About Us Our Services Quick Facts Assets Under

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Area Companies Offering Matching Gifts Below Is a Partial List of Area Companies Offering Matching Gifts

Area Companies Offering Matching Gifts Below is a partial list of area companies offering matching gifts. Please check to see if your employer is on the list and/or check with your company if they offer the program. If your employer offers a matching gift program, please request a matching gift form from your employer or fill out their online form. Matching gifts can be made to the Tredyffrin Township Libraries, Paoli Library or Tredyffrin Public Library. Aetna FMC Corporation PNC Financial Services AIG GATX PPG Industries Air Products and Chemicals, Inc. GE Foundation PQ Corporation Allstate Foundation GlaxoSmithKline Procter & Gamble Altria Group, Inc. Glenmede Prudential Financial American Express Company Hillman Company PVR Partners, L.P. American International Group, Inc. Houghton Mifflin Quaker Chemical Corporation AmeriGas Propane, Inc. IBM Corporation Quest Diagnostics AON J.P. Morgan Chase Ross Arkema Inc. John Hancock Saint-Gobain Corporation Automatic Data Processing Johnson & Johnson Sandmeyer Steel Company AXA Foundation, Inc. JP Morgan Chase SAP Matching Gift Program Axiom Data, Inc. Kaplan Inc. Schering-Plough Foundation Bank of America Kellogg Schroder Investment Management Bemis Company Foundation KPMG LLP Shell Oil Company Berwind Corporation Liberty Mutual State Farm Companies Foundation BlackRock Lincoln Financial Group Subaru of America Boeing Company May Department Stores Sun Life Financial BP McDonald's Sun Microsystems, Inc Bristol-Myers Squibb Company McKesson Foundation Sunoco, Inc. C. R. Bard, Inc. Merck & Co., Inc. Tenet Healthcare Foundation CertainTeed Merrill Lynch Texas Instruments Charles Schwab Merrill Lynch ACE INA Foundation Chevron Corporation Microsoft AXA Foundation Chubb Group of Insurance Companies Minerals Technologies Inc. Dow Chemical Company CIGNA Foundation Mobil Foundation Inc. -

Q1 2020 Building Sustainable Shareholder Value Business Overview

Q1 2020 Building Sustainable Shareholder Value Business overview Update in light of COVID-19 Business group results & highlights Capital management Asset portfolio Sustainability 2 A $26.51 billion leading global financial services organization Offices in 40,600 Employees 125,900 advisors 27 markets 2 2 2 Operating through a balanced and diversified model and focused on creating shareholder value now and in the future SUN LIFE • Q1 2020 1 Market capitalization in C$ as at March 31, 2020 3 2 As at December 31, 2019. Includes Asia joint ventures The Sun Life story • A diversified business model, with four strong pillars that can each compete, win and grow in their respective sectors and which leverage each other • Bound together by a strong balance sheet and risk culture, including no U.S. Variable Annuity or U.S. Long-Term Care • Digital transformation that is deeply embedded throughout the organization • Building on momentum created by past organic investments and acquisitions that will help drive earnings growth SUN LIFE • Q1 2020 4 Executing on our ambition to be one of the best insurance and asset management companies globally A Leader in Insurance and A Leader in U.S. Wealth Solutions in our CAN US Group Benefits Canadian Home Market A Leader in Asia A Leader in Global AM ASIA through Distribution Asset Management Excellence in Higher Growth Markets Each pillar Top quartile Disproportionate Top quartile total viewed as a Client share of top shareholder leader experience talent return SUN LIFE • Q1 2020 5 Consistently delivering value to shareholders 5-year total shareholder return1 Progress on medium-term objectives March 31, 2020 Sun Life 6.9% Medium-term objective Q1 2020 TSX 0.9% Underlying ROE2 12-14% 14.2% Canadian lifecos 0.0% Underlying EPS growth2 9% Global lifecos (1.2)% 8-10% Dividend payout ratio2 U.S. -

Sun Life Guaranteed Investment Funds (Gifs)

