Interim Report Refers to the Louis Dreyfus Company B.V

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Release-SUEBA March 2011.Pages

Renowned Builder Sueba USA Selected as Builder Partner for Imperial SUGAR LAND, TEXAS - With a reputation for building quality, upscale mid- rise multi-family homes, Johnson Development Corporation’s Imperial has selected Sueba USA as their multi-family builder partner. With a host of luxury mid-rise projects in the Houston and Phoenix areas, Sueba was the builder of the 167-unit City Plaza at Town Square in Sugar Land. “Sueba’s quality speaks for itself,” said Shay Shafie, General Manager of Imperial. “With a continual need for more housing in Sugar Land due to the forecasted growth rates, Imperial is dedicated to meeting that need with upscale, luxury multi-family homes perfect for individuals in transition, young professionals and couples, empty nesters and our ever-increasing work force.” According to a preliminary report released by the Census Bureau, Fort Bend County has been named the second fastest growing county in Texas moving up a spot from the 2000 Census where it ranked third. The county experienced an over 65% growth in ten years. Fort Bend remains the tenth largest county in Texas with an annual average population increase of 23,000 people, and it is the fastest growing county in the Greater Houston area. Imperial plans call for phasing of the multi-family units beginning in the spring of 2012. The majority of the multi-family housing will be mid-rises located within the community adjacent to and near the new Star Tex Power Stadium. “Sueba is extremely excited to have the opportunity to partner with Johnson Development in creating a high quality, long lasting and desirable mid-rise development within the Ballpark District and with the residents of Sugar Land,” said Douglas Bergen, Vice President, Sueba USA. -

Imperial Sugar Company Refinery Historic District, Sugar Land, Fort Bend County, Texas

United States Department of the Interior National Park Service / National Register of Historic Places REGISTRATION FORM NPS Form 10-900 OMB No. 1024-0018 Imperial Sugar Company Refinery Historic District, Sugar Land, Fort Bend County, Texas 5. Classification Ownership of Property x Private Public - Local Public - State Public - Federal Category of Property x building(s) district site x structure object Number of Resources within Property Contributing Noncontributing 4 0 buildings 0 0 sites 1 2 structures 0 0 objects 5 2 total Number of contributing resources previously listed in the National Register: 0 6. Function or Use Historic Functions: COMMERCE/warehouse; INDUSTRY/manufacturing facility Current Functions: RECREATION/museum; VACANT; WORK IN PROGRESS 7. Description Architectural Classification: NO STYLE Principal Exterior Materials: Brick, Concrete Narrative Description (see continuation sheets 7 through 11) Page 2 United States Department of the Interior National Park Service / National Register of Historic Places REGISTRATION FORM NPS Form 10-900 OMB No. 1024-0018 Imperial Sugar Company Refinery Historic District, Sugar Land, Fort Bend County, Texas 8. Statement of Significance Applicable National Register Criteria X A Property is associated with events that have made a significant contribution to the broad patterns of our history. B Property is associated with the lives of persons significant in our past. C Property embodies the distinctive characteristics of a type, period, or method of construction or represents the work of a master, or possesses high artistic values, or represents a significant and distinguishable entity whose components lack individual distinction. D Property has yielded, or is likely to yield information important in prehistory or history. -

The Abcds' Transformation: How Far Will Downstream Integration

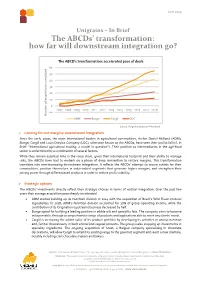

June 2019 Unigrains – In Brief The ABCDs’ transformation: how far will downstream integration go? The ABCD's transformation: accelerated pace of deals 60 50 40 30 20 10 0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 -10 Number Number acquisitions of cumulated ADM Bunge Cargill LDC Source: Unigrains based on Pitchbook ➢ Looking for lost margins: downstream integration Since the early 2010s, the main international traders in agricultural commodities, Archer Daniel Midland (ADM), Bunge, Cargill and Louis Dreyfus Company (LDC), otherwise known as the ABCDs, have seen their profits fall (cf. In Brief: “International agricultural trading: a model in question”). Their position as intermediaries in the agri-food sector is undermined by a combination of several factors. While they remain essential links in the value chain, given their international footprint and their ability to manage risks, the ABCDs have had to embark on a phase of deep reinvention to restore margins. This transformation translates into ever-increasing downstream integration. It reflects the ABCDs’ attempt to secure outlets for their commodities, position themselves in value-added segments that generate higher margins, and strengthen their pricing power through differentiated products in order to reduce profit volatility. ➢ Strategic options The ABCDs’ investments directly reflect their strategic choices in terms of vertical integration. Over the past few years their average acquisition pace sharply accelerated. • ADM started building up its Nutrition division in 2014 with the acquisition of Brazil’s Wild Flavor (natural ingredients). In 2018, ADM’s Nutrition division accounted for 10% of group operating income, while the contribution of its Origination (upstream) business decreased by half. -

"SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V

Erkende referenten / Recognised sponsors Arbeid Regulier en Kennismigranten / Regular labour and Highly skilled migrants Naam bedrijf/organisatie Inschrijfnummer KvK Name company/organisation Registration number Chamber of Commerce "@1" special projects payroll B.V. 70880565 "SOLIZE India Technologies Private Limited" 56553102 .FABRIC 34354648 @Fentures B.V. 82701695 01-10 Architecten B.V. 24257403 100 Grams B.V. 69299544 10X Genomics B.V. 68933223 12Connect B.V. 20122308 180 Amsterdam BV 34117849 1908 Acquisition B.V. 60844868 2 Getthere Holding B.V. 30225996 20Face B.V. 69220085 21 Markets B.V. 59575417 247TailorSteel B.V. 9163645 24sessions.com B.V. 64312100 2525 Ventures B.V. 63661438 2-B Energy Holding 8156456 2M Engineering Limited 17172882 30MHz B.V. 61677817 360KAS B.V. 66831148 365Werk Contracting B.V. 67524524 3D Hubs B.V. 57883424 3DUniversum B.V. 60891831 3esi Netherlands B.V. 71974210 3M Nederland B.V. 28020725 3P Project Services B.V. 20132450 4DotNet B.V. 4079637 4People Zuid B.V. 50131907 4PS Development B.V. 55280404 4WEB EU B.V. 59251778 50five B.V. 66605938 5CA B.V. 30277579 5Hands Metaal B.V. 56889143 72andSunny NL B.V. 34257945 83Design Inc. Europe Representative Office 66864844 A. Hak Drillcon B.V. 30276754 A.A.B. International B.V. 30148836 A.C.E. Ingenieurs en Adviesbureau, Werktuigbouw en Electrotechniek B.V. 17071306 A.M. Best (EU) Rating Services B.V. 71592717 A.M.P.C. Associated Medical Project Consultants B.V. 11023272 A.N.T. International B.V. 6089432 A.S. Watson (Health & Beauty Continental Europe) B.V. 31035585 A.T. Kearney B.V. -

2018 Louis Dreyfus Foundation Activity Report

Fondation d’entreprise Activity Report 2018 LDF | ACTIVITY REPORT 2018 | 28.06.19 | PROOF 10 LDF | ACTIVITY REPORT 2018 | 28.06.19 | PROOF 10 1ABOUT US About the Louis Dreyfus Foundation 02 Governance 03 Message from the President 04 Message from the General Manager 05 Our projects in 2018 06 The year in numbers 08 2OUR WORK Micro-farming 12 Education 18 Communities & environment 20 The Emergency Fund for Food Aid 22 What’s next? 24 Financial information 2018 27 Credits & acknowledgments 28 For more information please visit: www.louisdreyfusfoundation.org LDF | ACTIVITY REPORT 2018 | 28.06.19 | PROOF 10 ABOUT US 1ABOUT US SNNP REGION, ETHIOPIA LOUIS DREYFUS FOUNDATION ACTIVITY REPORT 2018 01 LDF | ACTIVITY REPORT 2018 | 28.06.19 | PROOF 10 About the Louis Dreyfus Foundation Vision Mission To help alleviate hunger and poverty Improving food security through by bringing sustainable solutions sustainable micro-farming and to small farmers. education. How we work Sustainable micro-farming and Empowering communities & education help farmers to become preserving the environment allows self-sufficient, contributing to food us to reinforce the potential impact security and alleviating poverty. of our work, now and in the future. Partnering with Louis Dreyfus Company allows our programs to benefit from the presence of LDC and the expertise of its employees, maximizing our positive impact. 02 LOUIS DREYFUS FOUNDATION ACTIVITY REPORT 2018 LDF | ACTIVITY REPORT 2018 | 28.06.19 | PROOF 10 LDF | ACTIVITY REPORT 2018 | 28.06.19 | PROOF 10 ABOUT US Governance The Louis Dreyfus Foundation is a company foundation operating under French law, with a registered office in Paris. -

