For the Year Ended 31 March 2014

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Jharkhand Report No 4 of 2016 Revenue Sector

Report of the Comptroller and Auditor General of India on Revenue Sector for the year ended 31 March 2016 Government of Jharkhand Report No. 4 of the year 2016 TABLE OF CONTENTS Paragraph Page Preface v Overview vii CHAPTER – I: GENERAL Trend of receipts 1.1 1 Analysis of arrears of revenue 1.2 5 Arrears in assessments 1.3 6 Evasion of tax detected by the Department 1.4 7 Pendency of Refund Cases 1.5 7 Response of the Departments/Government towards Audit 1.6 8 Analysis of mechanism for dealing with issues raised by 1.7 11 Audit Audit execution for the financial year 2015-16 1.8 12 Results of audit 1.9 13 Coverage of this Report 1.10 13 CHAPTER – II: TAXES ON SALES, TRADE ETC. Tax administration 2.1 15 Results of Audit 2.2 15 Implementation of mechanism of cross-verification of VAT/CST transactions in Commercial Taxes 2.3 17 Department System of collection of arrears of revenue in 2.4 28 Commercial Taxes Department in Jharkhand Irregularities in determination of actual turnover 2.5 46 Interest not levied 2.6 48 Irregularities in compliance to the Central Sales Tax Act 2.7 51 Application of incorrect rate of tax under JVAT Act 2.8 53 Incorrect exemptions 2.9 54 Irregularities in grant of Input Tax Credit (ITC) 2.10 55 Purchase tax was not levied 2.11 56 Penalty not imposed 2.12 57 CHAPTER – III: STATE EXCISE Tax administration 3.1 59 Results of Audit 3.2 60 Provision of Acts/Rules not complied with 3.3 61 Retail liquor shops not settled 3.4 61 Short lifting of liquor by retail vendors 3.5 62 i Audit Report for the year ended 31 March 2015 -

Geographic Information System (GIS) Representation of Coal-Bearing Areas in India and Bangladesh

Geographic Information System (GIS) Representation of Coal-Bearing Areas in India and Bangladesh Compiled by Michael H. Trippi and Susan J. Tewalt Open-File Report 2011–1296 U.S. Department of the Interior U.S. Geological Survey U.S. Department of the Interior KEN SALAZAR, Secretary U.S. Geological Survey Marcia K. McNutt, Director U.S. Geological Survey, Reston, Virginia 2011 For product and ordering information: World Wide Web: http://www.usgs.gov/pubprod Telephone: 1-888-ASK-USGS For more information on the USGS—the Federal source for science about the Earth, its natural and living resources, natural hazards, and the environment: World Wide Web: http://www.usgs.gov Telephone: 1-888-ASK-USGS Suggested citation: Trippi, M.H., and Tewalt, S.J., comps., 2011, Geographic information system (GIS) representation of coal-bearing areas in India and Bangladesh: U.S. Geological Survey Open-File Report 2011–1296, 27 p., available only at http:// pubs.usgs.gov/of/2011/1296. Any use of trade, product, or firm names is for descriptive purposes only and does not imply endorsement by the U.S. Government. Although this report is in the public domain, permission must be secured from the individual copyright owners to reproduce any copyrighted material contained within this report. Contents Overview ........................................................................................................................................................................ 1 India .............................................................................................................................................................................. -

Government of India

Contents: Sl. No Topic Page No 1 General characteristics of the District 1 1.1 Location & geographical area 1 1.2 Topography 1 1.3 Availability of Minerals 2 1.4 Forest 2 1.5 Administrative setup 2 2 District at a Glance 3-5 2.1 Existing status of Industrial Area in the District 6 3 Industrial Scenario of …. 6 3.1 Industry at a glance 6 3.2 Year wise trend of Units registered 7 3.3 Details of existing Micro & small enterprises & Artisan Units in the 8 District 3.4 Large Scale Industries/ Public Sector Undertakings 9 3.5 Major Exportable Items 9 3.6 Growth Trend 10 3.7 Vendarization /Ancillarisation of the Industry 10 3.8 Medium Scale Enterprises 11 3.8.1 List of the units in Dhanbad & near by Area 11 3.8.2 Major Exportable Item 11 3.9 Service Enterprises 11 3.9.1 Coaching Industry --------- 3.9.2 Potential Areas for Service Industry 11 3.10 Potentials for New MSMEs 12-15 4 Existing clusters of Micro & Small Enterprise 15 4.1 Details of Major Clusters 15 4.1.1 Manufacturing Sector 15 4.1.2 Service Sector 15 4.2 Details of identified cluster 15 4.2.1 Refractory Cluster: Present Status, 15 5 General issues raised by the industry association during the course of 16 meeting 6 Steps to set up MSMEs 17 Brief Industrial Profile of Dhanbad District 1. General Characteristics of the District: Dhanbad District, an administrative district of Jharkhand has it’s headquarter at Dhanbad. -

