Ayeyarwady Region Investment Opportunity Survey— Will Provide Potential Investors with In-Depth Information on the Situations in Ayeyarwady Region

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Yangon University of Economics Department of Commerce Master of Banking and Finance Programme

YANGON UNIVERSITY OF ECONOMICS DEPARTMENT OF COMMERCE MASTER OF BANKING AND FINANCE PROGRAMME INFLUENCING FACTORS ON FARM PERFORMANCE (CASE STUDY IN BOGALE TOWNSHIP, AYEYARWADY DIVISION) KHET KHET MYAT NWAY (MBF 4th BATCH – 30) DECEMBER 2018 INFLUENCING FACTORS ON FARM PERFORMANCE CASE STUDY IN BOGALE TOWNSHIP, AYEYARWADY DIVISION A thesis summited as a partial fulfillment towards the requirements for the Degree of Master of Banking and Finance (MBF) Supervised By : Submitted By: Dr. Daw Tin Tin Htwe Ma Khet Khet Myat Nway Professor MBF (4th Batch) - 30 Department of Commerce Master of Banking and Finance Yangon University of Economics Yangon University of Economics ABSTRACT This study aims to identify the influencing factors on farms’ performance in Bogale Township. This research used both primary and secondary data. The primary data were collected by interviewing with farmers from 5 groups of villages. The sample size includes 150 farmers (6% of the total farmers of each village). Survey was conducted by using structured questionnaires. Descriptive analysis and linear regression methods are used. According to the farmer survey, the household size of the respondent is from 2 to 8 members. Average numbers of farmers are 2 farmers. Duration of farming experience is from 11 to 20 years and their main source of earning is farming. Their living standard is above average level possessing own home, motorcycle and almost they owned farmland and cows. The cultivated acre is 30 acres maximum and 1 acre minimum. Average paddy yield per acre is around about 60 bushels per acre for rainy season and 100 bushels per acre for summer season. -

ANNEX 12C: PROFILE of MA SEIN CLIMATE SMART VILLAGE International Institute of Rural Reconstruction; ;

ANNEX 12C: PROFILE OF MA SEIN CLIMATE SMART VILLAGE International Institute of Rural Reconstruction; ; © 2018, INTERNATIONAL INSTITUTE OF RURAL RECONSTRUCTION This work is licensed under the Creative Commons Attribution License (https://creativecommons.org/licenses/by/4.0/legalcode), which permits unrestricted use, distribution, and reproduction, provided the original work is properly credited. Cette œuvre est mise à disposition selon les termes de la licence Creative Commons Attribution (https://creativecommons.org/licenses/by/4.0/legalcode), qui permet l’utilisation, la distribution et la reproduction sans restriction, pourvu que le mérite de la création originale soit adéquatement reconnu. IDRC Grant/ Subvention du CRDI: 108748-001-Climate and nutrition smart villages as platforms to address food insecurity in Myanmar 33 IDRC \CRDl ..m..»...u...».._. »...m...~ c.-..ma..:«......w-.«-.n. ...«.a.u CLIMATE SMART VILLAGE PROFILE Ma Sein Village Bogale Township, Ayeyarwaddy Region 2 Climate Smart Village Profile Introduction Myanmar is the second largest country in Southeast Asia bordering Bangladesh, Thailand, China, India, and Laos. It has rich natural resources – arable land, forestry, minerals, natural gas, freshwater and marine resources, and is a leading source of gems and jade. A third of the country’s total perimeter of 1,930 km (1,200 mi) is coastline that faces the Bay of Bengal and the Andaman Sea. The country’s population is estimated to be at 60 million. Agriculture is important to the economy of Myanmar, accounting for 36% of its economic output (UNDP 2011a), a majority of the country’s employment (ADB 2011b), and 25%–30% of exports by value (WB–WDI 2012). -

