Feasibility of New Liquid Fuel Blends for Medium-Speed Engines

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Reasoned Request on Failure of Bosnia Herzegovina to Comply With

ANNEX 9a/14th MC/10-08-2016 TO THE MINISTERIAL COUNCIL OF THE ENERGY COMMUNITY represented by the Presidency and the Vice-Presidency of the Energy Community REASONED REQUEST in Case ECS-2/13 Submitted pursuant to Article 90 of the Treaty establishing the Energy Community and Article 29 of Procedural Act No 2008/1/MC-EnC of the Ministerial Council of the Energy Community of 27 June 2008 on the Rules of Procedure for Dispute Settlement under the Treaty, the SECRETARIAT OF THE ENERGY COMMUNITY against BOSNIA AND HERZEGOVINA seeking a Decision from the Ministerial Council that Bosnia and Herzegovina, 1. by failing to ensure within the prescribed time limit that heavy fuel oils are not used if their sulphur content exceeds 1.00 % by mass in the entire territory of the Contracting Party, Bosnia and Herzegovina has failed to fulfil its obligations under Article 3(1) of Directive 1999/32/EC in conjunction with Article 16 of the Treaty establishing the Energy Community; 2. by failing to ensure within the prescribed time limit that gas oils are not used if their sulphur content exceeds 0.1 % by mass in the entire territory of the Contracting Party, Bosnia and Herzegovina has failed to fulfil its obligations under Article 4(1) of Directive 1999/32/EC in conjunction with Article 16 of the Treaty establishing the Energy Community. The Secretariat of the Energy Community has the honour of submitting the following Reasoned Request to the Ministerial Council. I. Relevant Facts (1) As a Contracting Party to the Treaty establishing the Energy Community (“the Treaty”), Bosnia and Herzegovina is under an obligation to implement the acquis communautaire on environment as listed in Article 16 of the Treaty. -

Naphtha Safety Data Sheet According to Regulation (EC) No

Naphtha Safety Data Sheet according to Regulation (EC) No. 1907/2006 (REACH) with its amendment Regulation (EU) 2015/830 Revision date: 29 Dec 2020 Version: 4.0 SECTION 1: Identification of the substance/mixture and of the company/undertaking 1.1. Product identifier Product form : Substance (UVCB) Trade name : Naphtha Chemical name : Solvent naphtha (petroleum), light aliph.; Low boiling point naphtha; [A complex combination of hydrocarbons obtained from the distillation of crude oil or natural gasoline. It consists predominantly of saturated hydrocarbons having carbon numbers predominantly in the range of C5 through C10 and boiling in the range of approximately 35°C to 160°C (95°F to 320°F).] IUPAC name : Solvent naphtha (petroleum), light aliph. EC Index-No. : 649-267-00-0 EC-No. : 265-192-2 CAS-No. : 64742-89-8 REACH registration No : 01-2119471306-40 Type of product : Hydrocarbons Synonyms : Solvent naphtha (petroleum), light aliph. Product group : Raw material BIG No : F06734 1.2. Relevant identified uses of the substance or mixture and uses advised against 1.2.1. Relevant identified uses Main use category : Industrial use Use of the substance/mixture : Chemical raw material Function or use category : Intermediates Title Life cycle stage Use descriptors Use of substance as intermediate Industrial SU8, SU9, PROC1, PROC2, PROC3, PROC8a, PROC8b, (ES Ref.: ES 2) PROC15, PROC28, ERC6a Manufacture of substance Manufacture PROC1, PROC2, PROC3, PROC8a, PROC8b, PROC15, (ES Ref.: ES 1) PROC28, ERC1 Full text of use descriptors: see section 16 1.2.2. Uses advised against No additional information available NOR1.3. Details of the supplier of product safety information sheet Manufacturer Only Representative ZapSibNeftekhim LLC Gazprom Marketing and Trading France Promzona avenue des Champs-Elysées 68 626150 Tobolsk, Tyumen region - Russion Federation 75008 Paris - France T +7 (3456) 398-000 - F +7 (3456) 266-449 T +33 1 42 99 73 50 - F +33 1 42 99 73 99 [email protected] [email protected] 1.4. -

