A BUDGET for a Better America PROMISES KEPT

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

A BUDGET for a Better America PROMISES KEPT

A BUDGET FOR A Better America PROMISES KEPT. TAXPAYERS FIRST. FISCAL YEAR 2020 BUDGET OF THE U.S. GOVERNMENT THE BUDGET DOCUMENTS Budget of the United States Government, provided on certain activities whose transactions Fiscal Year 2020 contains the Budget Message of are not part of the budget totals. the President, information on the President’s priori- Major Savings and Reforms, Fiscal Year ties, and summary tables. 2020, which accompanies the President’s Budget, Analytical Perspectives, Budget of the United contains detailed information on major savings and States Government, Fiscal Year 2020 contains reform proposals. The volume describes both major analyses that are designed to highlight specified discretionary program eliminations and reductions subject areas or provide other significant presenta- and mandatory savings proposals. tions of budget data that place the budget in perspec- tive. This volume includes economic and accounting BUDGET INFORMATION AVAILABLE ONLINE analyses; information on Federal receipts and collec- tions; analyses of Federal spending; information on The President’s Budget and supporting materi- Federal borrowing and debt; baseline or current ser- als are available online at https://www.whitehouse. vices estimates; and other technical presentations. gov/omb/budget/. This link includes electronic ver- sions of all the budget volumes, supplemental ma- Supplemental tables and other materials that terials that are part of the Analytical Perspectives are part of the Analytical Perspectives volume volume, spreadsheets of many of the budget tables, are available at https://www.whitehouse.gov/omb/ and a public use budget database. This link also in- analytical-perspectives/. cludes Historical Tables that provide data on budget Appendix, Budget of the United States receipts, outlays, surpluses or deficits, Federal debt, Government, Fiscal Year 2020 contains detailed and Federal employment over an extended time pe- information on the various appropriations and funds riod, generally from 1940 or earlier to 2020 or 2024. -

Chief of Staff Calendar 2019 Year-To-Date

January 2019 February 2019 January 1, 2019 SuMo TuWe Th Fr Sa SuMo TuWe Th Fr Sa 12345 12 Tuesday 6789101112 3456789 13 14 15 16 17 18 19 10 11 12 13 14 15 16 20 21 22 23 24 25 26 17 18 19 20 21 22 23 27 28 29 30 31 24 25 26 27 28 TUESDAY Notes 1 7 AM 8 Morning Staff Mtg; Conference Room; Griffin, Payne P. EOP/USTR 9 10 COS meeting EEOB, 230A 11 12 PM BRIEFING: Ben; Winder 211 Briefing-COS Greer; W 211; Parsell, Benjam 1 2 Copy: Cabinet Affairs Agency Call 5; (b) (6) Murphy, Christ 3 4 5 6 9:15pm - 9:30pm Nightly scheduling email Greer, Jamieson L. EOP/USTR 3 2/21/2019 3:52 PM January 2019 February 2019 January 2, 2019 SuMo TuWe Th Fr Sa SuMo TuWe Th Fr Sa 12345 12 Wednesday 6789101112 3456789 13 14 15 16 17 18 19 10 11 12 13 14 15 16 20 21 22 23 24 25 26 17 18 19 20 21 22 23 27 28 29 30 31 24 25 26 27 28 WEDNESDAY Notes 2 7 AM 8 Morning Staff Mtg; Conference Room; Griffin, Payne P. EOP/USTR 9 10 11 Cabinet Meeting German Autos Call Cabinet Room Dial In: (b) (6) ; Burne FN-USTR-SCHEDULING 12 PM 1 2 Copy: Cabinet Affairs Age Pottinger/Lighthizer mtg MEETING: Pottinger; 205 W USTR; Pottinger, Matthew F. 3 MEETING: Navarro; 205 Winder; FN-USTR-SCHEDULING 4 5 6 9:15pm - 9:30pm Nightly scheduling email Greer, Jamieson L. -

