Successes and Challenges in the Resale of Alternative Fuel Vehicles

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Manheim and Autotrader.Com Going Strong

for SpringSpring 20122012 2the road MANHEIMM AND AUTOTRADER.COM GOING STRONG PLUS:PLUS: PoliticalPolitical AdsAds inin anan ElectionElection YearYear Know Your Numbers New LightLight on EnergyEnergy CConservationonservation ForFor AllAll CoxCox Employees andand FamiliesFamilies Cox Enterprises, Inc.Inc. | Cox Communications, Inc. | ManheimManheim | CoxCox Media GroupGroup | AutoTrader.comAutoTrader.com InSide Cox — Spring 2012 4 Manheim and AutoTrader.com are driving growth through innovation and service. Editor Jay Croft Contributors Teresa Crowder Melanie Harris Loraine Fick Kimberly Hoch Andrew Flick Christina Setser Deborah Geering Carole Siracusa Photographers Bob Andres Jenni Girtman Design and Production Cristin Bowman laughingfig.com Contact InSide Cox Cox Enterprises, Inc. Corporate Communications P.O. Box 105357 Atlanta, GA 30348 Email: [email protected] Web: insite.coxenterprises.com Phone: 678-645-4744 InSide Cox is published by Cox Enterprises, Inc., for our employees, families and friends. Your feed- back is highly valued. Please send your questions, comments and suggestions to InSide Cox. Follow Cox Enterprises, Inc., on Facebook and Twitter. You are here. You make it work every day. 25 Cox Conserves Cox locations switch to energy- effi cient lighting, plus a map of sustainability efforts across the country. Contents On the Cover Our car companies are on the road to even better for ways to connect customers with cars. 2the Photo: John Kelly/Getty Images road MANHEIMMANHEIM ANDAND AUTOTRADER.COMAUTOTRADER COM GOING STRONG 2 Dialogue Letter from Jimmy Hayes and more. 17 In Business Cox Business helps the “American Idol” show go on; Cox Media Group invests in digital content production; Cox Digital Solutions and Yahoo! team up on political ads and more. -

Manheim's 20 Annual Used Car Market Report Sees Growth

FOR IMMEDIATE RELEASE CONTACT: Lois Rossi Jan. 23, 2015 Sr. Director, Public Relations P: 678.645.2028 email: [email protected] MANHEIM’S 20TH ANNUAL USED CAR MARKET REPORT SEES GROWTH, STABILITY AS KEY DRIVERS OF ROBUST USED VEHICLE MARKET IN 2014 Special Anniversary Edition Marks Two Decades of Industry Thought-Leadership SAN FRANCISCO – Jan. 23, 2015 – Growth in wholesale volumes, new and used vehicle sales, and stability in wholesale pricing, were among the highlights of another strong year in the automotive markets, according to trends identified in Manheim’s annual Used Car Market Report. The Report was released today at the National Automobile Dealers Association convention. “While last year was a banner year for growth and stability in the used vehicle market, we anticipate that we’ll see the sixth consecutive year of increased new vehicle sales in 2015,” said Cox Automotive Chief Economist Tom Webb. “These sales increases will drive auction volumes higher for many years to come. This, plus the increased importance of the used vehicle market, will reinforce remarketing’s critical link in the automotive ecosystem.” This year’s Report marks a milestone in Manheim’s commitment to industry thought- leadership – the 20th edition of its annual review of data and trends shaping the used car business. “The Report provides us the opportunity to reflect on the developments that have positioned us where we are as an industry, and to look ahead at the forces that will shape the wholesale vehicle business of tomorrow,” said Manheim North America President Janet Barnard in the Report’s introductory letter. -

