2016 Pharma Dealmaking

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

By in Vivo's Biopharma, Medtech and Diagnostics Teams

invivo.pharmaintelligence.informa.com JANUARY 2018 Invol. 36 ❚ no. 01 Vivopharma intelligence ❚ informa 2018 OUTLOOK By In Vivo’s Biopharma, Medtech and Diagnostics Teams PAGE LEFT BLANK INTENTIONALLY invivo.pharmaintelligence.informa.com STRATEGIC INSIGHTS FOR LIFE SCIENCES DECISION-MAKERS CONTENTS ❚ In Vivo Pharma intelligence | January 2018 BIOPHARMA MEDTECH 2018 DIAGNOSTICS OUTLOOK 12 22 28 Biopharma 2018: Medtech 2018: Diagnostics 2018: Is There Still A Place For Pharma The Place For Innovation Steady Progress And In The New Health Care As Value-based Health Care The Big Get Bigger Economy? Gains Momentum MARK RATNER WILLIAM LOONEY ASHLEY YEO If the beginning of 2017 was marked 2018 will be a time of transition in health 2017 was a watershed year in many by doubts around whether and how care, when biopharma’s counterparts respects, politically, economically the FDA would act with respect to in adjacent industry segments scale up and commercially for many players complex diagnostics, we enter 2018 in a radical redesign of their traditional in the medtech field. Where will the feeling that slow-moving vessel may business models. Biopharma is not opportunities lie in 2018? Will finally be turning. moving as quickly, and it confronts a breakthrough medtech innovation still strategic dilemma on how to address the have a place among providers often prospect of a much more powerful set of riding on fumes when it comes to 36 rivals in the ongoing battle to own the budgets, and is it all as bad as some patient experience in medicine. would make out? Thirty-five Years Covering Health Care: The More Things Change… 30 PETER CHARLISH A Virtuous Cycle: What The The health care industry has come a Immuno-Oncology Revolution long way in the past 35 years, although Means For Other Disease Areas in some areas very little has changed. -

Infectious Diseases

2013 MEDICINES IN DEVELOPMENT REPORT Infectious Diseases A Report on Diseases Caused by Bacteria, Viruses, Fungi and Parasites PRESENTED BY AMERICA’S BIOPHARMACEUTICAL RESEARCH COMPANIES Biopharmaceutical Research Evolves Against Infectious Diseases with Nearly 400 Medicines and Vaccines in Testing Throughout history, infectious diseases hepatitis C that inhibits the enzyme have taken a devastating toll on the lives essential for viral replication. and well-being of people around the • An anti-malarial drug that has shown Medicines in Development world. Caused when pathogens such activity against Plasmodium falci- For Infectious Diseases as bacteria or viruses enter a body and parum malaria which is resistant to multiply, infectious diseases were the current treatments. Application leading cause of death in the United Submitted States until the 1920s. Today, vaccines • A potential new antibiotic to treat methicillin-resistant Staphylococcus Phase III and infectious disease treatments have proven to be effective treatments in aureus (MRSA). Phase II many cases, but infectious diseases still • A novel treatment that works by Phase I pose a very serious threat to patients. blocking the ability of the smallpox Recently, some infectious pathogens, virus to spread to other cells, thus 226 such as pseudomonas bacteria, have preventing it from causing disease. become resistant to available treatments. Infectious diseases may never be fully Diseases once considered conquered, eradicated. However, new knowledge, such as tuberculosis, have reemerged new technologies, and the continuing as a growing health threat. commitment of America’s biopharma- America’s biopharmaceutical research ceutical research companies can help companies are developing 394 medicines meet the continuing—and ever-changing and vaccines to combat the many threats —threat from infectious diseases. -

