 Existing and Future Businesses of the study Area .................................. 22 2.1 Chatswood dive site (northern) ........................................................ 22 2.2 Artarmon support facility ................................................................