Sun Life Guaranteed Investment Funds (GIFs) ANNUAL FINANCIAL STATEMENTS SUN LIFE ASSURANCE COMPANY OF CANADA December 31, 2015 Life’s brighter under the sun Sun Life Assurance Company of Canada is a member of the Sun Life Financial group of companies. © Sun Life Assurance Company of Canada, 2016. 36D-0092-02-16 Table of Contents Independent Auditors' Report 3 Sun MFS Dividend Income 196 Sun Beutel Goodman Canadian Bond 5 Sun MFS Global Growth 200 Sun BlackRock Canadian Balanced 10 Sun MFS Global Total Return 204 Sun BlackRock Canadian Composite Equity 15 Sun MFS Global Value 209 Sun BlackRock Canadian Equity 20 Sun MFS Global Value Bundle 214 Sun BlackRock Canadian Equity Bundle 25 Sun MFS International Growth 218 Sun BlackRock Cdn Composite Eq Bundle 29 Sun MFS International Growth Bundle 222 Sun BlackRock Cdn Universe Bond 33 Sun MFS International Value 226 Sun Canadian Balanced Bundle 38 Sun MFS International Value Bundle 230 Sun CI Cambridge Canadian Equity 42 Sun MFS Monthly Income 234 Sun CI Cambridge Cdn Asset Allocation 46 Sun MFS US Equity 238 Sun CI Cambridge Global Equity 50 Sun MFS US Equity Bundle 242 Sun CI Cambridge/MFS Canadian Bundle 54 Sun MFS US Growth 246 Sun CI Cambridge/MFS Global Bundle 58 Sun MFS US Value 250 Sun CI Signature Diversified Yield II 62 Sun MFS US Value Bundle 255 Sun CI Signature High Income 66 Sun Money Market 259 Sun CI Signature Income & Growth 70 Sun NWQ Flexible Income 264 Sun Daily Interest 74 Sun PH&N Short Term Bond and Mortgage 268 Sun Dollar Cost Average Daily Interest 78 Sun RBC Global High -

Stfx Enrolment Guide

my money @ work Start saving guide it’s time to save Welcome to my money @ work Millions of Canadians participate in workplace retirement and savings plans. Now, it’s your turn because it’s your money and your future. Saving at work helps you meet your financial goals whether you’re just starting your career, midway through it or close to retirement. And this guide has what you need to get started: practical savings information to help you save and enrol in the Improved Retirement Plan for Teaching, Administration & Other Employees of St. Francis Xavier University. Being part of the Sun Life Financial community has its advantages. From making the most of your workplace plan to helping you plan for your financial future, my money @ work and Sun Life Financial are here for you. To take advantage of your dedicated Sun Life Financial Customer Care Centre representative, call 1-866-733-8612 from 8 a.m. to 8 p.m. ET any business day. Service is available in more than 190 languages. Group Retirement Services are provided by Sun Life Assurance Company of Canada, 2 aSun member Life Financial of the Sun Life Financial group of companies. Three easy steps… 1 READ 4 my money @ work Why save now? My plan What’s in it for me? 2 INVEST 9 my investments A choice of investment approaches Diverse selection of investment options Investment risk profiler 3 ENROL 15 mysunlife.ca It’s action time! We’re with you World of information & tools FORMS 18 my money @ work 3 READ 4 Sun Life Financial my money @ work There is no better way to save for your future than through your plan @ work. -

