Fusion Events Limited

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

State District Branch Address Centre Ifsc Contact1 Contact2 Utib0001208 07543

STATE DISTRICT BRANCH ADDRESS CENTRE IFSC CONTACT1 CONTACT2 SONAL APARTMENT, NR. RAILWAY STATION, BILALA MILL ROAD, ASHOK SHRI. AAFAK MADHYA ASHOK ASHOK NAGAR - 473 ASHOKNAGA MANSOORI. PRADESH NAGAR NAGAR 331. M. P R UTIB0001208 MANAGER 07543 - 222194 GROUND FLOOR, “VASANT VIHAR”,HAN UMAN CHOWK, SHRI BALAGHAT,M DEBASISH ADHYA PAL. MADHYA PRADESH, ASST. VICE PRADESH BALAGHAT BALAGHAT PIN 481001 BALAGHAT UTIB0001170 PRESIDENT (0763) 224466 Anjad Branch Ground Floor,Barwani Road Near IOCL Petrol Pump, Anjad, Anjad, District: MADHYA Barwani Barwani Pin: PRADESH BARWANI (Semi Urban) 451556 ANJAD UTIB0002537 7554097913 - KUNDIYA PALACE, OPP. OLD ROADWAYS DEPOT, KHANDWA- SHRI BARODA SONESH ROAD, TIWARI MADHYA BARWANI - ASST VICE PRADESH BARWANI BARWANI 451551 BARWANI UTIB0001313 PRESIDENT 07290-223377 150/25, GROUND FLOOR,"KES HAV KUNJ", A.B.ROAD,SE NDHWA, SHRI. DIST.BARWA ABHISHEK NI,MADHYA JOSHI. MADHYA PRADESH, SR. PRADESH BARWANI SENDHWA PIN 451666 SENDHWA UTIB0001174 MANAGER (07281) 222400 COLLEGE ROAD, SHRI BEETUL,MAD SOMESH HYA MISHRA. MADHYA PRADESH, SR. PRADESH BETUL BEETUL PIN 460001. BETUL UTIB0001350 MANAGER (07141) 234047,234057 AXIS BANK LTD, SHAHPURA BRANCH, GR. FLOOR, OPP. BSNL OFFICE, JABALPUR ROAD, MR. SHAHPURA - BRIJENDRA 481 990. KUMAR MADHYA MADHYA SR. PRADESH BETUL SHAHAPURA PRADESH SHAHAPURA UTIB0001397 MANAGER 07640 - 230064 VEERABHAD RESWARA NILAYA,BIDA R- BANGALORE ROAD,SHAH PUR,DIST.GU SHRI LBARGA,KAR BANDISH MADHYA NATAKA,PIN SR. PRADESH BETUL SHAHPUR 585223 SHAHPUR UTIB0001320 MANAGER (08479) 240500/ 01 /02 SHREE SATYA SAI COMPLEX,W ARD NO.12, LIC SATELITE OFFICE,GWA LIOR SHRI ROAD,BHIND SANKET ,MADHYA UPADHYAY MADHYA PRADESH,PI SR. PRADESH BHIND BHIND N 477001 BHIND UTIB0001351 MANAGER (07534) 233054/ 55 GROUND FLOOR C 1 AND C 2 COMMERCIA L COMPLEX AWADHPURI PHASE II MADHYA AWADHPURI BHOPAL 91 PRADESH BHOPAL BHOPAL 462022 BHOPAL UTIB0002663 7554097914 GROUND & MEZZANINE FLOORS, 74, RAJDEV COLONY, OFF. -

