The Impact of Over the Top Service Providers on the Global Mobile Telecom Industry: a Quantified Analysis and Recommendations for Recovery

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

An Overview of Today's and Tomorrow's M- Commerce In

AN OVERVIEW OF TODAY’S AND TOMORROW’S M- COMMERCE IN THE NETHERLANDS AND EUROPE Hong-Vu Dang BMI Paper AN OVERVIEW OF TODAY’S AND TOMORROW’S M- COMMERCE IN THE NETHERLANDS AND EUROPE Hong-Vu Dang BMI Paper Vrije Universiteit Amsterdam Faculty of Sciences Business Mathematics and Informatics De Boelelaan 1081a 1081 HV Amsterdam www.few.vu.nl August 2006 PREFACE A part of the masters programme of the study that I am following, Business Mathematics & Informatics (BMI) at the Vrije Universiteit Amsterdam, is writing a BMI paper. In this paper a problem in the field of BMI is assessed using existing literature. The subjects addressed in this paper are the past, present and future developments of the relatively new phenomenon called m-commerce. Developments discussed will be from a technological perspective as well as a business perspective. I would like to express my gratitude to Dr. S. Bhulai of the Vrije Universiteit Amsterdam for his guidance while I was writing this paper. Hong-Vu Dang BMI paper: An Overview Of Today’s And Tomorrow’s M-Commerce In The Netherlands And Europe ABSTRACT This paper explains: • What m-commerce is: in a nutshell, it is commerce using a mobile device such as a hand-held device or a smart phone; • What it is used for: currently, m-commerce in Europe mainly consists of messaging, such as SMS, and mobile entertainment (think of ringtones, wallpapers, and mobile games); • What technology is involved with m-commerce: this paper describes the history and future of mobile networks from 1G to 3G, and how other technologies can be used for m-commerce such as GPS, and Wi-Fi; • The business aspects of m-commerce: how much does it cost to enable m- commerce (for instance the costs of the European UMTS network) and how much turnover is made. -

Android (Operating System) 1 Android (Operating System)

Android (operating system) 1 Android (operating system) Android Home screen displayed by Samsung Nexus S with Google running Android 2.3 "Gingerbread" Company / developer Google Inc., Open Handset Alliance [1] Programmed in C (core), C++ (some third-party libraries), Java (UI) Working state Current [2] Source model Free and open source software (3.0 is currently in closed development) Initial release 21 October 2008 Latest stable release Tablets: [3] 3.0.1 (Honeycomb) Phones: [3] 2.3.3 (Gingerbread) / 24 February 2011 [4] Supported platforms ARM, MIPS, Power, x86 Kernel type Monolithic, modified Linux kernel Default user interface Graphical [5] License Apache 2.0, Linux kernel patches are under GPL v2 Official website [www.android.com www.android.com] Android is a software stack for mobile devices that includes an operating system, middleware and key applications.[6] [7] Google Inc. purchased the initial developer of the software, Android Inc., in 2005.[8] Android's mobile operating system is based on a modified version of the Linux kernel. Google and other members of the Open Handset Alliance collaborated on Android's development and release.[9] [10] The Android Open Source Project (AOSP) is tasked with the maintenance and further development of Android.[11] The Android operating system is the world's best-selling Smartphone platform.[12] [13] Android has a large community of developers writing applications ("apps") that extend the functionality of the devices. There are currently over 150,000 apps available for Android.[14] [15] Android Market is the online app store run by Google, though apps can also be downloaded from third-party sites. -