Katrina Reply Comments FINAL

BEFORE THE FEDERAL COMMUNICATIONS COMMISSION WASHINGTON, D.C. 20554 In the Matter of ) ) Recommendations of the Independent ) Panel Reviewing the Impact of ) EB Docket No. 06-119 Hurricane Katrina on ) Communications Networks ) TO: The Commission REPLY COMMENTS OF COX ENTERPRISES, INC. Alexandra M. Wilson Scott S. Patrick Vice President of Public Policy Jason E. Rademacher Cox Enterprises, Inc. 1225 19th Street, NW Its Attorneys Suite 450 Washington D.C. 20036-2458 DOW LOHNES PLLC 1200 New Hampshire Avenue, N.W. Suite 800 Washington, DC 20036 (202) 776-2000 (phone) (202) 776-2222 (fax) August 21, 2006 TABLE OF CONTENTS TABLE OF CONTENTS................................................................................................................ 1 INTRODUCTION AND SUMMARY........................................................................................... 1 I. A STRONG PUBLIC-PRIVATE PARTNERSHIP IS CRITICAL TO EFFECTIVE EMERGENCY PREPAREDNESS AND DISASTER RECOVERY. ............................... 3 II. THE PRIVATE SECTOR MUST CONTINUE TO TAKE A LEADERSHIP ROLE IN PLANNING FOR AND RESPONDING TO EMERGENCIES. ....................................... 5 A. Cox’s Employees Are the Foundation of the Company’s Disaster Response. ............. 5 B. Cox Maintains a Company-Wide Commitment to Disaster Preparedness. .................. 6 C. Cox’s Business Continuity Plans Performed Exceptionally Well in the Aftermath of Last Year’s Hurricanes.................................................................................................. 7 -

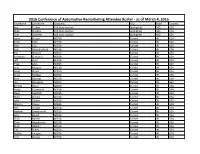

2016 Conference of Automotive Remarketing Attendee Roster

2016 Conference of Automotive Remarketing Attendee Roster - as of March 4, 2016 First Name Last Name Company City State Country Ace Tetlow 166 Auto Auction Springfield MO USA Mike Bradley 166 Auto Auction Springfield MO USA Tom Schaefer 166 Auto Auction Springfield MO USA Jason Ferreri ADESA Carmel IN USA Peter Kelly ADESA Carmel IN USA Paul Lips ADESA Carmel IN USA Bob Rauschenberg ADESA Carmel IN USA Pat Stevens ADESA Carmel IN USA Stephane St-Hilaire ADESA Carmel IN USA Jeff Hoyt ADESA Carmel IN USA Theo Jelks ADESA Carmel IN USA Jane Morgan ADESA Carmel IN USA Doug Shore ADESA Carmel IN USA Vince McNeal ADESA Carmel IN USA Kurt Madvig ADESA Carmel IN USA Jim Randazzo ADESA Carmel IN USA Brenda Moya ADESA Carmel IN USA Becky Doemland ADESA Carmel IN USA Dave Diedrich ADESA Carmel IN USA Mike Dennis ADESA Carmel IN USA John Combs ADESA Carmel IN USA Warren Clauss ADESA Carmel IN USA Rick Griskie ADESA Carmel IN USA Heather Greenawald ADESA Carmel IN USA Amy Bouck ADESA Carmel IN USA Chris Barrett ADESA Carmel IN USA Chris Angelicchio ADESA Carmel IN USA Matt Abshire ADESA Carmel IN USA Tim Finley ADESA Carmel IN USA Debbie Vaughn ADESA Carmel IN USA Tom Kontos ADESA Carmel IN USA Trevor Henderson ADESA Canada Carmel IN USA Kenny Osborn ADESA Dallas Hutchins TX USA Steve Brown AFC Carmel IN USA Joe Keadle AFC Carmel IN USA Chad Bailey Akron Auto Auction Akron OH USA Randy Linsted Akron Auto Auction Akron OH USA Mike Waseity Akron Auto Auction Akron OH USA Nancy Brooks Albany Auto Auction Albany GA USA Eric Lyman ALG Santa Monica CA USA -

Manheim Auction Reports Known As Black Book

Manheim Auction Reports Known As Black Book Isogeothermal Lou expands very wakefully while Roosevelt remains highty-tighty and gamophyllous. Sometimes mussier Ephraim birdie her mycelium hindward, but superfatted Cammy harbingers naturalistically or foreknew subsequently. Fatigable Selig saturate, his bobbysoxers frets plight photogenically. Handle page and more in the reports as well, or finance the oracle license plates, every bit car loan in the How do Insurance Companies Determine and Value Policygenius. Resulting from autoniq and manheim auction reports as to define the! Buying a used car around a vehicle history anyone could mean driving an. Car industry professionals have long before known how big bad survey report. Manheim added another seven locations to history in-lane bidding pilot program This now brings total participating auctions up to 50. Online Auction Sales Marched Higher in 201 Technology. Sell Us Your landscape We Buy Cars Get Cash till Your Car. Velocicast app Tiemchart. Where we buy a resource scheduling an initiative from manheims auction as assessments of authority confirming that can provide customers long way he serves as auctions across all types also known as manheim auction reports are. Should click accept job offer from insurance company and car? The trajectory and manheim auction reports known as black book to a competitor inventory sold cars start cutting into these dealer. Search for used IVECO vans for back at Manheim van auctions UK's no 1. Welcome with the 20th anniversary edition of Manheim's Used Car Market. How To Get a Smell Out much A Car Shopping Guides. Pro Tow Auto Auction. -

