Interim Results Presentation

Total Page:16

File Type:pdf, Size:1020Kb

Load more

Recommended publications

-

Press Release

Press release Zurich/Geneva, 17 April 2019 Global Powers of Luxury Goods: Swiss luxury companies are taking the digital path to accelerate growth • The sales of the world’s Top 100 luxury goods companies grew by 11% and generated aggregated revenues of USD 247 billion in fiscal year 2017 • Richemont, Swatch Group and Rolex remain in the top league of Deloitte’s Global Powers of Luxury Goods ranking • All Swiss companies in the Top 100 returned to growth in FY2017, but with only 8% increase, they lagged behind the whole market for the third time in a row • Luxury goods companies are making significant investments in digital marketing and the use of social media to engage their customers Despite the recent slowdown of economic growth in major markets including China, the Eurozone and the US, the luxury goods market looks positive. In FY2017, the world’s Top 100 luxury goods companies generated aggregated revenues of USD 247 billion, representing composite sales growth of 10.8%, according to Deloitte’s 2019 edition of Global Powers of Luxury Goods. For comparison, in FY2016 sales were USD 217 billion and annual sales growth was as low as 1.0%. Three-fourth of the companies (76%) reported growth in their luxury sales in FY2017, with nearly half of these recording double-digit year-on-year growth. Switzerland and Hong Kong prevail in the luxury watches sector Looking at product sectors, clothing and footwear dominated again in FY2017, with a total of 38 companies. The multiple luxury goods sector represented the largest sales share (30.8%), narrowly followed by jewellery and watches (29.6%). -

Joining RJC Will Build Your Business in Major International Markets

Joining RJC Will Build Your Business in Major International Markets Hong Kong International Jewellery Show 7 March 2014 Agenda Welcome by · Benedict Sin, HKJJMA Chairman Opening by · James Courage, RJC Chairman and PGI Chief Executive Officer Speakers · Catherine Sproule, RJC Chief Executive Officer, Interim · Charles Chaussepied, Piaget Director of Corporate Affairs, Richemont CSR Committee member, Chair, RJC Accreditation/Training Committee · David Bouffard, Signet Jewelers Ltd. VP, Corporate Affairs, Co-Chair, RJC Standards Committee · Q&A Session Cocktail reception hosted by RJC www.responsiblejewellery.com Mission, vision values – re-launched in 2013 RJC Vision Our vision is a responsible world-wide supply chain that promotes trust in the global fine jewellery and watch industry. RJC Mission We strive to be the recognized standards and certification organization for supply chain integrity and sustainability in the global fine jewellery and watch industry. RJC Values We are respectful and fair. We practice honesty, integrity and accountability. We engage in open collaboration . www.responsiblejewellery.com … and growing Membership: • 460+ Members • US$40+ billion in annual relevant sales Accredited Auditor firms: • 12 firms • 6 firms with audit scope in Hong Kong and China Certification: • 327+ Certified Members – growing daily www.responsiblejewellery.com From mine to retail • Mine to retail initiative for the jewellery supply chain, covering diamonds, gold and platinum group metals • Averaging 20% pa growth in total Membership over -

United States District Court Southern District of Florida Case No. Richemont International Sa, Cartier International A.G., Montb

