Lincolnshire County Council Coastal Pathfinder Economic Study

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

THE WIVES of the Lees of QUETHIOCK & THEIR ANCESTRY

THE WIVES OF THE LEEs of QUETHIOCK & THEIR ANCESTRY Let us now make a helpmate for this man, A creature like himself, Then he made Eve. It is evident from this, proof positive, That woman is for man`s help and delight, His comfort and his earthly paradise, How can they but live in unity? One flesh they are; and one flesh, so I`d guess, Has but one heart, come grief or happiness. So if you are man not a mouse Thank God for sending you a wife; Geoffrey Chaucer -Canterbury Tales 1386 The ancestors of the wives of the ancestral Lee`s of Quethiock, that I have identified, bore 73 different family names. Of these families, 53 came from the corner of southeast Cornwall that lies within 20 miles of Plymouth; 13 came from elsewhere in Cornwall and 7 from outside the county. All those from outside the county are the ancestors of my mother, Florence Maud Clarke. All of those of my father were from Cornwall But in addition to the above 73 names we know another 23 probable ones. These are the family names of the ancestors of Jane Coode, who married William Lee (1535?-1607) and had a daughter Jane. This Jane I believe, but cannot prove conclusively, is the Jane Lee who is recorded in the Parish Records of Quethiock Church as marrying in 1581 my 8th greatgrandfather John, the nephew of William Lee. If so, then the ancestors of Jane Coade are mine too. The Coades were armigerous gentry and so their family trees were recorded by the Heralds during their Visitations to Cornwall in 1530,1573 & 1620 and are listed by J.L.Vivien in his publication of 1887, `Heraldic Visitations of Cornwall`, of which I was able to purchase an original copy from the Antique Booksellers in Bristol. -

NCA Profile 42 Lincolnshire Coast and Marshes

National Character 42. Lincolnshire Coast and Marshes Area profile: Supporting documents www.gov.uk/natural-england 1 National Character 42. Lincolnshire Coast and Marshes Area profile: Supporting documents Introduction National Character Areas map As part of Natural England’s responsibilities as set out in the Natural Environment White Paper,1 Biodiversity 20202 and the European Landscape Convention,3 we are revising profiles for England’s 159 National Character Areas North (NCAs). These are areas that share similar landscape characteristics, and which East follow natural lines in the landscape rather than administrative boundaries, making them a good decision-making framework for the natural environment. Yorkshire & The North Humber NCA profiles are guidance documents which can help communities to inform West their decision-making about the places that they live in and care for. The information they contain will support the planning of conservation initiatives at a East landscape scale, inform the delivery of Nature Improvement Areas and encourage Midlands broader partnership working through Local Nature Partnerships. The profiles will West also help to inform choices about how land is managed and can change. Midlands East of Each profile includes a description of the natural and cultural features England that shape our landscapes, how the landscape has changed over time, the current key drivers for ongoing change, and a broad analysis of each London area’s characteristics and ecosystem services. Statements of Environmental South East Opportunity (SEOs) are suggested, which draw on this integrated information. South West The SEOs offer guidance on the critical issues, which could help to achieve sustainable growth and a more secure environmental future. -

Technical Note, Lincshore 2013

Coastal Morphology Technical Note Lincshore TN002/L/2013 March 2013 Title here in 8pt Arial (change text colour to black) i We are the Environment Agency. We protect and improve the environment and make it a better place for people and wildlife. We operate at the place where environmental change has its greatest impact on people’s lives. We reduce the risks to people and properties from flooding; make sure there is enough water for people and wildlife; protect and improve air, land and water quality and apply the environmental standards within which industry can operate. Acting to reduce climate change and helping people and wildlife adapt to its consequences are at the heart of all that we do. We cannot do this alone. We work closely with a wide range of partners including government, business, local authorities, other agencies, civil society groups and the communities we serve. Published by: Shoreline Monitoring Group Environment Agency Kingfisher House, Goldhay Way Orton Goldhay, Peterborough PE2 5ZR Email: enquiries@environment- agency.gov.uk www.environment-agency.gov.uk Further copies of this report are available from our publications catalogue: © Environment Agency 2013 http://publications.environment- agency.gov.ukor our National Customer All rights reserved. This document may be Contact Centre: T: 03708 506506 reproduced with prior permission of the Environment Agency. Email: enquiries@environment- agency.gov.uk. ii Coastal Morphology Technical Note, Lincshore Contents 1 Introduction 1 1.1 Coastal morphology technical note 1 1.2 Anglian Coastal Monitoring 1 1.3 Survey area 1 1.4 Data collection & survey dates 3 2 Survey data outputs & results 4 2.1 Introduction 4 2.2 Analysis 4 3 Summary 22 Appendix A 23 References 24 Glossary 25 List of Tables Table 1: Survey campaigns and dates 3 Table 2: ACM strategic (1 km) survey transects. -