Usg Humanitarian Assistance to Burma

USG HUMANITARIAN ASSISTANCE TO BURMA RANGOON CITY AREA AFFECTED AREAS Affected Townships (as reported by the Government of Burma) American Red Cross aI SOURCE: MIMU ASEAN B Implementing NGO aD BAGO DIVISION IOM B Kyangin OCHA B (WEST) UNHCR I UNICEF DG JF Myanaung WFP E Seikgyikanaunglo WHO D UNICEF a WFP Ingapu DOD E RAKHINE b AYEYARWADY Dala STATE DIVISION UNICEF a Henzada WC AC INFORMA Lemyethna IC TI Hinthada PH O A N Rangoon R U G N O I T E G AYEYARWADY DIVISION ACF a U Zalun S A Taikkyi A D ID F MENTOR CARE a /DCHA/O D SC a Bago Yegyi Kyonpyaw Danubyu Hlegu Pathein Thabaung Maubin Twantay SC RANGOON a CWS/IDE AC CWS/IDE AC Hmawbi See Inset WC AC Htantabin Kyaunggon DIVISION Myaungmya Kyaiklat Nyaungdon Kayan Pathein Einme Rangoon SC/US JCa CWS/IDE AC Mayangone ! Pathein WC AC Î (Yangon) Thongwa Thanlyin Mawlamyinegyun Maubin Kyauktan Kangyidaunt Twantay CWS/IDE AC Myaungmya Wakema CWS/IDE Kyauktan AC PACT CIJ Myaungmya Kawhmu SC a Ngapudaw Kyaiklat Mawlamyinegyun Kungyangon UNDP/PACT C Kungyangon Mawlamyinegyun UNICEF Bogale Pyapon CARE a a Kawhmu Dedaye CWS/IDE AC Set San Pyapon Ngapudaw Labutta CWS/IDE AC UNICEF a CARE a IRC JEDa UNICEF a WC Set San AC SC a Ngapudaw Labutta Bogale KEY SC/US JCa USAID/OFDA USAID/FFP DOD Pyinkhayine Island Bogale A Agriculture and Food Security SC JC a Air Transport ACTED AC b Coordination and Information Management Labutta ACF a Pyapon B Economy and Market Systems CARE C !Thimphu ACTED a CARE Î AC a Emergency Food Assistance ADRA CWS/IDE AC CWS/IDE aIJ AC Emergency Relief Supplies Dhaka IOM a Î! CWS/IDE AC a UNICEF a D Health BURMA MERLIN PACT CJI DJ E Logistics PACT ICJ SC a Dedaye Vientiane F Nutrition Î! UNDP/PACT Rangoon SC C ! a Î ACTED AC G Protection UNDP/PACT C UNICEF a Bangkok CARE a IShelter and Settlements Î! UNICEF a WC AC J Water, Sanitation, and Hygiene WC WV GCJI AC 12/19/08 The boundaries and names used on this map do not imply official endorsement or acceptance by the U.S. -

Health Impact Assessment of Artisanal and Small-Scale Gold Mining Area in Myanmar, Mandalay Region: Preliminary Research

International Journal of Environmental Research and Public Health Article Health Impact Assessment of Artisanal and Small-Scale Gold Mining Area in Myanmar, Mandalay Region: Preliminary Research Win Thiri Kyaw 1,* , Xiaoxu Kuang 1 and Masayuki Sakakibara 1,2,3 1 Research Institute for Humanity and Nature, 457-4 Motoyama, Kamigamo, Kita-ku, Kyoto 603-8047, Japan; [email protected] (X.K.); [email protected] (M.S.) 2 Graduate School of Science & Engineering, Ehime University, 2-5 Bunkyo-cho, Matsuyama City, Ehime Prefecture 790-8577, Japan 3 Faculty of Collaborative Regional Innovation, Ehime University, 3 Bunkyo-cho, Matsuyama City, Ehime Prefecture 790-8577, Japan * Correspondence: [email protected]; Tel.: +81-0757-072-443 Received: 31 August 2020; Accepted: 14 September 2020; Published: 16 September 2020 Abstract: Increasing artisanal and small-scale gold mining (ASGM) in developing countries has raised health concerns in mining communities. A preliminary health survey was conducted in Thabeikkyin Township, Mandalay Region, Myanmar, in February 2020 to assess the health conditions of an ASGM community. Respiratory function and other clinical assessments were evaluated in miners and non-miners, and participants’ hair was analyzed for heavy metals. Respiratory function of miners was similar to that of non-miners. However, miners’ respiratory function declined with longer mining activity duration. In total, 3 out of 18 miners showed neurological signs and symptoms of chronic mercury intoxication. The median concentration of the hair mercury was significantly higher in miners than non-miners (P = 0.01), and 9 out of 18 miners and 2 out of 11 non-miners showed the warning level of mercury. -