Louis Dreyfus Company Netherlands

Louis Dreyfus Company Netherlands Sectors: Agriculture for Biofuels, Agriculture for Food Crops, Agriculture for Industrial Crops, Chemical Manufacturing, Commodities Trading Active This profile is actively maintained Send feedback on this profile By: BankTrack Created on: May 19 2020 Last update: Dec 23 2020 Contact: Marília Monteiro, Forest Campaigner. Sectors Agriculture for Biofuels, Agriculture for Food Crops, Agriculture for Industrial Crops, Chemical Manufacturing, Commodities Trading Headquarters Ownership The Louis Dreyfus family has ownership of approximately 95%, and LDC employees and management have around 5%. Subsidiaries Website https://www.ldc.com/ About Louis Dreyfus Company Louis Dreyfus Company (LDC) is a leading processor and trader of agricultural commodities. LDC is active in over 100 countries and indirectly reaches a consumer base of 500 million people by originating, processing, and transporting approximately 81 million tons of commodities annually. Revenues in 2017 were USD 43 billion, and LDC employs 19,000 people worldwide. Louis Dreyfus Company is one of the major processors and exporters of soy in South America and one of the largest commodity traders globally. The company has significant oilseed crushing facilities in Brazil and Argentina, as well as having an annual capacity of several million metric tons in China. LDC is among the top ten soy exporters in Argentina and among the top five in Paraguay and Brazil. The company’s palm oil operations are also significant with the company handling over 2 million metric tons of palm oil and derivatives in 2015. It is also a major producer of biodiesel. Why this profile? Louis Dreyfus' operations, particularly in the soy and orange supply chains, are implicated in several social and environmental issues, such as poor working and living conditions, and deforestation of the Amazon and Cerrado biomes. -

Louis Dreyfus Commodities

N9-515-065 DECEMBER 12, 2014 DAVID E. BELL Louis Dreyfus Commodities In late 2014, the Louis Dreyfus company was at a crossroads. As seemed to be a constant in the company’s 163-year history, changes were underway in the ownership structure, and more significantly, major changes were occurring in the company’s primary business: the international buying and selling of agricultural commodities. In 2009 Robert Louis-Dreyfus, chairman of Louis Dreyfus and great-grandson of the founder, died of leukemia leaving the company in the trust of his widow, Margarita Louis-Dreyfus, for the ultimate benefit of their three sons. The complex ownership structure that Robert left behind had caused some upheaval and raised questions about the appropriate corporate strategy for the future. Dreyfus, the “D” in the ABCD of grain traders (ADM, Bunge and Cargill being the others) had enjoyed some spectacular returns in the years prior to 2014, and sales had reached $63 billion, but there were reasons to suppose the future would not be so rosy. China had grown in significance in world markets to the point where in soybeans and cotton more than half of all international grain flows were at their behest. While many Chinese corporations bought and sold in the world markets, these corporations ultimately reported to the government, which coordinated strategy. Chinese policy for some time had been that the country was working to be self–sufficient in food, but lately there were clear signs that they had accepted that long term importation was to be a fact of life. In early 2014 China had purchased majority shares in two large trading firms, Noble and Nidera (see Table 1 for a list of Ag trading firms). -

View Annual Report

Annual Report & Audited Consolidated Financial Statements 2017 Realizing our Potential. Contents This is LDC 02 Global Presence 04 Our Value Chain 06 Perspectives 10 Louis Dreyfus Company is a leading Message from our Chairperson 12 merchant and processor of agricultural Message from our CEO 14 goods, leveraging its global reach and Corporate Governance 16 extensive asset network to deliver Strategic Approach 20 for our customers around the world – Our Strategy 22 safely, responsibly and reliably. Our Capabilities 26 2017 Review 34 2017 from A-Z 36 Financial Highlights 40 Platform Performance 42 Regional Overview 50 Audited Consolidated Financial Statements 56 Management Discussion & Analysis 58 Financial Highlights 58 Income Statement Analysis 59 Balance Sheet Analysis 61 Independent Auditor’s Report 64 Consolidated Income Statement 67 Consolidated Balance Sheet 68 Consolidated Statement of Comprehensive Income 70 Consolidated Statement of Cash Flows 71 Unless otherwise indicated, “Louis Dreyfus Company”, “LDC”, “Group”, Consolidated Statement of Changes in Equity 72 “Louis Dreyfus Company Group” and related terms such as “our”,“we”, etc. used in this Annual Report refer to the Louis Dreyfus Company B.V. Group. Notes to Consolidated Financial Statements 73 Louis Dreyfus Company Annual Report & Audited Consolidated Financial Statements 2017 1 Our vision Our mission 11 Platforms To work towards a safe To use our know-how Our diversified activities span the entire value chain from farm to fork, and sustainable future, and global reach to bring across a broad range of business lines (platforms). contributing to the the right product to the global effort of providing right location, at the The Value Chain Segment sustenance for a growing right time. -

