YG Entertainment (122870 KS)

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Universidad Peruana De Ciencias Aplicadas Facultad

Caracterización de los procesos de consumo de los K- Dramas y videos musicales de K-Pop, y su incidencia en la construcción de la identidad y formas de socialización en la comunidad Hallyu de Lima. Una aproximación desde los fenómenos de audiencia en K-Dramas Descendants of the Sun y Goblin: The Lonely and Great God, y los fenómenos de tendencia musical de los grupos BIG BANG y Bangtan Boys; Beyond The Scene a.k.a BTS Item Type info:eu-repo/semantics/bachelorThesis Authors Mosquera Anaya, Heidy Winie Publisher Universidad Peruana de Ciencias Aplicadas (UPC) Rights info:eu-repo/semantics/openAccess; Attribution- NonCommercial-ShareAlike 4.0 International Download date 10/10/2021 11:56:20 Item License http://creativecommons.org/licenses/by-nc-sa/4.0/ Link to Item http://hdl.handle.net/10757/648589 UNIVERSIDAD PERUANA DE CIENCIAS APLICADAS FACULTAD DE COMUNICACIONES PROGRAMA ACADÉMICO DE COMUNICACIÓN AUDIOVISUAL Y MEDIOS INTERACTIVOS Caracterización de los procesos de consumo de los K-Dramas y videos musicales de K-Pop, y su incidencia en la construcción de la identidad y formas de socialización en la comunidad Hallyu de Lima. Una aproximación desde los fenómenos de audiencia en K-Dramas Descendants of the Sun y Goblin: The Lonely and Great God, y los fenómenos de tendencia musical de los grupos BIG BANG y Bangtan Boys; Beyond The Scene a.k.a BTS. TESIS Para optar el título profesional de Licenciado en Comunicación Audiovisual y Medios Interactivos AUTOR(A) Mosquera Anaya, Heidy Winie (0000-0003-4569-9612) ASESOR(A) Calderón Chuquitaype, Gabriel Raúl (0000-0002-1596-8423) Lima, 01 de Junio de 2019 DEDICATORIA A mis padres Abraham y Luz quienes con su amor, paciencia y esfuerzo me han permitido llegar a cumplir hoy un sueño más. -

Birth and Evolution of Korean Reality Show Formats

Georgia State University ScholarWorks @ Georgia State University Film, Media & Theatre Dissertations School of Film, Media & Theatre Spring 5-6-2019 Dynamics of a Periphery TV Industry: Birth and Evolution of Korean Reality Show Formats Soo keung Jung [email protected] Follow this and additional works at: https://scholarworks.gsu.edu/fmt_dissertations Recommended Citation Jung, Soo keung, "Dynamics of a Periphery TV Industry: Birth and Evolution of Korean Reality Show Formats." Dissertation, Georgia State University, 2019. https://scholarworks.gsu.edu/fmt_dissertations/7 This Dissertation is brought to you for free and open access by the School of Film, Media & Theatre at ScholarWorks @ Georgia State University. It has been accepted for inclusion in Film, Media & Theatre Dissertations by an authorized administrator of ScholarWorks @ Georgia State University. For more information, please contact [email protected]. DYNAMICS OF A PERIPHERY TV INDUSTRY: BIRTH AND EVOLUTION OF KOREAN REALITY SHOW FORMATS by SOOKEUNG JUNG Under the Direction of Ethan Tussey and Sharon Shahaf, PhD ABSTRACT Television format, a tradable program package, has allowed Korean television the new opportunity to be recognized globally. The booming transnational production of Korean reality formats have transformed the production culture, aesthetics and structure of the local television. This study, using a historical and practical approach to the evolution of the Korean reality formats, examines the dynamic relations between producer, industry and text in the -

The Korean Internet Freak Community and Its Cultural Politics, 2002–2011

The Korean Internet Freak Community and Its Cultural Politics, 2002–2011 by Sunyoung Yang A thesis submitted in conformity with the requirements for the degree of Doctor of Philosophy Graduate Department of Anthropology University of Toronto © Copyright by Sunyoung Yang Year of 2015 The Korean Internet Freak Community and Its Cultural Politics, 2002–2011 Sunyoung Yang Doctor of Philosophy Department of Anthropology University of Toronto 2015 Abstract In this dissertation I will shed light on the interwoven process between Internet development and neoliberalization in South Korea, and I will also examine the formation of new subjectivities of Internet users who are also becoming neoliberal subjects. In particular, I examine the culture of the South Korean Internet freak community of DCinside.com and the phenomenon I have dubbed “loser aesthetics.” Throughout the dissertation, I elaborate on the meaning-making process of self-reflexive mockery including the labels “Internet freak” and “surplus (human)” and gender politics based on sexuality focusing on gender ambiguous characters, called Nunhwa, as a means of collective identity-making, and I explore the exploitation of unpaid immaterial labor through a collective project making a review book of a TV drama Painter of the Wind. The youth of South Korea emerge as the backbone of these creative endeavors as they try to find their place in a precarious labor market that has changed so rapidly since the 1990s that only the very best succeed, leaving a large group of disenfranchised and disillusioned youth. I go on to explore the impact of late industrialization and the Asian financial crisis, and the nationalistic desire not be left behind in the age of informatization, but to be ahead of the curve. -

