Pfizer Wins Over Medivation with $14B Buyout by Chelsea Naso

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Critical Analysis of Valuation and Strategical Orientation of Merger

EXPERT REVIEW OF PHARMACOECONOMICS & OUTCOMES RESEARCH, 2018 https://doi.org/10.1080/14737167.2018.1417040 REVIEW Critical analysis of valuation and strategical orientation of merger and acquisition deals in the pharmaceutical industry Raphaela Marie Louisa Dierks, Olivier Bruyère and Jean-Yves Reginster Faculty of Medicine, Department of Public Health, Epidemiology and Health Economics, CHU Sart-Tilman, Liège, Belgium ABSTRACT ARTICLE HISTORY Introduction: The pharmaceutical industry is undergoing major shifts due to changing macro and Received 21 October 2017 micro factors. As the industry is highly capital intensive and patents are expiring, the outlook is on Accepted 11 December 2017 generating inorganic growth, mainly through M&A. Using the income valuation approach, one analyses KEYWORDS two completed deals in 2016 above 1bn USD. Thereafter one outlines the main motives behind M&A Pharmaceutical industry; deals and concluded by discussing whether M&A harms medical innovations. merger and acquisitions Areas covered: The paper is based on empirical study questioning existing literature in order to (M&A); valuation; inorganic critically analyse valuation and the strategical orientation of pharmaceutical companies growth; medical innovation; Expert commentary: Pharmaceutical companies understand the changing market conditions and non-core assets; drug favour their expertise. The restructuring of the industry moves to small niche companies (I.e. pipeline; tax inversion Biopharma or biotech companies) researching key innovations and big companies purchasing them to develop them, create clinical trials and distribute them as this is a costly manner Conclusion: One can expect more M&A deals during the next years focusing on value rather than volume. Pharmaceutical players resilient to the market changes may survive if they change their business model from a traditional vertical one to outsourcing and diversification including external players. -

Radium-223 in Combination with Docetaxel in Patients with Castration

HHS Public Access Author manuscript Author ManuscriptAuthor Manuscript Author Eur J Cancer Manuscript Author . Author manuscript; Manuscript Author available in PMC 2020 September 06. Published in final edited form as: Eur J Cancer. 2019 June ; 114: 107–116. doi:10.1016/j.ejca.2019.04.007. Radium-223 in combination with docetaxel in patients with castration-resistant prostate cancer and bone metastases: a phase 1 dose escalation/randomised phase 2a trial This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/). *Corresponding author: Memorial Sloan Kettering Cancer Center, 1275 York Avenue, New York, NY 10065, USA. Fax: þ1 646 227 2417., [email protected] (M.J. Morris). 1Current address: Division of Hematology, Oncology and Transplantation, University of Minnesota, Minneapolis, MN, USA. 2Current address: Department of Medical Sciences, University of Turin Division of Nuclear Medicine, Turin, Italy. Conflict of interest statement M.J.M. discloses consultancy/advisory roles with Astellas Pharma, Bayer, Endocyte and Advanced Accelerator Applications and has received travel/accommodation expenses from Bayer and Endocyte, and his institution has received research funding from Bayer, Endocyte, Progenics and Sanofi; Y.L. discloses consultancy/advisory roles with Astellas Pharma, AstraZeneca, Janssen, Merck Sharp & Dohme, Pfizer, Roche, Seattle Genetics and Sanofi, and his institution has received research funding from Sanofi; C.J.S. declares stock ownership in relation to Leuchemix, consultancy/advisory roles with Astellas Pharma, AstraZeneca, Bayer, Genentech/Roche, Janssen Biotech, Pfizer and Sanofi and intellectual property interests in relation to Leuchemix and Exelixis, and his institution has received research funding from Astellas Pharma, Bayer, Janssen Biotech, Sanofi and Sotio; K.F. -

