City of Mobile

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

About Mobile Opportunities Are Here, It’S Our to Exercise

Mobile Area Chamber of Commerce JUNE 2015 the What We Two Local Companies Love Receive Trade Awards About Legislation Helps Mobile Compete for Jobs Mobile 2 the business view JUNE 2015 the Mobile Area Chamber of Commerce JUNE 2015 | In this issue ON THE COVER Chamber member Ron Moore with Alabama Power and his family love attending Mobile BayBears games. Learn more about what to love about From the Publisher - Bill Sisson Mobile on pages 18-19. Photo by Jeff Tesney Follow the Trail to Growth 4 News You Can Use 11 Small Business of the Month: It is my firm belief that It’s easy to think of 3 Echoes Production growth and prosperity of any “urban trails” as something 12 A Banner Year for Economic community are driven by jobs. residents can live without. Development in the Alabama Legislature It’s as simple as that. But community leaders So it’s very good news that from across the country 14 Small Business of the Year and Mobile was recently ranked as a are beginning to realize Outstanding Entrepreneur Awarded top 20 city in ZipRecruiter’s list that parks, pedestrian trails 16 Small Business Corner: Want to Get of Southern cities for jobs right and bike paths serve more Paid? Practice Prompt, Smart Invoicing now. Now that the job of a purpose than just places 18 What We Love About Mobile opportunities are here, it’s our to exercise. They can 20 Investor Focus: BancorpSouth challenge and opportunity to propel growth. 22 Military Appreciation Luncheon recruit the families taking these new In the past, those amenities were and Legislative Reception positions to our city and county. -

The Clotilda Legacy: Part 3 the Reckoning

Part 3: The Reckoning SAM: Before we begin, a quick programming note - this will be our last episode of 2019, but Season Three of Family Ghosts is just getting started. We’re taking a short break for the holidays, and we’ll be back with a brand new story on January 8th. Stay tuned after the credits for a sneak preview of that episode, and thank you, as always, for tuning in. [Spoke audio logo] SAM: Previously, on Family Ghosts… [music bed] NEWS: Now to a truly historic discovery in southern Alabama... NEWS: The schooner Clotilda brought 110 africans to US shores in 1860. NEWS: After the ship was brought ashore, the ship was burned, the evidence destroyed. Ever since people have tried to find it. LORNA maybe some one day they conscience won't let them go to sleep and they'll up one morning and say, I'm gonna call the newspaper and tell them that we sorry for what happened to those Africans that came on the Clotilda. Maybe that would give some validation to them acknowleging what they had did. VERA: This is--? JOYCELYN: Mayor. VERA: Mayor Street, AV? JOYCELYN: Mayor Avenue. JOYCELYN ...they still have this strong hold over the community, they still have the land... JOYCELYN: I don't really use bad words, but I just said forget them. I just said forget them. [...] this history is so much more than them JOYCELYN: I don't know how people feel about spirits or their ancestors, but I just feel like, you know, my grandmother, my great grandmother are pushing me to be the next in line. -

February 23, 2017 MOBILE COUNTY COMMISSION the Mobile County Commission Met in Regular Session in the Government Plaza Auditoriu

February 23, 2017 MOBILE COUNTY COMMISSION The Mobile County Commission met in regular session in the Government Plaza Auditorium, in the City of Mobile, Alabama, on Thursday, February 23, 2017, at 10:00 A. M. The following members of the Commission were present: Merceria Ludgood, President, Connie Hudson and Jerry L. Carl, Members. Also present were John F. Pafenbach, County Administrator/Clerk of the Commission, Jay Ross, County Attorney, and W. Bryan Kegley II, Assistant County Engineer. President Ludgood chaired the meeting. __________________________________________________ INVOCATION The invocation was given by Reverend Chester Battles, Associate Minister, Lily Baptist Church, 358 Kennedy Street, Mobile, Alabama 36603. __________________________________________________ PRESENT RESOLUTION CELEBRATING THE LIFE & LEGACY OF MR. ISAAC WHITE, SR. WHEREAS, Mr. Isaac White, Sr., founder of White’s Barber College, is a beloved community icon, who is being honored during Black History Month by Allstate Insurance Company as part of its “Worth Telling” campaign, which is featured on digital, social media and radio. We want to take a moment to applaud him and recognize his many accomplishments; and WHEREAS, born to sharecroppers in Wilkerson County, Mississippi in 1919, Mr. White, Sr., moved to Mobile in 1942 and worked at Brookley Air Force Base as a truck driver, while working at a barbershop on the side. A few years later, he opened his own barber shop with only one chair, and that business which was started more than half a century ago, is still open in the same location today; and WHEREAS, in 1960, Mr. White, Sr., opened a barber’s college intent on fulfilling a promise to God to “serve him until I die.” His college offers tuition-free barber training to any applicant who completes their coursework and secures a job, thus providing a significant impact on numerous of people; and February 23, 2017 WHEREAS, today at age 97, Mr. -

