FACTS and FIGURES 2018 Geography Surface (In Sqkm) 1,001,450 O.W

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Egypt Real Estate Trends 2018 in Collaboration With

know more.. Egypt Real Estate Trends 2018 In collaboration with -PB- -1- -2- -1- Know more.. Continuing on the momentum of our brand’s focus on knowledge sharing, this year we lay on your hands the most comprehensive and impactful set of data ever released in Egypt’s real estate industry. We aspire to help our clients take key investment decisions with actionable, granular, and relevant data points. The biggest challenge that faces Real Estate companies and consumers in Egypt is the lack of credible market information. Most buyers rely on anecdotal information from friends or family, and many companies launch projects without investing enough time in understanding consumer needs and the shifting demand trends. Know more.. is our brand essence. We are here to help companies and consumers gain more confidence in every real estate decision they take. -2- -1- -2- -3- Research Methodology This report is based exclusively on our primary research and our proprietary data sources. All of our research activities are quantitative and electronic. Aqarmap mainly monitors and tracks 3 types of data trends: • Demographic & Socioeconomic Consumer Trends 1 Million consumers use Aqarmap every month, and to use our service they must register their information in our database. As the consumers progress in the usage of the portal, we ask them bite-sized questions to collect demographic and socioeconomic information gradually. We also send seasonal surveys to the users to learn more about their insights on different topics and we link their responses to their profiles. Finally, we combine the users’ profiles on Aqarmap with their profiles on Facebook to build the most holistic consumer profile that exists in the market to date. -

A Catalogue of Coleoptera Specimens with Potential Forensic Interest in the Goulandris Natural History Museum Collection

ENTOMOLOGIA HELLENICA Vol. 25, 2016 A catalogue of Coleoptera specimens with potential forensic interest in the Goulandris Natural History Museum collection Dimaki Maria Goulandris Natural History Museum, 100 Othonos St. 14562 Kifissia, Greece Anagnou-Veroniki Maria Makariou 13, 15343 Aghia Paraskevi (Athens), Greece Tylianakis Jason Zoology Department, University of Canterbury, Private Bag 4800, Christchurch, New Zealand http://dx.doi.org/10.12681/eh.11549 Copyright © 2017 Maria Dimaki, Maria Anagnou- Veroniki, Jason Tylianakis To cite this article: Dimaki, M., Anagnou-Veroniki, M., & Tylianakis, J. (2016). A catalogue of Coleoptera specimens with potential forensic interest in the Goulandris Natural History Museum collection. ENTOMOLOGIA HELLENICA, 25(2), 31-38. doi:http://dx.doi.org/10.12681/eh.11549 http://epublishing.ekt.gr | e-Publisher: EKT | Downloaded at 27/12/2018 06:22:38 | ENTOMOLOGIA HELLENICA 25 (2016): 31-38 Received 15 March 2016 Accepted 12 December 2016 Available online 3 February 2017 A catalogue of Coleoptera specimens with potential forensic interest in the Goulandris Natural History Museum collection MARIA DIMAKI1’*, MARIA ANAGNOU-VERONIKI2 AND JASON TYLIANAKIS3 1Goulandris Natural History Museum, 100 Othonos St. 14562 Kifissia, Greece 2Makariou 13, 15343 Aghia Paraskevi (Athens), Greece 3Zoology Department, University of Canterbury, Private Bag 4800, Christchurch, New Zealand ABSTRACT This paper presents a catalogue of the Coleoptera specimens in the Goulandris Natural History Museum collection that have potential forensic interest. Forensic entomology can help to estimate the time elapsed since death by studying the necrophagous insects collected on a cadaver and its surroundings. In this paper forty eight species (369 specimens) are listed that belong to seven families: Silphidae (3 species), Staphylinidae (6 species), Histeridae (11 species), Anobiidae (4 species), Cleridae (6 species), Dermestidae (14 species), and Nitidulidae (4 species). -