Fidelity® Extended Market Index Fund

Quarterly Holdings Report for Fidelity® Extended Market Index Fund May 31, 2021 SEI-QTLY-0721 1.816014.116 Schedule of Investments May 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.8% Shares Value Shares Value COMMUNICATION SERVICES – 6.0% CarGurus, Inc. Class A (a) 481,276 $ 13,581,609 Diversified Telecommunication Services – 0.5% Cars.com, Inc. (a) 356,794 5,212,760 Alaska Communication Systems Group, Inc. 306,734 $ 1,018,357 Creatd, Inc. (a) (b) 42,672 156,606 Anterix, Inc. (a) (b) 65,063 3,218,016 DHI Group, Inc. (a) 262,377 839,606 ATN International, Inc. 49,421 2,336,131 Eventbrite, Inc. (a) (b) 368,036 7,471,131 Bandwidth, Inc. (a) (b) 118,706 14,041,733 EverQuote, Inc. Class A (a) (b) 54,748 1,726,204 Cincinnati Bell, Inc. (a) 265,617 4,090,502 IAC (a) 439,438 70,077,178 Cogent Communications Group, Inc. (b) 226,643 17,134,211 Izea Worldwide, Inc. (a) 258,392 718,330 Consolidated Communications Holdings, Inc. (a) 325,131 3,043,226 Kubient, Inc. (b) 44,094 228,848 Cuentas, Inc. (a) (b) 48,265 108,596 Liberty TripAdvisor Holdings, Inc. (a) 380,876 1,812,970 Globalstar, Inc. (a) (b) 3,272,215 5,235,544 Match Group, Inc. (a) 1,417,570 203,251,187 IDT Corp. Class B (a) 96,642 2,789,088 MediaAlpha, Inc. Class A (b) 91,323 3,864,789 Iridium Communications, Inc. (a) 621,382 23,743,006 Pinterest, Inc. Class A (a) 2,805,904 183,225,531 Liberty Global PLC: Professional Diversity Network, Inc. -

Critical Analysis of Valuation and Strategical Orientation of Merger

EXPERT REVIEW OF PHARMACOECONOMICS & OUTCOMES RESEARCH, 2018 https://doi.org/10.1080/14737167.2018.1417040 REVIEW Critical analysis of valuation and strategical orientation of merger and acquisition deals in the pharmaceutical industry Raphaela Marie Louisa Dierks, Olivier Bruyère and Jean-Yves Reginster Faculty of Medicine, Department of Public Health, Epidemiology and Health Economics, CHU Sart-Tilman, Liège, Belgium ABSTRACT ARTICLE HISTORY Introduction: The pharmaceutical industry is undergoing major shifts due to changing macro and Received 21 October 2017 micro factors. As the industry is highly capital intensive and patents are expiring, the outlook is on Accepted 11 December 2017 generating inorganic growth, mainly through M&A. Using the income valuation approach, one analyses KEYWORDS two completed deals in 2016 above 1bn USD. Thereafter one outlines the main motives behind M&A Pharmaceutical industry; deals and concluded by discussing whether M&A harms medical innovations. merger and acquisitions Areas covered: The paper is based on empirical study questioning existing literature in order to (M&A); valuation; inorganic critically analyse valuation and the strategical orientation of pharmaceutical companies growth; medical innovation; Expert commentary: Pharmaceutical companies understand the changing market conditions and non-core assets; drug favour their expertise. The restructuring of the industry moves to small niche companies (I.e. pipeline; tax inversion Biopharma or biotech companies) researching key innovations and big companies purchasing them to develop them, create clinical trials and distribute them as this is a costly manner Conclusion: One can expect more M&A deals during the next years focusing on value rather than volume. Pharmaceutical players resilient to the market changes may survive if they change their business model from a traditional vertical one to outsourcing and diversification including external players. -

Monday, April 22 Chicago Bears Room Chicago Bulls Room Chicago Cubs Room Merck KLOX Technologies Immune Design Leading Biote

