Securities and Exchange Commission Form 8-K

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

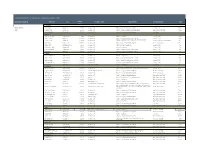

Track Record of Prior Experience of the Senior Cobalt Team

Track Record of Prior Experience of the Senior Cobalt Team Dedicated Executives PROPERTY City Square Property Type Responsibility Company/Client Term Feet COLORADO Richard Taylor Aurora Mall Aurora, CO 1,250,000 Suburban Mall Property Management - New Development DeBartolo Corp 7 Years CEO Westland Center Denver, CO 850,000 Suburban Mall Property Management and $30 million Disposition May Centers/ Centermark 9 Years North Valley Mall Denver, CO 700,000 Suburban Mall Property Management and Redevelopment First Union 3 Years FLORIDA Tyrone Square Mall St Petersburg, FL 1,180,000 Suburban Mall Property Management DeBartolo Corp 3 Years University Mall Tampa, FL 1,300,000 Suburban Mall Property Management and New Development DeBartolo Corp 2 Years Property Management, Asset Management, New Development Altamonte Mall Orlando, FL 1,200,000 Suburban Mall DeBartolo Corp and O'Connor Group 1 Year and $125 million Disposition Edison Mall Ft Meyers, FL 1,000,000 Suburban Mall Property Management and Redevelopment The O'Connor Group 9 Years Volusia Mall Daytona Beach ,FL 950,000 Suburban Mall Property and Asset Management DeBartolo Corp 1 Year DeSoto Square Mall Bradenton, FL 850,000 Suburban Mall Property Management DeBartolo Corp 1 Year Pinellas Square Mall St Petersburg, FL 800,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year EastLake Mall Tampa, FL 850,000 Suburban Mall Property Management and New Development DeBartolo Corp 1 Year INDIANA Lafayette Square Mall Indianapolis, IN 1,100,000 Suburban Mall Property Management -

3Q08 SUPP V2

Third Quarter 2008 Supplemental Information TAUBMAN CENTERS, INC. Table of Contents Third Quarter 2008 Introduction 1 Summary Financial Information 2 Income Statement- Quarter 3 Income Statement- Year to Date 4 Earnings Reconciliations: Net Income Allocable to Common Shareowners to Funds from Operations 5 Net Income to Beneficial Interest in EBITDA 6 Net Income to Net Operating Income 7 Changes in Funds from Operations and Earnings Per Share 8 Components of Other Income, Other Operating Expense, and Gains on Land Sales and Other Nonoperating Income - Quarter 9 Components of Other Income, Other Operating Expense, and Gains on Land Sales and Other Nonoperating Income - Year to Date 10 Recoveries Ratio Analysis 11 Balance Sheets (Updated as of 11/03/08) 12 Debt Summary (Updated as of 11/03/08) 13 Other Debt, Equity, and Certain Balance Sheet Information 14 Construction 15 Capital Spending 16 Operational Statistics 17 Owned Centers 18 Major Tenants in Owned Portfolio 19 Anchors in Owned Portfolio 20 TAUBMAN CENTERS, INC. Introduction Third Quarter 2008 Taubman Centers, Inc. (the Company or TCO) is a Michigan corporation that operates as a self-administered and self-managed real estate investment trust (REIT). The Taubman Realty Group Limited Partnership (Operating Partnership or TRG) is a majority-owned partnership subsidiary of TCO that owns direct or indirect interests in all of its real estate properties. In this report, the term “Company" refers to TCO, the Operating Partnership, and/or the Operating Partnership's subsidiaries as the context may require. The Company engages in the ownership, management, leasing, acquisition, disposition, development, and expansion of regional and super-regional retail shopping centers and interests therein. -

Simon Property Group, Inc

UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2007 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 04-6268599 (State or other jurisdiction of (Commission File No.) (I.R.S. Employer incorporation or organization) Identification No.) 225 West Washington Street Indianapolis, Indiana 46204 (Address of principal executive offices) (ZIP Code) (317) 636-1600 (Registrant’s telephone number, including area code) Securities registered pursuant to Section 12 (b) of the Act: Name of each exchange Title of each class on which registered Common stock, $0.0001 par value New York Stock Exchange 6% Series I Convertible Perpetual Preferred Stock, $0.0001 par value New York Stock Exchange 83⁄8% Series J Cumulative Redeemable Preferred Stock, $0.0001 par value New York Stock Exchange Securities registered pursuant to Section 12 (g) of the Act: None Indicate by check mark if the Registrant is a well-known seasoned issuer (as defined in Rule 405 of the Securities Act). Yes ፤ No អ Indicate by check mark if the Registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes អ No ፤ Indicate by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. -