Report 2019 Bank Audi Annual Report 2019

2019 ANNUAL REPORT EGYPT 1 BANK AUDI ANNUAL REPORT 2019 BANK AUDI ANNUAL REPORT 2019 BANK AUDI “S.A.E.” INDEPENDENT AUDITOR’S REPORT AND FINANCIAL STATEMENTS FOR THE FINANCIAL YEAR ENDED 31 December 2019 ANNUAL REPORT 2019 BANK AUDI “S.A.E.” BANK AUDI “S.A.E.” Annual Report 2019 01 OVERVIEW 01 OVERVIEWA. The Chairman’s Statement.............................................................. 8 B. CEO,A. The Managing Chairman’s Director's Statement............................................................... Statement............................................. 10 6 C. B.Strategic Bank Audi Direction sae Strategic & Values Direction of Bank & AudiValues................................... sae.............................. 1210 D. C.Overview Bank Audi of Group...............................................................................Bank Audi Group.......................................................... 1310 E. KeyD. Bank Financial Audi sae highlights Key Financial of Bank Highlights......................................... Audi sae.................................. 1411 F. GlobalE. The Egyptian & Regional Economy Economy in 2019....................................................... in 2019............................................ 1412 G. The Egyptian Economy in 2019.................................................... 16 022 CORPORATE GOVERNANCE CORPORATEA. Board of Directors............................................................................. GOVERNANCE 16 02 B. Governance....................................................................................... -

Disclosure Guide

WEEKS® 2021 - 2022 DISCLOSURE GUIDE This publication contains information that indicates resorts participating in, and explains the terms, conditions, and the use of, the RCI Weeks Exchange Program operated by RCI, LLC. You are urged to read it carefully. 0490-2021 RCI, TRC 2021-2022 Annual Disclosure Guide Covers.indd 5 5/20/21 10:34 AM DISCLOSURE GUIDE TO THE RCI WEEKS Fiona G. Downing EXCHANGE PROGRAM Senior Vice President 14 Sylvan Way, Parsippany, NJ 07054 This Disclosure Guide to the RCI Weeks Exchange Program (“Disclosure Guide”) explains the RCI Weeks Elizabeth Dreyer Exchange Program offered to Vacation Owners by RCI, Senior Vice President, Chief Accounting Officer, and LLC (“RCI”). Vacation Owners should carefully review Manager this information to ensure full understanding of the 6277 Sea Harbor Drive, Orlando, FL 32821 terms, conditions, operation and use of the RCI Weeks Exchange Program. Note: Unless otherwise stated Julia A. Frey herein, capitalized terms in this Disclosure Guide have the Assistant Secretary same meaning as those in the Terms and Conditions of 6277 Sea Harbor Drive, Orlando, FL 32821 RCI Weeks Subscribing Membership, which are made a part of this document. Brian Gray Vice President RCI is the owner and operator of the RCI Weeks 6277 Sea Harbor Drive, Orlando, FL 32821 Exchange Program. No government agency has approved the merits of this exchange program. Gary Green Senior Vice President RCI is a Delaware limited liability company (registered as 6277 Sea Harbor Drive, Orlando, FL 32821 Resort Condominiums -

