News Brief 28 Sunday, 09 July 2017

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Urban Megaprojects-Based Approach in Urban Planning: from Isolated Objects to Shaping the City the Case of Dubai

Université de Liège Faculty of Applied Sciences Urban Megaprojects-based Approach in Urban Planning: From Isolated Objects to Shaping the City The Case of Dubai PHD Thesis Dissertation Presented by Oula AOUN Submission Date: March 2016 Thesis Director: Jacques TELLER, Professor, Université de Liège Jury: Mario COOLS, Professor, Université de Liège Bernard DECLEVE, Professor, Université Catholique de Louvain Robert SALIBA, Professor, American University of Beirut Eric VERDEIL, Researcher, Université Paris-Est CNRS Kevin WARD, Professor, University of Manchester ii To Henry iii iv ACKNOWLEDGMENTS My acknowledgments go first to Professor Jacques Teller, for his support and guidance. I was very lucky during these years to have you as a thesis director. Your assistance was very enlightening and is greatly appreciated. Thank you for your daily comments and help, and most of all thank you for your friendship, and your support to my little family. I would like also to thank the members of my thesis committee, Dr Eric Verdeil and Professor Bernard Declève, for guiding me during these last four years. Thank you for taking so much interest in my research work, for your encouragement and valuable comments, and thank you as well for all the travel you undertook for those committee meetings. This research owes a lot to Université de Liège, and the Non-Fria grant that I was very lucky to have. Without this funding, this research work, and my trips to UAE, would not have been possible. My acknowledgments go also to Université de Liège for funding several travels giving me the chance to participate in many international seminars and conferences. -

Phhwlqjv Lqfhqwlyh W

October 2008 MEET, EAT& SLEEP Why some conference menus are turkeys + How the Sage Gateshead won plaudits and business + Case studies: MSC Cruises, IPE International, Ungerboeck Systems International + EIBTM preview Distinctive locations. Rich rewards. BOOK+EARN BONUS JANUARY – JUNE 2009 Earn 2,500 bonus Starpoints for every event until 30 June, 2009. Now you can earn 2,500 bonus Starpoints® for every 25 room nights you book by 31 December, 2008, at Starwood properties throughout Europe, Africa and the Middle East for events from 1 January until 30 June, 2009. In addition to your bonus Starpoints, you’ll earn one Starpoint for every three US dollars spent on eligible meeting revenue. Visit the Special Offers section and terms & conditions on starwoodmeetings.com or ring +353 21 4539100 for more information. Sheraton Park Tower, London | UK Not a Starwood Preferred Planner? Sign up today and start accumulating thousands of Starpoints for each event that you book, redeemable for Free Night Awards without blackout dates and a host of other redemption options. STARWOOD Preferred Planner SPG, Starpoints, Preferred Guest, Sheraton, Four Points, W, Aloft, The Luxury Collection, Le Méridien, Element, Westin, St. Regis and their respective logos are the trademarks of Starwood Hotels & Resorts Worldwide, Inc., or its affi liates. © 2008 Starwood Hotels & Resorts Worldwide, Inc. All rights reserved. SHWSPP.08039 EAME 8/08 contents MANAGING EDITOR: MARTIN LEWIS 31 PUBLISHER: STEPHEN LEWIS EDITOR: JOHN KEENAN DEPUTY Meet, eat EDITOR: KATHERINE SIMMONS -