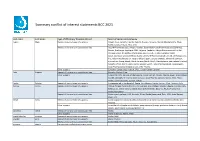

Summary Conflict of Interest Statements BCC 2021

Summary conflict of interest statements BCC 2021 Last name First name Type of affiliation/ financial interest Name of commercial company Aapro Matti Receipt of grants/research supports: Amgen, Eisai, Genomic Health, Helsinn, Hospira, Novartis, Merck, Mundipharma, Pfizer, Rache, Sandoz, Tesaro, Teva, Vifor Receipt of honoraria or consultation fees: Accord Pharmaceuticals, Amgen, Astellas, Bayer HealthCare Pharmaceuticals (Schering), Biocon, Boehringer Ingelheim, BMS, Celgene, Cephalon, Chugai Pharmaceutical Co. Ltd., Clinigen Group, Dr.Reddy's Laboratories, Eisai Co. Ltd., Eli Lilly, Genomic Health (Exact Sciences), GlaxoSmithKline (GSK), Glenmark Pharmaceuticals Limited, Gl Therapeutics, lnc., Helsinn Healthcare SA, Hospira (Pfizer), lpsen, Janssen Biotech, Johnson & Johnson, Kyowa Kirin Group, Merck, Merck Serono (Merck KGaA), Mundipharma International Limited, Novartis, Pfizer, Pierre Fabre, Rache, Sandoz, Sanofi, Taiho Pharmaceutical, Tesaro (GSK), Teva Pharmaceutical lndustries Ltd., Vifor Pharma Other support: European Cancer Organisation, SPCC, Cancer Center Genolier Aebi Stephan Receipt of honoraria or consultation fees: Novartis, Roche, Pfizer Other support: Support for CME lectures of the Lucerne Cancer Center: Amgen, Astellas, Bayer, Bristol-Myers Squibb, Debiopharm International SA, Eisai, Ipsen Pharma, Janssen, Merck, MSD, Pfizer, Roche, Sanofi Genzyme, Servier, Takeda André Fabrice Receipt of grants/research supports: Comepensated to the hospital: Roche, AstraZeneca, Daiichi Sankyo, Pfizer, Novartis, Lilly Barrios Carlos -

The Veeda Newsletter

The Veeda Newsletter July 2017 For the first time, analyst group lowers 2022 sales forecast as pricing backlash takes a toll For a decade, each new projection for drug sales from analyst group Evaluate has been higher than the last as new blockbusters and price hikes have pushed up its forecasts. Not this year. For the first time since it has been publishing its World Preview reports, the life science commercial intelligence firm has lowered its forecast for industry wide drug sales, based largely on new attention to pricing. Read More:http://www.fiercepharma.com/pharma/pricing-scrutiny-to-hurt-pharma-sales-analysis-shows-as- opdivo-and-keytruda-soar-through Shire's $800M Lialda confronted by generic competition but Zydus copy will fly solo for now After years of patent battles, the last legal barrier between Shire and a generic version of its lucrative ulcerative colitis drug Lialda has fallen and the FDA has approved a generic from ZydusCadila. It is a rude surprise for Shire investors who had believed the $800 million drug was safe for a few more years, but there is a chance that instead of flood of generics, the Zydus copy may be the only competition for awhile. Read More:http://www.fiercepharma.com/pharma/shire-s-800m-lialda- confronted-by-generic-but-zydus-copy-will-fly-solo-for-now How will Novartis price its groundbreaking CAR-T med? R&D exec offers some clues The FDA isn't the only hurdle for Novartis' forthcoming CAR-T therapy, which could be the world's first. There's pricing and access, too. -

Trends in Oncology Business Development

SACHS ASSOCIATES, 19TH ANNUAL BIOTECH IN EUROPE FORUM SESSION ON ONCOLOGY BUSINESS DEVELOPMENT Trends in Oncology Business Development September 26, 2019 Presentation by Tim Opler, Ph.D. Partner, Torreya www.torreya.com Securities offered in the United States are offered through Torreya Capital LLC, Member FINRA/SIPC. In Europe such services are offered through Torreya Partners (Europe) LLP, which is authorized and regulated by the UK Financial Conduct Authority. Oncology M&A Transaction Volume by Year 2019 has been by far the most active year in oncology M&A (through mid-September) Oncology M&A Dollar Volume, 2015-2019 $120,000 $100,000 Loxo Daiichi Array $80,000 $60,000 Celgene Dollar Volume($ Millions) $40,000 Kite $20,000 Juno Medivation Ariad Pharma- Tesaro cyclics Stemcentrx $0 2015 2016 2017 2018 2019 Note: Included upfront and near-term milestones only when calculating dollar value of a deal. Source: Torreya M&A database. TORREYA ONCOLOGY BUSINESS DEVELOPMENT TRENDS | SACHS CONFERENCE – SEPTEMBER 2019 2 Licensing Deals More Common But Much Less Value We count 1,756 transactions in the 2015-2019 period. Less than 5% of these deals were M&A. Total Deal Activity by Transaction Count, Total Deal Activity by Upfront Value 2015-2019 (2019 annualized) 2015-2019 450 120000 400 100000 350 300 80000 250 60000 200 Transaction Count 150 Dollar Value ($mm) 40000 100 20000 50 0 0 2015 2016 2017 2018 2019 2015 2016 2017 2018 2019 Licensing M&A Licensing M&A Source: Licensing Deal Activity Obtained from BioSci and Biopharm Insight Databases, M&A from Torreya database. -