As of 4/23/2013 Schedule subject to change Monday, Chicago Bears Room Chicago Bulls Room Chicago Cubs Room April 22 Merck KLOX Technologies Immune Design 1:00 PM Leading Biotech/Big Pharma Medical Devices Vaccines Eli Lilly NewSouth Innovations Syntiron 1:15 PM Leading Biotech/Big Pharma University/Academia Vaccines Amgen Radius Health BioCrea 1:30 PM Leading Biotech/Big Pharma Musculoskeletal Neurology/CNS Nat. Inst. of Neurological Dis. & Stroke Cytokinetics Xenon Pharmaceuticals 1:45 PM Neurology/CNS Musculoskeletal Neurology/CNS Curis OrgaNext Research BV Trigemina 2:00 PM Oncology Regenerative Medicine Neurology/CNS Verastem Flexion Therapeutics Neurocrine Biosciences 2:15 PM Oncology Musculoskeletal Hormone Therapy/CNS Michael J. Fox Foundation Antisense Pharma GmbH Versartis 2:30 PM Non-profit/Patient Advocacy Oncology Hormone Therapy Takeda Pharmaceutical Company TBD KODE Biotech 2:45 PM Leading Biotech/Big Pharma Drug Delivery Resverlogix Corp. Advaxis Q Chip 3:00 PM Cardiovascular Disease Oncology Drug Delivery Grünenthal GmbH Array BioPharma 3:15 PM Neurology/CNS Oncology/Drug Discovery Discovery Labs Mersana Therapeutics 3:30 PM Drug Delivery/Pulmonary Oncology Bayer HealthCare Igenica 3:45 PM Leading Biotech/Big Pharma Oncology Presentations are open to all Convention attendees and are located outside the main entrance of the BIO Business Forum As of 4/23/2013 - Schedule subject to change Tuesday, Chicago Bears Room Chicago Bulls Room Chicago Cubs Room Chicago Blackhawks Room April 23 Pfizer 8:00 AM Leading Biotech/Big Pharma -

February 11-12, 2013 the Waldorf Astoria New York

February 11-12, 2013 The Waldorf Astoria New York 15th ANNU AL EVENT Now in its fifteenth year, the BIO CEO & Investor Conference is the largest independent investor conference focused on leading publicly-traded biotech companies. The meeting provides a neutral forum where institutional investors, industry analysts, and senior biotechnology executives have the opportunity to shape the future investment landscape of the biotechnology industry. Reasons Top 10 to attend 1 Present your company story to an audience of targeted investors. 2 Hear the Washington perspective on the Affordable Care Act, debt ceiling, and other timely policy developments affecting the industry. 3 Evaluate fresh investment opportunities including compatible, complementary and competitive companies. 4 Learn about the hottest clinical developments and industry catalysts by attending the conference’s therapeutic workshops and business roundtables. 5 Attend fireside chats with CEOs who will share their recent company successes, what keeps the C-suite up at night, and where the industry’s leading companies are headed in 2013. 6 Gain access to BIO’s 1x1 Partnering System for scouting potential deal partners and optimizing your time at the event. 7 Access presentations from more than 140 established public and private biotech companies and non-profit funding organizations, including many you won’t hear from at other investor conferences. 8 Get the pulse on the current and proposed investment trends in biotechnology. 9 Network with peers, investors and potential partners attending the conference. 10 It’s the first NYC biotech conference of the year, kicking off a week of key industry events that you don’t want to miss. -

Fidelity® Total Market Index Fund

Quarterly Holdings Report for Fidelity® Total Market Index Fund May 31, 2021 STI-QTLY-0721 1.816022.116 Schedule of Investments May 31, 2021 (Unaudited) Showing Percentage of Net Assets Common Stocks – 99.3% Shares Value Shares Value COMMUNICATION SERVICES – 10.1% World Wrestling Entertainment, Inc. Class A (b) 76,178 $ 4,253,780 Diversified Telecommunication Services – 1.1% Zynga, Inc. (a) 1,573,367 17,055,298 Alaska Communication Systems Group, Inc. 95,774 $ 317,970 1,211,987,366 Anterix, Inc. (a) (b) 16,962 838,941 Interactive Media & Services – 5.6% AT&T, Inc. 11,060,871 325,521,434 Alphabet, Inc.: ATN International, Inc. 17,036 805,292 Class A (a) 466,301 1,099,001,512 Bandwidth, Inc. (a) (b) 34,033 4,025,764 Class C (a) 446,972 1,077,899,796 Cincinnati Bell, Inc. (a) 84,225 1,297,065 ANGI Homeservices, Inc. Class A (a) 120,975 1,715,426 Cogent Communications Group, Inc. (b) 66,520 5,028,912 Autoweb, Inc. (a) (b) 6,653 19,028 Consolidated Communications Holdings, Inc. (a) 110,609 1,035,300 Bumble, Inc. 77,109 3,679,641 Globalstar, Inc. (a) (b) 1,067,098 1,707,357 CarGurus, Inc. Class A (a) 136,717 3,858,154 IDT Corp. Class B (a) (b) 31,682 914,343 Cars.com, Inc. (a) 110,752 1,618,087 Iridium Communications, Inc. (a) 186,035 7,108,397 DHI Group, Inc. (a) (b) 99,689 319,005 Liberty Global PLC: Eventbrite, Inc. (a) 114,588 2,326,136 Class A (a) 196,087 5,355,136 EverQuote, Inc. -