[email protected] +971 56 922 2281 DUBAI

+971 4 2942006 [email protected] +971 56 922 2281 www.sphinxrealestate.com DUBAI 200 + 3.1 MN DIRHAM $30.22 BN NATIONALITIES RESIDENTS STABLE CURRENCY TRANSACTIONS IN FIRST HALF 2018 WORLD CLASS INFRASTRUCUTRE 25 MN $77,55 BN 27,642 VISITORS TRANSACTIONS IN TRANSACTIONS EXPO 2020 2017 IN FIRST HALF 2018 AL JADDAF 5 MINUTES FROM VIEWS TO 5 MINUTES FROM , EASY ACCESS TO DOWNTOWN DUBAI CREEK THE WORLD S AL JADDAF DUBAI WATERFRONT TALLEST TOWER METRO STATION 5 5 MIN FROM DUBAI CREEK TOWER 5 AL JADDAF 5 Al Jaddaf is a mixed-use community surrounded by the Dubai Creek and Royal Za’abeel Community. The name ‘Al Jaddaf’ literally translates to ‘The Rower’, a testament to the area’s historic use as a traditional dhow sailboat building hub. The area is developing into a hospitality oasis with up to 5 Hotels at present in construction and 3 hotels build namely Marriott Al Jadaf, 5 MIN FROM The community is home to progressive young professionals seeking a fast-paced lifestyle within minutes of every major DOWNTOWN landmark in Dubai. Residents enjoy easy access to the Dubai Metro, amenities are also in near proximity such as Latifa 5 minutes away, DUBAI together with DIFC. AN A W ARD WINN ING DE V ELO PER W INNER G ULF REAL E S TATE A W ARDS 2 019 W INNER G ULF REAL E S TATEA W ARDS 2018 W INNER REAL E S TATE TYC O O N A W ARD 2017 W INNER D ESIGN MIDDL E EAS T A W ARDS 2 018 W INNER INTERN ATIO NAL PRO PER TY A W ARDS D UBAI 2 0 18-2 019 W INNER ARABIAN PROPER TY A W ARDS 2017- 2018 BINGHATTI DEVELOPERS W INNER ARABIAN BUSIN E S S REAL E S TATE -

Residences & Hotel Apartments

Residences & Hotel Apartments CAYAN CANTARA BY ROTANA Dubai’s latest architectural landmark will offer private residences and deluxe hotel apartments on Umm Suqeim Road. PRIVATE RESIDENCES HOME COMFORT, HOTEL QUALITY Private, contemporary and spacious apartments, lovingly crafted with high-quality materials, workmanship and attention to detail. Homeowners will enjoy hotel quality services on demand, via every interaction with the on-site Rotana team. Cayan Cantara by Rotana will deliver homeowners a level of service and lifestyle fitting a deluxe hotel, while still maintaining the privacy, personality and comfort of their very own home. HOTEL APARTMENTS INVEST IN EXPERIENCE Modern, luxurious and spacious suites, fully furnished with contemporary styling. Guests will enjoy the full Rotana experience, from the moment they arrive to their final checkout. Backed with more than 25 years of experience in the region, Cayan Cantara by Rotana gives the opportunity to gain significant returns on your investment, as well as establish your ‘home away from home’ in Dubai and significantly save on hotel bills. THE ROTANA EXPERIENCE Cayan Cantara by Rotana will offer homeowners and guests the full suite of deluxe hotel services and facilities, embodying the very best of middle eastern hospitality and values. FACILITIES AND SERVICES INCLUDE: • Valet Parking • Children’s Playground • Hotel Car Service • Restaurant & Cafe • Porter Service • Juice Bar • Concierge services • In-room Dining • Housekeeping Service • Room Service • Laundry Service • Daily Newspaper • Gymnasium • Spa Facilities • Personal Trainer • Guest Lounge • Swimming Pools • Business Centre • Lifeguard Service • Reception Lobby • Towel Service • On-site Security • Landscaped Gardens • On-site Maintenance STYLE THAT SPEAKS FOR ITSELF Cayan Cantara by Rotana will blend high quality fixtures, fittings and materials, with professional workmanship – to create a quality of product that will speak for itself. -

