2012 Northwest Cider & Perry Seminar History of Cider Production

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

The Best Year

Carlsberg Brewery Malaysia Berhad (9210-K) Berhad Malaysia Brewery Carlsberg Annual Report 2018 Annual Report PROBABLY THE BEST Carlsberg Brewery Malaysia Berhad (9210-K) No. 55, Persiaran Selangor, Section 15 40200 Shah Alam, Selangor Darul Ehsan, Malaysia Tel : +603 5522 6688 Fax : +603 5519 1931 YEAR www.carlsbergmalaysia.com.my ANNUAL REPORT 2018 TABLE OF CONTENTS 2 Carlsberg Malaysia Group at a Glance 90 Audit & Risk Management Committee Report 4 Our Winning Portfolio of Brands 93 Responsibility Statement 6 Probably The Best Year by the Board of Directors 8 2018 Brand Highlights 94 Financial Statements 28 Chairman’s Address 183 Carlsberg Malaysia’s Sales Offices 30 Managing Director’s Message and 184 Particulars of Group Properties Management Discussion & Analysis 185 Analysis of Shareholdings 40 Sustainability Statement 187 Material Contracts 64 Management Team 188 List of Recurrent Related Party Transactions 66 Profile of Management eamT 190 Notice of Annual General Meeting 68 Profile of the Directors 195 Statement Accompanying Notice of Annual 72 Corporate Governance Overview Statement General Meeting 86 Statement on Risk Management Form of Proxy & Internal Control Corporate Information COVER RATIONALE This year’s theme of Probably the Best Year reflects the success we enjoyed on several fronts. We recorded strong top- and bottom-line growth as our mainstream, premium, craft and cider brands all grew. We delivered considerable value for shareholders with total declared and proposed dividends of 100.0 sen per ordinary share, driven by a 25.3% growth in net profit*. *Net profit refers to Group’s profit attributable to shareholders of the Company ANNUAL REPORT 2018 CARLSBERG +7.4% +25.3% +14.6%* FREE MALAYSIA GROUP NET PROFIT REVENUE CASH FLOW RM1.98 bil AT A GLANCE RM277.2 mil RM328.0 mil 100% Ownership 100% Ownership 51% Ownership MALAYSIA Carlsberg Marketing Sdn. -

Q 2 Shareholder M Agazine a Ugust 2013

Q2 Shareholder Magazine August 2013 WorldReginfo - a00da095-b474-43bf-a8db-f2f5b26cb8fd Q2 August 2013 3 Photo front page: GreenFest Russia The Tuborg brand is closely connected with music and sponsors music events across a large number of Carlsberg’s markets. The DEAR CARLSBERG Tuborg GreenFest is an annual series of rock music events which has Tuborg as its main sponsor. Read more on page 9. SHAREHOLDER Welcome to this edition of News! focused and by improving our ability to commercialise our ideas and knowledge. CONTENTS In the first half year, we grew our earnings In this edition of News, we have dedicated despite tough European markets. Asia con- four pages to shed more light on how we tinued its strong performance, supported work with innovation and provide exam- by strong growth from our international ples of recent innovations in our markets. premium brands. In Russia, we increased Please see pages 4-7. 03 CEO statement our market share in a declining beer 04 Innovation – the legacy and the future market, which continued to be impacted The Carlsberg Group has a long tradi- 06 A taste of Carlsberg Group innovations closure of non-permanent outlets and tion for sponsorships and they play an slower economic growth. In Western important part in our marketing efforts. 08 Sponsorship – it’s all about passion Europe, our market share remained flat, We consider sponsorships an efficient and 10 A glimpse of Carlsberg Group Jørgen a solid performance bearing in mind the engaging way of building brand awareness 13 Financial Statements as at 30 June 2013 Buhl Rasmussen difficult economic environment and tough and communicating with our consumers. -

