Committee Daily Bulletin

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

LOC. NC CASE NO. PARTIES DEC EOJ 1 B36 CR 18929 6- Nov-78 4

No. LOC. NC CASE NO. PARTIES RESO DEC ACTION EOJ LOT EOJ CASE NO. BRANCH RTC CFI - SILAY CITY, NEGROS PP vs. Rolando Treyes Y Repuspuyo DISMISSED 15- May-79 433 SILAY CITY 1 B36 CR 18929 6- Nov-78 4- Dec-78 OCCIDENTAL 2 B36 CR 21597 PP vs. Rodolfo Aguillon Y Arasa 29- Jan-79 AFFIRMED 16- Feb-79 15- May-79 36847 CFI – MANILA 3 B153 CR 11116 PP. VS. ALFREDO VENTURA 30- Jun-80 AFFIRMED 24- Jul-80 10- Sep-80 23097 CCC PANGASINAN CCC – LINGAYEN, PP VS. ALBERTO EVANGELISTA, ET AL. AFFIRMED 4- Sep-79 D-1960 4 B48 CR 11196 18- Jan-79 18- May-79 PANGASINAN 5 B45 CR 11451 PP VS. DANILO ITCHON, ET AL. 25- Jan-79 MODIFIED 15- Feb-79 5- Jun-79 Q9521 XVIII QC 6 B40 CR 11748 PP VS. CRESPO CODILANA 14- Feb-79 AFFIRMED 8- Mar-79 2- May-79 3187 CFI LEGASPI CITY ALBAY 7 B45 CR 11983 PP VS. AGAPITO CABACUNGAN 28- Nov-78 AFFIRM 8- Feb-79 4- Sep-79 07/27/79 379-1 II CFI-ZAMBALES B213 8 CR 12194 PP VS. CEFERINO LEYNES, JR. 9- May-78 AFFIRMED 21- Mar-80 27- May-80 Q-7498 IV CFI RIZAL QC 1980 9 B45 CR 12487 PP VS. PANFILO BEDUA, JR. 8- Jan-79 AFFIRMED 4- Feb-79 21- May-79 II-20196 CC- BACOLOD CITY 10 B59 CR 12852 PP VS. BONIFACIO AGUILA Y AGUILA 26- Apr-77 AFFIRMED 30- Jul-79 1- Oct-79 07/30/79 5217 MC BULACAN 11 B36 CR 12875 PP vs. -

For the Month of April, 2014

SUMMARY OF FOREIGN TRAVEL AUTHORITY ISSUED TO LOCAL OFFICIALS AND EMPLOYEES FOR THE MONTH OF APRIL, 2014 Region LGU Name Position Destination Duration Purpose Nature of Travel I Ilocos Norte Imee R. Marcos Governor Hong Kong, SAR of China May 16‐19 Personal On leave I Ilocos Norte Imee R. Marcos Governor Indonesia May 25‐28 Personal On leave I Ilocos Norte Imee R. Marcos Governor Singapore May 28‐June 2 Personal On leave I Candon Ericson G. Singson City Mayor Colombia April 4‐11 Knowledge Exchange and Learning Visit On official time I Dagupan Belen T. Fernandez City Mayor Thailand April 15‐19 Personal On leave I Dagupan Atty. Farah Marie G. Decano City Administrator United States of America April 8‐12 Negotiate the renewal of the Sister City Relationship bet. Dagupan & Milpitas On official bus. I San Fernando Engr. Leocadio C. Balanon Jr. City Engineer Dhaka, Bangladesh May 3‐9 Strengthening the Capacity of City Officials for Urban Adaptation& Resilience On official time I San Fernando Mr. Valmar M. Valdez City Environment & Nat. Resources Offr. Dhaka, Bangladesh May 3‐9 Strengthening the Capacity of City Officials for Urban Adaptation& Resilience On official time II Isabela Faustino G. Dy III Governor United States of America May 23‐June 8 Personal On leave III Bataan Albert S. Garcia Governor Republic of Korea April 23‐26 Study Cum Observation Tour on Environmentally Friendly Tech. & Operational Plans On official bus. III Nueva Ecija Aurelio M. Umali Governor United States of America April 28‐May 30 Personal On leave III Quirino Junie E. -