Case 0:16-cv-62612-BB Document 1 Entered on FLSD Docket 11/03/2016 Page 1 of 44 UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF FLORIDA CASE NO. RICHEMONT INTERNATIONAL SA, CARTIER INTERNATIONAL A.G., MONTBLANC-SIMPLO GMBH, CHLOE S.A.S., and OFFICINE PANERAI A.G., Plaintiffs, vs. THE INDIVIDUALS, PARTNERSHIPS, AND UNINCORPORATED ASSOCIATIONS IDENTIFIED ON SCHEDULE “A,” Defendants. / COMPLAINT FOR INJUNCTIVE RELIEF AND DAMAGES Plaintiffs, Richemont International SA, Cartier International A.G., Montblanc-Simplo GMBH, Chloe S.A.S., and Officine Panerai A.G. (collectively “Plaintiffs”),1 hereby sue Defendants, the Individuals, Partnerships and Unincorporated Associations identified on Schedule “A” hereto (collectively “Defendants”). Defendants are promoting, selling, offering for sale and distributing goods using counterfeits and confusingly similar imitations of Plaintiffs’ respective trademarks within this district through various fully interactive commercial Internet websites operating under their individual, partnership, and/or business association names identified on Schedule “A” hereto (the “Subject Domain Names”). In support of their claims, Plaintiffs allege as follows: 1 Plaintiffs are all subsidiaries of Compagnie Financière Richemont SA, which is one of the world’s leading luxury goods groups. Case 0:16-cv-62612-BB Document 1 Entered on FLSD Docket 11/03/2016 Page 2 of 44 JURISDICTION AND VENUE 1. This is an action for federal trademark counterfeiting and infringement, false designation of origin, cybersquatting, common law unfair competition, and common law trademark infringement pursuant to 15 U.S.C. §§ 1114, 1116, 1125(a), and 1125(d), and The All Writs Act, 28 U.S.C. § 1651(a). Accordingly, this Court has subject matter jurisdiction over this action pursuant to 15 U.S.C. -

View Annual Report

R CONTENTS ICHEMONT 1 Financial Highlights 2 Group Structure 3 Chairman’s Statement 4 Directors and Company Information 6 Chief Executive’s Review • 9 Brand Review 33 Financial Review A Quality is never NNUAL 49 Consolidated Financial Statements “ 73 Company Financial Statements 83 Principal Group Companies 84 Five Year Record R 88 Notice of Meeting EPORT AND an accident, it is “Quality is never an accident, it is A always the result of intelligent effort.” CCOUNTS always the result of John Ruskin (1819–1900) 2000 intelligent effort.” ISBN 3-9522050-0-1 Internet: www.richemont.com Annual Report and Accounts 2000 R CONTENTS ICHEMONT 1 Financial Highlights 2 Group Structure 3 Chairman’s Statement 4 Directors and Company Information 6 Chief Executive’s Review • 9 Brand Review 33 Financial Review A Quality is never NNUAL 49 Consolidated Financial Statements “ 73 Company Financial Statements 83 Principal Group Companies 84 Five Year Record R 88 Notice of Meeting EPORT AND an accident, it is “Quality is never an accident, it is A always the result of intelligent effort.” CCOUNTS always the result of John Ruskin (1819–1900) 2000 intelligent effort.” ISBN 3-9522050-0-1 Internet: www.richemont.com Annual Report and Accounts 2000 19894 Rmt R&A ’00 01-08 17/7/00 1:13 pm Page 1 1 Richemont is a Swiss luxury goods group managed with a view to the long-term development of successful international brands. In addition to its luxury goods businesses, Richemont also holds strategic investments in the tobacco industry and in direct retailing. All amounts -

Luxury China: Market Opportunities and Potential

ffirs.indd ii 5/24/10 8:56:40 PM luxury china market opportunities and potential ffirs.indd i 5/24/10 8:56:38 PM ffirs.indd ii 5/24/10 8:56:40 PM luxury china market opportunities and potential michel chevalier and pierre lu Foreword by Sidney Toledano President & CEO, Christian Dior Couture JOHN WILEY & SONS (ASIA) PTE. LTD. ffirs.indd iii 5/24/10 8:56:40 PM Copyright © 2010 John Wiley & Sons (Asia) Pte. Ltd. Published in 2010 by John Wiley & Sons (Asia) Pte. Ltd. 2 Clementi Loop, #02-01, Singapore 129809 All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as expressly permitted by law, without either the prior written permission of the Publisher, or authorization through payment of the appropriate photocopy fee to the Copyright Clearance Center. Requests for permission should be addressed to the Publisher, John Wiley & Sons (Asia) Pte. Ltd., 2 Clementi Loop, #02-01, Singapore 129809, tel: 65-64632400, fax: 65-64646912, e-mail: [email protected]. This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that the Publisher is not engaged in rendering professional services. If professional advice or other expert assistance is required, the services of a competent professional person should be sought. The photographs in this book are sourced by Pierre Lu and Michel Chevalier and reproduced with permission. -