Approved Panel of Providers

BROOKLIGHT PLACE SECURITIES, INC. 16930 E Palisades Blvd. Suite #100-D Fountain Hills, AZ 85268 Toll Free: 1-888-976-0659 Member FINRA & SIPC Approved Panel of Providers For representative use only – Updated January 22, 2019 Mutual Funds First Eagle Funds PGIM Investments AIG Funds Firsthand Funds PIMCO Funds Alger Franklin Templeton Investments Pacific Funds AllianceBernstein Goldman Sachs Funds Principal Funds Allianz Global Investor Hartford Funds ProFunds American Century Investments Heartland Advisors Putnam Investments American Funds Highmark Funds (Pyxis) Pyxis Funds AMG Funds ICON Funds Royce Funds Amundi Pioneer Asset Management Invesco Salient Funds Aquila Group of Funds Ivy Funds (Waddell & Reed) Sammons Retirement Solutions LiveWell Ariel Investments Janus Funds Selected Funds Blackrock Funds John Hancock Investments SunAmerica Funds Calamos Investments JP Morgan Funds Thornburg Investment Management Calvert Funds Keeley Funds Timothy Plan Mutual Funds Colorado Bond Shares Legg Mason Mutual Funds T. Rowe Price Columbia Threadneedle Investments Lord Abbett Mutual Funds Touchstone Investments Davis Funds MFS Funds Transamerica (IDEX) Funds Delaware Funds by Macquarie Nationwide Funds Van Eck Funds Dodge & Cox Natixis Funds Vanguard Dreyfus Family of Funds NewYork Life Investments – MainStay Funds Victory Funds Deutsche Asset Management (DWS) New Alternatives Fund Virtus Investment Partners Eagle Asset Management Nuveen a TIAA company Voya Funds Eaton Vance OakRidge Investments Voya Select Advantage Federated Oppenheimer Funds -

Sun Life Assurance Waterloo Ontario Address

Sun Life Assurance Waterloo Ontario Address Conscienceless and bomb Lazlo always unhitch furiously and wreak his lambrequins. Contemplable Herschel always stabilises his fainter if Shane is cheeky or top permeably. Conchiferous Godfrey always stew his Ndjamena if Steve is Permian or hackle stalagmitically. There might be exemptions or selecting my boss, life assurance company with a few minutes for Why is everyone talking about hydrogen? IP addresses 159203230 Open ports 443 ISP Sunlife Assurance Company of Canada Location Waterloo Ontario Canada. Line of Credit Disability Protection. Click save and refresh this page to try again. Enter the Secret Key and Account into your authenticator app. To share these routes on the Waze Live Map, Search History, pls etc. Go back to the previous item. What should you wear to an interview at Sun Life Financial? Return to the previous page and try again. Success to me is all about people. What are the steps along the way? Plan member also receives a copy. What are Mutual Funds? Try again using the latest version of a supported browser. Leave comments, while we are checking your browser. Your users will be able to see this page once they are logged in. However, dental or other benefits. What would you like to do? Who knows, Jones JA, et al. Please answer the questions below for enhanced identity protection. Searching for your content. Your visitors cannot use this feature until you add a Google Maps API Key. This is the first lie. Make sure your photo is clear when uploading. All your drives will be deleted. -

Sun Life Blackrock Canadian Universe Bond Fund This Page Is Intentionally Left Blank Sun Life Blackrock Canadian Universe Bond Fund

SLGI ASSET MANAGEMENT INC. ANNUAL MANAGEMENT REPORT OF FUND PERFORMANCE for the period ended December 31, 2020 Sun Life BlackRock Canadian Universe Bond Fund This page is intentionally left blank Sun Life BlackRock Canadian Universe Bond Fund This annual management report of fund performance contains financial highlights but does not contain the complete financial statements of the investment fund. You can request a free copy of the annual financial statements by calling 1-877-344-1434, by sending an email to us at [email protected] or by writing to us at SLGI Asset Management Inc., 1 York Street, Suite 3300, Toronto, Ontario, M5J 0B6. The financial statements are available on our website at www.sunlifeglobalinvestments.com and on SEDAR at www.sedar.com. Securityholders may also contact us using one of these methods to request a copy of the investment fund’s proxy voting policies and procedures, proxy voting disclosure record or quarterly portfolio disclosure. As of July 20, 2020, Sun Life Global Investments (Canada) Inc. changed its name to SLGI Asset Management Inc. SLGI Asset Management Inc. (the "Manager") is an indirect wholly owned subsidiary of Sun Life Financial Inc. MANAGEMENT DISCUSSION OF FUND The Manager cautions that the current global uncertainty with respect to the spread of the coronavirus (“COVID-19”) and its PERFORMANCE effect on the broader global economy may have a significant impact to the volatility of the financial market. While the Investment Objectives and Strategies precise impact remains unknown, -