Tourist Places in and Around Dhanbad

Tourist Places in and around Dhanbad Dhanbad the coal capital of India lies at the western part of Eastern Indian Shield, the Dhanbad district is ornamented by several tourist spots, namely Parasnath Hill, Parasnath Temple, Topchanchi, famous Jharia coalfields, to mention a few. Other important places are Bodh Gaya, Maithon Dam, and this town is only at 260 km distance by rail route from Kolkata. Bodh Gaya Lying at 220 km distance from Dhanbad. Bodh Gaya is the place where Gautam Buddha attained unsurpassed, supreme Enlightenment. It is a place which should be visited or seen by a person of devotion and which would cause awareness and apprehension of the nature of impermanence. About 250 years after the Enlightenment, the Buddhist Emperor, Ashoka visited the site of pilgrimage and established the Mahabodhi temple. Parasnath Temple The Parasnath Temple is considered to be one of the most important and sanctified holy places of the Jains. According to Jain tradition, no less than 23 out of 24 Tirthankaras (including Parsvanatha) are believed to have attained salvation here. Baidyanath Temple Baidyanath Jyotirlinga temple, also known as Baba dham and Baidyanath dham is one of the twelve Jyotirlingas, the most sacred abodes of Shiva. It is located in Deoghar at a distance of 134 km from Dhanbad. It is a temple complex consisting of the main temple of Baba Baidyanath, where the Jyotirlinga is installed, and 21 other temples. Maithon Dam Maithon is 52 km from Dhanbad. This is the biggest reservoir in the Damodar Valley. This dam, designed for flood control, has been built on Barakar river. -

Dto Name Jun 2016 Jun 2016 1Regn No V Type

DTO_NAME JUN_2016 JUN_2016_1REGN_NO V_TYPE TAX_PAID_UPTO O_NAME F_NAME ADD1 ADD2 CITY PINCODE STATUS TAX_AMOUNT PENALTY TOTAL RANCHI N N JH01BZ8715 BUS 19-08-16 KRISHNA KUMHARS/O LATE CHHOTUBARA MURIKUMHAR CHHOTASILLI MURI RANCHI SUCCESS 6414 1604 8018 RANCHI N N JH01G 4365 BUS 15-08-16 ASHISH ORAONS/O JATRU ORAONGAMARIYA SARAMPO- MURUPIRIRANCHI -PS- BURMU 000000 SUCCESS 5619 1604 7223 RANCHI N N JH01BP5656 BUS 29-06-16 SURESH BHAGATS/O KALDEV CHIRONDIBHAGAT BASTIBARIATU RANCHI SUCCESS 6414 6414 12828 RANCHI N N JH01BC8857 BUS 22-07-16 SDA HIGH SCHOOLI/C HENRY SINGHTORPA ROADKHUNTI KHUNTI , M- KHUNTI9431115173 SUCCESS 6649 3325 9974 RANCHI Y Y JH01BE4699 BUS 21-06-16 DHANESHWARS/O GANJHU MANGARSIDALU GANJHU BAHERAPIPARWAR KHELARIRANCHI , M- 9470128861 SUCCESS 5945 5945 11890 RANCHI N N JH01BF8141 BUS 19-08-16 URSULINE CONVENTI/C GIRLSDR HIGH CAMIL SCHOOL BULCKERANCHI PATH , M- RANCHI9835953187 SUCCESS 3762 941 4703 RANCHI N N JH01AX8750 BUS 15-08-16 DILIP KUMARS/O SINGH SRI NIRMALNEAR SINGH SHARDHANANDANAND NAGAR SCHOOLRANCHI KAMRE , M- RATU 9973803185SUCCESS 3318 830 4148 RANCHI Y Y JH01AZ6810 BUS 12-01-16 C C L RANCHII/C SUPDT.(M)PURCHASE COLLY MGR DEPARTMENTDARBHANGARANCHI HOUSE PH.NO- 0651-2360261SUCCESS 19242 28862 48104 RANCHI Y Y JH01AK0808 BUS 24-04-16 KAMAKHYA NARAYANS/O NAWAL SINGH KISHORECHERI KAMRE NATHKANKE SINGH RANCHI SUCCESS 4602 2504 7106 RANCHI N N JH01AE6193 BUS 04-08-16 MRS. GAYTRIW/O DEVI SRI PRADEEPKONBIR KUMARNAWATOLI GUPTA BASIAGUMLA SUCCESS 4602 2504 7106 RANCHI Y Y JH01AE0222 BUS 22-06-16 RANCHI MUNICIPALI/C CEO CORPORATIONGOVT OF JHARKHANDRANCHI RANCHI SUCCESS 2795 3019 5814 RANCHI N N JH01AE0099 BUS 06-07-16 RANCHI MUNICIPALI/C CEO CORPN.GOVT. -