2008-2009 Is Given in Annexure 3

ANNUAL REPORT 2008-09 Contents Sl. No. Particulars Page 1. From the Director 65 2. PGP Admission and Financial Aid 66 3. Post Graduate Programme (PGP) 67 4. Convocation 69 5. Placement 71 6. Student Activities 73 7. Fellow Programme in Management (FPM) 75 8. Executive Post Graduate Programme in Management (EPGP) 76 9. Management Development Programme 77 10. Computer Facilities 79 11. Library 80 12. On – Going Research Projects 81 13. Foundation Day 82 14. Publication and Conferences 83 15. Visitors to the Institute 87 16. Grant- in – Aid 88 17. On – Going Campus Development Projects 89 18. Personnel 91 19. Faculty 92 20. Board of Governors 94 21. Society Members 95 22. Audit Report 96 23. Balance Sheet 100 24. Annexures 119 64 1. From the Director The Indian Institute of Management (IIM) Indore is in its second decade of existence. IIM, Indore has already gained the reputation of the fastest growing management Institute in the country. As in the past, the Institute continues to offer the flagship Post Graduate Programme (PGP), 18 months Executive Post Graduate Programme and a portfolio of open and incompany courses. The placement activities of the Institute in 2009 have been smooth despite an economic meltdown. There has been a change in the leadership position since 27.11.2008. The year ending March 2009 saw a number of initiatives to strengthen the processes and systems in the Institute. The faculty and staff profile is being redefined in order to encourage effective quality delivery of academic activities in the Institute. The Institute is poised for significant growth in academic activities. -

Route Map for Indore Metro

LINE 1 CH 0 + 000.000 SRI ARBINDO HOSPITAL BHAWARSALA SQUARE SUPER CORRIDOR 1 2 3 + 0 LINE 2 0 1 CH 5 0 0 .8 + 00 1 0.0 9 00 7 2 + 4 3 + 2 0 1 H 0 5 .8 C 0 1 2 2 0 DEWAS NAKA + 4 2 2 + H MR 10 ROAD 0 C 0 SUPER CORRIDOR 2 0 C H 2 1 + C 36 H 1 .8 2 5 2 LINE 4 1 1 2 + 5 + 1 15 + 1. 0 8 0 5 1 0 1 0 5 0 .8 SANWER 1 0 8 0 CH + 0 5 + 2 00 INDUSTRIAL AREA 0.0 MR 9 SUPER CORRIDOR 3 H 00 C 1 5 .8 1 5 4 ISBT / MR 10 FLYOVER + 5 2 H C 2 LAHIYA COLONY 0 NIRANJANPUR CIRCLE + 2 6 0 + 0 0 0 0 0 SUPER CORRIDOR 4 CONVENTION CENTER 19 +0 0 2 0 7 + ARANYA NAGAR 0 0 CHANDRAGUPTA SQARE0 GANESH SHAM COLONY HIRA NAGAR 2 8 + 0 0 1 0 8+ 00 SUPER CORRIDOR 5 0 SUKLIYA BAPAT SQUARE IDA PARK MEGHDHOOT GARDEN 2 9 + VIJAY NAGAR SQUARE BANGANGA 0 0 3 17 0 + 0 0 0 0 0 0 + 0 . 0 5 0 9 + 0 0 0 3 0 0 4 . 0 1 H 3 2 + C + 0 5 NANDA NAGAR 0 H SUPER CORRIDOR 6 0 MAIN ROAD C LAXMIBAI NAGAR SQUARE RADISON SQUARE BHAMORI 16 0 C 0 0 + + H 2 T 0 3 0 6 + 0 57 O 0.0 MAZDOOR 00 P PATNI PURA / E MAIDAN LINE 3 D ST JOSEPH CHURCH MUMTAJ BAG COLONY 0 CH 6 + 840.00 C CH 6 + H 15 900.000 + 36 1.852 00 CH 0 MARI MATA SQUARE +15 + 0 15 81.852 0.000 CH 7 + 20 MALWA MILL 3 3 + 0 0 SQUARE 0 LINE 3S 2 5 C 2 GHANDI NAGAR / 8 H . -