MINDANAO REPRESENTATIVES 1987-2013 Mindanews Table 1B

MINDANAO REPRESENTATIVES 1987-2013 MindaNews Table 1b. Mindanao Representatives 2001-2013 REPRESENTATIVES DIST. 2001-2004 2004-2007 2007-2010 2010-2013 PROVINCES Agusan del Norte 1 Leovigildo B. Leovigildo B. Aquino, Jose II Aquino, Jose II Banaag (LDP) Banaag (Lakas-CMD) 2 Edelmiro A. Amante-Matba, Amante, Amante, Ma. Angelica Amante (Lakas- Ma. Angelica Edelmiro Atega Rosedell NUCD-UMDP) Rosedell (Lakas- (Kampi) NUCD-UMDP) Agusan del Sur 1 Rodolfo Rodrigo Rodolfo Rodrigo Plaza, Rodolfo Plaza, Ma. Valentina G. Plaza (LDP) G. Plaza (LDP) Rodrigo Galido Galido (NPC) 2 Xxx Xxx xxx Mellana, Everlyn Plaza Basilan 1 Abdulgani A. Abdulgani A. Akbar, Wahab Hataman-Salliman, Salapuddin Salapuddin Muhtamad (LP) Hadjiman Sabbihi (Lakas-NUCD- UMDP) Bukidnon 1 JR Nereus O. JR Nereus O. Pancrudo, Paras, Jesus Acosta (LP) Acosta (LP) Candido Jr. Pios (Lakas-CMD) 2 Berthobal R. Guingona, Guingona, Flores, Florencio, Jr. Ancheta (Lakas- Teofisto III Teofisto Iii De NUCD-UMDP) Lara (NP-UNO) 3 Juan Miguel F. Juan Miguel F. Zubiri, Jose Ma. Zubiri, Jose Ma. III F. Zubiri (Lakas- Zubiri III Fernandez NUCD-UMDP) (Lakas-CMD) 4 Xxx Xxx Xxx xxx Camiguin 1 Jurdin Jesus M. Jurdin Jesus M. Romualdo, Romualdo, Pedro Romualdo (NPC) Romualdo (NPC) Pedro Compostela Valley 1 Manuel E. Manuel E. Zamora, Manuel Zamora-Apsay, Ma. Zamora (Lakas- Zamora Esquivel (Lakas- Carmen NUCD-UMDP) CMD) 2 Prospero S. Prospero S. Amatong, Amatong, Rommel Amatong (Lakas- Amatong Rommel (Lakas- NUCD-UMDP) CMD) Davao del Norte 1 Arrel R. Olaño Arrel R. Olaño Olaño, Arrel Del Rosario, Antonio (Lakas-NUCD- Reyes (Lakas- Rafael UMDP) CMD) 2 Antonio DR. -

Committee Daily Bulletin

CCoommmmiitttteeee DDaaiillyy BBuulllleettiinn 17th Congress A publication of the Committee Affairs Department Vol. II No. 98 Second Regular Session March 14, 2018 COMMITTEE MEETINGS MEASURES COMMITTEE PRINCIPAL SUBJECT MATTER ACTION TAKEN/DISCUSSION NO. AUTHOR Appropriations Substitute Bill Rep. Biazon, Institutionalizing the Pantawid Pamilyang The Committee, chaired by Rep. Karlo Alexei to HBs 17, 41, Deputy Speaker Pilipino Program (4Ps) to reduce poverty Nograles (1st District, Davao City), approved 73, 207, 293, Quimbo, Reps. and promote human capital development the Substitute Bill to the 32 measures. 318, 366, Vargas, Violago, and providing funds therefor 399, 501, Suansing (H.), 518, 699, Primicias- 823, 887, Agabas, Deputy 901, 1098, Speaker 1429, 1548, Hernandez, 1661, 1694, Reps. Belmonte 1948, 2278, (J.C.), Yap (V.), 2456, 2545, Deputy Speaker 2688, 2772, Castro, Reps. 4135, 4155, Macapagal- 5401, 6536, Arroyo, Yap (A.), 6600, HR 464 Tan (A.), & Privilege Fortuno, Speech 277 Castelo, Tupas, Angara-Castillo, Rodriguez (M.), Santos-Recto, Tambunting, Pineda, Tan (S.), Mercado, Bag-ao, Bolilia, Olivarez, Villarin, Romero, and De Jesus Substitute Bill Reps. Fortun Establishing marine protected areas in all The Committee approved the Substitute Bill to to HBs 48 & and coastal municipalities and cities HBs 48 and 2126. 2126 Salimbangon Substitute Bill Reps. Violago, Providing for the mandatory PhilHealth The Committee approved the Substitute Bill to to HBs 209, Garbin, Velarde, coverage for all persons with disability the 11 bills. 524, 591, Treñas, Vargas, (PWDs), amending for the purpose RA 656, 1831, Santos-Recto, 7277, as amended, otherwise known as 2173, 2513, Roa-Puno, the Magna Carta for Persons with 2546, 2738, Pineda, Tupas, Disability 3490 & 5579 Tan (A.), and Bagatsing Substitute Bill Reps. -