Administration of Donald J. Trump, 2019 Digest of Other White House

Administration of Donald J. Trump, 2019 Digest of Other White House Announcements December 31, 2019 The following list includes the President's public schedule and other items of general interest announced by the Office of the Press Secretary and not included elsewhere in this Compilation. January 1 In the afternoon, the President posted to his personal Twitter feed his congratulations to President Jair Messias Bolsonaro of Brazil on his Inauguration. In the evening, the President had a telephone conversation with Republican National Committee Chairwoman Ronna McDaniel. During the day, the President had a telephone conversation with President Abdelfattah Said Elsisi of Egypt to reaffirm Egypt-U.S. relations, including the shared goals of countering terrorism and increasing regional stability, and discuss the upcoming inauguration of the Cathedral of the Nativity and the al-Fatah al-Aleem Mosque in the New Administrative Capital and other efforts to advance religious freedom in Egypt. January 2 In the afternoon, in the Situation Room, the President and Vice President Michael R. Pence participated in a briefing on border security by Secretary of Homeland Security Kirstjen M. Nielsen for congressional leadership. January 3 In the afternoon, the President had separate telephone conversations with Anamika "Mika" Chand-Singh, wife of Newman, CA, police officer Cpl. Ronil Singh, who was killed during a traffic stop on December 26, 2018, Newman Police Chief Randy Richardson, and Stanislaus County, CA, Sheriff Adam Christianson to praise Officer Singh's service to his fellow citizens, offer his condolences, and commend law enforcement's rapid investigation, response, and apprehension of the suspect. -

Office of the Chief of Staff, in Full

THE WHITE HOUSE TRANSITION PROJECT 1997-2021 Smoothing the Peaceful Transfer of Democratic Power Report 2021—20 THE OFFICE OF THE CHIEF OF STAFF David B. Cohen, The University of Akron Charles E. Walcott, Virginia Polytechnic Institute & State University Smoothing the Peaceful Transfer of Democratic Power WHO WE ARE & WHAT WE DO THE WHITE HOUSE TRANSITION PROJECT. Begun in 1998, the White House Transition Project provides information about individual offices for staff coming into the White House to help streamline the process of transition from one administration to the next. A nonpartisan, nonprofit group, the WHTP brings together political science scholars who study the presidency and White House operations to write analytical pieces on relevant topics about presidential transitions, presidential appointments, and crisis management. Since its creation, it has participated in the 2001, 2005, 2009, 2013, 2017, and now the 2021. WHTP coordinates with government agencies and other non-profit groups, e.g., the US National Archives or the Partnership for Public Service. It also consults with foreign governments and organizations interested in improving governmental transitions, worldwide. See the project at http://whitehousetransitionproject.org The White House Transition Project produces a number of materials, including: . White House Office Essays: Based on interviews with key personnel who have borne these unique responsibilities, including former White House Chiefs of Staff; Staff Secretaries; Counsels; Press Secretaries, etc. , WHTP produces briefing books for each of the critical White House offices. These briefs compile the best practices suggested by those who have carried out the duties of these office. With the permission of the interviewees, interviews are available on the National Archives website page dedicated to this project: . -

State of California E-Mail: [email protected] VIA

XAVIER EECERRA State of California Attorney General DEPARTMENTOF JUSTICE 1300 I STREET, SUITE 125 p.o. BOX 944255 SACRAMENTO, CA 94244-2550 Public: (916) 445-9555 Telephone: (916) 210-6091 Facsimile: (916) 324-8835 E-Mail: [email protected] October 15, 2019 VIA ELECTRONIC MAIL: [email protected] Anonymous Requester MuckRock News DEPT MR 72290 411A Highland Avenue Somerville, Massachusetts 02144-2516 RE: Public Records Requests Received April 29, 2019 (DOJ PRA 2019-01000) and May 8, 2019 (DOJ PRA 2019-01084) - Anonymous Person Dear Sir or Madam: This letter is in response to your recent correspondences, which were received by the California Department of Justice on April 29, 2019, and May 8, 2019, in which you sought records under the California Public Records Act (Gov. Code, § 6250 et seq.). Specifically, you requested the following in your first request (received April 29, 2019): Electronic copies, via email, of all email, calendar invites, text/SMS/MMS/instant messages, or memos sent, written, or received between January 1, 2017 and 2019-04- 27(inclusive), to or from (1) any employee or officer and (2) any of the following: Rl. Donald Trump, R2. Barack Obama R3. MickMulvaney R4. Rahm Emanuel R5. Denis McDonough R6. Melania Trump R7. Michelle Obama R8. Eric Holder R9. Loretta Lynch Rl O. Sally Yates Rl 1. Dana Boente R12. Jeff Sessions R13. Matthew Ritaker R14. William Barr R15. Robert Mueller October 15, 2019 Page 2 R16. Rod Rosenstein Rl 7. Zachary Fuentes R18. John Kelly R19. Reince Priebus R20. John R. Bolton R21. Kirstjen Nielsen R22. -

