MICROCAP-INVESTOR.Pdf

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Otc Markets Group Inc

OTC MARKETS GROUP INC. A Delaware Corporation 304 Hudson Street New York, NY 10013 _______________________ Telephone: (212) 896-4400 Facsimile: (212) 868-3848 _______________________ Federal EIN: 13-3941069 NAICS: 523999 SIC Code: 6289 Issuer’s Quarterly Report For the quarterly period ended June 30, 2014 ISSUER’S EQUITY SECURITIES COMMON STOCK Class A Common Stock $0.01 Par Value Per Share 14,000,000 Shares Authorized 11,053,241 Shares Outstanding as of July 31, 2014 OTCQX: OTCM Class C Common Stock $0.01 Par Value Per Share 130,838 Shares Authorized 130,838 Shares Outstanding as of July 31, 2014 OTC Markets Group Inc. is responsible for the content of this Quarterly Report. The securities described in this document are not registered with, and the information contained in this report has not been filed with, or approved by, the U.S. Securities and Exchange Commission. TABLE OF CONTENTS ITEM 1 THE EXACT NAME OF THE ISSUER AND THE ADDRESS AND TELEPHONE NUMBER OF THE ISSUER’S PRINCIPAL EXECUTIVE OFFICES 3 ITEM 2 SHARES OUTSTANDING 4 ITEM 3 UNAUDITED INTERIM CONDENSED CONSOLIDATED FINANCIAL STATEMENTS 5 ITEM 4 MANAGEMENT’S DISCUSSION AND ANALYSIS 6 ITEM 5 LEGAL PROCEEDINGS 25 ITEM 6 DEFAULTS UPON SENIOR SECURITIES 25 ITEM 7 OTHER INFORMATION 25 ITEM 8 EXHIBITS 25 ITEM 9 CERTIFICATIONS 26 2 OTC MARKETS GROUP INC. A Delaware Corporation QUARTERLY REPORT Cautionary Note Regarding Forward-Looking Statements Information set forth in this Quarterly Report (the “Quarterly Report”) contains forward-looking statements, which involve a number of risks and uncertainties that could cause our actual results to differ materially from those reflected in the forward-looking statements. -

SUPPORTING STATEMENT for the Paperwork Reduction Act New Information Collection Submission for Rule 15C2-11

SUPPORTING STATEMENT For the Paperwork Reduction Act New Information Collection Submission for Rule 15c2-11 A. Justification 1. Necessity of Information Collection On September 13, 1971, effective December 13, 1971 (see 36 FR 18641, September 18, 1971), the Commission adopted Rule 15c2-11 (17 CFR 240.15c2-11) (“Rule 15c2-11” or “Rule”) under the Securities Exchange Act of 1934 (15 U.S.C. 78a et seq.) (“Exchange Act”) to regulate the initiation or resumption of quotations in a quotation medium by a broker-dealer for over-the-counter (“OTC”) securities. The Rule was designed primarily to prevent certain manipulative and fraudulent trading schemes that had arisen in connection with the distribution and trading of unregistered securities issued by shell companies or other companies having outstanding but infrequently traded securities. Subject to certain exceptions, the Rule prohibits brokers-dealers from publishing a quotation for a security, or submitting a quotation for publication, in a quotation medium unless they have reviewed specified information concerning the security and the issuer. This information review requirement is intended to have a broker-dealer give some measure of attention to financial and other information about an issuer before it initiates or resumes quotations for that issuer’s securities. Pursuant to subsection (c) of the Rule, the documents and information required by Rule 15c2-11 must be preserved by the broker-dealer for a period of not less than three years. Generally, Rule 15c2-11 applies to broker-dealers that initiate or resume publication of quotations of securities that are not listed and traded on a national securities exchange (“covered OTC securities”). -