Download (PDF)

DOLE launches virtual forum P2 NATIVE SPIRIT, GLOBAL HEROES OFWs get due recognition from host photo by Dodong Echavez, IPS countries for providing diligence PROUD PINOYS. It has been a common sight at the NAIA to see an unending stream of OFWs happily returning home. The Labor Department expects the festive homecomings to return once the global pandemic is over specially during the and care in unsure times P2 holidays. File photo shows Labor Secretary Silvestre Bello in his annual "Year-end Salubong" for OFWs. Gov't guarantees OFWs START GOING BACK TO WORK Kin of displaced FILIPINO workers abroad have started going back to work amid easing lockdowns workers given welfare, health and the reopening of economies in their host countries as observed by several Philippine Overseas Labor Offices (POLO). P2 educational of all seafarers help P3 THE Philippine Overseas Employment Administration (POEA) Governing Board has issued its latest interim guidelines on Phl hails big Qatar Large companies the deployment and repatriation of Filipino seafarers to further ensure their protection and welfare in the current crisis brought by urged to provide the COVID-19 pandemic. migrant reforms P3 P2 shuttle for workers TO STRENGTHEN government’s anti-COVID campaign and help ease the plight of workers affected by the pandemic-induced transport crunch government now requires large companies to provide shuttle services for their workers. P3 OVERSEAS Ex-rebels, child workers Bahrain lifts virus photo by Dodong Echavez, IPS P7 ban on PH labor BIG BROTHER'S VISIT. Labor Secretary Silvestre Bello III (left) head of the Coordinated Operations to Defeat aided P5 COVID-19 (CODE) Team confers with Malabon Mayor Antolin Oreta (right) and Rep. -

Corona Impeachment Trial Momblogger, Guest Contributors, Press Releases, Blogwatch.TV

Corona Impeachment Trial momblogger, Guest Contributors, Press Releases, BlogWatch.TV Creative Commons - BY -- 2012 Dedication Be in the know. Read the first two weeks of the Corona Impeachment trial Acknowledgements Guest contributors, bloggers, social media users and news media organizations Table of Contents Blog Watch Posts 1 #CJTrialWatch: List of at least 93 witnesses and documentary evidence to be presented by the Prosecution 1 #CJtrialWatch DAY 7: Memorable Exchanges, and One-Liners, AHA AHA! 10 How is the press faring in its Corona impeachment trial coverage? via @cmfr 12 @senmiriam Senator Santiago lays down 3 Crucial Points for the Impeachment Trial 13 How is the press faring in its Corona impeachment trial coverage? via @cmfr 14 Impeachment and Reproductive Health Advocacy: Parellelisms and Contrasts 14 Impeachment Chronicles, 16-19 January 2012 (Day 1-4) via Akbayan 18 Dismantling Coronarroyo, A Conspiracy of Millions 22 Simplifying the Senate Rules on Impeachment Trials 26 Statement of Assets, Liabilities and Net Worth (SALN) 36 #CJTrialWatch: Your role as Filipino Citizens 38 Video & transcript: Speech of Chief Justice Renato Corona at the Supreme Court before trial #CJtrialWatch 41 A Primer on the New Rules of Procedure Governing Impeachment Trials in the Senate of the Philippines 43 Making Sacred Cows Accountable: Impeachment as the Most Formidable Weapon in the Arsenal of Democracy 50 List of Congressmen Who Signed/Did Not Sign the Corona Impeachment Complaint 53 Twitter reactions: House of Representatives sign to impeach Corona 62 Full Text of Impeachment Complaint Against Supreme Court Chief Justice Renato Corona 66 Archives and Commentaries 70 Corona Impeachment Trial 70 Download Reading materials : Corona Impeachment trial 74 Blog Watch Posts #CJTrialWatch: List of at least 93 witnesses and documentary evidence to be presented by the Prosecution Blog Watch Posts #CJTrialWatch: List of at least 93 witnesses and documentary evidence to be presented by the Prosecution Lead prosecutor Rep. -