Strategic Advice for the Real Estate Community and Retailers. Since 1969

Strategic advice for the real estate community and retailers. Since 1969. Retail properties Residential properties Shopco Properties LLC Commercial properties www.shopcogroup.com Marc Yassky Joseph Speranza Principal Principal [email protected] [email protected] 424 Madison Ave 16th floor 485 Madison Ave 22nd floor New York NY 10017 New York NY 10122 212 223 1270 212 594 9400 212 202 7777 fax 888 308 1030 fax ABOUT US Shopco Properties LLC is a real estate consultancy firm focused on retail centers and multifamily residential buildings, offering strategic advice regarding development, redevelopment, finance, construction, leasing, management, marketing, and acquisition and disposition. Shopco’s depth of experience comes from the firm’s history as a developer and acquirer of regional malls, other shopping centers, and multifamily projects, across the nation. Founded in 1969, its primary focus has been retail, residential, and commercial real estate. Along with the company’s development and acquisition activities, Shopco acts as a consultant to a variety of clients, including Wall Street firms engaged in real estate lending, development and workouts, developers, private equity funds, family offices with real estate holdings, and retail ten- ants seeking locations. Clients include or have included: Lehman Brothers, JPMorgan Chase Bank, Swedbank, and Tishman Speyer, amongst others. Since the company is a small one, the principals’ experience and expertise is directly available to our clients. Our history of developing, as well as redeveloping and operating retail, residential and commercial projects, gives us particular insight when serving our customers. Shopco Properties LLC www.shopcogroup.com HISTORY Shopco was founded in 1969 to develop enclosed regional malls. -

A Brief History of Outlet Malls

Faculty & Research A Survey of Outlet Mall Retailing: Past, Present, and Future by A. Coughlan and D. Soberman 2004/36/MKT Working Paper Series A Survey of Outlet Mall Retailing: Past, Present, and Future by Anne T. Coughlan* and David A. Soberman** April 2004 *Anne T. Coughlan, Marketing Department, Kellogg School of Management, Northwestern University, 2001 Sheridan Road, Evanston, IL 60208-2008. e-mail: [email protected] **David A. Soberman, Marketing Department, INSEAD, Boulevard de Constance, 77305 Fontainebleau CEDEX, France. e-mail: [email protected] © 2004 Anne T. Coughlan and David A. Soberman. The authors’ names are listed alphabetically but their contributions to this paper were equal. ABSTRACT In this article, we summarize the history and current state of outlet retailing, from its beginnings with individual stores connected to textile factories up to today’s extensive multi- store malls. We describe prototypical practices in individual outlet mall stores as discovered in original research done in the Chicago marketplace. From this we develop a number of propositions relating to future practices in and prospects for outlet malls. The discussion suggests several avenues for further research in the area. In sum, the paper provides a comprehensive framework for understanding the outlet mall phenomenon and also provides a roadmap for future research in the area. 1 A Survey of Outlet Mall Retailing: Past, Present, and Future 1. Introduction The following is a brief survey of outlet stores, an important sector of the U.S. retailing industry. We recount the historical background for outlet stores and provide an analysis of the current state of the phenomenon (based on secondary data and primary data collected by survey). -

2007 Successful Businesses Possess Certain Attributes That Distinguish Them from Their Peers and Competitors

2007 Successful businesses possess certain attributes that distinguish them from their peers and competitors. Once again in 2007, our people, strategy and assets – Taubman Centers’ points of difference – continued to deliver industry-leading growth and performance. 1. People Our people are at the heart of our success. At all levels of our company we love what we do, bringing unmatched expertise, passion and pride to the planning, merchandising and management of the retail environments we create for communities and investors. Retailing is in our DNA, so we approach our years, and our 11-person operating committee work with a deep respect for and knowledge of our averages 17 years with the company. And the customers – both shoppers and retailers. Taubman efforts of all our people are driven by a perfor- is a great company to work for, so talented, mance culture rooted in more than five decades dedicated people stick around. The tenure of our of success, innovation and industry leadership. three most senior executives averages over 20 page 1 Taubman Centers, Inc. page 2 2. Strategy In an industry sector dominated by consolidators and acquirers, we prefer to grow through the disciplined development of our own properties and the intense management of our existing centers. Our portfolio – at $7 billion of enterprise value -- is to materially increase our growth. When it makes large enough to give us important economies of sense, we will also sell centers and recycle capital. scale and solidify our relationships with the world’s How’s this strategy working? Based on total best retailers. But it’s not so large that we can’t return to shareholders, Taubman Centers has out- maximize the potential of every property. -