Main Modification Consultation Responses

MAIN MODIFICATION CONSULTATION RESPONSES MM Ref Name or Response Councils Response No 1 Organisation of Respondent Page 5, North ED054 – CS3 – New addition to plan (page 6) This matter was discussed at the Examination Key Somercotes Hearings. The definition of the Coastal Zone is set Diagram Parish Council Unfortunately, the Revised Policies Map Two is out in Policy SP3 and the Council have suggested a still unclear: modification to make it clearer under Main Modification MM4. Unfortunately the Coastal Zone 1. It does not show the coastal East Lindsey does not run in a clear line along the Coast and it area clearly. Where is the demarcation between therefore also requires words as well as a map to the coastal east Lindsey and inland East define it. Lindsey? The designated ‘coastal’ area needs to be properly defined so people can see where it The matter of which settlements are in the Coastal starts and ends and shown precisely on the Zone and which are not was also discussed at the map. There is reference to it being shown Examination Hearings and the Council is satisfied correct on the policies map but there is no area with the list as it now stands for the reasons marked out as Coastal and Inland on the maps – discussed, Marshchapel, Hogsthorpe, and just a superimposed title of Coastal East Grainthorpe were d iscussed and their sites reviewed. Lindsey. Grainthorpe is shown above Covenham Huttoft was not a settlement raised by the Reservoir instead of over the actual village respondent previously at the hearings though they which could be considered misleading, and did attend and could have commented at that time. -

Mablethorpe to Humber Bridge Overview to Natural England’S Compendium of Statutory Reports to the Secretary of State for This Stretch of Coast

www.gov.uk/englandcoastpath England Coast Path Stretch: Mablethorpe to Humber Bridge Overview to Natural England’s compendium of statutory reports to the Secretary of State for this stretch of coast 1 England Coast Path | Mablethorpe to Humber Bridge | Overview Map A: Key Map – Mablethorpe to Humber Bridge Stretch 2 England Coast Path | Mablethorpe to Humber Bridge | Overview Report number and title MHB 1: Mablethorpe North End to Saltfleet Haven (Maps MHB 1a to MHB 1e) MHB 2: Saltfleet Haven to Humberston (Maps MHB 2a to MHB 2l) MHB 3: Humberston to Immingham Docks (Maps MHB 3a to MHB 3n) MHB 4: Immingham Docks to Humber Bridge (Maps MHB 4a to MHB 4o) Using Key Map Map A (opposite) shows the whole of the Mablethorpe to Humber Bridge stretch divided into shorter numbered lengths of coast. Each number on Map A corresponds to the report which relates to that length of coast. To find our proposals for a particular place, find the place on Map A and note the number of the report which includes it. If you are interested in an area which crosses the boundary between two reports, please read the relevant parts of both reports. Printing If printing, please note that the maps which accompany reports 1 to 4 should ideally be printed on A3 paper. If you don’t have the facility to print at A3 size, we suggest you print the text of the report you are interested in on A4 paper and view the associated map on your computer screen, using the zoom tool to view it at a suitable size. -