Fall 2020 Activity Guide

Fall 2020 Activity Guide MOBILE PARKS AND RECREATION WWW.CITYOFMOBILE.ORG/PARKS FALL @mobileparksandrec @mobileparksandrec 2020 FROM THE SENIOR DIRECTOR OF PARKS AND RECREATION Greetings, As I write this letter, six months into the COVID-19 pandemic, I think about all the changes we’ve had to endure to stay safe and healthy. The Parks and Recreation team has spent this time cleaning and organizing centers, creating new virtual and physical distancing activities, and most importantly continuing to provide meals to our seniors and youth. I would like to share many of the updates that happened in Parks and Recreation since March. • Special Events is now under the umbrella of Parks and Recreation. • Community Centers received new Gym floors, all floors were buffed and deep cleaned. Staff handmade protective face masks for employees, and over 28,123 meals were distributed to children ages 0-18. • Azalea City Golf Course staff cleaned and sanitized clubhouse, aerated greens, driving range, trees and fairways, completed irrigation upgrade project funded by Alabama Trust Fund Grant, contractor installed 45’ section of curb in parking lot and parking lot was restriped, painted fire lane in front of clubhouse, painted tee markers & fairway yardage markers and cleaned 80 golf carts. • Tennis Centers staff patched and resurfaced 6 Tennis courts, 118 light poles were painted, 9.5 miles of chain link fence was painted around 26 Tennis courts, 3 storage sheds were painted, 15 picnic tables were painted, 8 sets of bleachers were painted & park benches, 14 white canopy frames were painted plus 28 trash bins, court assignment board painted & 26 umpire chairs assembled. -

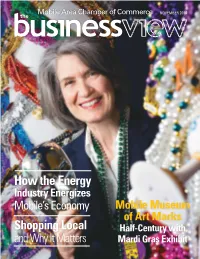

How the Energy

Mobile Area Chamber of Commerce NOVEMBER 2014 the How the Energy Industry Energizes Mobile’s Economy Mobile Museum of Art Marks Shopping Local Half-Century with and Why It Matters Mardi Gras Exhibit ADVANCED TECHNOLOGY IS: Fiber optic data that doesn’t slow you down C SPIRE BUSINESS SOLUTIONS CONNECTS YOUR BUSINESS. • Guaranteed speeds up to 100x faster than your current connection. • Synchronous transfer rates for sending and receiving data. • Reliable connections even during major weather events. CLOUD SERVICES Get Advanced Technology Now. Advanced Technology. Personal Service. 1.855.212.7271 | cspirebusiness.com 2 the business view NOVEMBER 2014 the Mobile Area Chamber of Commerce NOVEMBER 2014 | In this issue From the Publisher - Bill Sisson ON THE COVER Deborah Velders, director of the Mobile Museum Mobile Takes Bridge Message to D.C. of Art, gets in the spirit of Mardi Gras for the museum’s upcoming 50th anniversary celebration. Story on Recently, the Coastal Alabama as the Chamber’s “Build The I-10 page 10. Photo by Jeff Tesney Partnership (CAP) organized a Bridge Coalition,” as well as the regional coalition of elected officials work of CAP and many others. But from the Mobile Bay region to visit we’re still only at the beginning of Sens. Jeff Sessions and Richard the process. Now that the federal 4 News You Can Use Shelby, Cong. Bradley Byrne, and agencies have released the draft several congressmen from Alabama, Environmental Impact Study, 10 Mobile Museum of Art Celebrates Florida, Louisiana and Mississippi in public hearings have been held and 50 Years Washington, D.C. -