Imports of Crude Oil in Czech Republic January to September 2015

Imports of Crude Oil in Czech republic January to September 2015 Country of Origin Imports (kt) Shares (%) Azerbaijan 1 740,7 30,90 Kazakhstan 619,6 11,00 Hungary 15,3 0,27 Russia 3 257,5 57,83 Total 5 633,1 Mean retail prices of motor fuels in CZK/litre in years 2011, 2012, 2013, 2014 and 2015, monthly 2011 product 1/11 2/11 3/11 4/11 5/11 6/11 7/11 8/11 9/11 10/11 11/11 12/11 Average Regular Unleaded gasoline 91, 10 ppm 33,54 33,41 34,13 34,65 - - - - - - - - 33,93 Premium Unl. gasoline 95, 10 ppm 33,47 33,38 34,22 34,86 35,21 34,88 34,75 34,78 34,65 34,81 34,99 34,95 34,58 Super plus Unl. 98, 10 ppm 35,35 35,27 35,94 36,33 36,94 36,74 36,64 36,70 36,67 36,77 36,85 36,77 36,41 Regular Unl. 91 with AK additive 32,97 32,95 33,31 33,62 33,78 33,69 33,96 33,91 33,84 34,07 34,43 34,51 33,75 ULS Diesel, 10 ppm 32,72 32,84 33,80 34,42 34,44 34,24 34,25 34,34 34,38 34,69 35,31 35,58 34,25 LPG 17,16 17,56 17,40 17,41 17,34 17,21 17,03 16,93 16,84 16,76 16,79 17,19 17,14 Comment: Observation of Regular Unleaded Gasoline 91 have been stopped since 1.5.2011 (low market share) 2012 product 1/12 2/12 3/12 4/12 5/12 6/12 7/12 8/12 9/12 10/12 11/12 12/12 Average Premium Unl. -

Russia in the Finnish Economy

Russia in the Finnish Economy Simon-Erik Ollus & Heli Simola Sitra Reports 66 Russia in the Finnish Economy Sitra Reports 66 Russia in the Finnish Economy Simon-Erik Ollus & Heli Simola SITRA • HELSINKI Sitra Reports 66 Layout: Sanna Laajasalo Cover picture: Lehtikuva/Antti Aimo-Koivisto ISBN 951-563-537-3 (paperback) ISSN 1457-571X (paperback) ISBN 951-563-538-1 (URL: http://www.sitra.fi) ISSN 1457-5728 (URL: http://www.sitra.fi) In the Sitra Reports series Sitra publishes results from research, reports and evaluations. The publications can be ordered from Sitra, tel. +358 9 618 991, e-mail publications@sitra.fi Edita Prima Ltd. Helsinki 2006 Executive Summary Trade between Finland and Russia has fl ourished throughout the present dec- ade and Russia has risen back to being among the most important trading partners for Finland. Finnish exports to Russia in particular have boomed, but according to our calculations at least a quarter of them are actually re-exports. The income and employment effects of re-exports are considerably smaller for Finland than those of its own exports. But even excluding re-exports, Russia has been the fastest growing export market for Finland. In trade with Russia grey schemes are still commonly used and are refl ected in the large discrepan- cies between Russia’s import statistics and its trading partners’ export statis- tics. For Finland the discrepancy was nearly 60%, which is higher than for most other EU countries. After excluding re-exports from the trade, Finnish exports still lose a third of their value at the Russian border, mainly due to double in- voicing. -

