Review of Alternatives for Rural High Speed Internet 39 Page PDF File Size

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Telecom Notice of Consultation CRTC 2011-761

Telecom Notice of Consultation CRTC 2011-761 PDF version Ottawa, 8 December 2011 Call for comments Notification requirements for competitive local exchange carriers seeking to offer local services in new exchanges, and filing of related documents File number: 8663-C12-201115791 Introduction 1. In Telecom Decision 97-8, the Commission determined, among other things, that a competitive local exchange carrier (CLEC) would have to meet a number of notification requirements and file certain documents before it could begin offering local services in an exchange. Such requirements include (in part) the following: filing a letter of intention to offer local services in a new exchange prior to negotiating the necessary interconnection arrangements and completing the required testing for the proposed exchange; filing Schedule C of the Master Agreement for Local Interconnection (MALI) for the Commission’s approval, pursuant to Telecom Decision 2007- 129; filing a notification letter, once the requirements imposed on CLECs in Telecom Decision 97-8 and subsequent decisions have been satisfied, along with a map of the proposed serving area; and serving the documentation filed with the Commission on all Canadian carriers that currently provide services in the exchange where the CLEC is proposing to provide service. 1. In the Policy Direction,1 the Governor in Council required, among other things, that when relying on regulation, the Commission use measures that are efficient and proportionate to their purpose and that interfere with the operation of competitive market forces to the minimum extent necessary to meet the policy objectives. 1 Order Issuing a Direction to the CRTC on Implementing the Canadian Telecommunications Policy Objectives, P.C. -

ClosingCanada'sDigitalDivide: AReview Of

CLOSING CANADA’S DIGITAL DIVIDE: A REVIEW OF POLICIES IN CANADA AND ABROAD by Charlie Crabb A Major Research Paper presented to Ryerson University in partial fulfillment of the requirements for the degree of Master of Digital Media In the Yeates School of Graduate Studies Ryerson University Toronto, Ontario, Canada © Charlie Crabb, 2017 Author's Declaration I hereby declare that I am the sole author of this MRP. This is a true copy of the MRP, including any required final revisions. I authorize Ryerson University to lend this MRP to other institutions or individuals for the purpose of scholarly research. I further authorize Ryerson University to reproduce this MRP by photocopying or by other means, in total or in part, at the request of other institutions or individuals for the purpose of scholarly research. I understand that my MRP may be made electronically available to the public. 1 Abstract This paper explores Canada’s telecommunications policy landscape, with an aim of evaluating its -

Rogers.Com O 416.935.7009 M 416.371.6708

Howard Slawner 350 Bloor Street East, 6th Floor Toronto, ON M4W 0A1 [email protected] o 416.935.7009 m 416.371.6708 August 10, 2018 Via email: [email protected] Aline Chevrier Senior Director, Spectrum Licensing and Auction Operations Innovation, Science and Economic Development Canada 235 Queen Street, 6th floor Ottawa, Ontario K1A 0H5 Re: Canada Gazette Notice No. SLPB-004-18: Consultation on Revisions to the 3500 MHz Band to Accommodate Flexible Use and Preliminary Consultation on Changes to the 3800 MHz Band Please find the reply comments of Rogers Communications Canada Inc. (Rogers) in response to Canada Gazette, Part I, June 16, 2018, Consultation on Revisions to the 3500 MHz Band to Accommodate Flexible Use and Preliminary Consultation on Changes to the 3800 MHz Band (SLPB-004-18). Rogers thanks the Department for the opportunity to provide input on this important issue. Yours very truly, Howard Slawner Vice President – Regulatory Telecom HS/pg Attach. Consultation on Revisions to the 3500 MHz Band to Accommodate Flexible Use and Preliminary Consultation on Changes to the 3800 MHz Band SLPB‐004‐18 Reply Comments of Rogers Communications Canada Inc. August 10, 2018 Rogers Communications Consultation on Revisions to the 3500 MHz Band to August 10, 2018 Accommodate Flexible Use and Preliminary Consultation on Changes to the 3800 MHz Band (SLPB-004-18) Table of Contents Page Executive Summary 2 Introduction 4 Rogers’ Reply Comments of Other Parties Q1 Timelines for 5G ecosystems for 3500 -