Zamboanga Peninsula Regional Recovery Program 2020-2022

ZAMBOANGA PENINSULA REGIONAL RECOVERY PROGRAM 2020-2022 Regional Development Council Regional Disaster Risk Reduction and Management Council Region IX 15 June 2020 MESSAGE The Corona Virus-19 (COVID-19) pandemic has caught all of us unaware. It has not only disrupted our normal daily lives but also caused damage to our economy, infrastructures, livelihood, agriculture, health and environment , among others. The different national and regional line agencies and local government units (LGUs) have been working relentlessly together to establish health protocols and guidelines to minimize the damage and lessen the impact of COVID-19 to the people and their means of living, and to save lives. The private sector is also doing its share as partner of the government during this crisis. As we are rebuilding our economy, we hope that the lessons we are learning from this pandemic would influence and transform us to a new and better normal way of living. The Zamboanga Peninsula Recovery Program (RRP) is intended to help the region recover from the impact of COVID-19. It will serve as the region’s blueprint towards rebuilding a resilient and better community. It includes an assessment of the extent of damage caused by the pandemic, the government’s response, the framework on how to go about rebuilding, and the proposed programs and projects for recovery. The RRP shall be undertaken through the collaboration among the line agencies, LGUs, the private sector and the citizenry. We recognize the efforts put together by the region’s stakeholders and their contribution in the formulation of the Regional Recovery Program in such a short period of time. -

Committee Daily Bulletin

CCoommmmiitttteeee DDaaiillyy BBuulllleettiinn Vol. II No. 95 A publication of the Committee Affairs Department March 17, 2015 COMMITTEE MEETINGS MEASURES COMMITTEE PRINCIPAL SUBJECT MATTER ACTION TAKEN/DISCUSSION NO. AUTHOR Good HR 622 Rep. Dela Cruz Inquiry into the anomalies relating to the The Committee, chaired by Rep. Oscar Government and exercise of functions and authority by the Rodriguez (3rd District, Pampanga), Public Land Transportation Franchising and terminated its deliberations on HR 622. The Accountability Regulatory Board (LTFRB), particularly on Secretariat was directed to prepare the draft the granting of special franchises and Committee Report. other considerations to certain bus companies LTFRB Chair Winston Ginez explained that the agency may suspend the operations of a bus company involved in a serious accident for a period of up to 30 days even before the conduct of a hearing on the incident, and may suspend or cancel its Certificate of Public Conveyance (CPC) if there is gross negligence or violation of the terms and conditions of its franchise. On the unauthorized issuance of CPC in Region III, Ginez reported that appropriate charges have been filed in court against several officials and personnel of LTFRB Region III involved. The case against former Regional Director Bruno Patricio, who has retired from the service, will be brought to the Ombudsman for the filing of criminal and civil charges. Ginez added that the hearing for the cancellation of the questionable CPCs issued in Region III is still ongoing. The subject of the ongoing cancellation proceedings includes 112 bus units of Pangasinan Solid North, 50 units of Pangasinan Five Star, 80 units of First Luzon and 14 units of Luzon Cisco Lines. -