Annual Report 2013 Management Financial Review Statements

Annual Report 2013 Management Financial review statements 3 The Carlsberg Group at a glance 54 Consolidated financial statements 8 Letter from the Chairman 140 Parent Company 9 Statement from the CEO 160 Management statement 12 In the spotlight: Supply chain 161 Auditors’ report 13 Our regions 19 In the spotlight: China 20 Our business model and Strategy Wheel 21 KPIs 22 Strategy 28 CSR in the value chain 29 CSR targets 30 In the spotlight: Self-regulation 31 Risk management 35 In the spotlight: Sponsorships 36 Corporate governance 43 Remuneration report 49 Executive Committee 50 Shareholder information 52 Financial review 162 Supervisory Board DISCLAIMER This Annual Report contains forward-looking may contain the words “believe, anticipate, then current expectations or forecasts. Such actual results to differ materially from those distribution-related issues, information tech- not be possible for management to predict all statements, including statements about the expect, estimate, intend, plan, project, will be, information is subject to the risk that such expressed in its forward-looking statements nology failures, breach or unexpected termina- such risk factors, nor to assess the impact of Group’s sales, revenues, earnings, spending, will continue, will result, could, may, might”, expectations or forecasts, or the assumptions include, but are not limited to: economic and tion of contracts, price reductions resulting all such risk factors on the Group’s business or margins, cash flow, inventory, products, or any variations of such words or other words underlying such expectations or forecasts, may political uncertainty (including interest rates from market-driven price reductions, market the extent to which any individual risk factor, actions, plans, strategies, objectives and with similar meanings. -

Wine Beverage Alcohol Manual 08-09-2018

Department of the Treasury Alcohol & Tobacco Tax & Trade Bureau THE BEVERAGE ALCOHOL MANUAL (BAM) A Practical Guide Basic Mandatory Labeling Information for WINE TTB-G-2018-7 (8/2018) TABLE OF CONTENTS PURPOSE OF THE BEVERAGE ALCOHOL MANUAL FOR WINE, VOLUME 1 INTRODUCTION, WINE BAM GOVERNING LAWS AND REGULATIONS CHAPTER 1, MANDATORY LABEL INFORMATION Brand Name ................................................................................................................................. 1-1 Class and Type Designation ........................................................................................................ 1-3 Alcohol Content ........................................................................................................................... 1-3 Percentage of Foreign Wine ....................................................................................................... 1-6 Name and Address ..................................................................................................................... 1-7 Net Contents ................................................................................................................................ 1-9 FD&C Yellow #5 Disclosure ........................................................................................................ 1-10 Cochineal Extract or Carmine ...................................................................................................... 1-11 Sulfite Declaration ...................................................................................................................... -

Drink Menu Specialty Drinks

Drink Menu Specialty Drinks Mai Thai………………………………………………………………………………………...…………. 7.5 Bacardi, pineapple & orange juice, grenadine and a dark rum float. Moscow Mule………………………………………………………………………….……...……7 Sobieski Vodka, fresh squeezed lime and Gosling’s ginger beer. (Make it a Dark & Stormy! Substitute the vodka for Dark Rum!) The Kinky Cosmo…………………………………………………………………...…………. 8 Ketel One Vodka, Kinky Liqueur, Triple Sec, cranberry juice and fresh squeezed orange. Shaken and strained. Shucks Bloody Mary………………………………………………………...…………. 8 Garnished with fresh shrimp, pepperoncini, pickle, lime and a green olive. (Lookin’ for a little extra spice? For a $1 more make it a Major Mary!) Pat O’ Brien’s Hurricane…………………………………………...…………. 7 A healthy pour of Dark rum mixed with Pat O’ Brien’s own hurricane mix! Louisiana Sunrise…………………………………………………….…...…………. 6.50 Southern Comfort, house punch, orange juice and sour.. The Oyster Shooter……………………………………………..……………...……….…. 6 Chilled Absolut Peppar Vodka, house made cocktail sauce and a fresh shucked oyster. The Beer On Tap Anchor Steam • Bud Light • Zipline IPA (Lincoln, NE) Goose Island 312 • Stella Artois Domestics Bud Light (20 oz. Aluminum) • Budweiser (20 oz. Aluminum) Busch Light (can) • Coors Light • Coors Light N/A • Michelob Ultra Miller Lite • PBR Tallboy 16oz can Micro Brews 90 Shilling Ale • Ace Pineapple Cider • Ace Perry Hard Cider • Blue Moon Boulevard Wheat • Brickway (Rotating) (Omaha, NE) • Deschutes Black Butte Porter • Deschutes Fresh Squeezed IPA • Founders All Day IPA • Glacial Till Original -