List Ayurvedic Manufacturing Unit Web Side.Pdf

List Ayurvedic Manufacturing Unit S.N Name Address Licence No M/S. Aburva Herbal Products Plot No. 6, Survey No.-259, Sukhaliya Gaon, MP/25D/14/333 1 Near Sector-D, Sanwer Road, Indore (M.P.) 2 M/S. Abhijeet Industrial 119 Vivcka Nand Ward Yadav Colony Jablpur MP25D/11/158 3 M/S. Ajmera Herbals Ltd., 276, Sector E, Sanwer Road, Indore) MP/25D/10/111 4 M/S. Afex Herbal, 136&137 A Industrial Area Ext Road Indore MP/25D/13/241 M/S. Anglo French Drug & Industries 41-3rd Cross,Ssi Area,Block- MP25E08/057 V,Rajajinagar,Bangalore560010 (Loan Lic. M/S. Makson Health Care Plot No 6-A Sector D New 5 Industrial Area Akvn Mandideep Raisen) 6 M/S. Anachem Labs B - 8, Scheme No.-51, Commercial Sector, Indore MP/25D/15/367 7 M/S Anuj Herbals Products Main Road Burhar Distt Shahdol MP25D/11/164 8 M/S. Ammmi Pharmaceuticals 2-Dr. Lagan Compound, Sehore-1 25D/13/81 9 M/S. Atul Pharmaceuticals, Budhni Tiraha, Budhni, Distt.-Sehore MP/25D/14/322 10 M/S. Adarsh Pharmaceuticals Post Office Bariatha, Sagar 25D/7/89 11 M/S. Anglo Swift Medi Science, 119 - Industrial Area, Dewas Road Ujjain MP/25D/14/344 M/S. Ayurvedic Herbals Products Research Center Khasra No 162,Near Police Station Ghughri Distt MP25D/08/050 12 Mandla 13 M/S. Arvind Brothers 32-Doodh Talai Road, Padawa, Khandwa AYUR 33D/77 14 M/S. Ashwani Pharmaceutical Gram Lahehua Past Raghunath Pul Distt Siddhi MP/25D/09/62(B) 15 M/S. -

Trade Marks Journal No: 1965, 14/09/2020

Trade Marks Journal No: 1965, 14/09/2020 Reg. No. TECH/47-714/MBI/2000 Registered as News Paper p`kaSana : Baart sarkar vyaapar icanh rijasT/I esa.ema.raoD eMTa^p ihla ko pasa paosT Aa^ifsa ko pasa vaDalaa mauMba[mauMba[---- 400037400037400037 durBaaYa : 022 24101144 ,24101177 ,24148251 ,24112211. Published by: The Government of India, Office of The Trade Marks Registry, Baudhik Sampada Bhavan (I.P. Bhavan) Near Antop Hill, Head Post Office, S.M. Road, Mumbai-400037. Tel: 022 24101144, 24101177, 24148251, 24112211. 1 Trade Marks Journal No: 1965, 14/09/2020 Anauk/maiNakaAnauk/maiNakaAnauk/maiNaka INDEX AiQakairk saucanaaeM Official Notes vyaapar icanh rijasT/IkrNa kayaakayaa----layalaya ka AiQakar xao~ Jurisdiction of Offices of the Trade Marks Registry sauiBannata ko baaro maoM rijrijaYT/araYT/ar kao p`arMiBak salaah AaoOr Kaoja ko ilayao inavaodna Preliminary advice by Registrar as to distinctiveness and request for search saMbaw icanhsaMbaw icanh Associated Marks ivaraoQa Opposition ivaiQak p`maaNa p`p`~~ iT.ema.46 pr AnauraoQa Legal Certificate/ Request on Form TM-46 k^apIra[T p`maaNa p`~ Copyright Certificate t%kala kayat%kala kaya-kaya--- Operation Tatkal saavasaavasaava-saava---jainakjainak saucanaaeM Public Notices iva&aipt Aavaodna Applications advertised class-wise: 2 Trade Marks Journal No: 1965, 14/09/2020 vagavagavaga-vaga--- /// Class - 1 11-122 vagavagavaga-vaga--- /// Class - 2 123-163 vagavagavaga-vaga--- /// Class - 3 164-607 vagavagavaga-vaga--- /// Class - 4 608-662 vagavagavaga-vaga--- / Class - 5 663-2319 vagavagavaga-vaga--- -