Cologix Torix Case Study

Internet Exchange Case Study The Toronto Internet Exchange (TorIX) is the largest IX in Canada with more than 175 peering participants benefiting from lower network costs & faster speeds The non-profit Toronto Internet Exchange (TorIX) is a multi-connection point enabling members to use one hardwired connection to exchange traffic with 175+ members on the exchange. With peering participants swapping traffic with one another through direct connections, TorIX reduces transit times for local data exchange and cuts the significant costs of Internet bandwidth. The success of TorIX is underlined by its tremendous growth, exceeding 145 Gbps as one of the largest IXs in the world. TorIX is in Cologix’s data centre at 151 Front Street, Toronto’s carrier hotel and the country’s largest telecommunications hub in the heart of Toronto. TorIX members define their own routing protocols to dictate their traffic flow, experiencing faster speeds with their data packets crossing fewer hops between the point of origin and destination. Additionally, by keeping traffic local, Canadian data avoids international networks, easing concerns related to privacy and security. Above: In Dec. 2014, TorIX traffic peaked above 140 Gbps, with average traffic hovering around 90 Gbps. Beginning Today Launched in July 1996 Direct TorIX on-ramp in Cologix’s151 Front Street Ethernet-based, layer 2 connectivity data centre in Toronto TorIX-owned switches capable of handling Second largest independent IX in North America ample traffic Operated by telecom industry volunteers IPv4 & IPv6 address provided to each peering Surpassed 145 Gbps with 175+ peering member to use on the IX participants, including the Canadian Broke the 61 Gbps mark in Jan. -

An Introduction to Telecommunications Policy in Canada

Australian Journal of Telecommunications and the Digital Economy An Introduction to Telecommunications Policy in Canada Catherine Middleton Ryerson University Abstract: This paper provides an introduction to telecommunications policy in Canada, outlining the regulatory and legislative environment governing the provision of telecommunications services in the country and describing basic characteristics of its retail telecommunications services market. It was written in 2017 as one in a series of papers describing international telecommunications policies and markets published in the Australian Journal of Telecommunications and the Digital Economy in 2016 and 2017. Drawing primarily from regulatory and policy documents, the discussion focuses on broad trends, central policy objectives and major players involved in building and operating Canada’s telecommunications infrastructure. The paper is descriptive rather than evaluative, and does not offer an exhaustive discussion of all telecommunications policy issues, markets and providers in Canada. Keywords: Policy; Telecommunications; Canada Introduction In 2017, Canada’s population was estimated to be above 36.5 million people (Statistics Canada, 2017). Although Canada has a large land mass and low population density, more than 80% of Canadiansi live in urban areas, the majority in close proximity to the border with the United States (Central Intelligence Agency, 2017). Telecommunications services are easily accessible for most, but not all, Canadians. Those in lower-income brackets and/or living in rural and remote areas are less likely to subscribe to telecommunications services than people in urban areas or with higher incomes, and high-quality mobile and Internet services are simply not available in some parts of the country (CRTC, 2017a). On average, Canadian households spend more than $200 (CAD)ii per month to access mobile phone, Internet, television and landline phone services (2015 data, cited in CRTC, 2017a). -