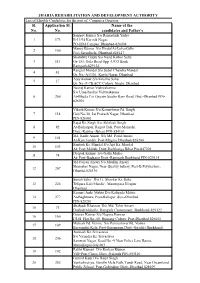

Sl. No. Application Sl. No. Name of the Candidates and Father's JHARIA

JHARIA REHABILITATION AND DEVELOPMENT AUTHORITY List of Eligible Candidates for the post of Computer Operator Sl. Application Sl. Name of the No. No. candidates and Father's Sanjeev Kumar S/o Ramashish Yadav 1 173 B-11/94 Karmik Nagar, PO-ISM Campus, Dhanbad-826004 Manoj Kumar S/o HiralalAt-Loharkulhi 2 100 Post-Saraidhela, Dhanbad-828127 Shambhu Gupta S/o Nand Kishor Sahu 3 113 Gr-153, Gola Road Opp.-UCO Bank Ramgarh-829122 Ranglal Mandal S/o Subal Chandra Mandal 4 41 Qr. No.-A1/301, Koyla Nagar, Dhanbad Ajay Kumar S/o Krishna Sahu 5 17 Qr. No.-F-7B ACC Colony, Sindri, Dhanbad Neeraj Kumar Vishwakarma S/o Umashankar Vishwakarma 6 260 At-Bhuda C/o Gayatri Studio Rani Road, Dist.-Dhanbad PIN- 826001 Vikash Kumar S/o Kameshwar Pd. Singh 7 114 Gali No-10, Jai Prakash Nagar, Dhanbad PIN-826001 Rajat Kr. Singh S/o Akhilesh Singh 8 92 At-Bishanpur, Rajput Tola, Post-Mansahi, Distt.-Katihar (Bihar) PIN-854103 Md. Kadir Ansari S/o Md. Farid Ansari 9 101 At-Kanchandih, Post-Mugma Dhanbad-828204 Santosh Kr. Mandal S/o Ajit Kr. Mandal 10 103 At+Post-Mahuli, Distt-Darbhanga Bihar Pin-847201 Deepak Kumar S/o Gallu Mahto 11 74 At+Post-Badgaon Distt.-Ramgarh Jharkhand PIN-829134 Md Faiyaz Ansari S/o Muslim Ansari Shamsher Nagar, Near Quality bakery, Post-B.Polytechnic, 12 267 Dhanbd-828130 Sonali Saha D/o Lt. Shankar Kr. Saha 13 224 Telipara Kali Mandir , Masterpara Hirapur Dhanbad Kumari Janki Mahto D/o Kalipada Mahto 14 277 At-Baghmara, Post-Baliapur, dist.-Dhanbad PIN-828201 Shahjadi Khatoon D/o Md. -