Fincare Small Finance Bank

THE SMARTER www.fincarebank.com ALTERNATIVE Leveraging SmartBanking technology, for inclusive growth Annual Report 2017-18 Index 1 Bank with a difference - What Sets us Apart 02 2 From a Rich Legacy to a Smarter and Brighter future 03 3 The Growth Years 05 4 Smart Growth - the Year in Perspective 07 5 Chairman’s Message 13 6 MD & CEO's Message 15 7 Board of Directors 18 8 Management Team 19 9 Our Network 21 10 Our Product Portfolio 23 11 A Smart Transformation from Microfinance to Rural Banking 33 12 Digital Banking – Smarter Way to Rurban Banking 37 13 Ahead with Smart Technology 40 14 Fincare – The Making of a Smart Bank 43 15 Social Initiatives - Caring for the Communities we work within 47 16 Human Capital - People are the Biggest Strength 49 17 SmartBanking Outlets 55 18 Centralized Processing Centre – the Smart Backbone 57 19 Risk, Compliance, Field Monitoring and Audit – Building Smart Controls 59 20 Director's Report (Annexures I,II,III,IV) 67 21 Management Discussion and Analysis 104 22 Pillar III Disclosures 108 23 Independent Auditors Report 119 24 Financials with all the Schedules 121 SMARTER IS THE NEW BETTER Using technology, we have simplified, dis-intermediated and democratized the access to Finance. We truly believe that - "if it is worth doing, it is worth doing smarter!" This is Fincare SFB's chosen path. BANK WITH A DIFFERENCE WHAT SETS US APART Superior understanding of Assisted banking - tab based customers - a strong legacy in solutions across all retail Micronance and deep businesses. penetration in rural markets. -

Unpaid Dividend for the Year 2010-2011 Vakrangee Limited

VAKRANGEE LIMITED UNPAID DIVIDEND FOR THE YEAR 2010-2011 Sr. No. Folio No./DPCLID Name of the Shareholder Shareholder Address Dividend Amount Proposed date of transfer to IEPF 1 '0000061 KAPILMUNI CHATURVEDI B-305, BHARATI DEEP, NAVGHAR CROSS ROAD, 200 24.10.2018 BHAYANDER(EAST), THANE 2 '0005299 PITAMBER DUTT LOHIMI 200 24.10.2018 3 '0005300 MUKATA LOHOMI 200 24.10.2018 4 '0005301 NAMITA LOHOMI 200 24.10.2018 5 '0011947 DHARAM CHAND JAIN 400 24.10.2018 6 '0011948 JATAN DEVI JAIN 400 24.10.2018 7 '0012212 MANGAL BHAWAN GOENKA'S AMBER COMPLEX, SANSAR CHANDRA 800 24.10.2018 HOLDINGS PVT LTD ROAD, LL-50, IST FLOOR, JAIPUR (RAJASTHAN) 8 '0012512 YOGITA KUCHERIA 2-B/104, TRIVENI NAGAR, JANATA NAGAR ROAD, 400 24.10.2018 BHAYANDER (W), DIST. THANE 9 '0012957 A V MURTHY NO.7,OUT HOUSE, 10TH MAIN 3RD BLOCK, 200 24.10.2018 JAYANAGAR, BANGALORE - 11 10 '0013249 SARUJIT SINGH MAKKER 1-JOINT HOUSE, HARDEV NAGAR, KAPURTHALA 200 24.10.2018 ROAD, JALANDHAR - 2 11 '0013262 SWAROOPCHAND M MARKET YARD, LASALGAON, TQ. NIPHAD. DIST. 200 24.10.2018 CHATTURMUTHA NASIK 12 '0013269 BARKHA B MUTHA MUTHA BHAVAN COURT ROAD AHMEDNAGAR 200 24.10.2018 13 '0013308 JASWANTSINGH C THAKUR BARRACK NO 1324, CAMP NO 4, ULHASNAGR, DIST. 200 24.10.2018 THANE 14 '0013665 NIDHI DHIMANTRAY TARPANKHADO, SHAKTINAGAR, NEAR GAYATRI 400 24.10.2018 JASANI MANDIR, KALAWAD ROAD, RAJKOT 15 '0013917 RAGHUNATH D WANI SANTOSHI MATA NAGAR, GROGRASS WADI, 600 24.10.2018 DOMBIVALI (E), DIST - THANE. 16 '0013965 TIKAM CHAND 1068, DUDHIYA MOHALA, POST NASIRABAD 200 24.10.2018 17 '0014039 RUKAMANI DEVI 1068, DUDHIYA MOHALLA POST NASIRABAD RAJ 200 24.10.2018 18 '0014901 VINAY KUMAR KANSAL 17, ACHROL HOUSE CIVIL LINES JAIPUR - RAJASTHAN. -