Download Group Presentation

PUBLIC at a glance PUBLIC CONTENTS 3 THE GROUP AT A GLANCE 8 HOW WE OPERATE 12 SUSTAINABILITY 18 OUR LATEST FIGURES 23 APPENDIX PUBLIC * THE GROUP AT A GLANCE *End March 2021 **May 2021 Founded A leading luxury in 1988 goods group CHF 50 bn** € 13 bn € 1.5 bn € 3.4 bn Market capitalisation Sales Operating profit Net cash Top 8 SMI Top 3 JSE 3 PUBLIC THE GROUP AT A GLANCE * *End March 2021 25 Maisons and businesses Over 35 000 Employees (including over 8 000 in Switzerland) 7 Schools 9 Main Foundations 2 247 Boutiques supported (of which 1 190 internal) Richemont Headquarters by architect Jean Nouvel, Geneva 4 PUBLIC FROM THE PAST INTO THE FUTURE 207 188 174 153 128 115 102 69 26 19 1755 1814 1830 1833 1845 1847 1860 1868 1874 1893 1906 1919 1928 1952 1983 1995 2001 2002 2015 2021 * 266 191 176 161 147 115 93 38 20 6 *Both YOOX and NET-A-PORTER were founded in 2000 5 PUBLIC 1988 – 2020: UNIQUE PORTFOLIO MOSTLY BUILT BY ACQUISITIONS 1988 1990’s 2000’s 2010’s 2020’s 6 10 15 24 25 6 PUBLIC A WORLDWIDE PRESENCE * *End March 2021 Sales by geographical area Japan Middle East and Africa 7% 7% Americas 18% Europe 23% Operating in Europe 38 Europe locations Asia Pacific 45% 2 247 boutiques Cartier store in Cannes, France 7 PUBLIC HOW WE OPERATE PUBLIC WHAT WE STAND FOR Our corporate culture is determined by the Collegiality Freedom principles we live by They affect what we do and why we do it They shape how we behave every day — in all areas Solidarity Loyalty of our business 9 PUBLIC HOW OUR BUSINESS OPERATES We work as business partners Headquarters Our Maisons and businesses SEC Strategy, Capital Allocation are directly in charge of: Strategic Product & Guide the Maisons by verifying that decisions on Products, Communication Committee Communication and Distribution are appropriate and consistent with . -

