Gigaset Sponsored Research Newsflash 3 December 2020

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Siemens Limited Siemens Aktiengesellschaft

LETTER OF OFFER THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION This Letter of Offer is sent to you as a shareholder(s) / beneficial owner(s) of Siemens Limited. If you require any clarifications about the action to be taken, you may consult your stock broker or investment consultant or the Manager to the Offer / Registrar to the Offer. In case you have recently sold your shares in Siemens Limited, please hand over this Letter of Offer and the accompanying Form of Acceptance-cum-Acknowledgement, Form of Withdrawal and Transfer Deed (in case of physical form) to the member of the stock exchange through whom the said sale was effected. CASH OFFER AT Rs. 930/- (Rupees Nine Hundred and Thirty only) PER FULLY PAID-UP EQUITY SHARE (“Offer Price”) Pursuant to The Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 1997 and subsequent amendments thereof (the “SEBI (SAST) Regulations”) TO ACQUIRE 66,829,060 fully paid-up equity shares of face value Rs. 2/- each (“Offer”) representing 19.82% of the issued, subscribed and fully paid-up equity share capital (“Offer Size”) OF Siemens Limited Registered Office: 130, Pandurang Budhkar Marg, Worli, Mumbai - 400 018 Tel: +91-22-2498 7000, Fax: +91-22-2498 7500 (the “Target Company”) BY Siemens Aktiengesellschaft Registered Office: Wittelsbacherplatz 2, 80333 Munich, Germany Tel: +49 (0) 89 636-00, Fax:+ +49 (0) 89 636-34-242 (the “Acquirer” or “Siemens AG”) Note: 1. The Offer is being made pursuant to and in accordance with the provisions of Regulation 11(2A) of the SEBI (SAST) Regulations and subsequent amendments thereto. -

Annual Report

ANNUAL REPORT Gigaset Annual Report 2011 ! TABLE OF CONTENTS Executive Board interview 6 Dialog with resellers and customers 12 The Capital Market and the Gigaset Share 24 Corporate Governance 28 Report of the Supervisory Board 34 Combined Management Report 38 Consolidated Financial Statements of Gigaset AG 88 - Consolidated Income Statement 90 - Statement of Comprehensive Income 92 - Consolidated Statement of Financial Position 94 - Consolidated Statement of Changes in Equity 96 - Consolidated Cash Flow Statement 98 - Notes to the Consolidated Financial Statements 100 A. General Information and Presentation of the Consolidated Financial Statements 100 B. Summary of Principal Accounting and Valuation Methods 112 C. Notes on Financial Instruments 130 D. Notes to the Income Statement 147 E. Notes to the Balance Sheet 159 F. Other Information 191 Report of the Executive Board 220 Auditor‘s Report 221 Financial Calender 222 Imprint 223 List of Shareholdings 224 4 Gigaset Annual Report 2011 GIGASET AG 2011 ANNUAL REPORT Milestones in 2011 January zzGigaset AG sells its interest in Carl Froh to the management February zz100% of the shares of SM Electronic GmbH are taken over zzThe Company‘s new name, Gigaset AG, is recorded in the commercial register zzGigaset AG sells its interest in Oxxinova March zzDr. Alexander Blum is appointed to the Executive Board as CFO zzGigaset enters the enterprise customer market with telephone systems from the Gigaset pro series. zzInclusion of Gigaset AG in the TecDAX April zzWorld‘s first in fixed-line telephony. Gigaset launches handsfree clip for complete freedom of movement. June zzThe annual shareholders’ meeting of Gigaset AG elects Rudi Lamprecht and Susanne Klöß as two new members of the Supervisory Board zzRudi Lamprecht is voted Chairman of the Supervisory Board zzProf. -