ACLED) - Revised 2Nd Edition Compiled by ACCORD, 11 January 2018

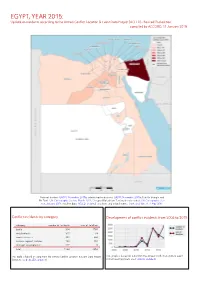

EGYPT, YEAR 2015: Update on incidents according to the Armed Conflict Location & Event Data Project (ACLED) - Revised 2nd edition compiled by ACCORD, 11 January 2018 National borders: GADM, November 2015b; administrative divisions: GADM, November 2015a; Hala’ib triangle and Bir Tawil: UN Cartographic Section, March 2012; Occupied Palestinian Territory border status: UN Cartographic Sec- tion, January 2004; incident data: ACLED, undated; coastlines and inland waters: Smith and Wessel, 1 May 2015 Conflict incidents by category Development of conflict incidents from 2006 to 2015 category number of incidents sum of fatalities battle 314 1765 riots/protests 311 33 remote violence 309 644 violence against civilians 193 404 strategic developments 117 8 total 1244 2854 This table is based on data from the Armed Conflict Location & Event Data Project This graph is based on data from the Armed Conflict Location & Event (datasets used: ACLED, undated). Data Project (datasets used: ACLED, undated). EGYPT, YEAR 2015: UPDATE ON INCIDENTS ACCORDING TO THE ARMED CONFLICT LOCATION & EVENT DATA PROJECT (ACLED) - REVISED 2ND EDITION COMPILED BY ACCORD, 11 JANUARY 2018 LOCALIZATION OF CONFLICT INCIDENTS Note: The following list is an overview of the incident data included in the ACLED dataset. More details are available in the actual dataset (date, location data, event type, involved actors, information sources, etc.). In the following list, the names of event locations are taken from ACLED, while the administrative region names are taken from GADM data which serves as the basis for the map above. In Ad Daqahliyah, 18 incidents killing 4 people were reported. The following locations were affected: Al Mansurah, Bani Ebeid, Gamasa, Kom el Nour, Mit Salsil, Sursuq, Talkha. -

Semaines Points

SEMAINES POINTS 2013 - 2014 Guide d’information Le présent document comporte des renseignements sur les centres de villégiature participant au Programme d’échange de Semaines RCI et au Programme d’échange de Points RCI exploités par RCI, LLC et donne des explications au sujet des modalités et de l’utilisation de ces programmes. Vous êtes prié instamment de le lire attentivement. Le présent document comprend les Guides d’information portant respectivement sur le Programme d’échange de Points RCI et sur le Programme d’échange de Semaines RCI, étant donné que l’adhésion au Programme d’échange de Points RCI donne accès au Programme d’échange de Semaines RCI. Le Guide d’information sur le Programme d’échange de Points RCI est présenté à la partie A, et le Guide d’information sur le Programme d’échange de Semaines RCI, à la partie B du présent document. Partie A Guide d’information sur le Programme d’échange de Points RCI GUIDE D’INFORMATION Geoffrey Ballotti Président du conseil et chef de la direction SUR LE PROGRAMME D’ÉCHANGE DE 14, Sylvan Way, Parsippany, NJ 07054 POINTS RCI Marcus A. Banks Le présent Guide d’information sur le Programme Vice-président principal, Affaires juridiques et secrétaire d’échange de Points RCI (le « Guide adjoint d’information ») donne des explications au sujet du 22, Sylvan Way, Parsippany, NJ 07054 programme que RCI, LLC (« RCI ») offre aux Philip S. Brojan Propriétaires de droits de séjour. Les Propriétaires Vice-président principal de droits de séjour sont invités à le lire attentivement 14, Sylvan Way, Parsippany, NJ 07054 et à s’assurer de bien comprendre les modalités et le fonctionnement du programme. -

Asset-Based Development: Success Stories from Egyptian Communities

Asset-Based Development: Success Stories from Egyptian Communities A Manual for Practitioners English translation of original document, published in Arabic by the Center for Development Services in Cairo, Egypt 2005 CONTENTS Acknowledgements 3 Introduction 5 Case Studies 7 Success Breeds Success 8 A Creative Community Based Composting Initiative 13 Moving Beyond Conventional Charity Work 18 Building Community Capacity 23 The Transformative Power of Art 29 Fan Sina 34 Linking Community and Government for Development 39 Peer-to-Peer Learning through the Living University 45 Bridging Gaps between Communities and Institutions 50 Rising from Modest Roots through Partnership 56 Mobilizing, Renewing and Building Assets: Methods, Tools, and Strategies 61 Identifying and Mobilizing Assets 63 Appreciative Interviewing and Analyzing Community Success 63 Mapping and Organizing 64 · Appreciative Interviewing 65 · Community Analysis of Success 67 · Positive Deviance 69 · Identifying Individual Skills: Hand, Heart, Head 71 · Mapping Community Groups or Associations 74 · Capacity Inventories 76 Linking Assets to Opportunities 78 Institutional Mapping and the Leaky Bucket 78 · Linking, Mobilizing & Organizing 79 · Mapping Institutions 81 · Leaky Bucket 84 The Role of the Intermediary 88 Fostering Broad-Based Leadership 89 Identifying “Gappers” 90 Helping Communities to Build Assets 91 Helping Communities to Link Assets to External Opportunities 92 Leading by Stepping Back 93 Tracking the Process as it Unfolds 93 Extended Case Studies 94 Success Breeds -