BHARAT COKING COAL LIMITED (A Subsidiary of Coal India Limited) OFFICE of the G.M., E.J

BHARAT COKING COAL LIMITED (A subsidiary of coal India limited) OFFICE OF THE G.M., E.J. AREA PO. BHOWRA (DHANBAD) Ref. no. – GM(EJA) ACE/NIT/10-11/462 Dated: - 31.01.2011 Notice inviting Tender Sealed tenders in two parts ( Part-I & Part –II) on overall percentage rate basis are invited from experienced and eligible contractors for the following works. Cost of Sl. Estimated Time of Name of work E.M tender No. amount Completion paper 1. Repair of overhead structure Rs 68,075.03 Rs 681.00 Rs. 100 1 month at KM 319/J 12-13 between Bhowra – Jamadoba SE Rly. Track under EJ Area AVAILABILITY OF TENDER DOCUMENTS From 11.02.2011 to 12.02.2011 Tender documents will be issued on all working days during working hours except on Sunday & holiday in the event of thr specified date for submission, opening of bids being declared a holiday the bids will be received opened on the appointed time on the next working day. The Tender document is also available on web site : http://bccl:cmpdi:co:in and can be downloaded. TIME & DATE IF RECEIPT/OPENING OF TENDER The Tender will be received on 15.02.2011 from 10.00AM to 1.00PM in Tender box at (1). CISF post near Koyla Bhawan gate, Koyla Nagar, BCCL, Dhanbad. (2). CISF’S office of EJ Area and will be opened on 18.02.2011 at 4.00 PM in the office of the ACE/EJA 1. ELIGIBILITY CRITERIA a). The intending Tenderer must have in its name as a prime contractor experience of having successfully completed similar works during last 7(seven) years ending last day of month previous to the one in which bid applications are invited should be either of the following :- (1). -

Block) Mobile No RAKESH KUMAR (71036) JHARKHAND (Garhwa

Volunteer Name with Reg No State (District) (Block) Mobile no RAKESH KUMAR (71036) JHARKHAND (Garhwa) (Majhiaon) 7050869391 AMIT KUMAR YADAW (71788) JHARKHAND (Garhwa) (Nagar Untari) 0000000000 AMIRA KUMARI (70713) JHARKHAND (Garhwa) (Danda) 7061949712 JITENDRA KUMAR GUPTA (69517) JHARKHAND (Garhwa) (Sagma) 9546818206 HARI SHANKAR PAL (69516) JHARKHAND (Garhwa) (Ramna) 9905763896 RENU KUMARI (69513) JHARKHAND (Garhwa) (Dhurki) 8252081219 VANDANA DEVI (69510) JHARKHAND (Garhwa) (Meral) 840987061 PRIYANKA KUMARI (69509) JHARKHAND (Garhwa) (Bardiha) 8969061575 RAVIKANT PRASAD GUPTA (69496) JHARKHAND (Garhwa) (Chiniya) 9905448984 RAKESH TIWARI (71431) JHARKHAND (Garhwa) (Ramkanda) 9934009456 CHANDAN KUMAR RAM (72016) JHARKHAND (Garhwa) (Ramkanda) 6207157968 NEHA NISHE TIGGA (71038) JHARKHAND (Garhwa) (Bhandariya) 7061187175 SATENDRA KUMAR YADAV (71186) JHARKHAND (Garhwa) (Sadar) 8863853368 BHUSHBU KUMARI (69501) JHARKHAND (Garhwa) (Kandi) 9155478910 DURGA KUMARI (69499) JHARKHAND (Garhwa) (Dandai) 7070518032 CHATURGUN SINGH (69498) JHARKHAND (Garhwa) (Ranka) 7489917090 KUMARI SABITA SINGH (69766) JHARKHAND (Garhwa) (Chiniya) 8252202210 RAM AWATAR SHARMA (69497) JHARKHAND (Garhwa) (Kandi) 9939333182 RAHUL KUMAR PAL (69495) JHARKHAND (Garhwa) (Sadar) 9155182855 JIYA SHALIYA TIGGA (69502) JHARKHAND (Garhwa) (Bhandariya) 7323001422 CHANDAN KUMAR PAL (69569) JHARKHAND (Garhwa) (Ramna) 9608927730 MANAS KISHOR MEHTA (73595) JHARKHAND (Garhwa) (Majhiaon) 8002796352 OMPRAKASH YADAV (67380) JHARKHAND (Garhwa) (Bhavnathpur) 9504289861 NAGENDRA RAM (73338) -