Tender Document for Providing, Erecting & Furnishing

INDIAN INSTITUTE OF MANAGEMENT INDORE Prabandh Shikhar, Rau-Pithampur Road, Indore-453556 (M.P.), India Tender Document TENDER DOCUMENT FOR PROVIDING, ERECTING & FURNISHING TENTS/STALLS/STAGE AND SUPPORTING INFRASTRUCTURE FOR IIM FOUNDATION DAY (2ND OCTOBER 2014 TO 3RD OCTOBER 2014) TO BE HELD AT IIM INDORE. BID ISSUE DATE : 20-09-2014 From 3:00 PM ONWARDS FORM OF TENDER : Limited Tendering LAST DATE OF BID : 26/09/2014 SUBMISSION Up to 3:00 PM DATE OF TECHNICAL : 26/09/2014 BID OPENING At 4:00 PM Page 1 of 48 TENDER DOCUMENTS VOLUME- I : (TECHNICAL BID) VOLUME- II : (TENDER SPECIFICATION) VOLUME- III : (TENDER DRAWINGS) VOLUME- IV : (FINANCIAL BID) Note: Tender document can be downloaded from official website of IIM Indore under URL: http://www.iimidr.ac.in/iimi/index.php/tenders. The bid along with the Demand draft for EMD and Tender Fees (Non Refundable) shall be submitted by the bidder in the form of Cash / DD in original (as applicable) through Dak or hand delivery so as to reach to the Director, IIM Indore, on or before 26.09.2014 at 03:00PM. Page 2 of 48 VOLUME-I TECHNICAL BID TENDER DOCUMENT FOR PROVIDING, ERECTING & FURNISHING TENTS/STALLS/STAGE AND SUPPORTING INFRASTRUCTURE FOR IIM FOUNDATION DAY (2ND OCTOBER 2014 TO 3RD OCTOBER 2014) TO BE HELD AT IIM INDORE. VOLUME I – A CONTENTS 1.0 INVITATION TO BID 2.0 FORM OF TENDER & CONTRACT DATA 3.0 INSTRUCTIONS TO BIDDERS 1.0 INVITATION TO BID Sub: Invitation to bid for Providing, Erecting & Furnishing Tents/Stalls/Stage and supporting Infrastructure for the foundation day of IIM Indore to be held at Indore, scheduled on 02/10/2014 to 03/10/2014. -