Time and Cost Overruns in the UAE Construction Industry: a Critical Analysis

International Journal of Construction Management ISSN: 1562-3599 (Print) 2331-2327 (Online) Journal homepage: https://www.tandfonline.com/loi/tjcm20 Time and cost overruns in the UAE construction industry: a critical analysis Reshma Mary Johnson & Robin Itty Ipe Babu To cite this article: Reshma Mary Johnson & Robin Itty Ipe Babu (2018): Time and cost overruns in the UAE construction industry: a critical analysis, International Journal of Construction Management, DOI: 10.1080/15623599.2018.1484864 To link to this article: https://doi.org/10.1080/15623599.2018.1484864 Published online: 13 Nov 2018. Submit your article to this journal Article views: 82 View Crossmark data Full Terms & Conditions of access and use can be found at https://www.tandfonline.com/action/journalInformation?journalCode=tjcm20 INTERNATIONAL JOURNAL OF CONSTRUCTION MANAGEMENT https://doi.org/10.1080/15623599.2018.1484864 ARTICLE Time and cost overruns in the UAE construction industry: a critical analysis Reshma Mary Johnson and Robin Itty Ipe Babu School of Energy, Geoscience, Infrastructure and Society, Heriot-Watt University, Dubai, United Arab Emirates ABSTRACT KEYWORDS Time and cost are the two main indicators of success in a construction project as it affects all Budget overrun; causes; the project participants with equal positive and negative effects. Yet, poor time and cost per- construction sector; cost formance have been a critical issue prevailing in the global construction market and UAE have overrun; schedule overrun; not been an exception. This research adopted a concurrent mixed-methods approach, utilizing a time overrun; UAE questionnaire and an interview with UAE construction professionals, to analyse the major causes of this poor time and cost performance. -

Headline/Title Here

From Sacramento to Dubai A Magic Carpet Ride? 2006 Railvolution Conference Taiwo Jaiyeoba, Sacramento Regional Transit 1 PlaceMaking Fast Facts Sacramento Dubai Population: 1.4 million One of 7 Emirates that make up Land Area: 966 Square miles the United Arab Emirates (UAE) 97 bus routes & 37 miles of light Population: 1.4 million rail covering 418 square miles Land Area: 1,000 square miles area 62 bus routes and 516 bus fleet 76 light rail vehicles, 256 buses, 240,000 passengers daily 17 shuttles, 43 stations Dubai LRT (Metro): 43.4 miles & 30 million passengers in FY2005 43 stations 43,600 daily LRT ridership & Implementation: 2009 67,000 daily bus ridership 100 trains and 55 stations (weekday) TOD activities in planning 6 current TOD proposals and 7 phase TOD opportunity sites 2 PlaceMaking Team of Experts Henry Williamson Rajiv Batra Jones Lang LaSalle. PB PlaceMaking National Director, Asia Capital Senior Supervising Urban Designer Markets 3 PlaceMaking DubaiDubai MetroMetro CitiesCities Transit Oriented Development for the 21st Century and Beyond Dubai Roads and Transport Authority RTA Henry Williamson Rajiv Batra RailVolution Nov. 2006 Overview Client Project Scope Dubai Principles Process Strategies TOD Concepts Conclusions 5 PlaceMaking Dubai Roads and Transport Authority Fundamental Transformation Dubai Vision + Metro connects important places End to end solution Branding TOD is Key Max. real estate value Max. rail / transit ridership Cash The Value Connection 6 PlaceMaking Metro Red Line 2009 Green Line 2010 Purple Line 7 PlaceMaking Al Ras/ Al Shingdagha f A Union Al Kif Square PlaceMaking Jumeirah Island Scope JebelVillage Ali 8 Findings Jebel Ali itical SuccessRole of FactorsRTAJebel A li Border ivestment Strategy D ster Plans of Key Sites Dubai scenes…. -