Appendix 6 Satellite Map of Proposed Project Site

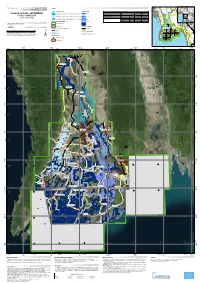

APPENDIX 6 SATELLITE MAP OF PROPOSED PROJECT SITE Hakha Township, Rim pi Village Tract, Chin State Zo Zang Village A6-1 Falam Township, Webula Village Tract, Chin State Kim Mon Chaung Village A6-2 Webula Village Pa Mun Chaung Village Tedim Township, Dolluang Village Tract, Chin State Zo Zang Village Dolluang Village A6-3 Taunggyi Township, Kyauk Ni Village Tract, Shan State A6-4 Kalaw Township, Myin Ma Hti Village Tract and Baw Nin Village Tract, Shan State A6-5 Ywangan Township, Sat Chan Village Tract, Shan State A6-6 Pinlaung Township, Paw Yar Village Tract, Shan State A6-7 Symbol Water Supply Facility Well Development by the Procurement of Drilling Rig Nansang Township, Mat Mon Mun Village Tract, Shan State A6-8 Nansang Township, Hai Nar Gyi Village Tract, Shan State A6-9 Hopong Township, Nam Hkok Village Tract, Shan State A6-10 Hopong Township, Pawng Lin Village Tract, Shan State A6-11 Myaungmya Township, Moke Soe Kwin Village Tract, Ayeyarwady Region A6-12 Myaungmya Township, Shan Yae Kyaw Village Tract, Ayeyarwady Region A6-13 Labutta Township, Thin Gan Gyi Village Tract, Ayeyarwady Region Symbol Facility Proposed Road Other Road Protection Dike Rainwater Pond (New) : 5 Facilities Rainwater Pond (Existing) : 20 Facilities A6-14 Labutta Township, Laput Pyay Lae Pyauk Village Tract, Ayeyarwady Region A6-15 Symbol Facility Proposed Road Other Road Irrigation Channel Rainwater Pond (New) : 2 Facilities Rainwater Pond (Existing) Hinthada Township, Tha Si Village Tract, Ayeyarwady Region A6-16 Symbol Facility Proposed Road Other Road -

Pathein University Research Journal 2017, Vol. 7, No. 1

Pathein University Research Journal 2017, Vol. 7, No. 1 2 Pathein University Research Journal 2017, Vol. 7, No. 1 Pathein University Research Journal 2017, Vol. 7, No. 1 3 4 Pathein University Research Journal 2017, Vol. 7, No. 1 စ Pathein University Research Journal 2017, Vol. 7, No. 1 5 6 Pathein University Research Journal 2017, Vol. 7, No. 1 Pathein University Research Journal 2017, Vol. 7, No. 1 7 8 Pathein University Research Journal 2017, Vol. 7, No. 1 Pathein University Research Journal 2017, Vol. 7, No. 1 9 10 Pathein University Research Journal 2017, Vol. 7, No. 1 Spatial Distribution Pattrens of Basic Education Schools in Pathein City Tin Tin Mya1, May Oo Nyo2 Abstract Pathein City is located in Pathein Township, western part of Ayeyarwady Region. The study area is included fifteen wards. This paper emphasizes on the spatial distribution patterns of these schools are analyzed by using appropriate data analysis methods. This study is divided into two types of schools, they are governmental schools and nongovernmental schools. Qualitative and quantitative methods are used to express the spatial distribution patterns of Basic Education Schools in Pathein City. Primary data are obtained from field surveys, informal interview, and open type interview .Secondary data are collected from the offices and departments concerned .Detailed facts are obtained from local authorities and experience persons by open type interview. Key words: spatial distribution patterns, education, schools, primary data ,secondary data Introduction The study area, Pathein City is situated in the Ayeyarwady Region. The study focuses only on the unevenly of spatial distribution patterns of basic education schools in Pathein City . -