Reverse Merger As a Method of Going Public: Regulatory Approach in U.S

American International Journal of Available online at http://www.iasir.net Research in Humanities, Arts and Social Sciences ISSN (Print): 2328-3734, ISSN (Online): 2328-3696, ISSN (CD-ROM): 2328-3688 AIJRHASS is a refereed, indexed, peer-reviewed, multidisciplinary and open access journal published by International Association of Scientific Innovation and Research (IASIR), USA (An Association Unifying the Sciences, Engineering, and Applied Research) Reverse Merger as a Method of Going Public: Regulatory Approach in U.S. Chaitra R. Beerannavar, Research Scholar, Symbiosis International University, Pune, India Dr. Shashikala Gurpur, Fulbright Scholar, Director & Dean, Faculty of Law, Symbiosis International University, Pune, India Abstract: Reverse Mergers have grown as viable and profitable means of attaining public status in U.S. With a tightening of the laws surrounding the technique, the prospects of fraud have become minimal and reverse mergers have become a promising vehicle to take small companies public in U.S. In this direction the American markets Model for the small business issuer sets an example. The present article analysis the regulations in U.S. in detail with focus on compliance issues. Keywords: Reverse Merger, Shell Company, SEC, SOX, IPO I. Introduction In Global capital markets, IPO have been the traditional and predominant path to go public. However the recent developments have created opportunities for alternatives to IPOs. The most popular alternative has always been the Reverse Merger. Because of the unique features of the Reverse Merger commonly known as backdoor listings are complex inter-corporate transactions by which unlisted private-held companies achieve a listing status through merger with the publicly-listed shell companies. -

The Twilight Zone: Otc Regulatory Regimes and Market Quality

NBER WORKING PAPER SERIES THE TWILIGHT ZONE: OTC REGULATORY REGIMES AND MARKET QUALITY Ulf Brüggemann Aditya Kaul Christian Leuz Ingrid M. Werner Working Paper 19358 http://www.nber.org/papers/w19358 NATIONAL BUREAU OF ECONOMIC RESEARCH 1050 Massachusetts Avenue Cambridge, MA 02138 August 2013 We thank the following individuals for helping us with or providing data: Juan Alcacer; Burch Kealey; Matthew Fuchs, Ed McCann and the OTC Markets Group; Frank Lovaglio and Standard & Poor’s; Pedro Saffi; Michael Strauss and Mergent; Aysem Tkacik and NASDAQ. We also thank two referees, the editor Itay Goldstein, Robert Bartlett, Chyhe Becker, John Cochrane, Alixe Cormick, Holger Daske, Michael Erkens, Jennifer Marietta-Westberg, Maria Weigel, Josh White as well as workshop participants at the University of Chicago, 2013 EAA Conference, 2014 EFA Conference, ETH Zürich, Goethe University Frankfurt, HEC Paris, Humboldt University of Berlin, Securities and Exchange Commission, VfS-Annual Conference 2015 and WHU for helpful discussions and comments. Samaar Haider, Maria Kamenetsky, Russell Ruch, and Yingdi Wang provided excellent research assistance. Christian Leuz gratefully acknowledges financial support by Chicago Booth’s Initiative on Global Markets and the Humboldt Research Award. The views expressed herein are those of the authors and do not necessarily reflect the views of the National Bureau of Economic Research. NBER working papers are circulated for discussion and comment purposes. They have not been peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies official NBER publications. © 2013 by Ulf Brüggemann, Aditya Kaul, Christian Leuz, and Ingrid M. Werner. All rights reserved. Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full credit, including © notice, is given to the source. -

OHO Proceeding No. 20080138685

FINANCIAL INDUSTRY REGULATORY AUTHORITY OFFICE OF HEARING OFFICERS DEPARTMENT OF ENFORCEMENT, Complainant, Disciplinary Proceeding No. 20080138685 v. Hearing Officer – LBB RON WILLIAM HOWELL (CRD No. 2895047), HEARING PANEL DECISION Respondent. November 22, 2011 For unregistered sales of securities, in violation of NASD Conduct Rule 2110, Respondent Ron William Howell is suspended in all capacities for three months and fined $7,500. For failure to supervise a registered representative, failure to maintain adequate written supervisory procedures with respect to one of his firm’s types of business, and failure to implement adequate supervisory controls over his own account activities as a producing manager, in violation of NASD Conduct Rules 3010, 3012, and 2110, Howell is fined an additional $5,000 and suspended in all principal capacities for three months, to run consecutively with the suspension in all capacities. Howell is also ordered to pay costs. Appearances Scott M. Andersen, Esq., Director, Enforcement Center, Joseph Darcy, Esq., Principal Counsel, and Robert Moreiro, Esq., Senior Counsel, New York, New York, for the Department of Enforcement. Ron William Howell, pro se. DECISION The Department of Enforcement (“Enforcement”) filed the Complaint in this disciplinary proceeding on February 25, 2011, asserting three causes of action against Respondent Ron William Howell (“Howell”) and one cause of action against Respondent Dan Evan Landau (“Landau”). The First Cause of Action charges both Respondents with the sale of unregistered securities, in violation of Section 5 of the Securities Act of 1933 (“Securities Act”) and NASD Conduct Rule 2110. The Second Cause of Action charges Howell with failure to supervise Landau with respect to Landau’s sale of unregistered securities, and failure to implement adequate written supervisory procedures concerning the sale of stock distributed pursuant to a Securities and Exchange Commission (“SEC”) Form S-8 registration, in violation of NASD Conduct Rules 3010 and 2110. -