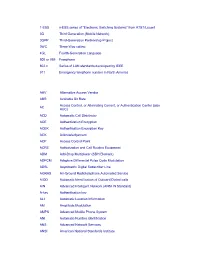

From AT&T/Lucent 3G Third Generation (Mobile Network) 3GPP

1-ESS x-ESS series of "Electronic Switching Systems" from AT&T/Lucent 3G Third Generation (Mobile Network) 3GPP Third-Generation Partnership Project 3WC Three Way calling 4GL Fourth-Generation Language 800 or 888 Freephone 802.x Series of LAN standards developed by IEEE 911 Emergency telephone number in North America AAV Alternative Access Vendor ABR Available Bit Rate Access Control, or Alternating Current, or Authentication Center (also AC AUC) ACD Automatic Call Distributor ACE Authentication Encryption ACEK Authentication Encryption Key ACK Acknowledgement ACP Access Control Point ACRE Authorization and Call Routing Equipment ADM Add-Drop Multiplexer (SDH Element) ADPCM Adaptive Differential Pulse Code Modulation ADSL Asymmetric Digital Subscriber Line AGRAS Air-Ground Radiotelephone Automated Service AIOD Automatic Identification of Outward Dialed calls AIN Advanced Intelligent Network (ANSI IN Standard) A-key Authentication key ALI Automatic Location Information AM Amplitude Modulation AMPS Advanced Mobile Phone System ANI Automatic Number Identification ANS Advanced Network Services ANSI American National Standards Institute ANSI-41 ANSI standard for mobile management (ANSI/TIA/EIA-41) ANT ADSL Network Terminator AOA Angle of Arrival AOL America On Line (ISP) API Application Programming Interface APPC Advanced Program-to Program Communications (IBM SNA) APPN Advanced Peer-to-Peer Network (IBM SNA) ARCnet Attached Resource Computer Network (Datapoint) ARDIS Advanced Radio Data Information Service ARP Address Resolution Protocol ARPA -

2020 Annual Report Dear Stockholders

2020 ANNUAL REPORT DEAR STOCKHOLDERS, 2020 was a year like no other for Consolidated Communications. Searchlight’s investment enabled us to completely refinance our debt and We entered the year with strong momentum and a clear set of strategic extend our maturity profile by seven years. Importantly, this investment goals to guide our path and focus for the year: and partnership with an experienced strategic investor in our sector is • stabilize revenue and EBITDA while growing free cash flow enabling us to accelerate our fiber expansion plans immediately. • leverage our network across the regional territories we serve while • We are in a strong position to accelerate our fiber investments with continuing to invest in the expansion of our fiber network; and a fully funded build, supporting our growth initiatives across three customer groups; carrier, commercial and consumer. We have • continue to execute on our disciplined capital allocation plan, including a embarked on a five-year investment initiative to upgrade 1.6 million strategic refinancing, to position the Company for investment in the future. passings and enable multi-gigabit, symmetrical speeds over fiber services. And then the COVID-19 pandemic arrived, testing us in previously We have a proven track record of growing broadband, and we are now unimaginable ways. But your Company and its employees responded positioned to expedite our fiber expansion plans, boost customer speeds with incredible energy, engagement and support for one another. We and expand gigabit fiber services to 70 percent of our addressable market. focused immediately and intensely to ensure the safety of our employees As part of our fiber expansion plans, we intend to transform the customer and customers while at the same time ensuring business continuity and experience by making it easy for customers to do business with us. -

TECHNOLOGY LANDSCAPE Work Better

April 2015 2020 TECHNOLOGY LANDSCAPE Work better. Live better. CITRIX 2020 TECHNOLOGY LANDSCAPE | APRIL 2015 Contents 01 Executive Summary 02 Trends Update 03 Work Transformed 04 Innovation Special Feature 05 IoT Special Feature 06 Retail and Finance 07 The Future of Education 08 Healthcare of Things CITRIX 2020 TECHNOLOGY LANDSCAPE | APRIL 2015 Contents 01 Executive Summary 02 Trends Update 03 Work Transformed 04 Innovation Special Feature 05 IoT Special Feature 06 Retail and Finance 07 The Future of Education 08 Healthcare of Things Staff CITRIX 2020 TECHNOLOGY LANDSCAPE | APRIL 2015 GUY BIEBER – MANAGING EDITOR / LEAD AUTHOR MATT HYNE – AUTHOR (EDUCATION, HEALTHCARE) Guy Bieber leads the production of the Technology Landscape as Citrix’s chief futurist. Guy is the Director of Strategy and Matt Hyne is the Director of Strategy and Communications in the Citrix Technology Office and a member of the Citrix Architecture for Citrix Labs and the CTO Office. Guy drives strategy, advanced research, and architectural initiatives. Guy CTO Office. Matt is responsible for researching new technology and market opportunities that will develop into new previously served in the CTO Office at General Dynamics having worked on advanced military research and architected business areas for Citrix. Matt is also the co-lead for the Citrix Future of Healthcare initiative that is looking at applying billion dollar programs. Guy has worked on everything from large command and control centers, to wearable fighting systems, new technology innovations to improve healthcare. Prior to Citrix, Matt held R&D leadership roles at Cisco, Ericsson and to intelligence and surveillance systems, targets for the Patriot missile, and many other systems. -

