Annual Information Form for the Year Ended December 31

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

1 2 March 2021 Flutter Entertainment

2 March 2021 Flutter Entertainment plc - 2020 Preliminary Results Transformational year for Group; Earnings ahead of expectations Flutter Entertainment plc (the “Group”) announces preliminary results for year ended 31 December 2020. Reported1 Pro forma2 2020 2019 2020 2019 CC3 £m £m YoY % £m £m YoY % YoY % Group revenue4 4,398 2,140 +106% 5,264 4,144 +27% +28% Adjusted5 Group EBITDA6 excluding US 1,037 462 +125% 1,401 1,170 +20% +23% Adjusted Group EBITDA 889 425 +109% 1,231 1,089 +13% +16% Profit before tax 1 136 -99% Earnings per share7 29.3p 180.2p -84% Adjusted earnings per share 402.7p 298.4p +35% 496.6p 415.7p +19% Net debt at year end8 2,814 265 Operational highlights • Transformational year for Group - Unparalleled scale and diversification achieved following merger with The Stars Group, Inc (“TSG”) - Accelerated buy-out of minority shareholders in FanDuel at compelling valuation - Reinforced balance sheet to support investment and growth • Excellent momentum with 19% growth in recreational players9 across Group - Acceleration of channel shift from retail to online and increased share of entertainment spend • Further investment in safer gambling initiatives to ensure sustainable growth - Enhanced predictive technology; increase in safer gambling tool usage by customers - Advocating a customer driven approach to affordability • Merger integration progressing well - Australian integration complete, PokerStars strategy in place and core momentum maintained - Annualised cost synergies now expected to be £170m, up from £140m previously -

The Stars Group and FOX Sports Announce Historic U.S. Media and Sports Wagering Partnership

The Stars Group and FOX Sports Announce Historic U.S. Media and Sports Wagering Partnership May 8, 2019 Toronto and Los Angeles, May 8, 2019 – The Stars Group Inc. (Nasdaq: TSG)(TSX: TSGI) and FOX Sports, a unit of Fox Corporation (Nasdaq: FOXA, FOX), today announced plans to launch FOX Bet, the first-of-its kind national media and sports wagering partnership in the United States. The Stars Group and FOX Sports have entered a long-term commercial agreement through which FOX Sports will provide The Stars Group with an exclusive license to use certain FOX Sports trademarks. The Stars Group and FOX Sports expect to launch two products in the Fall of 2019 under the FOX Bet umbrella. One will be a nationwide free-to-play game, awarding cash prizes to players who correctly predict the outcome of sports games. The second product, which will be named FOX Bet, will give customers in states with regulated betting the opportunity to place real money wagers on the outcome of a wide range of sporting events in accordance with the applicable laws and regulations. In addition to the commercial agreement of up to 25 years and associated product launches, Fox Corporation will acquire 14,352,331 newly issued common shares in The Stars Group, representing 4.99% of The Stars Group’s issued and outstanding common shares, at a price of $16.4408 per share, the prevailing market price leading up to the commencement of exclusive negotiations. The Stars Group currently intends to use the aggregate net proceeds of approximately $236 million for general corporate purposes and to prepay outstanding indebtedness on its first lien term loans. -