August 30, 2013

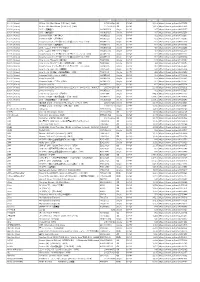

August 30, 2013 KOREA Company News & Analysis Major Indices Close Chg Chg (%) KOSPI 1,926.36 18.82 0.99 Partron (Buy/TP: W24,700) KOSPI 200 251.74 2.88 1.16 Beneficiary of mid- to low-end smartphone growth KOSDAQ 516.74 -3.63 -0.70 Turnover ('000 shares, Wbn) Soulbrain (Buy/TP: W60,000) Volume Value Balanced growth to continue KOSPI 296,211 4,961 KOSPI 200 67,262 3,519 Duksan Hi-Metal (Buy/TP: W34,000) KOSDAQ 392,253 1,938 Finding opportunity in uncertainty Market Cap (Wbn) Sungwoo Hitech (Buy/TP: W18,800) Value Back on track KOSPI 1,128,186 KOSDAQ 120,078 YG Entertainment (Buy/TP: W59,500) Lower TP KOSPI Turnover (Wbn) Potential of new artists and businesses has yet to be proven Buy Sell Net Foreign 1,781 1,283 498 Silicon Works (Buy/TP: W29,000) Institutional 1,236 1,282 -46 A long-awaited breakthrough Retail 1,927 2,366 -439 KOSDAQ Turnover (Wbn) SM Entertainment (Buy/TP: W46,000) Lower TP Buy Sell Net Royalty income recognition deferred to 2H Foreign 122 184 -61 Institutional 84 90 -6 Daesang (Trading Buy/TP: W36,000) Lower TP Retail 1,726 1,661 65 Taking a breather Program Buy / Sell (Wbn) Buy Sell Net KOSPI 1,091 821 271 KOSDAQ 35 23 12 Advances & Declines Advances Declines Unchanged KOSPI 419 376 79 KOSDAQ 411 500 71 KOSPI Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value NHN Entertainment 108,500 -19,000 555 Samsung Electronics 1,368,000 24,000 464 KODEX LEVERAGE 11,230 165 401 NHN 446,500 -33,500 342 KODEX INVERSE 7,860 -55 188 KOSDAQ Top 5 Most Active Stocks by Value (Wbn) Price (W) Chg (W) Value Celltrion 45,100 -7,900 478 Speco 4,140 -60 44 AHNLAB 58,000 2,400 34 Lumens 8,580 -530 34 SM 33,400 2,000 31 Note: As of August 30, 2013 This document is a summary of a report prepared by Daewoo Securities Co., Ltd. -

The Globalization of K-Pop: the Interplay of External and Internal Forces

THE GLOBALIZATION OF K-POP: THE INTERPLAY OF EXTERNAL AND INTERNAL FORCES Master Thesis presented by Hiu Yan Kong Furtwangen University MBA WS14/16 Matriculation Number 249536 May, 2016 Sworn Statement I hereby solemnly declare on my oath that the work presented has been carried out by me alone without any form of illicit assistance. All sources used have been fully quoted. (Signature, Date) Abstract This thesis aims to provide a comprehensive and systematic analysis about the growing popularity of Korean pop music (K-pop) worldwide in recent years. On one hand, the international expansion of K-pop can be understood as a result of the strategic planning and business execution that are created and carried out by the entertainment agencies. On the other hand, external circumstances such as the rise of social media also create a wide array of opportunities for K-pop to broaden its global appeal. The research explores the ways how the interplay between external circumstances and organizational strategies has jointly contributed to the global circulation of K-pop. The research starts with providing a general descriptive overview of K-pop. Following that, quantitative methods are applied to measure and assess the international recognition and global spread of K-pop. Next, a systematic approach is used to identify and analyze factors and forces that have important influences and implications on K-pop’s globalization. The analysis is carried out based on three levels of business environment which are macro, operating, and internal level. PEST analysis is applied to identify critical macro-environmental factors including political, economic, socio-cultural, and technological. -