130643653012924000 Lagniap

2 | LAGNIAPPE | January 1, 2015 - January 7, 2015 LAGNIAPPE ••••••••••••••••••••••••••• WEEKLY January 1, 2015 – January 7, 2015 | www.lagniappemobile.com Ashley Trice BAY BRIEFS Co-publisher/Editor Beneficiaries of county lodging tax [email protected] proceeds have shifted from initial recipients. Rob Holbert Co-publisher/Managing Editor 5 [email protected] Steve Hall COMMENTARY Marketing/Sales Director 2015 promises to be a big year for the Port [email protected] City. Gabriel Tynes Assistant Managing Editor 8 [email protected] Dale Liesch BUSINESS Reporter Baldwin County surpasses Shelby as [email protected] the fastest growing in the state. Jason Johnson Reporter 14 [email protected] Alyson Stokes CUISINE Web & Social Media Manager/Reporter [email protected] Fine wine and food Kevin Lee CONTENTS pairings at a low-key, Associate Editor/Arts Editor West Mobile hideout. [email protected] Andy MacDonald Cuisine Editor [email protected] Stephen Centanni Music Editor [email protected] J. Mark Bryant Sports Writer 15 [email protected] Daniel Anderson Chief Photographer COVER [email protected] The Mobile Housing Laura Rasmussen Board’s $750 million Art Director redevelopment plan may www.laurarasmussen.com 20 change the perception Brooke Mathis Advertising Sales Executive of public housing. [email protected] Beth Williams Advertising Sales Executive [email protected] Misty Groh Advertising Sales Executive [email protected] -

Project HOPE Reentry Strategic Plan Subcommittee Chairs, Facilitators, and Members

A Reentry Strategic Plan for Southwest Alabama April 2017 A Reentry Strategic Plan for Southwest Alabama April 2017 Project HOPE Reentry Taskforce Members Chair Vivian Davis Figures Senator, Alabama Legislature Members Greg Albritton Senator, Alabama Legislature James H. Barber, II Chief of Police, Mobile Police Department Delores Bagsby Retired, Alabama Department of Pardons and Paroles Joe E. Basenberg Judge, District Court, Mobile County Christopher Baugh Asst. U. S. Attorney, Southern District of Alabama Darrius Bell Advocate Stacey A Blomgren Assistant Director, Mobile County DHR Brina Bolden Attorney Kenyen R. Brown U. S. Attorney, Southern District of Alabama Therese Brown Administrator, Chaplaincy Office, Mobile County Metro Jail Laura Davis Chandler Executive Director, Southwest AL Workforce Development Council Sam Cochran Sheriff, Mobile County Randy Davis Representative, Alabama Legislature Dr. Wallace T. Davis President and CEO, Volunteers of America Southeast, Inc. Sandy Delchamps Director, City of Refuge for Men Barbara Drummond Representative, Alabama Legislature Dominique Fierro Reentry Affairs, FBOP Pensacola David L. Frazier, Sr. Pastor, Revelation Missionary Baptist Church Aaron Früh Head Pastor, Knollwood Church Virginia Guy Executive Director, Drug Education Council Eddie Irby Veteran Advocate, Buffalo Soldiers Dennis J. Knizley Attorney Dr. Levy H. Knox Bishop, Living Word Christian Center Sandra Koblas Director, Human Resources, Austal USA John R. Lockett Judge, Circuit Court, Mobile County Merceria Ludgood Commissioner, Mobile County Commission Marvin Lue Pastor, Stewart Memorial CME Church Levon C. Manzie Member, Mobile City Council, District 2 Dr. Latitia McCane Dean, Instructional Services, Bishop State Community College Larry C. Moorer Attorney Edmond G. Naman Judge, Juvenile Court, Mobile County Noah Price “Trey”Oliver, III Warden, Mobile County Metro Jail Lisa Diane Owen DVOP, Alabama Career Center System Darrell Randle VP, Workforce Development, Mobile Area Chamber of Commerce Tim Russell Judge of Probate, Baldwin County William E. -