EU Top Applicants 2010-2014 Based on Assignees2014 5Yr.Tsv

EU top applicants 2010-2014 Based on Assignees2014 5yr.tsv table_row ordering_cd 15943 309 13406 105 13407 105 13408 105 13409 105 13410 105 13411 105 13412 105 13413 105 13414 105 13415 105 13416 105 13417 105 13418 105 13419 105 13420 105 13421 105 13422 105 13423 105 13424 105 Page 1 of 1235 09/26/2021 EU top applicants 2010-2014 Based on Assignees2014 5yr.tsv st_country_cd us_or_foreign FRX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) ATX (Foreign) Page 2 of 1235 09/26/2021 EU top applicants 2010-2014 Based on Assignees2014 5yr.tsv state_country_of_origin assignee_name FRANCE IMERJ, LTD. AUSTRIA INFINEON TECHNOLOGIES AG AUSTRIA ~INDIVIDUALLY OWNED PATENT AUSTRIA AMS AG AUSTRIA NXP B.V. AUSTRIA JULIUS BLUM GMBH AUSTRIA BAXTER INTERNATIONAL INC. AUSTRIA EPCOS AG AUSTRIA INFINEON TECHNOLOGIES AUSTRIA AG AUSTRIA MED-EL ELEKTROMEDIZINISCHE GERAETE GMBH AUSTRIA SIEMENS AKTIENGESELLSCHAFT AUSTRIA AVL LIST GMBH AUSTRIA MAGNA POWERTRAIN AG & CO KG AUSTRIA HILTI AKTIENGESELLSCHAFT AUSTRIA BOEHRINGER INGELHEIM INTERNATIONAL GMBH AUSTRIA FRONIUS INTERNATIONAL GMBH AUSTRIA SIEMENS VAI METALS TECHNOLOGIES GMBH AUSTRIA CONTINENTAL AUTOMOTIVE GMBH AUSTRIA INTEL MOBILE COMMUNICATIONS GMBH AUSTRIA MAGNA STEYR FAHRZEUGTECHNIK AG & CO. KG Page 3 of 1235 09/26/2021 EU top applicants 2010-2014 Based on Assignees2014 5yr.tsv CY_2010 CY_2011 -

Company Vendor ID (Decimal Format) (AVL) Ditest Fahrzeugdiagnose Gmbh 4621 @Pos.Com 3765 0XF8 Limited 10737 1MORE INC

Vendor ID Company (Decimal Format) (AVL) DiTEST Fahrzeugdiagnose GmbH 4621 @pos.com 3765 0XF8 Limited 10737 1MORE INC. 12048 360fly, Inc. 11161 3C TEK CORP. 9397 3D Imaging & Simulations Corp. (3DISC) 11190 3D Systems Corporation 10632 3DRUDDER 11770 3eYamaichi Electronics Co., Ltd. 8709 3M Cogent, Inc. 7717 3M Scott 8463 3T B.V. 11721 4iiii Innovations Inc. 10009 4Links Limited 10728 4MOD Technology 10244 64seconds, Inc. 12215 77 Elektronika Kft. 11175 89 North, Inc. 12070 Shenzhen 8Bitdo Tech Co., Ltd. 11720 90meter Solutions, Inc. 12086 A‐FOUR TECH CO., LTD. 2522 A‐One Co., Ltd. 10116 A‐Tec Subsystem, Inc. 2164 A‐VEKT K.K. 11459 A. Eberle GmbH & Co. KG 6910 a.tron3d GmbH 9965 A&T Corporation 11849 Aaronia AG 12146 abatec group AG 10371 ABB India Limited 11250 ABILITY ENTERPRISE CO., LTD. 5145 Abionic SA 12412 AbleNet Inc. 8262 Ableton AG 10626 ABOV Semiconductor Co., Ltd. 6697 Absolute USA 10972 AcBel Polytech Inc. 12335 Access Network Technology Limited 10568 ACCUCOMM, INC. 10219 Accumetrics Associates, Inc. 10392 Accusys, Inc. 5055 Ace Karaoke Corp. 8799 ACELLA 8758 Acer, Inc. 1282 Aces Electronics Co., Ltd. 7347 Aclima Inc. 10273 ACON, Advanced‐Connectek, Inc. 1314 Acoustic Arc Technology Holding Limited 12353 ACR Braendli & Voegeli AG 11152 Acromag Inc. 9855 Acroname Inc. 9471 Action Industries (M) SDN BHD 11715 Action Star Technology Co., Ltd. 2101 Actions Microelectronics Co., Ltd. 7649 Actions Semiconductor Co., Ltd. 4310 Active Mind Technology 10505 Qorvo, Inc 11744 Activision 5168 Acute Technology Inc. 10876 Adam Tech 5437 Adapt‐IP Company 10990 Adaptertek Technology Co., Ltd. 11329 ADATA Technology Co., Ltd. -