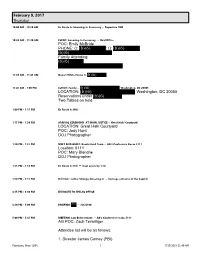

07.30.21. AG Sessions Calendar Revised Version

February 9, 2017 Thursday 10:00 AM - 10:30 AM En Route to Swearing-In Ceremony -- Departure TBD 10:30 AM - 11:30 AM EVENT: Swearing-In Ceremony -- Oval Office POC: Emily McBride PHONE: C: (b)(6) ; D: (b)(6) (b)(6) Family Attending: (b)(6) 11:30 AM - 11:45 AM Depart White House to (b)(6) 11:45 AM - 1:00 PM LUNCH: Family -- (b)(6) Washington, DC 20005 LOCATION: (b)(6) Washington, DC 20005 Reservations under (b)(6) Two Tables on hold 1:00 PM - 1:15 PM En Route to DOJ 1:15 PM - 1:30 PM ARRIVAL CEREMONY AT MAIN JUSTICE -- Great Hall/ Courtyard LOCATION: Great Hall/ Courtyard POC: Jody Hunt DOJ Photographer 1:30 PM - 1:35 PM MEET AND GREET: Beach Head Team -- AG's Conference Room 5111 Location: 5111 POC: Mary Blanche DOJ Photographer 1:35 PM - 1:50 PM En Route to Hill ** must arrive by 1:50 1:50 PM - 3:15 PM Hill Visit : Luther Strange Swearing In -- Carriage entrance of the Capitol. 3:15 PM - 3:30 PM EN ROUTE TO THE AG OFFICE 3:30 PM - 5:00 PM BRIEFING: (b)(5) -- JCC 6100 5:00 PM - 5:45 PM MEETING: Law Enforcement -- AG's Conference room; 5111 AG POC: Zach Terwilliger Attendee list will be as follows: 1. Director James Comey (FBI) Flannigan, Brian (OIP) 1 7/17/2019 11:49 AM February 9, 2017 Continued Thursday 2. Acting Director Thomas Brandon (ATF) 3. Acting Director David Harlow (USMS) 4. Administrator Chuck Rosenberg (DEA) 5. Acting Attorney General Dana Boente (ODAG) 6. -

Administration of Donald J. Trump, 2020 Digest of Other White House

Administration of Donald J. Trump, 2020 Digest of Other White House Announcements December 31, 2020 The following list includes the President's public schedule and other items of general interest announced by the Office of the Press Secretary and not included elsewhere in this Compilation. January 1 In the morning, the President traveled to the Trump International Golf Club in West Palm Beach, FL. In the afternoon, the President returned to his private residence at the Mar-a-Lago Club in Palm Beach, FL, where he remained overnight. The President announced the designation of the following individuals as members of a Presidential delegation to attend the World Economic Forum in Davos-Klosters, Switzerland, from January 20 through January: Steven T. Mnuchin (head of delegation); Wilbur L. Ross, Jr.; Eugene Scalia; Elaine L. Chao; Robert E. Lighthizer; Keith J. Krach; Ivanka M. Trump; Jared C. Kushner; and Christopher P. Liddell. January 2 In the morning, the President traveled to the Trump International Golf Club in West Palm Beach, FL. In the afternoon, the President returned to his private residence at the Mar-a-Lago Club in Palm Beach, FL, where he remained overnight. During the day, President had a telephone conversation with President Recep Tayyip Erdogan of Turkey to discuss bilateral and regional issues, including the situation in Libya and the need for deescalation of the conflict in Idlib, Syria, in order to protect civilians. January 3 In the morning, the President was notified of the successful U.S. strike in Baghdad, Iraq, that killed Maj. Gen. Qasem Soleimani of the Islamic Revolutionary Guard Corps of Iran, commander of the Quds Force. -