The K-Pop Wave: an Economic Analysis

The K-pop Wave: An Economic Analysis Patrick A. Messerlin1 Wonkyu Shin2 (new revision October 6, 2013) ABSTRACT This paper first shows the key role of the Korean entertainment firms in the K-pop wave: they have found the right niche in which to operate— the ‘dance-intensive’ segment—and worked out a very innovative mix of old and new technologies for developing the Korean comparative advantages in this segment. Secondly, the paper focuses on the most significant features of the Korean market which have contributed to the K-pop success in the world: the relative smallness of this market, its high level of competition, its lower prices than in any other large developed country, and its innovative ways to cope with intellectual property rights issues. Thirdly, the paper discusses the many ways the K-pop wave could ensure its sustainability, in particular by developing and channeling the huge pool of skills and resources of the current K- pop stars to new entertainment and art activities. Last but not least, the paper addresses the key issue of the ‘Koreanness’ of the K-pop wave: does K-pop send some deep messages from and about Korea to the world? It argues that it does. Keywords: Entertainment; Comparative advantages; Services; Trade in services; Internet; Digital music; Technologies; Intellectual Property Rights; Culture; Koreanness. JEL classification: L82, O33, O34, Z1 Acknowledgements: We thank Dukgeun Ahn, Jinwoo Choi, Keun Lee, Walter G. Park and the participants to the seminars at the Graduate School of International Studies of Seoul National University, Hanyang University and STEPI (Science and Technology Policy Institute). -

アーティスト 商品名 品番 ジャンル名 定価 URL 100% (Korea) RE

アーティスト 商品名 品番 ジャンル名 定価 URL 100% (Korea) RE:tro: 6th Mini Album (HIP Ver.)(KOR) 1072528598 K-POP 2,290 https://tower.jp/item/4875651 100% (Korea) RE:tro: 6th Mini Album (NEW Ver.)(KOR) 1072528759 K-POP 2,290 https://tower.jp/item/4875653 100% (Korea) 28℃ <通常盤C> OKCK05028 K-POP 1,296 https://tower.jp/item/4825257 100% (Korea) 28℃ <通常盤B> OKCK05027 K-POP 1,296 https://tower.jp/item/4825256 100% (Korea) 28℃ <ユニット別ジャケット盤B> OKCK05030 K-POP 648 https://tower.jp/item/4825260 100% (Korea) 28℃ <ユニット別ジャケット盤A> OKCK05029 K-POP 648 https://tower.jp/item/4825259 100% (Korea) How to cry (Type-A) <通常盤> TS1P5002 K-POP 1,204 https://tower.jp/item/4415939 100% (Korea) How to cry (Type-B) <通常盤> TS1P5003 K-POP 1,204 https://tower.jp/item/4415954 100% (Korea) How to cry (ミヌ盤) <初回限定盤>(LTD) TS1P5005 K-POP 602 https://tower.jp/item/4415958 100% (Korea) How to cry (ロクヒョン盤) <初回限定盤>(LTD) TS1P5006 K-POP 602 https://tower.jp/item/4415970 100% (Korea) How to cry (ジョンファン盤) <初回限定盤>(LTD) TS1P5007 K-POP 602 https://tower.jp/item/4415972 100% (Korea) How to cry (チャンヨン盤) <初回限定盤>(LTD) TS1P5008 K-POP 602 https://tower.jp/item/4415974 100% (Korea) How to cry (ヒョクジン盤) <初回限定盤>(LTD) TS1P5009 K-POP 602 https://tower.jp/item/4415976 100% (Korea) Song for you (A) OKCK5011 K-POP 1,204 https://tower.jp/item/4655024 100% (Korea) Song for you (B) OKCK5012 K-POP 1,204 https://tower.jp/item/4655026 100% (Korea) Song for you (C) OKCK5013 K-POP 1,204 https://tower.jp/item/4655027 100% (Korea) Song for you メンバー別ジャケット盤 (ロクヒョン)(LTD) OKCK5015 K-POP 602 https://tower.jp/item/4655029 100% (Korea) -

YG Entertainment Buy (122870 KQ ) (Maintain)