Heritage Park Mall Redevelopment Scenarios

Heritage Park Mall Redevelopment Scenarios Midwest City, Oklahoma March 2017 This page was intentionally left blank ACKNOWLEDGMENTS City Leadership Matt Dukes - Mayor Susan Eads- Ward 1 Pat Byrne - Ward 2 Rick Dawkins - Ward 3 Sean Reed - Ward 4 Christine Allen - Ward 5 Jeff Moore - Ward 6 City Staff J. Guy Henson, City Manager Tim Lyon, Assistant City Manager Kay Hunt, Public and Media Relations Specialist Robert Coleman, Economic Development Director Kathy H. Spivey, GIS Coordinator Billy Harless, Community Development Director Julie Shannon, Comprehensive Planner Kellie Gilles. Planning Manager Consultant Team Catalyst Commercial Jason Claunch Reid Cleeter Sue Walker Monica James Special Thanks The City and Catalyst Team acknowledges stakeholders that participated in this study including residents, property owners, developers, and real estate brokers. 3 This page was intentionally left blank 7 INTRODUCTION 12 MARKET TRENDS 20 MARKET DEMAND 38 COMMUNITY INPUT 42 CASE STUDIES 48 POTENTIAL SCENARIOS 54 FISCAL ANALYSIS 1. Introduction City Po est pul idw ati M on THE GREATER OKLAHOMA CITY 58,210 REGION Population Stillwater Hennessey Yale (2016) PAYNE Cushing 24,093 Perkins Crescent KINGFISHER LOGAN Langston Households Guthrie Kingsher Dayti City me est Po 35 w pu ¨¦§ id la ti Chandler M o n Edmond Luther ¨¦§44 23,260 LINCOLN Jones Employees CANADIANEl Reno OKLAHOMASpencer ¨¦§40 Yukon Choctaw ¨¦§235 Harrah Prague (2016) Oklahoma City Midwest City « McLoud Union City Tinker AFB Mustang Will Rogers 1,878 Employers World Airport ¨¦§240 40 -

Securities and Exchange Commission Form 8-K

SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 8-K CURRENT REPORT Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 Date of Report (Date of earliest event reported): October 29, 2007 24MAR200612322016 SIMON PROPERTY GROUP, INC. (Exact name of registrant as specified in its charter) Delaware 001-14469 046268599 (State or other jurisdiction (Commission (IRS Employer of incorporation) File Number) Identification No.) 225 WEST WASHINGTON STREET INDIANAPOLIS, INDIANA 46204 (Address of principal executive offices) (Zip Code) Registrant’s telephone number, including area code: 317.636.1600 Not Applicable (Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: អ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) អ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) អ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) អ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) Item 2.02. Results of Operation and Financial Condition On October 29, 2007, Simon Property Group, Inc. (the ‘‘Registrant’’) issued a press release containing information on earnings for the quarter ended September 30, 2007 and other matters. A copy of the press release is attached hereto as Exhibit 99.2 and the information in the press release is incorporated by reference into this report. -

THE MILLS CORPORATION (Exact Name of Registrant As Specified in Its Charter)

SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ፤ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2002 or អ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 1-12994 THE MILLS CORPORATION (Exact Name of Registrant as Specified in Its Charter) DELAWARE 52-1802283 (State or other jurisdiction of (I.R.S. Employer Identification No.) incorporate or organization) 1300 WILSON BOULEVARD, SUITE 400 ARLINGTON, VA 22209 (Address of principal executive office) (Zip Code) Registrant's telephone number, including area code: (703) 526-5000 Securities registered pursuant to Section 12(b) of the Act: Title of each Class Name of each exchange on which registered COMMON STOCK, $0.01 PAR VALUE NEW YORK STOCK EXCHANGE 9% SERIES B CUMULATIVE REDEEMABLE NEW YORK STOCK EXCHANGE PREFERRED STOCK, $0.01 PAR VALUE 9% SERIES C CUMULATIVE REDEEMABLE NEW YORK STOCK EXCHANGE PREFERRED STOCK, $0.01 PAR VALUE Securities registered pursuant to Section 12(g) of the Act: None Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter periods that the registrant was required to file such report(s)) and (2) has been subject to such filing requirements for the past 90 days. Yes ፤ No អ Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (Section 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. -