Radium-223 in Combination with Docetaxel in Patients with Castration

HHS Public Access Author manuscript Author ManuscriptAuthor Manuscript Author Eur J Cancer Manuscript Author . Author manuscript; Manuscript Author available in PMC 2020 September 06. Published in final edited form as: Eur J Cancer. 2019 June ; 114: 107–116. doi:10.1016/j.ejca.2019.04.007. Radium-223 in combination with docetaxel in patients with castration-resistant prostate cancer and bone metastases: a phase 1 dose escalation/randomised phase 2a trial This is an open access article under the CC BY-NC-ND license (http://creativecommons.org/licenses/by-nc-nd/4.0/). *Corresponding author: Memorial Sloan Kettering Cancer Center, 1275 York Avenue, New York, NY 10065, USA. Fax: þ1 646 227 2417., [email protected] (M.J. Morris). 1Current address: Division of Hematology, Oncology and Transplantation, University of Minnesota, Minneapolis, MN, USA. 2Current address: Department of Medical Sciences, University of Turin Division of Nuclear Medicine, Turin, Italy. Conflict of interest statement M.J.M. discloses consultancy/advisory roles with Astellas Pharma, Bayer, Endocyte and Advanced Accelerator Applications and has received travel/accommodation expenses from Bayer and Endocyte, and his institution has received research funding from Bayer, Endocyte, Progenics and Sanofi; Y.L. discloses consultancy/advisory roles with Astellas Pharma, AstraZeneca, Janssen, Merck Sharp & Dohme, Pfizer, Roche, Seattle Genetics and Sanofi, and his institution has received research funding from Sanofi; C.J.S. declares stock ownership in relation to Leuchemix, consultancy/advisory roles with Astellas Pharma, AstraZeneca, Bayer, Genentech/Roche, Janssen Biotech, Pfizer and Sanofi and intellectual property interests in relation to Leuchemix and Exelixis, and his institution has received research funding from Astellas Pharma, Bayer, Janssen Biotech, Sanofi and Sotio; K.F. -

The Weekly Shot Biotech Issue a Weekly Summary of Healthcare Industry Valuation and Near-Term Catalysts June 17, 2010

Small Cap The Weekly Shot Biotech Issue June 17, 2010 A weekly summary of healthcare industry valuation and near-term catalysts The Weekly Shot: Overview and Comment - Small Cap Biotechnology Next week's sector highlights include LGND’s Thursday analyst event at the Eventi - Pharmaceuticals and Large Cap Biotech Hotel in NYC. The company on 6/15 announced updated 2010 revenue guidance of approx $25M, op ex of approx $30M, and expects to finish the year with $30M - Generics and Specialty Pharmaceuticals in cash (vs approx $43M as of 1Q10). Management will likely focus on partner GSK’s progress with add’l trials of Promacta (for ITP), which could potentially expand the drug’s label to Hep C, AML, and MDS (LGND receives <10% royalty from GSK). Investors should focus on pipeline plans following LGND’s opportunistic 2008/09 M&A activity. Key pipeline programs include LGD-4033 (ph.I, SARM candidate from PCOP) and RG7348, partnered with Roche (ph.I, Hep C candidate from MBRX). We do not expect major data announcements at the event. FDA’s Pediatric Drugs Advisory Committee will meet Monday to discuss pediatric safety reviews of multiple approved drugs, including Kogenate, Casodex, Apidra, NovoLog, Arimidex, Desmopressin, Prevacid, Nexium, Aciphex, Priolex, OraVerse, Zemuron, and Suprane . While important from a public safety perspective, we do not anticipate regulatory activity to be announced. Brian Lian, Ph.D. Small caps biotechs rebounded mid-week as elevated volatility continued across 212.500.6646 [email protected] the broader market. Investors are struggling to balance economic data supporting a modest recovery against concerns on EU debt loads, financial reform legislation, and aggressive govt rhetoric on BP’s oil spill. -