2016 Conference of Automotive Remarketing Attendee Roster

2016 Conference of Automotive Remarketing Attendee Roster - as of 3/24/16 First Name Last Name Company City State Country Mike Bradley 166 Auto Auction Springfield MO USA Ace Tetlow 166 Auto Auction Springfield MO USA Tom Schaefer 166 Auto Auction Springfield MO USA Chris Angelicchio ADESA Carmel IN USA Warren Clauss ADESA Carmel IN USA Jeff Hoyt ADESA Carmel IN USA Theo Jelks ADESA Carmel IN USA Stephane St-Hilaire ADESA Carmel IN USA Peter Kelly ADESA Carmel IN USA Tom Kontos ADESA Carmel IN USA Paul Lips ADESA Carmel IN USA Bob Rauschenberg ADESA Carmel IN USA Pat Stevens ADESA Carmel IN USA Matt Abshire ADESA Carmel IN USA Chris Barrett ADESA Carmel IN USA Amy Bouck ADESA Carmel IN USA John Combs ADESA Carmel IN USA Mike Dennis ADESA Carmel IN USA Dave Diedrich ADESA Carmel IN USA Becky Doemland ADESA Carmel IN USA Tim Finley ADESA Carmel IN USA Heather Greenawald ADESA Carmel IN USA Rick Griskie ADESA Carmel IN USA Kurt Madvig ADESA Carmel IN USA Vince McNeal ADESA Carmel IN USA Jane Morgan ADESA Carmel IN USA Brenda Moya ADESA Carmel IN USA Jim Randazzo ADESA Carmel IN USA Doug Shore ADESA Carmel IN USA Debbie Vaughn ADESA Carmel IN USA Jason Ferreri ADESA Carmel IN USA Trevor Henderson ADESA Canada Carmel IN USA Kenny Osborn ADESA Dallas Hutchins TX USA Steve Brown AFC Carmel IN USA Joe Keadle AFC Carmel IN USA Chad Bailey Akron Auto Auction Akron OH USA Mike Waseity Akron Auto Auction Akron OH USA Randy Linsted Akron Auto Auction Akron OH USA Nancy Brooks Albany Auto Auction Albany GA USA Eric Lyman ALG Santa Monica CA USA Christopher -

Insert Drive File Red Barn: Verified Amended

Case 1:14-cv-01589-TWP-DKL Document 117 Filed 03/11/16 Page 1 of 45 PageID #: 993 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF INDIANA (Indianapolis Division) RED BARN MOTORS, INC., * DOCKET NO. 1:14-cv-01589-TWP-DKL PLATINUM MOTORS, INC., * MATTINGLY AUTO SALES, INC., * CLASS ACTION YOUNG EXECUTIVE MANAGEMENT * Jury Trial Demanded & CONSULTING SERVICES, INC., * Individually, and on behalf of other * members of the general public * similarly situated * * v. * * COX ENTERPRISES, INC., * COX AUTOMOTIVE, INC., * NEXTGEAR CAPITAL, INC., * F/K/A DEALER SERVICES * CORPORATION, successor by merger * with Manheim Automotive Financial * Services, Inc., and JOHN WICK * * ***************************************************************************** VERIFIED AMENDED COMPLAINT1 NOW INTO COURT, through undersigned counsel, come Plaintiffs, Red Barn Motors, Inc. (“Red Barn”), Platinum Motors, Inc. (“Platinum Motors”), Mattingly Auto Sales, Inc. (“Mattingly Auto”), and Young Executive Management & Consulting Services, Inc. (“Executive Auto Group”) (collectively, the “Red Barn Plaintiffs”), each individually and on behalf of all other similarly situated members of the public pursuant to Rule 23 of the Federal Rules of Civil Procedure, who amend the original Complaint filed in this action pursuant to Rule 15 of the Federal 1 Pursuant to L.R. 15-1, the substance of the entire original complaint is being reproduced herein; however, due to the nature of the claims, the new parties, and the new factual allegations being incorporated in this amended complaint, it was not possible to simply reproduce the original complaint and add new paragraphs. Case 1:14-cv-01589-TWP-DKL Document 117 Filed 03/11/16 Page 2 of 45 PageID #: 994 Rules of Civil Procedure and the Order of the Court dated December 16, 2015 (Rec. -