Disclosure Summary

DISCLOSURE SUMMARY As a sponsor accredited by the Accreditation Council for Continuing Medical Education, the International Association for the Study of Lung Cancer (IASLC) must insure balance, independence, objectivity, and scientific rigor in all its sponsored educational activities. All speakers/contributors participating in a sponsored activity are expected to disclose to the accredited provider any significant financial interest or other relationship(s) involving themselves or their spouse/partner within the last 12 months with any proprietary entity producing health care goods or services related to the content of the activity. The intent of this disclosure is not to prevent a speaker with a significant financial or other relationship from making the presentation, but rather to identify and resolve any conflicts of interest that may control the content of the activity. It is also intended that any potential conflict be identified openly so that the listeners have a full disclosure of the facts and may form their own judgments about the presentation. It remains for the audience to determine whether the speaker’s interests or relationships may influence the presentation with regard to exposition or conclusion. All other faculty/contributors have reported no commercial affiliation associated with this conference or intent to reference off-label/unapproved uses of products or devices in their presentations. First Name Last Name Nature of Relevant Name of Company(s) Financial Relationship Nivedita Aanur Full-time/part-time Employee BMS Nivedita Aanur Stock Shareholder (directly BMS purchased) A Abbattista Full-time/part-time Employee Pfizer A Abbattista Stock Shareholder (directly Pfizer purchased) Chihiro Abe Full-time/part-time Employee Daiichi Sankyo. -

Sanofi Could Pursue Other Oncology M&A Targets After Medivation Loss

With Medivation, Pfizer Sees GSK, J&J And Roche Speak Up Stockwatch A Chance For More Combinations On Women’s Equality Day Last week the increasing volume of Pfizer is relying on future growth of Scrip spoke to big pharma about press backlash against Mylan’s Turing the prostate cancer therapy Xtandi to gender equality issues that need Pharmaceuticals-like pricing policy on justify the $14bn price it will pay to highlighting across the life science EpiPen resulted in another social media buy Medivation (p3) industry (p14) condemnation (p19) 2 September 2016 No. 3818 Scripscrip.pharmamedtechbi.com Pharma intelligence | informa maceutical Inc. as well as a trio of firms that could offer significant cancer assets – Re- generon Pharmaceuticals Inc., Incyte Corp. and Ariad Pharmaceuticals Inc. While BioMarin – an oft-cited takeout target of late – could add heft to the rare disease franchise within Sanofi’s Genzyme Corp. unit and Vertex would bring along a potential blockbuster cystic fibrosis fran- chise, a deal that could spark the established but dwindling cancer business at Sanofi might be the most desirable way to go. A further consideration against pursuing Bio- Marin is the reality that potential interest by rare disease specialist Shire PLC could pro- duce another bidding war like the one that rose up around Medivation. In an Aug. 23 note, Bryan Garnier & Co. ana- Shutterstock: Mmaxer Shutterstock: lyst Eric LeBerrigaud called Pfizer’s acquisition of Medivation “not great news” for Sanofi de- spite the premium price, saying it could have Sanofi Could Pursue Other Oncology “dramatically boosted” the pharma’s cancer franchise and been immediately accretive. -