Sustainability Our Profile

SUSTAINABILITY REPORT 2015 OUR PROFILE Louis Dreyfus Company is a leading FUNDAMENTALS 2 merchant and processor of agricultural CEO MESSAGE: SUSTENANCE IN A SUSTAINABLE FUTURE 2 goods, leveraging its global reach and SNAPSHOT 4 extensive asset network to deliver for OUR VALUES 6 OUR ROLE: THE INDUSTRY & THE WORLD 8 its customers around the world – safely, responsibly and reliably. PILLARS OF SUSTAINABILITY 10 PEOPLE 12 Our diversified activities span the entire value chain from farm ENVIRONMENT 18 to fork, across a broad range of business lines (platforms). PARTNERS 24 Since 1851 our portfolio has grown to include Oilseeds, Grains, COMMUNITY 30 Rice, Freight, Finance, Coffee, Cotton, Sugar, Juice, Dairy, Fertilizers & Inputs and Metals. We help feed and clothe some 500 million people every year PLATFORMS’ INSIGHT 34 by originating, processing and transporting approximately PALM 36 81 million tons of commodities. In our efforts to help sustain a JUICE 38 growing global population we rely on our worldwide presence, responsible practices, sophisticated risk management and COFFEE 40 in-depth market knowledge. COTTON 42 The commitment of our employees is essential to those efforts, SOYBEANS 44 which is reflected in their ownership of approximately 10% of the Group. Our diversified approach generated US$55.7 billion in net sales supported by a US$3.9 billion asset base for the LOOKING AHEAD 46 year ended 31 December 2015. Unless otherwise indicated, “Louis Dreyfus Company”, “LDC”, “Group”, “Louis Dreyfus Company Group” and related terms such as “our”,“we”, etc. used in this Sustainability Report mean the Louis Dreyfus Company B.V. Group. 1 FUNDAMENTALS CEO MESSAGE: SUSTENANCE IN A SUSTAINABLE FUTURE 2015 has been a year of change for agribusiness and for Louis Dreyfus Company. -

G I S E L a T O U S S a I

G I S E L A T O U S S A I N T ATTORNEY – AT – LAW RAin G. Toussaint,Geigersbergstr.31, D - 76227 Karlsruhe, Germany Attorney-at-law The International Criminal Court Gisela Toussaint Office of the Prosecutor Geigersbergstr. 31 The Hon. Fatou Bensouda D - 76227 Karlsruhe Oude Waalsdorperweg 10 Germany NL - 2597 AK, The Hague The Netherlands Tel.: 0049 (0)721 1838647 Mail. [email protected] 1st. March 2020 List of surposed culprits of Global Genocide and Crime against Humanity: I. Brazilian Government members: 1. Jair Bolsonaro, President of Brazil, 2. Hamilton Mourão, Vice President of Brazil 3. Paulo Guedes, Minister of Economy 4. Ricardo Salles, Environment Minister 5. Onyx Lorenzoni, Defence Minister 6. Serjo Moro, Minister of Justice 7. NN. II. Bolivian Government members: 1. Evo Morales, Ex-President of Bolivia 2. Luis Arce, minister of Economy 2. NN III. Other MERCOSUR-States Presidents 1. Tabaré Vázquez, Ex-President Uruguay 2. Luis Lacalle Pou, President Uruguay 3. Mario Abdo Benítez, President Paraguay 4. Alberto Ángel Fernández, President of Argentina 5. Mauricio Macri, Ex-President of Argentina 6. NN. IV. Illegal and/or “legalized” Rain Forest Land-Grabbers: 1. NN. - Grileiros in Brazilian and Bolivian Rain Forest 2. Ricardo de Nadai, Novo Progresso, Pará, Brazil 3. Donizete Servino Duarte, Novo Progresso, Pará, Brazil 4. Agamenon Meneses, Novo Progresso, Pará, Brazil 5. Nn. - Golddiggers in Brazilian Rain Forest 6. Companies under IV. 1.-6. as Buyers of destroyed Rain Forest Land V. Global Agro Industrial Complex: 1. David W. MacLennan, CEO Cargill, Minesota, USA 2. Greg Heckman, CEO Bunge Ltd., White Plains, NY, USA 3. -