Data Privacy Transparency of Canadian Internet Carriers

Keeping Internet Users in the Know or in the Dark A Report on the Data Privacy Transparency of Canadian Internet Carriers Andrew Clement* & Jonathan A. Obar** [email protected]. [email protected] IXmaps.ca & New Transparency Projects *Faculty of Information, University of Toronto **Faculty of Social Science and Humanities, University of Ontario Institute of Technology in collaboration with the Centre for Innovation Law and Policy (CILP), Faculty of Law, University of Toronto March 12, 2015 Acknowledgements We appreciate the contributions of our research collaborators and assistants at the University of Toronto: Antonio Gamba, Alex Goel and Colin McCann. We are also pleased to acknowledge the input of Steve Anderson, (Openmedia.ca), Nate Cardozo (EFF), Andrew Hilts (Cyber Stewards Initiative), Tamir Israel (CIPPIC) and Christopher Parsons (Citizen Lab). The research reported here benefited significantly from collaboration with the Centre for Innovation Law and Policy (CILP), Faculty of Law, University of Toronto. We worked most closely with Matthew Schuman, Assistant Director, and Ainslie Keith, who led a Volunteer Student Working Group consisting of Shawn Arksey, Michael Cockburn, Caroline Garel- Jones, Aaron Goldstein, Nathaniel Rattansey, Kassandra Shortt, Jada Tellier and Matthew Vaughan. Website and report design assistance: Jennette Weber This research was conducted under the auspices of the IXmaps: Mapping Canadian privacy risks in the internet ‘cloud’ project (see IXmaps.ca) and the Information Policy Research Program (IPRP), with the support of the Office of the Privacy Commissioner of Canada (2012-13), The New Transparency: Surveillance and Social Sorting project funded by the Social Sciences and Humanities Research Council (2012-15), and the Mapping Canadian internet traffic, infrastructure and service provision (2014-15), funded by the Canadian Internet Registration Authority (CIRA). -

Canadian Telecommunications Services

RBC Dominion Securities Inc. Drew McReynolds, CFA, Caleb Ho, CPA, CFA CA, CPA (Analyst) (Associate) (416) 842-3805 (416) 842-3806 [email protected] [email protected] Riley Gray (Associate) (416) 842-4123 [email protected] August 31, 2020 Canadian Telecommunications Services August Channel Checks and Market Developments We summarize notable market developments within the Canadian telecommunications sector since July. For more detail on sector trends, please see our August 21, 2020 report entitled "Q2/20 Review - Wireless Competitive Intensity in Focus (Again)". EQUITY RESEARCH Notable sequential pick-up in promotional activity with what appears to be less back-to- school fanfare We observed a healthy dose of main brand promotional activity in August focused on the 20GB data bucket that was largely characterized by handset and plan pricing discounts, alongside what appears to be less YoY back-to-school promotional activity. On a sequential basis, promotional activity not surprisingly stepped up in August driven by incumbent responses to the launch of Shaw Mobile last month. Notably: (i) the iPhone 11 was offered on discount (~$520 off) by incumbent operators on refurbishing unlimited plans; (ii) in mid-August, while pricing on the promotional $80/20GB unlimited plans was momentarily increased to $85/20GB, $75/20GB pricing was re-introduced by all incumbents with this pricing remaining in-market through the end of August; (iii) in mid-August, TELUS launched a ‘Great Big Sale’ offering the aforementioned $75/20GB “Peace of Mind” -

Appendix A: Complaints by Service Provider

Appendix A ‐ Complaints by Service Provider Complaints Change all % of Concluded Resolved Closed Resolved Closed Accepted Issued Accepted Rejected Accepted Y/Y % Provider Accepted and Concluded Complaints Pre‐Investigation Investigation Recommendation Decision #100 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 1010100 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 1010580 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 1010620 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 1010738 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 1011295.com 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 295.ca 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 3Web 0.0% 0 ‐100.0% 0 0 0 0 0 0 0 0 0 450Tel 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 768812 Ontario Inc. 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 8COM 0.1% 8 ‐88.4% 10 2 0 8 0 0 0 0 0 A dimension humaine 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 Acanac Inc. 0.6% 64 ‐16.9% 64 37 1224 0 0 0 0 Access Communications Inc. 0.0% 1 0.0% 1 0 1 0 0 0 0 0 0 Achatplus Inc. 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 ACN Canada 0.8% 82 9.3% 81 54 2 22 3 0 0 0 0 AEBC Internet Corporation 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 AEI Internet 0.0% 3 ‐40.0% 5 0 0 41 0 0 0 0 AIC Global Communications 0.0% 1 0.0% 1 0 0 1 0 0 0 0 0 Alberta High Speed 0.0% 0 0.0% 0 0 0 0 0 0 0 0 0 Allstream Inc. -