Jon D. Gruber, Et Al. V. Dakota Plains Holdings, Inc., Et Al. 16-CV-09727

Case 1:16-cv-09727-WHP Document 175 Filed 03/08/19 Page 1 of 158 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK JON D. GRUBER, Individually And On Case No. 16-cv-09727-WHP Behalf Of All Others Similarly Situated, Plaintiff, THIRD AMENDED CLASS ACTION COMPLAINT FOR VIOLATIONS OF v. THE FEDERAL SECURITIES LAWS AND THE RACKETEER INFLUENCED RYAN R. GILBERTSON; MICHAEL L. AND CORRUPT ORGANIZATIONS ACT REGER; GABRIEL G. CLAYPOOL; CRAIG M. MCKENZIE; TIMOTHY R. BRADY; TERRY H. RUST; PAUL M. JURY TRIAL DEMANDED COWNIE; DAVID J. FELLON; GARY L. ALVORD; JAMES L. THORNTON; JAMES RANDALL REGER; JOSEPH CLARK REGER Individually And As Custodian for W. J. R. And J. M. R. (UTMA); WELDON W. GILBERTSON Individually And As Custodian for H.G. (UTMA), and as Trustee of the RYAN GILBERTSON 2012 FAMILY IRREVOCABLE TRUST; THE TOTAL DEPTH FOUNDATION; JESSICA C. GILBERTSON (a/k/a Jessica Medlin); and KELLIE TASTO, As Custodian for H.G. (UTMA), Defendants. Case 1:16-cv-09727-WHP Document 175 Filed 03/08/19 Page 2 of 158 TABLE OF CONTENTS Page(s) I. INTRODUCTION .............................................................................................................. 3 II. JURISDICTION AND VENUE ....................................................................................... 22 III. PARTIES .......................................................................................................................... 22 A. Lead Plaintiff ........................................................................................................ 22 B. -

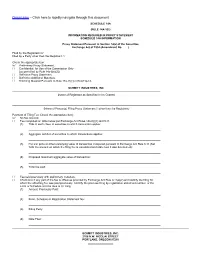

Quicklinks -- Click Here to Rapidly Navigate Through This Document

QuickLinks -- Click here to rapidly navigate through this document SCHEDULE 14A (RULE 14A-101) INFORMATION REQUIRED IN PROXY STATEMENT SCHEDULE 14A INFORMATION Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ) Filed by the Registrant /x/ Filed by a Party other than the Registrant / / Check the appropriate box: /x/ Preliminary Proxy Statement. / / Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)). / / Definitive Proxy Statement. / / Definitive Additional Materials. / / Soliciting Material Pursuant to Rule 14a-11(c) or Rule14a-12. SCHMITT INDUSTRIES, INC. (Name of Registrant as Specified In Its Charter) (Name of Person(s) Filing Proxy Statement if other than the Registrant) Payment of Filing Fee (Check the appropriate box): /x/ No fee required. / / Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. (1) Title of each class of securities to which transaction apples: (2) Aggregate number of securities to which transactions applies: (3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined): (4) Proposed maximum aggregate value of transaction: (5) Total fee paid: / / Fee paid previously with preliminary materials. / / Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. -