Volume 50, Edition 07

VOLUME 50, ISSUE 7 | February 3rd, 2021 | Holding the line since 1971 Image Courtesy of Sophia Jeroncic Bandersnatch is a student run John Abbott College newspaper at John Abbott College. It Executive Positions 21275 Lakeshore Road is published biweekly and is partially Sainte-Anne-de-Bellevue, funded by the Student Activities Sebastian Socorro Michelle Akim Quebec, Canada H9X 3L9 Committee and by advertising solicited customers. Submissions are welcome Editor-in-Chief News Editor Office: H-049 and become property of Bandersnatch. Vanessa Marion Sophia Jeroncic Web: www.bandersnatch.ca Submissions must be sent via MIO E-mail: [email protected] Assistant Editor-in-Chief Arts Editor through John Abbott College’s Omnivox Editors can be reached by MIO. to the respective editors, and must be Marc Randy Position Available in Microsoft Word Document format Production Manager Entertainment Editor (.doc). All submissions must include Sections the full name of the contributor, as Maxim Maiore Andréa Nikolov well as the e-mail address if applicable. Webmaster Games Editor Student Life......................................2 Bandersnatch reserves the right to Paola Peñate Position Available reject submissions or to edit any News...................................................3 submissions for length, legality, or Social Media Manager Sports Editor Arts..................................................4-5 clarity. Submissions should be a Kimberley Huard-Jones Gursagar Singh minimum of 250 words and a maximum Archivist Opinions Editor Entertainment..............................6-7 -

Rising Virus Fears Leave Trail of Wall St. Carnage

C M Y K Nxxx,2020-03-07,A,001,Bs-4C,E2 Late Edition Today, windy, turning out sunny, high 45. Tonight, clear, chilly, low 34. Tomorrow, mostly sunny, chilly start, milder afternoon, high 58. Light wind. Weather map, Page B12. VOL. CLXIX ... No. 58,625 © 2020 The New York Times Company NEW YORK, SATURDAY, MARCH 7, 2020 $3.00 Rising Virus Fears Leave Trail of Wall St. Carnage Uncertainty Abounds as Recent Decline in Markets Erases $3 Trillion in Wealth This article is by David Enrich, that the modern world is in an un- James B. Stewart and Matt Phillips. precedented situation. “There’s There is nothing investors hate no playbook for this,” said Derek more than uncertainty. Right now, Devens, a portfolio manager at that is all there is. the fund company Neuberger Uncertainty about the severity Berman. “That’s been really hard and duration of the coronavirus for people to digest.” outbreak, ripping around the The financial mayhem extends world at something like light beyond the stock market. speed. Uncertainty about how the Many companies are essen- global economy will fare as fac- tially frozen in place, unable to tories, airports, stores, schools, predict how the coronavirus entire cities shut down. Uncer- might affect their businesses. tainty about the ability of govern- Their immediate task is to figure ments to contain the disease and out how to keep operating while the power of central banks to making sure their employees are counter its economic fallout. Un- safe. In Silicon Valley, Apple and certainty about how long all this Twitter told people to work from uncertainty will last. -

Trump Administration Key Policy and Health Policy Personnel CABINET

Trump Administration Key Policy and Health Policy Personnel Updated: August 16, 2020 Positions NOT subject to Senate confirmation in italics _____________________________________________________________________________________________ CABINET Secretary of State: Mike Pompeo Pompeo previously served as the U.S. Representative for Kansas’s 4th congressional district (2011-2017) and sat on the House Energy and Commerce Committee. He was Director of the CIA from 2017 to 2018, when President Trump nominated him to succeed Rex Tillerson as Secretary of State. He was confirmed by the Senate by a vote of 57-42 on April 26, 2018. Secretary of the Treasury: Steven Mnuchin Mnuchin worked as the national finance chairman of Trump’s presidential campaign. He is a former partner at Goldman Sachs, founded the hedge fund Dune Capital Management, and was an investor in the film industry. The Senate confirmed Mr. Mnuchin by a vote of 53-47 on February 13, 2017. The Senate confirmed Justin Muzinich as deputy secretary of the Treasury by a vote of 55-44 on December 11, 2018. Secretary of Defense: Mark Esper Esper previously served as Army Secretary. He was confirmed by the Senate on July 23, 2019 by a vote of 90-8. Attorney General: William Barr Barr previously held the position of attorney general from 1991 to 1993. Before becoming attorney general the first time, Barr held numerous other posts within the Department of Justice, including serving as Deputy Attorney General from 1990 to 1991. The Senate confirmed Barr by a vote of 54-45 on February 14, 2019. Secretary of the Interior: DaviD Bernhardt President Trump has nominated Deputy Secretary of the Interior David Bernhardt as Secretary, following the resignation of Ryan Zinke. -