Canada Sets World Record for Prices of Mid-Band Spectrum Licenses

Canada Sets World Record for Prices of Mid-Band Spectrum Licenses 3500 MHz Auction Results – August 2021 An LYA® ® c-Ahead Report © LYA, 2021 Ò Canada Sets World Record for Prices of Mid-Band Spectrum Licenses 3500 MHz Auction Results August 2, 2021 – Canada’s recently completed auction of 3.5 GHz licenses – results announced July 29, 2021 – blasted through the previous high-water market for mid- band spectrum licenses. The total of C$8.91 billion (US$7.13 billion) in revenues for an average of 125 MHz per market in the 3450-3650 MHz range represents a record C$2.26 per MHz-pop or US$1.81… essentially double the valuations seen on average in the US C Band auction held earlier in 2021, and close to 10x the averages seen in earlier auctions. Canada is often viewed as a country with relatively high retail prices for mobile services. High prices for spectrum paid in auctions may ultimately flow to consumers helping to keep prices high in the future. We discuss herein some of the causes of these prices pertaining to auction rules and dynamics. LYA c-Ahead Report – Canadian 3500 MHz Spectrum License Auction Reproduction or dissemination of this Report in whole or in part is strictly prohibited – all rights reserved. Permission from LYA is required to quote or excerpt any part of this Report. © LYA, 2021 Page 1 Ò We also note how CRTC became a “player” in this auction via the awkward or inappropriate timing of the release of two major decisions impacting telecom carriers across the country. -

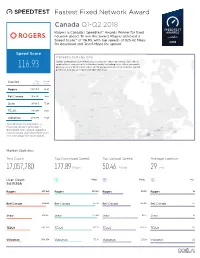

Fastest Fixed Network Award Canada Q1-Q2 2018 Rogers Is Canada’S Speedtest® Awards Winner for Fixed Network Speed

Fastest Fixed Network Award Canada Q1-Q2 2018 Rogers is Canada’s Speedtest® Awards Winner for fixed network speed. To win this award, Rogers achieved a Speed Score™ of 116.93, with top speeds of 325.42 Mbps for download and 30.05 Mbps for upload. Speed Score Canada’s Tests by City Ookla® compared user-initiated tests that are taken on various Speedtest applications connected to a fixed network, including tests taken on mobile 116.93 phones over a Wi-Fi connection. All major provider results from the award period in Canada are represented in the map. Test Speed Carrier Count Score Rogers 3,874,719 116.93 Bell Canada 2,918,367 74.53 Shaw 1,974,613 73.28 TELUS 1,763,951 59.53 Videotron 1,185,988 49.27 Speed Score incorporates a measure of each provider’s download and upload speed to rank network speed performance. See next page for more detail. Market Statistics Test Count Top Download Speed: Top Upload Speed: Average Latency: 17,057,780 177.89 Mbps 50.46 Mbps 29 ms User Count Mbps Mbps ms 9,619,868 Rogers 835,941 Rogers 325.42 Rogers 30.05 Rogers 19 Bell Canada 762,096 Bell Canada 237.13 Bell Canada 125.68 Bell Canada 23 Shaw 501,037 Shaw 172.40 Shaw 16.32 Shaw 18 TELUS 454,749 TELUS 167.12 TELUS 149.22 TELUS 20 Videotron 306,938 Videotron 135.16 Videotron 23.99 Videotron 22 Fastest Fixed Network Award Canada Q1-Q2 2018 How Speed Score Works When analyzing fastest operators, Ookla solely considers top carriers (all carriers with 3% or more of total test samples in the market for the period). -

Part 1 Application to Review and Vary Telecom Regulatory Policy CRTC 2019-269, the Internet Code