Argus Nefte Transport

Argus Nefte Transport Oil transportation logistics in the former Soviet Union Volume XVI, 5, May 2017 Primorsk loads first 100,000t diesel cargo Russia’s main outlet for 10ppm diesel exports, the Baltic port of Primorsk, shipped a 100,000t cargo for the first time this month. The diesel was loaded on 4 May on the 113,300t Dong-A Thetis, owned by the South Korean shipping company Dong-A Tanker. The 100,000t cargo of Rosneft product was sold to trading company Vitol for delivery to the Amsterdam-Rotter- dam-Antwerp region, a market participant says. The Dong-A Thetis was loaded at Russian pipeline crude exports berth 3 or 4 — which can handle crude and diesel following a recent upgrade, and mn b/d can accommodate 90,000-150,000t vessels with 15.5m draught. 6.0 Transit crude Russian crude It remains unclear whether larger loadings at Primorsk will become a regular 5.0 occurrence. “Smaller 50,000-60,000t cargoes are more popular and the terminal 4.0 does not always have the opportunity to stockpile larger quantities of diesel for 3.0 export,” a source familiar with operations at the outlet says. But the loading is significant considering the planned 10mn t/yr capacity 2.0 addition to the 15mn t/yr Sever diesel pipeline by 2018. Expansion to 25mn t/yr 1.0 will enable Transneft to divert more diesel to its pipeline system from ports in 0.0 Apr Jul Oct Jan Apr the Baltic states, in particular from the pipeline to the Latvian port of Ventspils. -

2012 CCG Template

Doing Business in Finland: 2012 Country Commercial Guide for U.S. Companies INTERNATIONAL COPYRIGHT, U.S. & FOREIGN COMMERCIAL SERVICE AND U.S. DEPARTMENT OF STATE, 2012. ALL RIGHTS RESERVED OUTSIDE OF THE UNITED STATES. • Chapter 1: Doing Business In Finland • Chapter 2: Political and Economic Environment • Chapter 3: Selling U.S. Products and Services • Chapter 4: Leading Sectors for U.S. Export and Investment • Chapter 5: Trade Regulations, Customs and Standards • Chapter 6: Investment Climate • Chapter 7: Trade and Project Financing • Chapter 8: Business Travel • Chapter 9: Contacts, Market Research and Trade Events • Chapter 10: Guide to Our Services Return to table of contents Chapter 1: Doing Business In Finland • Market Overview • Market Challenges • Market Opportunities • Market Entry Strategy Market Overview Return to top Finland, a member of the European Union (EU) since 1995, has redefined itself from a quiet agricultural based economy to a trend setting, global center for technology. Finland has commercial clout far in excess of its modest 5.4 million population. Finland routinely ranks at the very top in international surveys of research and development funding, competitiveness, transparency, literacy, and education. Helsinki, is a pocket-sized green maritime metropolis, and the Design Capital for 2012; a yearlong event showcasing the global influence of Finnish design and innovation. In Finland, nature reigns supreme and it is no surprise that Helsinki was the site of the first LEED certified building in the Nordics. Finland, along with all its Nordic neighbors, has a focused interest in green build and energy efficient and intelligent building products, services and technologies. Contrary to popular misconception, Finland is not a part of Scandinavia. -

Advanced Biofuels Based on Fischer–Tropsch Synthesis for Applications in Gasoline Engines

materials Article Advanced Biofuels Based on Fischer–Tropsch Synthesis for Applications in Gasoline Engines Jiˇrí Hájek 1,2, Vladimír Hönig 1,* , Michal Obergruber 1 , Jan Jenˇcík 1,2 , Aleš Vráblík 2 , Radek Cernˇ ý 2 , Martin Pšeniˇcka 2 and Tomáš Herink 2 1 Department of Chemistry, Faculty of Agrobiology, Food and Natural Resources, Czech University of Life Sciences Prague, Kamýcká 129, 165 00 Prague, Czech Republic; [email protected] (J.H.); [email protected] (M.O.); [email protected] (J.J.) 2 ORLEN UniCRE a.s., 436 01 Litvínov, Czech Republic; [email protected] (A.V.); [email protected] (R.C.);ˇ [email protected] (M.P.); [email protected] (T.H.) * Correspondence: [email protected] Abstract: The aim of the article is to determine the properties of fuel mixtures of Fischer–Tropsch naphtha fraction with traditional gasoline (petrol) to be able to integrate the production of advanced alternative fuel based on Fischer–Tropsch synthesis into existing fuel markets. The density, octane number, vapor pressure, cloud point, water content, sulphur content, refractive index, ASTM color, heat of combustion, and fuel composition were measured using the gas chromatography method PIONA. It was found that fuel properties of Fischer–Tropsch naphtha fraction is not much comparable to conventional gasoline (petrol) due to the high n-alkane content. This research work recommends the creation of a low-percentage mixture of 3 vol.% of FT naphtha fraction with traditional gasoline to minimize negative effects—similar to the current legislative limit of 5 vol.% of bioethanol in E5 Citation: Hájek, J.; Hönig, V.; gasoline. -