[Korea] Entertainment May 13, 2021 YG Entertainment Buy (122870 KQ ) (Maintain) Increasing content leverage TP: W56,000 Upside: 25.8% Mirae Asset Securities Co., Ltd. Jeong -yeob Park [email protected] 1Q21 review : Big earnings beat Consolidated revenue of W97bn (+83.9% YoY), OP of W9.5bn (turn to profit YoY) In 1Q21, YG Entertainment proved its enhanced fundamentals by overcoming the absence of offline performances/activities with the release of new content (Rosé and Treasure). Revenue from albums/digital content/goods was up 170.6% YoY, driven by strong sales of albums (980,000 copies; helped by new releases) and goods. Digital content revenue surged 125.6% YoY, boosted by BLACKPINK’s online concert (280,000 paid views and net revenue of around W8bn). Revenue from Google came in strong at W4.5bn (excluding BLACKPINK concert; vs. W2.5bn in 1Q20) on the back of new releases and subscriber growth. Despite constraints on artist activities, management revenue expanded 44.7% YoY, fueled by luxury advertisers’ (Dior, Saint Laurent and Tiffany & Co.) strong preference for YG artists. Elsewhere, the company recorded W15.6bn from TV production (YG Studioplex’s Mr. Queen ) and a valuation gain of roughly W5bn related to Tencent Music Entertainment. Expectations on 2H21 artist Artist activities to gather steam; IP monetization to strengthen on Weverse incl usion activities and Weverse 1) Earnings: During the 2018-20 absence of its main artist group, YG Entertainment built a robust lineup that includes BLACKPINK, Treasure, and iKON. We expect robust ad and appearance income to continue, supported by the growing international profile of the company’s artists. -

URL 100% (Korea)

アーティスト 商品名 オーダー品番 フォーマッ ジャンル名 定価(税抜) URL 100% (Korea) RE:tro: 6th Mini Album (HIP Ver.)(KOR) 1072528598 CD K-POP 1,603 https://tower.jp/item/4875651 100% (Korea) RE:tro: 6th Mini Album (NEW Ver.)(KOR) 1072528759 CD K-POP 1,603 https://tower.jp/item/4875653 100% (Korea) 28℃ <通常盤C> OKCK05028 Single K-POP 907 https://tower.jp/item/4825257 100% (Korea) 28℃ <通常盤B> OKCK05027 Single K-POP 907 https://tower.jp/item/4825256 100% (Korea) Summer Night <通常盤C> OKCK5022 Single K-POP 602 https://tower.jp/item/4732096 100% (Korea) Summer Night <通常盤B> OKCK5021 Single K-POP 602 https://tower.jp/item/4732095 100% (Korea) Song for you メンバー別ジャケット盤 (チャンヨン)(LTD) OKCK5017 Single K-POP 301 https://tower.jp/item/4655033 100% (Korea) Summer Night <通常盤A> OKCK5020 Single K-POP 602 https://tower.jp/item/4732093 100% (Korea) 28℃ <ユニット別ジャケット盤A> OKCK05029 Single K-POP 454 https://tower.jp/item/4825259 100% (Korea) 28℃ <ユニット別ジャケット盤B> OKCK05030 Single K-POP 454 https://tower.jp/item/4825260 100% (Korea) Song for you メンバー別ジャケット盤 (ジョンファン)(LTD) OKCK5016 Single K-POP 301 https://tower.jp/item/4655032 100% (Korea) Song for you メンバー別ジャケット盤 (ヒョクジン)(LTD) OKCK5018 Single K-POP 301 https://tower.jp/item/4655034 100% (Korea) How to cry (Type-A) <通常盤> TS1P5002 Single K-POP 843 https://tower.jp/item/4415939 100% (Korea) How to cry (ヒョクジン盤) <初回限定盤>(LTD) TS1P5009 Single K-POP 421 https://tower.jp/item/4415976 100% (Korea) Song for you メンバー別ジャケット盤 (ロクヒョン)(LTD) OKCK5015 Single K-POP 301 https://tower.jp/item/4655029 100% (Korea) How to cry (Type-B) <通常盤> TS1P5003 Single K-POP 843 https://tower.jp/item/4415954 -