Spansion Inc. Consolidated List of Creditors

SPANSION INC. CONSOLIDATED LIST OF CREDITORS @FUJITSU REFRE,LTD. @HITACHI CAPITAL CO.,LTD @MARUTO FUDOUSAN CO., LTD. FUJITSU(KABU)KAWASAKIKOJONAI 2-15-12 NISHI-SHIMBASHI 892-1 HIKATA 4-1-1, KAMIKODANAKA, MINATO-KU, TKY 105-8712 OGORI, FKK 838-0112 NAKAHARA-KU JAPAN JAPAN JAPAN @NISSHIN HANBAI CENTER @PEACEMIND, INC. @TOYOTA RENTALEASE CO.,LTD CORPORATION [ADDRESS UNKNOWN] 195-1, IKEDA, SURUGA-KU [ADDRESS UNKNOWN] JAPAN 104 JOB BANK 10K WIZARD TECHNOLOGY, LLC 2S TECH CO. LTD., BAUJUNG RD. 231 3232 MCKINNEY, SUITE 750 302, SIHEUNG BLDG, 382-4, HSINTIEN CITY, TAIPEI HSIEN DALLAS, TX 75204 YATAP-DONG, BUNDANG-KU TAIWAN SUNGNAM-CITY, 09 463-827 SOUTH KOREA 2S TECH CO., LTD 3C SOFTWARE 3COM TECHNOLOGIES NO. 302, SIHUENG BLDG PARKWOOD CIRCLE [ADDRESS UNKNOWN] 382-4 YATAP-DONG, BUNDANG-KU, ATLANTA, GA 30339 SUNGNAM, KYUNGKI-DO 463-070 SOUTH KOREA 3E COMPANY 3E TECHNOLOGY INC. 3M MALAYSIA SDN BHD ASTON AVENUE 87TH STREET SUITE 403 LOT 15 & 19, PERSIARAN BUNGA CARLSBAD, CA 92008 NEW YORK, NY 10128 TANJUNG 2, SENAWANG INDUSTRIAL PARK, SEREMBAN 70450, NEGERI SEMBILAN 3M THAILAND, LTD. 3M 3M 159 12TH FLOOR SERMMIT TOWER BGV7706 PAYSPHERE CIR ASOKE ROAD (SUKHUMVIT 21) PO BOX 200715 CHICAGO, IL 60674-0000 KLONGTOEY WATTANA DALLAS, TX 75320-0715 BANGKOK, THAILAND 10110 1 LA\1947564.1 SPANSION INC. CONSOLIDATED LIST OF CREDITORS 3RD COAST CATERING,LLC 451.COM INC A & B VENDING CO., INC. MILWAUKEE AVE, FIFTH AVENUE 12TH FLOOR 50 NEW SALEM ST. VERNON HILLS, IL 60061 NEW YORK, NY 10010 WAKEFIELD, MA 01880 A E PETSCHE CO., INC. A E STAMP SDN BHD A NURTURED WORLD, INC. -

Interim Report

Interim Report First Quarter of Fiscal !"## www.siemens.com Table of contents Table of contents 03 Key fi gures 0 4 Interim group management report 28 Condensed Interim Consolidated Financial Statements 34 Notes 52 Supervisory Board and Managing Board 53 Review report 54 Quarterly summary 55 Financial calendar INTRODUCTION Siemens AG’s Interim Report for the Siemens Group complies with the applicable le- gal requirements of the German Securities Trading Act (Wertpapierhandelsgesetz – WpHG) regarding quarterly fi nancial reports, and comprises Condensed Interim Consolidated Financial Statements and an Interim group management report in ac- cordance with §!"x (!) WpHG. The Condensed Interim Consolidated Financial State- ments have been prepared in accordance with International Financial Reporting Standards (IFRS) and its interpretations issued by the International Accounting Stan- dards Board (IASB), as adopted by the European Union (EU). The Condensed Interim Consolidated Financial Statements also comply with IFRS as issued by the IASB. This Interim Report should be read in conjunction with our Annual Report for fi scal #$%$, which includes a detailed analysis of our operations and activities. Due to rounding, numbers presented throughout this and other documents may not add up precisely to the totals provided and percentages may not precisely refl ect the absolute fi gures. #, Key fi gures Q# !"## (unaudited; in millions of €, except where otherwise stated) Revenue growth % Volume Q# &## Q# !"#" % Change Q1 2011 19,489 Continuing operations -