East Division. Binbrook, Saint Mary, Binbrook, Saint Gabriel. Croxby

2754 East Division. In the Hundred of Ludborough. I Skidbrooke cum Saltfleetj Brackenborough, ] Somercotes, North, Binbrook, Saint Mary, 1 Somercotes, South, Binbrook, Saint Gabriel. Covenham, Saint Bartholomew, ; ; Covenham, Saint Mary, Stewton, Croxby, 1 1 TathweU, Linwood, Fotherby, ', Grimsby Parva, Welton on the Wolds, Orford, jWithcall, Rasen, Middle, Ludborough, , Ormsby, North, Utterby, Wykeham, Rasen, Market, I Yarborough. Stainton le Vale, Wyham cum Cadeby. Tealby, In the Hundred of Calceworth. In t?ie Hundred of Wraggoe. Thoresway, I Aby with Greenfield, Thorganby, Benniworth, Biscathorpe, f Anderby, Walesby, Brough upon Bain cum Girsby, JAlford, Willingham, North. Hainton, Belleau, Ludford Magna, Ludford Parva, Beesby in the Marsh, In the Hundred of Wraggoe. "Willingham, South. Bilsby with Asserby, an$ Kirmond le Mire, Thurlby, Legsby with Bleasby and CoIIow, In the Hundred of Gartree. Claythorpe, Calceby, SixhiUs, ' ' •: .Asterby, Cawthorpe, Little, Torrington, East. Baumber, Belchford, Cumberworth, Cawkwell, Claxby, near Alford, Donington upon Bain, Farlsthorpe, In the Hundred of Bradley Gayton le Marsh, Haverstoe, West Division. Edlington, Goulceby, Haugh, Aylesby, Heningby, Horsington, Hannah cum Hagnaby, Barnoldby le Beck, Langton by Horncastle, Hogsthorpe, Huttoft, Beelsby, Martin, Legburn, Bradley, Ranby, Mablethorpe, Cabourn, Scamblesby, Mumby cum Chapel Elsey and Coats, Great, Stainton, Market, Langham-row, Coates, Little, Stennigot, Sturton, Maltby le Marsh, Cuxwold, Thornton. Markby, Grimsby, Great, Reston, South, Hatcliffe with Gonerby, In the Hundred of Louth Eske. Rigsby with Ailby, Healing, Alvingham, Sutton le Marsh, Irby, Authorpe, Swaby with White Pit, Laceby, Burwell, Saleby with Thoresthorpe, Rothwell, Carlton, Great, Carlton Castle, Strubby with Woodthorpe; Scartho, Theddlethorpe All Saints, Carlton, Little, Theddlethorpe Saint Helen, Swallow. Conisholme, Thoresby, South, East Division. Calcethorpe, Cockerington, North, or Saint Tothill, Trusthorpe, Ashby cum Fenby, Mary, . -

Well Pastures, Saddleback Road, Skidbrooke, Lincolnshire Awaiting Pics Well Pastures, Saddleback Road, Skidbrooke, Lincolnshire

Well Pastures, Saddleback Road, Skidbrooke, Lincolnshire Awaiting Pics Well Pastures, Saddleback Road, Skidbrooke, Lincolnshire East Coast - 1 mile Louth - 8 miles Situated in a rural location and with open field views, Well Pastures is a delightful equestrian holding set in approximately 6.8 acres (STS) comprising a well presented three bedroom bungalow of about 2,300 sq.ft with an array of useful outbuildings and stables with approximately 4.7 acres (STS) of paddocks. Accommodation briefly comprises entrance hall/boot room, open plan living/dining room, kitchen/diner, study, utility, garden room and bathroom with three bedrooms, one with en-suite. Outside, the property is set in around 6.8 acres (STS) with well-presented mature gardens, five paddocks (4.7 acres STS), a large barn, stable block and steel portal frame workshop of around 1,300 sq.ft. ACCOMMODATION Family Bathroom 3.77m x 2.96m (12’4 x 9’8) Secondary Hallway Double glazed window to side elevation. Comprising bath and Double glazed windows to front elevation, two radiators. Ground Floor shower cubicle with large fixed head and separate shower attachment, low level WC, wash hand basin in vanity unit with Bedroom One 6.04m x 3.65m max (19’10 x 12’0) Entrance Porch mixer tap, exposed beams and heated towel rail. There is also a Double glazed window to rear elevation. Comprising walk-in Solid wood glazed door to front elevation. useful laundry cupboard housing an oil boiler unit and hot water wardrobe, exposed timber beams and radiator. tank. Entrance Hall/Boot Room 3.20m x 2.41m (10’6 x 7’11) En-Suite Bathroom 3.73m x 1.85m (12’3 x 6’1) Double glazed window to side elevation. -