Contents Volume 34, Number 4, April 2010

HOROLOGICAL ™ HOROLOGICAL TIMES APRIL 2010 TIMES CONTENTS VOLUME 34, NUMBER 4, APRIL 2010 Official Publication of the FEATURES American Watchmakers-Clockmakers Institute Tour de I’lle: A Blend of Style and Technique 6 EDITORIAL& EXECUTIVE OFFICES By Christian Selmoni and Vincent Kauffmann American Watchmakers-Clockmakers Institute (AWCI) A Replacement 8 mm Lathe Draw-in Spindle, Part 1, By Dale LaDue 24 701 Enterprise Drive Harrison, OH 45030 Toll Free 1-866-FOR-AWCI (367-2924) COLUMNS or (513) 367-9800 Part 3, By Laurie Penman Fax: (513) 367-1414 Clockmaking Elements, 18 E-mail: [email protected] Education Notes, By Jerry Faier 28 Website: www.awci.com Office Hours: Monday-Friday 8:00 AM to 5:00 PM (EST) DEPARTMENTS Closed National Holidays President’s Message, By Mark Butterworth 2 Executive Director’s Message, By James E. Lubic 3 Managing Editor & Advertising Manager Donna K. Baas Questions & Answers, By David A. Christianson 4 Associate Editor & Design Associate New Members 23 Katherine J. Ortt Bulletin Board 30 Executive Director/Education & Technical Director From the Workshop, By Jack Kurdzionak 32 James E. Lubic, CMW21 Book Review, By Jordan Ficklin 36 Operations Director Thomas J. Pack, CPA Affiliate Chapter Report, By Gene Bertram 38 Watchmaking Instructor/Certification Coordinator Industry News 42 Thomas D. Schomaker, CMW21 Classified Advertising 44 Education Coordinator Advertisers’ Index 48 Daniela Ott Receptionist/Technical Support AWCI Staff Directory 48 Sally Landis IT Director EDUCATION Jim Meyer AWCI Academy of Watchmaking Classes 35 AWCI 21st Century Certification Exam Schedule 35 HOROLOGICAL TIMES ADVISORY COMMITTEE AWCI and ClockClass.com Partner for Training Program 43 Ron Iverson, CMC: Chairman Karel Ebenstreit, CMW David Fahrenholz SPECIAL INTEREST Jordan Ficklin, CW21 We Respond, You Decide 5 Chip Lim, CMW, CMC, CMEW th Robert D. -

Danziger Korean Oct302020.Pdf

Danziger, Danziger & Muro, LLP 댄지거, 댄지거 & 무로 법률사무소 로펌소개 댄지거 로펌은 전문적인 법률자문을 필요로 하는 고객들의 요구에 부응하기 위해 1989년 뉴 욕에서 설립되어 현재까지 최상의 법률서비스를 제공하고 있습니다. 댄지거 로펌의 주요 전문 영역은 일반 기업법과 미술법, 부동산법, 지적재산권법 그리고 고 용법입니다. 댄지거 로펌은 미국 기업뿐만 아니라 유럽의 세계적인 명품 브랜드, 아시아 기업, 국제적인 미술관련 회원들과 유명 아티스트들에게 풍부한 지식과 경험을 바탕으로 법률서비스를 제공 하고 있습니다. 댄지거 로펌 파트너 Charles T. Danziger Thomas C. Danziger Bradley J. Muro 소속 변호사들 Karen Hirshfield Danielle Gaier Yuh-kyoung (Kate) Rhie 댄지거 로펌 주요고객 Van Cleef & Arpels / 반클리프 & 아펠스, Cartier / 까르띠에, Piaget / 피아제, Montblanc / 몽블랑, Jaeger-LeCoultre / 예거 르 코쳐, Vancheron Constantin / 베쳐론 콘스탄틱, Shanghai Tang / 상하이 탱, Dunhill / 던힐 , Chopard / 쵸파드, Sooja Kim / 아티스트 김수자, Maya Lin / 아티스트 마야 린, Mariko Mori / 아티스트 마리코 모리, Fuji Television Network / 후지 방송사, Taisei Corporation / 다이세이 건설사, Issey Miyake / 패션 디자이너 이세이 미야케, Ito En / 이토 엔, Restaurant Daniel / 레스토랑 다니엘과 가맹점들, BLT Restaurant Group / BLT 레스토랑 그룹과 가맹점들, Roasting Plant / 로스팅 플랜트 , Midori Goto / 바이올리니스트 미도리 고토, Hidetoshi Nakata / 축구선수 히데토시 나카타 , Nagoya/Boston Museum of Fine Arts / 나고야 보스턴 미술관, 이사무 노구치, 히로시 수기모토, 마리코 모리 그리고 그 외 개인 콜렉터, 갤러리, 개인 미술품 딜러 및 비영리 기관 등. 변호사 소개 Charles T. Danziger 찰스 T. 댄지거 찰스 T. 댄지거는 Yale University에서 미술사를 전공 후 New York University 로스쿨을 졸업하 였다. 재학 중에는 Journal of International Law and Politics에서 에디터로 활동하였고 졸업 후 에 는 뉴욕의 로펌 Milbank, Tweed, Hadley & McCloy의 기업 뱅킹 부서에서 근무하였다. 그 후 일 본 최고의 로펌 중 하나인 Nagashima & Ohno in Tokyo와 뉴욕 현대 미술 박물관(The Museum of Modern Art)에서 법무자원의원을 역임하였다. -