Xerox Corporation 00-00-02

00-00-00 (hex) XEROX CORPORATION 00-00-01 (hex) XEROX CORPORATION 00-00-02 (hex) XEROX CORPORATION 00-00-03 (hex) XEROX CORPORATION 00-00-04 (hex) XEROX CORPORATION 00-00-05 (hex) XEROX CORPORATION 00-00-06 (hex) XEROX CORPORATION 00-00-07 (hex) XEROX CORPORATION 00-00-08 (hex) XEROX CORPORATION 00-00-09 (hex) XEROX CORPORATION 00-00-0A (hex) OMRON TATEISI ELECTRONICS CO. 00-00-0B (hex) MATRIX CORPORATION 00-00-0C (hex) CISCO SYSTEMS, INC. 00-00-0D (hex) FIBRONICS LTD. 00-00-0E (hex) FUJITSU LIMITED 00-00-0F (hex) NEXT, INC. 00-00-10 (hex) SYTEK INC. 00-00-11 (hex) NORMEREL SYSTEMES 00-00-12 (hex) INFORMATION TECHNOLOGY LIMITED 00-00-13 (hex) CAMEX 00-00-14 (hex) NETRONIX 00-00-15 (hex) DATAPOINT CORPORATION 00-00-16 (hex) DU PONT PIXEL SYSTEMS . 00-00-17 (hex) TEKELEC 00-00-18 (hex) WEBSTER COMPUTER CORPORATION 00-00-19 (hex) APPLIED DYNAMICS INTERNATIONAL 00-00-1A (hex) ADVANCED MICRO DEVICES 00-00-1B (hex) NOVELL INC. 00-00-1C (hex) BELL TECHNOLOGIES 00-00-1D (hex) CABLETRON SYSTEMS, INC. 00-00-1E (hex) TELSIST INDUSTRIA ELECTRONICA 00-00-1F (hex) Telco Systems, Inc. 00-00-20 (hex) DATAINDUSTRIER DIAB AB 00-00-21 (hex) SUREMAN COMP. & COMMUN. CORP. 00-00-22 (hex) VISUAL TECHNOLOGY INC. 00-00-23 (hex) ABB INDUSTRIAL SYSTEMS AB 00-00-24 (hex) CONNECT AS 00-00-25 (hex) RAMTEK CORP. 00-00-26 (hex) SHA-KEN CO., LTD. 00-00-27 (hex) JAPAN RADIO COMPANY 00-00-28 (hex) PRODIGY SYSTEMS CORPORATION 00-00-29 (hex) IMC NETWORKS CORP. -

IRISLEABHAR OIFIG NA Bpaitinní

PATENTS OFFICE JOURNAL IRISLEABHAR OIFIG NA bPAITINNÍ Iml. 94 Cill Chainnigh 12 June 2019 Uimh. 2387 CLÁR INNSTE Cuid I Cuid II Paitinní Trádmharcanna Leath Leath Official Notice 3976 Applications for Trade Marks 2371 Applications for Patents 3977 Oppositions under Section 43 2418 Applications Published 3978 Revocation of Trade mark 2418 Patents Granted 3979 Application(s) Withdrawn 2418 European Patents Granted 3980 Trade Marks Registered 2418 Applications Withdrawn, Deemed Withdrawn or Trade Marks Renewed 2419 Refused 4152 International Registrations under the Madrid Applications Lapsed 4152 Protocol 2423 Request for Grant of Supplementary Protection International Trade Marks Protected 2439 Certificate 4153 Cancellations effected under the Madrid Supplementary Protection Certificate Granted 4153 Protocol 2441 Supplementary Protection Certificate Withdrawn 4154 Changes/Corrections in the International Application for Extension of the Duration of a Register 2453 Supplementary Protection Certificate 4154 Dearachtaí Designs Information under the 2001 Act Designs Registered 4155 Designs Renewed 4160 The Patents Office Journal is published fortnightly by the Irish Patents Office. Each issue is freely available to view or download from our website at www.patentsoffice.ie © Government of Ireland, 2019 © Rialtas na hÉireann, 2019 (12/06/2019 Patents Office Journal (No. 2387) 3975 Patents Office Journal Irisleabhar Oifig Na bPaitinní Cuid I Paitinní agus Dearachtaí No. 2387 Wednesday, 12 June, 2019 NOTE: The office does not guarantee the accuracy -