Irrawaddy Delta - MYANMAR Flooded Area Delineation 11/08/2015 11:46 UTC River R

Nepal (!Loikaw GLIDE number: N/A Activation ID: EMSR130 I Legend r n r India China e Product N.: 16IRRAWADDYDELTA, v2, English Magway a Rakhine w Bangladesh e a w l d a Vietnam Crisis Information Hydrology Consequences within the AOI on 09, 10, 11/08/2015 d Myanmar S Affected Total in AOI y Nay Pyi Taw Irrawaddy Delta - MYANMAR Flooded Area delineation 11/08/2015 11:46 UTC River R ha 428922,1 i v Laos Flooded area e ^ r S Flood - 01/08/2015 Flooded Area delineation 10/08/2015 23:49 UTC Stream Estimated population Inhabitants 4252141 11935674 it Bay of ( to Settlements Built-up area ha 35491,8 75542,0 A 10 Bago n Bengal Thailand y g Delineation Map e Flooded Area delineation 09/08/2015 11:13 UTC Lake y P Transportation Railways km 26,0 567,6 a Cambodia r i w Primary roads km 33,0 402,1 Andam an n a Gulf of General Information d Sea g Reservoir Secondary roads km 57,2 1702,3 Thailand 09 y Area of Interest ) Andam an Cartographic Information River Sea Missing data Transportation Bay of Bengal 08 Bago Tak Full color ISO A1, low resolution (100 dpi) 07 1:600000 Ayeyarwady Yangon (! Administrative boundaries Railway Kayin 0 12,5 25 50 Region km Primary Road Pathein 06 04 11 12 (! Province Mawlamyine Grid: WGS 1984 UTM Zone 46N map coordinate system Secondary Road 13 (! Tick marks: WGS 84 geographical coordinate system ± Settlements 03 02 01 ! Populated Place 14 15 Built-Up Area Gulf of Martaban Andaman Sea 650000 700000 750000 800000 850000 900000 950000 94°10'0"E 94°35'0"E 95°0'0"E 95°25'0"E 95°50'0"E 96°15'0"E 96°40'0"E 97°5'0"E N " 0 ' 5 -

Title Precious and Base Metal Mineralization in Kwinthonze-Nweyon Area, Singu and Thabeikkyin Townships, Mandalay Region, Myanmar

Title Precious and Base Metal Mineralization in Kwinthonze-Nweyon area, Singu and Thabeikkyin Townships, Mandalay Region, Myanmar All Authors Tin Aung Myint1*, Than Than Nu1 , Min Aung2 Publication Type International Publication Publisher (Journal name, PROCEEDINGS OF SUNDALAND RESOURCES 2014 MGEI ANNUAL issue no., page no CONVENTIONMasyarakat Geologi Ekonomi Indonesia (Indonesian Society of etc.) Economic Geologists) Gold-silver and associated base metal mineralization occurs in the Kwinthonze- Nweyon area within the Mogok Metamorphic Belt (MMB) in Myanmar. The area is mainly underlain by high-grade metamorphic units and intrusive rocks. Gold-sulphide bearing quartz veins are predominantly hosted in gneisses and marbles. Numerous faults striking N, NNE, ENE and E to ESE with moderate to steep dips occurred in the area. The veins are characterized by banded, colloform, cockcade, breccia and some vuggy textures. The vein-related alteration is characterized by silicification, sericitization and chloritization from the inner to the outer zones. Principal metallic minerals are pyrite, chalcopyrite, sphalerite, galena, arsenopyrite in addition to electrum. The mineralogy of the vein is recognized into three paragenetic stages. Stage 1 is pre-mineralization stage. Stage 2 is main mineralization stage and stage 3 is post-ore carbonate Abstract stage. Quartz with minor sulfide, mainly pyrite was deposited during stage 1. Precious and base metals were precipitated during stage 2. In this stage, adularia is common. Gold and silver are more enriched in the veins containing abundant adularia than virtually quartz rich veins. In stage 3, the veins are barren. Bullion fineness data of the whole area display a wide range of fineness (416-875). -

Members of Parliament-Elect, Myanmar/Burma

To: Hon. Mr. Ban Ki-moon Secretary-General United Nations From: Members of Parliament-Elect, Myanmar/Burma CC: Mr. B. Lynn Pascoe, Under-Secretary-General, United Nations Mr. Ibrahim Gambari, Under-Secretary-General and Special Adviser to the Secretary- General on Myanmar/Burma Permanent Representatives to the United Nations of the five Permanent Members (China, Russia, France, United Kingdom and the United states) of the UN Security Council U Aung Shwe, Chairman, National League for Democracy Daw Aung San Suu Kyi, General Secretary, National League for Democracy U Aye Thar Aung, Secretary, Committee Representing the Peoples' Parliament (CRPP) Veteran Politicians The 88 Generation Students Date: 1 August 2007 Re: National Reconciliation and Democratization in Myanmar/Burma Dear Excellency, We note that you have issued a statement on 18 July 2007, in which you urged the State Peace and Development Council (SPDC) (the ruling military government of Myanmar/Burma) to "seize this opportunity to ensure that this and subsequent steps in Myanmar's political roadmap are as inclusive, participatory and transparent as possible, with a view to allowing all the relevant parties to Myanmar's national reconciliation process to fully contribute to defining their country's future."1 We thank you for your strong and personal involvement in Myanmar/Burma and we expect that your good offices mandate to facilitating national reconciliation in Myanmar/Burma would be successful. We, Members of Parliament elected by the people of Myanmar/Burma in the 1990 general elections, also would like to assure you that we will fully cooperate with your good offices and the United Nations in our effort to solve problems in Myanmar/Burma peacefully through a meaningful, inclusive and transparent dialogue. -