Deep South Genealogical Quarterly

DEEP SOUTH GENEALOGICAL QUARTERLY VOLUME 53 - NUMBER 1 FEBRUARY 2016 Published by MOBILE GENEALOGICAL SOCIETY, INC. Mobile, Alabama CONTENTS PAGE ARTICLE PAGE ARTICLE 2 ������� Submissions policy 22 ������ Death Notices 1890 A-J from ����������� The Mobile Daily Register 3 ������� Letter from the Editor- “Think” ����������� Transcribed by Kathy Richardson ����������� By Kathy Richardson 29 ������ Genealogical Abstracts from 5 ������� Membership application; ����������� Fairhope Courier, 1894 ����������� MGS research guidelines ����������� Abstracted by Kathy Richardson 6 ������� Genealogical Abstracts from 30 ������ The History of Monterey Street ����������� The Weekly Register, July 19, 1879 ����������� By Jay Higginbotham ����������� Abstracted by Kathy Richardson 41 ������ Genealogical Abstracts from 7 ������� Eleven Generations and 313 Years ����������� Mobile Advertiser and Register, 1864 ����������� in Mobile (Part 4 of 4) ����������� Transcribed by Michelle Woodham ����������� By Llewellyn M. Toulmin, Ph.D., F.R.G.S. 44 ������ Genealogical Abstracts from 16������� Genealogical Abstracts from ����������� Mobile Daily Register, 1916 ����������� The Mobile Register, 1916 ����������� Transcribed by Kathy Richardson ����������� Abstracted by Kathy Richardson 46 ������ MGS publications available for purchase 17 ������� Destruction by the Hurricane of 1916 51 ������� Index 19������� Genealogical Abstracts from ����������� The Mobile Register, 1916 56 ������ MGS publications order form ����������� Abstracted by Kathy Richardson Photo, -

Public Art Policy the City of Mobile, Alabama

Public Art Policy The City of Mobile, Alabama Prepared by Project for Public Spaces, Inc. 153 Waverly Place, 4th Floor New York, New York 10014 (212) 620-5660, www.pps.org Prepared for Mobile Tricentennial Committee, Inc. The City of Mobile, AL Fall 2002 2 City of Mobile PUBLIC ART POLICY PUBLIC ART POLICY FOR THE CITY OF MOBILE, AL Prepared by: Project for Public Spaces, Inc. 153 Waverly Place, 4th Floor New York, NY 10014 (212) 620-5660 Prepared for: Mobile Tricentennial Committee, Inc. and The City of Mobile, AL Fall 2002 Cover photo: ‘Portal’ by Casey Downing City of Mobile PUBLIC ART POLICY 3 Executive Summary 7 Introduction 7 A. Vision for Public Art in Mobile 7 B. Qualities of Successful Public Art Policies 9 C. Benefits of a Public Art Policy 11 D. Why a Public Art Policy is Timely for Mobile 14 E. Policy Approach 15 Action Plan 21 A. Introduction 21 How a Public Art Policy Differs From an Action Plan 21 Background 23 B. Objectives to be Achieved by Early Public Art Projects 24 1. Reflect The Unique Character Of Mobile 24 2. Anchor, Activate, And Revitalize The City's Public Spaces 25 3. Act As A Catalyst For Social Interaction And Education 25 C. Next Steps 26 1. Formalize An Entity To Move The Public Art Policy Forward. 26 2. Get the Policy Adopted 25 3. Undertake Projects to Demonstrate Early Successes 28 4. Build a Constituency and Partners for Public Art through a Public Relations Campaign 28 5. Institute a Program of Public Education Activities Around Public Art 31 6. -

"Clotilda: the Exhibition" To

MOBILE COUNTY COMMISSION, CITY OF MOBILE, AND HISTORY MUSEUM OF MOBILE ANNOUNCE CLOTILDA: THE EXHIBITION TO BE IN NEW AFRICATOWN FACILITY FOR IMMEDIATE RELEASE Stephanie Evans Marketing & Events Manager, History Museum of Mobile [email protected] (MOBILE, ALA) March 10, 2020 – The History Museum of Mobile, together with the Alabama Historical Commission (AHC), Mobile County Commission, and the City of Mobile, is pleased to announce Clotilda: The Exhibition. Mobile County Commissioner Merceria Ludgood, Mayor Sandy Stimpson, and City Council President Levon Manzie have announced plans to construct a new, permanent facility, tentatively called the “Africatown Heritage House,” that will house the exhibition. The Africatown Heritage House will be located on property owned by the City of Mobile, adjacent to the Robert Hope Community Center and Mobile County Training School. The facility, jointly funded by Mobile County Commission and the City of Mobile, is expected to be a 5,000 square foot building. The facility will be a permanent fixture in the Africatown community, and, in years and decades to come, will be functional for a variety of purposes. The facility is expected to be complete in late summer 2020. In addition to telling the story of the last slave ship, Clotilda: The Exhibition will include over a dozen Clotilda artifacts, recovered from the shipwreck in the Mobile River and on loan from the Alabama Historical Commission, the State Historic Preservation Office. Drawing on the archaeological reports released by the Alabama Historical Commission, Clotilda: The Exhibition tells the stories of the Clotilda and Africatown in the context of slavery and maritime shipping along the Gulf Coast. -