Fortified Wine Production

BEGINNER FORTIFIED WINE PRODUCTION Content contributed by Kimberly Bricker, Imperial Beverage Material contained in this document applies to multiple course levels. Reference your syllabus to determine specific areas of study. Wine was originally fortified, or strengthened, to better sustain itself during the journey to those importing it. The addition of brandy or neutral grape spirit would kill off the yeasts, which are constantly in the process of converting sugars to alcohol. Once the alcohol by volume reaches 16-18%, yeasts die. The remaining sugars are never converted into alcohol, and the natural sugars of the wine persist. Wines can be fortified at various stages in their fermentation, sweetened or colored with a variety of techniques. Different grape varietals can be used. Grapes can be dried. Wines can be boiled and reduced, cooked, aged in a solera, or aged in a boat that travels halfway across the world and back. They can be enjoyed immediately or aged for over 200 years. Port, Sherry, Madeira, Marsala, Malaga, Montilla-Moriles, and Vin Doux Naturels (VDN’s) are all Fortified Wines. Most people think of stuffy British old men drinking out of little glasses in a mahogany Sherry library with their pinkies out when they “Oh I must’ve been a dreamer think of Sherry- if they think of Sherry. And I must’ve been someone else While that image may have relegated Sherry, as an old-fashioned wine, to the And we should’ve been over back of the cool class, that is only part of Oh Sherry, our love the picture. Both Christopher Columbus Holds on, holds on…” and Ferdinand Magellan filled their ships ‘Oh Sherry’ by Steve Perry with Sherry when they set sail to discover the New World. -

Glassmaking Trends in Malaysia

Focus ASEAN Glassmaking trends in Malaysia Malaysia has emerged as an important player for flat glass manufacture in recent times, the arrival of leading Chinese producers contributing to the nation becoming one of the region’s leading players. In comparison, glass container production/demand has failed to grow in parallel, as Sunder Singh explains. With a population of nearly 32 million Three producers in each of in 2018, Malaysia is the smallest the two major segments cater for among four major South East Asian Malaysian flat and container glass countries. It has the highest per capita demand. In recent years, Chinese income of the four, however. The glass producers have invested heavily country’s flat and hollow glass industry in the country’s flat and downstream has benefited from steady economic glass processing activities. growth, averaging above 5% for the Addressing the Malaysian media past five years, leading to higher per recently, Ms Woo Wan Zheng, capita income and reducing already President of the Malaysia Glass low poverty levels. Association said: “The glass industry Malaysia also has some of the needs to push for new technology to best ingredients for the development improve glass (product mix) quality. of flat and container glass production The industry is doing well, with a lot in the future. The country has a young of players in the market providing population with 17% in the 15-24 year healthy competition. It keeps all age group and 41% in the 25-54 age players on their toes and may help band. About half of the population them to innovate their products.The is in the middle to high income second thing we would have to note Flat glass industry group, with growing purchasing (to improve the industry) would be to The Malaysian flat glass industry has witnessed one of the power. -