Concurso Público Do Departamento Estadual De Trânsito-Detran/Rs

CONCURSO PÚBLICO DO DEPARTAMENTO ESTADUAL DE TRÂNSITO-DETRAN/RS EDITAL N° 19/2013 Homologação Final do Concurso DETRAN/RS – 2013 – Exceto cargo de Técnico Superior O Diretor-Presidente do Departamento Estadual de Trânsito – DETRAN/RS, por este edital, torna pública a Homologação final exceto para o cargo de Técnico Superior , conforme segue: 1. HOMOLOGAÇÃO DO RESULTADO FINAL CANDIDATOS COM DEFICIÊNCIA Estão sendo homologados, através deste edital, os resultados finais dos candidatos com deficiência nos cargos de Auxiliar Técnico – Mecânica, Assistente Administrativo e Operacional, do Concurso 01/2013, conforme segue: Legenda: Nome, Inscrição, nota, classificação geral, classificação final candidatos com deficiência. 2 - 1-Auxiliar Técnico - Mecânica: MARCOS MARQUES DOS SANTOS, 23902831361-3, 37, 26, 1;4 - 2- Assistente Administrativo e Operacional: MAíRA TEIXEIRA CORDEIRO, 23904814409-7, 36, 700, 1;ANDRESA FRAGOSO DOS SANTOS (LIMINAR), 23904806269-9, 35, 731, 2;RODRIGO SCANDOLARA ZEFERINO, 23904834053-0, 35, 883, 3;RAFAEL MENEZES FERRETTO, 23904850020-0, 34, 1120, 4;EDUARDO MAGALHAES AZAMBUJA, 23904809300-6, 33, 1214, 5;FELIPE DA ROSA, 23904804886-6, 32, 1509, 6;MARCOS JOSé BELLOLI, 23904844360-5, 32, 1540, 7;LEONARDO PEDRETTI DOLEJAL, 23904845877-6, 32, 1602, 8;CAROLINA GODOI BRUM, 23904845310-0, 30, 2317, 9;ADRIANO BONIFÁCIO SOUZA, 23904794615-9, 30, 2326, 10;BRUNO DE CAMPOS GARCIA, 23904804022-9, 30, 2333, 11;IRINEU MACHADO REINALDO, 23904820506-4, 30, 2536, 12;BRUNO DE FREITAS, 23904854443-1, 28, 3427, 13;LUCAS KLEIN HAMERSKI, 23904818256-9, -

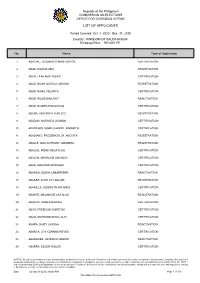

List of Applicants

Republic of the Philippines COMMISSION ON ELECTIONS OFFICE FOR OVERSEAS VOTING LIST OF APPLICANTS Period Covered: Oct. 1, 2020 - Dec. 31, 2020 Country : KINGDOM OF SAUDI ARABIA Embassy/Post : RIYADH PE No. Name Type of Application 1 ABACIAL, TEODERICO MAGTORTOR CERTIFICATION 2 ABAD, HALIMA ABO REGISTRATION 3 ABAD, LEAH MAE PONCE CERTIFICATION 4 ABAD, NOAH ANGELO VARGAS REGISTRATION 5 ABAD, RAMIL FELARCA CERTIFICATION 6 ABAD, ROSIE BALUYUT REACTIVATION 7 ABAD, SAMIRA PINAGAYAO CERTIFICATION 8 ABADA, VERONICA SUPLICO REGISTRATION 9 ABADAN, NORHATA GUIMAN CERTIFICATION 10 ABADEJOS, MORK GABRIEL ABOBOTO CERTIFICATION 11 ABADIANO, PRODENCIO JR. ANCHITA REGISTRATION 12 ABALLE, MAX ANTHONY OMAMBAC REGISTRATION 13 ABALOS, IRENE REGATCHO CERTIFICATION 14 ABALOS, MHARLON AMANCIO CERTIFICATION 15 ABAN, EDELDEN MORALES CERTIFICATION 16 ABANDO, ELENA CABARRIBAN REACTIVATION 17 ABANES, LOVE JOY DALIDA REGISTRATION 18 ABANILLA, JUDERLYN ARCENIO CERTIFICATION 19 ABANTE, MELANI DE LAS ALAS REGISTRATION 20 ABANTO, ARMER BARING CERTIFICATION 21 ABAO, FREEDOM GUIRITAN CERTIFICATION 22 ABAO, MOHAMMAD NUL ALIH CERTIFICATION 23 ABARA, DAISY LAGUNA REACTIVATION 24 ABARCA, JOY CZARINE REYES CERTIFICATION 25 ABARQUEZ, JOVENCIO ABDON REACTIVATION 26 ABARRA, EDLEN VIGUAS CERTIFICATION NOTICE: All authorized recipients of any personal data, personal information, privileged information and sensitive personal information contained in this document, including other pertinent documents attached thereto that are shared by the Commission on Elections in compliance with the existing laws and rules, and in conformity with the Data Privacy Act of 2012 ( R.A. No. 10173 ) and its implementing Rules and Regulations, as well as the pertinent Circulars of the National Privacy Commission, are similarly bound to comply with the said laws, rules and regulations, relating to data privacy, security, confidentiality, protection and accountability. -