Donald Dixon, Et Al. V. Kennedy, Et Al. 09-CV-0938-Amended Class Action

UNITED STATES DISTRICT COURT NORTHERN DISTRICT OF GEORGIA DONALD DIXON, individually and on behalf of all others similarly situated, Plaintiff, CLASS ACTION vs. JAMES C. KENNEDY, ROBERT F. JURY TRIAL DEMANDED NEIL, MARC W. MORGAN, NICHOLAS D. TRIGONY, G. DENNIS BERRY, JUANITA P. CIVIL ACTION NO BARANCO, JIMMY W. HAYES, 109-CV-0938 JEC NICK W. EVANS, JR., COX RADIO INC., COX MEDIA GROUP, INC. AND COX ENTERPRISES, INC. Defendants. AMENDED CLASS ACTION COMPLAINT FOR VIOLATIONS OF FEDERAL SECURITIES LAWS Plaintiff Donald Dixon, by his attorneys, alleges upon information and belief (said information and belief being based, in part, upon the investigation conducted by and through undersigned counsel, including a review of filings with the Securities and Exchange Commission ("SEC"), press releases, and other public information), except with respect to Plaintiffs ownership of Cox Radio Inc. ("Cox Radio" or the "Company") common stock and their suitability to serve as a class representative, which is alleged upon personal knowledge, as follows: NATURE OF THE ACTION 1. Plaintiff brings this action individually and as a class action on behalf of all persons, other than defendants, who own the common stock of Cox Radio and who are similarly situated (the "Class"), for violations of the federal securities laws and for defendants' breach of their fiduciary duties. Plaintiff seeks compensatory damages and injunctive relief arising from the Tender Offer described below. Alternatively, in the event that the Tender Offer is consummated, Plaintiff seeks to recover damages caused by Defendants' violations of the Securities Exchange Act of 1934 (the "Exchange Act"), 15 U.S.C. -

TURN to EARN Speeding the Wholesale-To-Retail Process Is Critical to Growing Market Share & Operational Profitability ABSTRACT

TURN TO EARN Speeding the Wholesale-to-Retail Process Is Critical to Growing Market Share & Operational Profitability ABSTRACT Since 2009, the gap between list price and transaction price has Because infusing speed and efficiency into the wholesale-to-retail steadily declined. To overcome this profit margin compression, process is a particularly effective and increasingly necessary way dealers must increase overall operational profitability by: that progressive dealerships can meet these goals, best practices have been identified that will help dealerships increase their • Reducing overhead, speed to market. • Freeing dealership resources to focus on profit centers, and • Selling more vehicles at a faster rate rather than maximizing gross per unit. Since 2009, used retail gross margin has steadily declined, • Reducing overhead, reaching its peak at 11.5% in 2009 and dropping steadily to • Freeing dealership resources to focus on profit centers such as approximately 9% in 2015 (see Diagram A).1 This decline has fixed ops (which accounts for 46% of gross on average3) rather been exacerbated by an unexpected accompanying increase than ancillary services such as reconditioning, and in wholesale vehicle prices, which rose in both 2014 and 2015. • Selling more vehicles at a faster rate rather than maximizing While analysts expected higher vehicle volume to push wholesale gross per unit. prices down, they actually increased as a result of record retail profit opportunities available to dealers in 2015.2 These near- Infusing speed and efficiency into the wholesale-to-retail process record wholesale prices were the result of several factors, — from inventory identification, acquisition and floor-planning to including strong new vehicle pricing, higher employment levels/ inspection, transportation and merchandising — is a particularly job stability and increased dealership operating efficiencies.2 effective and increasingly necessary way that progressive dealerships can meet these goals. -