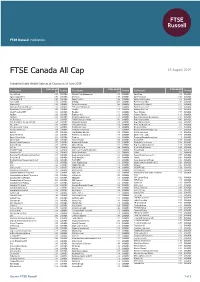

FTSE Publications

2 FTSE Russell Publications 19 August 2019 FTSE Canada All Cap Indicative Index Weight Data as at Closing on 28 June 2019 Index weight Index weight Index weight Constituent Country Constituent Country Constituent Country (%) (%) (%) Aecon Group 0.05 CANADA Element Fleet Management 0.19 CANADA Onex Corp 0.3 CANADA Agnico Eagle Mines 0.73 CANADA Emera Inc 0.58 CANADA Open Text Corp 0.65 CANADA Air Canada Cl B 0.25 CANADA Empire Co Cl A 0.26 CANADA Osisko Gold Royalties 0.1 CANADA Alacer Gold 0.06 CANADA Enbridge 4.35 CANADA Pan American Silver 0.16 CANADA Alamos Gold 0.14 CANADA Encana Corporation 0.46 CANADA Paramount Res Class A 0.02 CANADA Algonquin Power & Utilities Co 0.36 CANADA Endeavour Mining Corp. 0.07 CANADA Parex Resources Inc 0.14 CANADA Alimentation Couche-Tard B 1.63 CANADA Enerflex 0.07 CANADA Parkland Fuel Corp. 0.28 CANADA Allied Properties REIT 0.24 CANADA Enerplus 0.11 CANADA Pason Systems 0.07 CANADA AltaGas. 0.25 CANADA Enghouse Sys 0.06 CANADA Pembina Pipeline 1.14 CANADA Aphria Inc 0.09 CANADA Ensign Energy Services 0.03 CANADA Peyto Exploration & Development 0.03 CANADA Arc Resources 0.1 CANADA Fairfax Financial Holdings 0.81 CANADA Power Corp Canada 0.46 CANADA Artis Real Estate Investment Trust 0.07 CANADA Finning International 0.18 CANADA Power Financial Corp 0.32 CANADA Atco Class I 0.15 CANADA First Capital Realty 0.16 CANADA PrairieSky Royalty Ltd 0.2 CANADA ATS Automation Tooling 0.07 CANADA First Majestic Silver 0.08 CANADA Precision Drilling 0.03 CANADA Aurora Cannabis Inc 0.38 CANADA First National Financial 0.02 CANADA Premium Brands Holdings Corp 0.12 CANADA B2Gold 0.18 CANADA First Quantum Minerals 0.39 CANADA Pretium Resources 0.1 CANADA Bank of Montreal 2.93 CANADA FirstService Corporation 0.18 CANADA Quebecor Inc. -

Quarterly Commentary 18 AM Canadian Equity Portfolio March 31, 2020

Quarterly Commentary 18 AM Canadian Equity Portfolio March 31, 2020 18 AM Canadian Equity Highlights The 18 AM Canadian Equity portfolio is uniquely positioned, with 50/50 exposure to two focused style portfolios, Offence (growth and momentum) and Defence (income, quality and low risk). We manage the Offence and Defence styles independently, using 15-stock portfolios of companies that exhibit attractive balance sheet and income statement fundamentals (factors) of the respective style. As of the close of 2019, the 18 AM Canadian Equity portfolio reached a 6-year track record. Over that period, the portfolio realized objectives by: ✓ Outperforming the benchmark S&P/TSX Composite (TSX) in 5 of 6 calendar years, and overall since inception before fees. ✓ Experiencing a lower risk profile versus the TSX, evidenced by having both a lower volatility, and by losing less during calendar years when the index declined. ✓ Maintaining a fundamental profile that is superior to the benchmark across a variety of impactful factors as intended within each style, such as: i) a lower Price/Earnings ratio, ii) higher Return on Equity, iii) better Earnings Growth and iv) enhanced Yield. Details of the portfolio and style performance are shown in the following table. Since Inception Performance Q1 2020 1 Year 3 Year 5 Year Return Volatility Offence* -25.6% -20.0% -3.6% -2.1% 0.2% 14.1% Defence* -15.9% -7.7% 0.9% 4.1% 6.3% 10.0% Portfolio** -20.8% -13.9% -1.1% 1.1% 3.3% 11.1% Benchmark -20.9% -14.2% -1.9% 0.9% 2.8% 11.4% *The chart depicts performance data for the style portfolios managed by 18 AM and is for information purposes only. -