Directory of Development Organizations

EDITION 2010 VOLUME I.A / AFRICA DIRECTORY OF DEVELOPMENT ORGANIZATIONS GUIDE TO INTERNATIONAL ORGANIZATIONS, GOVERNMENTS, PRIVATE SECTOR DEVELOPMENT AGENCIES, CIVIL SOCIETY, UNIVERSITIES, GRANTMAKERS, BANKS, MICROFINANCE INSTITUTIONS AND DEVELOPMENT CONSULTING FIRMS Resource Guide to Development Organizations and the Internet Introduction Welcome to the directory of development organizations 2010, Volume I: Africa The directory of development organizations, listing 63.350 development organizations, has been prepared to facilitate international cooperation and knowledge sharing in development work, both among civil society organizations, research institutions, governments and the private sector. The directory aims to promote interaction and active partnerships among key development organisations in civil society, including NGOs, trade unions, faith-based organizations, indigenous peoples movements, foundations and research centres. In creating opportunities for dialogue with governments and private sector, civil society organizations are helping to amplify the voices of the poorest people in the decisions that affect their lives, improve development effectiveness and sustainability and hold governments and policymakers publicly accountable. In particular, the directory is intended to provide a comprehensive source of reference for development practitioners, researchers, donor employees, and policymakers who are committed to good governance, sustainable development and poverty reduction, through: the financial sector and microfinance, -

QIZ Ref. Sector Location Company Name Address Contact Name Title Tel Fax Mobile Email

QIZ Ref. Sector Location Company Name Address Contact Name Title Tel Fax Mobile Email Textile & Egyptian Company for Trade & Suez Canal St. Moharam Bek, El-Bar El-Kibly, Vice 3 Alexandria Salem Mohamed Salem 03-3615748 03-3618004 0122-2166302 [email protected] RMG Industry (SOGIC) Industrial Area President Textile & Shoubra El The Modern Egyptian Spinner 3 Montaser El Gabalawy St., Bahteem Old misrspain@misrsp 5 Essam Abd El Fattah Lawyer 02-2201107 02-2211184 0122-3788634 RMG Kheima (Ghazaltex) S.A.E Road, Shoubra El Kheima ain.com Textile & 120 Osman Basha Street, EL-Bar El-Kibly, Sherine Issa Hamed Managing babycoca1@babyc 8 Alexandria Baby Coca for Clothing 03-3815052 03-3815054 0122-2142042 RMG Semouha Ellish Director oca.com.eg Textile & Shoubra El Misr Company for Industrial Number 64, 15th May Road, Shoubra El- Mohamed Wadah Vice wadah@misrgrou 9 02-2208880 02-2211220 0122-7495992 RMG Kheima Investments , Private Free Zone Kheima, Kalyoubia Shamsi President p.com Textile & Misr El Ameria Spinning & Desert Road Alex/Cairo ( KM 23 ), Mohamed Ahmed Accountant export@misramre 10 Alexandria 03-2020395 03-2020390 0100-6123011 RMG Weaving Co. Petrochemical Road, Alexandria Mohamed Hegazy at Export Dep ya.com Textile & Obour City - Industrial Zone B,G Block No. Hosam El-Din General [email protected] 11 El Obour El Magmoua El Togaria 02-42157431 02-42155526 0111-7800123 RMG 22009 - Plot Industrial 2A Mohamed Mohab Manager om Textile & Shoubra El 2 El Mallah Street, Bigam Road, Shoubra El- Saber Ibrahim El Director In info@elmallahgro 12 El Mallah -