Appendix B Greater Lincolnshire Coastal Vision

Appendix B Greater Lincolnshire Coastal Vision Draft (version 3.1: January 2016) The Greater Lincolnshire Local Enterprise Partnership: a Vision for Greater Lincolnshire's Coast by 2030 Greater Lincolnshire's key strengths in agri-food and tourism are concentrated in its coastal areas. So are many of greatest opportunities for realizing and developing those strengths as well as important challenges such as flood risk management, future water supply, environmental protection, economic growth, housing and infrastructure. This Coastal Vision sets out how Greater Lincolnshire can build on its existing strengths, its plans and ambitions for the coast, to join with its emerging aspirations for the economy to become a force for growth. A number of important strategies and plans set out significant aspirations for the future of Coastal Greater Lincolnshire, often based on extensive public and stakeholder consultations. The Coastal vision seeks to draw these together into a coherent whole, while focusing on the GLLEP's ambitions for the coast's contribution to Greater Lincolnshire's economic growth. Strategic context Greater Lincolnshire overall provides £12bn GVA to the UK economy (in 2013) £1bn visitor economy with over 17m visitors (in 2012) The fourth most popular tourism destination in the UK £1.5bn manufacturing economy 25% of the UK's grade 1 agricultural land 25% of all UK-grown vegetables 20% of the UK's RAF bases The second-fastest growing of all the shire counties with net inward migration twice the national average. Greater Lincolnshire is ambitious to Increase economic output by £2.5bn over the next ten years Establish the UK's largest Enterprise Zone on the Humber Estuary Create or safeguard 9,000 jobs Create 1m square metres of commercial floor space 1 Much of this happens – or will happen – at the coast. -

The East Midlands Is a Region of Contrasts

The East Midlands is a region of contrasts: from the hills of the Peak District to the flat and fertile fens of Lincolnshire, farming is the backbone of the region’s countryside and its economy. More than 80% of the East Midlands is farmed, but food processing is a major employer, too, as well as tourism, particularly in and around the Peak District National Park and the Lincolnshire coast, where it plays a key role in the rural economy. In Derbyshire, over 39 million visitors flock to the county each year. Total farming output from the East Midlands was valued in 2010 at £2.24bn, reflecting the productivity and diversity of the crops we grow. As a predominantly arable region, wheat and oilseed rape are our main crops, but field vegetable and potato growing dominate parts of Nottinghamshire and Lincolnshire. Dairying, beef, sheep, pig and poultry farms are important to the region, too: more than a third of our holdings are involved in livestock production. Melton Mowbray is the rural food capital of England and is famed for pork pies and Stilton cheese. And the hills of Derbyshire are home to thousands of cattle and sheep, shaping and maintaining the beautiful landscape and protecting the environment for future generations. And Lincolnshire’s horticultural area is more than 20% of England’s total vegetable and potato production; the fertile silts of the south of the county provide produce for one of the major production, processing and packing centres of Europe. In Nottinghamshire in particular, renewable energy is a growing sector; willow and Miscanthus for power generation, wind turbines and solar farms are all reducing the country’s reliance on fossil fuels. -

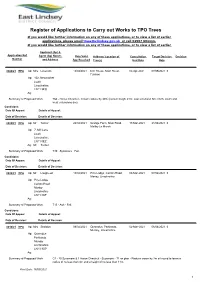

Register of Applications to Carry out Works to TPO Trees

Register of Applications to Carry out Works to TPO Trees If you would like further information on any of these applications, or to view a list of earlier applications, please email [email protected] or call 01507 601111. If you would like further information on any of these applications, or to view a list of earlier Applicant (Ap) & Application Ref Agent (Ag) Names Date Valid Address/ Location of Consultation Target Decision Decision Number and Address App Received Tree(s) End Date Date 0026/21 /TPA Ap: Mrs Laverack 12/03/2021 00:00:00Elm House, Main Street, 02-Apr-2021 07/05/2021 00:00:00 Fulstow Ap: 102, Newmarket Louth Lincolnshire LN11 9EQ Ag: Summary of Proposed Work T64 - Horse Chestnut - Crown reduce by 30% (current height 21m; east extension 5m; north, south and west extensions 6m). Conditions: Date Of Appeal: Details of Appeal: Date of Decision: Details of Decision: 0023/21 /TPA Ap: Mr Turner 24/02/2021 00:00:00Grange Farm, Main Road, 17-Mar-2021 21/04/2021 00:00:00 Maltby Le Marsh Ap: 7, Mill Lane Louth Lincolnshire LN11 0EZ Ag: Mr Turner Summary of Proposed Work T39 - Sycamore - Fell. Conditions: Date Of Appeal: Details of Appeal: Date of Decision: Details of Decision: 0022/21 /TPA Ap: Mr Lougheed 10/02/2021 00:00:00Pine Lodge, Carlton Road, 03-Mar-2021 07/04/2021 00:00:00 Manby, Lincolnshire Ap: Pine Lodge Carlton Road Manby Lincolnshire LN11 8UF Ag: Summary of Proposed Work T15 - Ash - Fell. Conditions: Date Of Appeal: Details of Appeal: Date of Decision: Details of Decision: 0018/21 /TPA Ap: Mrs Sheldon 09/02/2021 00:00:00Quorndon, Parklands, 02-Mar-2021 06/04/2021 00:00:00 Mumby, Lincolnshire Ap: Quorndon Parklands Mumby Lincolnshire LN13 9SP Ag: Summary of Proposed Work G1 - 20 Sycamore & 1 Horse Chestnut - Sycamore - T1 on plan - Reduce crown by 2m all round to leave a radius of no less than 4m and a height of no less than 11m. -