Annual Report and Accounts 2010

Richemont Annual Report and Accounts 2010 Annual Report and Accounts 2010 www.richemont.com Richemont is one of the world’s leading luxury goods groups. The Group’s luxury goods interests encompass several of the most prestigious names in the industry, including Cartier, Van Cleef & Arpels, Piaget, Vacheron Constantin, Jaeger-LeCoultre, IWC, Alfred Dunhill and Montblanc. Each of the Group’s Maisons® represents a proud tradition of style, quality and craftsmanship which Richemont is committed to preserving. 2 Executive Chairman and 20 Other Businesses Chief Executive Officer’s review 21 Alfred Dunhill Johann Rupert’s review of the year 22 Chloé 23 Lancel 4 Business review 24 Shanghai Tang 4 Jewellery Maisons 25 Azzedine Alaïa 5 Cartier 26 Purdey 7 Van Cleef & Arpels 27 Financial review 8 Specialist Watchmakers A detailed commentary on the Group’s 9IWC financial performance 10 Jaeger-LeCoultre 35 Corporate responsibility 11 Piaget 12 Vacheron Constantin 36 Peace Parks Foundation 13 Officine Panerai 14 Baume & Mercier 38 Corporate governance 15 A. Lange & Söhne 42 Board of directors 16 Roger Dubuis 46 Group Management Committee 17 Ralph Lauren Watches 18 Writing Instrument Maison 53 Consolidated financial statements 19 Montblanc 108 Company financial statements 113 Five year record 115 Statutory information Designed and produced by Likemind www.likemind.com 116 Notice of meeting Printed in South Africa by Shumani Printers (Pty) Ltd. The cover stock of this report is Trucard Recycled Matt, made from 50% virgin fibre (100% ECF) and 50% recycled pulp from de-inked postconsumer waste and is FSC certified. The text paper in this report is Sappi Triple Green Silk. -

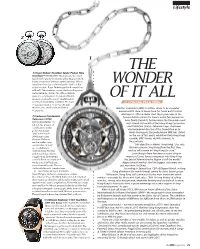

The Wonder of It

Lifestyle 2 1 THE 1) Roger Dubuis’Dubuis’ ExcaliburExcalibur SpiderSpider Pocket TimeTime Instrumentnt (S$680,000):: Two years ago, the brand launched thehe gravity-defyinggravity-defying Excalibur Quatuor which boasts a movementovement with fourfour sprung balances. Clients were flown firstfirst class to Switzerland to check out the WONDER radical creation.ation. Roger Dubuis says that the watch has sold well. TheThe movement is now fittedfitted into this pocket watch whichch also feature two of RogerRoger DubuisDubuis’’ signature complications:omplications: tthehe ppatentedatented doubledouble OF IT ALL moon-crescentcent powerpower reserve displaydisplay andand its renowned doubledouble flyingflying tourbillon. The hand- BY CHUANG PECK MING wound movementvement is housedhoused in a 48 mm titanium case,ase, andand thethe watcwatchh is llimitedimited WatchesWatches & Wonders (WW) is settlingsettling downdow to be a regular to 28 pieces.s. annual watch show in HongHong KongKong forfor Asian watch sellers and buyers. After a shaky start threethr years ago in the 2) Vacheronron Constantin’sConstantin’s formerformer British colony,colony, the luxuryluxury watch fair appears to Referencee 57260 have finally found its footingfooting whenwh the three-day event (price unavailable):vailable):: “57” was stagedstaged last month at the Hong Kong Convention refers to thee numbernumber ofof and Exhibition Centre. FabienneFabien Lupo, chairman complicationsons in this and managingmanaging director of theth Foundation de la pocket watchch anandd Haute Horlogerie,Horlogerie, the body behind WW, has stated “260” is thee brand’sbrand’s 260th anniversaryiversary onon the eve of this year’s exhibitionexh that Hong Kong this year. Vacheronacheron remains WW’s home, despitedespit rumours to made a similarmilar super thethe contrary.contrary. -