País Região Cidade Nome De Hotel Morada Código Postal Algeria

País Região Cidade Nome de Hotel Morada Código Postal Algeria Adrar Timimoun Gourara Hotel Timimoun, Algeria Algeria Algiers Aïn Benian Hotel Hammamet Ain Benian RN Nº 11 Grand Rocher Cap Caxine , 16061, Aïn Benian, Algeria Algeria Algiers Aïn Benian Hôtel Hammamet Alger Route nationale n°11, Grand Rocher, Ain Benian 16061, Algeria 16061 Algeria Algiers Alger Centre Safir Alger 2 Rue Assellah Hocine, Alger Centre 16000 16000 Algeria Algiers Alger Centre Samir Hotel 74 Rue Didouche Mourad, Alger Ctre, Algeria Algeria Algiers Alger Centre Albert Premier 5 Pasteur Ave, Alger Centre 16000 16000 Algeria Algiers Alger Centre Hotel Suisse 06 rue Lieutenant Salah Boulhart, Rue Mohamed TOUILEB, Alger 16000, Algeria 16000 Algeria Algiers Alger Centre Hotel Aurassi Hotel El-Aurassi, 1 Ave du Docteur Frantz Fanon, Alger Centre, Algeria Algeria Algiers Alger Centre ABC Hotel 18, Rue Abdelkader Remini Ex Dujonchay, Alger Centre 16000, Algeria 16000 Algeria Algiers Alger Centre Space Telemly Hotel 01 Alger, Avenue YAHIA FERRADI, Alger Ctre, Algeria Algeria Algiers Alger Centre Hôtel ST 04, Rue MIKIDECHE MOULOUD ( Ex semar pierre ), 4, Alger Ctre 16000, Algeria 16000 Algeria Algiers Alger Centre Dar El Ikram 24 Rue Nezzar Kbaili Aissa, Alger Centre 16000, Algeria 16000 Algeria Algiers Alger Centre Hotel Oran Center 44 Rue Larbi Ben M'hidi, Alger Ctre, Algeria Algeria Algiers Alger Centre Es-Safir Hotel Rue Asselah Hocine, Alger Ctre, Algeria Algeria Algiers Alger Centre Dar El Ikram 22 Rue Hocine BELADJEL, Algiers, Algeria Algeria Algiers Alger Centre -

Radiological Characterization of Beach Sediments Along the Alexandria–Rosetta Coasts of Egypt

+Model JTUSCI-165; No. of Pages 9 ARTICLE IN PRESS Available online at www.sciencedirect.com ScienceDirect Journal of Taibah University for Science xxx (2015) xxx–xxx Radiological characterization of beach sediments along the Alexandria–Rosetta coasts of Egypt a,∗ b A.A. Abdel-Halim , I.H. Saleh a Department of Basic and Applied Sciences, College of Engineering and Technology, The Arab Academy for Sciences and Technology and Maritime Transport, P.O. Box 1029, Alexandria, Egypt b Department of Environmental Studies, Institute of Graduate Studies and Research, Alexandria University, P.O. Box 832, EL-Shatby, Alexandria, Egypt Abstract In the present study, 52 sediment samples were collected from 14 sites along the area extending from west of Alexandria (El-MAX) to the eastern side of the Rosetta promontory (the terminal of the Nile River with the Mediterranean Sea). The collected samples 226 228 40 137 were analyzed for radioactive contents. Ra, Ra, K and Cs were detected. The distribution of radionuclide activity and mass concentrations of Th and U displayed a specific pattern that reflects the mineralogical formations and beach stability. Radiological hazards were investigated by calculating the following radiological parameters: the radium equivalent, radiation hazard index and annual effective dose. It was observed that the levels of radiological parameter are higher in eastern locations than in western ones. In addition, the western side displayed radiological parameters higher than the recommended world-wide values. © 2015 The Authors. Production and hosting by Elsevier B.V. on behalf of Taibah University. This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/). -

Innovative Educator Experts

Innovative Educator Experts 2019-2020 The Microsoft Innovative Educator (MIE) Expert program is an exclusive program created to recognize global educator visionaries who are using technology to pave the way for their peers for better learning and student outcomes. Microsoft Innovative Educator Experts Names are sorted by region, then country, then last name. Table of Contents Contents Asia Pacific Region ............................................................................................................................................................. 6 Bangladesh ........................................................................................................................................................................................................... 6 Brunei .................................................................................................................................................................................................................... 7 Cambodia ............................................................................................................................................................................................................. 8 Indonesia .............................................................................................................................................................................................................. 8 Korea ....................................................................................................................................................................................................................