FUTURE CITIES Trade Delegation UAE the Future Is Now…

Strategic Partners: FUTURE CITIES Trade Delegation UAE The Future is Now… 1 FUTURE CITIES TRADE DELEGATION UAE BRIEFING PACK AND PROGRAMME 20th to 23nd MARCH 2017 Objective of the Trade Delegation The United Arab Emirates (UAE) is at the forefront of redefining architectural design and leading the way for the future today. The trade delegation will explore the possibilities and provide a detailed analysis of futuristic concepts in design that exist alongside groundbreaking projects. The two-day program has been carefully devised directly with the experts behind this growth and mastery of the future. Delegates will be inspired by the possibilities that exist now and in the future, and learn how architectural obstacles have been overcome. Innovative Design Since its independence in 1971, the UAE has come a long way. It has invested heavily to break traditional barriers with revolutionary architectural design, and to redefine what is possible in construction. With its sci-fi-like cityscape, the UAE is emerging as a desert metropolis well beyond its era. When it comes to architecture, there's no denying the UAE is home to some of the world’s most iconic and advanced buildings. Technological Initiatives Dubai is already one step ahead with a number of innovation-led initiatives announced in 2016. According to His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of UAE and Ruler of Dubai, 25 per cent of Dubai's buildings are to be 3D- printed by 2030. With the launch of the Dubai Future Accelerators program, the world's top innovators are invited to help develop concepts in the city, with the focus on development, research, cutting-edge technologies and start-ups. -

Dubai Metro Project Is the Longest Automated Driverless System in the Dubai Metro – Red Line and Project Green Line Contracts World

ONE STOP MONITORING SOLUTIONS | HYDROLOGY | GEOTECHNICAL | STRUCTURAL | GEODECTIC Over 50 years of Excellence through ingenuity PROJECT DOSSIER DUBAI METRO PROJECT OVEREVIEW Dubai Metro Project is the longest automated driverless system in the Dubai Metro – Red line and Project Green Line Contracts world. It is first urban metro network to run in the Gulf’s Arab Location Dubai, UAE states. The system has eased the daily commute for thousands of Client Roads & Transport Authority, Dubai the workers in the emirate. The Red Line and Green Line were the Contractor Dubai Rail Link (DURL) consortium first lines to be operational, completed in 2 phases: Consultants Systra- Parsons Corporation JV . Phase 1 Red Line (Al-Rashidiya to Jebel Ali): ~53 km long with Duration 2006 - 2010 26stations, out of which 5.6 km is underground (tunnels) with 4 underground stations (2006- 2009). Phase 2 Green Line (Al-Qusais and Al-Jadaf): ~18 km long with 14 stations, out of which 7.9 km is underground (tunnels) with 6 underground stations(2007-2010). The routes run underground in the city center, from the Sheikh Rashid/Sheikh Khalifa Bin Zayed intersection to Salahuddin/Abu Bakr Al Siddique intersection on Red line and from Garhoud to Oud Metha Road on Green line. The underground works have been carried out without affecting buildings in the zone of influence. A good instrumentation and monitoring plan was designed to meet the purpose. www.encardio.com Monitoring solution Encardio-rite was awarded the I&M sub-contract for the complete monitoring and surveying solutions by DURL consortium consisting of Mitsubishi Heavy Industries, Mitsubishi Corporation, Obayashi Corporation, Kajima Corporation and YapiMerkezi. -

Dubai 2020: Dreamscapes, Mega Malls and Spaces of Post-Modernity

Dubai 2020: Dreamscapes, Mega Malls and Spaces of Post-Modernity Dubai’s hosting of the 2020 Expo further authenticates its status as an example of an emerging Arab city that displays modernity through sequences of fragmented urban- scapes, and introvert spaces. The 2020 Expo is expected to reinforce the image of Dubai as a city of hybrid architectures and new forms of urbanism, marked by technologically advanced infrastructural systems. This paper revisits Dubai’s spaces of the spectacle such as the Burj Khalifa and themed mega malls, to highlight the power of these spaces of repre- sentation in shaping Dubai’s image and identity. INTRODUCTION MOHAMED EL AMROUSI Initially, a port city with an Indo-Persian mercantile community, Dubai’s devel- Abu Dhabi University opment along the Creek or Khor Dubai shaped a unique form of city that is con- stantly reinventing itself. Its historic adobe courtyard houses, with traditional PAOLO CARATELLI wind towers-barjeel sprawling along the Dubai Creek have been fully restored Abu Dhabi University to become heritage houses and museums, while their essential architectural vocabulary has been dismembered and re-membered as a simulacra in high-end SADEKA SHAKOUR resorts such as Madinat Jumeirah, the Miraj Hotel and Bab Al-Shams. Dubai’s Abu Dhabi University interest to make headlines of the international media fostered major investment in an endless vocabulary of forms and fragments to create architectural specta- cles. Contemporary Dubai is experienced through symbolic imprints of multiple policies framed within an urban context to project an image of a city offers luxu- rious dreamscapes, assembled in discontinued urban centers. -