Mount Allison University Endowment Fund Holdings As of December 31, 2017

Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) EQUITY HOLDINGS Canadian Holdings 5N PLUS INC $ 155 ABSOLUTE SOFTWARE CORP $ 851 ACADIAN TIMBER CORP $ 302 ADVANTAGE OIL & GAS LTD $ 283,788 AECON GROUP INC $ 1,728 AFRICA OIL CORP $ 684 AG GROWTH INTERNATIONAL INC $ 1,163 AGELLAN COMMERCIAL REAL ESTATE $ 349 AGF MANAGEMENT LTD $ 990 AGNICO-EAGLE MINES LTD $ 427,207 AGT FOOD AND INGREDIENTS INC $ 653 AIMIA INC $ 832 AIR CANADA INC $ 325,411 AIRBOSS OF AMERICA CORP $ 315 ALACER GOLD CORP $ 1,289 ALAMOS GOLD INC $ 2,216 ALAMOS GOLD INC NEW COM CLASS A $ 4,877 ALARIS ROYALTY CORP $ 1,107 ALGOMA CENTRAL CORP $ 330 ALIMENTATION COUCHE-TARD INC $ 98,854 ALIO GOLD INC $ 472 ALLIED PROPERTIES REAL ESTATE INVESTMENT TRUST $ 2,575 ALTIUS MINERALS CORP $ 1,233 ALTUS GROUP LTD/CANADA $ 1,916 ANDREW PELLER LTD $ 1,448 ARGONAUT GOLD INC $ 656 ARTIS REAL ESTATE INVESTMENT TRUST $ 1,539 ASANKO GOLD INC $ 209 ATCO LTD $ 119,947 ATHABASCA OIL COP $ 703 ATS AUTOMATION TOOLING SYSTEMS INC $ 1,769 AURICO METALS INC $ 311 AUTOCANADA INC $ 1,128 AVIGILON CORP $ 1,258 B2GOLD CORP $ 29,898 BADGER DAYLIGHTING LTD $ 1,525 BANK OF MONTREAL $ 725,449 BANK OF NOVA SCOTIA $ 2,019,757 BARRICK GOLD CORP $ 459,749 BAYTEX ENERGY CORP $ 1,213 BCE INC $ 791,441 BELLATRIX EXPLORATION LTD $ 94 BIRCHCLIFF ENERGY LTD $ 1,479 BIRD CONSTRUCTION INC $ 731 1 Mount Allison University Endowment Fund Holdings As of December 31, 2017 Security Name Market Value ($Can) BLACK DIAMOND GROUP LTD $ 95 BLACKBERRY LIMITED $ 151,777 BLACKPEARL RESOURCES INC $ 672 BOARDWALK REAL ESTATE INVESTMENT TRUST $ 1,610 BONAVISTA ENERGY CORP $ 686 BONTERRA ENERGY CORP $ 806 BORALEX INC $ 2,276 BROOKFIELD ASSET MANAGEMENT INCORPORATED $ 672,870 BROOKFIELD INFRASTRUCTURE PARTNERS L.P. -

Annual Report & Accounts 2007

Annual Report & Accounts 2007 William Hill PLC Greenside House 50 Station Road Wood Green London N22 7TP Tel: 020 8918 3600 Fax: 020 8918 3775 Reg No: 4212563 England Founded in 1934, William Hill is one of the leading providers of fixed odds bookmaking services, offering odds and taking bets on a wide range of sporting and other events, as well as offering amusement with prizes machines and fixed odds betting terminals in licensed betting offices and operating online casino, poker and games sites as well as two greyhound stadia. It is a market leader in all major betting channels in the UK with an established international presence through its online business and its joint ventures in Spain and Italy. Interactive Channels : williamhill.co.uk williamhillcasino.com williamhillpoker.com williamhillskill.com williamhillgames.com williamhillbingo.com mobile.willhill.com Telephone Channels : Debit: 0800 44 40 40 Credit: 0800 289 892 Retail Channel : Nearly 2,300 shops Corporate Website : williamhillplc.co.uk Contents Financial Highlights 2 Chairman’s Statement 3 Operating and Financial Review 4 Board of Directors 12 Directors’ Report 14 Directors’ Remuneration Report 16 Statement on Corporate Governance 24 Report of the Nomination Committee 28 Report of the Audit and Risk Management Committee 29 Corporate Responsibility Report 31 Statement of Directors’ Responsibilities 37 Group Independent Auditors’ Report 38 Group Financial Statements 40 Parent Company Independent Auditors’ Report 76 Parent Company Financial Statements 77 5 Year Summary -

BCI's 2018 Responsible Investing Annual Report

Responsible Investing Annual Report 2018 British Columbia Investment Management Corporation Table of Contents 2018 Highlights ...............................................................1 Private Markets .............................................................22 To Our Clients ..................................................................2 Mortgage ..................................................................23 BCI and Responsible Investing ......................................3 Real Estate ................................................................24 BCI's Responsible Investing Principles .........................4 Infrastructure & Renewable Resource ..................26 Climate Action .................................................................5 Private Equity ...........................................................27 Climate Action Plan ...................................................6 Corporate Updates & Collaboration ...........................28 Public Markets .................................................................8 Corporate Reporting & Disclosure ........................29 Public Equities ............................................................9 BCI's PRI Involvement .............................................30 Fixed Income ............................................................20 Collaboration ...........................................................32 Appendices ...................................................................34 1 — BCI's Policy Submissions .................................35 -