Bankruptcy Forms for Non-Individuals, Is Available

Case 16-10056-RAM Doc 1 Filed 01/04/16 Page 1 of 47 Fill in this information to identify your case: United States Bankruptcy Court for the: SOUTHERN DISTRICT OF FLORIDA Case number (if known) Chapter you are filing under: Chapter 7 Chapter 11 Chapter 12 Chapter 13 Check if this an amended filing Official Form 201 Voluntary Petition for Non-Individuals Filing for Bankruptcy 12/15 If more space is needed, attach a separate sheet to this form. On the top of any additional pages, write the debtor's name and case number (if known). For more information, a separate document, Instructions for Bankruptcy Forms for Non-Individuals, is available. 1. Debtor's name Goodman and Dominguez, Inc. 2. All other names debtor DBA Traffic used in the last 8 years DBA Traffic Shoe Include any assumed DBA Traffic Shoes names, trade names and DBA Traffic Shoe, Inc. doing business as names DBA Goodman & Dominguez, Inc. 3. Debtor's federal Employer Identification 59-2268839 Number (EIN) 4. Debtor's address Principal place of business Mailing address, if different from principal place of business 10701 NW 127 St Medley, FL 33178 Number, Street, City, State & ZIP Code P.O. Box, Number, Street, City, State & ZIP Code Miami-Dade Location of principal assets, if different from principal County place of business Various retail stores located in several states in the US and Puerto Rico Number, Street, City, State & ZIP Code 5. Debtor's website (URL) www.trafficshoe.com 6. Type of debtor Corporation (including Limited Liability Company (LLC) and Limited Liability Partnership (LLP)) Partnership Other. -

City Plan Commission Agenda Packet Tuesday, June 16, 2015

City of Richardson City Plan Commission Agenda Packet Tuesday, June 16, 2015 To advance to the background material for each item in the agenda, click on the item title in the agenda or click on Bookmarks in the tool bar on the left side of your screen. AGENDA CITY OF RICHARDSON - CITY PLAN COMMISSION JUNE 16, 2015 7:00 P.M. CIVIC CENTER – COUNCIL CHAMBERS 411 W. ARAPAHO ROAD BRIEFING SESSION: 6:00 P.M. Prior to the regular business meeting, the City Plan Commission will meet with staff in the East Conference Room, located on the first floor, to receive a briefing on: A. Discussion of Regular Agenda items. B. Staff Report on pending development, zoning permits, and planning matters. MINUTES 1. Approval of minutes of the regular business meeting of June 2, 2015. CONSENT ITEMS All items listed under the Consent Agenda are considered to be routine by the City Plan Commission and will be enacted by one motion in the form listed below. There will be no separate discussion of these items unless desired, in which case any item(s) may be removed from the Consent Agenda for separate consideration. 2. Amending Plat – Bush Central Station Addition, Lot 1B, Block I: A request for approval of an amending plat for a single lot, having 11.62 acres of land located at 1201 State Street; the southwest corner of President George Bush Highway and Plano Road. Applicant: Brad Moss, Kimley-Horn and Associates, representing BCS Office Investments One, LP. Staff: Susan M. Smith. 3. Amending Plat – Bush Central Station Addition, Lot 2A, Block H, and Lot 3A, Block X: A request for approval of an amending plat for two lots totaling 3.44 acres, located at 1150 State Street and 1230 State Street respectively; the northeast corner of Routh Creek Parkway and Hill Street. -

2008 Annual Report Imon Property Group, Inc

2008 Annual Report imon Property Group, Inc. (NYSE: SPG), headquartered in Indianapolis, Indiana, is the largest public real estate company in the United States. We operate from five retail real estate platforms – regional malls, Premium S ® ® Corporate Outlet Centers , The Mills , community/lifestyle centers and international properties. As of December 31, 2008, we owned or had an interest in 386 properties comprising 263 million square feet of gross leasable area in North Profile America, Europe and Asia. Simon Property Group is an S&P 500 Company. Additional Simon Property Group information is available at www.simon.com. Table of Contents Simon’s Five Retail Real Estate Platforms Financial Highlights 1 From the Chairman & CEO 2 Selected Financial Data 5 Management’s Discussion and Analysis 6 Consolidated Financial Statements 27 Notes to Consolidated REGIONAL MALLS PREMIUM OUTLET CENTERS® Financial Statements 32 Properties 61 Board of Directors 64 Executive Officers and Members of Senior Management 66 Investor Information 67 THE MILLS® COMMUNITY/LIFESTYLE CENTERS INTERNATIONAL PROPERTIES Simon Property Group, Inc. Financial Highlights Percent Change 2008 vs. 2008 2007 2007 Operating Data (in millions) Consolidated Revenue $ 3,783 $ 3,651 3.6% Funds from Operations (FFO)* 1,852 1,692 9.5% Per Common Share Data FFO* (Diluted) $ 6.42 $ 5.90 8.8% Net Income (Diluted) 1.87 1.95 (4.1%) Dividends 3.60 3.36 7.1% Common Stock Price at December 31 53.13 86.86 (38.8%) Stock and Limited Partner Units at Year End Shares of Common Stock Outstanding (in thousands) 231,320 223,035 Limited Partner Units in the Operating Partnership Outstanding (in thousands) 56,368 57,913 Market Value of Common Stock and Limited Partner Units (in millions) $ 15,285 $ 24,403 Total Market Capitalization** (in millions) $ 40,273 $ 49,265 Other Data Total Number of Properties in the U.S.