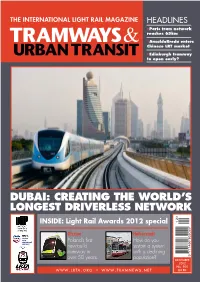

Dubai: CREATING the WORLD’S LONGEST DRIVERLESS NETWORK INSIDE: Light Rail Awards 2012 Special

THE INTERNATIONAL LIGHT RAIL MAGAZINE HEADLINES l Paris tram network reaches 65km l AnsaldoBreda enters Chinese LRT market l Edinburgh tramway to open early? DUBAI: CREATING THE WORLD’S LONGEST DRIVERLESS NETWORK INSIDE: Light Rail Awards 2012 special Olsztyn Halberstadt Poland’s first How do you new-build sustain a system tramway in with a declining over 50 years population? DECEMBER 2012 No. 900 WWW . LRTA . ORG l WWW . TRAMNEWS . NET £3.80 PESA Bydgoszcz SA 85-082 Bydgoszcz, ul. Zygmunta Augusta 11 tel. (+48)52 33 91 104 fax (+48)52 3391 114 www.pesa.pl e-mail: [email protected] Layout_Adpage.indd 1 26/10/2012 16:15 Contents The official journal of the Light Rail Transit Association 448 News 448 DECEMBER 2012 Vol. 75 No. 900 Three new lines take Paris tram network to 65km; www.tramnews.net Mendoza inaugurates light rail services; AnsaldoBreda EDITORIAL signs Chinese technology partnership; München orders Editor: Simon Johnston Siemens new Avenio low-floor tram. Tel: +44 (0)1832 281131 E-mail: [email protected] Eaglethorpe Barns, Warmington, Peterborough PE8 6TJ, UK. 454 Olsztyn: Re-adopting the tram Associate Editor: Tony Streeter Marek Ciesielski reports on the project to build Poland’s E-mail: [email protected] first all-new tramway in over 50 years. Worldwide Editor: Michael Taplin Flat 1, 10 Hope Road, Shanklin, Isle of Wight PO37 6EA, UK. 457 15 Minutes with... Gérard Glas 454 E-mail: [email protected] Tata Steel’s CEO tells TAUT how its latest products offer News Editor: John Symons a step-change reduction in long-term maintenance costs. -