Medivation, Inc

MEDIVATION, INC. FORM 10-K (Annual Report) Filed 02/26/16 for the Period Ending 12/31/15 Address 525 MARKET STREET 36TH FLOOR SAN FRANCISCO, CA 94105 Telephone 415-543-3470 CIK 0001011835 Symbol MDVN SIC Code 2834 - Pharmaceutical Preparations Industry Biotechnology & Drugs Sector Healthcare Fiscal Year 12/31 http://www.edgar-online.com © Copyright 2016, EDGAR Online, Inc. All Rights Reserved. Distribution and use of this document restricted under EDGAR Online, Inc. Terms of Use. uNITEd STATES SECuRITIES ANd EXChANgE COMMISSION Washington, d.C. 20549 Form 10-k x ANNuAl REPORT PuRSuANT TO SECTION 13 OR 15(d) OF ThE SECuRITIES EXChANgE ACT OF 1934 For the Fiscal Year Ended December 31, 2015 OR o TRANSITION REPORT PuRSuANT TO SECTION 13 OR 15(d) OF ThE SECuRITIES EXChANgE ACT OF 1934 For the Transition period from to . Commission file number: 001-32836 MEdIvATION, INC. (Exact name of Registrant as specified in its charter) delaware 13-3863260 (State or other jurisdiction of incorporation or organization) (I.R.S. Employer Identification No.) 525 Market Street, 36th Floor San Francisco, California 94105 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: (415) 543-3470 Securities registered pursuant to Section 12(b) of the Act: Title of Each Class Name of Each Exchange on Which Registered Common Stock, par value $0.01 per share The NASDAQ Stock Market LLC Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. -

2016 Pharma Dealmaking

invivo.pharmamedtechbi.com SEPTEMBER 2016 Invol. 34 ❚ no. 08 Vivopharma intelligence ❚ informa 2016 Pharma Dealmaking: Waiting On The High-Value Deals Six pharma deals announced thus far in 2016 carried up-front values of $1 billion or more, down considerably from the high-volume, high-value M&A industry experienced the prior two years. Pharma manufacturers appear to be recalibrating, but fundamentals suggest dealmaking will pick up. By Jessica Merrill ❚ AstraZeneca’s Seasoned ❚ BTG Deals Its Way Into ❚ Pharma R&D Efficiency: ❚ Olympus Targets A Dealmaker Grady On Interventional Medicine Mid-Sized Companies Excel Bigger Medical Future Strategy To Grow Pipeline BY ASHLEY YEO BY AMANDA MICKLUS BY ASHLEY YEO BY STEN STOVALL invivo.pharmamedtechbi.com CONTENTS ❚ In Vivo Pharma intelligence | September 2016 10 COVER ❚ 2016 Pharma Dealmaking: Waiting On The High-Value Deals Jessica Merrill Six pharma deals announced thus far in 2016 carried up-front values of $1 billion or more, down considerably from the high-volume, high-value M&A industry experienced the prior two years. Pharma manufacturers appear to be recalibrating – digesting previous acquisitions, adjusting to new biotech valuations and taking stock of the political and macro-economic climate – but fundamentals suggest pharma dealmaking will pick up. Pfizer’s $14 billion offer for Medivation might represent a turning point. FEATURes 26 32 1 AstraZeneca’s Seasoned Olympus Targets A Bigger Dealmaker Grady On Strategy Medical Future To Grow Pipeline ASHLEY YEO STEN STOVALL A medical company that has some other AstraZeneca’s Shaun Grady is an affable businesses – that is the shorthand dealmaker whose talents – honed over description that Olympus Corp. -

Medivation: No to Sanofi's Renewed Press to Take $9.3B Offer 5 May 2016, by by Linda A

Medivation: No to Sanofi's renewed press to take $9.3B offer 5 May 2016, by By Linda A. Johnson Medivation again rejected Sanofi's bid to acquire one approved product, Xtandi for advanced prostate the biologic drugmaker for $9.3 billion, saying cancer that doesn't respond to hormone-based Thursday that it "substantially undervalues" medicines. Its pipeline includes enzalutamide, in Medivation and its prospects. mid- and late-stage patient testing for prostate, liver and breast cancer, plus talazoparib for breast The swift response came hours after Paris-based cancer and pidilizumab, which is in mid-stage Sanofi, France's biggest drugmaker, threatened testing against the blood cancer B-cell lymphoma. Medivation's board members with possible removal if they won't discuss a deal. Last year, Medivation posted revenue of $943.3 billion, about half of it from Xtandi and the rest from Sanofi SA released a letter it sent to the board of payments from various collaborators. Medivation, which about a month ago became a hot acquisition target for large multinational The company released its first-quarter financial drugmakers looking for ways to boost their results after the market closed Thursday. medicine portfolios and future sales. Medivation swung to a profit of $4.82 million, or 3 cents per share, for the first three months of the The letter stated that the acquisition is a "priority year. Adjusted earnings per share improved to 11 for Sanofi." It said Sanofi might raise its offer price cents, while revenue rose 41 percent to $182.5 if Medivation will discuss the deal and can show million. -