Fraud in the Micro-Capital Markets Including Penny Stock Fraud

S. Hrg. 105±266 FRAUD IN THE MICRO-CAPITAL MARKETS INCLUDING PENNY STOCK FRAUD HEARING BEFORE THE PERMANENT SUBCOMMITTEE ON INVESTIGATIONS OF THE COMMITTEE ON GOVERNMENTAL AFFAIRS UNITED STATES SENATE ONE HUNDRED FIFTH CONGRESS FIRST SESSION SEPTEMBER 22, 1997 Printed for the use of the Committee on Governmental Affairs ( U.S. GOVERNMENT PRINTING OFFICE 44±227 cc WASHINGTON : 1997 For sale by the Superintendent of Documents, Congressional Sales Office U.S. Government Printing Office, Washington, DC 20402 1 VerDate 22-SEP-99 11:58 Sep 28, 1999 Jkt 010199 PO 00000 Frm 00001 Fmt 5011 Sfmt 5011 E:\HEARINGS\44227 txed02 PsN: txed02 COMMITTEE ON GOVERNMENTAL AFFAIRS FRED THOMPSON, Tennessee, Chairman SUSAN M. COLLINS, Maine JOHN GLENN, Ohio SAM BROWNBACK, Kansas CARL LEVIN, Michigan PETE V. DOMENICI, New Mexico JOSEPH I. LIEBERMAN, Connecticut THAD COCHRAN, Mississippi DANIEL K. AKAKA, Hawaii DON NICKLES, Oklahoma RICHARD J. DURBIN, Illinois ARLEN SPECTER, Pennsylvania ROBERT G. TORRICELLI, BOB SMITH, New Hampshire New Jersey ROBERT F. BENNETT, Utah MAX CLELAND, Georgia HANNAH S. SISTARE, Staff Director and Counsel LEONARD WEISS, Minority Staff Director MICHAL SUE PROSSER, Chief Clerk PERMANENT SUBCOMMITTEE ON INVESTIGATIONS SUSAN M. COLLINS, Maine, Chair SAM BROWNBACK, Kansas JOHN GLENN, Ohio PETE V. DOMENICI, New Mexico CARL LEVIN, Michigan THAD COCHRAN, Mississippi JOSEPH I. LIEBERMAN, Connecticut DON NICKLES, Oklahoma DANIEL K. AKAKA, Hawaii ARLEN SPECTER, Pennsylvania RICHARD J. DURBIN, Illinois BOB SMITH, New Hampshire ROBERT G. TORRICELLI, New Jersey ROBERT F. BENNETT, Utah MAX CLELAND, Georgia TIMOTHY J. SHEA, Chief Counsel and Staff Director JEFFREY S. ROBBINS, Chief Counsel to the Minority MARY D. -

NASDAQ Stock Market LLC (“Nasdaq Exchange”), a Subsidiary of the Nasdaq Stock Market, Inc

July 31, 2006 Nancy M. Morris, Esq. Secretary US Securities and Exchange Commission 100 F Street, NE Washington, DC 20549 RE: Request for Relief from § 12 of the Securities Exchange Act of 1934 Dear Ms. Morris: On January 13, 2006, the Securities and Exchange Commission (“SEC” or “Commission”) approved the application of The NASDAQ Stock Market LLC (“Nasdaq Exchange”), a subsidiary of The Nasdaq Stock Market, Inc. (“Nasdaq”), to register under Section 6 of the Securities Exchange Act of 1934 (“Act” or “Exchange Act”) as a national securities exchange.1 Nasdaq’s transition of its listing and trading activities to the Nasdaq Exchange will further Congress’s instruction to promote “fair competition . between exchange markets.”2 Absent the relief requested herein, however, Nasdaq’s transition to a national securities exchange would require approximately 3,200 Nasdaq Global Market3 and Capital Market issuers with securities registered pursuant to the Act, or exempt from registration under Section 12(g) of the Act,4 to file registration statements5 to register those securities under Section 12(b) of the Act.6 1 Securities Exchange Act Release No. 53128 (January 13, 2006), 71 FR 3550 (January 23, 2006) (the “Exchange Approval Order”). 2 Exchange Act Section 11A(a)(1)(C)(ii). 3 Effective July 1, 2006, Nasdaq renamed the Nasdaq National Market as the Nasdaq Global Market and created a new segment within the Global Market called the Global Select Market. References to the Nasdaq Global Market include those securities listed on the Nasdaq Global Market and the Nasdaq Global Select Market. See Securities Exchange Act Release No. -