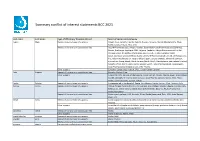

Summary Conflict of Interest Statements BCC 2021

Summary conflict of interest statements BCC 2021 Last name First name Type of affiliation/ financial interest Name of commercial company Aapro Matti Receipt of grants/research supports: Amgen, Eisai, Genomic Health, Helsinn, Hospira, Novartis, Merck, Mundipharma, Pfizer, Rache, Sandoz, Tesaro, Teva, Vifor Receipt of honoraria or consultation fees: Accord Pharmaceuticals, Amgen, Astellas, Bayer HealthCare Pharmaceuticals (Schering), Biocon, Boehringer Ingelheim, BMS, Celgene, Cephalon, Chugai Pharmaceutical Co. Ltd., Clinigen Group, Dr.Reddy's Laboratories, Eisai Co. Ltd., Eli Lilly, Genomic Health (Exact Sciences), GlaxoSmithKline (GSK), Glenmark Pharmaceuticals Limited, Gl Therapeutics, lnc., Helsinn Healthcare SA, Hospira (Pfizer), lpsen, Janssen Biotech, Johnson & Johnson, Kyowa Kirin Group, Merck, Merck Serono (Merck KGaA), Mundipharma International Limited, Novartis, Pfizer, Pierre Fabre, Rache, Sandoz, Sanofi, Taiho Pharmaceutical, Tesaro (GSK), Teva Pharmaceutical lndustries Ltd., Vifor Pharma Other support: European Cancer Organisation, SPCC, Cancer Center Genolier Aebi Stephan Receipt of honoraria or consultation fees: Novartis, Roche, Pfizer Other support: Support for CME lectures of the Lucerne Cancer Center: Amgen, Astellas, Bayer, Bristol-Myers Squibb, Debiopharm International SA, Eisai, Ipsen Pharma, Janssen, Merck, MSD, Pfizer, Roche, Sanofi Genzyme, Servier, Takeda André Fabrice Receipt of grants/research supports: Comepensated to the hospital: Roche, AstraZeneca, Daiichi Sankyo, Pfizer, Novartis, Lilly Barrios Carlos -

UNITED STATES SECURITIES and EXCHANGE COMMISSION Washington, D.C

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K/A (Amendment No. 1) ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2008 or ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to COMMISSION FILE NUMBER 000-31161 ARENA PHARMACEUTICALS, INC. (Exact name of registrant as specified in its charter) Delaware 23-2908305 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 6166 Nancy Ridge Drive, San Diego, CA 92121 (Address of principal executive offices) (Zip Code) 858.453.7200 (Registrant’s telephone number, including area code) Securities registered pursuant to 12(b) of the Act: Title of each class Name of each exchange on which registered Common Stock, $0.0001 par value NASDAQ Global Market Preferred Stock Purchase Rights NASDAQ Global Market Securities registered pursuant to 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Biodelivery Sciences International, Inc. (Exact Name of Registrant As Specified in Its Charter)

Table of Contents UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Form 10-K ☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2012 ☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission file number 001-31361 BioDelivery Sciences International, Inc. (Exact name of registrant as specified in its charter) Delaware 35-2089858 (State or other jurisdiction of (I.R.S. Employer incorporation or organization) Identification No.) 801 Corporate Center Drive, Suite #210 Raleigh, NC 27607 (Address of principal executive offices) (Zip Code) Issuer’s telephone number: 919-582-9050 Securities registered pursuant to Section 12(b) of the Act: Title of each class Name of exchange on which registered Common stock, par value $.001 Nasdaq Capital Market Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒ Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒ Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.