Week 16 Newsletter

The Sunday Investor Week 16: Ending April 17, 2020 An Introduction For subscribers, new and old. First of all, thank you to all my subscribers, including brand new ones and for those Basic fundamental metrics such as return on equity, price-earnings ratios, free cash who signed up to receive this newsletter almost a year ago when I first started The flow per share, earnings per share, and interest coverage ratios – they’re all freely Sunday Investor. Administering this website has brought out the true passion I available on many websites in the form of stock screeners, but even some of the have for the investing industry and each time I get a new subscriber, it motivates best stock screeners don’t allow you to filter for exactly what you need. me to keep going. I hope you find The Sunday Investor to be a reliable and useful source as you seek to achieve your investment goals. Here you will find the tools you need to keep track of your Canadian and U.S. equity holdings. I maintain a weekly total return tracker for all S&P/TSX Composite Prior to starting my website, I had been noticing a gap in the information the and S&P 500 issuers, and provide several fundamental monthly reports depending average investor has access to on popular investment and financial planning on your investment strategy. I routinely write about the importance of developing websites. While a lot of data is publicly available, many websites do a poor job of a low-volatile portfolio aimed at maximizing the Sharpe Ratio, behavioural finance compiling this information into a format that is easily digestible. -

Nation's #1 Poker Tour August 2017

NATION'S #1 POKER TOUR AUGUST 2017 AUGUST 2017 Mid-States Poker Tour PAGE 3 Letter from the Editor FORMER CANTERBURY PARK FALL POKER CLASSIC LADIES CHAMP PASSES Vol. 2/No. 8 BY CHAD HOLLOWAY President and Publisher Bryan Mileski Poker is a great game. It gives people of all ages from a wide variety of [email protected] backgrounds to meet and compete. Comradery is one of the biggest reasons people love to play. Unfortunately, players come and go, oftentimes without Editor-in-Chief Chad Holloway explanation. [email protected] Be it going broke, taking a break from the game, or simply moving on, sometimes players simply disappear. Other times, news reaches us that a Art Director player has been dealt their last hand. On June 19, we received word such was Carolyn Borgen [email protected] the case for Mary Ellen Hampton, 78, who passed away peacefully surrounded by her family. Advertising Information Hampton, who hailed from La Crosse, Wisconsin, was an avid traveler, family [email protected] woman, and a huge poker fan. In fact, we’ve even written about her in the past Story Ideas back when this publication was known as Minnesota Poker Magazine. That’s [email protected] because in 2010 she topped a field of 213 players to win the Canterbury Park Fall Poker Classic Event #7: $300 Ladies Event for $3,056. Our Mission MSPT Magazine is a monthly A year later, Hampton traveled out to Las Vegas and placed 14th out of 187 magazine dedicated to serving entries in the Caesars Palace Winter Poker Classic $130 No-Limit Hold’em, poker players and gaming facilities good for $363. -

Online Gambling and Crime: a Sure Bet?

Online gambling and crime: a sure bet? BANKS, James <http://orcid.org/0000-0002-1899-9057> Available from Sheffield Hallam University Research Archive (SHURA) at: http://shura.shu.ac.uk/6903/ This document is the author deposited version. You are advised to consult the publisher's version if you wish to cite from it. Published version BANKS, James (2012). Online gambling and crime: a sure bet? The ETHICOMP Journal. Copyright and re-use policy See http://shura.shu.ac.uk/information.html Sheffield Hallam University Research Archive http://shura.shu.ac.uk The Ethicomp Journal ONLINE GAMBLING AND CRIME: A SURE BET? Dr James Banks Senior Lecturer in Criminology, Department of Law, Criminology and Community Justice, Sheffield Hallam University, Sheffield, UK Despite a growing body of research that is exploring the deleterious social effects of online gambling, there has, to date, been very little empirical research into internet gambling and crime. This paper seeks to initiate discussion and exploration of the dimensions of crime in and around internet gambling sites through an analysis of the current literature on gambling online. The paper forms part of a wider study that seeks to examine online gambling related crime and identify appropriate legal, technological and educational frameworks through which to limit victimisation. 1. Introduction The explosive growth of the internet as a public and commercial vehicle has provided new opportunities for gambling based activities to take place online. Facilitated by the development of the first gambling software, by Microgaming in 1994, and encrypted communication protocols which enable online monetary transactions, by Cryptologic in 1995, Antiguan based company InterCasino became the first internet gambling site to accept an online wager in January 1996 (Williams and Wood 2007). -