Binghatti Gateway Brochure

800-15 DUBAI 200 + 3.1 MN DIRHAM $30.22 BN NATIONALITIES RESIDENTS STABLE CURRENCY TRANSACTIONS IN FIRST HALF 2018 WORLD CLASS INFRASTRUCUTRE 25 MN $77,55 BN 27,642 VISITORS TRANSACTIONS IN TRANSACTIONS EXPO 2020 2017 IN FIRST HALF 2018 AL JADDAF 5 MINUTES FROM VIEWS TO 5 MINUTES FROM , EASY ACCESS TO DOWNTOWN DUBAI CREEK THE WORLD S AL JADDAF DUBAI WATERFRONT TALLEST TOWER METRO STATION الجداف 5 دقائــق مــن برج الجــــــداف هــــــو مجمــــــع متعــــــدد االســــــتخدامات محــــــاط بخــــــور دبــــــي ومجتمــــــع زعبيــــــل. ان اســــــم المنطقه يرتبط بشــكل وثيق مع إســــــتخدامها التاريخــــــي كمركز لبنــــــاء المراكــــــب الشــــــراعية التقليديــــة. خور دبي تتمتــع منطقــة الجــداف ببنيــة تحتيــة تتطــور بشــكل مســتمر لتصبــح واحــة للضيافــه حيــث يوجــد فــي المنطقــة حاليــا مــا يصــل إلــى MIN FROM 5 خمســة فنــادق تحــت اإلنشــاء وغيرهــا ثالثــة مكتملــة وهــي ماريــوت الجــداف وريفلكشــن للشــقق الفندقيــة وفنــدق اريبيــان بــارك. و يعدالجــــداف مركــــزا مهمــــا للمهنييــــن الشــــباب الذيــــن يســــعون إلــــى نمــــط حيــــاة ســــريع و حديــــث يمكنهــــم مــــن الوصــــول فــــي DUBAI CREEK غضــــون دقائــــق إلــــى أهــــم المعالــــم و الوجهــــات الرئيســــية فــــي دبــــي. يتمتع السكان في الجداف بسهوله الوصول إلى مترو دبي TOWER باإلضافــة الــى المعالــم واالماكــن الرئيســية األخــرى مثــل مستشــفى لطيفــه ومركــز وافــي مــول ودبــي مــول وال يمكــن أن ننســى المعلــم اإليقونــي الشــهير ) بــرج خليفــة ( باإلضافــة إلــى مركــز دبــي المالــي العالمــي والــذي يقــع كليهمــا علــى بعــد 5 دقائــق فقــط مــن الجــداف. AL JADDAF ’Al Jaddaf is a mixed-use community surrounded by the Dubai Creek and Royal Za’abeel Community. The name ‘Al Jaddaf 5 دقائــق من داون literally translates to ‘The Rower’, a testament to the area’s historic use as a traditional dhow sailboat building hub. -

MEET US at GULFOOD 21-25 FEBRUARY We Invite You Ali Group Offers to Discover the Widest Range Our Brands

MEET US Ali Group offers the widest range AT GULFOOD of innovative, cost-saving 21-25 FEBRUARY Photo: Subbotina Anna / Shutterstock.com and eco-friendly products in the foodservice equipment industry. 2016 We invite you to discover our brands. Click here to see where our brands are located Gulfood venue map and opening times Dubai Metro FIND OUR BRANDS ZA’ABEEL HALL 4 ZA’ABEEL HALL 5 ZA’ABEEL HALL 6 HALL 2 Booth Z4-A60 Booth Z5-C38 Booth Z6-A29 Booth B2-18 Booth Z4-A76 Booth Z6-A62 Booth B2-39 Booth Z6-C55 Booth Z4-C8 Booth Z6-E8 Booth Z4-C82 Booth Z5-D8 Booth Z4-F60 Booth Z5-D32 Booth Z4-G28 Booth Z5-D60 VENUE MAP OPENING TIMES 21 February 11am - 7pm 22 February 11am - 7pm 21 - 25 February 2016 23 February 11am - 7pm Dubai World Trade Centre 24 February 11am - 7pm www.gulfood.com 25 February 11am - 5pm Convention Tower CONVENTION GATE For any further information P A VILION HALL SHEIKH ZA’ABEEL NEW HALLS MAKTOUM please visit: HALL 8 HALL ZA’ABEEL www.gulfood.com PLAZA HALL 7 SHEIKH ZA’ABEEL HALL RASHID HALL HALL 6 HALL 5 HALL 1 HALL 2 HALL 3 HALL 4 4A EXHIBITION GATE Ibis Hotel TRADE CENTRE ARENA & SHEIKH SAEED HALLS HALL 9 FOOD AND DRINK BEVERAGE & BEVERAGE EQUIPMENT RESTAURANT & CAFÉ FOODSERVICE EQUIPMENT SALON CULINAIRE REGISTRATION AREAS DUBAI METRO The Dubai Metro’s red line ‘World Trade Centre Station’ serves the exhibition centre. Burj Khalifa/Dubai Mall Jumeirah Lake Towers METRO OPERATIONS HOURS Mall of the Emirates World Trade Centre Trade World Al Ras Palm Deira Dubai Internet City Noor Islamic Bank Financial Center Emirates