Printmgr File

This document constitutes three base prospectuses for the purposes of Art. 5.4 of Directive 2003/71/EC: (i) the base prospectus for Siemens Aktiengesellschaft in respect of non-equity securities within the meaning of Article 22 no. 6 (4) of the Commission Regulation (EC) No. 809/2004 of April 29, 2004 (“Non-Equity Securities”), (ii) the base prospectus for Siemens Capital Company LLC in respect of Non-Equity Securities, and (iii) the base prospectus for Siemens Financieringsmaatschappij N.V. in respect of Non-Equity Securities (together, the “Prospectus”). SIEMENS AKTIENGESELLSCHAFT (A stock corporation incorporated with limited liability in the Federal Republic of Germany) as Issuer of Instruments and as Guarantor for Instruments issued by Siemens Capital Company LLC and Siemens Financieringsmaatschappij N.V. SIEMENS CAPITAL COMPANY LLC (A limited liability company organized under the laws of the State of Delaware, United States of America) as Issuer of Instruments SIEMENS FINANCIERINGSMAATSCHAPPIJ N.V. (A public company incorporated with limited liability in the Netherlands) as Issuer of Instruments €15,000,000,000 PROGRAMME FOR THE ISSUANCE OF DEBT INSTRUMENTS Application has been made to the Luxembourg Stock Exchange for debt instruments (the “Instruments”) issued under the €15,000,000,000 programme for the issuance of debt instruments (the “Programme”) up to the expiry of 12 months after the date of publication hereof to be listed on the official list of the Luxembourg Stock Exchange and admitted to trading on the Luxembourg Stock Exchange’s regulated market (the “Luxembourg Stock Exchange’s Regulated Market”), which is a regulated market for the purposes of Directive 2004/39/EC on Markets in Financial Instruments amending Council Directives 85/611/EEC and 93/6/EEC and Directive 2000/12/EC of the European Parliament and of the Council and repealing Council Directive 93/22/EEC. -

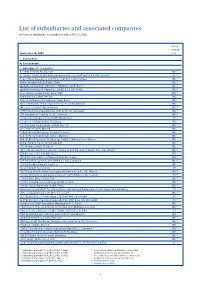

List of Subsidiaries and Associated Companies of Siemens Worldwide in Accordance with § 313 (2), HGB

List of subsidiaries and associated companies of Siemens worldwide in accordance with § 313 (2), HGB Equity interest September 30, 2008 in % I. Subsidiaries A) Consolidated 1. Germany (171 companies) A. Friedr. Flender AG, Bocholt 100 (5) A. Friedr. Flender Grundstücksmanagementgesellschaft mbH & Co. KG, Bocholt 95 (4) Airport Munich Logistics and Services GmbH, Hallbergmoos 100 Alpha Verteilertechnik GmbH, Cham 100 (5) applied international informatics (Holding) GmbH, Berlin 100 applied international informatics GmbH & Co. KG, Berlin 100 (4) Atecs Mannesmann GmbH, Dusseldorf 100 (5) Audio Service GmbH, Herford 100 Berliner Vermögensverwaltung GmbH, Berlin 100 (5) bibis Information Technology and Services GmbH, Munich 100 BWI Services GmbH, Meckenheim 100 (5) CAPTA Grundstücksgesellschaft mbH & Co. KG, Grünwald 100 (4) CAS innovations GmbH & Co. KG, Erlangen 100 (4) CePLuS Steuerungstechnik GmbH, Magdeburg 75 Chemfeed Holding GmbH, Günzburg 100 CommerzFinance & Leasing GmbH, Munich 100 (5) DA Creative GmbH, Munich 100 Dade Behring Beteiligungs GmbH, Eschborn 100 Dade Behring Grundstücks GmbH, Marburg 100 Dade Behring Vertriebs Beteiligungs GmbH, Schwalbach am Taunus 100 Demag Mobile Cranes GmbH, Munich 100 (5) DPC Holding GmbH, Eschborn 100 EDI – USS Umsatzsteuersammelrechnungen und Signaturen GmbH & Co. KG, Munich 100 (4) ELIN Energietechnik GmbH, Berlin 100 ePS & RTS Automation Software GmbH, Renningen 100 (5) ERA Verwaltungsgesellschaft mbH & Co. KG, Grünwald 100 (4) ETM Deutschland GmbH, Laatzen 100 evosoft GmbH, Nuremberg 98 FACTA Grundstücks-Entwicklungsgesellschaft mbH & Co. KG, Munich 100 (4) Flender Grundstücksmanagementgesellschaft mbH & Co. KG, Bocholt 95 (4) Flender Guss GmbH, Chemnitz 100 (5) Flender Immobilien Verwaltungs GmbH, Bocholt 100 (5) Flender Industriegetriebe GmbH, Penig 100 (5) HanseCom Gesellschaft für Informations- und Kommunikationsdienstleistungen mbH, Hamburg 74 HSP Hochspannungsgeräte GmbH, Troisdorf 100 (5) ILLIT Grundstücks-Verwaltungsgesellschaft mbH, Grünwald 95 ILLIT Grundstücks-Verwaltungsgesellschaft mbH & Co. -