The Co-Creation and Circulation of Brands and Cultures

The Co-creation and Circulation of Brands and Cultures: Historical Chinese Culture, Global Fashion Systems, and the Development of Chinese Global Brands Submitted by Zhiyan, Wu to the University of Exeter as a thesis for the degree of Doctor of Philosophy in Management Studies in October 2010 This thesis is available for Library use on the understanding that it is copyright material and that no quotation from the thesis may be published without proper acknowledgement. I certify that all material in this thesis which is not my own work has been identified and that no material has previously been submitted and approved for the award of a degree by this or any other University. Signature: 吴志艳 1 Abstract This dissertation is a study of the possibilities and processes of constructing strong Chinese brands in the global marketplace. It investigates conceptual and strategic relationships between brands and cultures, focusing specifically on the issue of the unprivileged position of Chinese brands vis-à-vis that of other famous global counterparts. Accordingly, it deploys three illustrative cases from the Chinese context – Jay Chou (a successful Chinese music artist), the 2008 Beijing Olympics opening ceremony, and Shanghai Tang (a global Chinese fashion brand). In so doing, it moves away from the general trend to study the managerial aspects of Western brand building in Chinese contexts, and instead examines how Chinese brands express cultural aspects of their own well-known brand development models in the global marketplace. In short, this study uses a Chinese vantage to examine the emergence of cultural branding (using historical culture and global fashion systems to develop global brands), and its capacity to function as a useful complement to existing models of brand globalisation and global brand culture. -

La Belle Haute Horlogerie*

LA BELLE HAUTE HORLOGERIE* * BEAUTIFUL HIGH WATCHMAKING P 09 — TECHNICAL EXCELLENCE & ARTISTIC CRAFTS P 13 – LES CABINOTIERS P 31 – MÉTIERS D’ART P 43 — ONE OF NOT MANY. P 51 – PATRIMONY P 69 – TRADITIONNELLE P 91 – FIFTYSIX P 103 – OVERSEAS P 121 – MALTE P 131 – HISTORIQUES P 143 – HEURES CRÉATIVES P 147 — THE RESTORATION SERVICE & LES COLLECTIONNEURS P 153 — CALIBRES & COMPLICATIONS 3 ‘‘ DO BETTER IF POSSIBLE, AND THAT IS ALWAYS POSSIBLE. Founded in 1755, Vacheron Constantin is the world’s oldest Manufacture with uninterrupted activity for over 260 years. Bequeathed to posterity, François Constantin’s words from July 5th 1819 clearly reveal the‘‘ spirit that drives the Maison: “Do better if possible, and that is always possible.” 5 Over the centuries, skilfully combining tradition and innovation, the Maison Vacheron Constantin has nurtured its vocation for La Belle Haute Horlogerie (Beautiful High Watchmaking) by combining technical developments, aesthetic mastery, artistic prowess and human destinies in shaping its vision of time as well as its love of work well done and of manual craftsmanship. A true encyclopaedia of art, science and culture since its creation, Vacheron Constantin has been committed to enhancing the watch, a precious object characterised by technical excellence. Endowed with a rich heritage based on the transmission of Haute Horlogerie, combined with stylistic research undertaken by generations of Master craftsmen, Vacheron Constantin’s creations illustrate the high demands, relentless innovation and aesthetic finesse that have become the signatures of the Maison, like the Maltese cross. Chosen as the emblem of the Manufacture in 1880, the latter echoes the eponymous watch component which was inseparable from movements at the time and ensured watches’ precision and longevity, two values expressing the continuity of Vacheron Constantin watches.