December 6, 2019 VIA Intervention Comment Form Mr. Claude Doucet Secretary General Canadian Radio-television and Telecommunications Commission Ottawa, Ontario K1A 0N2 Dear Mr. Doucet, Subject: Part 1 Application to Review and Vary Telecom Regulatory Policy CRTC 2019-269, The Internet Code 1. The Canadian Communication Systems Alliance (“CCSA”) and the Independent Telecommunications Providers Association (“ITPA”) hereby submit their joint response to the Part 1 Application by Bell, Cogeco, Eastlink, Quebecor Media, SaskTel, Shaw and TELUS (collectively, “the Applicants” or “the large, facilities-based ISPs”) for a Commission review and variance of TRP CRTC 2019-269, “The Internet Code”. 2. In making this joint response, CCSA and ITPA speak for their combined memberships. While some CCSA/ITPA members offer non-facilities-based service outside their home networks, all such members who offer Internet service to the public are small, facilities- based ISPs. Executive Summary 3. The decisions in Telecommunications Regulatory Policy CRTC 2019-269 were based on the Commission’s consideration of an extensive body of evidence gathered in the course of a full public process. 4. That evidence included representations from “over 2,300 individuals, including more than 65 current or past employees of the Service Providers or of third parties offering the Service Providers’ services for sale; the CCTS; consumer and public advocacy groups; researchers; unions representing employees; government agencies and departments; and the 12 Service Providers [the -

Court File No. CV-16-11257-00CL ONTARIO SUPERIOR COURT of JUSTICE COMMERCIAL LIST

Court File No. CV-16-11257-00CL ONTARIO SUPERIOR COURT OF JUSTICE COMMERCIAL LIST IN THE MATTER OF THE COMPANIES’ CREDITORS ARRANGEMENT ACT, R.S.C. 1985, c. C-36, AS AMENDED AND IN THE MATTER OF A PLAN OF COMPROMISE OR ARRANGEMENT OF PT HOLDCO, INC., PRIMUS TELECOMMUNICATIONS CANADA, INC., PTUS, INC., PRIMUS TELECOMMUNICATIONS, INC., AND LINGO, INC. (Applicants) APPROVAL AND VESTING ORDER SERVICE LIST GENERAL STIKEMAN ELLIOTT LLP Samantha Horn 5300 Commerce Court West Tel: (416) 869- 5636 199 Bay Street Email: [email protected] Toronto, ON M5L 1B9 Maria Konyukhova Tel: (416) 869-5230 Email: [email protected] Kathryn Esaw Tel: (416) 869-6820 Email: [email protected] Vlad Calina Tel: (416) 869-5202 Lawyers for the Applicants Email: [email protected] FTI CONSULTING CANADA INC. Nigel D. Meakin TD Waterhouse Tower Tel: (416) 649-8100 79 Wellington Street, Suite 2010 Fax: (416) 649-8101 Toronto, ON M5K 1G8 Email: [email protected] Steven Bissell Tel: (416) 649-8100 Fax: (416) 649-8101 Email: [email protected] Kamran Hamidi Tel: (416) 649-8100 Fax: (416) 649-8101 Monitor Email: [email protected] 2 BLAKE, CASSELS & GRAYDON LLP Linc Rogers 199 Bay Street Tel: (416) 863-4168 Suite 4000, Commerce Court West Fax: (416) 863-2653 Toronto, ON M5L 1A9 Email: [email protected] Aryo Shalviri Tel: (416) 863- 2962 Fax: (416) 863-2653 Lawyers for the Monitor Email: [email protected] DAVIES WARD PHILLIPS VINEBERG LLP Natasha MacParland 155 Wellington Street West Tel: (416) 863 5567 Toronto, ON M5V 3J7 Fax: (416) 863 0871 Email: [email protected] Lawyers for the Bank of Montreal, as Administrative Agent for the Syndicate FOGLER, RUBINOFF LLP Gregg Azeff 77 King Street West Tel: (416) 365-3716 Suite 3000, P.O.