Linkedin Vs Twitter – Which Works Best? Sustainability Social Media Ranking II

CONTEXT SPECIAL REPORT LinkedIn vs Twitter – which works best? Sustainability Social Media Ranking II Our first Sustainability Social Media members benefiting from an increasing menu Ranking published in 2018, looked of functions. LinkedIn is now the prime social media forum for business. at how companies use Twitter to communicate sustainability messages. Now we turn our attention to LinkedIn – asking the same questions: how are companies using Cisco topped that ranking, with the platform for sustainability, and who is regular posts, strong engagement doing it best? and a large influencer following. If you still think of LinkedIn as a contact list, you might be surprised at the level of content being How are companies using LinkedIn for posted, using features such as groups, followers, sustainability communications? And who is likes, comments and shares. You can also post winning? We set out to answer these questions long format articles, pictures and videos. following the massive response to our first Twitter report. LinkedIn has come a long way As well as ranking 100 companies’ use of since its origins, in 2003, as a network for LinkedIn, we compared the findings with professional connections and job searches. those from our Twitter survey, to find out Following a NY Stock Exchange listing in which platform is more effective for 2011, and acquisition by Microsoft in 2016, sustainability communications. LinkedIn has powered ahead to 575 million 1 CONTEXT SPECIAL REPORT www.contextsustainability.com About this report Only one company made no sustainability posts TYPES OF ACCOUNT on its corporate account. Sustainability Social Media Ranking II examines Forty seven sustainability leaders use their how 100 leading companies with strong personal accounts for sustainability posts. -

Membres CCIG Au 23.01.17 Raison Sociale Officielle Ville Code Noga

Membres CCIG au 23.01.17 Raison sociale officielle Ville Code Noga Libellé Noga 100 RUE DU RHONE AVOCATS GENEVE M691001 Études d'avocats, de notaires 123... SOLEIL SARL ESPACE OVIA PLAN-LES-OUATES S960202 Instituts de beauté 12TH MANAGEMENT LTD GENEVE M702200 Conseil pour les affaires et autres conseils de gestion 1875 FINANCE SA GENEVE K663002 Gestion de fonds 2B PARTNERS SA GENEVE M692000 Activités comptables; fiduciaires 2HF SARL GENEVE M692000 Activités comptables; fiduciaires 2LCOACHING GENEVE J620200 Conseil informatique 360 PRO JAQUIER, GUILBAUD F., GUILBAUD T., MOULLET EYSINS M741002 Design graphique et communication visuelle 3C SERVICES SA ESTAVAYER-LE-LAC G4613 Intermédiaires du commerce en bois et matériaux de construction 3HPRO SA GENEVE N781000 Activités des agences de placement de main-d'œuvre 3JSC - 3MUNDI PLAN-LES-OUATES N791100 Activités des agences de voyage 4AM SA CAROUGE J620200 Conseil informatique A & S Benoît Junod JUSSY M702200 Conseil pour les affaires et autres conseils de gestion A&M GLOBAL FAMILY OFFICE SA GENEVE K649901 Sociétés d'investissement A. GRAS & CIE SA GENEVE G475100 Commerce de détail de textiles en magasin spécialisé A. REVENU-LOMBARD, Jeanne Revenu Successeur PUPLINGE G469000 Commerce de gros non spécialisé A.L.R CONSULTANTS GENEVE AAV CONTRACTORS SA PLAN-LES-OUATES C251200 Fabrication de portes et fenêtres en métal AB CROSS-CULTURAL SERVICES COMMUGNY P855903 Cours de perfectionnement professionnel AB INGENIEURS SA CHENE-BOUGERIES M711201 Bureaux d'ingénieurs en construction ABB - SECHERON SA