Notable New Bird Records from the Philippines ARNE E

FORKTAIL 31 (2015): 24–36 Notable new bird records from the Philippines ARNE E. JENSEN, TIMOTHY H. FISHER † & ROBERT O. HUTCHINSON The most recent checklist of the birds of the Philippines published by the Wild Bird Club of the Philippines recognises 682 species, based on the International Ornithological Union World Bird List. This is a substantial increase from the 572 species recognised by Kennedy et al. (2000), owing in part to the progression of taxonomic knowledge which has resulted in many taxa being elevated to full species status. Six species new to science have also been described since 2000 and an additional 54 species presently considered to be accidental visitors have been observed and recorded; these are summarised here with supporting notes for species that have not previously been documented. INTRODUCTION (AL), June Dale Lozada, Michael Lu (MLu), Norberto Madrigal, Tina Sarmiento Mallari (TSM), Wency Mallari (WM), Somjai Our knowledge of the taxonomy and distribution of the Philippine Manothirakul (SM), Lucia Mapua, Frederico Maravilla, James avifauna is rapidly expanding as a consequence of more research and McCarthy (JM), Jasmin Meeren, Hans Meÿer (HM), Editha fieldwork by professional and amateur ornithologists. In addition to Milan (EM), Spike Millington (SMi), Erik Mølgaard, Marianne six species new to science—Calayan Rail Gallirallus calayanensis, Mølgaard, Flemming Møller, Vibeke Møller (VM), Pete Morris Bukidnon Woodcock Scolopax bukidnonensis, Camiguin Hanging (PM), Shotaro Nakagun (SN), Ng Bee Choo, Romy Ocon (RO), Parrot Loriculus camiguinensis, Cebu Hawk Owl Ninox rumseyi, Somkiat Pakapinyo (SP), Christian Perez (CP), Romulo D. Camiguin Hawk Owl Ninox leventisi, and Sierra Madre Ground Quemado II, Sylvia Ramos, Tonji Ramos, Phil Round (PDR), Warbler Robsonius thompsoni—and many taxa elevated to full species Richard Ruiz (RR), Ivan Sarenas, Felix Servita (FS), Pete Simpson status as a result of morphological, bioacoustic and/or phylogenetic (PS), Angelique Songco (AS), Norman Songco, Dave van der Spool studies (e.g. -

October 2017

Carolina Medical Mission Volume 19, Issue 2 OCTOBER 2017 CMM LIKENED TO A MUSTARD SEED HOPE OF JOY: CAROLINA MEDICAL MISSION By Emma Dempsey By Jaime Lagasca “The Kingdom of heaven is like a mustard seed.” Mark 4:30-32, Still fresh in my mind were the joy of excitement and laughter that Matthew 13;31-32. The mustard seed is not only smaller than all reverberated across the rooms and hallways at Dr. PJ Garcia the other seeds in a garden, but when it is planted, it grows up and Memorial Hospital becomes a tree that is larger than all the other garden plants. in Cabanatuan City, Nueva Ecija, Like a mustard seed, CMM started small with only six volunteers and at Jose in 1993. This year, however, as CMM celebrates its Silver Lingad Memorial Anniversary, CMM has grown hundred fold. This year’s Mission Regional Hospital to Bataan has 82 in San Fernando, volunteers from the US Pampanga every & Philippines. CMM’s time Dr. James growth is a result of the Kiley removed the tenacity, dedication, eye dressing of an hard work and sacrifices indigent patient whom he operated cataract the previous day! of its many volunteers, “I can see, I can see” was said repeatedly, as tears of joy were partners, sponsors and pouring in their eyes. These indigent patients were not able to see donors. CMM’s mustard or were going blind for several years due to cataract, but now were seed is now a large tree able to see through the miracle of lens implantation.