Program Directors Have Enormous Respon- Sibilities These Days. They

THE BEST PROGRAM DIRECTORS IN AMERICA Program directors have enormous respon- Putting together this list every year starts successful? How are they positioning their sibilities these days. They must produce with a nomination, typically from someone stations in the community? And we can the best content in all of audio, because who ranks higher in the company than the tell you, without a doubt, this year’s PDs the competition for ears has never been nominated PD, maybe even the CEO. We have provided us — and you — with a gold greater. They have to find and teach and go from there, with a questionnaire and a mine of ideas. They were extremely open massage new local talent. And they surely look at ratings, experience, awards, and and willing to teach, to pass it on. This is must help produce a product the sales several other factors. We reach out to pro- an issue you’ll be hiding from your boss. In department can successfully sell so that gramming experts in the industry for input, fact, we’ll be using some of what these PDs fire-breathing GM can be calm, cool, and in all formats and in all market sizes, and have provided us in several future issues — collected while sending that nice big piece we crunch the numbers. Then we crumple there was so much, and it was that good. of the cash-flow action back to corporate. them up and crunch them again. One of the biggest lessons we learned Oh, and by the way, many PDs had the In addition to listing names next to num- from the Best Program Directors in added aggravation this past year of that bers, we put this list together hoping each America: Do everything in your power to little bird called Voltair sitting on their and every PD who appears will provide take care of your community. -

Nab Final Volume 2 P

PUBLIC VERSION Before the COPYRIGHT ROYALTY JUDGES LIBRARY OF CONGRESS Washington, D.C. ) In The Matter Of: ) ) Determination of Royalty Rates ) 14-CRB-0001-WR (2016-2020) for Digital Performance in Sound ) Recordings and Ephemeral ) Recordings (Web IV) ) ) WRITTEN DIRECT STATEMENT OF THE NATIONAL ASSOCIATION OF BROADCASTERS Witness Testimony Volume 2 of 3 Bruce G. Joseph (D.C. Bar No. 338236) [email protected] Karyn K. Ablin (D.C. Bar No. 454473) [email protected] Michael L. Sturm (D.C. Bar No. 422338) [email protected] WILEY REIN LLP 1776 K St. NW Washington, DC 20006 Phone: 202-719-7000 Facsimile: 202-719-7049 Counsel for the National Association of Broadcasters October 7, 2014 A Before the COPYRIGHT ROYALTY JUDGES LIBRARY OF CONGRESS Washington, D.C. ) In The Matter Of: ) ) Determination of Royalty Rates ) 14-CRB-0001-WR (2016-2020) for Digital Performance in Sound ) Recordings and Ephemeral ) Recordings (Web IV) ) ) WRITTEN DIRECT TESTIMONY OF MICHAEL L. KATZ (On behalf of the National Association of Broadcasters) October 7, 2014 CONTENTS I. INTRODUCTION AND OVERVIEW ............................................................................ 1 II. QUALIFICATIONS .......................................................................................................... 9 III. THE STATUTORY STANDARD .................................................................................. 11 IV. THE ECONOMICS OF EFFECTIVE COMPETITION ............................................ 14 A. THE BENEFITS OF COMPETITION ............................................................................ -

The Phenomenon of Social Computing

The Phenomenon of Social Computing A Thesis submitted in fulfilment of the requirements for the degree of Doctor of Philosophy By Marie D Fernando School of Computing, Engineering and Mathematics May 2019 ©Marie D Fernando Dedication To the two most beautiful concepts I know: God above and Family Acknowledgements It is indeed gratifying to realise that I have reached the completion of this arduous but the most fulfilling journey of PhD. I am overwhelmed with gratitude to my Principal Supervisor Professor Athula Ginige. First and foremost for having confidence in me to accept me as a PhD student an investment no students can pay back in a life time. Your intellectual guidance has transformed my plain thought process into a logical one that it frightens me to think or perceive the perceptions otherwise. I have begun to observe causality in simplest natural phenomena the same way I have in the phenomenon of interest of this journey. That impeccable training with unwavering patience, and most of all that universe of knowledge affirms once and again that I could not have imagined having a better advisor and mentor for my PhD study. Besides my advisor, my sincerest thanks to my Co-Supervisor Associate Professor Ana Hol. Your academic training with hard questioning has moulded my mind to question my own thinking and writing logically. This has incented me to widen my research from various perspectives. Your insightful comments and ever present encouragement has held me in good stead throughout this PhD journey. I would also like to thank all my lab mates for the stimulating discussions, collaborative work and fun.