European Technology Media & Telecommunications Monitor

European Technology Media & Telecommunications Monitor Market and Industry Update Second Quarter 2012 Piper Jaffray European TMT Team: Eric Sanschagrin Managing Director Head of European TMT [email protected] +44 (0) 207 796 8420 Stefan Zinzen Principal [email protected] +44 (0) 207 796 8418 Varun Verma Associate [email protected] +44 (0) 207 796 8416 Peter Shin Analyst [email protected] +44 (0) 207 796 8444 TECHNOLOGY MEDIA &TELECOMMUNICATIONS MONITOR Market and Industry Update Selected Piper Jaffray Q2 2012 TMT Transactions A – M&A Transactions Date: May 2012 $206,000,000 Client: NEXX Systems Inc. Appointment: Sale to Tokyo Electron Ltd. Transaction: Tokyo Electron (“TEL”), a Japan-based developer of semiconductor production Has Been Acquired By equipment, announced the completion of its acquisition of NEXX Systems (“NEXX”) for $206 million. The acquisition will expand TEL’s position in advanced packaging to include electrochemical deposition and physical vapor deposition systems that have won awards for outstanding performance, low cost of ownership, development flexibility and their extendibility to future May 2012 applications. Client Description: NEXX is a global leader in advanced semiconductor packaging equipment with focused solutions for back-end wafer level processing. PJC Role: Piper Jaffray acted as sole financial adviser to NEXX Systems. Date: April 2012 $1,400,000,000 Client: Stratasys Inc. Appointment: Merger with Objet Ltd. Transaction: Stratasys and privately held Objet announced that the boards of directors of both companies unanimously approved a definitive merger agreement under which the companies would Has Merged with combine in an all-stock transaction with a total equity value of approximately $1.4 billion. -

The International Communications Market 2016

The International Communications Market 2016 4 4 TV and audio-visual 117 Contents 4.1 TV and audio-visual: overview and key market developments 119 Overview 119 Subscriptions to video-on-demand services continue to grow 121 4.2 The TV and audio-visual industry 125 Revenues 125 The licence fee and public funding 130 4.3 The TV and audio-visual consumer 132 Digital TV take-up 132 IPTV services and take-up 135 Value-added services 135 Broadcast television viewing 138 Legacy terrestrial channels viewing 139 Domestic publicly-owned channels viewing 140 118 4.1 TV and audio-visual: overview and key market developments Overview Subscription revenues continued to make up over half of total TV revenue Global TV revenues from broadcast advertising, channel subscription and public funding including licence fees reached £263bn in 2015. Subscription revenues continue to make up over half of total revenue, at £137bn. TV revenue per capita in the UK was £221 in 2015, the third highest of our comparator countries after Germany (£289) and the US (£351). South Korea had the highest take-up of pay TV at 99%, compared to the UK which had one of the lowest of our comparator countries at 62%. Just over half of UK television homes received an HD service in 2015 (51%), putting the UK in tenth position among our 18 comparator countries. Declines in viewing to broadcast TV occurred across many countries The UK experienced a year-on-year decline in viewing to broadcast TV (-1.9%), with people watching an average of 3 hours 36 minutes of TV each day. -