Neste in 2015 We Create Responsible Choices Every Day 02

Neste in 2015 We create responsible choices every day 02 CEO’s review ......................................... 05 Strategy .............................. 07 01 Business areas in brief ................................. 08 Vision .............................................. 10 Megatrends .......................................... 11 Strategic targets ...................................... 12 Key figures .......................................... 16 Financial targets ...................................... 17 Information for investors ................................ 18 Sustainability .................. 20 Managing sustainability ................................. 21 Neste’s sustainability reporting ........................... 28 Our essential sustainability themes ........................ 30 Climate and resource efficiency ...................... 30 02 Sustainable supply chain ........................... 35 Sustainability of our operations ...................... 38 Key figures .......................................... 44 GRI Index and UN Global Compact ........................ 45 Principles for calculating the key indicators ................. 49 Independent Practitioner’s Assurance Report ................ 51 Case gallery ......................................... 53 Governance ................... 56 Corporate Governance Statement 2015 .................... 57 Risk management ..................................... 76 03 Neste Remuneration Statement 2015 . 80 03 Review by the 04 Board of Directors ....... 90 Financial statements 103 Key financial -

Specifications Guide Europe and Africa Refined Oil Products Latest Update: September 2021

Specifications Guide Europe And Africa Refined Oil Products Latest update: September 2021 Definitions of the trading locations for which Platts publishes daily indexes or assessments 2 LPG 4 Gasoline 7 Naphtha 9 Jet fuel 11 ULSD 13 Gasoil 16 Fuel oil 18 Feedstocks 23 Revision history 26 www.spglobal.com/platts Specifications Guide Europe And Africa Refined Oil Products: September 2021 DEFINITIONS OF THE TRADING LOCATIONS FOR WHICH PLATTS PUBLISHES DAILY INDEXES OR ASSESSMENTS The following specifications guide contains the primary specifications and methodologies for Platts refined oil products assessments throughout Europe and Africa. All the assessments listed here employ Platts Assessments Methodology, as published at https://www.spglobal.com/platts/plattscontent/_assets/_files/en/our-methodology/methodology-specifications/platts-assessments-methodology-guide.pdf. These guides are designed to give Platts subscribers as much information as possible about a wide range of methodology and specification questions. This guide is current at the time of publication. Platts may issue further updates and enhancements to this guide and will announce these to subscribers through its usual publications of record. Such updates will be included in the next version of this guide. Platts editorial staff and managers are available to provide guidance when assessment issues require clarification. Unnamed ship Seller has the responsibility to declare its Shipping considerations Northwest European and FOB Mediterranean oil product cargo commitment to meet either the vetting Bids: For the cargo assessment processes bids may be assessments reflect market activity where the seller nominates requirement of any buyer or conversely to expressed with a specific location. Bids with excessive the loading terminal 7 calendar days ahead of the first day of the declare up front how many ship vettings the limitations – whether expressed or implied – may be deemed 5-day laycan. -