Is the Head of the Administration of Our BCCL. Admini

ADMINISTRATION DEPARTMENT Director (Personnel) is the head of the Administration of our BCCL. Administration Department BCCL(HQ) successfully and smoothly functioning in the right direction and are always ready to undertake any type of challenging job for the Company as a whole and to develop image of the Company. Important activities of the Administration Department: (1) Koyla Bhawan Administration Activity : 1. Central Despatch 2. Central Store 3. Maintenance, repairing of office furniture /equipment new procurement. 4. Sanitation / Cleanliness 5. Gardening and beautification of land scap of Koyla Bhawan Complex (2) Koyla Bhawan Civil Deptt. : Maintenance of whole Building, Water Supply and Civil Jobs. (3) KNTA & JNTA, KARMIK NAGAR, EXEX----CBCBCBCB Colony a. Revenue Collection b. Within boundary Estate matter c. Maintenance of township . d. Transit Hostel e. Four Nos. Golambers maintenance and Gardening. i. Subhash Chowk ii. Ambedkar Chowk iii. Saheed Chowk iv. Rajiv Gandhi Chowk (4) BTA : Maintenance and repairing of Bhuli Township consisting of 6011 nos. of quarters (biggest workers colony of Asia) including water supply & electricity. (5) BCCL PRESS : Printing Jobs. (6) Guest House's/Transit Hostels : Maintenance and supervision of KNGH, JNGH, Expert Hostel & Executive Hostel. (7)CAW & CTP : 1. Departmental Vehicles, Repairing and Maintenance 2. Procurement & tender processing of LCV,TATA 407 for CISF & buses for school duty & CISF. (8) Regional Hospital, Bhuli ::: 1. 20 Bed Hospital, 2. PME 3. Outdoor function 4. Family welfare camp INFORMATION ON GUEST HOUSE OF HEAD QUARTER Sl. Name of Guest House Appx.Distance from Appx. Distance from Dhanbad Rail Station Dhanbad Bus Station No. 1. Jagjiwan Nagar Guest House 5 KM 5 KM 2. -

Social Impact Assessment Report for the Koderma -Jamuabypass Road in the District Koderma

SOCIAL IMPACT ASSESSMENT REPORT FOR THE KODERMA -JAMUABYPASS ROAD IN THE DISTRICT KODERMA SUBMITTED TO DISTRICT COLLECTOR KODERMA SUPPORT HAZARIBAG SOCIAL IMPACT ASSESSMENT ………………….KODERMA JAMUA BYPASS ROAD Table of Contents LIST OF FIGURES ........................................................................................................................ 5 LIST OF TABLES ........................................................................................................................... 5 LIST OF ABBRIVIATIONS ............................................................................................................ 6 EXECUTIVE SUMMARY .............................................................................................................. 7 1. PROJECT LOCATION AND PUBLIC PURPOSE ................................................................. 7 2. SIZE AND ATTRIBUTION OF LAND ACQUISITION ............................................................. 8 3. ALTERNATIVES CONSIDERED ............................................................................................ 8 4. SOCIAL IMPACT ASSESSMENT .......................................................................................... 9 5. Nature, Present Use and Classification of Land ........................................................... 9 6. Structures on the Land Proposed to be acquired ....................................................... 9 7. Directly Affected ........................................................................................................... -