January 2011 Newsletter

Issue 18/2011 http://www.oss-watch.ac.uk/newsletters/january2011.pdf January Supporting open source in education and research http://www.oss-watch.ac.uk elcometoourfirstnewsletterof2011.Inthisissue,we WbringyouanarticlebyRowanWilsononopensource In thIs Issue: developmentasitrelatestothemobiledeviceworld.Rowan alsobringsusablogpieceexaminingthenewsthat882 Appstoresandopenness patentsbelongingtoNovellhavebeensoldontoCPTN HoldingwiththeacquisitionofNovellbyAttachmate.Our TheNovelldeal secondblogpiececomesfromRossGardler,whodiscusses theJavaCommunityProcessandexaminestheimpactof TheJCPisdeadtome, Oracle’sacquisitionofSunfromaverypersonalperspective. longliveJava Wehopeyouenjoyreadingournewsletter.Asever,allcomments FAQs [email protected]. ElenaBlanco,ContentEditor,[email protected] stay up-to-date Onlinenewsletteravailableat: News from OSS Watch OSSWatchnewsfeed http://www.oss-watch.ac.uk/rss/osswatchnews.rss http://www.oss-watch.ac.uk/ newsletters/january2011.pdf LinuxFoundationpublishesannualreportonwho TheApacheSoftwareFoundationlaunches codesthekernel ‘ApacheExtras’toaccelerateinnovation TheLinuxFoundationhaspublisheditsannualreport TheApacheSoftwareFoundation(ASF)hasannounced onLinuxkerneldevelopment.Thereportdetails apache-extras.org,theGoogle-hostedsiteforcode whodoestheworkandhowfasttheLinuxkernelis associatedwithApacheprojectsthatarenotpartof growing.ItalsoreportsonwhosponsorstheLinux thefoundation’smorethan80top-levelprojectsand kernelandwhilstthetraditionalLinuxsupportersare dozensofinitiativesintheApacheIncubatorandLabs. -

Advanced Info Services (AIS), 155 Advanced Wireless Research Initiative (AWRI), 35 Africa, 161-162 AIR 6468, 23 Alaskan Telco GC

Index Advanced Info Services (AIS), 155 Belgium Competition Authority Advanced Wireless Research Initiative (BCA), 73 (AWRI), 35 Bharti Airtel, 144, 162 Africa, 161–162 Bite,´ 88 AIR 6468, 23 Bouygues, 79 Alaskan telco GCI, 134 Brazil, 125 Altice USA, 132 Broadband Radio Services (BRS), America´ Movil,´ 125, 129 137–138 Android, 184 BT Plus, 105 Antel, 139 BT/EE, 185 Apple, 186–190 Bulgaria, 74 Asia Pacific Telecom (APT), 154 Asia-Pacific Telecommunity (APT), 6, C-band, 26 25–26 Cableco/MVNO CJ Hello, 153 AT&T, 129, 131 Canada, 125–127 Auction Carrier aggregation (CA), 5, 22 coverage obligation, 10 CAT Telecom, 155 plans, 137–139 Cellular IoT (CIoT), 31 reserve prices, 9 Centimetre wave (cmWave), 34–35 Auction methods, 8–9 Centuria, 88 combinatorial clock, 8 Ceragon Networks, 93 simultaneous multi-round Channel Islands Competition and ascending, 8 Regulatory Authorities Augmented reality, 195 (CICRA), 83, 88 Australia, 139–140 Chief Technology Officer (CTO), 185 Austria, 71–73 Chile, 127–128 Autonomous transport, 195 Chile, private networks, 127–128 Average revenue per user (ARPU), China, 141–142 165–166, 197 China Broadcasting Network (CBN), Axtel, 129 141 China Mobile, 141 Backhaul, 24–25 China Telecom, 141 Bahrain, 156 China Unicom, 39, 141–142 Batelco, 156 Chipsets, 186–190 Beamforming, 24, 29 Chunghwa Telecom, 154 Beauty contest, 8 Citizens Broadband Radio Service Belgacom, 73 (CBRS), 130–131 Belgium, 73–74 CK Hutchison, 145 210 Index Cloud computing, 24 Eir Group, 85 Co-operative MIMO. See Coordinated Electromagnetic fields (EMFs), 38–39 -