The Intertain Group Limited Annual Information Form for the Year Ended December 31, 2015

THE INTERTAIN GROUP LIMITED ANNUAL INFORMATION FORM FOR THE YEAR ENDED DECEMBER 31, 2015 DATED MARCH 30, 2016 THE INTERTAIN GROUP LIMITED GENERAL INFORMATION All capitalized terms used in this AIF but not otherwise defined herein have the meanings set forth under “Glossary of Terms”. Unless the context otherwise requires, use in this AIF of the “Company”, “we”, “us” or “our” means the Company, and its subsidiaries, as applicable. Words importing the singular number include the plural and vice versa, and words importing any gender include all genders. Information contained in this AIF is given as of December 31, 2015 unless otherwise specifically stated. Unless otherwise indicated or the context otherwise requires, all dollar amounts in this AIF are in Canadian dollars. All references to “£” or “GBP” refer to British pound sterling, all references to “€” or “EUR” refer to Euros, and all references to US$ or USD refer to United States dollars. Market and Industry Data Unless otherwise indicated, market and industry data contained in this AIF is based upon information from industry and other publications, the knowledge of management and the experience of the Company in the markets in which it operates. While management of the Company believes this data is reliable, market and industry data is subject to variations and cannot be verified with complete certainty due to limits on the availability and reliability of raw data, the voluntary nature of the data gathering process and other limitations and uncertainties inherent in any statistical survey. The Company has not independently verified any of the data from third-party sources referred to in this AIF or ascertained the underlying assumptions relied upon by such sources. -

Daniel Dvoress Seizes the First $1 Million Top Prize of the 2020 World Series of Poker CANADIAN CRUSHER WINS ‘MILLIONAIRE MAKER’ for $1,489,289 and FIRST BRACELET

www.CardPlayer.com Vol. 33/No. 19 September 9, 2020 Daniel Dvoress Seizes The First $1 Million Top Prize of the 2020 World Series of Poker CANADIAN CRUSHER WINS ‘MILLIONAIRE MAKER’ FOR $1,489,289 AND FIRST BRACELET The Best Celebrity This Week's Big Winner: Hurry Up Poker Players Kristen Bicknell Scores And Think In Hollywood Her Third WSOP Bracelet Ahead PLAYER_33_19_Cover.indd 1 8/18/20 3:22 PM PLAYER_18_GlobalPoker_DT.indd 2 8/4/20 10:44 AM PLAYER_18_GlobalPoker_DT.indd 3 8/4/20 10:44 AM Masthead - Card Player Vol. 33/No. 19 PUBLISHERS Barry Shulman | Jeff Shulman ASSOCIATE PUBLISHER Justin Marchand Editorial Corporate Office MANAGING EDITOR Julio Rodriguez 6940 O’Bannon Drive TOURNAMENT CONTENT MANAGER Erik Fast Las Vegas, Nevada 89117 ONLINE CONTENT MANAGER Steve Schult (702) 871-1720 Art [email protected] ART DIRECTOR Wendy McIntosh Subscriptions/Renewals 1-866-LVPOKER Website And Internet Services (1-866-587-6537) CHIEF TECHNOLOGY OFFICER Jaran Hardman PO Box 434 DATA COORDINATOR Morgan Young Congers, NY 10920-0434 Sales [email protected] ADVERTISING MANAGER Mary Hurbi Advertising Information NATIONAL SALES MANAGER Barbara Rogers [email protected] LAS VEGAS AND COLORADO SALES REPRESENTATIVE (702) 856-2206 Rich Korbin Distribution Information cardplayer Media LLC [email protected] CHAIRMAN AND CEO Barry Shulman PRESIDENT AND COO Jeff Shulman Results GENERAL COUNSEL Allyn Jaffrey Shulman [email protected] CHIEF MEDIA OFFICER Justin Marchand VP INTL. BUSINESS DEVELOPMENT Dominik Karelus Schedules CONTROLLER Mary Hurbi [email protected] FACILITIES MANAGER Jody Ivener Follow us www.facebook.com/cardplayer @CardPlayerMedia Card Player (ISSN 1089-2044) is published biweekly by Card Player Media LLC, 6940 O’Bannon Drive, Las Vegas, NV 89117.