WINE INDUSTRY BUSINESS JOURNAL: Who’S Who in Wine Law

pressdemocrat.com printer version http://www.busjrnl.com/apps/pbcs.dll/article?AID=/20090126/BUSINE... northbaybusinessjournal.com This is a printer friendly versio n o f an article fro m www.northbaybusinessjournal.com To print this article open the file menu and choose Print. Back Article published - Jan 26, 2009 WINE INDUSTRY BUSINESS JOURNAL: Who’s Who in Wine Law By D. Ashley Furness, Business Journal Staff Reporter The more than two dozen attorneys chosen for the Business Journal’s first Who’s Who in Wine Law represent a range of specialization and a deep appreciation of wine making, often extending to their own vineyards and vintages. Researchers surveyed attorneys from the largest 20 firms on the Business Journal’s 2008 “Legal Service Providers to the Wine Industry List,” and accepted recommendations from lo cal wineries and vineyards. Others were selected from Wine Institute suggestions, and several were also found through the Napa, Marin and Sonoma County bar associations. (Listed alphabetically by name) Richard Abbey Abbey, Weitzenberg, Warren & Emery, 100 Stony Point Road, Santa Rosa 95401, 707-542-5050, www.abbeylaw.com Abbey, Weitzenberg, Warren & Emery Partner Richard Abbey is considered one of the North Bay’s premier litigators, with close to 40 years in the business and a wide breadth of experience. He’s spent much o f his career representing financial institutio ns in co mmercial, co rpo rate, emplo yment and banking law, but in recent years he has also prioritized representation of those in the wine industry. He has served several years as a judge pro tem for the Sonoma County Superior Court, and he is a member of the Arbitration Panel for Sonoma County Consolidated Courts and fee arbitrator and past president of the Sonoma County Bar Association. -

Imperial Hops: How Beer Traveled the World, Especially to Asia Jeffrey M

Imperial Hops: How Beer Traveled the World, Especially to Asia Jeffrey M. Pilcher This is a very preliminary discussion of a book I hope to write on the globalization of beer. The first section outlines the literature and my research plan as sort of a first draft of a grant proposal intended to convince some funding agency to pay for me to travel the world drinking beer. The rest of the paper illustrates some of these ideas with three Asian case studies. I started with Asia in response to an invitation to participate in a recent SSRC Interasia Workshop in Istanbul and because the languages and meager secondary literature make it the hardest part of the project to research. There are mostly questions where the conclusions should be, and I welcome all suggestions. In June of 2013, Turkish crowds gathered in Istanbul’s Taksim Square to protest the growing authoritarianism of Prime Minister Recep Tayyip Erdogan. Refusing to surrender their democratic freedoms, they opened bottles of Efes Pilsner and raised mock toasts to the tee-totaling Islamist politician: “Cheers, Tayyip!”1 The preference for European-style beer, rather than the indigenous, anise-flavored liquor arak, illustrates the complex historical movements that have shaped global consumer culture, and at times, political protests. Turkish entrepreneurs founded the Efes brewery in 1969, less than a decade after guest workers first began traveling to Germany and returning home with a taste for lager beer.2 This brief episode illustrates both the networks of migration, trade, and colonialism that carried European beer around the world in the nineteenth and twentieth centuries, and the new drinking cultures that emerged as a result. -

Defining Cider Styles and Competitions

Exploring the Many Styles of Cider Eric West Founder – Cider Guide Director – Great Lakes International Cider & Perry Competition (GLINTCAP) [email protected] Great Lakes International Cider and Perry Competition (GLINTCAP) First held in 2005 at Great Lakes EXPO. 617 entries in 2015. 800-1000 expected in 2016. Most respected judging in North America. glintcap.org Great Lakes International Cider and Perry Competition (GLINTCAP) Standard Class Specialty Class New World Modern Cider New England Cider New World Heritage Cider Fruit Cider English Cider Applewine French Cider Hopped Cider Spanish Cider Spiced Cider New World Perry Wood-Aged Cider Traditional Perry Specialty Cider & Perry Unlimited Cider & Perry Mead Beer Great Lakes International Cider and Perry Competition (GLINTCAP) Intensified and Distilled Class Ice Cider Pommeau Eau de vie Brandy glintcap.org/styles New World Modern Cider New World broadly refers to the ciders typically made in the US, Canada, Australia, New Zealand, and South Africa. Typically less than 7% ABV. Commonly grown apple varieties such as Winesap, Macintosh, Golden Delicious, Jonathan are used. Often packaged like craft beer: 12oz or 16oz bottles and cans, 22oz bottles, and on draft. New World Heritage Cider Inspired by Old World traditions but with a clean, New World fermentation. Typically 6-9% ABV. Heirloom and dual-purpose varieties like Northern Spy, Baldwin, Winesap, Rhode Island Greening, Newtown Pippin, Gravenstein. English and French apples are also used. Often packaged like wine: 375ml, 500ml, 750ml bottles. English Cider Typically drier and more austere than New World ciders. Often made with tannic varieties known as bittersweets and bittersharps. Natural fermentation often used. -