Enterprise Apps & the Mobile Workplace

The Future of Mobile Enterprise Enterprise Apps & The Mobile Workplace Evolution to a Mobile World Mobile Web Compung and Global IT Ecosystem 10,000,000,000 Desktop Web 1,000,000,000 PCs 100,000,000 10B 1B Microprocessors 100M 10,000,000 Number of Units Mainframes 10M 1,000,000 1M 100,000 1970 1980 1990 2000 2010 2020E Changing Landscape PC Industry Mobile Industry 370M PC’s sold in 2012 Est 1.9b units sold worldwide in 2012 Est. 1.8b PC’s currently in use worldwide 3.5b mobile users, over 50% of the world’s populaon Accepted lifespan is 3 - 5 years Accepted lifespan is 2-3 years ONen shared amongst different users Unique end user Laptops are quasi-portable and accessible while desktops Can be taken and used anywhere are stac • Hardware Centric “My Device, My PC” Informaon Centric “My Data” PCs are turning into tradional Smart devices are the new PCs, with servers, used for large data storage, funconality and usage converging media collec&on, backup. with tradional PC usage. Mobile Enterprise Timeline 2010 2011 2012 2013 2014E 25% of enterprise 50% of enterprise Mobile devices exceed PCs communication on Mobile communication on mobile BYOD PC purchases by consumers surpass Flat & declining PC Tablet device sales exceed Sales enterprise sales sales PCs Workflows uncaptured by Enterprise mobile apps duplicate/appify PC Mobile begins to replace PC software automated Apps based software functions legacy/PC software by mobile apps More established Small App Dev teams M&A market for enterprise Vendors players enter create first enterprise mobile heats up apps market Global Mobile Enterprise Market ($US B) Process & Back-end Reinven&on Ini&al App Builds $15,000 $12,500 $10,000 $7,500 $5,000 $2,500 $0 2010 2011 2012 2013E 2014E 2015E Source: Forrester Research, Inc. -

European Technology Report Tech Increased Interest in Continental

November 2016 Investment Banking European Tech M&A Activity Continues Post-Brexit Referendum In This Report SoftBank–ARM, Micro Focus–HP deals highlight ongoing activity in British European Technology Report tech Increased interest in Continental EuropeanTalend becomes fin tech the latest European tech company to have a successful U.S. IPO M&A, capital-raising, and public comps stats across European tech CONTENTS Executive Summary 1 Market Update and Analysis 3 William Blair Global Technology Banking Franchise 5 Sector and Transaction Data 7 EXECUTIVE SUMMARY European Tech M&A Activity Continues Post-Brexit Referendum Innovative technology industry. Two major transactions in Trustmarque Solutions, an end-to-end companies across the the third quarter, SoftBank’s IT solutions and services provider to acquisition of ARM and Micro Focus’s the public and private sector in the Continent are drawing acquisition of Hewlett Packard United Kingdom, on its sale to Capita, significant interest from Enterprise’s software business, one of the United Kingdom’s leading potential buyers. illustrate the continued outbound and providers of technology-enabled inbound activity involving U.K.-based business process management and The United Kingdom’s intended technology companies. outsourcing solutions. In August, we withdrawal from the European Union advised Liberata, a provider of On July 18, Japan-based SoftBank will be a complicated, drawn-out business process outsourcing, announced that it was acquiring process, and Brexit’s full impact on services, and automation to the U.K. Cambridge-based microprocessor M&A and capital-raising activity will public sector, on its sale to Tokyo- manufacturer ARM for $32 billion. -

PMP 450M and Cnmedusa™ Technology Table of Contents

TECHNICAL ADVANTAGES AND INNOVATION PMP 450m and cnMedusa™ Technology Table of Contents Introduction ..................................................................................................................................... 3 The Road to Massive MU-MIMO ..................................................................................................... 3 MIMO Evolution ............................................................................................................................... 3 Towards Massive MIMO .................................................................................................................. 3 Benefitting Multiple Subscribers ................................................................................................... 3 Spatial Multiplexing ......................................................................................................................... 4 Channel Sounding ............................................................................................................................ 4 Putting it all Together ..................................................................................................................... 4 PMP 450m Overview ........................................................................................................................ 5 Operating Modes ............................................................................................................................. 5 Advantages of PMP 450m powered by cnMedusa ......................................................................