Supplement A: Treaties and Agreements

Supplement A: Treaties and Agreements TREATY OF FRIENDSHIP, CO-OPERATION AND MUTUAL ASSISTANCE BETWEEN THE REPUBLIC OF FINLAND AND THE UNION OF SOVIET SOCIALIST REPUBLICS The President of the Republic of Finland and the Presidium of the Supreme Soviet of the USSR; Desiring further to develop friendly relations between the Repulic of Finland and the USSR; being convinced that the strengthening of good neighbourhood relations and cooperation between the Republic of Finland and the USSR lies in the interest of both countries; considering Finland's desire to remain outside the conflicting interests of the Great Powers; and Expressing their firm endeavour to collaborate towards the maintenance of international peace and security in accordance with the aims and principles of the United Nations Organization; have for this purpose agreed to conclude the present Treaty and have appointed as their Plenipotentiaries: the President of the Republic of Finland: Mauna Pekkala, Prime Minister of the Republic of Finland; The Presidium of the Supreme Soviet of the USSR: Vyacheslav Mihailovich Molotov, Vice-Chairman of the Council of Ministers of the USSR and Minister for Foreign Affairs, who, after exchange of their full powers, found in good and due form, have agreed on the following provisions: Article 1 In the eventuality of Finland, or the Soviet Union through Finnish territory, becoming the object of an armed attack by Germany or any State allied with the latter, Finland will, true to its obligations as an independent State, fight to repel the attack. Finland will in such cases use all its available forces for defending its territorial integrity by land, sea and air, and will do so within the frontiers of Finland in accordance with obligations defined in the present Treaty and, if necessary, with the assistance of, or jointly with, the Soviet Union. -

5.1 Petroleum Refining1

5.1 Petroleum Refining1 5.1.1 General Description The petroleum refining industry converts crude oil into more than 2500 refined products, including liquefied petroleum gas, gasoline, kerosene, aviation fuel, diesel fuel, fuel oils, lubricating oils, and feedstocks for the petrochemical industry. Petroleum refinery activities start with receipt of crude for storage at the refinery, include all petroleum handling and refining operations and terminate with storage preparatory to shipping the refined products from the refinery. The petroleum refining industry employs a wide variety of processes. A refinery's processing flow scheme is largely determined by the composition of the crude oil feedstock and the chosen slate of petroleum products. The example refinery flow scheme presented in Figure 5.1-1 shows the general processing arrangement used by refineries in the United States for major refinery processes. The arrangement of these processes will vary among refineries, and few, if any, employ all of these processes. Petroleum refining processes having direct emission sources are presented on the figure in bold-line boxes. Listed below are 5 categories of general refinery processes and associated operations: 1. Separation processes a. Atmospheric distillation b. Vacuum distillation c. Light ends recovery (gas processing) 2. Petroleum conversion processes a. Cracking (thermal and catalytic) b. Reforming c. Alkylation d. Polymerization e. Isomerization f. Coking g. Visbreaking 3.Petroleum treating processes a. Hydrodesulfurization b. Hydrotreating c. Chemical sweetening d. Acid gas removal e. Deasphalting 4.Feedstock and product handling a. Storage b. Blending c. Loading d. Unloading 5.Auxiliary facilities a. Boilers b. Waste water treatment c. Hydrogen production d. -

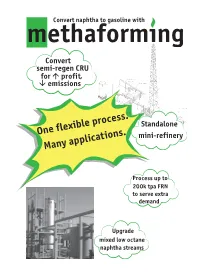

Convert Naphtha to Gasoline with Methaforming

Convert naphtha to gasoline with Convert semi-regen CRU á for profit, Êàáåëüíûå ëîòêè 100õ100ìì â Ïîäîãðåâàòåëü Ï-3 emissions à Ñâå÷à ðàññåèâàíèÿ Ãðàäèðíÿ ÃÐÄ-50Ì îãðåâàòåëü Ï-1 Ïîäîãðåâàòåëü Ï-2 Ðàìïà àçîòíàÿ Standalone One flexible process. Ìîmini-refineryäóëü ðèôîðìèíãà Á-1 Many applications. Process up to 200k tpa FRN to serve extra demand Upgrade mixed low octane naphtha streams Table of Contents Objective and Limitations. Process Overview ....................................................1 Feedstocks ........................................................................................................2 Types of naphtha Alcohols and Light Olefin Feeds .......................................................................4 Products ...........................................................................................................5 Process Description ..........................................................................................6 Process Chemistry Illustrative Process Flow Diagram and Description .........................................7 Applications and Economics ............................................................................8 General Specifications and Advantages. Service Factor. Reactor ...................9 Catalyst. Regeneration of the Catalyst ............................................................10 Utility Requirements ........................................................................................10 Waste Production and Utilization .....................................................................11