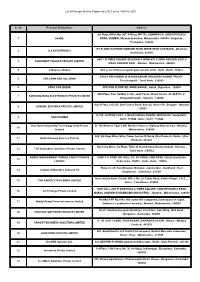

DLT Entities List

List of Principal Entities Registered in DLT as on 10th Feb 2021 Sr. No Principal Entity Name Address 9th Floor, Office No. 907, B-Wing, MITTAL COMMERCIA, ANDHERI KURLA 1 kwality ROAD, MUMBAI, Mumbai Suburban, Maharashtra, 400059 , Nalgonda , Telangana , 508246 1ST FLOOR RATHORE MANSION BANK MORE NEAR UCO BANK , Dhanbad , 2 S A ENTERPRISES Jharkhand , 826001 uNIT 1 B TIMES SQUARE BUILDING A WING 4TH FLOOR ANDHERI KURLA 3 DIGIKREDIT FINANCE PRIVATE LIMITED ROAD ANDHERI EAST , Mumbai , Maharashtra , 400059 4 ndfinancesolution A33 second floor peragarhi gaon pashim vihar , Delhi , Delhi , 110087 5/164/1 ARIYAVOOR VIJAYANAGARAM UKKADARIYAVOOR TRICHY , 5 CAR LOAN DSA ALL BANK Tiruchirappalli , Tamil Nadu , 620009 6 APNA CAR BAZAR OPP KGN FLOOR MIL SOOR SAGAR , KotaA , Rajasthan , 324005 20th Floor, Two Horizon Centre, Golf Course Road, Sector -43, DLF Ph. V , 7 SAMSUNG INDIA ELECTRONICS PRIVATE LIMITED GurgaonGurgaon , Haryana , 122002 Vipul Plaza, 215-220, Golf Course Road, Suncity, Sector 54 , Gurgaon , Haryana 8 GROUPE SEB INDIA PRIVATE LIMITED , 122002 D-798, JAITPUR PART -2, NEAR HOLIKA CHOWK, NEW DELHI, South Delhi, 9 HAACHI INDIA Delhi, 110044 , Delhi , Delhi , 110044 interTouch Hospitality Technology India Private B -708 Western Edge II Off, Western Express Highway Borivali East , Mumbai , 10 Limited Maharashtra , 400066 920, 9th Floor Wave Silver Tower Sector-18 Noida Uttar Pradesh , Noida , Uttar 11 Blink Advisory Services Pvt Ltd Pradesh , 201301 Kochchar Bliss, 1st Floor, Thiru Vi. Ka Industrial Estate, Guindy , Chennai , 12 TVS Automobile Solutions Private Limited Tamil Nadu , 600032 AGNES MANAGEMENT CONSULTANCY PRIVATE SHOP F-3, PROP NO. 602/2, F/F, GT ROAD, LONI ROAD, DELHI, East Delhi, 13 LIMITED Delhi, India, 110032 , Delhi , Delhi , 110032 Shop no- 05, Tulsi Bhawan ,Bistupur, Jamshedpur, Jharkhand , East 14 shrotam informatics india pvt ltd Singhbhum , Jharkhand , 831001 Karur Vysya Bank, Central Office, No. -

Indian Institute of Management Indore Prabhandh Shikhar, Rau-Pithampur Road, Indore, 453556, M.P

Indian Institute of Management Indore Prabhandh Shikhar, Rau-Pithampur Road, Indore, 453556, M.P. Phone: 731-2439666, Fax: 731-2439800 Website : www.iimidr.ac.in; Email: [email protected] INFORMATION PUBLISHED IN PURSUANCE OF SECTION 4(1) (a) OF THE RIGHT TO INFORMATION ACT, 2005 List of Files S. No. Departments 1 AA on RTI Matters 2 Admission 3 BBBEP 4 Dean (Administration) 5 Director’s Office 6 EPGP 7 EPGP-EG 8 Estate 9 FDP 10 Finance & Accounts 11 FPM 12 IPM Office 13 IT 14 Library 15 MDP 16 Office of CAO 17 Personnel 18 PGP 19 PIO Office 20 Placement 21 Project Department 22 Publication 23 Reception & Dispatch 24 Research 25 Safety 26 Sport Complex 27 Stores & Purchase 28 Students Affairs & Hostel 29 Transport Page | 1 1. AA on RTI Matters S. No. File Name Name/File No. 1 RTI Appeal File 1 2 RTI Appeal File 1 3 RTI Appeal File 1 4 RTI Appeal File 1 2. Admission S. No. File Name Name/File No. 1 Acceptance/Withdrawal Info 1997 2 Index of Student Files PGP 1998 - 2000 3 PGP Admissions 1998 - 2000 4 Acceptance/Withdrawal Info 1999 - 2001 5 Admissions Expenses 1999 - 2001 6 Index of Student Files - I PGP 1999 - 2001 7 Index of Student Files - II PGP 1999 - 2001 8 PGP Admissions 1999 - 2001 9 Admissions Expenses 2000 10 Budget Estimates 11 Education Loans 12 Education Loans 13 Govt. Matters (Reservations) 2000 - 2006 14 Index of Student Files - I PGP 2000 - 2002 15 Index of Student Files - II PGP 2000 - 2002 16 Inter Office Memo 17 Interview Reschedule 2000 - 2002 Batch 18 PGP Admission Interview 2000 - 2002 Batch 19 PGP Admissions -