Chancellor Blood Donor List-2

Binod Bihari Mahto Koyalanchal University Dhanbad Website: bbmku.org.in HB/ Age / Blood Sl. No. Name of the Blood Donor College Address Mobile No. Class/Session Roll No. BP/ DoB Group SUGAR 1 ANUSKA RAI PKRM Collge Dhanbad BARTAND 8227841054 18 UG II SEM 57 O+ 18 2 KUSH KUMAR PKRM Collge Dhanbad Dhanbad 8271665783 26 M.A. 26 B+ 15.3 3 SIMA MODAK PKRM Collge Dhanbad BHOWRA 7992304092 21 M.A. 84 O+ 15.2 4 PRIYANKA KUMARI PKRM Collge Dhanbad MICP SEC 3 9955256790 18 B.COM 260 O+ 15.1 5 MD DANISH PKRM Collge Dhanbad GOMOH 8973729781 19 B.COM 184 A+ 15.1 6 BALDEEP PKRM Collge Dhanbad PROFESSOR COLONY 7992453043 21 M.A. 121 O+ 15.1 7 ARUP KUMAR PKRM Collge Dhanbad SINDRI 8757734147 24 M.A. 183 B+ 15.1 8 SHAYAM SUNDAR PANDIT PKRM Collge Dhanbad GOVINDPUR 7004058701 19 B.COM 468 O+ 15 9 SALONI PRIYA PKRM Collge Dhanbad KARMIK NAGAR 7488376596 17 B.COM 331 O+ 14.8 10 ANIL KUMAR PKRM Collge Dhanbad ANUGARAH NAGAR 8581961439 21 BA 293 O+ 14.7 11 ARJUN KUMARI RAWANI PKRM Collge Dhanbad CHIRUDIH PUTKEE DHANBAD 9576283012 19 M.A. 119 O+ 14.7 12 RAGHUNANDAN BAURI PKRM Collge Dhanbad TETULMARI 7717702127 22 M.A. 110 O+ 14.7 13 PRIYA KUMARI PKRM Collge Dhanbad DEBAGRAM 8603676869 22 M.SC. 6 B- 14.6 14 ABHIJEET KR SHARMA PKRM Collge Dhanbad KORIBANDH JHARIA 9905551412 19 UG I SEM 4 B+ 14.5 15 MD SARFARZ ANSARI PKRM Collge Dhanbad GOVINDPUR 9304873258 19 B.COM 198 AB+ 14.3 16 DINESH MAHATO PKRM Collge Dhanbad TUNDI 9102950370 25 M.A. -

Second Five-Year Plan Bihar

GOVERNMENT OF BIHAR SECOND FIVE-YEAR PLAN IN BIHAR A Review of Progress in the Third Year (1958-59) PRINTED BY TKii SUPERINTENDENT SECRETARIAT PRESS, BIHAR, PATNA I960 CONTENTS. I. General appraisal II. Agi'icultural Production 2-3 III. Minor Irrigation 4'5 IV. Soil Conservation 5 Land Development 5-7 VI. Marketing 8 VII. Animal Husbandry 8 - ^ 0 VIII. Dairy and Milk Supply 10-11 IX. Forest U -12 X. Fisheries .. .. .. 12-13 'AJ. Community Development and X. E. S. 13-15 XII. Co-operation 15-17 XIIT. Major and Medium Irrigation Projects 17-18 XIV. Kosi Project ia-19 XV. Power ^ ■ 19^21 X V I. Major and Medium Industries 21-22 XVII. Industrial Estates and Village and Small-seal 22 Industries. XVIII. Roads 22-23 XIX. Road Transport 23 24 XX. Education.. 24-26 XXI. Technical Education .. 26 XXII HealtJi 2o~28 XXIII. Housing .. 28-2f> X X IV . Labour Welfare 39-30 XXV. Welfare of Scheduled Castes, Scheduled Tribes 30-32 and other Backward Gasses. XXVI. Social Welfare 32-33 XXVII. Jail Department, 33-34 XXVIII. Publicity and Propaganda 34-36 XXIX. Statistics .. 3fi XXX. Bihar Panchayat Raj Schemes 37 APPENDIX 38-40 P D - ^ Division lOD ' 3 ' g 6 l'v ( *-cr \%- n -" )) r :' , r or ‘ '-i Checked D it ; f TranJer REVIEW OF THE PROGRESS OF THE SECOND FIVE-YEAR PLAN FOR BIHAR DURING 1958-59 (THIRD YEAR). Tiie Second Five-Year Plan of Biliar originally comprised 487 schemes with a total outlay of Rs. 190.22 crores. But conse quent upon the reduction in the size of the National Plan from Rs.