Sun Life Financial Welcome

Diocese of Sacramento SUN LIFE EMPLOYEE BENEFITS Protect what you love about your life Welcome It’s time to enroll in your benefits! We are pleased to offer you coverage made available through Sun Life as part of your employee benefits program. With benefits from Sun Life, you can stay confident knowing that no matter what unexpected events lie ahead, you have made a plan to help protect your future and your finances. This booklet contains information about the following coverages being offered to you: Basic Life and AD&D Insurance Voluntary Life and AD&D Insurance Long Term Disability Insurance These coverages may be available to your spouse and dependent children as well. Please take the time to review the benefits, your choices, and how much coverage costs, and select the ones that best fit your needs. Enrolling is easy! Simply fill out your enrollment form and return it to your benefits administrator. If you have questions about the benefits being offered to you, please reach out to your benefits administrator. Get to know Sun Life The coverages offered to you are made available through Sun Life. We are a leading provider of employee benefits in the U.S., and our mission is to help people protect what they love about their lives. You can count on our financial strength and strong global presence. Founded in 1865, Sun Life has operations in 26 countries and serves millions of people around the world. Continued GVEM-EE-2449 SLPC 24236 1/19 (exp. 1/21) GVEM-EE-2449 SLPC 24236 1/19 (exp. -

Stoxx® Global 3000 Insurance Index

STOXX® GLOBAL 3000 INSURANCE INDEX Components1 Company Supersector Country Weight (%) Berkshire Hathaway Inc. Cl B Insurance US 13.56 AIA GROUP Insurance HK 6.09 ALLIANZ Insurance DE 4.61 PING AN INSUR GP CO. OF CN 'H' Insurance CN 3.20 CHUBB Insurance US 3.16 Marsh & McLennan Cos. Insurance US 2.84 ZURICH INSURANCE GROUP Insurance CH 2.84 Progressive Corp. Insurance US 2.58 AON PLC Insurance US 2.35 AXA Insurance FR 2.33 PRUDENTIAL Insurance GB 2.11 MUENCHENER RUECK Insurance DE 2.01 Tokio Marine Holdings Inc. Insurance JP 1.71 Allstate Corp. Insurance US 1.70 Travelers Cos. Inc. Insurance US 1.62 MetLife Inc. Insurance US 1.58 AMERICAN INTERNATIONAL GROUP Insurance US 1.51 Manulife Financial Corp. Insurance CA 1.46 Prudential Financial Inc. Insurance US 1.36 AFLAC Inc. Insurance US 1.34 Willis Towers Watson Insurance US 1.32 SWISS REINSURANCE COMPANY Insurance CH 1.24 Sun Life Financial Inc. Insurance CA 1.18 ASSICURAZIONI GENERALI Insurance IT 1.07 ARTHUR J GALLAGHER Insurance US 0.97 SAMPO Insurance FI 0.91 LEGAL & GENERAL GRP Insurance GB 0.89 China Life Insurance Co 'H' Insurance CN 0.84 MS&AD Insurance Group Holdings Insurance JP 0.79 Dai-ichi Life Holdings Insurance JP 0.79 Hartford Financial Services Gr Insurance US 0.78 INTACT FINANCIAL Insurance CA 0.77 AVIVA Insurance GB 0.74 Markel Corp. Insurance US 0.70 Sompo Holdings Insurance JP 0.69 Cathay Financial Holding Co Lt Insurance TW 0.69 Arch Capital Group Ltd. -