Internal Quality Assurance Cell (IQAC)

Internal Quality Assurance Cell (IQAC) Annual Quality Assurance Report (AQAR) [ 2010 – 11 ] Name of the Institution: PRESTIGE INSTITUTE OF MANAGEMENT AND RESEARCH, INDORE Year of Report: 2010-2011 Director : DR. YOGESHWARI PHATA K (O) 0731 – 4012222 / 03 (M) +91 -9826385332 E-Mail: [email protected] [email protected] Co -ordinator of IQAC : DR. KAPIL ARORA , Associate Professor (O) 0731 - 4012222 / 36 (M) +91 -97131 01567 E-Mail: [email protected] [email protected] 1 PIMR / IQAC / AQAR / 2010-11 PART – A The Institute was accredited by NAAC in 2009 and IQAC was constituted as a post accreditation exercise to monitor all aspects of quality improvement in the Institute. The following were decided as the plan of action for the academic year 2010-11 by the IQAC in consultation with the various departments of the Institute and also reported in the first IQAC Report to NAAC in the year 2009-10. Part C: Detail the plans of the institution for the next year. For the ensuing year 2010-11; the Institute has following plans: € Introduction of New Courses in MBA, viz., MBA (FA) and MBA (PA) € Running the MBA Institute in two shifts € Increasing the intake of students across all the courses € Updations of the old syllabuses of MBA(FA) and MBA(PA) of DAVV, Indore and bringing them on par with the existing courses € Strengthening of existing International MOUs and entering into newer MOUs with like minded Institutions and Universities € Upgradation of PIMR to the Status of Deemed University / Private University € Increasing International Linkages and tieups for exchange of Faculty and Students € Enhancing the scope of Consultancy and MDPs € Strengthening existing linkages with National Professional bodies, viz., ISTE, ISTD, NHRD, NEN, AIMS, etc. -

Final Report

To Collect Data of Raw Drugs Medicinal and Aromatic Plants Trader-Exporter-Importer-Extractor from approx. 50 Mandis of India Project No. F.No.A-11019/10/Mkt./ND-03/2016-NMPB VII Submitted with: National Medicinal Plants Board Ministry of AYUSH Government of India Indian Red Cross Society (IRCS), Annexe Building, 1st & 2nd Floor, 1, Red Cross Road, New Delhi-110 001 E: [email protected] | W: www.nmpb.nic.in From: Rawal Medherbs Consultants LLP C-3/22, Phase-2, Ashok Vihar, Delhi-110 052 E: [email protected] | W: www.medherb.in On: June, 2019 Disclaimer Rawal Medherbs Consultants LLP (RMC) did the best possible efforts to collect, compile, process and analysis the data, to be useful to readers. As we collected price data from different kinds of stakeholders i.e. trader, wholesaler, exporter, importer etc. in different markets (from north to south and east to west), it could be vary due to other factors involved i.e. distance from sourcing point to market, transportation cost, warehousing & cold storage charges, daily wages, commission structure etc. But we try our best to deliver near to accurate. RMC cannot be liable for omissions or inaccuracies. RMC does not warrant that the data will meet the user’s needs or expectations, that the use of the data will be uninterrupted, or that all non- conformities, defects, or errors can or will be corrected. RMC shall not be liable for any claim for any loss, arising from access to or use of data or information. Therefore, we release all of data with this disclaimer.