POLICE DEPARTMENT HEADQUARTERS 1245 3RD Street San Francisco, California 94158 LONDON N

CITY AND COUNTY OF SAN FRANCISCO POLICE DEPARTMENT HEADQUARTERS 1245 3RD Street San Francisco, California 94158 LONDON N. BREED WILLIAM SCOTT MAYOR CHIEF OF POLICE May 07, 2019 Via email [email protected] Anonymous RE: Public Records Request, dated May 01, 2019, Reference # P007602-050119 Dear Sir or Madam, The San Francisco Police Department (SFPD) received your Public Records Act request, dated May 01, 2019. You requested, "If any individual requests need clarification, please do not delay production of other requests. PART 1 Electronic copies, via email, of all email, calendar invites, text/SMS/MMS/instant messages, or memos sent, written, or received between January 1, 2017 and 2019-04-30(inclusive), to or from (1) any employee or officer and (2) any of the following: Rl. Donald Trump R2. Barack Obama R3. The Trump Organization LLC, Trump Golf, Trump Hotels, Trump International Realty, the owners or operators of Trump Tower, Trump International Golf Club, or Trump National Golf Club Mar a Lago, or any of their subsidiaries• R4. Mick Mulvaney R5. Rahm Emanuel R6. Denis McDonough R7. Melania Trump R8. Michelle Obama R9. Eric Holder R10. Loretta Lynch R11. Sally Yates ,R12. Dana Boente R13. Eric F Trump R14. Donald J Trump Jr R15. Jeff Sessions R16. Matthew Whitaker R17. William Barr R18. Robert Mueller R19. Rod Rosenstein R20. Zachary Fuentes R21. John Kelly R22. Reince Priebus R23. John R. Bolton R24. Kirstjen Nielsen R25. Kevin McAleenan R26. Kevin Hassett R27. Timothy Harleth R28. Marcia Lee Kelly R29. James W. Carroll R30. Kelvin Droegemeier R31. Robert Lighthizer R32. -

FY 2018 FOIA Log.Xlsx

FY 2018 FOIA Log (10.01.2017 to 09.30.2018) Requested Final Exemption Request ID Requester Name Organization Request Description Date Disposition Cited CFPB-2018-001-F 9/29/2017 Mahmud, Fatima - Request for a copy of every Federal Length of Service Other Reasons - - Recognition Certificate given to CFPB employees from Duplicate request 1/1/2016 to 12/31/2016. CFPB-2018-002-F 9/30/2017 Johnson, Yvette - Request for the information on The Consumer Financial Granted in Full - Protection Bureau’s Consumer Complaint Database related to the 30 banks listed on this site: https://www.yellowpages.com/brookline-ma/banks. CFPB-2018-004-F 10/3/2017 Kalpin, Christine The Capitol Forum Request for a copy of: 1. All entries made in the Consumer Granted/Denied (b)(6) Financial Protection Bureau FOIA request log between in Part September 1, 2017 and September 30, 2017 2. All entries made in the Consumer Financial Protection Bureau FOIA request log or any other records kept in which the Consumer Financial Protection Bureau invoked exemption 7(a) under 5 U.S.C. § 552(b)(7)(A) between September 1, 2017 and September 30, 2017 FY 2018 FOIA Log (10.01.2017 to 09.30.2018) Requested Final Exemption Request ID Requester Name Organization Request Description Date Disposition Cited CFPB-2018-005-F 10/2/2017 Murphy, Allison The Protect Democracy Request for a copy of: 1. any and all records created or Granted/Denied (b)(6) Project transmitted by or between White House staff, including but in Part not limited to their email addresses ending in “who.eop.gov,” including but not limited to Jared Kushner, Stephen (Steve) Bannon, Reince Priebus, John F.