Penny Stock Disclosure

Penny Stock Disclosure The term “Penny stock” generally refers to low-priced (below $5), speculative securities of very small companies. While penny stocks generally are quoted over-the-counter, such as on the OTC Bulletin Board or in the Pink Sheets, they may also be traded on securities exchanges, including foreign securities exchanges. In addition, penny stocks include the securities of certain private companies with no active trading markets. Risks Investments in low-priced securities are speculative and involve considerable risk. Low- priced securities often exhibit high price volatility and erratic market movements. Often, when investors buy or sell these securities, they significantly affect the quoted price. In some cases, the liquidation of a position in a low-priced security may not be possible within a reasonable period of time and is subject to additional fees. It may be difficult to properly value an investment in a low-priced security. Reliable information regarding issuers of low-priced securities, their prospects, or the risks associated with investing in such securities may not be available. Certain issuers of low- priced securities have no obligation to provide information to investors. Some issuers register securities with the Securities and Exchange Commission (SEC) and may provide regular reports to investors. Others however may not be required to maintain such registration or provide such reports. Securities may continue to be traded if issuers are delinquent in their reporting obligation to the SEC or other federal or state regulatory agencies. Penny stocks have not been approved or disapproved by the Securities and Exchange Commission (SEC). The SEC has not passed upon the fairness, the merits, the accuracy or adequacy of the information contained in any prospectus or any other information provided by an issuer or a broker or a dealer of penny stocks. -

Annnual Report 2011

DELTATHREE INC (DDDC) 10-K Annual report pursuant to section 13 and 15(d) Filed on 03/28/2012 Filed Period 12/31/2011 UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K x ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended December 31, 2011, or ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from __________ to _____________ Commission File Number: 000-28063 deltathree, Inc. (Exact name of registrant as specified in charter) Delaware 13-4006766 (State or other jurisdiction of incorporation or organization) (I.R.S. employer identification no.) 26 Avenue at Port Imperial, Suite #108, 07093 West New York, New Jersey (Address of principal executive offices) (Zip Code) Registrant's telephone number, including area code: (212) 500-4850 Securities registered pursuant to Section 12(b) of the Act: None. Securities registered pursuant to Section 12(g) of the Act: Title of Each Class Name of Each Exchange on Which the Securities are Registered Common Stock, par value $0.001 per share OTCQB Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No x Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x Indicate by a check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

NASAA March 4, 2010 Ms. Elizabeth M. Murphy Secretary U. S. Securities and Exchange Commission 100 F Street, NE Washington

NORTH AMERICAN SECURITIES ADMINISTRATORS ASSOCIATION, INC. 750 First Street N.E., Suite 1140 Washington, D.C. 20002 202/737-0900 Fax: 202/783-3571 NASAA www.nasaa.org March 4, 2010 Ms. Elizabeth M. Murphy Secretary U. S. Securities and Exchange Commission 100 F Street, NE Washington, DC 20549-1090 Re: Comments to Securities Exchange Act Release No. 60999 File No. SR-FINRA-2009-077 Dear Ms. Murphy: The Corporation Finance Section Committee of the North American Securities Administrators Association (the “Committee”) appreciates the opportunity to comment on the proposal by the Financial Industry Regulatory Authority, Inc. [“FINRA,” a self- regulatory organization (SRO) for purposes of the Securities Exchange Act of 1934 and subject to oversight by the SEC], to create a Quotation Consolidation Facility (“QCF”) that would serve as a commercial data consolidator and disseminator for quote data in the over-the-counter (OTC) equity market (the “QCF Proposal” or “Proposal”). The Committee’s interest in the QCF Proposal is from the investor protection perspective. Thus, we will not comment on issues that have been raised by others regarding the QCF Proposal, such as illegal and unconstitutional seizure of private intellectual property and the lack of SEC authority to approve the QCF Proposal. In presenting its Proposal to the Commission, it is FINRA’s burden and obligation to justify why and how the Proposal is in the best interest of both public investors and the OTC trading marketplace where investors participate. For the following reasons, we believe that the requisite justification has not been provided by FINRA: (1) Under the QCF, the dissemination of quote information for unregistered OTC securities in the NASDAQ Level 1 feed would be likely to give the false impression to public investors and other market participants that FINRA, as an SRO, is regulating or has regulatory power over the issuers of those securities.