Social Assessment for Ayeyarwady Region and Shan State

AND DEVELOPMENT May 2019 Public Disclosure Authorized Public Disclosure Authorized Public Disclosure Authorized SOCIAL ASSESSMENT FOR AYEYARWADY REGION AND SHAN STATE Public Disclosure Authorized Myanmar: Maternal and Child Cash Transfers for Improved Nutrition 1 Myanmar: Maternal and Child Cash Transfers for Improved Nutrition Ministry of Social Welfare, Relief and Resettlement May 2019 2 TABLE OF CONTENTS Executive Summary ........................................................................................................................... 5 List of Abbreviations .......................................................................................................................... 9 List of Tables ................................................................................................................................... 10 List of BOXES ................................................................................................................................... 10 A. Introduction and Background....................................................................................................... 11 1 Objectives of the Social Assessment ................................................................................................11 2 Project Description ..........................................................................................................................11 3 Relevant Country and Sector Context..............................................................................................12 3.1 -

Desk Review Cover and Contents.Indd

BASELINE ASSESSMENT OF COMMUNITY BASED TB SERVICES IN 8 ENGAGE-TB PRIORITY COUNTRIES WHO/CDS/GTB/THC/18.34 © World Health Organization 2018 Some rights reserved. This work is available under the Creative Commons Attribution-NonCommercial-ShareAlike 3.0 IGO licence (CC BY-NC-SA 3.0 IGO; https://creativecommons.org/licenses/by-nc-sa/3.0/igo). Under the terms of this licence, you may copy, redistribute and adapt the work for non-commercial purposes, provided the work is appropriately cited, as indicated below. In any use of this work, there should be no suggestion that WHO endorses any specific organization, products or services. The use of the WHO logo is not permitted. If you adapt the work, then you must license your work under the same or equivalent Creative Commons licence. If you create a translation of this work, you should add the following disclaimer along with the suggested citation: “This translation was not created by the World Health Organization (WHO). WHO is not responsible for the content or accuracy of this translation. The original English edition shall be the binding and authentic edition”. Any mediation relating to disputes arising under the licence shall be conducted in accordance with the mediation rules of the World Intellectual Property Organization. Suggested citation. Baseline assessment of community based TB services in 8 WHO ENGAGE-TB priority countries. Geneva: World Health Organization; 2018 (WHO/CDS/GTB/THC/18.34). Licence: CC BY-NC-SA 3.0 IGO. Cataloguing-in-Publication (CIP) data. CIP data are available at http://apps.who.int/iris. -

The Provision of Public Goods and Services in Urban Areas in Myanmar: Planning and Budgeting by Development Affairs Organizations and Departments

The Provision of Public Goods and Services in Urban Areas in Myanmar: Planning and Budgeting by Development Affairs Organizations and Departments Michael Winter and Mya Nandar Thin December 2016 Acknowledgements The authors thank the many Development Affairs Organization (DAO) officials in Shan, Mon and Kayin States and in Ayeyarwady and Tanintharyi Regions who discussed their work and generously provided access to DAO documentation. The authors would also like to thank members of Township Development Affairs Committees (TDACs) who contributed to the production of this report. In addition, the authors thank the staff of The Asia Foundation and Renaissance Institute for providing invaluable logistical and administrative support. About the Authors Michael Winter, the lead author of the report, over the last twenty years, has worked as a consultant on local government and local development issues in Asia and Africa. His main clients have included UNCDF, UNDP, the World Bank, the Asian Development Bank, SDC, and the UK’s Department for International Development (DFID). Mya Nandar Thin is a Program Associate at Renaissance Institute and provides support in the planning and implementation of research and advocacy activities lead by the Public Financial Management Reform team. About The Asia Foundation and Renaissance Institute The Asia Foundation is a nonprofit international development organization committed to improving lives across a dynamic and developing Asia. Informed by six decades of experience and deep local expertise, our programs address critical issues affecting Asia in the 21st century—governance and law, economic development, women’s empowerment, environment, and regional cooperation. In addition, our Books for Asia and professional exchanges are among the ways we encourage Asia’s continued development as a peaceful, just, and thriving region of the world.