Appendix a 2017 Financial Report Financial Review Pfizer Inc

Appendix A 2017 Financial Report Financial Review Pfizer Inc. and Subsidiary Companies GLOSSARY OF DEFINED TERMS Unless the context requires otherwise, references to “Pfizer,” “the Company,” “we,” “us” or “our” in this 2017 Financial Report (defined below) refer to Pfizer Inc. and its subsidiaries. We also have used several other terms in this 2017 Financial Report, most of which are explained or defined below: 2017 Financial Report This Financial Report for the fiscal year ended December 31, 2017, which was filed as Exhibit 13 to the Annual Report on Form 10-K for the fiscal year ended December 31, 2017 2017 Form 10-K Annual Report on Form 10-K for the fiscal year ended December 31, 2017 AAV Adeno-Associated Virus ABO Accumulated postretirement benefit obligation ACA (Also referred to as U.S. U.S. Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Healthcare Legislation) Act. ACIP Advisory Committee on Immunization Practices ALK anaplastic lymphoma kinase Allergan Allergan plc Alliance revenues Revenues from alliance agreements under which we co-promote products discovered or developed by other companies or us AM-Pharma AM-Pharma B.V. Anacor Anacor Pharmaceuticals, Inc. Astellas Astellas Pharma U.S. Inc. ASU Accounting Standards Update ATM-AVI aztreonam-avibactam Bamboo Bamboo Therapeutics, Inc. Baxter Baxter International Inc. BMS Bristol-Myers Squibb Company BRCA BReast CAncer susceptibility gene CDC U.S. Centers for Disease Control and Prevention Cellectis Cellectis SA Celltrion -

Bloomberg Intelligence Primers

Bloomberg Intelligence Primers PRIMER TYPE DASHBOARD CHAPTER_NAME Commodity ECONG Aluminum Commodity Primer Commodity ECONG Softwood Lumber Commodity Primer Commodity ECONG Potash Commodity Primer Commodity ECONG Gold Commodity Primer Commodity ECONG Thermal Coal Commodity Primer Commodity ECONG Oil Commodity Primer Commodity ECONG U.S. Natural Gas Commodity Primer Topic BESGG Activist Investing Topic Primer Topic ADVTG Advertising Agency Rebate Issue Topic Primer Topic AUTMN Auto Leasing Growth Topic Primer Topic IBNKG Bank Energy Risk Topic Primer Topic IBNKG Blockchain and Banking Topic Primer Topic BANKN Blockchain Topic Primer Topic ECONG Brexit: Economic Impact Topic Primer Topic EUROE Brexit: Financial Regulatory Impact Topic Primer Topic EATSN Casual Dining Topic Primer Topic BANKA China Banks' Bad Debt Topic Primer Topic REALA China Builders Diversify Topic Primer Topic COALG China Coal Miners' Distress Topic Primer Topic INETG China E-Commerce Topic Primer Topic COPPG China Metals Bubble Topic Primer Topic CHINA China's 13th Five-Year Plan Topic Primer Topic APPRA China's Evolving Duty-Free Topic Primer Topic HDWRG Cloud Computing Topic Primer Topic COALG Coal Regulation Topic Primer Topic INETG Digital Video Advertising Topic Primer Topic OILSN Energy Borrowing Base Topic Primer Topic DVENN E-Sports Topic Primer Topic TELCE European Mobile Consolidation Topic Primer Topic AGCHG Farm Incomes Topic Primer Topic ECONG Federal Reserve State of Play Topic Primer Topic SERVG Fracklog Topic Primer Topic IBNKG Global Bank Capital Topic