January 23, 2012 MOBILE COUNTY COMMISSION the Mobile County

January 23, 2012 MOBILE COUNTY COMMISSION The Mobile County Commission met in regular session in the Government Plaza Auditorium, in the City of Mobile, Alabama, on Monday, January 23, 2012, at 10:00 A. M. The following members of the Commission were present: Connie Hudson, President, Merceria Ludgood and Mike Dean, Members. Also present were John F. Pafenbach, County Administrator/Clerk of the Commission, Jay Ross, County Attorney, and Joe W. Ruffer, County Engineer. President Hudson chaired the meeting. __________________________________________________ INVOCATION The invocation was given by Commissioner Merceria Ludgood. __________________________________________________ President Hudson called for a moment of silent prayer for two (2) victims who lost their lives in a tornado in the Birmingham, Alabama area earlier this morning, which have also affected communities in Chilton and Monroe Counties, Alabama. __________________________________________________ PRESENT RESOLUTION/PROCLAIM JANUARY 27, 2012 AS EARNED INCOME TAX CREDIT (EITC) AWARENESS DAY President Hudson presented a resolution to the following members of nonprofit organizations: Diana Brinson, HandsOn South Alabama Raymond Huff, Internal Revenue Service Lanny Wilson, Goodwill Industries/Easter Seals of the Gulf Coast, Inc. Patsy Herron, United Way of Southwest Alabama Terri Grodsky, Retired Senior Volunteer Program President Hudson said tax preparation assistance helps low to moderate income families, the disabled, elderly and limited English proficiency individuals to take advantage of federal tax benefits such as, earned income tax credit, child tax credit and receive up to $5,751.00 in tax refunds which is a substantial financial benefit for families struggling to make ends meet. She said in 2011 local nonprofit organizations and numerous volunteers operated sixteen (16) tax sites within Mobile County that have helped 1,738 families claim over $2 million in tax refunds and credits. -

GUIDE to MOBILE a Great Place to Live, Play Or Grow a Business

GUIDE TO MOBILE A great place to live, play or grow a business 1 Every day thousands of men and women come together to bring you the wonder © 2016 Alabama Power Company that is electricity, affordably and reliably, and with a belief that, in the right hands, this energy can do a whole lot more than make the lights come on. It can make an entire state shine. 2 P2 Alabama_BT Prototype_.indd 1 10/7/16 4:30 PM 2017 guide to mobile Mobile is a great place to live, play, raise a family and grow a business. Founded in 1702, this port city is one of America’s oldest. Known for its Southern hospitality, rich traditions and an enthusiastic spirit of fun and celebration, Mobile offers an unmatched quality of life. Our streets are lined with massive live oaks, colorful azaleas and historic neighborhoods. A vibrant downtown and quality healthcare and education are just some of the things that make our picturesque city great. Located at the mouth of the Mobile River at Mobile Bay, leading to the Gulf of Mexico, Mobile is only 30 minutes from the sandy white beaches of Dauphin Island, yet the mountains of northern Alabama are only a few hours away. Our diverse city offers an endless array of fun and enriching activities – from the Alabama Deep Sea Fishing Rodeo to freshwater fishing, baseball to football, museums to the modern IMAX Dome Theater, tee time on the course to tea time at a historic plantation home, world-renowned Bellingrath Gardens to the Battleship USS ALABAMA, Dauphin Island Sailboat Regatta to greyhound racing, Mardi Gras to the Christmas parade of boats along Dog River.