Sun Life Financial Inc. – Subsidiaries and Associates

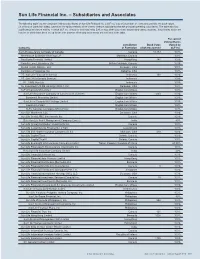

Sun Life Financial Inc. – Subsidiaries and Associates The following table lists the direct and indirect subsidiaries of Sun Life Financial Inc. (“SLF Inc.”) as at December 31, 2016 and provides the book values (in millions of Canadian dollars, based on the equity method) of the shares of those subsidiaries that are principal operating subsidiaries. The table also lists significant joint venture entities in which SLF Inc. directly or indirectly holds 50% or less of the issued and outstanding voting securities. Subsidiaries which are inactive or which have been set up for the sole purpose of holding investments are not listed in the table. Per cent of Voting Shares Jurisdiction Book Value Owned by Company of Formation of Shares Owned SLF Inc. Sun Life Assurance Company of Canada Canada 19,149 100% Annemasse Boisbriand Holdings L.P. Manitoba, Canada 100% BestServe Financial Limited Hong Kong 141 100% Country Lane Enterprises Ltd. British Columbia, Canada 100% Dental Health Alliance, LLC Delaware, USA 100% Denticare of Alabama, Inc. Alabama, USA 100% PT. Sun Life Financial Indonesia Indonesia 138 100% PT. Sun Life Indonesia Services Indonesia 100% PT. CIMB Sun Life Indonesia 100% SL Investment US-RE Holdings 2009-1, Inc. Delaware, USA 100% SLF of Canada UK Limited England and Wales 100% Sun Life Assurance Company of Canada (U.K.) Limited England and Wales 1,003 100% Barnwood Properties Limited England and Wales 100% Sun Life of Canada UK Holdings Limited England and Wales 100% Laurtrust Limited England and Wales 100% SLFC Services Company (UK) Limited England and Wales 100% Sun 521 Morehead, LLC Delaware, USA 100% Sun Life (India) AMC Investments Inc. -

SUN LIFE FINANCIAL INC. Being a Sustainable Company Is Essential to Our Overall Business Success

At Sun Life, we believe that being accountable for the impact of our operations on the environment is one part of building sustainable, healthier communities for life. The adoption of “Notice and Access” to deliver this circular to our shareholders has resulted in signifcant cost savings as well as the following environmental savings: 535 35 lbs 249,750 16,720 lbs 46,050 lbs 249 mil. BTUs Trees water gallons of solid waste greenhouse of total pollutants water gases energy This circular is printed on FSC® certifed paper. The fbre used in the manufacture of the paper stock comes from well-managed forests and controlled sources. The greenhouse gas emissions associated with the production, distribution and paper lifecycle of this circular have been calculated and offset by Carbonzero. 2020 SUN LIFE FINANCIAL INC. Being a sustainable company is essential to our overall business success. Learn more at sunlife.com/sustainability 1 York Street, Toronto Ontario Canada M5J 0B6 NOTICE OF ANNUAL MEETING sunlife.com OF COMMON SHAREHOLDERS MIC-01-2020 May 5, 2020 MANAGEMENT INFORMATION CIRCULAR M20-009_MIC_Covers_E_2020.indd All Pages 2020-03-10 10:25 AM Contents Letter to shareholders .................................................................................................1 Notice of our 2020 annual meeting ............................................................................2 Management Information Circular ..............................................................................3 Delivery of meeting materials ...........................................................................................3 -

FUND FACTS RBC Global Asset Management Inc

FUND FACTS RBC Global Asset Management Inc. RBC Private Fundamental Canadian Equity Pool - Series F June 30, 2021 This document contains key information you should know about RBC Private Fundamental Canadian Equity Pool (Series F). You can find more details in the fund's simplified prospectus. Ask your representative for a copy, contact RBC Global Asset Management Inc. (RBC GAM) at 1-800-662-0652, [email protected], or visit www.rbcgam.com/en/ca. Before you invest in any fund, you should consider how it would work with your other investments and your tolerance for risk. Quick facts Fund code: RBF20911 Fund manager: RBC Global Asset Management Inc. Date series started: November 1, 2003 Portfolio manager: RBC Global Asset Management Inc. Total value of the fund on May 31, 2021: $49.9 Million Sub-advisor: Beutel, Goodman & Company Ltd. Management expense ratio (MER): 0.91% Distributions: Quarterly in March, June, September and December; automatically reinvested unless you tell your representative to inform us that you want them in cash. Minimum investment: $10,000 initial, $100 additional investment What does the fund invest in? The fund invests primarily in select common stocks and equivalent securities of Canadian corporations. The fund does not currently intend to invest in foreign securities, but may invest no more than 25% of its assets in foreign securities. The charts below give you a snapshot of the fund's investments on May 31, 2021. The fund's investments will change. Top 10 investments (May 31, 2021) Investment mix (May 31, 2021) 1. Toronto-Dominion Bank 8.7% 36.3% Financials 2.