09Carlsberg A/S Annual Report

CARLSBERG A/S 09 ANNUAL REPORT The Carlsberg Group is one of the leading brewery groups in the world, with a large portfolio of beer and other beverage brands. The flagship brand – Carlsberg – is one of the best-known beer brands in the world. More than 43,000 people work for the Carlsberg Group, and our products are sold in more than 150 markets. MANAGEMENT REVIEW 2 CEO statement 5 Five-year summary 02 6 Earnings expectations 8 Executive Committee 12 Our beer markets 14 Market overview 16 Beer portfolio 18 Group strategy 20 People agenda 22 Corporate social responsibility 26 Events in 2009 30 Northern & Western Europe 34 Eastern Europe 38 Asia 42 Financial review 46 Corporate governance and risk management 52 Shareholder information FINANCIAL STATEMENTS 58 Carlsberg Group 126 Parent Company Carlsberg A/S 58 154 Management statement 155 Auditors’ report 156 Supervisory Board 2 Management review CEO statement STRONG PROFIT 2009 was a challeng- GROWTH ing year for Carlsberg and the global brewing industry. The global economy affected consumer behaviour negatively and overall beer market volumes declined. While the Asian markets were less affected by the crisis, the Northern & Western European and, in particular, the Eastern European markets were materially impacted. Although consumers reduced their consumption, they remained loyal to their favour- ite brands leading to a positive price/mix across many markets. This occurred despite the negative channel mix from on-trade to off-trade. Carlsberg was well prepared entering 2009. In late 2008 and early 2009 the Group implemented and accelerated numerous efficiency improvement ini- tiatives to protect earnings and improve cash flow and as a result was able to mitigate the impact from the declining markets. -

Chapter 1 – Alcoholic Beverages Definition –– a Potable

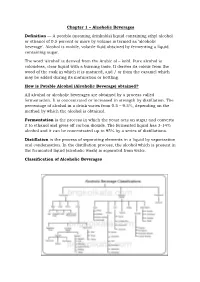

Chapter 1 – Alcoholic Beverages Definition –– A potable (meaning drinkable) liquid containing ethyl alcohol or ethanol of 0.5 percent or more by volume is termed as ‘alcoholic beverage’. Alcohol is mobile, volatile fluid obtained by fermenting a liquid containing sugar. The word ‘alcohol’ is derived from the Arabic al – kohl. Pure alcohol is colourless, clear liquid with a burning taste. It derives its colour from the wood of the cask in which it is matured, and / or from the caramel which may be added during its maturation or bottling. How is Potable Alcohol (Alcoholic Beverage) obtained? All alcohol or alcoholic beverages are obtained by a process called fermentation. It is concentrated or increased in strength by distillation. The percentage of alcohol in a drink varies from 0.5 – 9.5%, depending on the method by which the alcohol is obtained. Fermentation is the process in which the yeast acts on sugar and converts it to ethanol and gives off carbon dioxide. The fermented liquid has 3-14% alcohol and it can be concentrated up to 95% by a series of distillations. Distillation is the process of separating elements in a liquid by vaporization and condensation. In the distillation process, the alcohol which is present in the fermented liquid (alcoholic wash) is separated from water. Classification of Alcoholic Beverages Alcoholic beverages are classified as Fermented beverages, Distilled beverages and Compound beverages. Fermented Beverages Fermented beverages can be divided into two groups, wines and beers, broadly defined. Wines are fermented from various fruit juices containing fermentable sugars. Beers come from starch-containing products, which undergo enzymatic splitting by diastase, malting, and mashing, before the fermentable sugars become available for the yeasts and bacteria.