Annual Report Milestones in 2010

Annual Report Milestones in 2010 January/February October › Gigaset Communications GmbH achieves turnaround (ear- › Capital increase successfully completed with a volume of lier than expected) EUR 13 million and considerably oversubscribed › Gigaset Communications GmbH with a new management team November › Gigaset AG issues two-year convertible bonds with a volume April of EUR 23.8 million › Gigaset AG sells camping product distributor Fritz Berger to › Earnings position of Gigaset AG stabilizes: positive develop- a strategic investor ment of EBITDA, free cash flow and reduction of debt › Gigaset AG signs letter of intent regarding Gigaset with Sie- July mens AG › Gigaset AG sells Golf House to a strategic consortium December August › Convertible bond is successfully placed › Annual shareholders’ meeting of Gigaset AG elects three › Gigaset AG sells Anvis new members to the Supervisory Board › Agreement is reached with Siemens AG regarding Gigaset › Dr. Peter Löw is elected Chairman of the Supervisory Board Communications GmbH › Hans Gisbert Ulmke leaves his position as Chairman of the › Gigaset AG acquires outstanding 19.8 % of the Gigaset Group Executive Board to hold 100% of the shares › Gigaset AG sells Carl Froh to management September › Extraordinary shareholders’ meeting gives broad approval › Michael Hütten leaves the Executive Board to changing the business model, renaming the Company › Maik Brockmann is appointed to the Executive Board Gigaset AG and creating new authorized capital › Executive Board and Supervisory Board approve -

Mac Address Vendor Lookup

Mac Address Vendor Lookup BGP Looking Glass Mac Address Vendor Lookup MAC ADDRESS Vendor Lookup 00:00:00 XEROX CORPORATION 8 MAC ADDRESS Vendor Lookup 00:00:01 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:02 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:03 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:04 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:05 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:06 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:07 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:08 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:09 XEROX CORPORATION MAC ADDRESS Vendor Lookup 00:00:0A OMRON TATEISI ELECTRONICS CO. MAC ADDRESS Vendor Lookup 00:00:0B MATRIX CORPORATION MAC ADDRESS Vendor Lookup 00:00:0C CISCO SYSTEMS, INC. MAC ADDRESS Vendor Lookup 00:00:0D FIBRONICS LTD. MAC ADDRESS Vendor Lookup 00:00:0E FUJITSU LIMITED MAC ADDRESS Vendor Lookup 00:00:0F NEXT, INC. MAC ADDRESS Vendor Lookup 00:00:10 Hughes MAC ADDRESS Vendor Lookup 00:00:11 Tektrnix MAC ADDRESS Vendor Lookup 00:00:12 INFORMATION TECHNOLOGY LIMITED MAC ADDRESS Vendor Lookup 00:00:13 Camex MAC ADDRESS Vendor Lookup 00:00:14 Netronix MAC ADDRESS Vendor Lookup 00:00:15 DATAPOINT CORPORATION MAC ADDRESS Vendor Lookup 00:00:16 DU PONT PIXEL SYSTEMS . MAC ADDRESS Vendor Lookup 00:00:17 Oracle MAC ADDRESS Vendor Lookup 00:00:18 WEBSTER COMPUTER CORPORATION MAC ADDRESS Vendor Lookup 00:00:19 APPLIED DYNAMICS INTERNATIONAL MAC ADDRESS Vendor Lookup 00:00:1A AMD MAC ADDRESS Vendor Lookup 00:00:1B NOVELL INC.