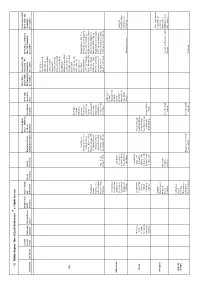

CD80 Green Infrastructure Data Web Table 2012

GI Within Approx 1km of Each Settlement * = Public Access Protected Open Green Space Green Space (20 Green Space (500 Coastal Children and Church Yards Space - additional Sport and (2Ha in 300m - Ha in 2km - NE Green Space (100 Ha in Ha in 10km - NE Access Parks and Amenity Green Youth and Green Sports Natural and Semi- to others Recreational Recreation NE Standards) Standards) 5km - NE Standards) Standards) Settlement Allotments Points Gardens Space Provision Cemeteries Corridors Provision natural Green Space identified Footpath Area Accessible * Accessible * Accessible * Accessible * Mother and Greenfield Woods SNCI (49 ha) * Swinn Wood SNCI (25 ha), Tothill Wood LWS (78.5ha), Calceby Marsh SSSI (9.346 ha) Calceby Beck, Ava Maria to Belleau Bridge LWS (3.969ha) and with Aby Calceby Beck, East Marsh LWS The Public (1.073ha) Ing Holt Footpath LWS (1.831ha) Network is Calceby Beck, *Kew Wood good and West Bank *Burwell Wood LWS (119 Woodland Trust Site would allow Grassland LWS ha) together with Haugham (0.26ha), Moors predominantly (1.471ha) *Calceby Wood LWS (75.873ha), Wood LWS ( 0.75ha), off road Beck Tributary LWS Haugham Slates Grassland *Aby Burial *Belleau Springs LWS walking around (1.309ha) *Swaby LWS (8.355ha) Eight Acre Ground (1.588ha) Disused most of the Valley SSSI Trust Plantation LWS (2.09 ha), (0.27ha), * St Railway North of village and a Reserve (3.591ha) Haugham Horseshoe LWS John the Baptist Swinn Wood LWS round walk to provide an area of (3.027ha) and Haugham Church Belleau Aby Fishing (1.527ha), * Swinn Belleau of 3 km 22.59ha part of Pasture Wood South LWS (0.215ha) Pond (0.75ha) Wood SNCI (25 ha), (1.75 miles). -

Coastal Trends Report Lincolnshire

Coastal Trends Report Lincolnshire (Subcells 2b-c - Grimsby to Gibraltar Point) RP007/L/2008 July 2008 Title here in 8pt Arial (change text colour to black) i We are the Environment Agency. We protect and improve the environment and make it a better place for people and wildlife. We operate at the place where environmental change has its greatest impact on people’s lives. We reduce the risks to people and properties from flooding; make sure there is enough water for people and wildlife; protect and improve air, land and water quality and apply the environmental standards within which industry can operate. Acting to reduce climate change and helping people and wildlife adapt to its consequences are at the heart of all that we do. We cannot do this alone. We work closely with a wide range of partners including government, business, local authorities, other agencies, civil society groups and the communities we serve. Published by: Shoreline Management Group Environment Agency Kingfisher House, Goldhay Way Orton goldhay, Peterborough PE2 5ZR Email: [email protected] www.environment-agency.gov.uk © Environment Agency 2008 Further copies of this report are available from our publications catalogue: All rights reserved. This document may be http://publications.environment-agency.gov.uk reproduced with prior permission of or our National Customer Contact Centre: T: the Environment Agency. 03708 506506 Email: [email protected]. ii Beach at Skegness (Photo: Environment Agency) Glossary Accretion The accumulation of sediment on a beach by the action of natural forces or as a result of man-made artificial structures Bathymetry The topographic relief of the seabed Chainage The distance along a topographic survey transect line, measured in metres.