ASPIRATION Journal Vol.1(2) November 2020, P.208-228 E-ISSN : 2723-1461

ASPIRATION Journal Vol.1(2) November 2020, p.208-228 E-ISSN : 2723-1461 ASPIRATION (ASPIKOM Jabodetabek International Research Journal of Communication) Journal homepage: www.aspiration.id/index.php STUDYING FANDOM ONLINE: A CASE STUDY OF TWICE and STRAY KIDS FANDOM ON FAN FICTION PRACTICES OF @ESKALOKAL AND @GABENERTWICE ON TWITTER Cendera Rizky Anugrah Bangun1*, Nareswari Kumaralalita2, Gabriela Frederika Febe Sukur3 1 Universitas Multimedia Nusantara, Jl. Scientia Boulevard, Gading Serpong, Tangerang Banten, 15811 2 LSPR Communication & Business Institute, Jl. K.H Mas Manyur Kav. 35, DKI Jakarta 10220 3 University of China, 1 Dingfuzhuang E St, Chaoyang, Beijing, China 1*[email protected], [email protected], [email protected] ARTICLE INFO ABSTRACT Received on July 21st, 2020 Popular culture is developing over time Received in revised from August 2 nd, 2020 Accepted November 22th, 2020 and fan fiction is product of popular Published on November 30th, 2020 culture. Furthermore, fan fiction is a work of fiction created by fans as a sense of involvement between them and Keywords: Fan fiction their idols. In addition to creating a Fandom sense of "closeness" with his idol, fan Popular culture fiction can also provide a feeling of Alternate universe K-pop satisfaction for fans who want an ending or even a whole new world for their idols. Alternate Universe (AU) is quite popular as one of the characteristics How to cite this article: Bangun, C.R.A; Nareawari, from Fan Fiction. Fan fiction usually has K; & Sukur, G.F.F (2020). Online Fan Fiction: Social Media Alternative Universe Practices on Twitter a fairly long format, with platforms like @Eskalokal and @Gaberntwice. -

Download Lagu Turn It up Top Bigbang

Download lagu turn it up top bigbang LINK TO DOWNLOAD 6/18/ · Turn it up loud, turn it up loud. You can’t bear to look at my monkey magic. Listen closely to this taunting message. Turn it up loud (la la la la), turn it up loud (la la la la) I’ma be satisfied with life. You and I, our future is bright. If you work hard and enjoy the ride, it’s . (Lyrics) T.O.P Big Bang - Turn It Up nan ni gomagui sungyeoreul ppaetji igeon neoreul yuhokhaneun meseji Turn it up loud Turn it up loud nun tteugoneun bol su eomneun mongkimaejik jal deureo neol yak ollineun meseji da Turn it up loud (rallarara-) Turn it up loud (rallarara-) naneunya The Official Pi** T.O.P nunimdeurui somang na hanbeon mannabogi. Download Lagu KPOP Untuk Dance Clubbing Party Terbaik: Top list tips and reviews about Download Lagu KPOP Untuk Dance Clubbing Party Terbaik. Read more at renuzap.podarokideal.ru 6/26/ · Big Bang to Perform Live in Singapore on September 28; Big Bang ALIVE World Tour in North and South Ameri "ALIVE" Tour in Fukuoka () [PHOTO/VIDEO] Official Facebook Update: ALIVE Tour in Fukuoka [P T.O.P. voted as a One of the Celebrity People Want Big Bang is one of the Most Viewed, Share and Disc. Up & Down - SHINee High High -GD&TOP Turn it Up - TOP I Am the Best - 2NE1 I Got A Boy – SNSD Break Down – Super Junior M I Like 2 Party – Jay Park Expectation – Girl’s Day This Love – SHINHWA Growl – EXO Do You Love Me – 2NE1 Tarzan – Wonder Boyz Incredible – XIA Give It To Me – SISTAR Smoky Girl – MBLAQ Wild – Nine. -

Ikon Artist Gets 3 Years in High Security Prison

W rld Edition No 1: Late summer 2019 Ikon artist gets 3 years in high Saqib Bhatti at the university. security prison Doctorate honour for Saqib One of the Westside BID’s top leaders has received an honorary doctorate from Aston University to recognise his work promoting business in the West Midlands. Saqib Bhatti, a chartered accountant by profession, has been a BID director for the last six years, as well as being its company secretary. The 34-year-old also became the youngest-ever president at the Greater Birmingham Chambers of Commerce last year and has been a director of the Greater Birmingham and Solihull Local Enterprise Partnership since 2015. Saqib, whose day job is an associate at Younis Bhatti & Co Ltd, a firm of chartered n Birmingham-born artist Dean Kelland is to be artist-in-residence at HMP Grendon. accountants based at 93 Broad Street, said: “It is such a great ...But Dean is on a mission to rehabilitate violent offenders privilege to be awarded this honorary doctorate. I receive it The Ikon Gallery has sent a re- By Steve Dyson Ikon Gallery, which is housed in a humbly. nowned Birmingham-born artist Grade II-listed former school at 1 “I think of the hard work to a high-security prison – as part mates who volunteer to be there, Oozells Square in Brindleyplace, that my parents have put into of a project to rehabilitate violent analysing behaviours to try to un- said: “We are delighted to have making me the man I am today criminals. derstand why they ended up behind Dean on board for Ikon’s second and so I dedicate this to them.